Overview of City Credit Capital (CCC)

City Credit Capital (CCC) was established in 2001 and is a UK-registered online trading broker providing foreign exchange and CFD trading services to investors, financial institutions, banks, and brokers. Operating under the regulation of the Financial Conduct Authority (FCA), CCC provides a level of trust and security for clients. The minimum deposit required to open an account with CCC is $500, and the maximum leverage available is 1:30.

CCC offers a variety of trading instruments, including forex currency pairs, CFDs on index futures, CFDs on commodity futures, and spot precious metals. Traders have access to popular trading pairs like EUR/USD, along with other major and minor currency pairs. The minimum spreads on the EUR/USD pair are set at 3 pips, providing transparency regarding trading costs.

The trading platform offered by CCC is the widely recognized MT4 trading platform, known for its user-friendly interface, and advanced charting tools. When it comes to payment methods, CCC accepts Visa and MasterCard credit/debit cards, bank transfers, Skrill, and Neteller. This provides flexibility and convenience for clients to fund their accounts and withdraw their profits.

Is City Credit Capital (CCC) legit or a scam?

City Credit Capital (CCC) is a forex broker that is currently regulated by the Financial Conduct Authority (FCA). This regulatory oversight ensures that CCC operates in compliance with the established standards and regulations set by the FCA. The broker holds a full license under the authority of the FCA, with the regulatory number 232015. It is important to note that City Credit Capital (UK) Limited does not accept customers from the United States. Traders from the US should consider alternative brokerage options that are available to them.

Pros & Cons

City Credit Capital (CCC) is a forex broker that boasts FCA regulation, ensuring a certain level of credibility and investor protection. On the positive side, CCC offers commission-free trading, allowing traders to execute trades without incurring additional costs. Additionally, they provide a 30-day demo account, giving users the opportunity to practice trading strategies without risking real funds. CCC also offers free deposit and withdrawal options, making it convenient for clients to manage their funds. However, one of the drawbacks of CCC is its high minimum deposit requirement, which may deter traders with limited capital from accessing their services. It is worth noting that CCC does not support Bitcoin trading, which may disappoint those interested in cryptocurrencies. Furthermore, the broker lacks live chat support, which could affect the responsiveness of customer assistance. Lastly, while CCC does not offer a sign-up bonus, they do provide a trading bonus that can be withdrawn, providing an added benefit for eligible traders.

Market Instruments

City Credit Capital (CCC) offers over 100 trading assets, including Forex, Indices, Metal, Commodities

Forex:

Forex, short for foreign exchange, involves trading currency pairs in the global market. Traders have the opportunity to speculate on the value fluctuations of major currency pairs like EUR/USD, GBP/USD, and USD/JPY, as well as minor and exotic currency pairs. This allows participants to take advantage of currency exchange rate movements to generate potential profits.

Indices:

Indices trading involves speculating on the performance of global stock market indices. Traders can access a wide range of indices, such as the S&P 500, FTSE 100, DAX 30, and Nikkei 225. By trading indices, investors can take positions on the overall performance of specific stock markets or sectors, rather than trading individual stocks

Metal:

Metal trading provides an opportunity to invest in precious metals like gold, silver, and platinum. These commodities are often sought after as safe-haven assets and can serve as a hedge against inflation or economic uncertainties. Traders can take advantage of the price movements in these metals to potentially profit from their trading activities.

Commodities:

Commodities trading involves the buying and selling of various tangible goods, including oil, gas, and agricultural products. Traders can speculate on the price movements of these commodities, influenced by factors such as supply and demand dynamics, geopolitical events, and weather conditions. Trading commodities allows investors to diversify their portfolios and potentially capitalize on market trends in different sectors.

Account Types

City Credit Capital (CCC) offers two types of trading accounts: the mini account and the standard account. The minimum initial deposit for a mini account is $500, while the standard account requires a higher deposit of $5,000. It's important to note that this minimum deposit is higher compared to many other brokers in the industry, as they often require deposits ranging from $100 to $200. Additionally, CCC provides demo accounts for novice investors, allowing them to practice trading without risking real funds.

Demo Accounts Available

In addition to the live trading accounts, City Credit Capital (CCC) also provides a 30-day practice account for clients. This demo account offers round-the-clock access to real-time market prices and all the features available on the trading platforms. Users can experience the trading environment from their desktop, web browser, or mobile app, using a virtual cash balance of $100,000. Demo accounts are suitable for both beginners and experienced traders, as they allow for risk-free practice and exploration of trading strategies.

How to Open an Account?

To open an account with City Credit Capital (CCC), please follow these steps:

1. Visit the official website of City Credit Capital at https://www.cccapital.co.uk/.

2. On the homepage, locate and click on the “Live Account”. This will typically be prominently displayed on the website.

3. You will be redirected to the account opening page. Here, you may need to provide personal information such as your name, email address, phone number, and country of residence.

