简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How to Start Trading with Tradeview: Account Types and Demo Account

Abstract:Founded in 2004, Tradeview is a regulated brokerage firm operating in the Cayman Islands and regulated by LFSA in Malaysia. The company offers straight-through processing (STP) and holds a full license for MT4/5, providing traders with access to various financial markets, such as forex, stocks, futures, etc. Tradeview's account settings are different from most brokers, read this article to have a comprehensive understanding of Tradeview's accounts.

Tradeview Review at a Glance

Tradeview, not TradingView! Please be aware that the Tradeview we review in this article is a forex and CFD broker from the Cayman Islands, not TradingView - a popular trading platform, like MetaTrader 4 and MetaTrader 5.

| Tradeview at a Glance |

| Founded | 2004 |

| Registered | Cayman Islands |

| Regulation | LFSA (Malaysia) |

| Security of Funds | Segregated accounts, regular audits, negative balance protection, risk management tools |

| Tradeview Markets | 1,000+, forex & CFDs, stocks, futures, commodities, indices |

| Demo Account | ✅ |

| Account Type | Forex trading: ILC, XLev, cTrader |

| Stocks trading: Sterling, Lightspeed, MT5, DAS, Takion | |

| Futures trading: MT5, CQG | |

| Account Minimum | $100 |

| Maximum Leverage | 1:500 |

| EUR/USD Spread | Floating around 0.1 pips |

| Trading Platform | MT4/MT5, cTrader |

| Social/Copy Trading | ✅ |

| Deposit & Withdrawal Methods | 20+, Accentpay, ADVcash, banregio, BBVA, BCP, BMO, DBS, FairPay, Fasapay, pix, Google Pay, Interac, Jpay, Connect, Proven, Skrill, Sticpay, UnionPay, uphold, Neteller, etc. |

Unlike most brokers, Tradeview breaks down the account types quite finely, offering different trading accounts based on trading assets. MT4, MT5 and cTrader are all available. Tradeview also supports social/copy trading and multiple payment methods. Overall, except for the regulatory license limited to LFSA in Malaysia, the performance is not bad in other aspects.

Is Tradeview Safe and Legit?

Yes. Tradeview has segregated accounts and regular audits to ensure that your funds are protected. You'll get automated negative balance protection and sophisticated risk management tools.

In addition, Tradeview currently holds two regulatory licenses, including

- Labuan Financial Services Authority (LFSA) in Malaysia

- Cayman Islands Monetary Authority (CIMA)

However, only the LFSA license is valid, while the CIMA license is exceeded. You can verify Tradeview's regulatory status and explore more details on WikiFX.

| Regulated Country | Regulated by | Current Status | Regulated Entity | License Type | License No. |

| LFSA | Regulated | TVM Global Limited | Straight Through Processing (STP) | MB/19/0037 |

| CIMA | Exceeded | Tradeview Ltd | Common Financial Service License | 585163 |

Tradeview Account

Demo Account

Tradeview offers risk-free demo accounts for forex, stocks and futures trading.

- Forex

If you select forex trading, you can trade on the MT4, MT5, or cTrader platform.

The MT4 and MT5 platforms accept USD, EUR, JPY, CAD, and GBP, while the cTrader platform accepts the same account currencies except for GBP.

No matter which trading platform you choose, the maximum leverage is up to 1:400 and the account balance is up to 1,000,000.

If you want to know more details about Tradeview forex demo accounts, please refer below:

| Tradeview Forex Demo Account Feature | ||

| Trading Platform | MT4/5 | cTrader |

| Account Opening Fee | ❌ | |

| Account Type | ILC, XLeverage | ILC |

| Account Currency | USD, EUR, JPY, CAD, GBP | USD, EUR, JPY, CAD |

| Leverage | 1:1, 1:10, 1:50, 1:100, 1:200, 1:400 | |

| Account Balance | 10,000, 50,000, 100,000, 500,000, 1,000,000 | |

| Account Duration | No limit | |

| Number of Demo Accounts | No limit | |

- Stocks

If you select stock trading, you can trade on the MT5, Sterling, Lightspeed, Takion, DAS, and API/FIX platforms.

However, compared to the Tradeview forex demo account, the account currency is only limited to USD and the maximum leverage is only 1:5.

If you want to know more details about Tradeview stocks demo accounts, please refer below:

| Tradeview Stocks Demo Account Feature | ||

| Trading Platform | MT5 | Sterling, Lightspeed, Takion, DAS, or API/FIX |

| Account Opening Fee | ❌ | |

| Account Currency | USD | |

| Leverage | 1:1, 1:5 | - |

| Account Balance | 10,000, 50,000, 100,000, 500,000, 1,000,000 | - |

| Account Duration | No limit | |

| Number of Demo Accounts | No limit | |

- Futures

If you select futures trading, CQG is your only available trading platform and USD is the only accepted account currency.

| Tradeview Futures Demo Account Feature | |

| Trading Platform | CQG |

| Account Opening Fee | ❌ |

| Account Currency | USD |

| Account Duration | No limit |

| Number of Demo Accounts | No limit |

Account Types

Tradeview sets different account types for different trading markets.

- Forex

If you are a forex trader, you can choose an account type between ILC, XLev and cTrader.

The minimum deposit requirement is $100 for the XLev and cTrader accounts, while up to $1,000 for the ILC account.

The ILC and cTrader accounts can enjoy raw spread from 0.0 pips, while the XLev account is commission-free.

If you are a beginner and do not want to deposit too much, you can choose the XLev or cTrdaer account based on your needs (raw spread or commission-free?).

If you have ever traded on forex and have some experience, you can consider the ILC account.

| Tradeview Forex Account Comparison | |||

| ILC | XLev | cTrader | |

| Best for | Experienced traders | Beginners who want to trade without commission | Beginners who want to trade from 0.0 pips |

| Minimum Deposit | $1,000 | $100 | |

| Minimum Trade Size | 0.1 lot | 0.01 lot | |

| Maximum Leverage | 1:200 | 1:400 | |

| Spread | From 0.0 pips | Competitive | From 0.0 pips |

| Commission | $2.50 per standard lot per side | ❌ | $2.50 commission per lot |

- Stocks

If you are a stock trader, you can have five account types to choose from, Sterling, Lightspeed, MT5, DAS, or Takion.

If you do not want to pay a software fee, the MT5 account is your only choice.

The DAS account requires a $180 software fee, while the other three account types require a software fee as high as $250.

Besides, the leverage on stock trading is not high, 1:5 or 1:6.

As for the commission, it starts from $0.1 per share for the MT5 account, while $0.05 per share for the other four account types.

| Tradeview Stocks Account Comparison | |||||

| Sterling | Lightspeed | MT5 | DAS | Takion | |

| Maximum Leverage | 1:6 | 1:5 | 1:6 | ||

| Starting Commission | $0.05 per share | $0.1 per share | $0.05 per share | ||

| Software fee | $250 | ❌ | $180 | $250 | |

Note: The $250 monthly fee represents the pricing on the desktop version only. Sterling Web/Mobile costs an additional $50 if bundled together and $70 for web/mobile only.

An all-in rate that includes clearing, regulatory, software, and market data charges. $0.1 is for the MT5 account without leverage.

- Futures

If you are a futures trader, you can choose the MT5 or CQG account, with the minimum deposit requirement of $500 and $1,000 respectively.

The commission is $0.99 standard and $0.49 micro per contract per side.

| Tradeview Futures Account Comparison | ||

| MT5 | CQG | |

| Minimum Deposit | $500 | $1,000 |

| Commission | Standard contracts: $0.99 per contract per side | |

| Micro contracts: $0.49 per contract per side | ||

However, note that the commission does not include:

Exchange fees: Vary by contract & exchange

Order routing: $0.25 per contract, per side

Monthly software fee: $25 on the CQC Desktop

Clearing fees: $0.80 standard and $0.45 micro per contract per side

Tradeview Demo Account Opening (9 Steps)

