简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Pangmatagalang Estratehiya sa Forex Trading (Bahagi 2)

abstrak:Alamin natin ang ilang Pangunahing Kaalaman sa Forex !

Unang Bahagi : https://cutt.ly/ZkW93to

Long-term Trading - Does Long-term Graphic Offer Less Configurations?

Yes, generally, there are less trading configurations available on longer periods than on shorter periods. The good news is that long-term one often offers less false breaks and less action and solid price trends.

Long-term configurations also tend to develop more slowly and efficiently. This is another advantage for longer periods because it creates less stress and fear during trading. Traders can take their time to evaluate carefully all angles and plan their next steps with care.

Long Term Investment vs. Long Term Trading

First of all, everyone must decide how to allocate their own assets and funds. In case of doubt, consulting financial experts could be a good first step in the construction of a portfolio.

There are significant advantages of long-term trading in terms of buy-and-hold strategies.

The main advantage is that long-term traders can use graphics and technical analysis to plan entry and exit points. Their ability to read graphics in the long run allows them to refer to the most accurate entries and exits. This should give them a better chance of closing the profitable trades in a shorter period of time.

“What goes up must go down” is a famous dictator who refers to objects that return to Earth in reason of gravity. Sometimes, financial instruments and assets appear to be subject to the same laws of gravity: Finally, the price decreases more or less, in extreme cases, the bulge of activity is extinguished.

Long-term traders should be:

- Conscients that the price does not always increase;

- Ready for any modification of the assets price;

- Ready to execute their trading plan;

- Being consents to leave wagers and reduce losses is essential for successful trading;

- Ready that (temporal) trends and momentum help their trades;

- In terms of benefiting from both bullish and bearish movements.

In general, long-term traders are becoming more adaptable and independent. They can capitalize on shorter price movements, which can take place in weeks or months rather than years or decades. This reduces their exposure to the risk of open trades.

(To be continued ...)

Matuto nang higit pa sa pangunahing kaalaman sa Forex upang simulan ang iyong karera sa pangangalakal, i-download ang WikiFX APP ngayon:

- Android: t.ly/4stP

- iOS: t.ly/cr7F

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Magbasa pa ng marami

Mga Sesyon ng Forex Trading

Ngayong alam mo na kung ano ang forex, bakit mo ito dapat i-trade, at kung sino ang bumubuo sa forex market, oras na para malaman mo kung kailan ka makakapag-trade.

Kailan Maaari kang Mag-trade ng Forex?

Dahil lamang na ang forex market ay bukas 24 na oras sa isang araw ay hindi nangangahulugan na ito ay palaging aktibo! Tingnan kung paano nahahati ang forex market sa apat na pangunahing sesyon ng pangangalakal at kung alin ang nagbibigay ng pinakamaraming pagkakataon.

Demo Trade Iyong Daan sa Tagumpay

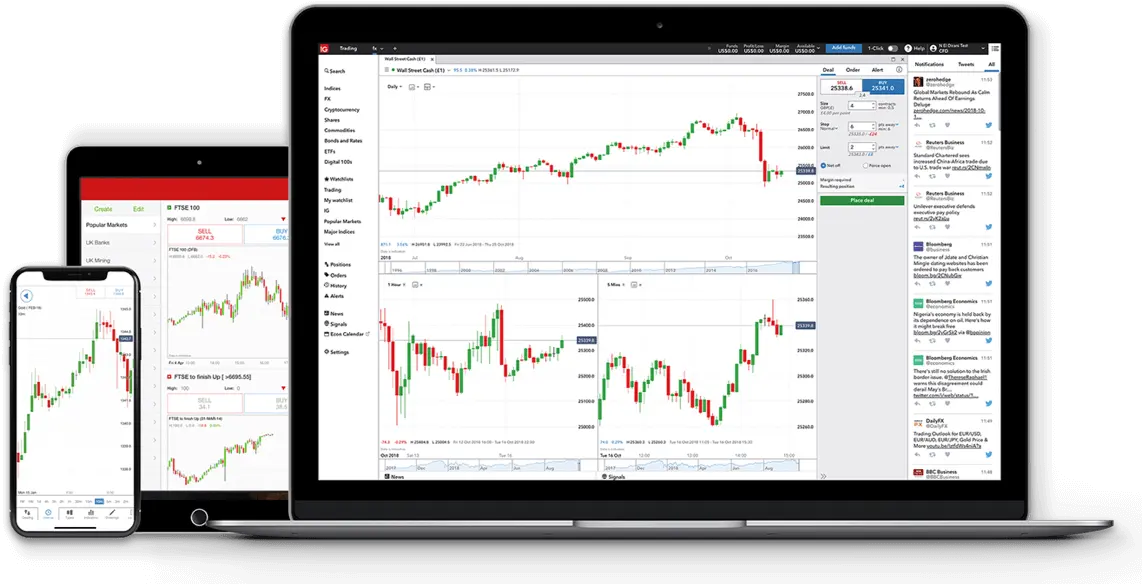

Maaari kang magbukas ng demo trade account nang LIBRE sa karamihan ng mga forex broker. Ang mga "pagpapanggap" na account na ito ay may karamihan sa mga kakayahan ng isang "tunay" na account.

Ano ang Spread sa Forex Trading?

Ang spread na ito ay ang bayad para sa pagbibigay ng agarang transaksyon. Ito ang dahilan kung bakit ang mga terminong "gastos sa transaksyon" at "bid-ask spread" ay ginagamit nang magkapalit.

Broker ng WikiFX

Pinakabagong Balita

Challenge Yourself: Transform from Novice to Expert

Exchange Rate