简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Gold And Silver Might Surprise in 2022, According to Saxo News

abstrak:Gold made a little rebound in the last days of 2021, decreasing the year's loss to around 3.6 percent. Despite the fact that this was the largest drop since 2015, the yellow metal had a good year. Not to mention the headwinds from rising interest rate expectations and the currency, which rose 5% against a basket of currencies, its best year since 2015.

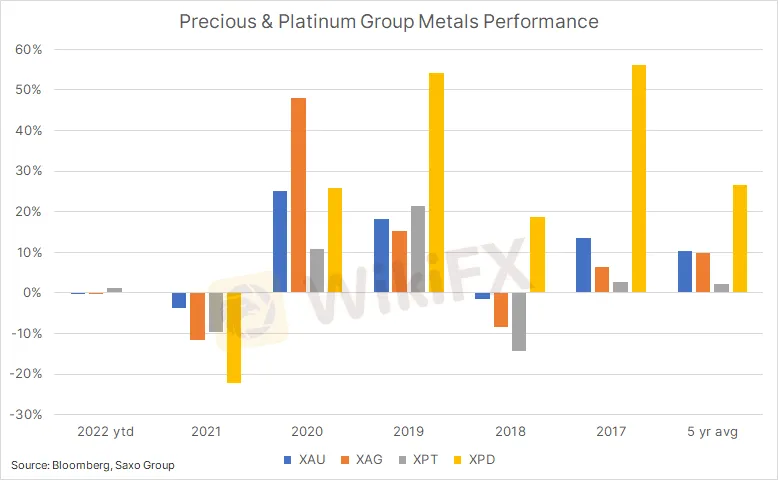

Gold achieved a tiny comeback in the last days of 2021, reducing the year loss to roughly 3.6 percent. While this was the greatest decrease since 2015, it was still a decent year for the yellow metal. Not to mention the headwinds from increasing interest rate expectations and the dollar, which climbed by 5% versus a basket of currencies, its highest year since 2015.

Fund managers often utilize gold as a hedge against the unexpected, whether it be macroeconomic or geopolitical occurrences. Following the initial wave of the Covid-19 epidemic, the wall of money given by governments and central banks helped decrease macroeconomic risks while pushing the stock market considerably higher, leading in what my colleague described as a mindboggling year for stocks.

Responding to these developments, total holdings in exchange-traded funds backed by bullion fell steadily throughout the year as investors, including some of the world's largest real-money asset managers, reduced their holdings by 287 tons, the most since 2013, reversing some of the 750 tons added in 2020 during the pandemic's first year.

During the opening days of trading in 2022, gold reverted to its established comfort zone at $1800 per ounce after achieving a six-week high. This was the sharpest drop in six weeks, prompted by rising bond rates as investors prepared for monetary policy tightening in 2022.

The downturn has been driven by a dramatic reversal in some of the other metals, most notably platinum, which fell more than $50 per ounce at one stage on Monday, increasing its discount to gold to a 13-month high over $870 per ounce.

The first couple of weeks of a new year often fail to deliver much in terms of directional inspiration and clues as to what will happen next, and gold may struggle for direction until the picture becomes clearer in terms of the direction of the dollar, the timing and pace of Fed rate hikes, and so on. As previously said, the key to the final direction is the direction of the dollar, as well as how high real yields may go. We anticipate that 2022 will be a difficult year for global equities as interest rates increase and people hold more money in their wallets after a wild year of consumer spending.

We must pay particular attention to what the US FOMC does rather than what it says, since this will have the greatest influence. Investors who understand the Fed's activities and, after that, the path of the Chinese economy in 2022 are likely to earn the most from their investments. We do not believe that US real yields can rise to the extent that others predict, and with that in mind, and given the prospect of US stocks cooling, we believe that gold, silver, and platinum will offer a positive return in 2022, with the yellow metal once again demonstrating its credentials as an investment that can improve returns while reducing risk and overall volatility in a portfolio.

A rising gold price is anticipated to boost silver's and even platinum's performance even more. Both metals will benefit from a greater emphasis on the emerging green energy transition, with platinum demand coming from the manufacturing of hydrogen, in addition to restoring the automotive sector, and silver demand coming from solar panels and other electrical appliances.

Disclaimer:

Ang mga pananaw sa artikulong ito ay kumakatawan lamang sa mga personal na pananaw ng may-akda at hindi bumubuo ng payo sa pamumuhunan para sa platform na ito. Ang platform na ito ay hindi ginagarantiyahan ang kawastuhan, pagkakumpleto at pagiging maagap na impormasyon ng artikulo, o mananagot din para sa anumang pagkawala na sanhi ng paggamit o pag-asa ng impormasyon ng artikulo.

Magbasa pa ng marami

Challenge Yourself: Transform from Novice to Expert

From a forex novice to a trading expert, all it takes is this one opportunity! Join us for the Forex Beginner's Advancement Journey challenge and unlock your potential! Here, if you're a beginner, participating in the event and posting on selected topics will not only deepen your understanding of forex basics and help you advance but also earn you a Learning Encouragement Award. For those with some experience in forex, discussing insights under the event topics will allow you to exchange experiences and share techniques with like-minded peers, while also having the chance to win a Perspective Sharing Award! Come challenge yourself and break through the limits of forex trading together!

Sa likod ng Orfinex Prime Brokerage: Isang kaso ng pagsalangsang at negligencia

Orfinex Prime: Mga Allegasyon ng Negligencia at Paglabas | Ang mga problema ng mga kliyente ay nagpapahayag ng mga hindi ligtas na pamamaraan sa pagbebenta, malinaw na presensya sa Dubai, at mga alalahanin ng pagsalangsang. Gumawa ng mga aksyon para sa proteksyon ng mga mamimili.

I-claim ang Iyong 50% Welcome Bonus hanggang $5000!

Bukas sa Parehong Bago at Existing na Customer!

The pound, gilts and renewables: the winners and losers under Britain’s future PM

The race to be the next leader of Britain’s ruling-Conservative Party and the country’s prime minister is into its final leg, with the September outcome likely to shape the fortunes of sterling, gilts and UK stocks in coming months.

Broker ng WikiFX

Exchange Rate