简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Currency Pairs with the Highest Volatility in 2022

abstrak:You've probably heard of the word "volatility." If this is the case, we recommend that you read this article – Volatility Explained in Simple Words – to understand more about the subject.

In this section, we will discuss the most volatile currency pairings in the Foreign Exchange (Forex) market in 2022.

You're undoubtedly acquainted with the term “volatility.” If so, we propose that you read this article – Volatility Explained in Simple Words – to learn more about the issue.

It is important to realize that volatility, by definition, varies over time and is not a constant.

Volatility is a Relative Term

If you've ever traded in the Forex market or just observed price swings from the sidelines, you've probably noticed that prices move non-linearly on the chart.

There are occasions when the currency price remains static or changes only within a restricted band. In this scenario, we're talking about the market's minimal volatility.

On the other hand, when important economic data is released or authorities give a statement, the market price moves swiftly and dramatically. As a result, we may witness an uptick or perhaps a surge in volatility.

Consider the Forex Volatility Calculator to demonstrate the non-constant nature of volatility.

Before you begin using the tool, all you need to do is input the period in weeks over which you wish to assess volatility.

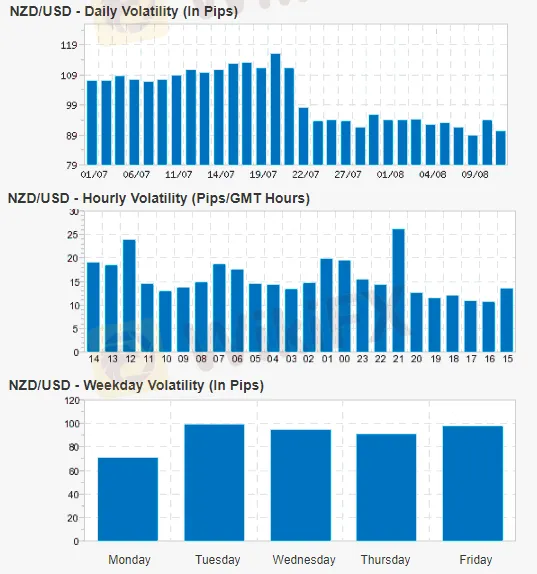

As an example, consider the NZD/USD (New Zealand currency vs. US dollar). On the above-mentioned website, we choose four weeks to calculate volatility. The outcomes are shown in three diagrams:

Since July 1, these graphs depict the average daily volatility of the NZD/USD pair. They also show the pair's typical weekly, daily, and hourly changes.

Based on these three graphs, we may infer that volatility varies throughout time.

The hourly volatility plot for NZD/USD is particularly interesting, with peaks at 12 and 21 o'clock (GMT). It perfectly corresponds with the publication of economic statistics for the United States and New Zealand. It also validates the earlier-mentioned notion about volatility increasing in response to important financial data releases.

Changes in volatility may be seen for all currency pairings. You may look at the statistics for any pair across various periods by selecting it.

What Factors Influence Volatility?

So, what factors influence the volatility of any currency pair?

The major cause of volatility is a lack of liquidity. According to a well-known rule, the greater the liquidity, the lower the volatility, and vice versa.

The quantity of supply and demand in the market is referred to as liquidity. The greater the supply and demand, the more difficult it is to move the price.

We may deduce from this rule that exotic currency pairings are the most volatile in the Forex market since their liquidity is often lower than that of the main ones.

Because volatility is common during important economic data releases, it may be good to download and install the MT4 news indicator:

It may assist you in protecting yourself from unexpected market activity.

Let's utilize statistics to back up our earlier assertions.

The Most Volatile Forex Pairs are Listed Below.

Let's choose seven main, cross, and exotic currency pairings for our research and create a comparison table based on the data:

The table shows that today the most volatile Forex pairs are exotic, namely, USD/SEK, USD/TRY, and USD/BRL. They all move more than 400 points every day on average.

The volatility of key currency pairings is much reduced. Only the GBP/USD pair fluctuates more than 100 points every day. The AUD/USD currency combination proved to be the least volatile.

As for the cross rates, GBP/NZD, GBP/AUD, GBP/CAD, and GBP/JPY are the most fluctuating currency pairs. All of them move on average for more than 100 points per day.

CAD/CHF, EUR/CHF, AUD/CHF, and CHF/JPY are the less volatile Forex pairs among the cross rates. The amplitude of their movements doesnt exceed 60 points per day.

Resume

Based on these statements, the reader may conclude that trading exotic currency pairs or cross rates promises large profits. However, it isnt quite that simple.

Indeed, the range of exotic pairs' movements is much broader than that of the major ones. However, such high volatility results from low liquidity, and trading the low liquidity currency pairs carries particular risks for a trader.

The fact is that various methods of technical analysis might not work in such situations. If you decide to trade, say, USD/SEK or GBP/NZD, your analysis may not work as effectively as, for example, when trading EUR/USD. Also, technical analysis patterns might generate false signals.

This is because the psychology of the market behavior in its most liquid form makes up the backbone of technical analysis. If the liquidity of a trading instrument is lower, the validity of technical analysis comes into question.

The second problem a trader can face when trading volatile financial instruments is widespread (additional trading expenses).

Of course, we won't discourage you from trading the low liquidity currency pairs. However, our task is to warn inexperienced traders and newbies that the risk of such trading is higher than that of trading the classic currency pairs.

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Kaugnay na broker

Magbasa pa ng marami

Challenge Yourself: Transform from Novice to Expert

From a forex novice to a trading expert, all it takes is this one opportunity! Join us for the Forex Beginner's Advancement Journey challenge and unlock your potential! Here, if you're a beginner, participating in the event and posting on selected topics will not only deepen your understanding of forex basics and help you advance but also earn you a Learning Encouragement Award. For those with some experience in forex, discussing insights under the event topics will allow you to exchange experiences and share techniques with like-minded peers, while also having the chance to win a Perspective Sharing Award! Come challenge yourself and break through the limits of forex trading together!

Sa likod ng Orfinex Prime Brokerage: Isang kaso ng pagsalangsang at negligencia

Orfinex Prime: Mga Allegasyon ng Negligencia at Paglabas | Ang mga problema ng mga kliyente ay nagpapahayag ng mga hindi ligtas na pamamaraan sa pagbebenta, malinaw na presensya sa Dubai, at mga alalahanin ng pagsalangsang. Gumawa ng mga aksyon para sa proteksyon ng mga mamimili.

I-claim ang Iyong 50% Welcome Bonus hanggang $5000!

Bukas sa Parehong Bago at Existing na Customer!

The pound, gilts and renewables: the winners and losers under Britain’s future PM

The race to be the next leader of Britain’s ruling-Conservative Party and the country’s prime minister is into its final leg, with the September outcome likely to shape the fortunes of sterling, gilts and UK stocks in coming months.

Broker ng WikiFX

Exchange Rate