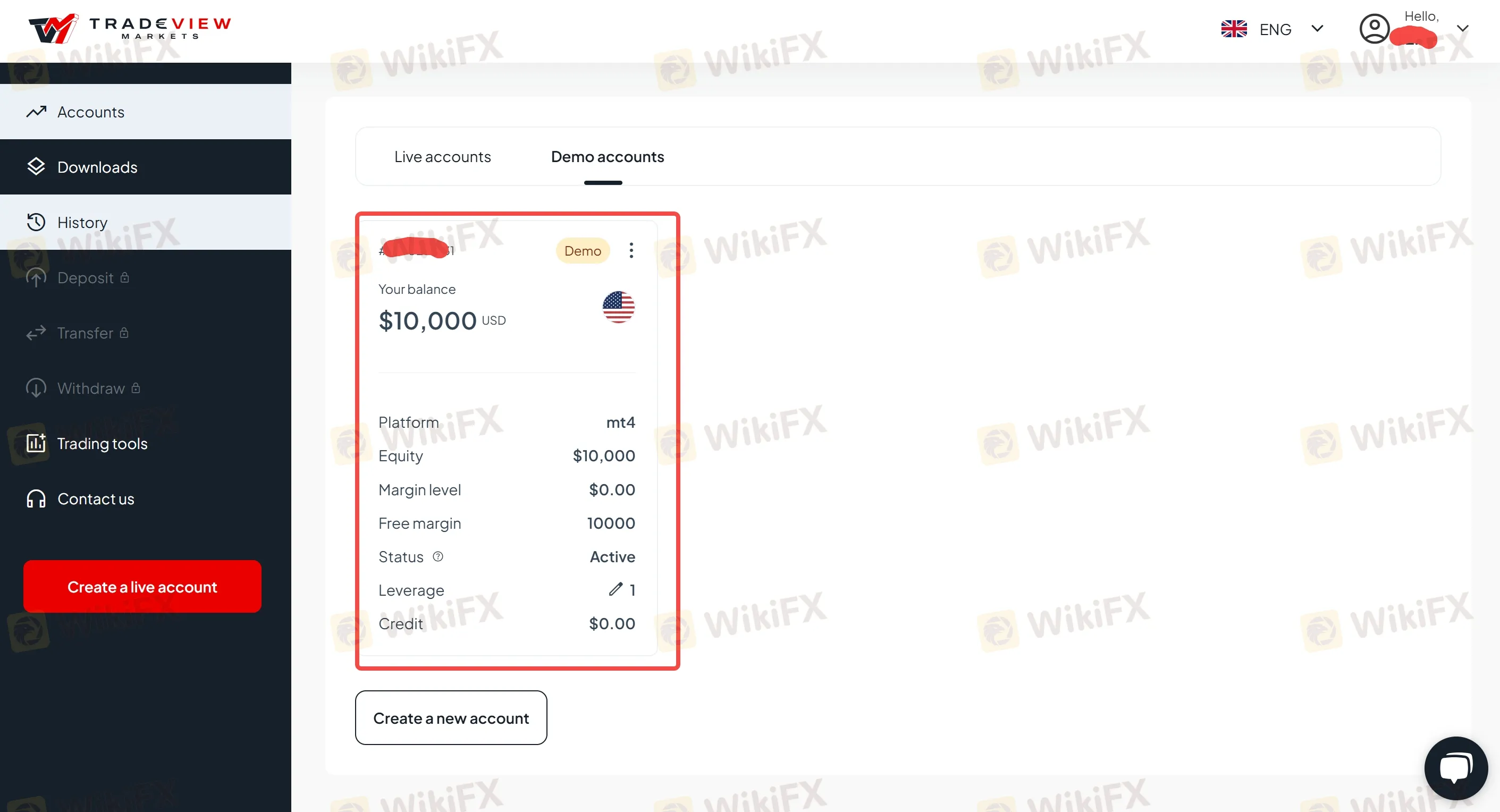

A Tradeview demo account is different from most brokers who only offer a unified demo account. On Tradeview, the demo accounts vary on the trading markets you choose. So, the demo account registration is kind of different, but overall, the process is clear. You can follow the step-by-step guide below:

