Overview of TempleFX

TempleFX is a brokerage firm established in 2016 with its headquarters based in the United Kingdom. As a global financial service provider, TempleFX offers a range of market instruments to cater to various trading preferences. Traders can access a diverse array of financial markets, including forex, commodities, precious metals, stock indices, and more.

The trading platform utilized by TempleFX is the widely recognized MetaTrader 4 (MT4). With its user-friendly interface and powerful features, MT4 enables traders to execute trades with efficiency and precision. The platform supports multiple assets, providing opportunities for both manual and algorithmic trading strategies. As with any brokerage firm, it is essential to verify their current regulatory status and conduct thorough research before engaging in any trading activities.

Is TempleFX regulated?

TempleFX claimed to be a trading name of TS Capital Limited and stated that it was authorized and regulated by the Financial Conduct Authority (FCA) in the UK. The FCA is known for its stringent regulations and commitment to client protection.

However, it is crucial to note that, since there have been concerns or suspicions that TempleFX is a suspected fake clone or falsely claiming FCA authorization, traders should exercise extreme caution and conduct thorough research before engaging with the broker. To verify a broker's regulatory status, potential clients should check the official FCA website or contact the FCA directly to confirm the broker's authorization. Dealing with unregulated or suspicious brokers poses significant risks to traders' funds and personal information, so it is vital to be diligent and cautious when choosing a brokerage firm.

Pros and Cons

TempleFX stands out as an appealing broker due to its diverse range of market instruments, including forex, commodities, precious metals, and stock indices. The broker's utilization of the MetaTrader 4 platform enhances the trading experience with advanced charting tools and automated capabilities. Competitive leverage of up to 1:400 allows traders to maximize their exposure, while support for algorithmic trading offers automated trading solutions. Additionally, the provision of Islamic account options ensures a more inclusive environment for traders.

However, concerns have been raised about the broker's regulatory status, and there is a lack of comprehensive educational resources. Additionally, live chat support is not available, and the minimum deposit requirements may be relatively higher. Furthermore, TempleFX provides only three account types, limiting options for traders with varying needs.

Market Instruments

TempleFX offers a diverse range of market instruments to cater to traders' needs. Clients can access Contracts for Difference (CFDs) on various assets, including forex pairs, commodities, and indices. Precious metals like gold and silver, as well as oil, are available for trading, providing exposure to the energy and precious metals markets. Additionally, TempleFX enables CFD trading on individual company shares, granting access to the stock market without owning the actual stocks.

Traders can explore futures contracts, giving them exposure to different asset classes. The platform further extends opportunities with ETFs, allowing traders to invest in a diversified portfolio of assets through a single investment. For those interested in Spread Betting, TempleFX supports this popular form of speculation in the UK, where traders can place bets on price movements without owning the underlying assets.

Account Types

TempleFX offers three distinct account types to cater to different trader needs. The Basic Account is ideal for beginners, requiring a minimum deposit of $50 and allowing various trading styles with leverage up to 1:500. Trading costs include tight spreads like EUR/USD starting from 2.2 pips.

The Advanced Account targets experienced traders, demanding a $500 minimum deposit. It offers better trading costs with EUR/USD spreads starting from 1.6 pips. Advanced tools cater to algorithmic trading, making it suitable for those employing automated strategies.

The ECN Account is for professionals seeking raw spreads, necessitating a $5,000 minimum account maintenance. Spreads start from 0 pips with interbank quotes, and a commission of $7 per lot is charged. This account is tailored for high-frequency traders and algo trading enthusiasts. Additionally, Islamic accounts are available for all three types, adhering to swap-free principles for traders following Islamic beliefs.

How to open an account in TempleFX?

Opening an account with TempleFX is a straightforward process that allows traders to access the financial markets and start trading. You can follow the steps below to get started:

Go to the official TempleFX website.

Click on “Open Live Account.”

Provide your personal details, including name, email address, phone number, and country of residence.

Select the account type that suits your trading needs, such as Basic Account, Advanced Account, or ECN Account.

Upload the necessary identification documents, such as a valid ID or passport, and proof of address, to verify your identity.

Deposit the minimum required amount (e.g., $50 for the Basic Account) to fund your trading account and start trading.

Completing these steps will allow you to successfully open an account with TempleFX and gain access to their trading platform and services. Remember to carefully review the terms and conditions and risk disclosure before proceeding with your account registration.

