Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

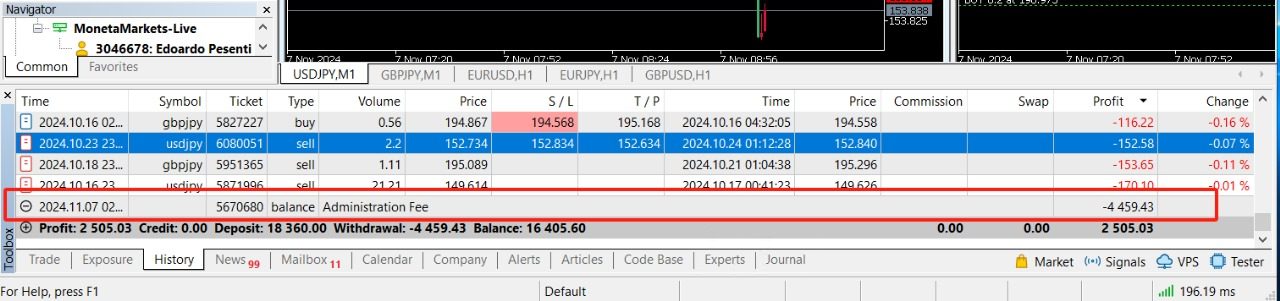

Edoardo

United Arab Emirates

I registered account 3046678 with Moneta and deposited $18360. After one month of trading, Moneta suddenly charged me $4459.43 Adiminstration Fee.