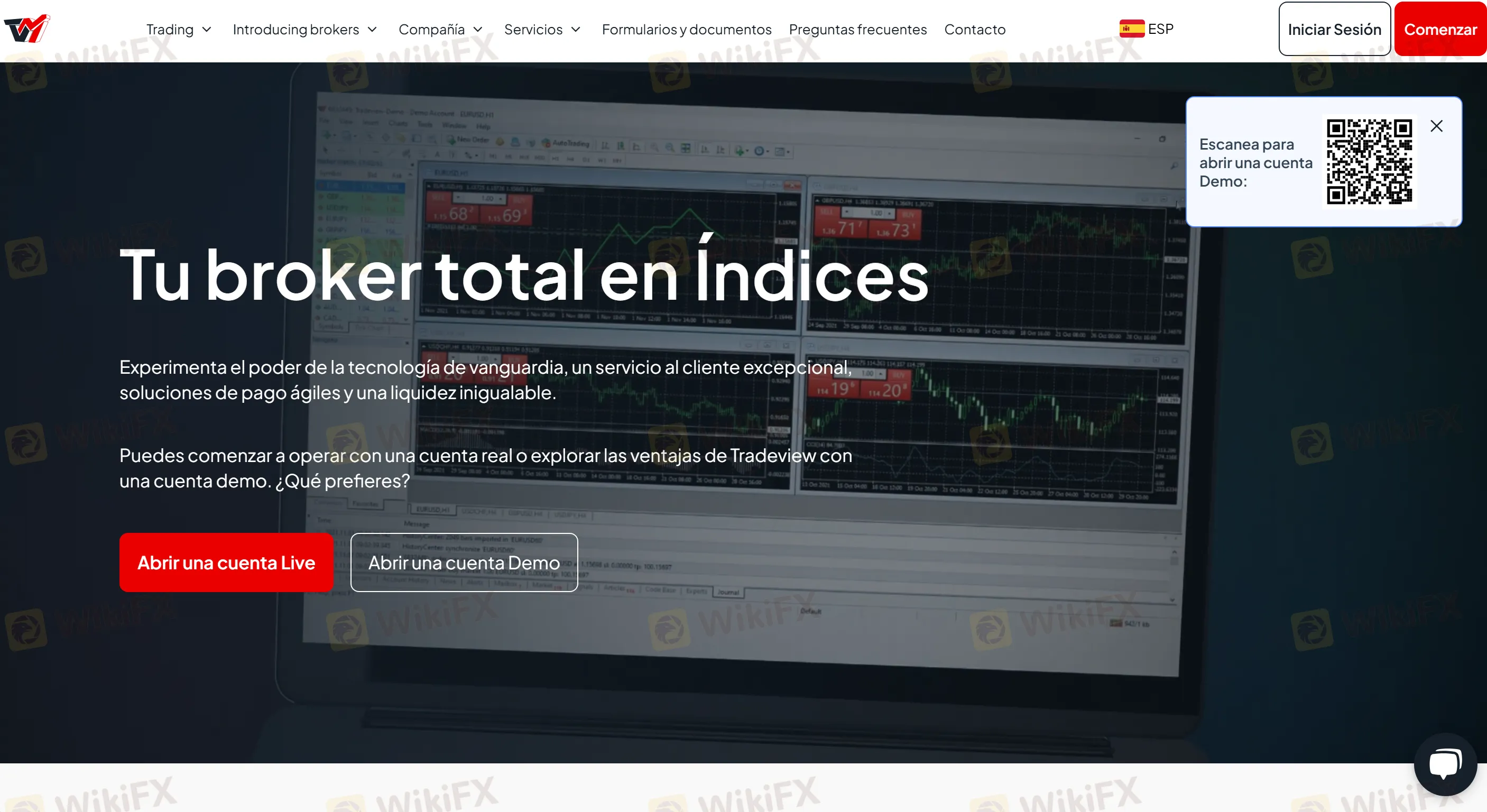

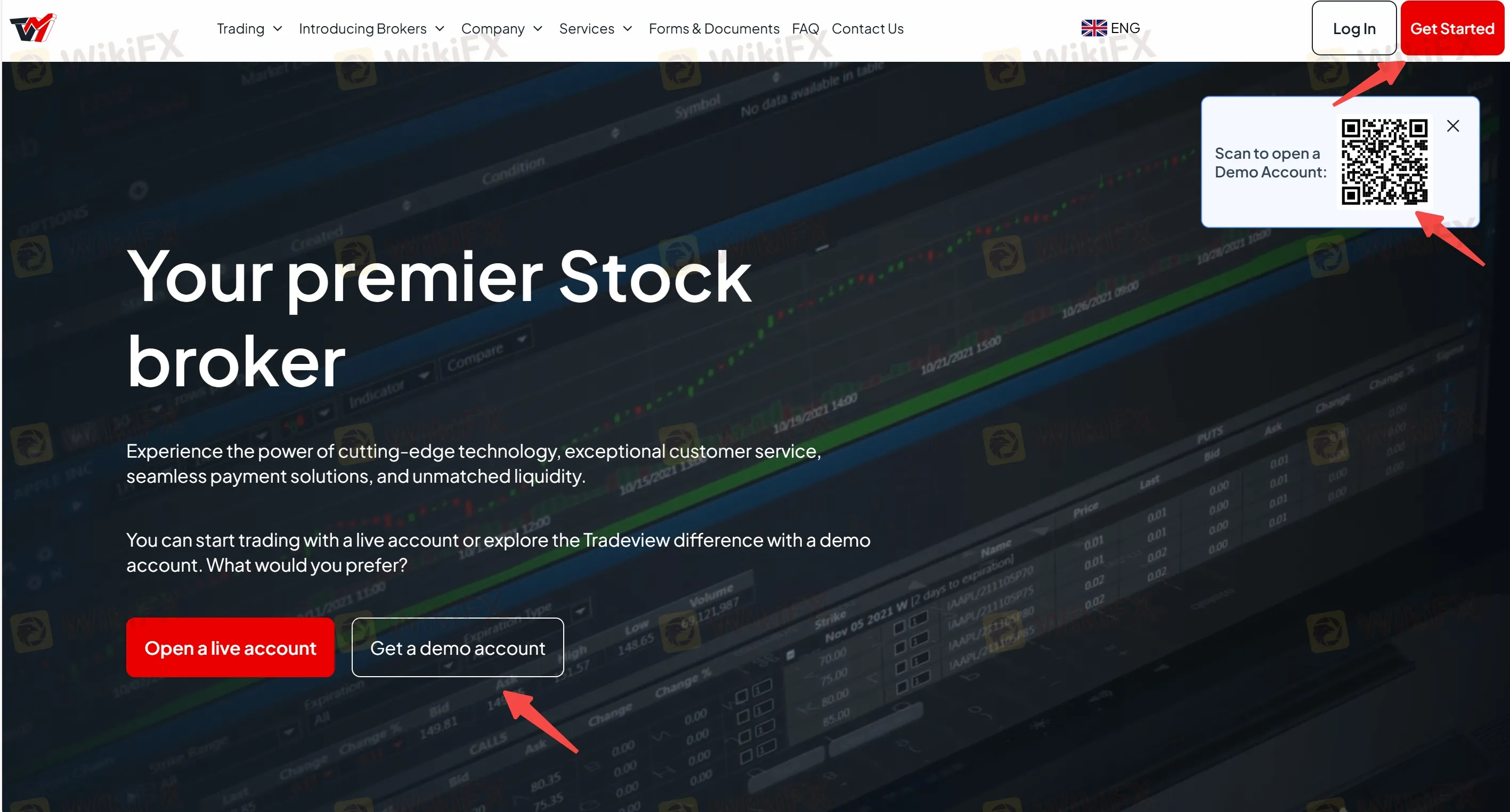

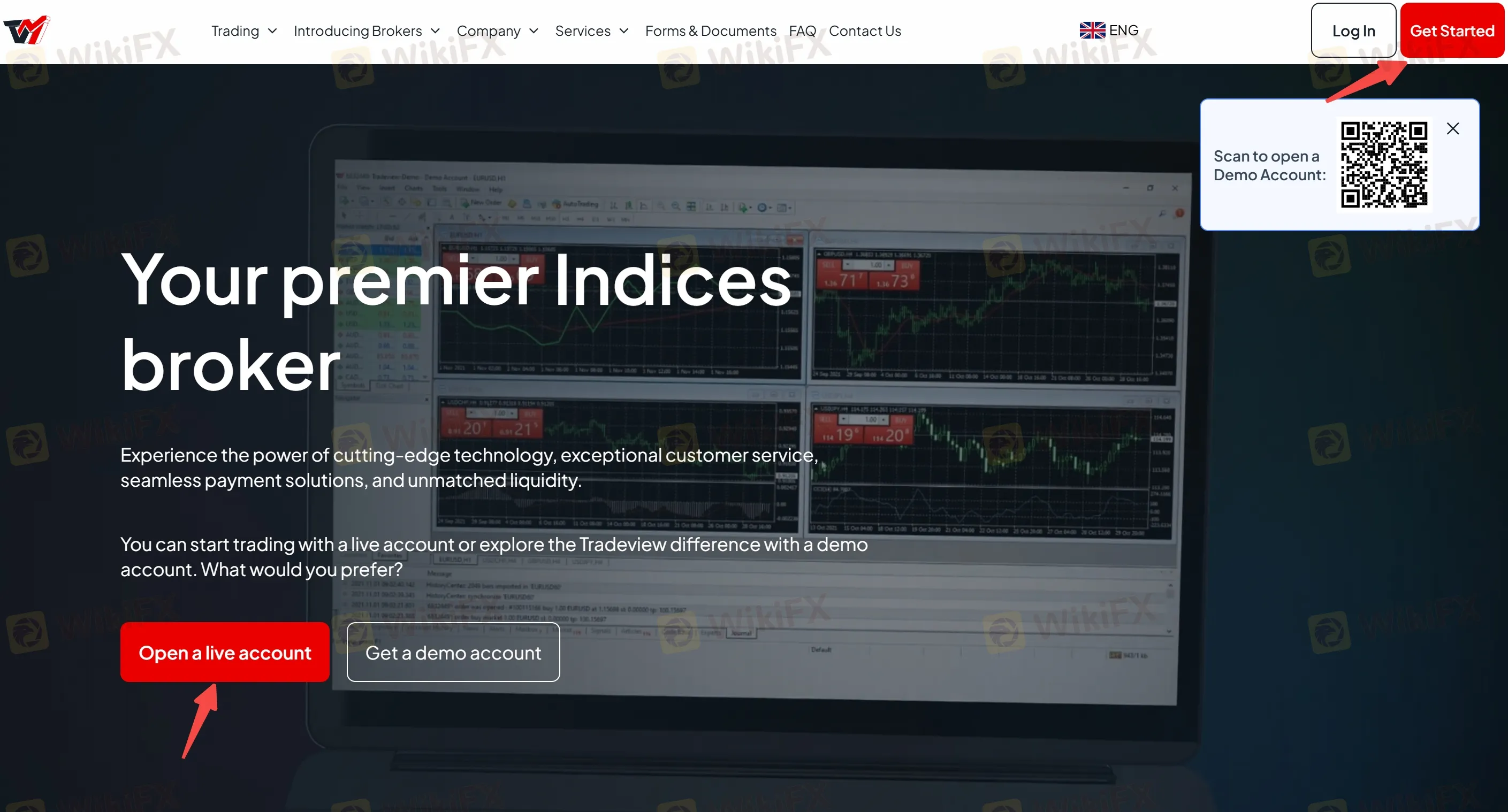

Step 1: Go to Tradeview's official website and click on 'Get Started' or 'Get a demo account' or directly scan the OR code at the top right corner of Tradeview's homepage to open a demo account.

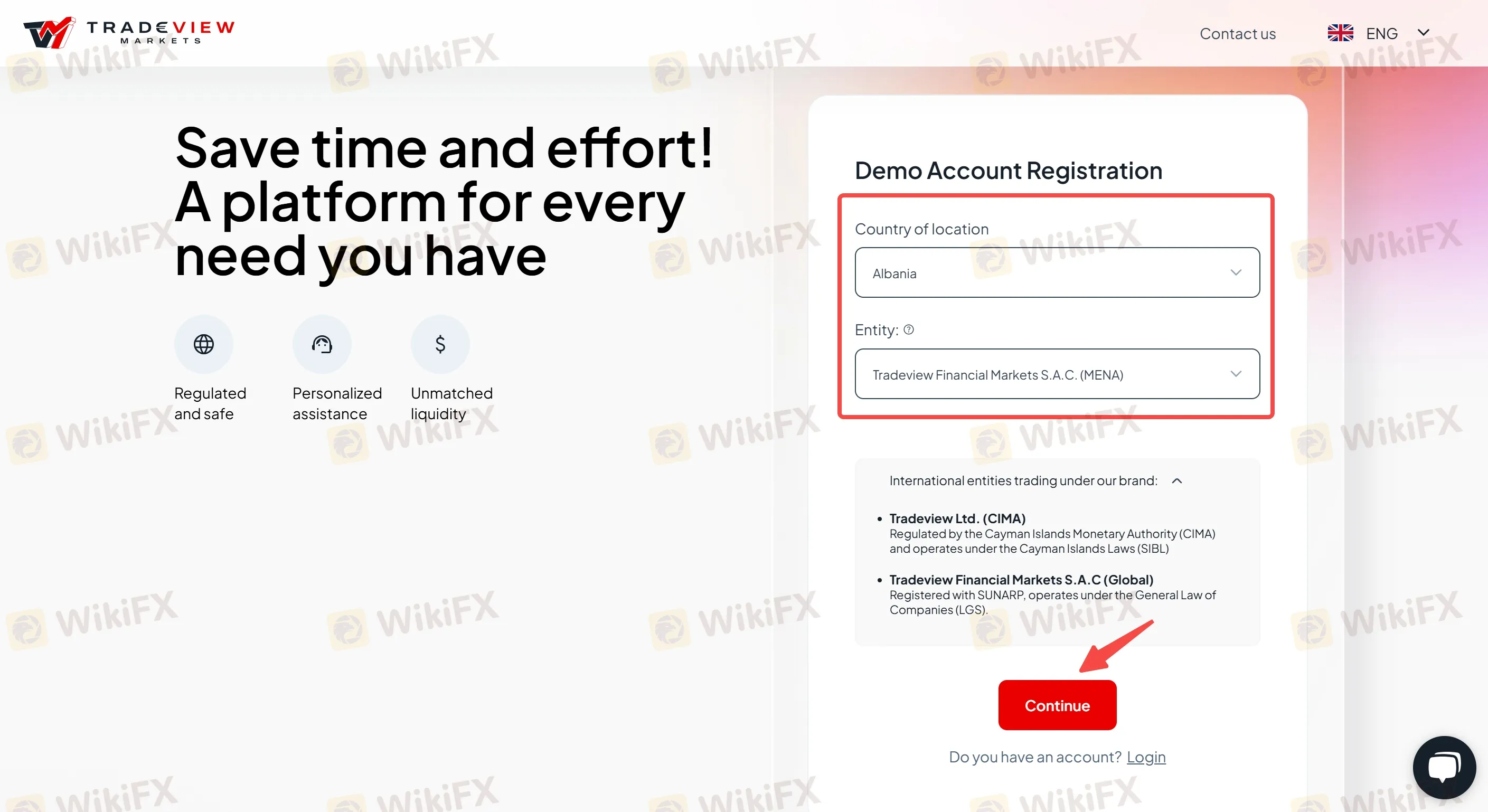

Step 2: Fill in the required info, including country of location and entity. Then click on 'Continue'.

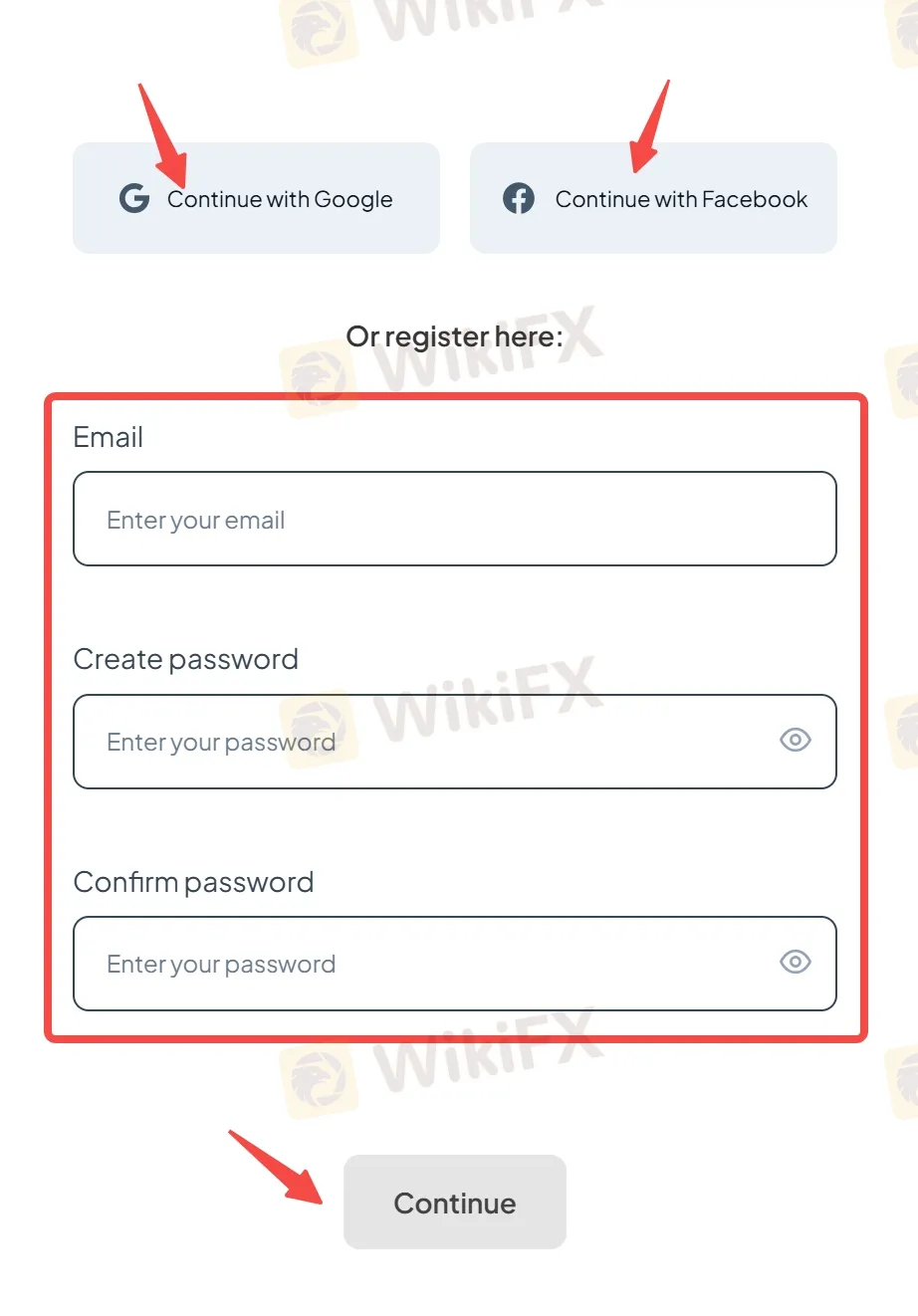

Step 3: You can continue your Tradeview demo account registration with Google, Facebook or email. If you choose email, you are required to enter your email address and create your password. Then click on 'Continue'.

