简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

MTFE Review 2025: Is It Real Or Fake?

Abstract: Established in 2022, Metaverse Foreign Exchange Group Inc., or MTFE, presented itself as a trustworthy online trading platform. Beyond offering traditional trading options like forex pairs, CFDs on commodities, indices, and stocks, MTFE notably promoted AI trading (requiring a $26 starting fee) and cryptocurrency trading, both promising exceptionally high returns.

MTFE (Metaverse Foreign Exchange Group Inc.), a trading firm, has been the subject of much negative discussion among investors. Numerous investors claim to have been defrauded by the company. Here we will delve into the specifics of their investment services to determine the validity of these claims.

MTFE- About the company

Established in 2022, Metaverse Foreign Exchange Group Inc., or MTFE, presented itself as a trustworthy online trading platform. Beyond offering traditional trading options like forex pairs, CFDs on commodities, indices, and stocks, MTFE notably promoted AI trading (requiring a $26 starting fee) and cryptocurrency trading, both promising exceptionally high returns.

To participate, users were required to create virtual trading accounts and deposit cryptocurrency into these accounts. MTFE misled users into believing that their funds were being used for actual trading, generating profits within a simulated trading environment.

Unlike many established trading platforms that offer industry-standard tools like MetaTrader 4 (MT4) or MetaTrader 5 (MT5), MTFE only provides a basic, in-house trading app accessible on Android and iOS devices.

Notably, MTFE claims that investors can maximize their earnings through two channels: AI Trading and Referral Commission. This promotion, however, is highly questionable. By positioning AI as a “black technology” that promises higher returns and lower risks, dishonest brokers prey on investors' optimism. Referral incentives enable these brokers to rapidly expand their client base and amass substantial funds.

Company details are listed below:

| Broker Name | Metaverse Foreign Exchange Group Inc. (MTFE) |

| Founded in | 2022 |

| Website | https://www.mtfe.ca/ https://www.mtfe.iohttps://www.mtfe-trade.com |

| Contact Info | N/A |

| Social Media | N/A |

| Registration Address | 500-7030 Woodbine Avenue Markham, ON, L3R 6G2, Canada |

| Products on MTFE | Manual Trading including Forex, CFDs on Commodities, Indices& Stocks, etc. AI Trading |

| Trading Platform | Android and iOS platforms |

MTFE-Tracking Its Illegal Records

- Metaverse Foreign Exchange Group, Inc. (MTFE) was established and has been operational since 2022 in Markham, Ontario.

- Later in 2022 Metaverse Foreign Exchange Group, Inc. (MTFE) expanded its operations by establishing multiple operational centers across the Middle East, South Asia, and Africa, including Nigeria.

- In 2023, WikiFX labeled MTFE as an illegal broker due to its complete lack of regulatory oversight and the multitude of complaints lodged by defrauded investors.

- The Ontario Securities Commission (OSC) also issued an investor warning in 2023, advising the public that MTFE was not registered to offer trading services within the province of Ontario.

- In August 2023, MTFE abruptly ceased operations, leaving investors' funds inaccessible. Court documents filed in Sri Lanka and subsequent statements from the country's central bank have classified MTFE as a pyramid scheme.

- In 2024, a growing number of defrauded investors have taken to online platforms to share their experiences with MTFE, further solidifying its reputation as an illegal broker and alleged pyramid scheme.

Concerning Features of MTFE Trading

Operating under no regulation

On MTFE website, it claims to be regulated under the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) and hold an MSB license. While FINTRAC oversees financial transactions in Canada, it does not regulate foreign exchange trading. This responsibility lies with the Investment Industry Regulatory Organization of Canada (IIROC). However, a search for this broker on the IIROC website yielded no results. Notably, the so-called MSB license corresponds to money services businesses, such as money exchange, remittance, and the sale of traveler's checks. Illegal traders often confuse these licenses to deceive investors.