Spread and Commission Fees

TempleFX offers a competitive spread structure to its traders, which is the difference between the buying (ask) and selling (bid) prices of an asset. The spread can vary depending on the type of account and the specific financial instrument being traded. For instance, the Basic Account features tight spreads, with examples like EUR/USD starting from 2.2 pips, providing cost-effective trading conditions.

Regarding commission charges, TempleFX follows a commission-based model for specific account types. For instance, the ECN Account, designed for professional traders seeking raw spreads, requires a commission of $7 per lot. This commission is in addition to the spread, allowing traders to access interbank quotes and benefit from direct market pricing.

Leverage

TempleFX offers maximum leverage of 1:400 to its traders. While this level of leverage is considered decent and is in line with industry standards, it falls within the average range compared to other brokers in the market. It allows traders to control larger positions with a relatively smaller amount of capital, potentially magnifying both profits and losses.

It's worth noting that higher leverage levels come with increased risk, as larger positions can lead to significant losses if trades move against the trader. Traders should always exercise caution when using leverage and be mindful of their risk management strategies to ensure they trade within their financial means. While higher leverage can offer greater trading opportunities, it also demands a higher level of risk awareness and discipline.

Trading Platform

At TempleFX, the primary trading platform is MetaTrader 4 (MT4), which is renowned for its powerful capabilities and user-friendly interface. Operating with the support of MEX Group as the liquidity provider, MT4 ensures fast execution and access to inter-bank liquidity.

MT4 serves as a versatile multi-asset platform, allowing traders to access a wide variety of financial instruments conveniently from both their personal computers and mobile devices through the dedicated application. With a comprehensive range of tools, traders can make informed decisions and execute smarter trades across different markets.

Deposit & Withdrawal

TempleFX offers a convenient and secure deposit process for traders. Clients can fund their trading accounts using various payment methods, including Credit and Debit Cards (Visa, MasterCard, Diners Club, American Express, Maestro, and JCB). This allows for instant transfers, enabling traders to start trading without delay. Additionally, bank transfers are accepted for depositing funds, providing an alternative for those who prefer traditional banking methods. With transactions available in GBP, USD, and Euro, traders can choose the currency that suits them best.

Withdrawals at TempleFX are straightforward, granting clients the freedom to access their funds when needed. Traders can withdraw both their profits and their initial deposit. This option allows for greater flexibility, enabling traders to take profits while keeping their trading capital intact. Withdrawals can be processed through the same payment methods used for deposits, including Credit and Debit Cards (Visa, MasterCard, Diners Club, American Express, Maestro, and JCB). Alternatively, traders can opt for bank transfers for withdrawal purposes.

Customer Support

TempleFX provides customer support through two primary channels: phone support and email. Traders can reach out to customer care executives via the provided phone number to seek assistance or get their queries addressed. Additionally, an email address is available for those who prefer written communication.

Educational Resources

One notable aspect where TempleFX falls short is the absence of comprehensive educational resources for traders. Unlike some other brokerage firms that prioritize trader education, TempleFX does not offer a dedicated educational section on its platform. This lack of educational resources can be a significant drawback, especially for novice traders who are seeking to learn and improve their trading skills.

Educational resources play a vital role in empowering traders with knowledge about various financial markets, trading strategies, risk management, and market analysis. The absence of educational resources in TempleFX could make it challenging for new traders to get started and navigate the complexities of the financial markets effectively. As a result, traders might need to seek educational materials from external sources, which can be inconvenient and may not align with the specific services offered by TempleFX.

Conclusion

TempleFX is a brokerage firm based in the United Kingdom, offering a range of trading services to global clients since its establishment in 2016. The broker provides access to various financial markets, including forex, commodities, precious metals, stock indices, and more. Traders can take advantage of the widely recognized MetaTrader 4 (MT4) platform, known for its user-friendly interface and powerful trading capabilities, enabling both manual and algorithmic trading strategies.

However, there have been concerns raised about the broker's regulatory status. TempleFX claimed to be authorized and regulated by the Financial Conduct Authority (FCA) in the UK. Nevertheless, it is essential to conduct thorough due diligence and verify the broker's current regulatory status, as there might be changes or updates that could affect the level of client protection and security. To make an informed decision, potential clients should carefully research the broker, verify its regulatory claims, and consider any concerns raised about its operations.

FAQs

Q: Is TempleFX a regulated broker?

A: No, TempleFX does not provide any licenses from any financial authorities.

