Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

FX4979454136

Hong Kong

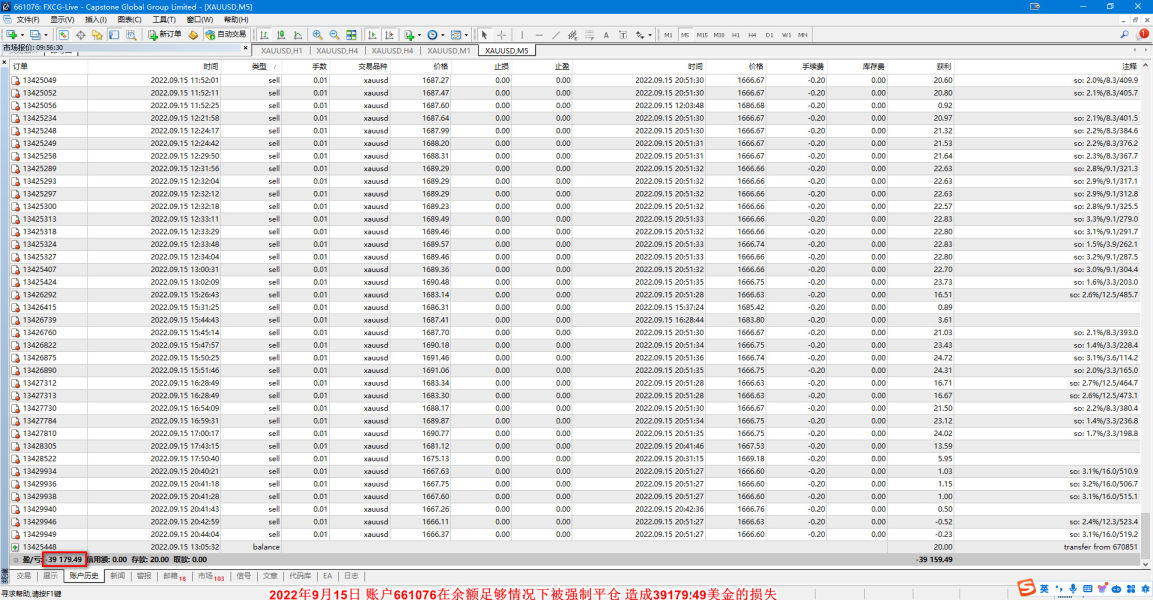

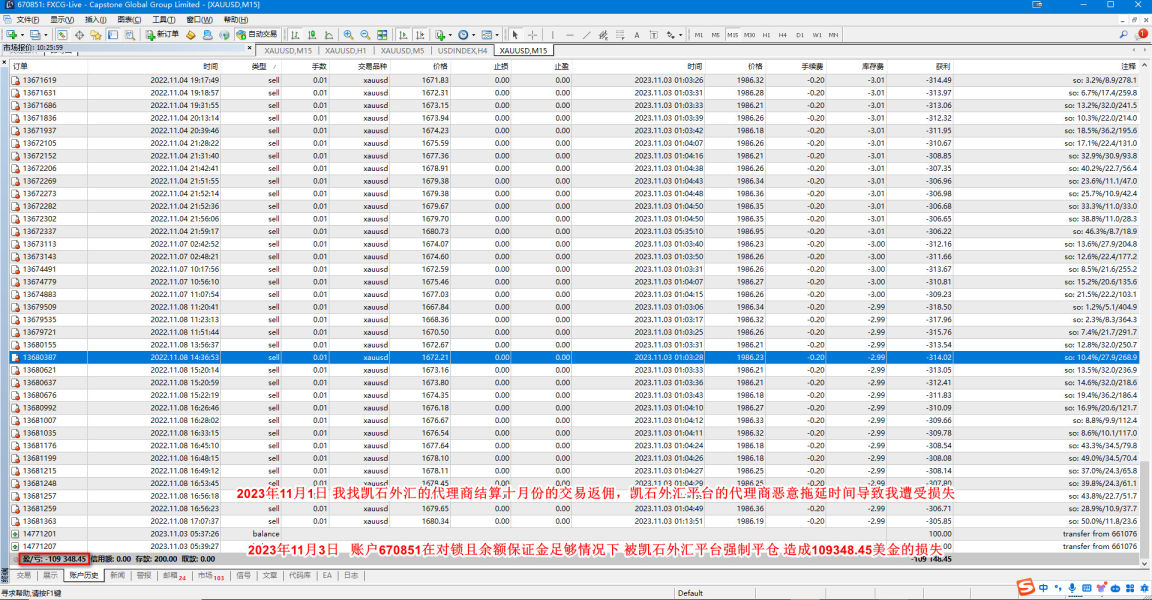

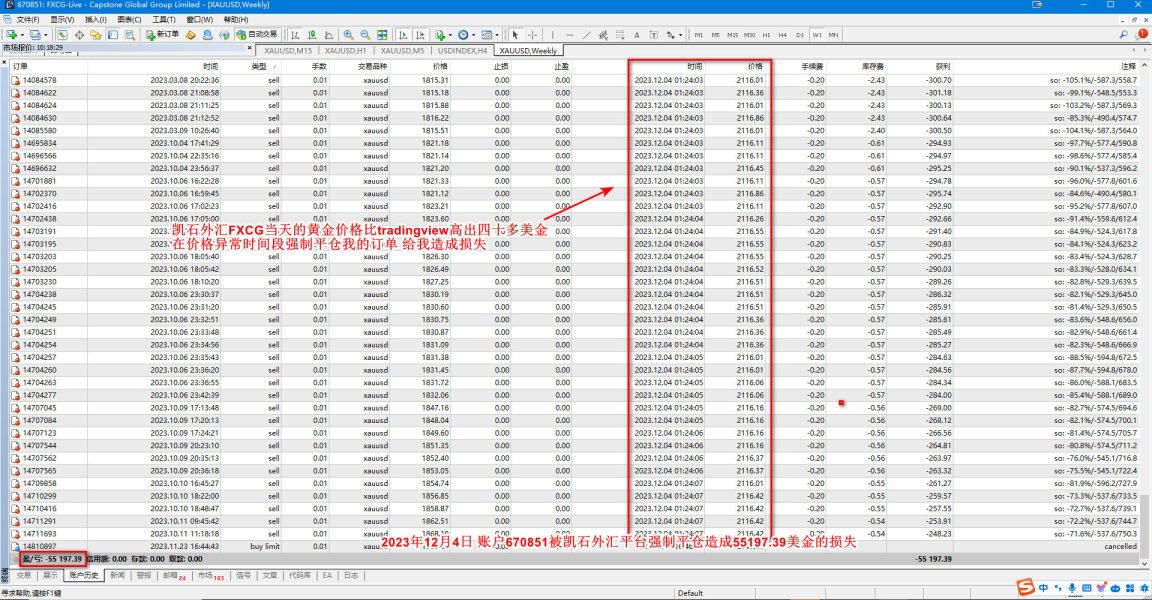

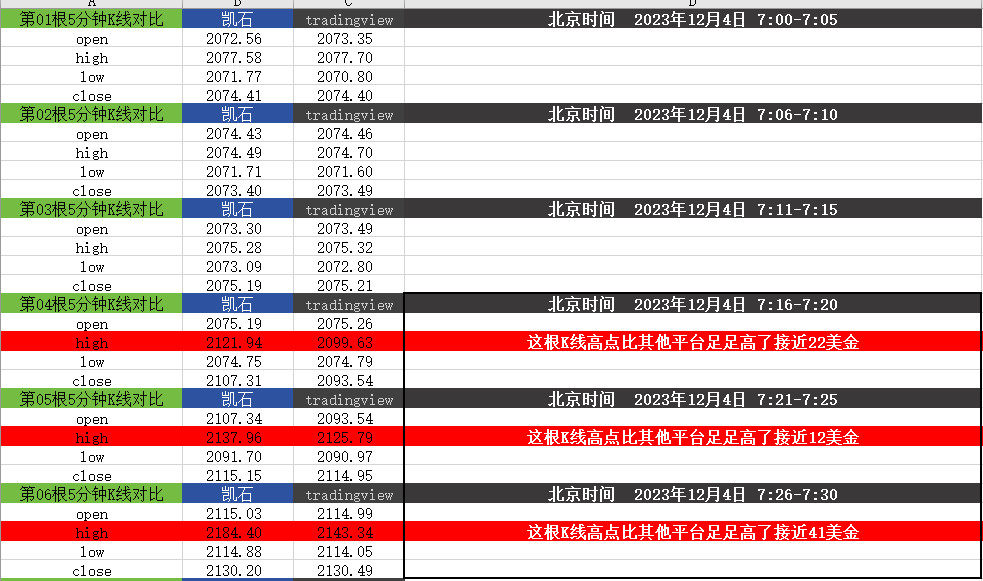

Kaishi Forex is now renamed FXCG. Through illegal means such as falsifying backend data, maliciously delaying commission payments, and unilaterally modifying inventory fees for gold short orders, I went bankrupt and lost a total of 1.59 million yuan. I now hope that the platform will help me expose it.