4. Select the type of account you wish to open. City Credit Capital may offer different account types tailored to the needs of various traders. Choose the one that suits your trading preferences and objectives.

5. Submit your application. Once you have completed all the required information, click on the “Submit” or similar button to send your account opening request to City Credit Capital.

6. Fund your account. Once your account is approved and verified, you will receive instructions on how to deposit funds into your trading account. City Credit Capital may offer various funding options such as bank transfers, credit/debit cards, or electronic payment methods. Choose the preferred method and follow the provided instructions.

7. Start trading. Once your account is funded, you can access the trading platform provided by City Credit Capital and begin executing trades in accordance with your trading strategy and preferences.

Leverage

Trading leverage depends on different instruments traded. The maximum trading leverage is 1:30 for major currency pairs, 1:20 for minor currency pairs, 20 for index futures, 1:10 for commodity futures, 1:20 for gold, and 1:10 for silver.

Spreads & Commissions

CCC charges fixed spreads on foreign exchange, indices, commodity CFDs, and precious metals, 3 pips on EUR/USD, about $0.04 on silver, and about 2 pips on the FTSE 100. Such spreads are not that competitive and mean higher transaction costs. CCC does not charge commissions or inactive account fees.

Trading Platforms

City Credit Capital (CCC) offers three trading platform options, the popular MT4 trading platform, the iMarkets Trader, and the Markets Trader.

iMarketsTrader

CCC customers can access their trading accounts using our iMarkets Trader application. This fully functional mobile app enables their customers to monitor their exposure, execute and manage trades, view charts, and place orders using their iPhone, iPad, or Android phone. The iMarketsTrader application allows clients to track the market direction through an advanced charting package, offering 20 different technical analytic indicators.

Markets Trader

CCC provides a customized online trading platform – Markets Trader, claiming to be a fast, secure, and flexible way to trade todays markets. Once logged in, customers have 24/7 access to a broad range of liquid financial trading instruments including foreign exchange, equity indices, precious metals, and commodities.

MetaTrader4

MetaTrader4 is a platform for trading Forex, analyzing financial markets, and using Expert Advisors. Mobile trading, Trading Signals, and the Market are the integral parts of MetaTrader4 that enhance your Forex trading experience.

Deposit and Withdrawal

City Credit Capital (CCC) accepts traders to deposit and withdraw funds from their accounts via Visa, MasterCard credit/debit cards, bank transfers, Skrill, and Neteller. Since the broker is regulated by the FCA, the company requires their clients to complete a lengthy account opening procedure that involves signing different documents and accepting various disclaimers, which ensures that traders adhere to the restrictions put forward by regulatory agencies.

Educational Resources

City Credit Capital (CCC) offers a range of educational resources to support traders in their journey. These resources include Trading Central, which provides valuable market analysis and insights. Traders can also access the Daily Market Brief, which offers daily updates on market news and trends. CCC provides various trading tools to enhance the trading experience, and they offer educational materials to help traders understand technical analysis. Additionally, CCC integrates MT4 Trading Central, allowing traders to utilize indicator charts to make informed trading decisions. These educational resources are designed to empower traders with knowledge and tools for successful trading.

Customer Support

Traders with any inquiries or trading-related issues can get in touch with City Credit Capital (CCC) through the following contact channels:

Telephone: +44 (0) 20 7614 4600

Email: customerservice@cccapital.co.uk

Registered Office Address: Heron Tower, 110 Bishopsgate, London, EC2N 4AY, United Kingdom.

Frequently Asked Questions

Q: Is City Credit Capital (CCC) regulated?

A: Yes, City Credit Capital (CCC) is regulated by the Financial Conduct Authority (FCA).

Q: What is the minimum deposit required to open an account with CCC?

A: The minimum deposit required to open an account with City Credit Capital (CCC) is $500.

Q: What is the maximum leverage offered by CCC?

A: CCC offers a maximum leverage of 1:30.

Q: What are the available trading platforms at CCC?

A: CCC offers the MT4 trading platform, iMarkets Trader, and Markets Trader as trading platform options.

Q: Are demo accounts available at CCC?

A: Yes, CCC provides a 30-day demo account for clients to practice trading strategies.

Q: What payment methods does CCC accept?

A: CCC accepts Visa and MasterCard credit/debit cards, bank transfers, Skrill, and Neteller as payment methods.

Q: How can I contact customer support at CCC?

A: You can contact CCC's customer support through telephone at +44 (0) 20 7614 4600 or via email at customerservice@cccapital.co.uk.

