简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

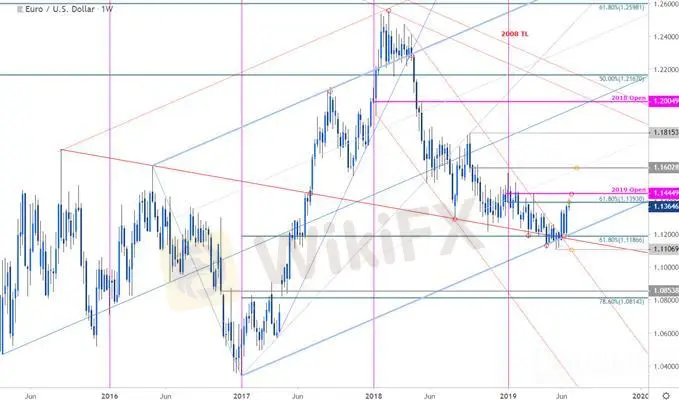

Euro Weekly Price Outlook: EUR/USD Breakout Eyes Yearly Open into Q3

Extracto:Euro has rallied more than 2.7% off the yearly lows with the advance now testing initial resistance targets. Here are the levels that matter on the EUR/USD weekly chart.

Weekly technicals on EUR/USD- Breakout testing key resistance targets into close of June / 2Q

每周技术面欧元/美元 - 突破测试6月/ 2季度关键阻力目标

The Euro is virtually unchanged against the US Dollar since the start of the week with price holding just below yearly Fibonacci resistance into the close of the month / quarter. These are the updated targets and invalidation levels that matter on the EUR/USD weekly chart. Review this weeks Strategy Webinar for an in-depth breakdown of this Euro setup and more.

欧元兑美元自此基本未变本周初,价格保持在年度斐波纳契阻力位于月/季度收盘价之前。这些是欧元/美元周线图上重要的更新目标和失效水平。回顾本周的战略网络研讨会,深入了解欧元设置等。

New to Forex Trading? Get started with this Free Beginners Guide

Forex Trading新手入门?开始使用此免费入门指南

EUR/USD Price Chart – Euro Weekly

欧元/美元价格走势图 - 欧元周报

Notes: In my last EUR/USD Weekly Price Outlook our ‘bottom line’ noted that, “Euro held long-term slope support for over two months with the breach above channel resistance this week shifting the focus back to the long-side as we head deeper into June trade.” The rally extended into initial weekly resistance targets this week at the 61.8% retracement of the yearly range at 1.1393 with more significant resistance is eyed just higher at the 2019 open at 1.1445- risk for near-term exhaustion heading into these levels. Critical support remains at 1.1187 with a break / close below 1.1107 needed to suggest a larger breakdown is underway.

注意:在我上一次欧元/美元每周价格展望中我们的'底线'指出,“欧元持有超过两个月的长期斜坡支撑位,本周突破通道阻力突破将焦点重新转移到长边,随着我们进一步深入6月交易。”反弹延伸至初始周线本周抵抗目标位于年度区间1.1393的61.8%回撤位,2019年开盘时的阻力位在1.1445附近,而近期疲惫的风险将进入这些水平。关键支撑位维持在1.1187,突破/收盘价低于1.1107需要表明正在进行更大的细分。

Bottom line: The Euro breakout is testing initial resistance targets here around 1.14 and while the broader focus remains higher, the advance is vulnerable near-term heading into the yearly open- Watch the weekly / monthly close tomorrow. From a trading standpoint, a good place to reduce long-exposure / raise protective stops. Be on the lookout for topside exhaustion here if price fails to close above- ultimately, well favor fading weakness while above 1.1270 targeting a test of 1.1445.Review my latest EUR/USD Technical Outlook for a closer look at the near-term Loonie trading levels.

底线:欧元突破正在测试1.14附近的初始阻力目标,而更广泛的焦点仍然更高,这一进展在短期内是脆弱的进入年度开放 - 观看明天的每周/每月收盘。从交易的角度来看,这是一个减少长时间曝光/提高保护性止损的好地方。如果价格未能收于上方,那么请关注上行疲惫 - 最终有利于消退弱势,同时高于1.1270,目标是测试1.1445。回顾我的近期欧元/美元技术展望,仔细研究近期Loonie交易水平。

EUR/USD Trader Sentiment

EUR / USD Trader情绪

A summary of IG Client Sentiment shows traders are net-short EUR/USD - the ratio stands at -1.5 (40.1% of traders are long) – bullish reading

IG Client Sentiment的摘要显示交易者是网络空头欧元/美元 - 该比率为-1.5(交易者持有多头的40.1%) - 看涨读数

Traders have remained net-short since June 20th; price has moved 0.6% higher since then

交易商自6月以来一直保持净空头20;此后价格已上涨0.6%

Long positions are 0.9% lower than yesterday and 9.2% lower from last week

多头头寸比昨天低0.9%,比上周下降9.2%

Short positions are 1.9% higher than yesterday and 39.4% higher from last week

空头头寸比昨天增加1.9%,比上周增加39.4%

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise. Traders are further net-short than yesterday and last week, and the combination of current positioning and recent changes gives us a stronger EUR/USD-bullish contrarian trading bias from a sentiment standpoint.

我们通常采取逆向观点来看待人群情绪,而交易商净空头表明欧元/美元价格可能继续上涨。交易商的净空头比昨天和上周还要短,目前的定位和最近的变化相结合,使我们从情绪的角度看待欧元兑美元看涨的逆势交易偏差。

{21}

Key Euro / US Data Releases

{21}

Economic Calendar - latest economic developments and upcoming event risk. Learn more about how we Trade the News in our Free Guide!

Economic Caendar - 最新的经济发展和即将发生的事件风险。了解我们如何在我们的免费指南中交易新闻!

Previous Weekly Technical Charts

以前的每周技术图表

Canadian Dollar (USD/CAD)

加拿大元(美元/加元)

Crude Oil (WTI)

原油(WTI)

US Dollar (DXY)

美元(DXY)

Gold (XAU/USD)

黄金(XAU / USD)

{28}

Kiwi (NZD/USD)

{28}{29}

Japanese Yen (USD/JPY)

{29}

Aussie (AUD/USD)

澳元(澳元/美元)

Descargo de responsabilidad:

Las opiniones de este artículo solo representan las opiniones personales del autor y no constituyen un consejo de inversión para esta plataforma. Esta plataforma no garantiza la precisión, integridad y actualidad de la información del artículo, ni es responsable de ninguna pérdida causada por el uso o la confianza en la información del artículo.

Brokers de WikiFX

últimas noticias

La CNMV alerta de 7 entidades no registradas.

ATFX ganó “Best Online Trading Company Global 2024” en World Business Outlook Awards 2024.

¿Qué son las opciones binarias y cómo funcionan?

Cálculo de tasa de cambio