Hyping up AI trading

MTFE has been marketing its AI trading services, promising that for a mere $26, users can leverage advanced AI smart trading. The broker's tiered system, linking higher deposit amounts to greater returns, bears striking similarities to the classic bait-and-switch tactics often employed by fraudulent entities. By cloaking its operations in the allure of cutting-edge AI technology, MTFE may be attempting to mislead investors into believing that huge profits are easily attainable. However, a closer examination suggests that the emphasis on technology may be a smokescreen designed to obscure underlying fraudulent activities.

Lure Users with Referral Commission

MTFE claims to encourage investors to refer friends for maximum returns, but this is nothing more than a classic Ponzi scheme tactic. By developing a downline, brokers can rapidly expand their capital pool, providing more funds for their platform. More investors mean more trading volume, and brokers can earn higher revenue through trading fees, spreads, and other means. Compared to attracting new customers through advertising, incentivizing existing customers to refer their friends is significantly less costly. By doing so, brokers can shift the risk onto investors. If the platform encounters problems, investors will often suspect their friends first, rather than the platform itself.

Unlawful sign-up procedure

To register, users had to buy and transfer cryptocurrency to one of MTFE's digital wallets. This unusual and uncommon practice allowed MTFE to quickly gather funds from many people, making it easier to operate a Ponzi scheme. Additionally, using cryptocurrency made it difficult for authorities to track the money, further enabling their illegal activities.

Unstable domain and contact info

MTFE has three websites: www.mtfe.ca, www.mtfe.io, www.mtfe-trade.com, respectively. And now, none of these websites can be opened. The constant alteration of MTFE's domain name is a tactic used to deceive investors into believing they are dealing with a new, legitimate entity. This high turnover of domains is a clear sign of an unstable and unreliable platform. Moreover, inconsistent or nonexistent contact information is a strong indicator of potentially fraudulent activity.

WikiFX: MTFE Exposed as Illegal

WikiFX indicates that MTFE is a relatively new brokerage firm with a short operating history of less than 5 years. What worse, this broker is flagged as “Illegal” and has a very low rating of 1.40/10.

This assessment is not without foundation, and it is substantiated by the trading firm's history of fraudulent behavior, as evidenced by multiple incidents documented on WikiFX. Let's pick three of these cases.

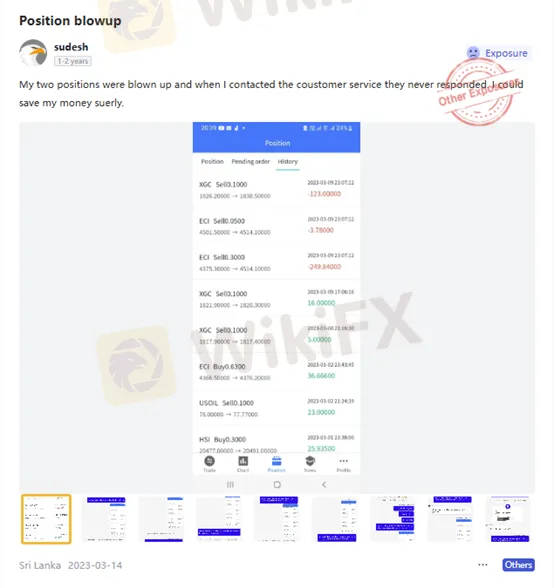

Case 1: My positions were blown up

A user from Sri Lanka posted on 14th March 2024 that his two positions were blown up and he got no response when he tried to contact MTFE customer support team. He also attached some trading screenshots for evidence.

Typically, brokers may misuse position liquidation through two primary unethical mechanisms. First, they can deliberately create trading losses and exploit an insufficient margin' as a justification to forcibly close positions and misappropriate client funds. Alternatively, brokers might liquidate positions strategically to eliminate potential evidence that could expose their illegal activities and help them avoid regulatory penalties.

Case 2: I was forced to use their AI trading

Another investor from India revealed MTFEs unethical behavior on its AI Trading. Here are some details:

“MTFE is collecting huge fund from India, Bangladesh and Africa through 3 Level Commission through its MLM program. It is taking high spread and Commission, so that no one can make profit by manual trading. All clients who have account with MTFE are forced to use their AI Trading which enables them to loot all public funds in a single trade one fine day.”

