What is AMARKETS?

AMARKETS offers trading services such as Currency pairs, Shares, Metals, Indices, Bonds to its clients, but it currently operates without valid regulation from recognized financial bodies.

In the upcoming article, we will comprehensively analyze this broker's attributes from various angles, delivering clear and well-organized information. If you find this topic intriguing, we encourage you to continue reading. At the conclusion of the article, we will provide a concise summary to offer you a quick grasp of the broker's key features.

Pros & Cons

AMARKETS boasts a range of pros including the availability of a demo account for traders to practice, multi-language support to cater to diverse audiences, implementation of multiple security measures such insurance and negative balance protection etc. to safeguard users' funds, and the absence of deposit fees, which can save traders' money.

However, the platform has its share of cons, notably being unregulated, exposing traders to risks and malpratices. Additionally, the excessively high leverage at 1:3000 offered could amplify losses for inexperienced traders. AMARKETS' availability is restricted in dozens of areas, limiting access for some interested users in this region. Furthermore, the absence of a download link for the claimed MT5 platform on its website raises concerns about transparency. Lastly, the platform's customer service channels are limited to social media only, potentially hindering effective communication and support for users.

Is AMARKETS Legit or a Scam?

When considering the safety of a brokerage like AMARKETS or any other platform, it's important to conduct thorough research and consider various factors.

User feedback: To get a deeper understanding of the brokerage, it is suggested that traders explore reviews and feedback from existing clients. These shared insights and experiences from users can be accessed on reputable websites and discussion platforms.

Security measures: AMARKETS prioritizes client security with robust measures. Client interests are insured up to €20,000 per claim by the Financial Commission's compensation fund. Ernst & Young audits attest to the company's financial health, ensuring cash balances exceed liabilities. Negative balance protection shields each client. Additionally, AMARKETS maintains stringent privacy policies safeguarding client data.

Ultimately, the choice to trade with AMARKETS is a personal decision. It is important to thoroughly assess the risks and benefits before arriving at a conclusion.

Market Instruments

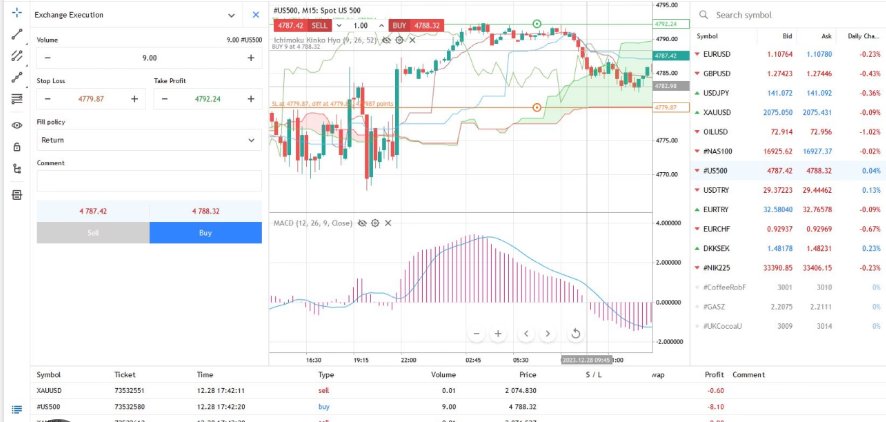

At AMARKETS, traders gain access to over 500 instruments across various asset classes, providing ample opportunities for portfolio diversification and trading strategies.

The platform offers a wide selection of currency pairs, including major pairs like EUR/USD and exotic pairs for more specialized trading approaches.

Share trading encompasses stocks from global giants such as Apple and Coca-Cola, allowing traders to capitalize on the performance of leading companies.

Precious metals like gold and silver serve as reliable options for portfolio hedging and diversification. Indices such as the S&P 500 and FTSE 100 enable traders to track market trends and take advantage of broader market movements.

Additionally, bond trading provides fixed-income opportunities with options from governments and corporations.

Accounts

At AMARKETS, traders have the choice between two distinct account types: demo and live accounts.

The demo account serves as a risk-free environment for traders to practice their strategies and familiarize themselves with the platform's functionality using virtual funds. It's an ideal starting point for beginners looking to gain confidence in their trading skills without risking real money.

In contrast, the live account offers traders the opportunity to execute trades using real funds, providing access to a wide range of financial instruments.

How to Open an Account?

To open an account with AMARKETS, you have to follow below steps:

Complete any verification process for security purposes.

Once your account has been approved, you can set up your investment preferences and start trading.

Leverage

AMARKETS, as a financial services platform, provides high leverage facilities, up to an impressive ratio of 1:3000. This significant level of leverage enables their traders to potentially make substantial trades on the platform with relatively small initial deposits. It is an attractive feature that might appeal to both novice and experienced traders, as it provides the opportunity for larger profits. However, trading with such high leverage also comes with proportional risk, meaning potential losses could be equally high.

Spread & Commission

AMARKETS stands out with its competitive spreads starting from 0.2 pips for major pairs like EUR/USD in the ECN account.

Moreover, the platform facilitates instant deposit and withdrawal of funds with zero commission on deposits, enhancing convenience for traders. However, specific details regarding other commission-related fees remain undisclosed, you should reach the broker direclty for details and clarification.

Trading Platforms

AMARKETS boasts of offering the innovative MT5 trading platform, available on various operating systems including iOS, Android, MacOS, and Windows. However, upon visiting its one-page website, we were unable to locate any download links for the MT5 platform. This discrepancy raises concerns about the platform's credibility and the accuracy of its advertised features.

Traders rely on accessible and reliable trading platforms to execute trades effectively, and the absence of download links hinders their ability to access the promised MT5 platform. Furthermore, the lack of transparency regarding the availability of the platform on the website undermines trust and transparency. Thus, traders should acess brokers who make bold claims but fail to provide clear and accessible information about their services with extreme caution.

Deposit & Withdrawal

AMarkets advertises more than 20 deposit and withdrawal methods for flexibility and convenience for clients. The platform claims to compensate for deposit fees and refund the amount of deposit commission back to the trading account, enhancing cost-effectiveness for users.

However, while various payment methods such as Visa, Mastercard, Neteller, WebMoney, FasaPay, Perfect Money, SWIFT, Skrill, and others are displayed as images on its main page, there is no direct link or confirmation of availability.

Bonus

Traders can benefit from a 15% First Deposit Bonus, usable both in trading and during drawdowns. However, this bonus comes with strings attached, as it's usable only under specific conditions, often making withdrawal a tedious process. While the offer seems appealing at first glance, traders should carefully consider the fine print before succumbing to the allure of bonus incentives.

Customer Service

AMarkets offers limited customer service channels with no phone, email, or live chat support. While active on Telegram, Facebook, YouTube, LinkedIn, and Instagram, direct communication options are lacking.

Conclusion

AMARKETS, a brokerage firm that offers Currency pairs, Shares, Metals, Indices, Bonds as market instruments to traders, operates without any valid regulation from recognized authorities currently, prompting concerns for investors about its credibility.

Therefore, individuals considering AMARKETS as their broker should be cautious, do own research and explore alternative, regulated brokers that prioritize transparency, security, and client protection

Frequently Asked Questions

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.