Overview of CICC

CICC, or China International Capital Corporation, is a global investment bank and asset management company headquartered in Beijing, China. It was founded in 1995 and is one of the largest investment banks in China. CICC offers a wide range of services, including investment banking, equities, fixed income, wealth management, asset management, and private equity.

Is CICC legit or a scam?

China International Capital Corporation (CICC) being regulated by the Securities and Futures Commission (SFC) in futures contracts adds a significant level of legitimacy to its operations. The SFC is a respected regulatory body in Hong Kong, overseeing the financial markets and ensuring the fair and orderly functioning of the futures industry.

By obtaining SFC regulation, CICC demonstrates its commitment to upholding regulatory standards and providing a secure and transparent environment for its clients in the futures market. The regulation also implies that CICC complies with stringent rules and requirements set by the SFC, including the segregation of client funds, risk management practices, and reporting obligations, further safeguarding the interests of its clients.

The SFC regulation enhances the credibility and trustworthiness of CICC in the eyes of investors and market participants. Clients can have confidence that the company operates with integrity and adheres to ethical practices, thereby minimizing potential risks associated with their futures trading activities.

Pros and Cons

CICC is a large and established investment bank with a good reputation. It offers a wide range of services, including investment banking, equities, fixed income, wealth management, asset management, and private equity. The company's strong research team provides comprehensive research reports on Chinese companies and markets, which can be valuable for investors seeking insights into the dynamic Chinese market. CICC's established presence and diverse services make it an attractive option for clients looking for a reputable and multifaceted financial partner.

As a Chinese company, CICC may not be suitable for investors who are not familiar with the Chinese market. Understanding the complexities and nuances of the Chinese financial landscape may require specialized knowledge and expertise. Additionally, CICC's fees may be higher than those of other investment banks, which could potentially impact cost-sensitive clients. Some investors may also find that CICC's customer support falls short of their expectations, as it may not match the level of service provided by other investment banks.

Market Instruments

CICC provides a wide range of market instruments, including equity financing, debt and structured finance, research, sales and trading services for equities, fixed income, commodities, foreign exchange securities, and derivatives. They also offer wealth management services for high-net-worth individuals and corporate clients, comprehensive asset management products, and private equity investments in innovative global companies across various industries.

Account Types

CICC provides a diverse range of account types tailored to different client needs. Individual accounts cater to individual investors, offering them access to various financial products and services for personal investment goals. Corporate accounts are designed for businesses and corporations seeking capital market services and financing solutions. Institutional accounts target institutional investors, including pension funds, insurance companies, and other large entities, providing them with specialized investment options and strategies.

In addition to the variety of account types, CICC offers a wide array of account features to enhance trading capabilities. Margin trading allows investors to borrow funds from CICC to increase their trading positions, potentially amplifying both gains and losses. Short selling enables investors to profit from declining market prices by selling borrowed securities and buying them back at a lower price. Stop-loss orders provide risk management tools, allowing traders to set specific price levels at which their positions will be automatically sold to limit potential losses.

How to Open an Account?

To open an account with CICC, you will need to provide some basic information, such as your name, address, and contact information. You will also need to provide a copy of your passport or other identification document.

Leverage

CICC provides the option for margin trading, allowing traders to borrow funds from the broker to amplify their trading positions. While this can increase potential profits, it also carries higher risks, as losses are also magnified. Traders should exercise caution and use leverage judiciously to manage their risk effectively.

Spreads & Commissions

CICC offers competitive spreads, which refer to the difference between the bid and ask prices of a financial instrument. Additionally, the broker charges commissions for each trade executed. The transparency of CICC's pricing structure ensures that traders are aware of the costs involved in their trades, promoting a fair and equitable trading environment.

Trading Platform

CICC's user-friendly trading platform is designed to provide a seamless and efficient trading experience. Traders can access real-time quotes, use technical analysis tools to analyze market trends, and utilize order management tools to execute trades effectively. The platform's intuitive interface caters to both novice and experienced traders, enhancing their overall trading journey.

Deposit & Withdrawal

CICC offers a variety of deposit and withdrawal methods to accommodate its clients' preferences. Traders can fund their accounts via wire transfers, bank transfers, and credit cards, providing convenience and flexibility when managing their trading funds. Similarly, withdrawals are processed efficiently, ensuring traders have timely access to their profits.

Customer Support

China International Capital Corporation (CICC) appears to have a comprehensive network of branches and offices across various regions, showcasing its commitment to providing customer support to its clients. With branches in major cities like Beijing, Shanghai, and Shenzhen, as well as international offices in locations such as Hong Kong, London, and New York, the company aims to offer accessible and localized assistance to its clientele.

CICC's extensive branch network is likely to enhance its customer support capabilities by enabling traders to access in-person assistance, should they prefer a face-to-face interaction. Clients can seek guidance on various financial services, get help with account-related inquiries, and receive updates on market trends and investment opportunities through these branches.

In addition to physical locations, CICC also provides customer support via phone, fax, and email, as indicated in the contact information provided. This multichannel approach ensures that clients have multiple avenues to reach out to the company's support team and obtain assistance promptly, regardless of their location or time zone.