Exposure

2024-11-15

FX2713451314

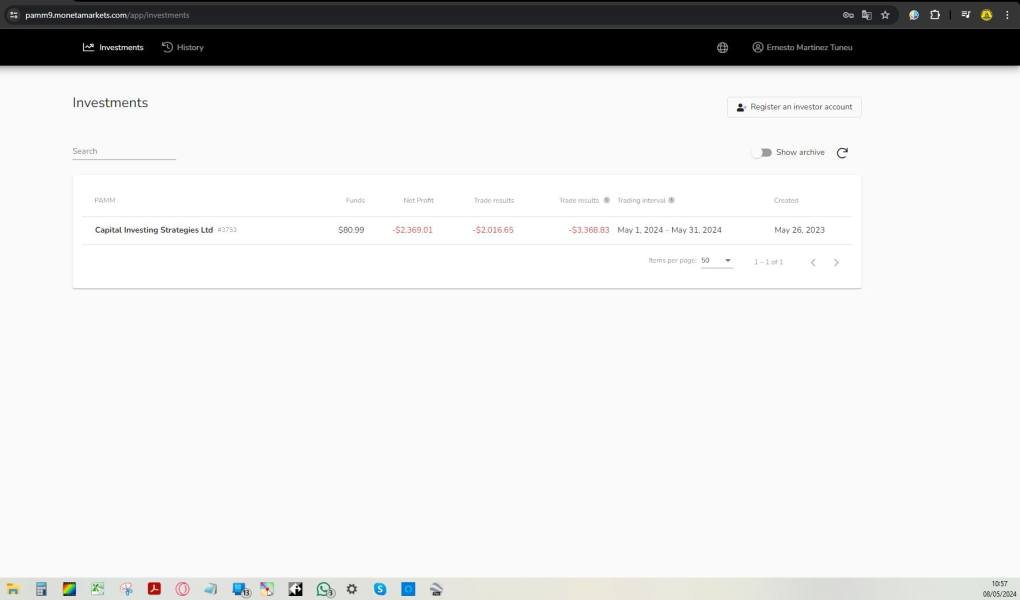

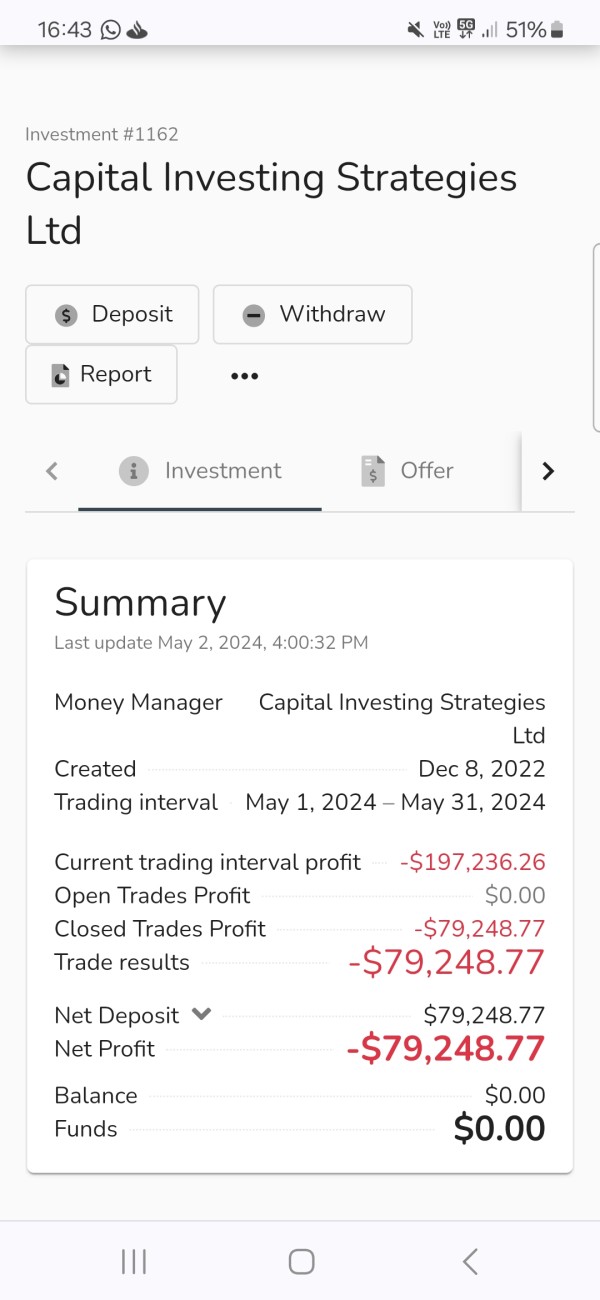

Brazil

After a year of selling an automated trading service, Moneta and Nexobot left several clients without their profitability and without their life savings invested in Moneta PAMM accounts!!! They started selling in April 2023 and in May of this year (2024) they sent a very strange email to all clients stating that they blocked all accounts to stop losses. The result: millions of dollars stolen from many clients. I had $3700 and they deducted $80 from my account. There are users who claim to have lost their life savings, over $100 or $200 thousand dollars!!! It seems that at the time I signed up, Moneta offered insurance coverage of up to $250,000 for Moneta accounts, but I haven't seen my stolen $3700 anymore! A MILLION DOLLAR ROBBERY IN BRAZIL - BEWARE!