Q: What is the maximum leverage offered by TempleFX?

A: The maximum leverage offered by TempleFX is 1:400.

Q: How can I contact customer support at TempleFX?

A: You can contact customer support at TempleFX by phone or email.

Q: What trading platform does TempleFX use?

A: TempleFX uses MetaTrader 4 (MT4) as its main trading platform.

Q: What is the minimum deposit required to open an account with TempleFX?

A: The minimum deposit required to open an account with TempleFX is $50 for the Basic Account.

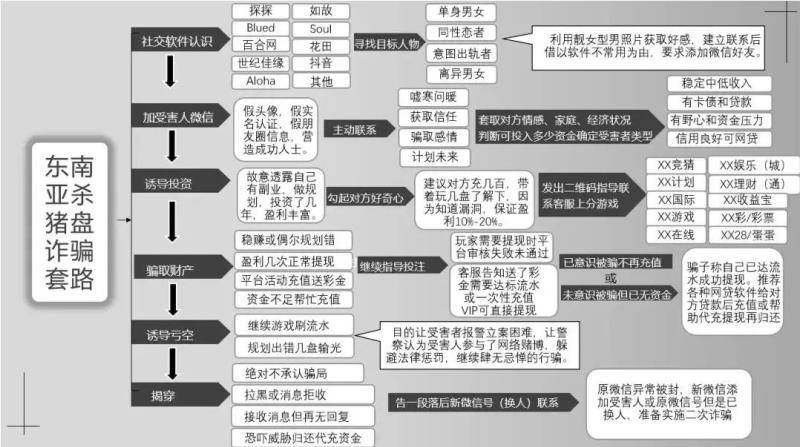

小米82941

Hong Kong

The staff of TempleFX masqueraded as a blind date and cheated people to deposit here. The victim will be vlacklisted after losing all the momney! Please stay away from TempleFX, or you'll be cheated of all the money by the staff

Exposure

2020-11-23

FX3996248377

Hong Kong

Deposit 30,000. However, the customer service said I operated illegally so I have to deposit money to withdraw funds. I know it's a bottomless hole so I didn't deposit.

Exposure

2020-11-22

小米82941

Hong Kong

The manager of TempleFX , together with its agent, made me suffer allo losses. After doing so, the agent blocked me. His Douyin account is mv2727. When I made a complaint to the palftorm, even the manager blocked me. After verification, the agent's name is Du Yu, who comes from Xinyang county, Henan, and has been blocked by Jiayuan webiste.Making his QQ exposed, hope you avoid being cheated.

Exposure

2020-02-05

小米82941

Hong Kong

After I reported TempleFX, instead of solving the problem, they banned my account. I’ve got some dollars in my account after they operated and liquidated my account, but they won’t let me withdraw because it is too little. And then these dollars were gone after they banned my account. What’s more, we were actually trading commodities instead of forex. Don’t deposit on such a platform.

Exposure

2019-09-22

小米82941

Hong Kong

On TempleFX, the market trend would suddenly slip or turn direction even though there are no big events happening. That would make your profitable order lose! What’s more, when you want to stop loss, the website would turn gray and you can’t operate, which leads to bigger loss!