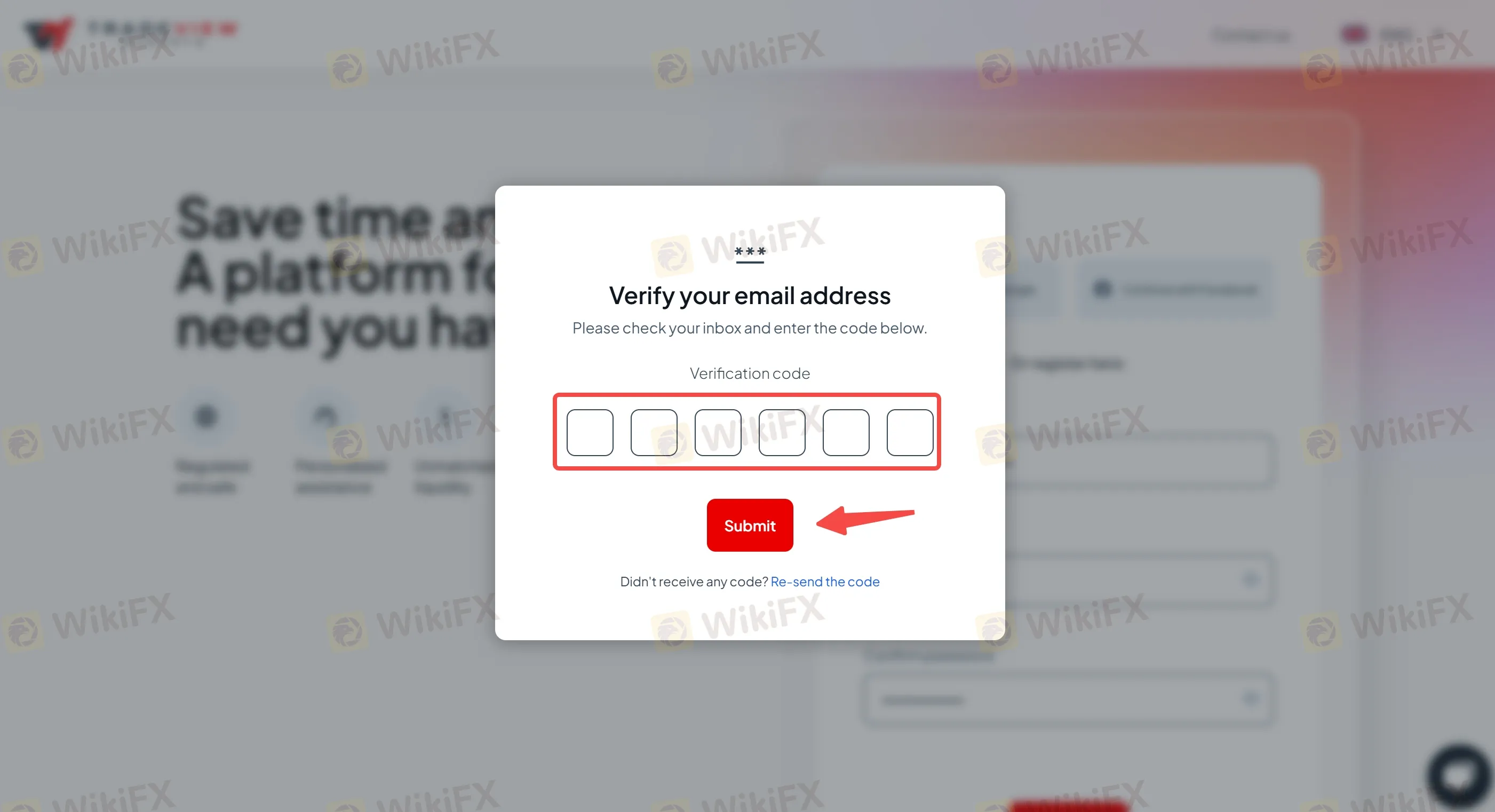

Step 4: Check your email box to find your six-digit verification code. Then click on 'Submit'.

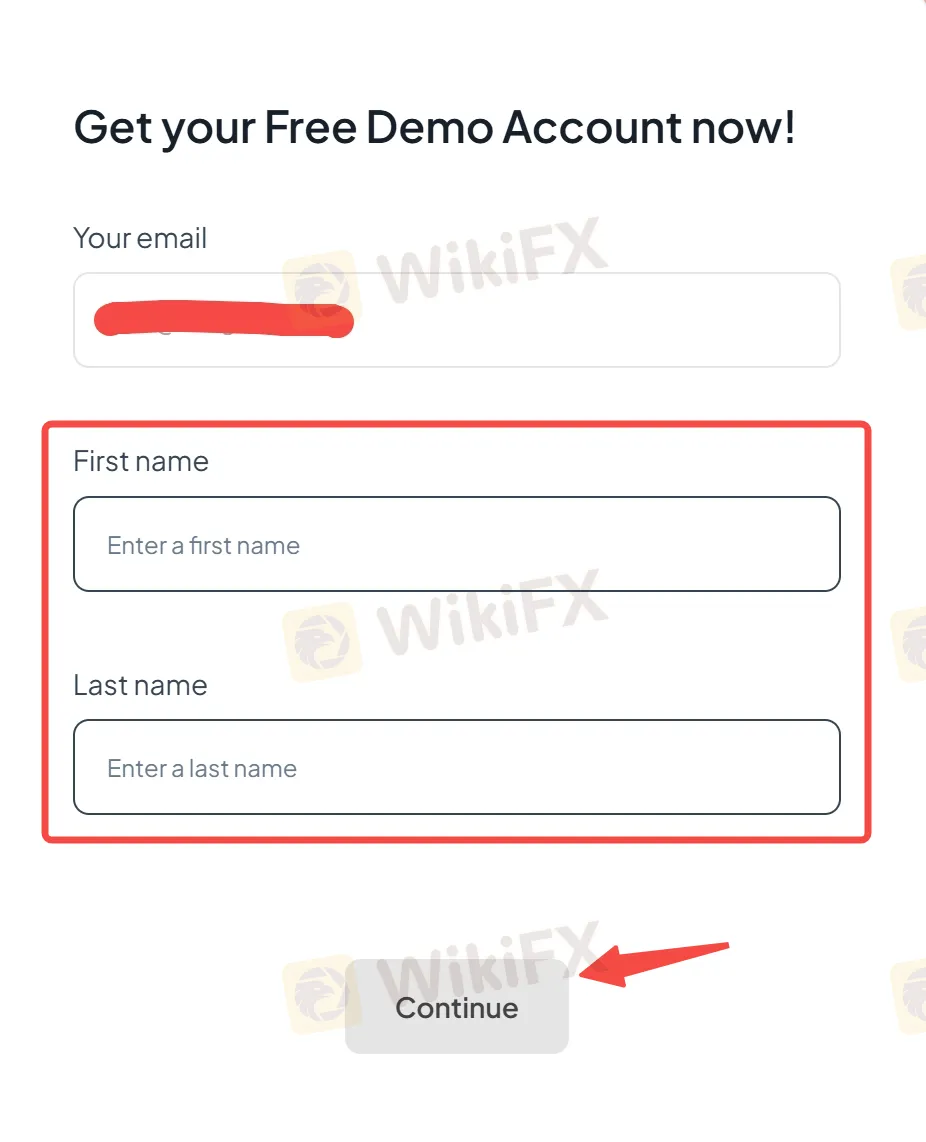

Step 5: Fill in your first name and last name, then click on 'Continue'.

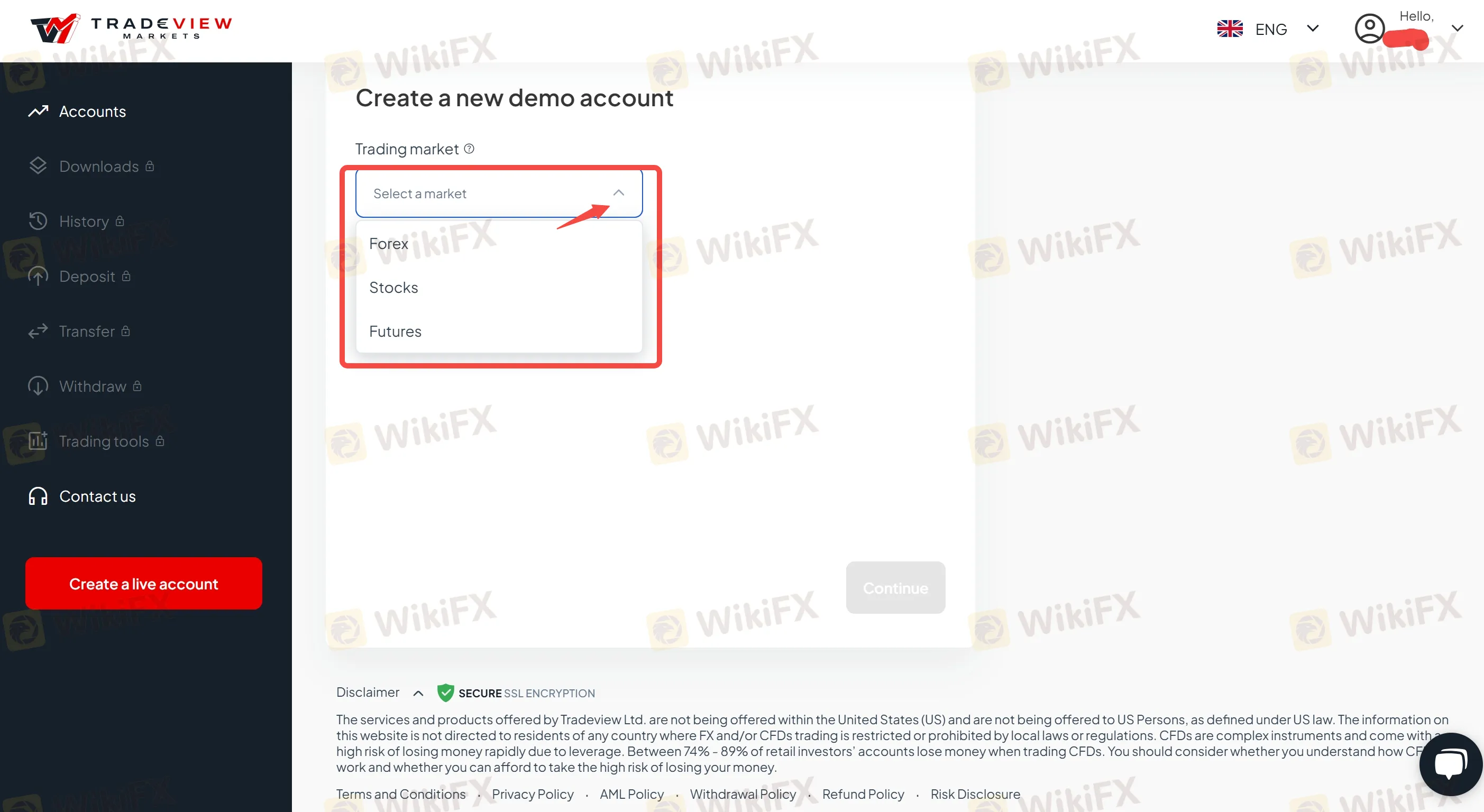

Step 6: Select the trading market that you want to trade, forex, stocks, or futures.