Exposure

2024-11-13

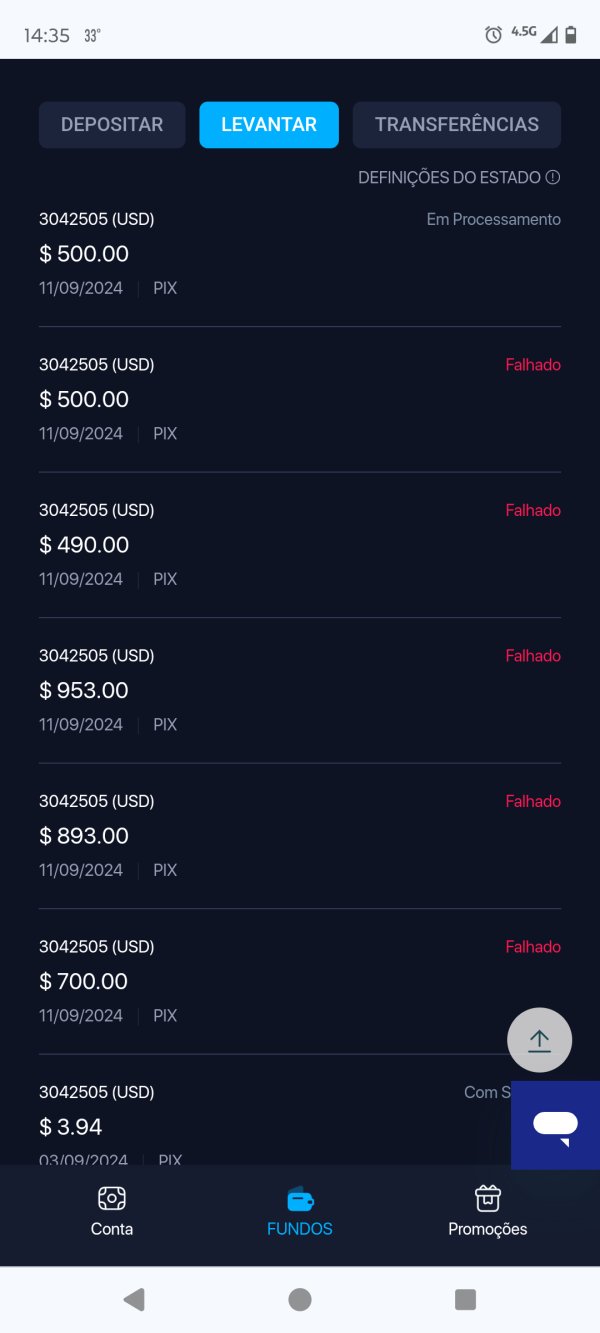

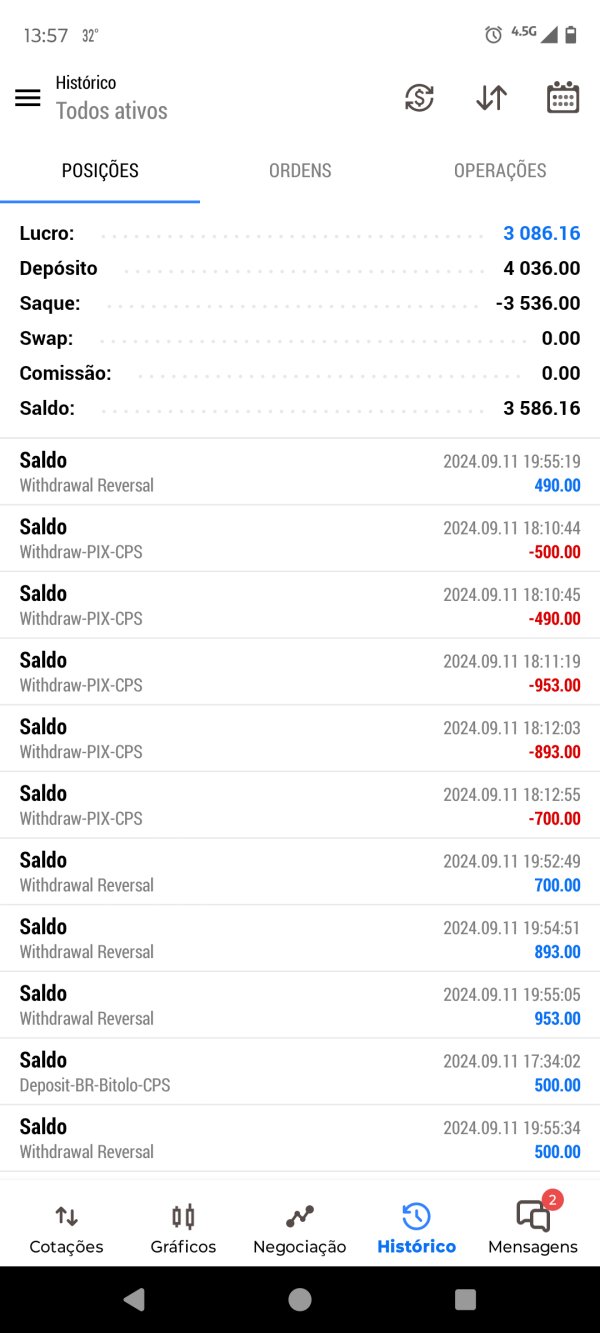

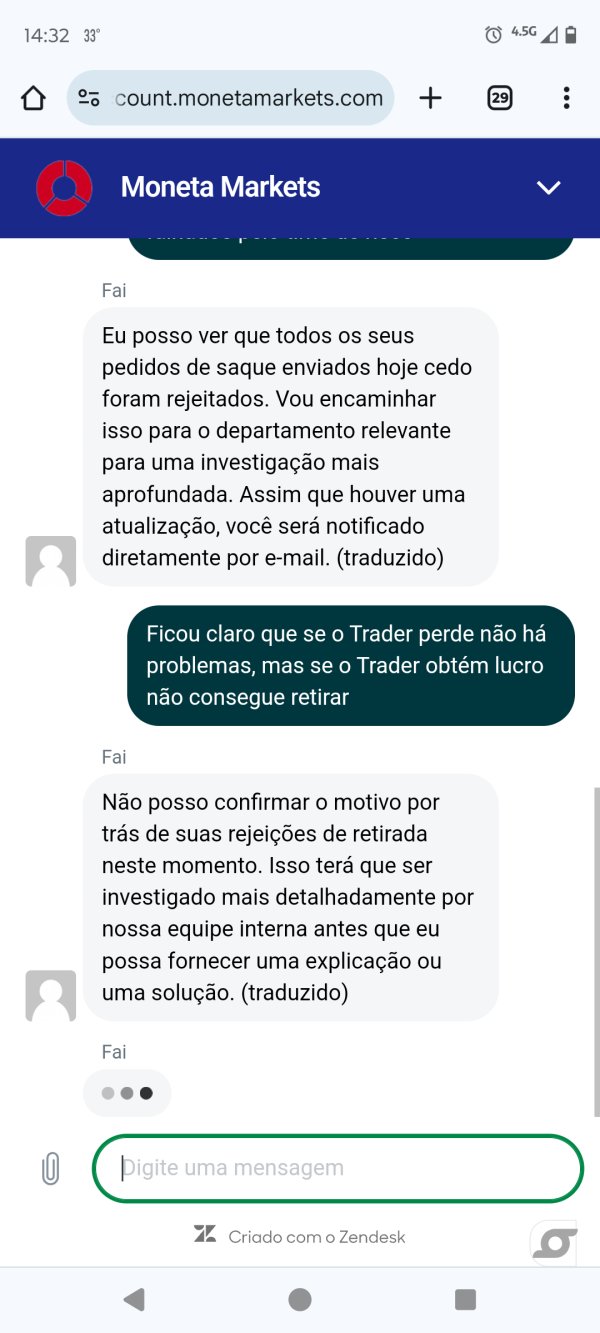

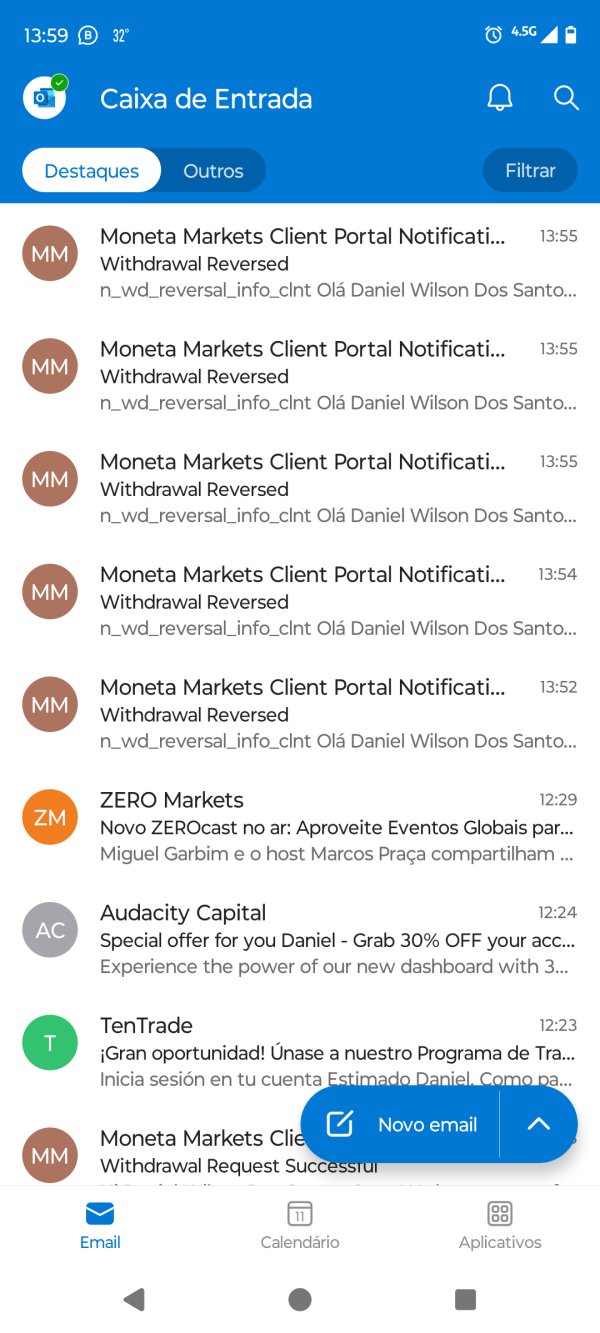

