简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

How To Trade Based on Support and Resistance Levels?

Abstract:The best way to determine the target price is to determine the support point and resistance point. The support point and the resistance point ( S & R ) are specific price points on the chart that are expected to attract the maximum buy or sell volume. The support price is the expected price of more buyers than sellers. Similarly, the resistance price is the expected seller more than the buyer 's price.

The best way to determine the target price is to determine the support point and resistance point. The support point and the resistance point ( S & R ) are specific price points on the chart that are expected to attract the maximum buy or sell volume. The support price is the expected price of more buyers than sellers. Similarly, the resistance price is the expected seller more than the buyer 's price.

Traders can independently use S & R to identify transaction entry points.

What is Support and Resistance?

The support level and the resistance level are the horizontal price level, which usually connect the high point of the price bar with other high points of the price bar, or connect the low point of the price bar with other low points of the price bar to form a horizontal level on the price chart.

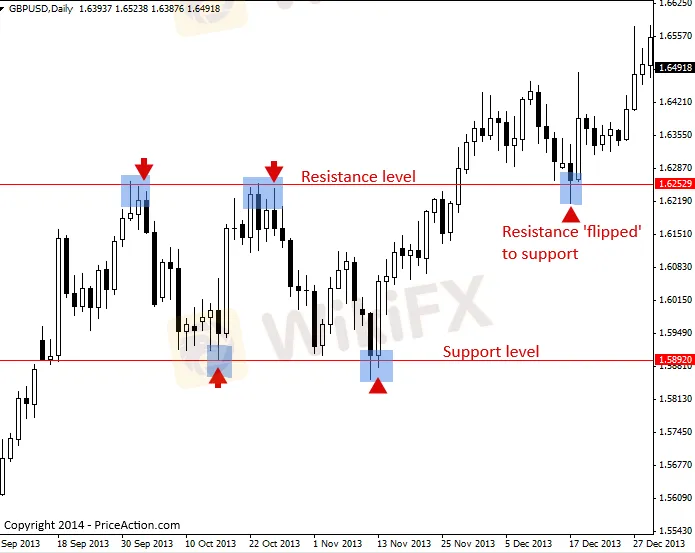

When the market price trend reverses and changes direction, leaving peaks or troughs ( oscillation points ) in the market, it will form a support or resistance level. The support level and the resistance level can draw the trading range. As shown in the following figure, they can also be seen in the trend market, because the market retreats and leaves a shock point.

Prices usually respect these support and resistance levels. In other words, they tend to suppress price movements until prices break through them.

In the figure below, we see an example where the support and resistance positions contain prices within the trading range. The trading range is only included in the price area between the parallel support position and the resistance position, as shown in the following figure.

Another main way of generating support and resistance in the market is from the fluctuation point in the trend.

With the emergence of market trends, it will retreat, and this retreat will leave a ' swing point ' in the market, the upward trend looks like a peak, in the downward trend looks like a trough.

In an upward trend, after prices break through the old highs, the old highs tend to become support levels, and then pull back to test them. In the downward trend, the opposite is true; after prices break through the old lows, the old lows tend to become resistance levels, and then pull back to test them.

The following is an example of the market testing the previous swing point ( support level ) in the downward trend. Please note that when the market falls back to test the old support level, the level will be shown as a ' new ' resistance level, and usually the price will remain unchanged. It is wise to look for entry points when the trend falls back and test these previous swing points ( see the needle sell signal in the figure below ), because the trend is most likely to recover at these levels, thereby creating low-risk / high-return potential:

How to Use Support Position and Resistance Position

One of the best uses of the support and resistance levels is for opening and closing positions, combined with effective risk management settings. Some practical uses include :

1.Profit. This is the profit settlement price. That is to say, when the price is close to the support line ( from above ), short sellers can make a profit. On the contrary, when the price is close to the resistance line ( from below ), long traders can gain a profit.

2.Establish new positions near the unbroken level. When the price is close to the support level, technology-driven investors tend to set buy limit orders near and above the defined support level, on the contrary, set sell limit orders near and below the resistance level.

3.Establish new positions when breaking a certain level. When the support line breaks through, investors can establish short positions because the technology expects the price to enter the next ( lower ) support position. On the contrary, if the resistance line breaks, investors can buy it, because the expected price will enter the next ( higher ) resistance level ( if any ).

4. Stop loss setting. Breaking through a certain level can also be used to limit losses. You can not only use the opportunity to break through support or resistance to establish a new position, but also use it to minimize losses. Loss positions should be withdrawn immediately. The signal to do this comes from breaking through the support or resistance position.

Once the breakthrough, the supporting position and the resistance position will exchange roles. This is a key aspect of identifying the support position and the resistance position: once a certain level ( whether it is a support position or a resistance position ) is broken, the technical characteristics of the level will reverse. That is to say, the support position of the breakthrough now becomes the resistance position, and the resistance position of the breakthrough now becomes the support position. As shown in the following figure.