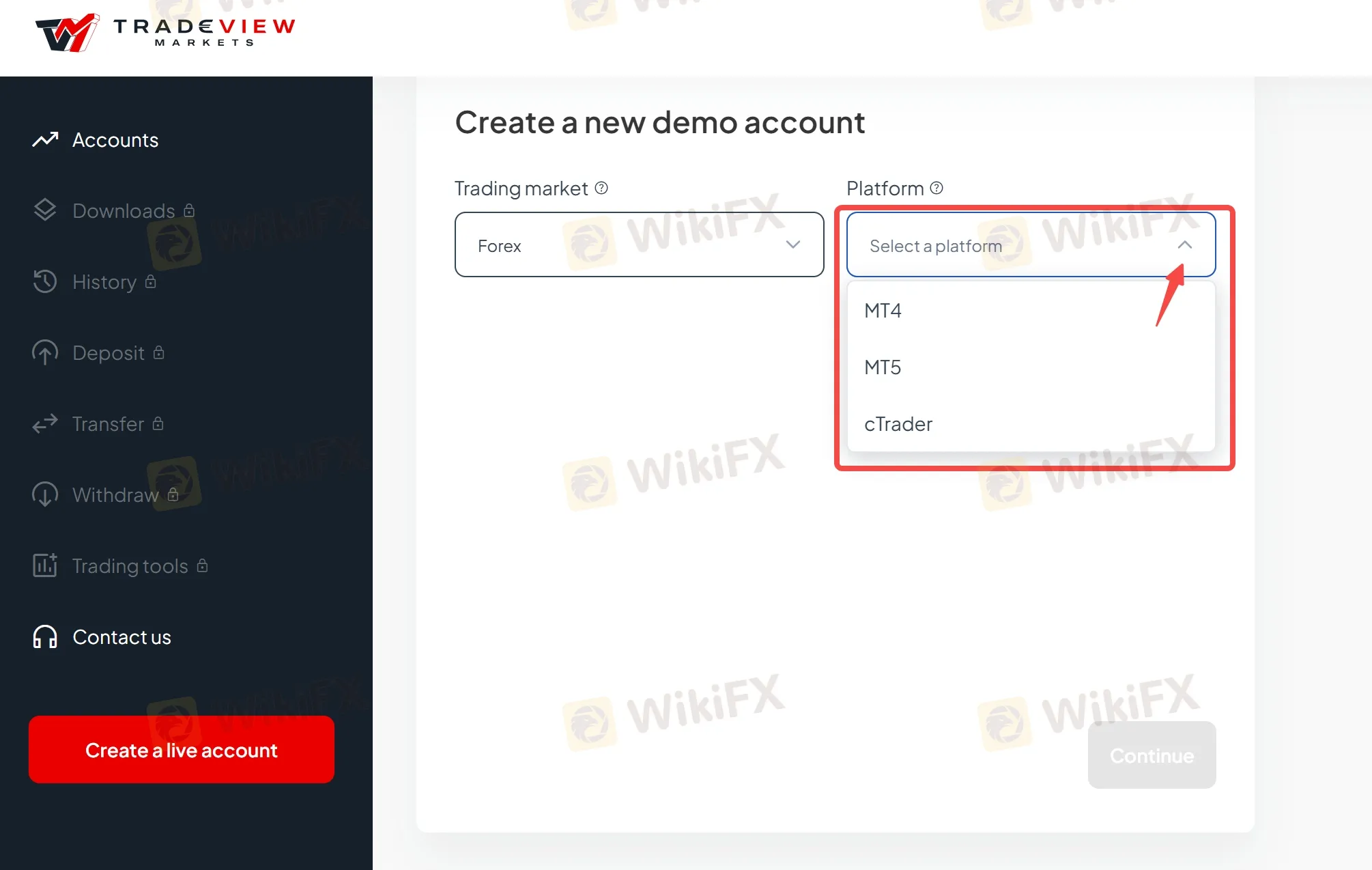

Step 7: Select your trading platform.

- Forex: If you select the forex market, then your platform can be MT4, MT5, or cTrader.

- Stocks: If you select stocks market, then your platform can be MT5, Sterling, Lightspeed, Takion, DAS, or API/FIX.

- Futures: If you select the futures market, then your platform is CQG.

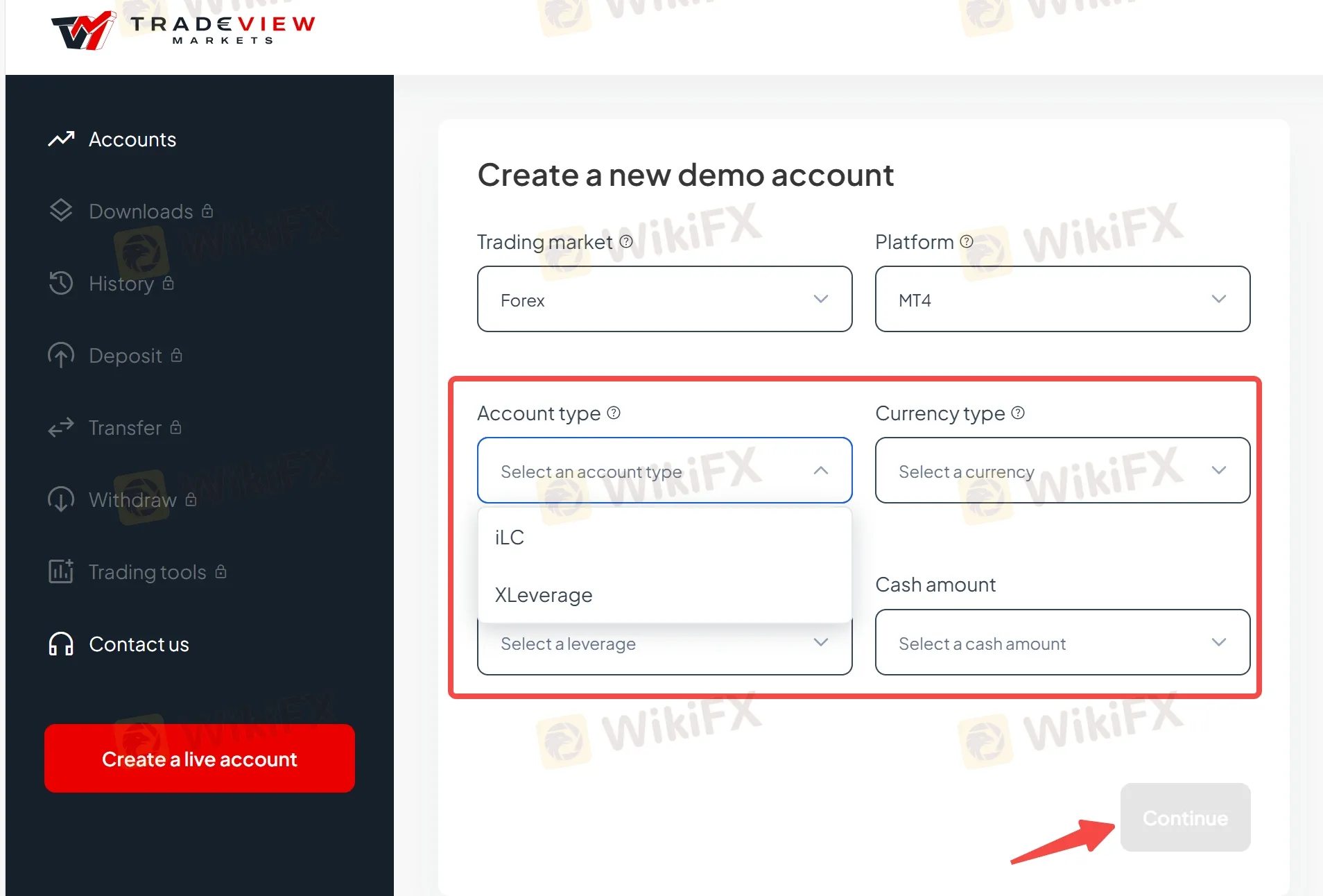

Step 8: Fill in other required information.

- Forex: If you select the forex market and MT4/5 platform, then you are required to select the account type (ILC or XLeverage), currency type (USD, EUR, JPY, CAD, or GBP), leverage (1:1, 1:10, 1:50, 1:100, 1:200, or 1:400), and cash amount (10,000, 50,000, 100,000, 500,000, or 1,000,000).

If you choose the cTrader platform, then you don't need to choose an account type and the currency type does not include GBP. Others are the same as the MT4/5.

- Stocks: If you select the stock market and MT5 platform, then you are required to select leverage (1:1 or 1:5) and cash amount (10,000, 50,000, 100,000, 500,000, or 1,000,000).

If you select other trading platforms, then you do not need to select leverage and cash amount.

Click on 'Continue'.