Exposure

2019-09-20

小米82941

Hong Kong

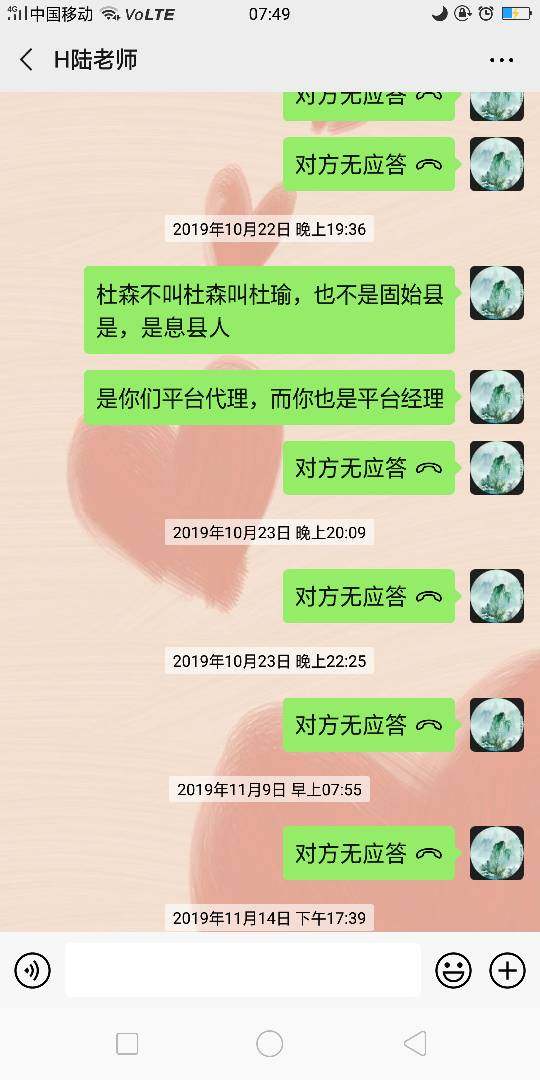

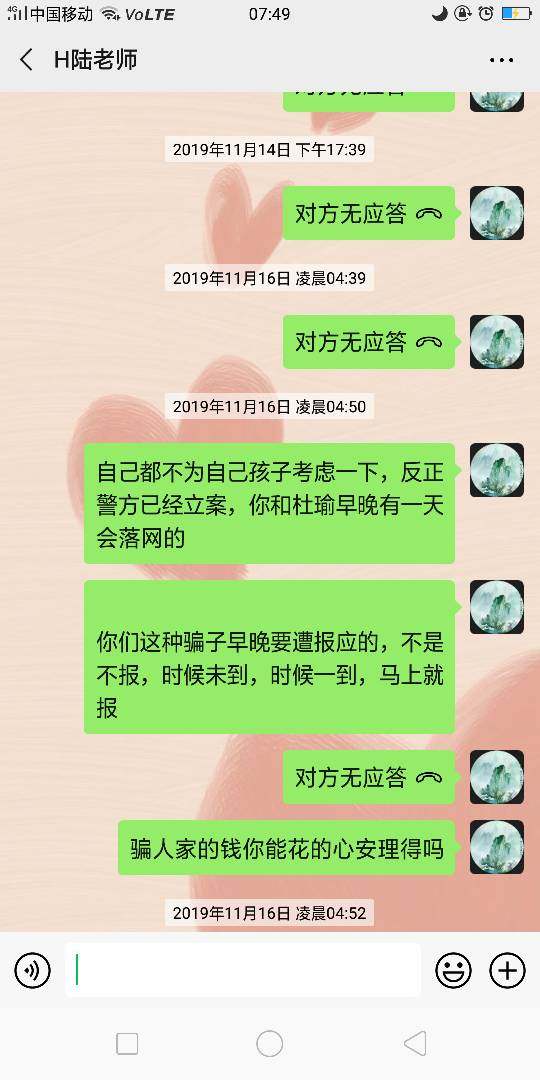

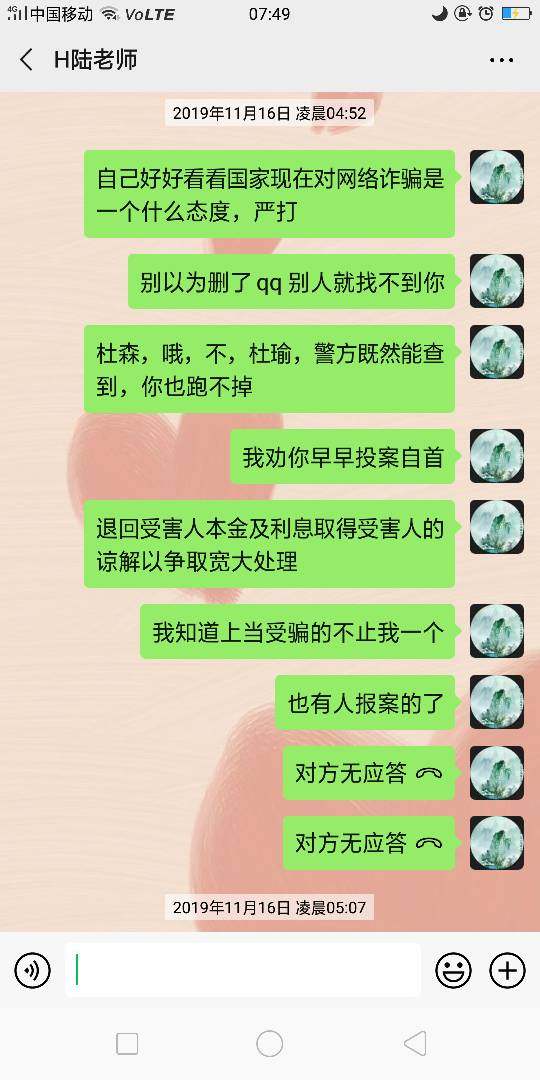

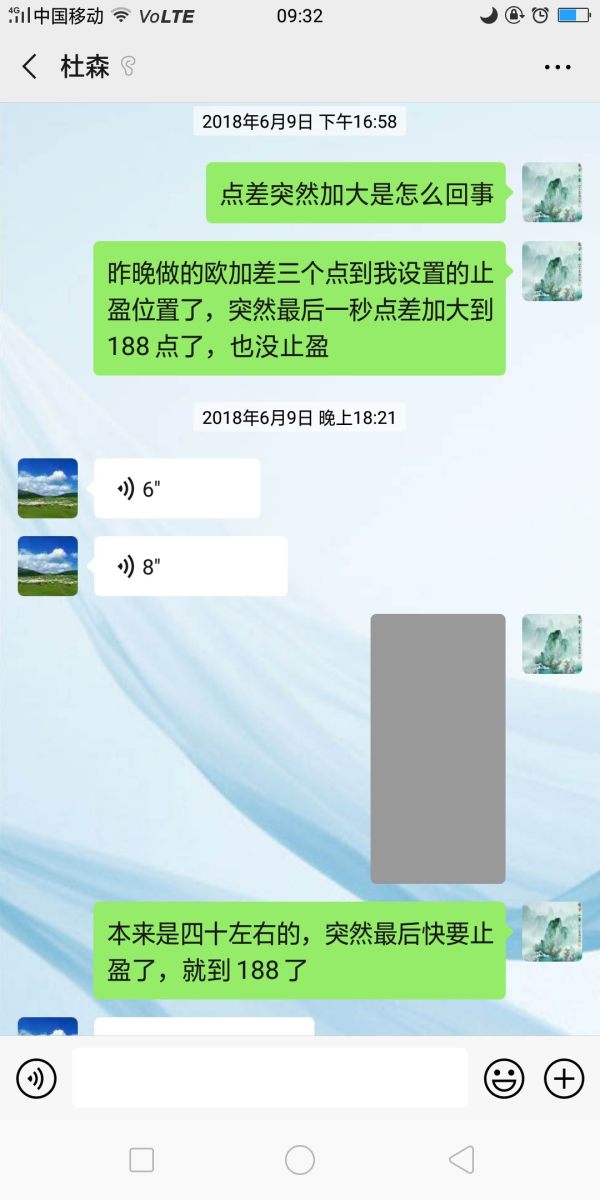

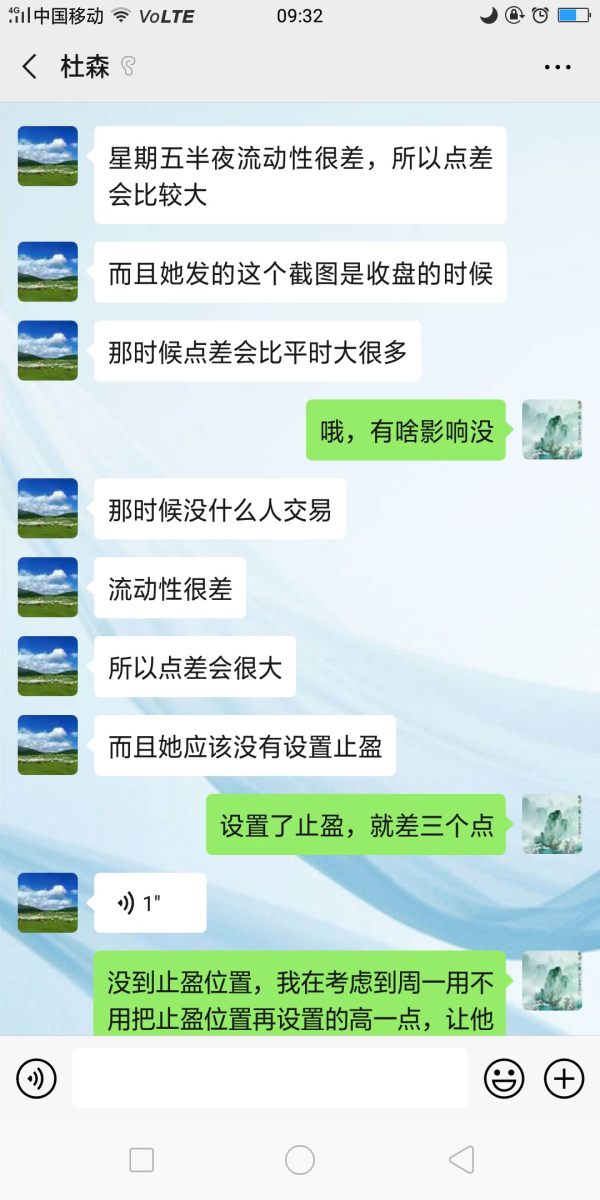

I knew Du Seng, TempleFX’s agent, in jiayuan.com, which is a dating website. Du also uploads pictures showing orders with profits on the WeChat friend circle. With this dating cover and profits incitement, Du persuaded me into depositing RMB71,500 into the platform and made orders on behalf of me. Within less than two months, I lost RMB67,412! Then I