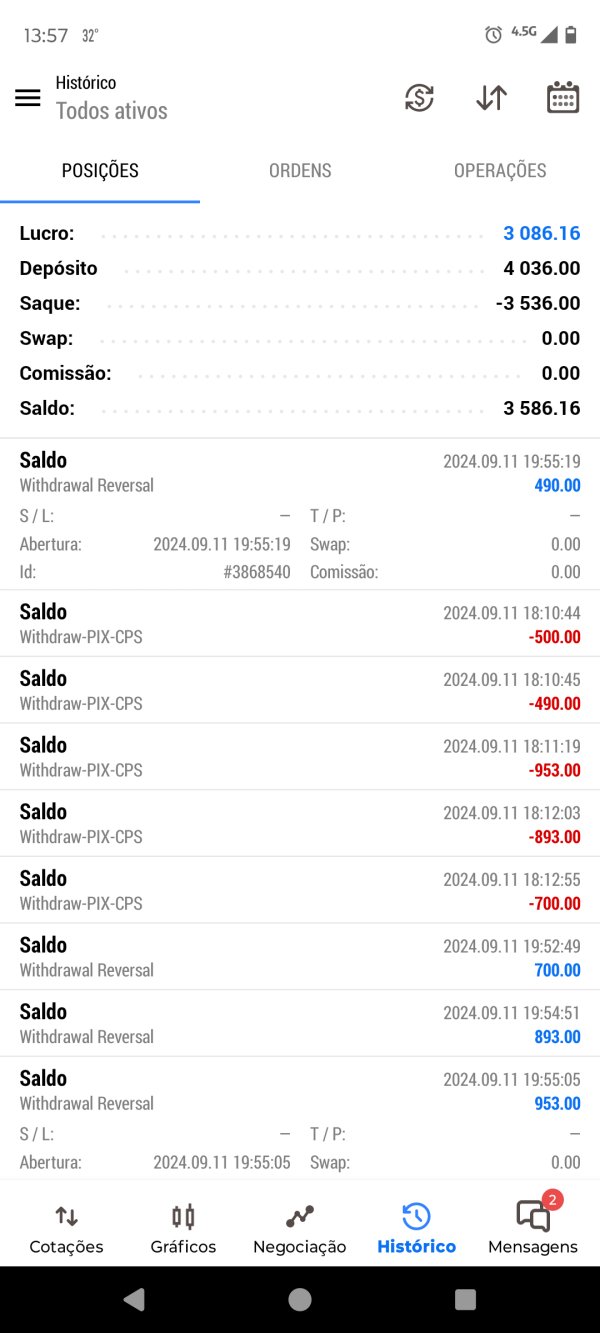

DANIEL6448

Brazil

If you lose your capital it's okay for that but if you make any high profit they will not let you withdraw. I lost 509 usd using my EA, no alert was issued by the broker, but when I adjusted my EA strategy and made profits, it quickly They rejected all my withdrawals. Stay away from this broker.