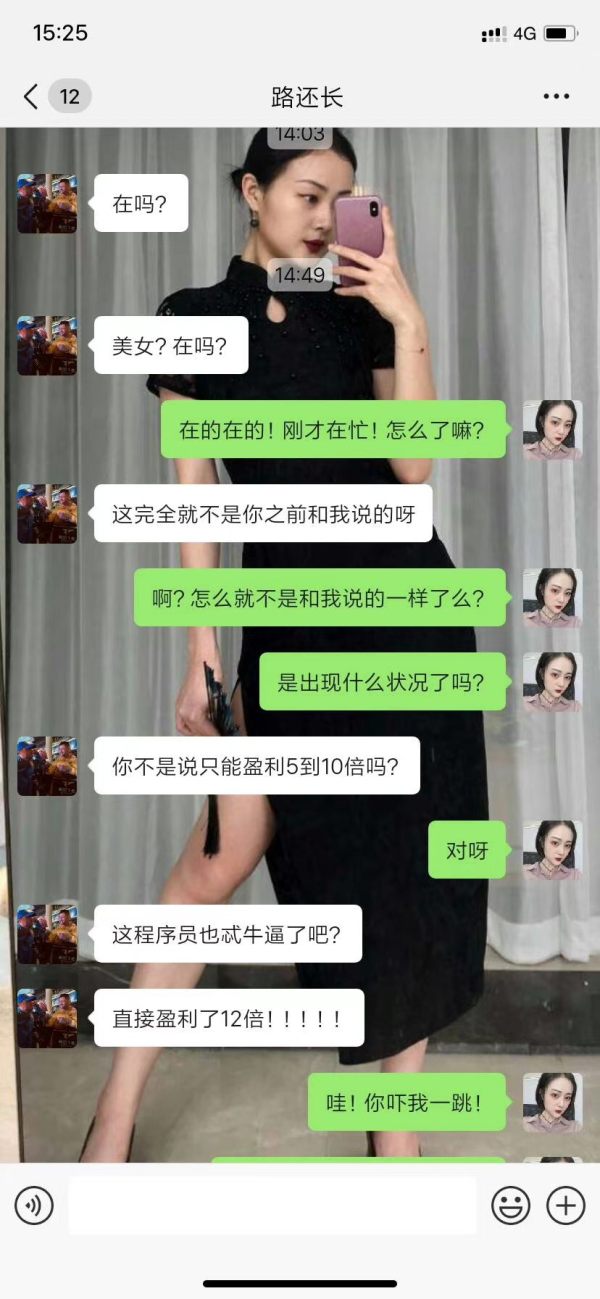

FX3371868743

Hong Kong

10% margin was required

Exposure

2021-04-02

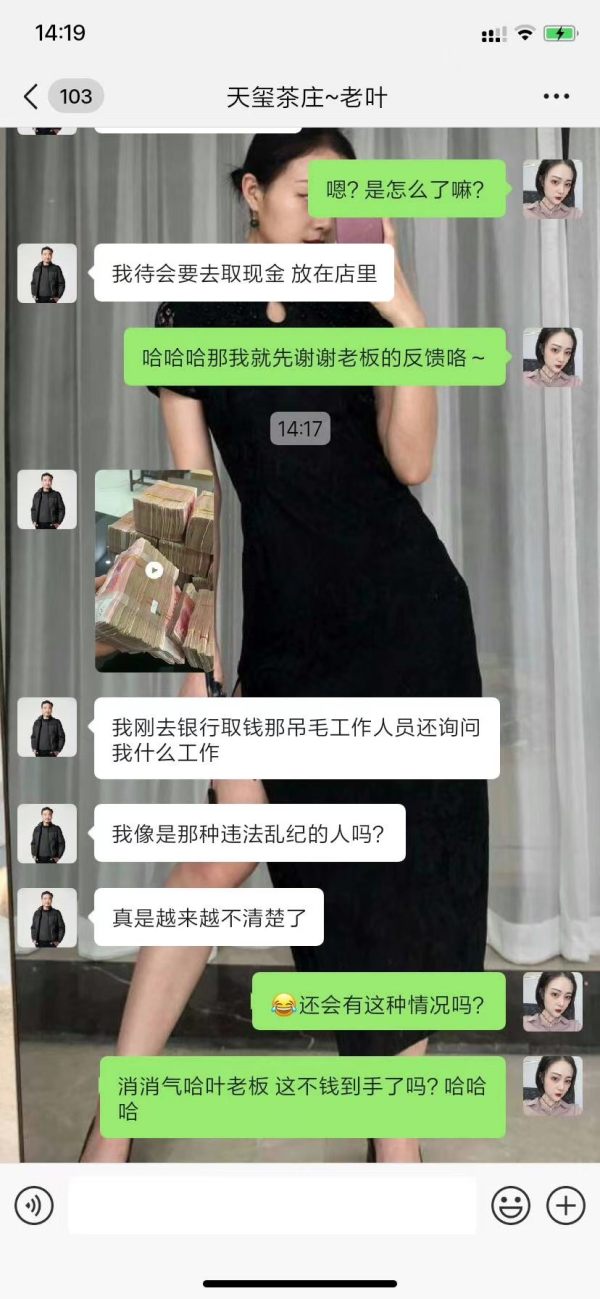

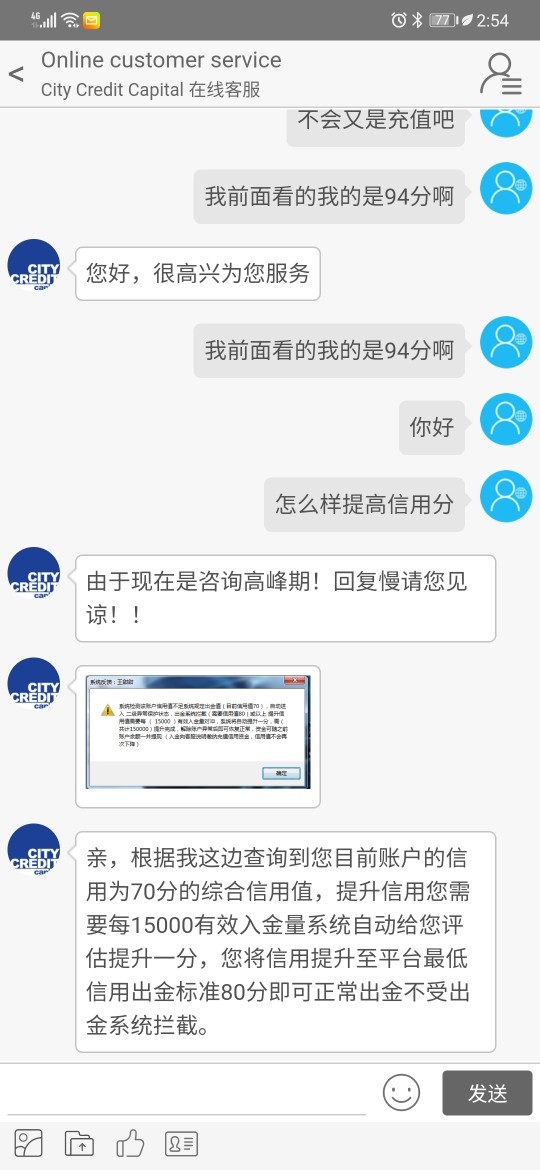

小宝妈

Hong Kong