By employing AI trading systems, illegal brokers can conceal fraudulent practices such as insider trading and market manipulation. Moreover, these systems allow them to launder illicit funds and shift blame for failed trades onto the AI technology.

Case 3: I Fail to withdraw my funds

An Indian investor has sounded the alarm, revealing that MTFE has inexplicably denied their withdrawal attempt. The investor, backed by irrefutable transaction records, has brought this troubling incident to light.

Behind a fraudulent broker's refusal to allow a user to withdraw funds, there often lies a complex web of interests and deceptive tactics.

- Ponzi Scheme: Brokers use funds from new investors to pay off older ones, creating an illusion of high returns to attract more investments. Once the money chain breaks, they abscond with the funds.

- Fictitious Trading: Trading data on the platform may be manipulated or entirely fabricated, and the profits seen by investors are illusory. Once an investor requests a withdrawal, the broker will delay or refuse it under various pretexts.

- Pooling of Funds: Brokers pool all investor funds and manipulate trading prices to obtain illegal profits. When investors request withdrawals, brokers will refuse on grounds such as market fluctuations.

- Insider Trading: Brokers may use non-public information to trade and obtain illicit gains. To cover up their illegal activities, they will refuse customer withdrawals.

OSC Warning: MTFE Poses Risks to Investors

“As part of the Ontario Securities Commissions (OSC) mandate to protect investors and the integrity of our markets, we issue investor warnings and alerts. Investor warnings caution the public about individuals or companies that may pose a risk to investors.”

On June 30, 2023, Ontario Securities Commission (OSC) posted a risk warning that This company is not registered to trade securities in Ontario, which means it may not be operating legally.

The OSC has issued an investor warning with the following information:

Conclusion

In conclusion, MTFE is unequivocally a fraudulent operation. It lures unsuspecting investors with the allure of AI-powered trading and promises of high returns. Clearly, MTFE is not a suitable platform for anyone seeking sound investment opportunities. For a comprehensive list of reputable and legit brokers, you can consider exploring WikiFX, a platform that features nearly 60,000 broker profiles.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Read more

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Interactive Brokers introduces Forecast Contracts in Canada, enabling investors to trade on economic, political, and climate outcomes. Manage risk with ease.

Bank Negara Malaysia Flags 12 New Companies for Unauthorised Activity

Bank Negara Malaysia (BNM) has updated its Financial Consumer Alert List (FCA List) by adding 12 more entities, reinforcing its efforts to warn the public against unregulated financial schemes. Check if your broker made the list!

IG Group Acquires Freetrade for £160M to Expand UK Investment Market

IG Group acquires Freetrade for £160M, boosting its UK investment offerings. Freetrade to operate independently, with plans for growth and innovation.

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

In its latest report for March 2025, WikiFX has released a cautionary ranking of brokers that have raised significant red flags within the trading community. These five platforms, marked by alarmingly low scores, serve as stark reminders of the importance of due diligence when selecting a broker. Below is an in-depth look at each one.

WikiFX Broker

Latest News

TradingView Brings Live Market Charts to Telegram Users with New Mini App

Trump tariffs: How will India navigate a world on the brink of a trade war?

Interactive Brokers Launches Forecast Contracts in Canada for Market Predictions

Authorities Alert: MAS Impersonation Scam Hits Singapore

Stocks fall again as Trump tariff jitters continue

INFINOX Partners with Acelerador Racing for Porsche Cup Brazil 2025

Regulatory Failures Lead to $150,000 Fine for Thurston Springer

April Forex Trends: EUR/USD, GBP/USD, USD/JPY, AUD/USD, USD/CAD Insights

March Oil Production Declines: How Is the Market Reacting?

Georgia Man Charged in Danbury Kidnapping and Crypto Extortion Plot

Currency Calculator