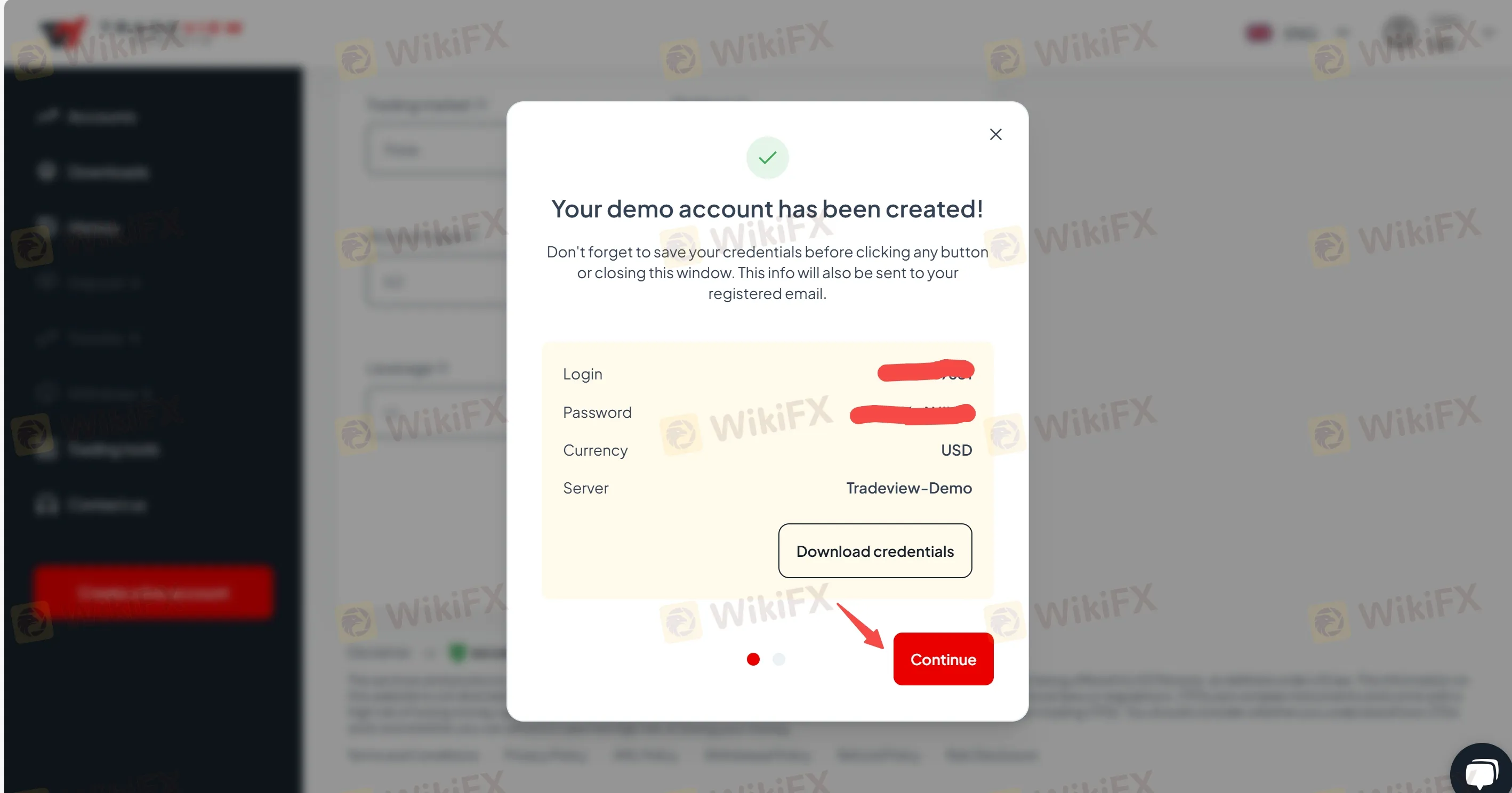

Step 9: Now, your demo account has been created.

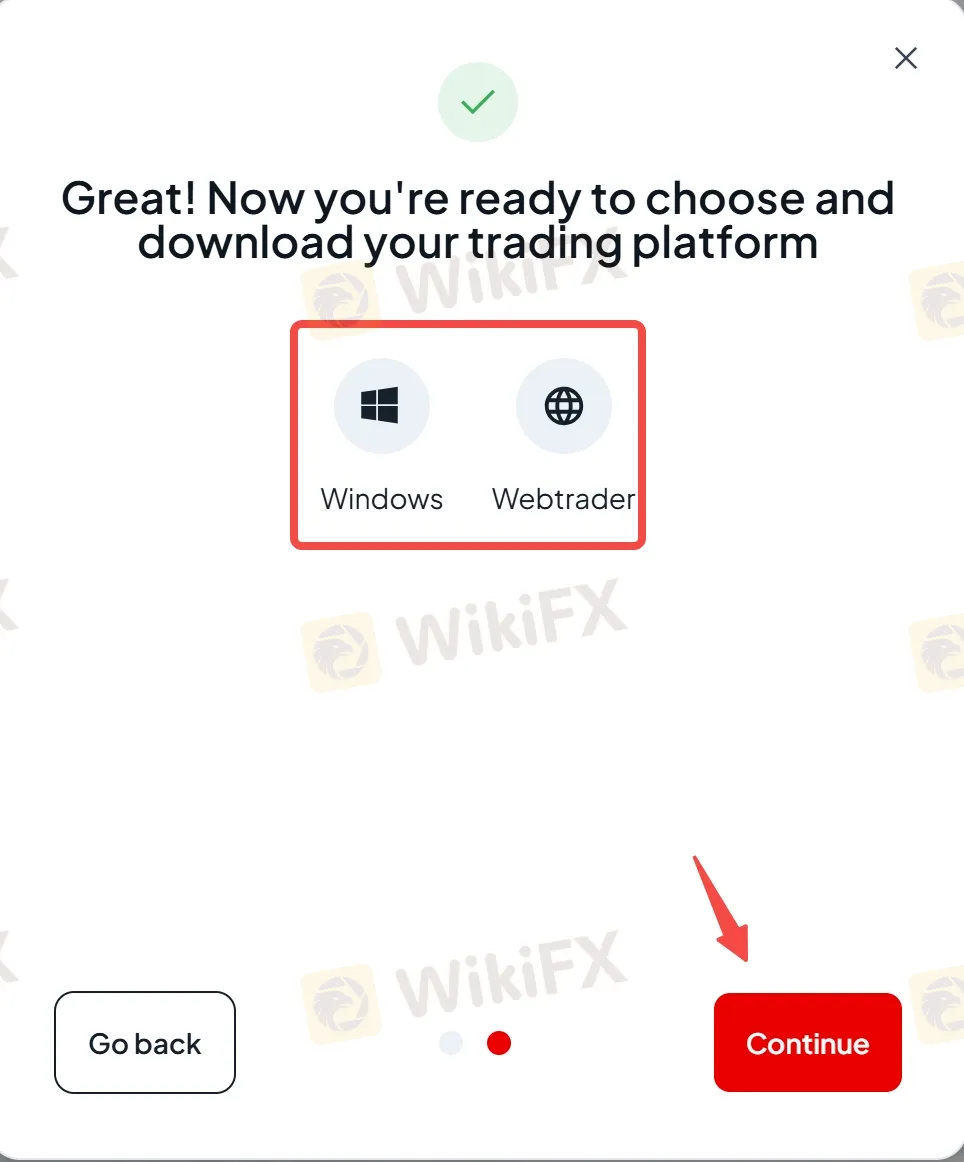

Click on 'Continue' to choose and download your trading platform, Windows or Webtrader.

Click on 'Continue' to finish your Tradeview demo account registration.

Tradeview Live Account Opening (6 Steps)

Like Tradeview demo accounts opening, Tradeview live account opening varies on the trading markets, too.

Step 1: Go to Tradeview's official website and click on 'Get Started' or 'Open a live account'.

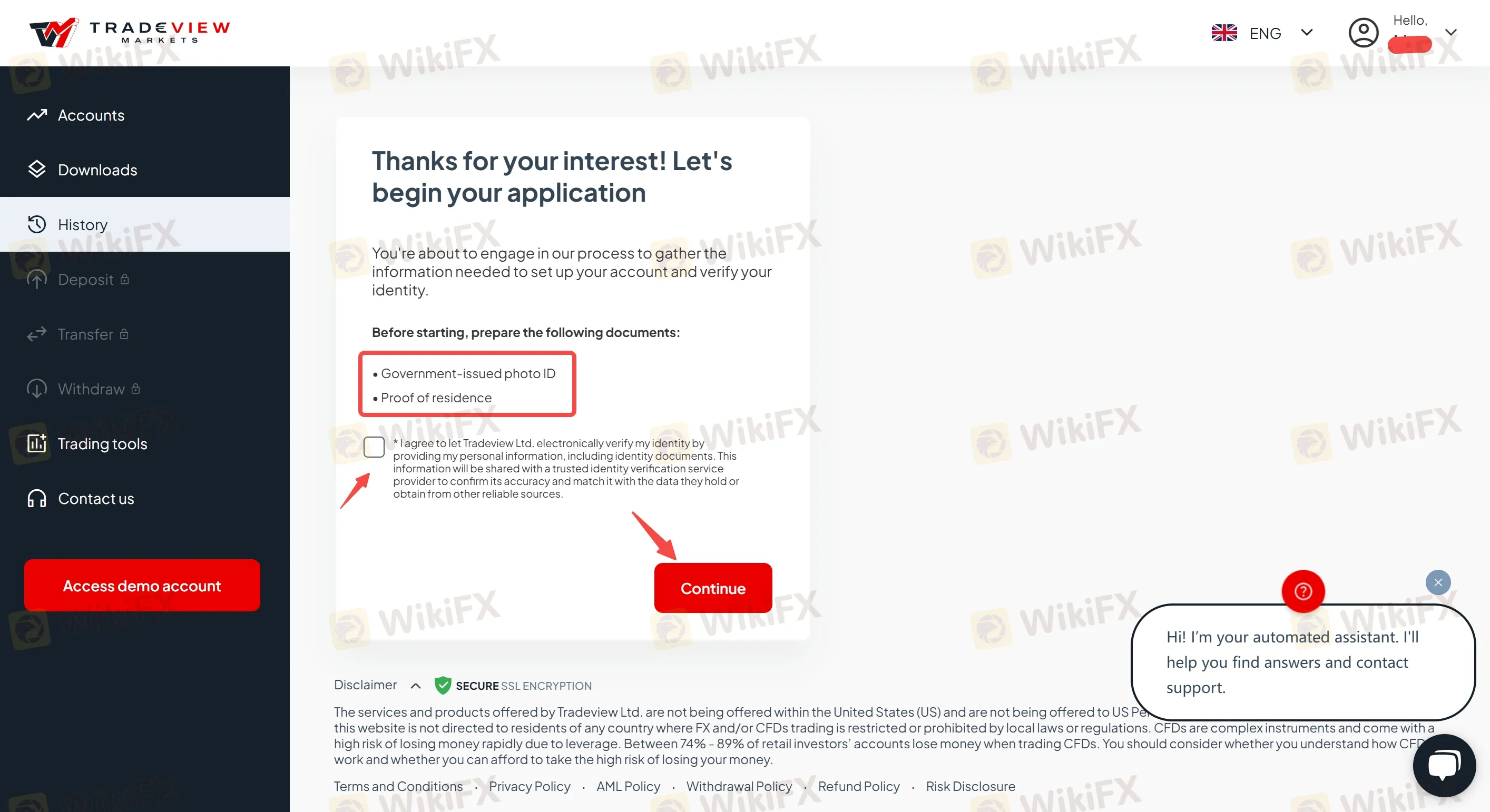

Step 2: Before starting your Tradeview live account registration, please ensure that you have prepared the following documents:

- Government-issued photo ID

- Proof of residence

Tick the terms of the Client Agreement.