Exposure

2024-09-12

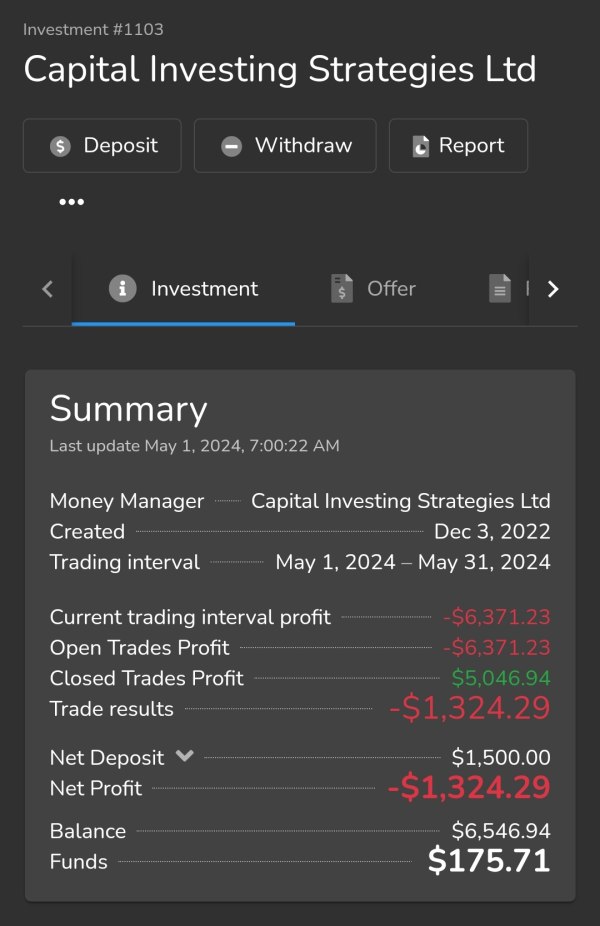

NandoMB

Brazil

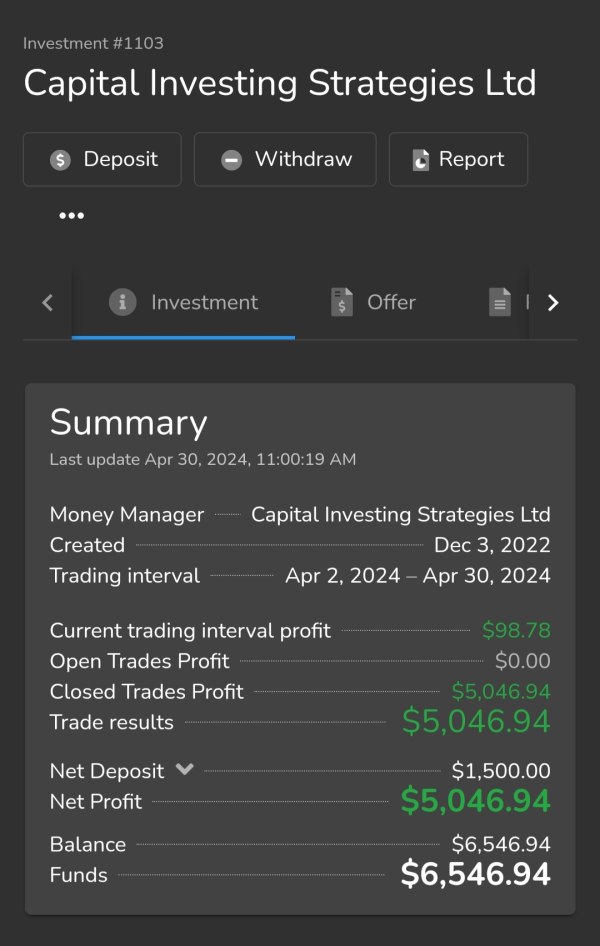

Moneta Markets allowed the PAMM account manager (Capital Investing Strategies Ltd / NexoBot) to DISABLE the display of open trades (Floating Balance/Floating) on its interface, misleading everyone, as clients were unaware of these VERY negative open trades. Capital Investing Strategies Ltd (manager of the PAMM account) concealed this huge drawdown from the PAMM account's clients, so that they were unaware of the high financial commitment that existed and, since January 2024, had been making withdrawals difficult for clients, making them practically impossible. When we tried to make withdrawals from Moneta's PAMM account and the manager wouldn't authorize it, we asked them to intervene and take action on behalf of the clients, but they said they couldn't do anything. We believe that Moneta Markets is co-responsible for this disaster, as it allowed such relevant information to be hidden in its own system (PAMM account interface, with a virtual domain bearing its name). There was talk of a protection mechanism by NEXOBOT of up to $250,000.00 per account, this amount could be used by MONETA to compensate the clients who were harmed.