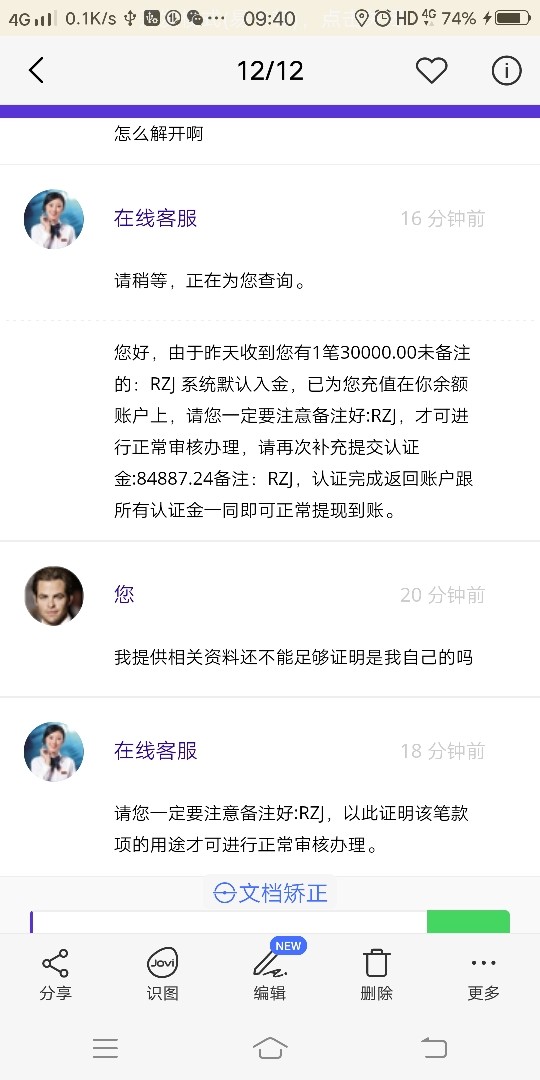

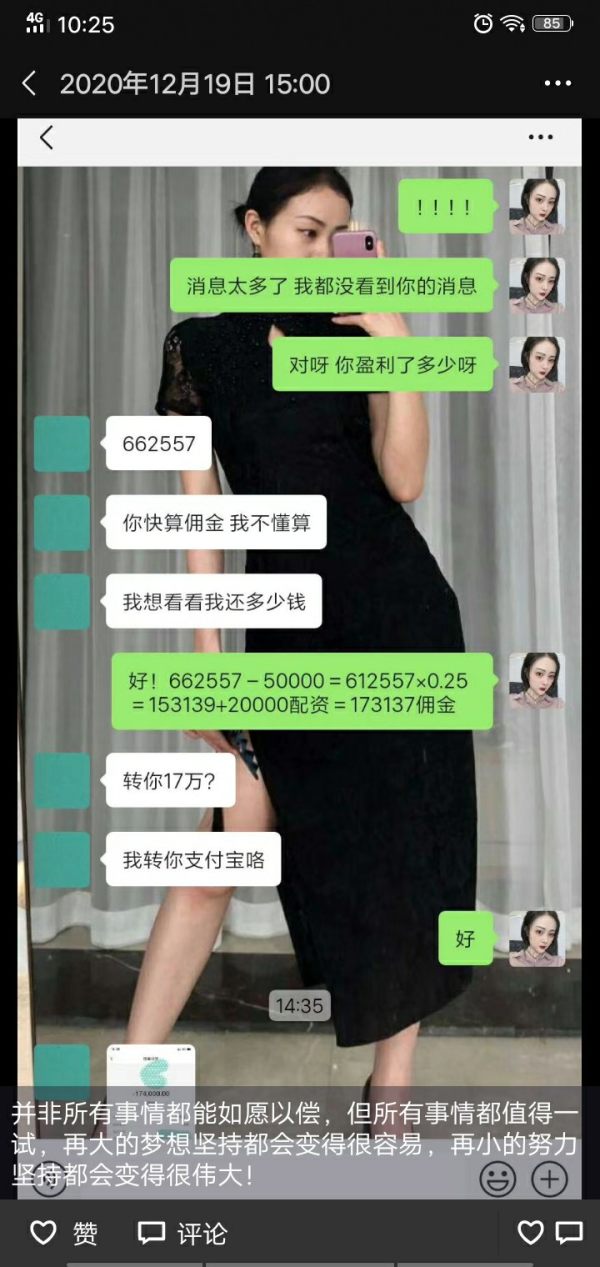

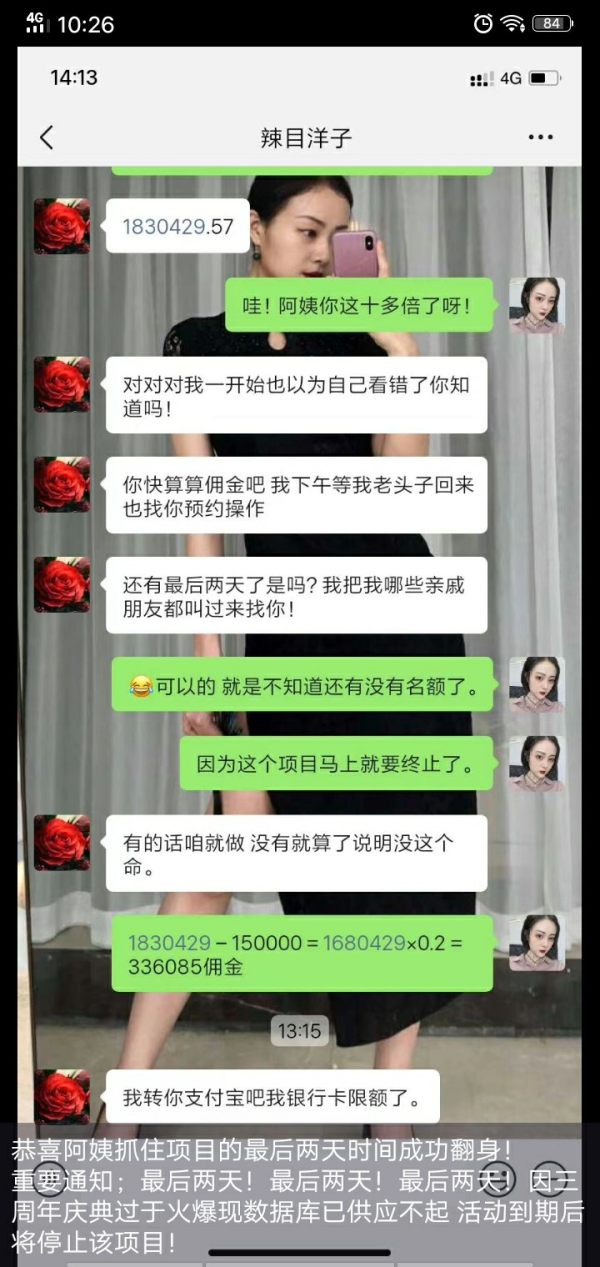

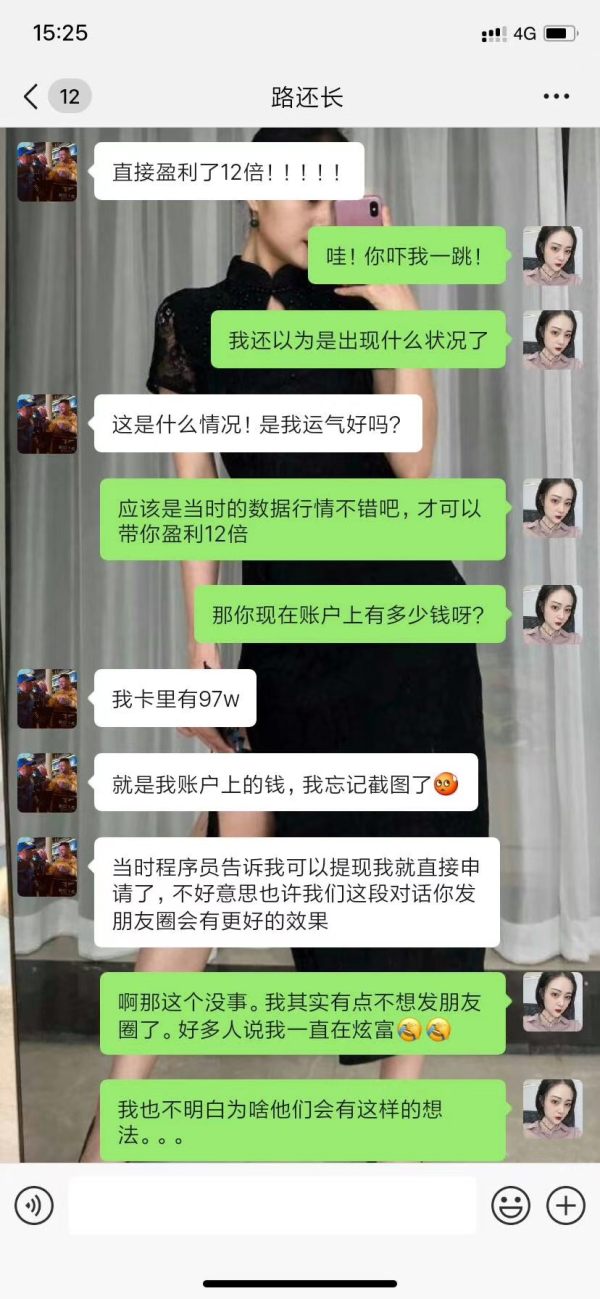

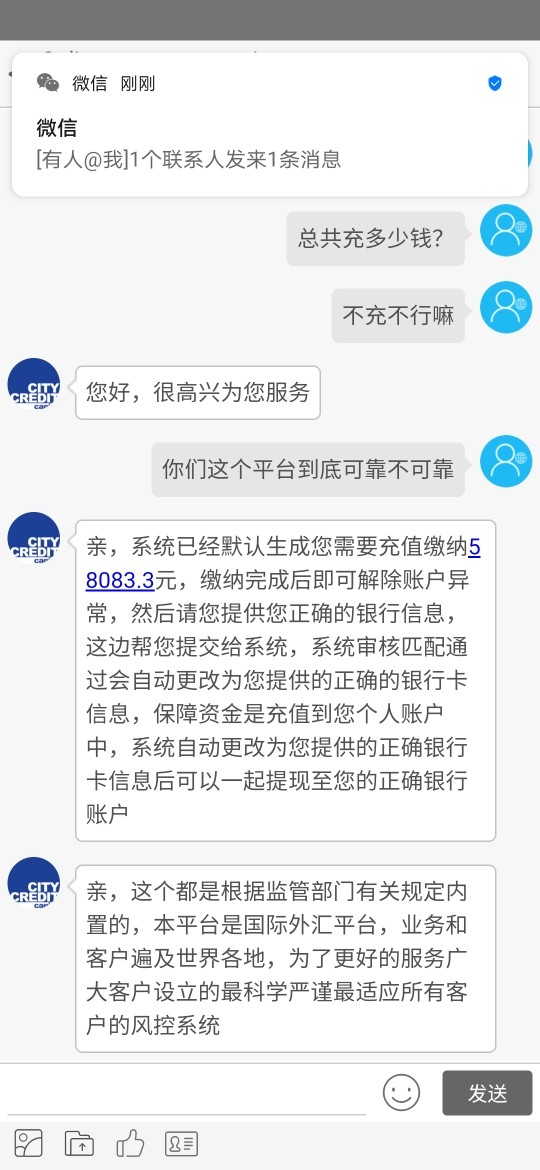

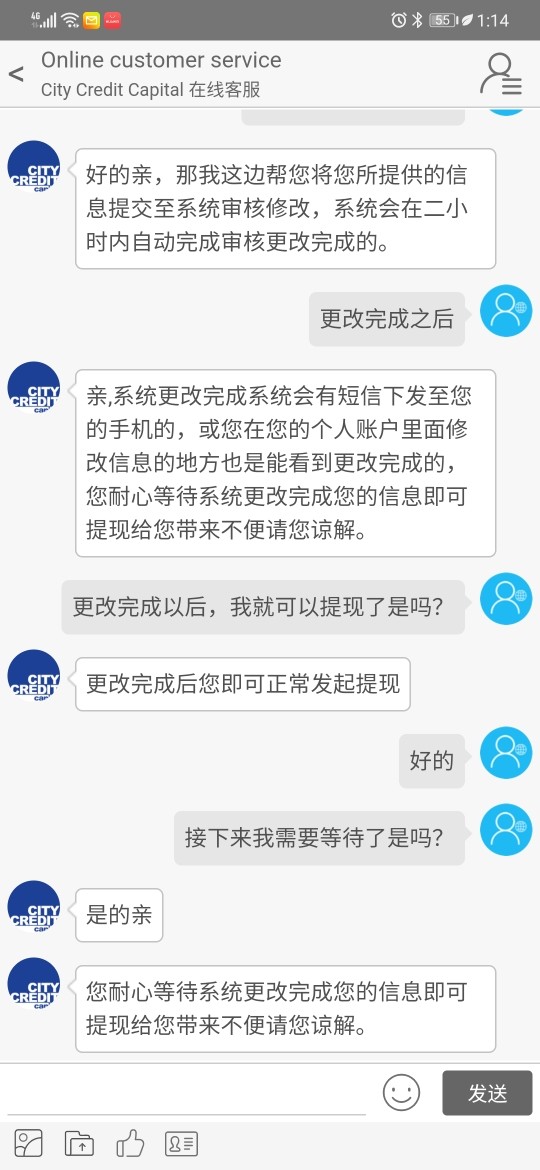

The fraud claimed him to be a member of AiWeiDe and guided customers to invest in this fraud platform. The platform asked me to pay 20% of the total amount to activate the account for wrong bank card number. But after I activated, I was told that my credit score was 80 and I have to improve the score to withdraw funds. I have a child and I deposited 614,000 in total. I hope the platform can give me an explanation. I really need this money

