简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Pangmatagalang Estratehiya sa Forex Trading (Pangwakas na Bahagi)

abstrak:Alamin natin ang ilang Pangunahing Kaalaman sa Forex !

Ika-apat na Bahagi : https://cutt.ly/dlwanw9

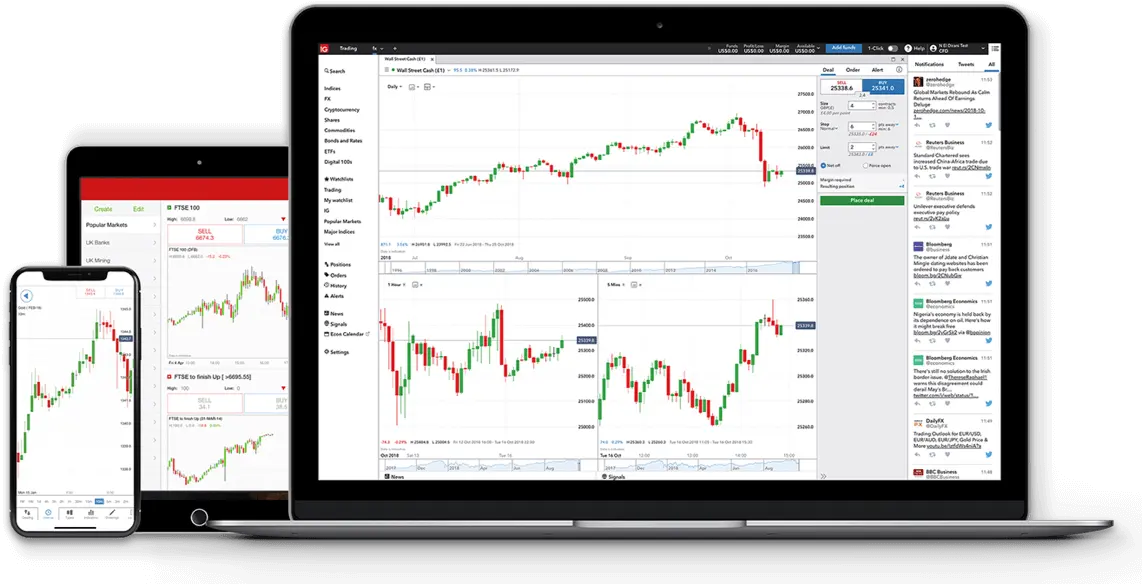

Investing for a Long Term - Long-Term Trading Account

To do long-term trading you need to have a suitable trading account. CFD trading accounts are not always suitable for long-term trading, due to swap fees. For this reason, traders use securities accounts for long-term trading or have a halal forex account.

Islamic trading accounts allow trading without swap fees. Thus, the traders can take longer term positions and swing trading. This can be especially interesting for traders on stock market indices such as the CAC 40, the DAX 30 or the Dow Jones.

Best Practices in Long-Term Forex Investing

Although strategies vary according to the knowledge and expectations of each person, there are always a few guidelines that are applicable for almost all long-term traders. These guidelines are primarily based on risk management and the nature of the Forex market.

Let's take a look and see what they are and how they could be implemented into one of your long-term Forex trading strategies. Also, these guidelines can potentially improve your trading strategy, especially in terms of long-term efficiency.

1. Use Reduced Leverage

When it comes to long-term trading, you should invest small amounts that constitute a small percentage of your trading margin. The main idea of long-term currency trading is to endure any intraday or even intra-week volatility easily.

We all know that a currency pair can easily move for a few hundred pips in a day. You should ensure that such price fluctuations will not represent negative results resulting in exiting your position. This is why it is vital to trade with the possible lowest leverage.

2. Beware of Trading Swaps

Long-term Forex trading can produce good income. However, you should understand that income does not always equal profits. Each trading instrument has Forex swaps, a fee for holding a position for nights. It is necessary to mention that a swap can sometimes be positive, yet in a few cases, it can be negative regardless of the direction of your position.

This is why it is essential to consider a possible expense regarding these, as sometimes your amount of pips earned will not be enough to compensate the expense to hold the position (over a long period of time). This is essential in profitable long-term Forex strategies. Sometimes you can even employ a strategy where the payoff of pips is small, but the trade is favorable for you.

3. The Risk/Reward Ratio

An important thing to remember is that even with the best long-term Forex trading strategy, you cannot achieve your targeted profit. This happens due to the fact that the leverage used for this type of position is too small. If your deposit is relatively tiny, you can expect proportionate returns.

That is why you should always consider the time spent on trading against the actual returns you will have. In most cases, long-term trading should be used with a relatively large capital and you should always seek to generate profits per position that are greater than the risk taken on those same positions.

(End.)

Matuto nang higit pa sa pangunahing kaalaman sa Forex upang simulan ang iyong karera sa pangangalakal, i-download ang WikiFX APP ngayon:

- Android: t.ly/4stP

- iOS: t.ly/cr7F

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Magbasa pa ng marami

Mga Sesyon ng Forex Trading

Ngayong alam mo na kung ano ang forex, bakit mo ito dapat i-trade, at kung sino ang bumubuo sa forex market, oras na para malaman mo kung kailan ka makakapag-trade.

Kailan Maaari kang Mag-trade ng Forex?

Dahil lamang na ang forex market ay bukas 24 na oras sa isang araw ay hindi nangangahulugan na ito ay palaging aktibo! Tingnan kung paano nahahati ang forex market sa apat na pangunahing sesyon ng pangangalakal at kung alin ang nagbibigay ng pinakamaraming pagkakataon.

Demo Trade Iyong Daan sa Tagumpay

Maaari kang magbukas ng demo trade account nang LIBRE sa karamihan ng mga forex broker. Ang mga "pagpapanggap" na account na ito ay may karamihan sa mga kakayahan ng isang "tunay" na account.

Ano ang Spread sa Forex Trading?

Ang spread na ito ay ang bayad para sa pagbibigay ng agarang transaksyon. Ito ang dahilan kung bakit ang mga terminong "gastos sa transaksyon" at "bid-ask spread" ay ginagamit nang magkapalit.

Broker ng WikiFX

Exchange Rate