简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Euro Eyeing ECB Rate Decision, Commentary and Eurozone GDP

abstrak:Euro traders will be watching tomorrows ECB rate decision and listening for key commentary from officials following the release of Eurozone GDP.

EURO TALKING POINTS – EUR/USD, ECB RATE DECISION, EUROZONE GD

ECB expected to hold rates – comments in focu

Will Eurozone GDP data fall short of estimates?

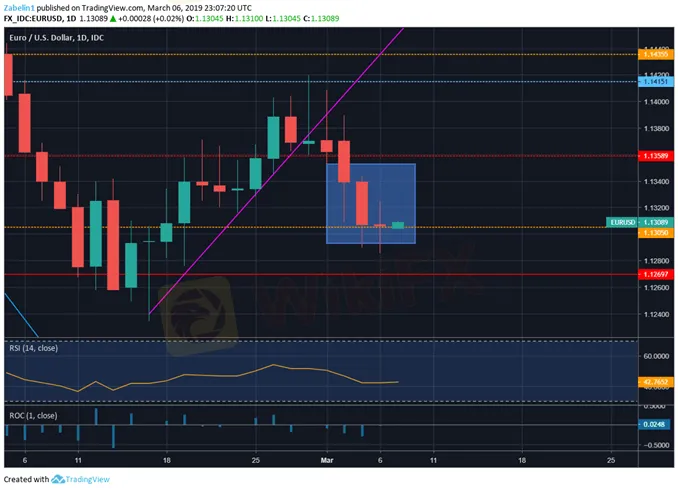

EUR/USD to break through 1.1305 key support?

See our free guide to learn how to use economic news in your trading strategy!

The Euro may break below a key support at 1.1305 if commentary from the ECB signals greater pessimism over Eurozone growth. Officials are expected to keep rates on hold while the Continent wrestles with slower growth in key Eurozone economies and unprecedented political fragmentation. Significant moves in the Euro will not likely stem from the actual rate decision but from the comments that will follow.

EUR/USD- Daily Chart

The ECB is anticipated to cut its outlook to such a degree that it may warrant the renewal of Targeted Long-Term Refinancing Operations (TLTROs) in effort to provide stimulus. Anticipation of slower growth and lower yields was a possible reason why Italian, French and German bond prices all edged higher. Bond prices and yields move inversely to each other.

Chart Showing German, Italian, French Bond Price

Eurozone GDP is scheduled to be released a few hours before the ECB announcement which may make Euro traders jittery. Preliminary forecasts show seasonally-adjusted year-on-year growth at 1.2 percent. With Italy in a technical recession and German growth showing stagnation, the possibility of overperforming GDP does not appear very likely.

Looking ahead, fears surrounding the uncertainty of Brexit and US-China trade relations may continue to weigh on risk appetite. Additional anxiety Euro traders may face is a possible eruption of an EU-US trade conflict. This concern re-emerged after President Trump received a report from the Commerce Department outlining potential threats posed by importing autos.

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Broker ng WikiFX

Exchange Rate