Main and Secondary Support and Resistance Positions

The smaller support position and resistance position will not last. For example, if the price shows a downward trend, it will create a low point, then rebound, and then begin to fall again. Since prices do stagnate and bounce back from that level, the low can be marked as a small support line ( area ). However, due to the downward trend, the price may eventually fall below the small support line without any problem.

Smaller support or resistance areas provide analytical insights and potential trading opportunities. In the above example, if the price does fall below the smaller support line, then we know that the downward trend is still intact. However, if the price stagnates and rebounds at or near the previous low point, an interval may be formed. If prices stagnate and rebound above the previous low, then we will have a higher low, indicating that the trend may change.

The main support lines and resistance lines ( regions ) are the price levels that have recently led to a trend reversal. If the price rises and then reverses to a downward trend, the price at which the reversal occurs is a strong resistance line. The place where the downward trend ends and the upward trend begins is a strong support line.

When the price returns to the main support line or resistance line, it usually tries to break through the line and move in another direction. For example, if the price falls to the strong support line, it usually rebounds from the line. The price may eventually break through the line, but usually the price will fall back several times from this level.

Tips on Support and Resistance

Don't get too addicted to trying to draw each small level on the chart. The goal is to find the key daily chart levels, as we show in the example above, because these are the most important levels.

The support or resistance horizontal line you draw does not always touch the ' accurate ' high or low point of the bar chart to which it is connected. Sometimes, it is also possible if the line is connected to a bar chart slightly downward from the high point or slightly upward from the low point. It's important to realize that this is not an exact science, but a skill and an art that you can improve through training, experience and time.

If you are not sure whether to take a specific price action admission signal, ask yourself whether it is in the key support or resistance level. If it is not in the key support or resistance position, it is best not to adopt the signal.

If the price trading strategy ( e.g. pin bar, fakey or inside bar strategy ) is formed at the support or resistance level of the market convergence, the chance of success will be greatly increased.

Advantages of Using Support and Resistance

The trading of support and resistance has many advantages. First, it provides a clear entry point and exit point based on the objective price level. These levels are easy to identify on the price chart, allowing traders to make structured trading plans. In addition, the support and resistance strategies can be applied to different time ranges to make them suitable for short-term trading and long-term investment.

The support level and the resistance level are also intuitive ways to measure market sentiment. When combined with technical indicators such as moving averages or RSI, they can fully reflect market conditions.

The Disadvantages of Relying on Support and Resistance

Trading only based on support and resistance has its limitations. Financial markets are unpredictable, and false breakthroughs or unexpected market events can cause price levels to fail. If the market suddenly changes, excessive reliance on historical levels may lead to missed opportunities.

In addition, the support and resistance positions are not always accurate. The price may hover around the support or resistance level for a period of time, so it is uncertain whether the level will be maintained. Therefore, traders should consider using other technical tools to supplement the support and resistance analysis.

What Tools are Available to Identify Support and Resistance

The following platforms have chart software that can be used to identify support and resistance :

TradingView: Provides customizable charts with real-time data, multiple indicators, and the ability to draw trend lines to identify support and resistance.

MetaTrader 4 / 5: Provide advanced charting tools and custom indicators.

StockCharts: Free basic charts and customizable tools to identify key price levels

Use Other Indicators to Supplement Support and Resistance

The following tools can enhance decision-making by providing more confirmation signals :

Moving average: Identify trends and potential support or resistance levels when prices interact with key moving averages ( such as 50 days or 200 days ).

Relative Strength Index ( RSI ): helps to determine the overbought or oversold situation near the support or resistance level, indicating a potential reversal.

Bollinger Bands: When the price approaches the upper band, it may indicate a resistance level, while the lower band can suggest support. A price move outside the bands may signal overbought or oversold conditions, enhancing the likelihood of reversals at these key levels.

Volume: To confirm the strength of the support or resistance level, traders should observe the trading volume. Larger trading volume is usually accompanied by major breakthroughs or rebounds at key levels, indicating that the trend is more reliable. On the contrary, the low volume during the price change indicates that the market confidence is weak, indicating that there may be a false breakthrough or rebound.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

WikiFX Broker

Latest News

Exposing the Top 5 Scam Brokers of March 2025: A Closer Look by WikiFX

Gold Prices Climb Again – Have Investors Seized the Opportunity?

Webull Launches SMSF Investment Platform with Zero Fees

Australian Regulator Warns of Money Laundering and Fraud Risks in Crypto ATMs

FCA Warns Against 10 Unlicensed or Clone Firms

CySEC Warns Against 14 Unlicensed Investment Websites

Top Currency Pairs to Watch for Profit This Week - March 31, 2025

Will natural disasters have an impact on the forex market?

Philippines Deports 29 Indonesians Linked to Online Scam Syndicate in Manila

The Withdrawal Trap: How Scam Brokers Lure Victims into Paying More

Currency Calculator