Exposure

2024-01-03

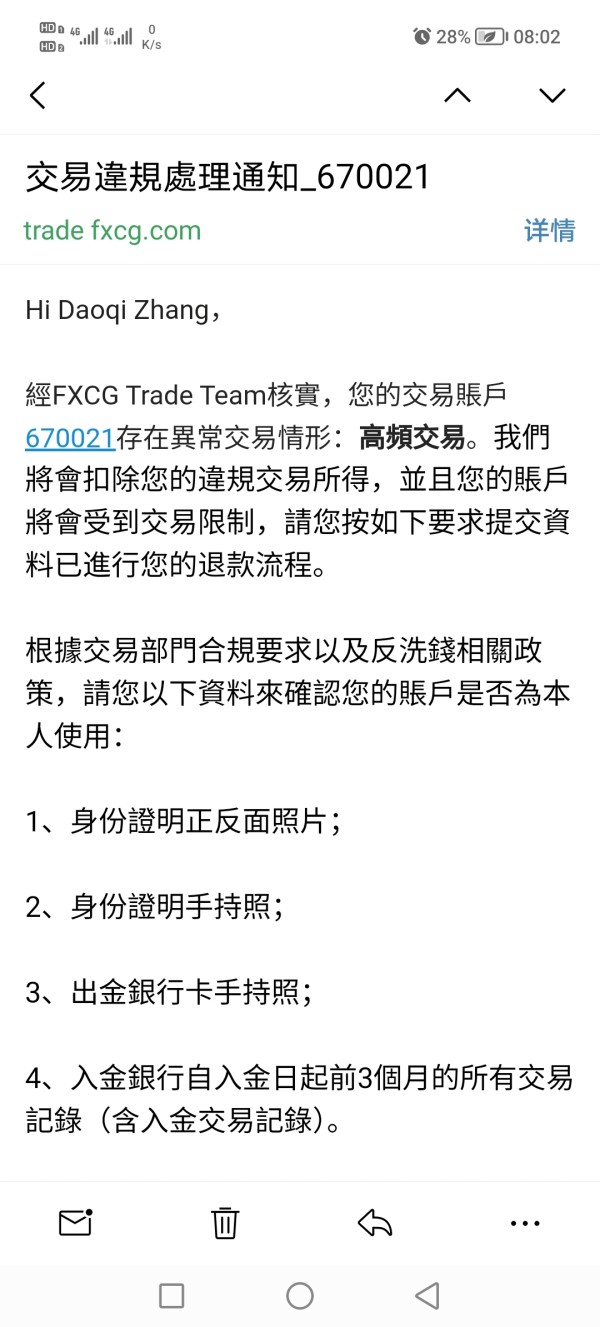

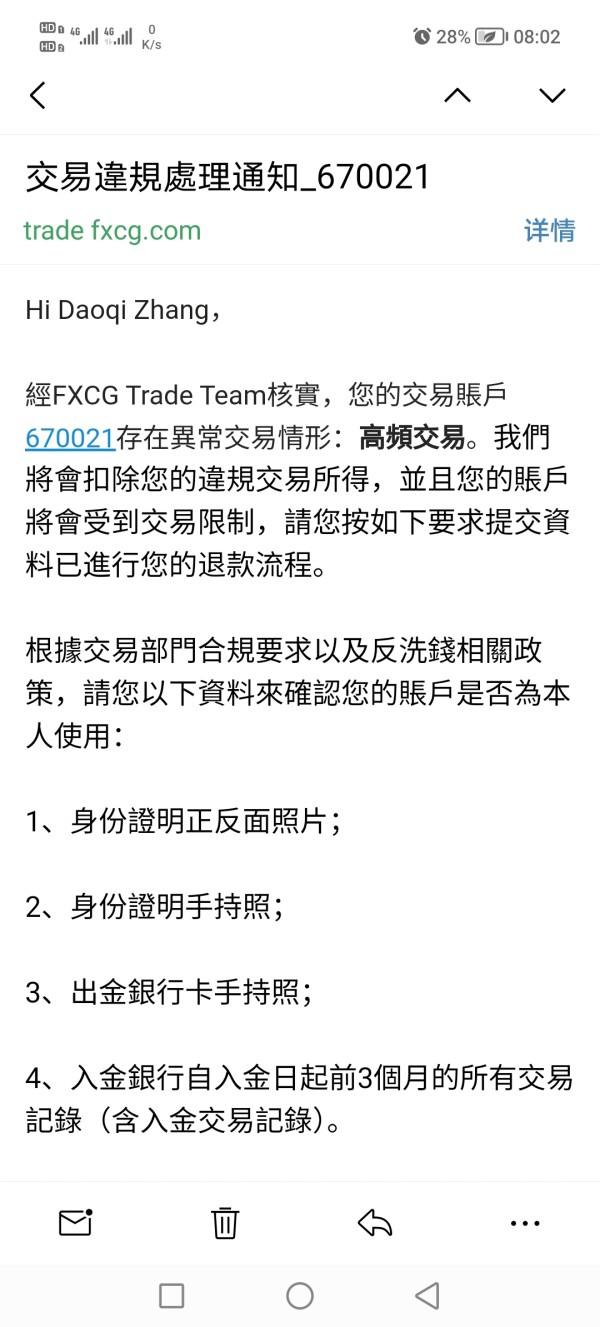

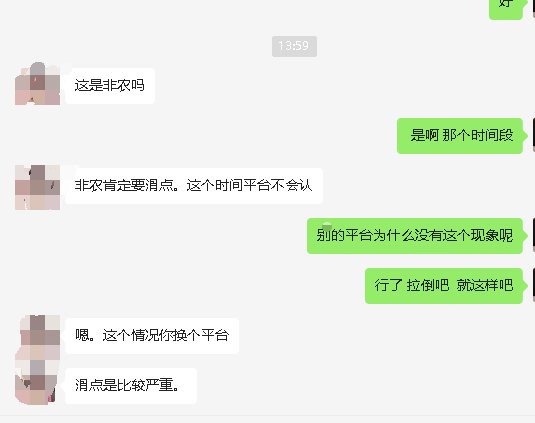

zdq17326678627

Hong Kong

They said that I traded at high frequency and deducted all profits maliciously. Communication was by email. Once I made a deposit, I still had to face difficulties. The deposit lasted for two weeks.

Exposure

2023-10-23

zdq17326678627

Hong Kong

All profits were maliciously deducted on the grounds of frequent trading. And the official website cannot log in to the account and cannot withdraw money.

Exposure

2023-10-18

李先学

Hong Kong

Because some friends are trading on this platform, I think it is relatively reliable! Slippage like this is happened almost every time when there is market! As long as the stop loss is too small, it must be stopped according to these rules, so on this platform, stop loss is useless! Fortunately, I did not deposit very much, so it doesn't matter! It is not recommended for newcomers to choose this platform, there are so many platforms to choose from! Just PASS this one! !

Exposure

2023-02-07

FX3517856271

Philippines

Capstone freezes the user's account privately and cannot withdraw funds without paying the deposit! The User want Capstone to return the blocked funds of $134,347. The user paid 100,000 to become a Silver member with Capstone and Capstone asked him to pay a deposit before he could withdraw his funds. The user paid the deposit within the stipulated time and the bank checked that the deposit had been credited, but Capstone customer service said that the funds had been intercepted and that it would return the funds to the user's personal bank account within 24 hours. However, Capstone did not return the intercepted deposit and asked the user to make another deposit, which the user said he had no more money. After the user's communication with customer service failed, Capstone blocked the user's account. The user wanted Capstone to return the blocked funds of $134,347.

Exposure

2021-09-13

FX4006896342

United States

Capstone induced me to deposit funds through global competitions, and induced me to conduct high-frequency trading with unnecessary bonuses, which led to liquidation. Capstone is a fraud and they have been redirecting funds to trade on other markets for their own selfish interest which is why they don't allow withdrawal. I am currently working with financialrecovery.tech to get my funds back after reading someone's review here on how they helped him recover his funds. I currently have over $166,000 in my capstone account.