Then click on 'Continue'.

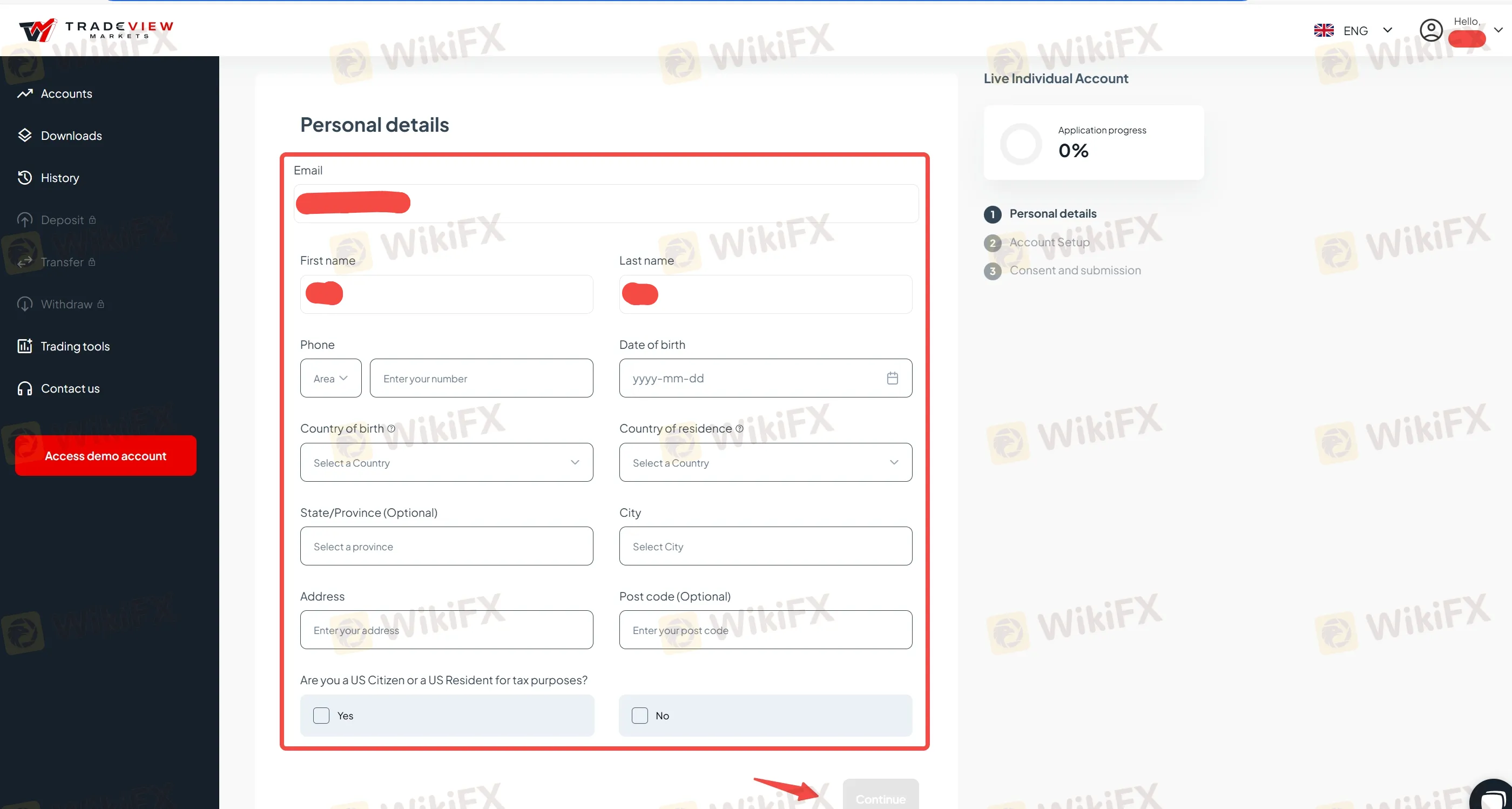

Step 3: Fill in personal details, including your email address, first name, last name, phone number, date of birth, country of birth, country of residence, state/province (optional), city, address, and postcode (optional).

Answer the question of whether you are a US citizen or a US resident for tax purposes. If your answer is 'Yes', then you cannot continue with your application. If your answer is 'No', then you can continue.

Click on 'Continue'.