Exposure

2020-12-21

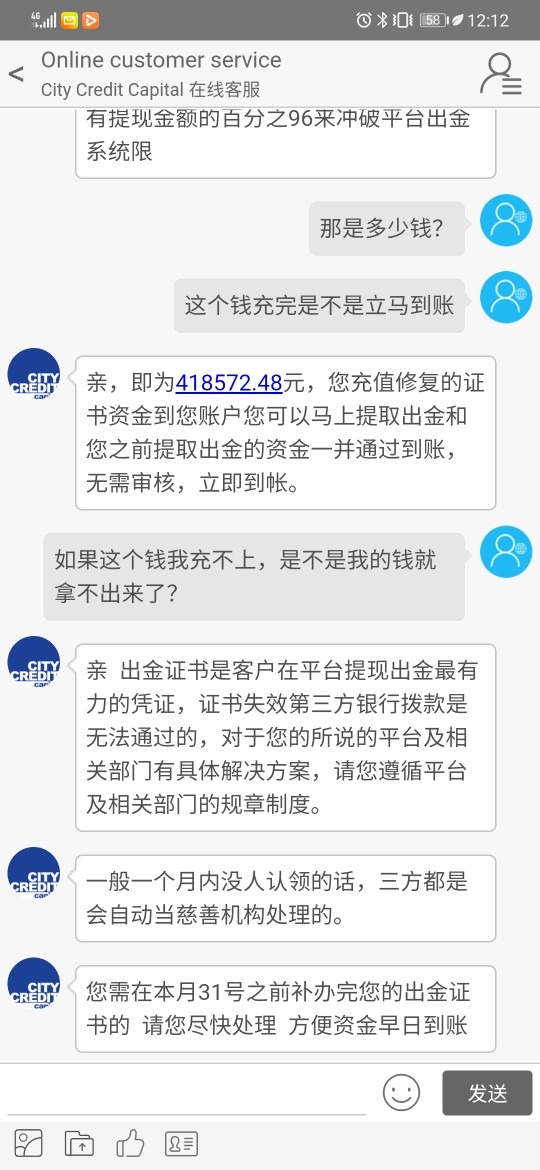

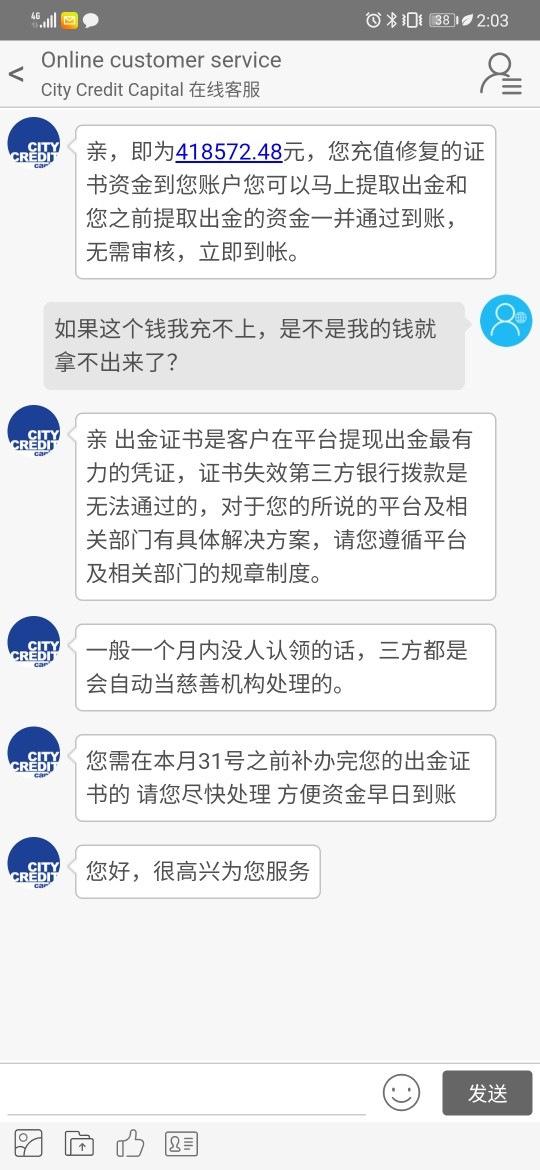

王美丽

Hong Kong

They claimed that they are a legal group. And aske cusomers to search them on the internet to win customers' trust! I'm pregnant and going into labour next month! But the fraud still cheats others. I was cheated of 230,000 which is going to be used for my baby! Every cent is my hard-earned money! I don't know whether the group exists or not, is it is, I hope you can return my money which I use for my baby[d83d][de2d][d83d][de2d][d83d][de2d]

Exposure

2020-11-08

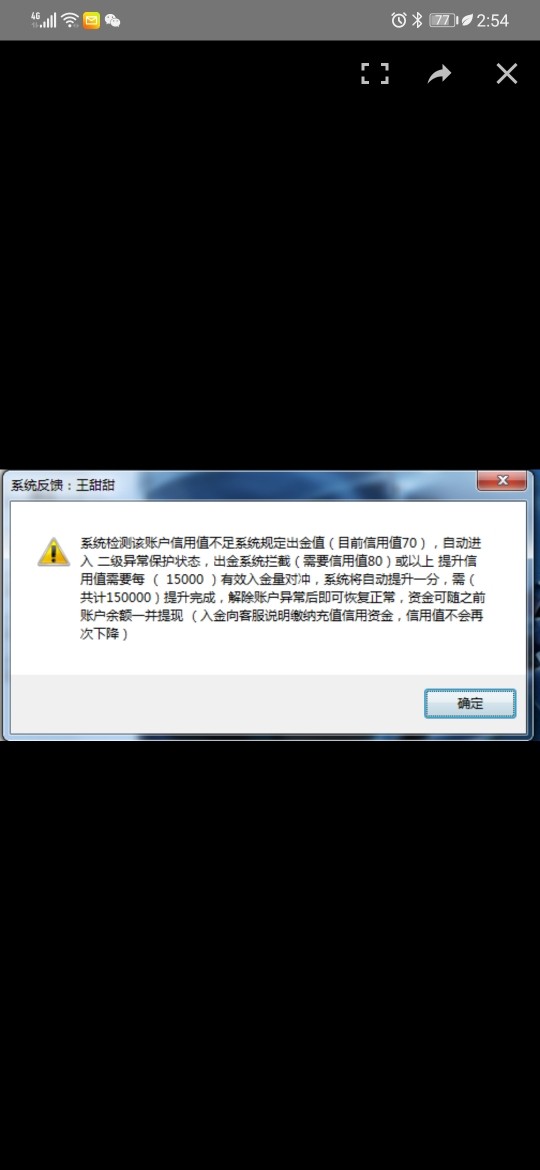

王美丽

Hong Kong

Someone leads me to invest at first. Then I added 58,000 to modify my card number. Later, I was told that my credit score was low and I have to deposit 150,000. Now I have to add 410,000 because there are some problems with the withdrawal certificate! I’ve added 230,000 now which is my hard-earned money. How can I get my money back?

Exposure

2020-10-29

Garyshe

Hong Kong

CCC would lock my position when the market was volatile. We clients couldn’t trade XAU/USD. The service kept shirking.

Exposure

2020-08-18

FX1023329039

United Kingdom

I can say trading with CCC is not good choice. It requires high minimum deposits as high as $500, wide spreads, salty trading fees charged. Before real trading, I checked many negative reviews about this broker, thus firmly in belief that this broker is not a reliable one. Someone who really want to trade with this broker can open a demo account first, its leverage up to 1:30…

Neutral

2022-11-18

FX1020526893

Hong Kong

At CCC! Opening a Mini account requires 500 dollars, that is amazing high!! the EUR/USD spread is also uncompetitive, up to 3 pips! If you have enough money, you can have a try. But for me, i will never invest in this broker.

Neutral

2022-11-16

久月

Hong Kong

It costs 500 US dollars to open a mini account in the company CCC, which is a bit much, so I plan to try it in a demo account first, and if it is ok, I will actually deposit money to trade.

Positive

2022-12-14