requested for withdrawing the rest money, but it took days to arrive my card! But my deposit then was instantly transferred to the platform! What’s more, Du ganged up with TempleFX’s worker Mr. Lu, whose first name was unknown, giving me reverse order recommendations. Du deleted and blacklisted me after I lost money! And Lu was also out of touch! I have contacted TempleFX by email several times informing on its worker and agent, but gave no answer! I discovered that there are negative reviews in WikiFX about the two people, who must have same experience as me. So I would like to warn other people by this exposure!

Exposure

2019-09-14

FX7809459933

Hong Kong

TempleFXs salesman induced and defrauded me, and maliciously gave reverse order advice. He also induced me to add positions, resulting in a loss of 81,925 yuan in two months. Why the platform ignores that?

Exposure

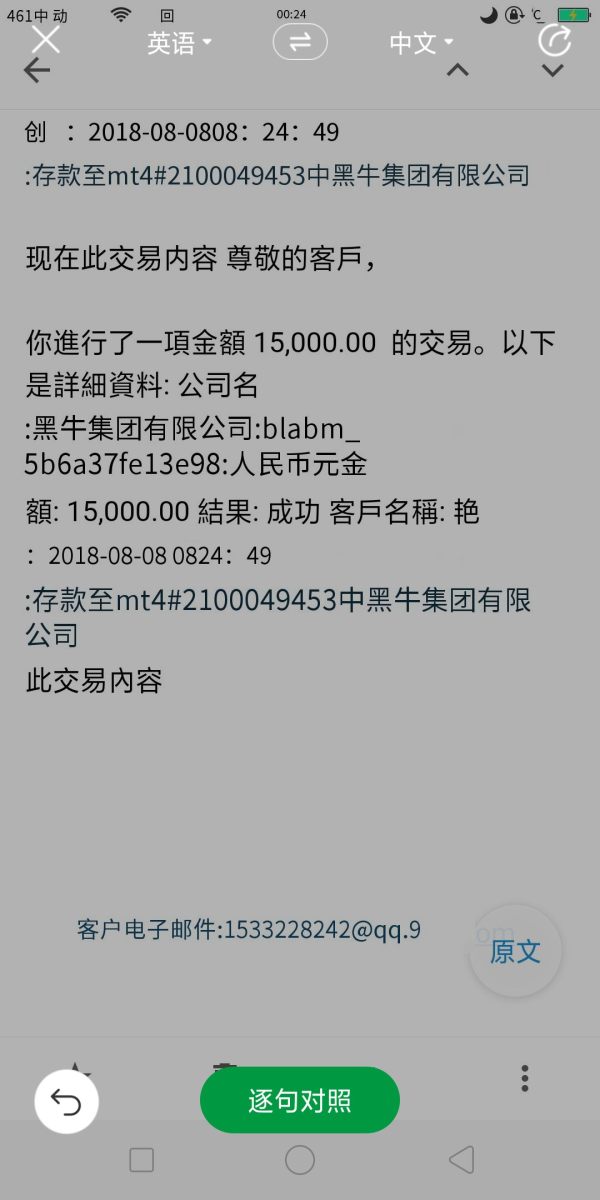

2018-08-24

FX7809459933

Hong Kong

Their salesman pretended to be an agent and induced me to trade and deliberately gave me wrong directions to make me lose. He urged me to deposit more every time I suffered a loss. I lost altogether 81925 RMB. I’ve called the police.

Exposure

2018-08-18