Exposure

2024-05-04

FX1448743152

Brazil

Moneta Markets allowed the PAMM account manager (NexoBot) to DISABLE the display of open trades (Floating Balance/Floating) on its interface, misleading everyone because clients were unaware of these VERY negative open trades. NexoBot (the manager of the PAMM account) hid this huge drawdown from the PAMM account's clients, so that they were unaware of the high financial commitment that existed and, since January 2024, had been making withdrawals difficult for clients, making them practically impossible. When we tried to make withdrawals from Moneta's PAMM account and the manager wouldn't authorize it, we asked them to intervene and take action on behalf of the clients, but they said they couldn't do anything. We believe that Moneta Markets is co-responsible for this disaster, as it allowed such relevant information to be hidden in its own system (PAMM account interface, with a virtual domain bearing its name).

Exposure

2024-05-04

FX1001236908

Brazil

Moneta Markets allowed the PAMM account manager (NexoBot) to DISABLE the display of open trades (Floating Balance/Floating) on its interface, misleading everyone because clients were unaware of these VERY negative open trades. NexoBot (the manager of the PAMM account) hid this huge drawdown from the PAMM account's clients, so that they were unaware of the high financial commitment that existed and, since January 2024, had been making withdrawals difficult for clients, making them practically impossible. When we tried to make withdrawals from Moneta's PAMM account and the manager wouldn't authorize it, we asked them to intervene and take action on behalf of the clients, but they said they couldn't do anything. We believe that Moneta Markets is co-responsible for this disaster, as it allowed such relevant information to be hidden in its own system (PAMM account interface, with a virtual domain bearing its name). There was talk of a protection mechanism by NEXOBOT of up to $250,000.00 per account, this amount could be used by MONETA to compensate the clients who were harmed.

Exposure

2024-05-04

visit quintelintelligenceltd7255

Australia

So, starting from October 26th, i tried to withdraw money but got rejected. They mentioned something about giving bonuses because of their activities, right? And then last week, i tried to withdraw your profits, there was a problem with the server, and the customer service gave a lot of excuses.

Neutral

2023-12-21

我

Singapore

Quick deposit and withdrawal service. The only issue was with its web-trader, which was especially problematic during peak trading hours. It is nearly hard to log onto the system. Even if you could log, execution was incredibly slow.

Neutral

2023-02-21

我

South Africa

Fast service with deposit and withdrawal. The only problem was with its web-trader, especially in busy hours with high trade volumes. It is almost impossible to log into system. Even if you can log, execution was extremely lagging.

Neutral

2023-02-21

闪客

Cyprus

Honestly, spreads are not the lowest, but I still trust this broker. Customer support team is extremely professional and responsive, helping me withdraw the funds very quickly.

Neutral

2022-12-16

Cuety

New Zealand

Moneta Markets International shines with its diverse market instruments and user-friendly trading platform, making it a top choice for traders seeking flexibility and efficiency.

Positive

2024-07-30

FX1482523789

Australia

Jumping into Moneta Markets was exciting with its low deposit requirement and high leverage. However, the lack of educational resources was a bit disappointing for a beginner like me.

Positive

2024-06-04

mohammad425

Iran

One of the best brokers that provides services in Iran and I am really happy to be working with this broker

Positive

2024-04-25

sdsadsa

Taiwan

A good friend recommended Moneta to give Moneta a try. The experience is quite good, the cost is low, and the transaction is smooth. I mainly do long-term transactions. I made two withdrawals and the funds were received quickly.

Positive

2023-10-26

金钱无眠

United States

The customer service is very professional and patiently answered my questions. The withdrawals arrived quickly. The environment is very stable, which is great.

Positive

2023-10-13

FX9940

United States

After using it for half a year, the trading experience is very good. The deposit and withdrawal speed are very fast. The most important thing is that the customer service is very enthusiastic and patient. I hope the platform will get better and better!

Positive

2023-10-12

华成返佣

United States

After a period of time, the experience is still good, whether it is UnionPay or digital currency deposits and withdrawals are very smooth. Their gold has no interest, which is good!

Positive

2023-03-14

HxIn

Cyprus

Quite a decent broker from Australia, pricing and execution were surprisingly good, no issues with deposits or withdrawals so far. Had some trouble with changing the leverage but that was sorted out pretty quickly, thanks Moneta Markets!

Positive

2023-02-14

曹古营瓷砖建材

Hong Kong

The transaction cost is very low, and the deposit is only 50 US dollars, which is really friendly for novices! The mt4 platform is also very stable, and there has never been a serious slippage in the past six months of trading, which is really good!

Positive

2022-12-15