Exposure

2021-03-26

FX3007696308

Japan

I learned through Capstone’s public account that they have bonus promotion. I deposited USD10,000 and they gave me USD2,500. As a result, my account was quickly liquidated. After my time of thinking, I found that recently many customers of Capstone having been deceived. I felt that I was scammed by Capstone with a high amount of bonus. They induced me to deposit, and giving me the rebate was to eat up my principal. Please return my principal of USD10,000.

Exposure

2021-03-26

FX3231552729

Hong Kong

Unable to withdraw for over 2 months. Kai Shi said i wasn't eligible for withdrawal because i violated regulations while trading and that i needed to Pay a security fund of $115,242. He promised that I could withdraw funds after paying it but it was my report to financialrecovery.tech that eventually got me a refund. Kai Shi lied about my being able to withdraw because after paying the security fund, he asked that i paid a clearance fee too, that was when i realized i was being deceived the whole time.

Exposure

2021-03-25

FX9724755562

Japan

In January 2021, Capstone used a 25% high bonus to induce me to open an account, stipulating that I can get withdrawals and bonuses based on the number of lots, and guided me to adjust to ultra-high leverage, which eventually led to my liquidation. Capstone's act of inducing customers to make heavy trading with high bonuses is a kind of fraud to customers. I hope to expose Capstone's fraudulent behavior and return my principal of USD20,000.

Exposure

2021-03-25

FX7512051572

United Kingdom

I made an investment of 52,000 US dollars with Capstone. As at February, I had made some considerable profits which I tried to cash, My three applications for withdrawal have been rejected and then the broker asked me to pay taxes, handling fees, etc. At first I was sceptical but I still went ahead to pay the fees after their support assured me it would be all that's required. Things went from bad to worse when the support stopped responding to my mails, they wouldn't process my withdrawal either.

Exposure

2021-03-23

FX3231552729

United States

I tried to get something, anything from my $107,000 usd Investment over the past 3 months, Capstone just lured me in and took all of my money and then blocked me from contacting them. They have support people on their website but no one replied to any correspondence as soon as i asked to withdraw, I reckon any positive reviews are from their own establishment.

Exposure

2021-03-23

FX8700848372

Japan

On February 1, 2021, Capstone suddenly liquidated my order, saying that I violated the regulations and directly deducted my profit. I have traded with Kai Shi in 2019. It has always been a normal transaction and I have more trust in this platform. So I have sent emails many times to inquire, Kai Shi said that I want to review, and I actively cooperated. After a while, my I can’t log on my account either. After a delay of one and a half months, Kai Shi refunded part of my principal in installments, but he ignored my request to restore profit.

Exposure

2021-03-22

汤智盛

Hong Kong

I can just get automatic replies from Capstone. There is 13,169 left!!!!

Exposure

2021-03-20

渣渣辉

Japan

Capstone deducted my profits and froze my account in February. I hope that 111 could return my profit of $33,383.72

Exposure

2021-03-19

FX1745426520

Hong Kong

Prevent u from withdrawing funds. Ask for margin at first and them tax. But you have to wait all along. Easy to deposit but hard to withdraw. I am going to call the police. Please stay away from this fraud platform!

Exposure

2021-02-19

FX3213768295

Hong Kong

A big liar, Capstone, because of frequent money laundering recently, asked me to pay a deposit of 200,000 yuan before I can withdraw money.

Exposure

2021-01-16

H Y L

Hong Kong

I applied for withdrawal yesterday. And I emailed them today, but no one reply to me

Exposure

2020-12-19

絆城烟沙

Hong Kong

I made constant losses due to the so-called program. After making profits, I was asked to pay a margin before a withdrawal. After doing so, I was asked to pay again since I hadn’t add a remark. Now the platform is disabled.

Exposure

2020-03-19

。。。12260

Hong Kong

After scamming all my money, the platform keeps shirking. Is it a Ponzi Sceme?

Exposure

2020-03-17

FX2315386889

Hong Kong

I knew this platform in last September. During that time, the funding process was normal. Having made a loss of 10 thousand dollars, I continued to deposit 10 thousand dollars or so. As the trend of XAU/USD kept cocking up, I took a chance to buy long. On the morning of 16th, I made 200-pip profit. I was to continue to trade, while my account was banned. At first, the account manager blamed it on wrong password, then he said that it was under verification by Australian regulator which needs 1 to 2 months. It is a rip-off. They claimed that they supported clients make profits. So why you withhold my money now? In addition, all my trading is legal. Hope relevant department see to this. I have uploaded the chatting record and the promotion post!

Exposure

2020-03-17