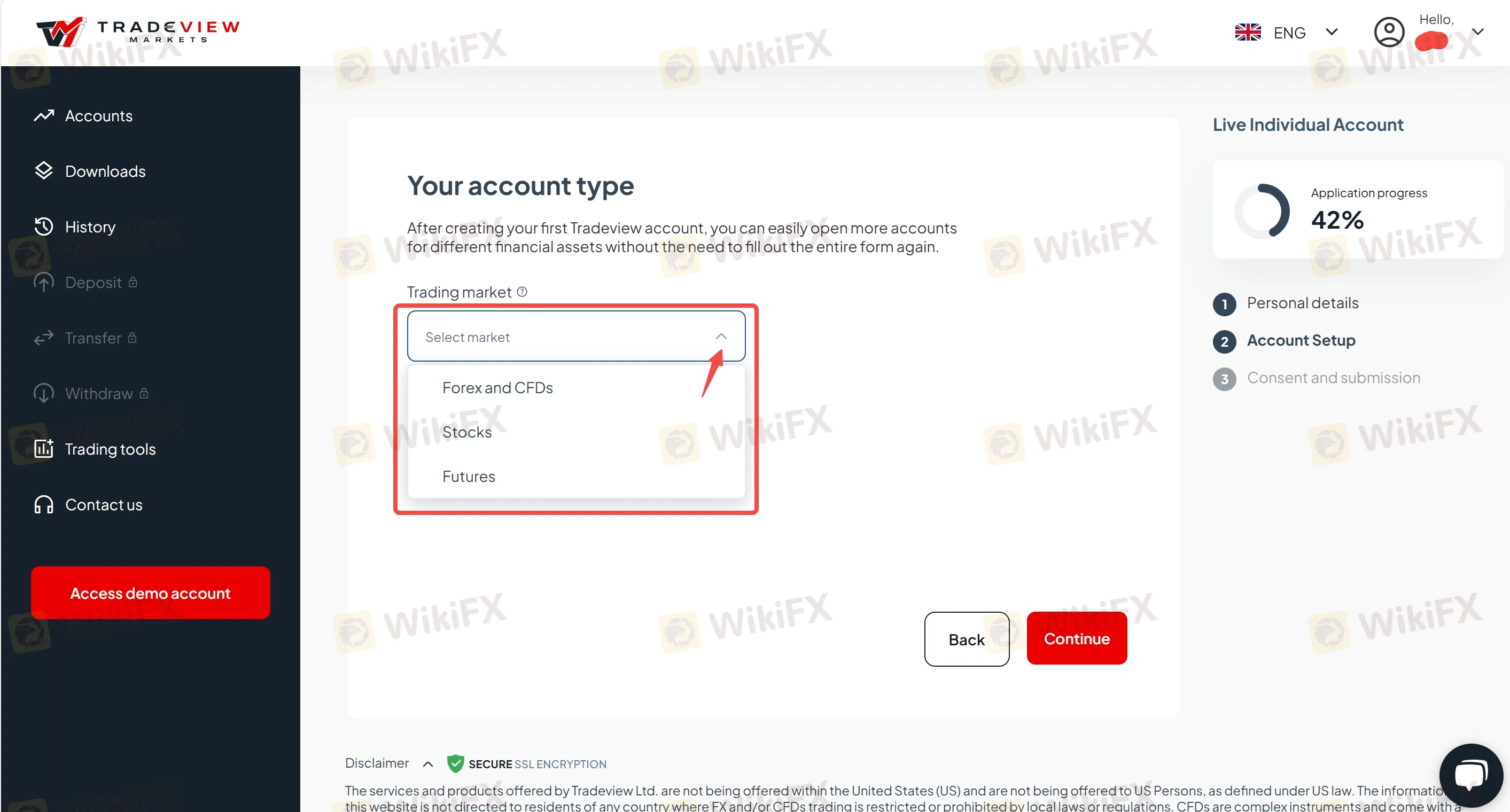

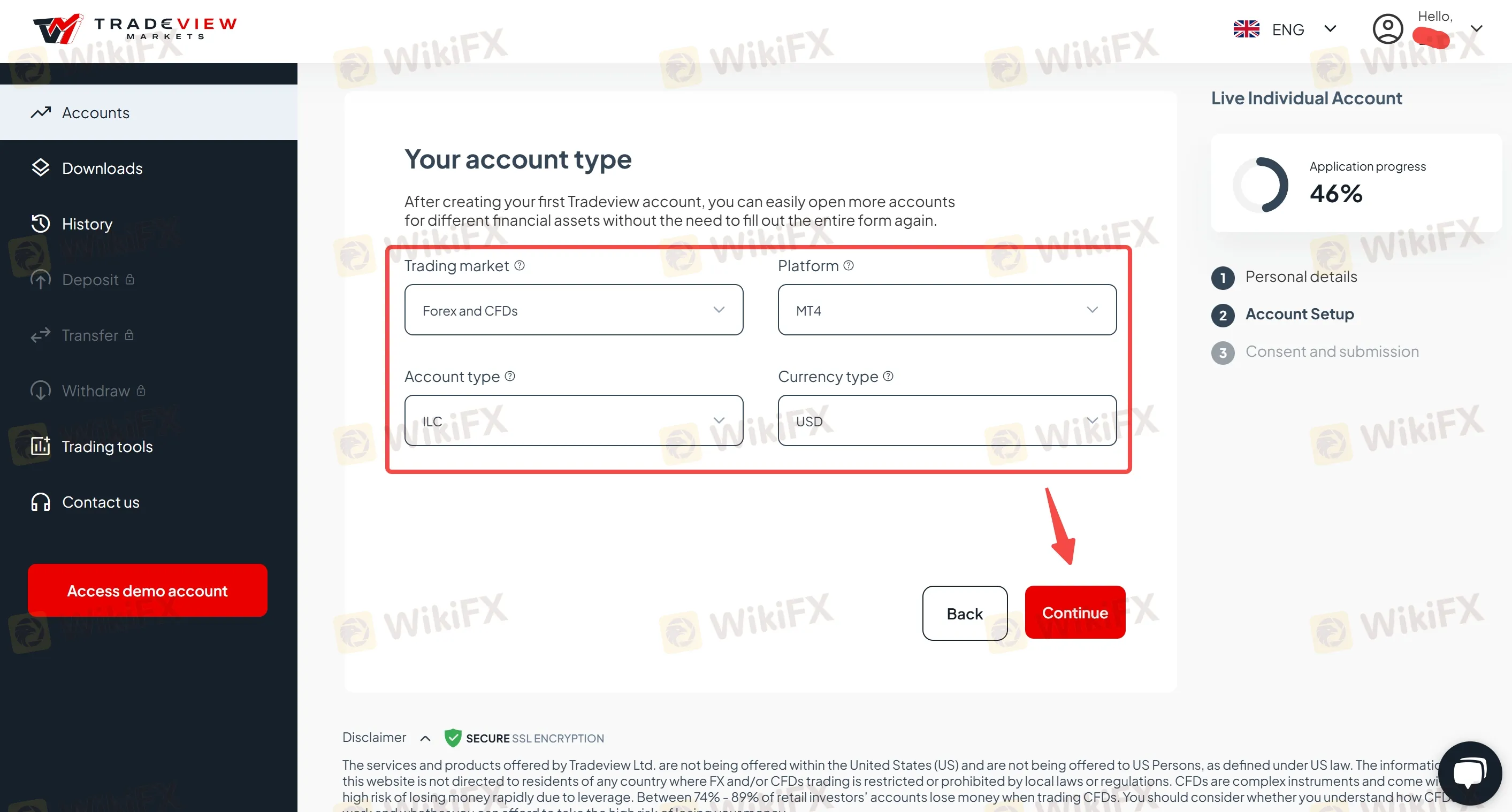

Step 4: Select your trading market, forex and CFDs, stocks, or futures.

Step 5: Fill in other required information.

- Forex and CFDs: If you select the forex/CFDs market and the MT4/5 platform, then you can select your account type between ILC and XLev, and select your currency type between USD, EUR, JPY, AUD, CAD, CHF, GBP, and MXN.

If you select the cTrader platform, then the ILC account is your only choice and you can also select your currency type between USD, EUR, JPY, AUD, CAD, CHF, GBP, and MXN.

- Stocks: If you select the stock market, then you are required to select your trading platform (MT5, Sterling, Lightspeed, Takion, DAS, or API/FIX) and currency type (USD only).

- Futures: If you select the futures market, then you are required to select your trading platform (CQG or API/FIX) and currency type (USD only).

Then click on 'Continue'.

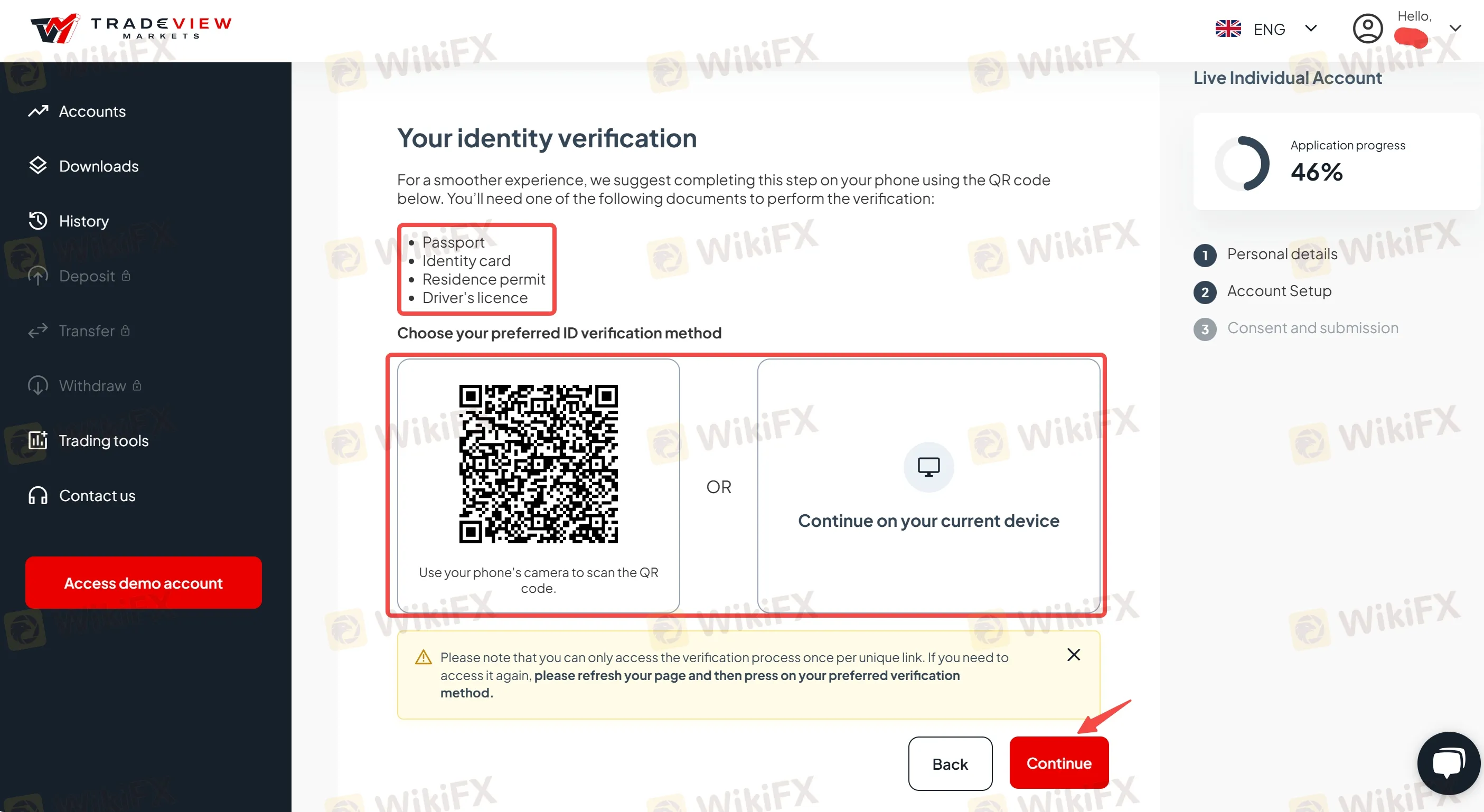

Step 6: Verify your identity. You need to prepare the following documents:

- Password

- Identity card

- Residence permit

- Driver's license

Choose your preferred ID verification method, use your phone's camera to scan the QR code or continue on your current device.

Then click on 'Continue' to follow the directions.

Broker Comparison: Tradeview vs Vantage

| Logo |  |  |

| Broker | Tradeview | Vantage |

| Regulation | LFSA | ASIC, FCA, CIMA/VFSC (Offshore), FSCA (General Registration) |

| Segregated Account | ✔ | ✔ |

| Negative Balance Protection | ✔ | ✔ |

| Demo Account | ✔($1,000,000 in virtual funds) | ✔($100,000 virtual credit) |

| Islamic Account | - | - |

| Account Minimum | $100 | $50⭐ |

| Maximum Leverage | 1:500 | 1:500 |

| Average Trading Cost (EUR/USD) | 0.1 pips⭐ | 1.1 pips |

| MetaTrader 4 (MT4) | ✔ | ✔ |

| MetaTrader 5 (MT5) | ✔ | ✔ |

| cTrader | ✔ | ❌ |

| TradingView | ❌ | |

| Proprietary Platform | ❌ | Vantage App, ProTrader |

| Copy/Social Trading | ✔ | ✔ |

| Promotion | ❌ | ✔ |

| Best for | Beginners | Beginners |

FAQs

Is Tradeview regulated?

Yes. Tradeview is regulated by the Labuan Financial Services Authority (LFSA) in Malaysia with license No. MB/19/0037.

Are my funds safe and segregated on Tradeview?

Yes. For the security of their clients' funds, Tradeview offers segregated accounts, regular audits, negative balance protection, and risk management tools.

Does Tradeview provide demo accounts?

Yes. Tradeview offers demo forex/stocks/futures accounts. You can find details in the 'Tradeview Demo Account' section.

Does Tradeview offer MAM/PAMM accounts?

Yes. Tradeview offers MAM accounts. You can click https://www.tvmarkets.com/en/services/multimam/ to learn more.

Which platforms does Tradeview offer?

Tradeview offers the MT4/5 and cTrader platforms.

How do I oen a Tradeview account?

You can click on 'Get Started' at the top right corner of Tradeview's homepage, then follow the directions to complete the account registration. Also, you can follow our step-by-step Tradeview account opening guide in the 'How do I Open a Tradeview Demo Account?' and 'How do I Open a Tradeview Live Account' sections.

Can I use different currencies to deposit into Tradeview?

Yes. Tradeview accepts USD, EUR, JPY, CAD, and GBP.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

WikiFX Broker

Latest News

How Crypto Trading Transforms FX and CFD Brokerage Industry

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

Exposed: Deceptive World of Fake Trading Gurus – Don’t Get Fooled!

AI-Powered Strategies to Improve Profits in Forex Trading

Stock Market Trading Volume Drops by 97.58 Billion Naira This Month

Why does your mood hinder you from getting the maximum return from an investment?

Currency Calculator