Educational Resources

China International Capital Corporation (CICC) is committed to providing comprehensive educational resources to its clients, empowering them with knowledge and insights to make informed investment decisions. The broker offers a wide range of educational materials, including webinars, articles, tutorials, and market research reports.

These resources cover various topics, such as fundamental and technical analysis, trading strategies, market trends, and economic indicators. Clients can access these educational materials through the broker's website or trading platform, ensuring that they have the tools and information they need to enhance their trading skills and stay up-to-date with the latest developments in the financial markets. Whether clients are beginners or experienced traders, CICC's educational resources aim to support their growth and success in the world of finance and investment.

Conclusion

CICC is a legit investment bank and asset management company with a good reputation. It offers a wide range of services and market instruments, and its fees are competitive. CICC's trading platform is user-friendly and easy to use. Its customer support is available 24/7. If you are looking for a reputable investment bank to trade Chinese stocks and other market instruments, CICC is a good option.

FAQs

Q: What are the minimum deposit requirements for opening an account with CICC?

A: The minimum deposit requirements for opening an account with CICC vary depending on the account type. For individual accounts, the minimum deposit requirement is $1,000. For corporate accounts, the minimum deposit requirement is $10,000.

Q: What are the trading hours for CICC?

A: CICC's trading hours are Monday through Friday, from 9:30am to 5:00pm (Beijing time).

Q: What are the fees for trading with CICC?

A: CICC's fees vary depending on the market instrument and the account type. For example, the fee for trading stocks is 0.05% of the trade value for individual accounts and 0.02% of the trade value for corporate accounts.

Q: Is CICC suitable for non-Chinese investors?

A: CICC may require Chinese market familiarity for non-Chinese investors.

Q: Are CICC's fees competitive?

A: CICC's fees may be higher compared to other banks.

M.A.C.99

Bolivia

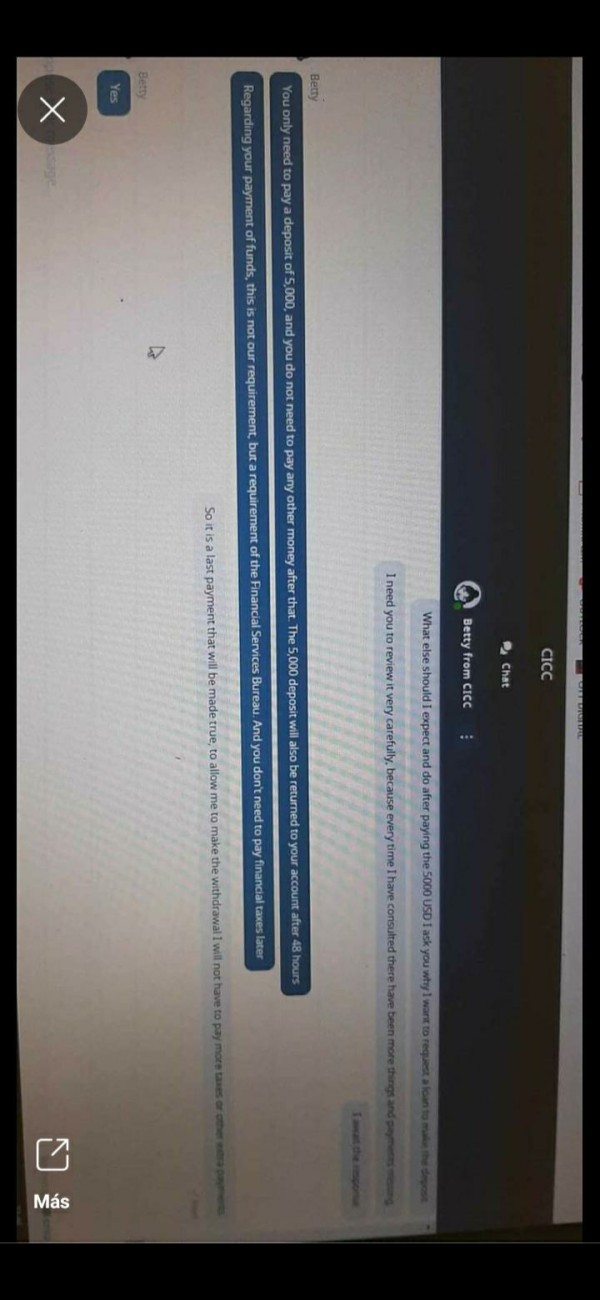

Next I want to present my case, through a friend I accessed this broker to carry out market operations and well I made a first deposit of 500usd between profits and loss, to recover my friend helped me with 500usd and hey we started a market operation with 1802usd. which generated a total of initial investment plus profits of 5550.68usd, from that moment everything started when I requested to withdraw the funds I was rejected, customer service indicated that a payment of 20% tax had to be made, I paid 1,111usd I was rejected again Withdrawal he told me that I had to pay another 30% tax which I paid 1665usd again in my withdrawal attempt, I was refused, I submitted my claim to customer service and they told me that I must make a new deposit of 5,000usd to be able to withdraw and that this last tax was not It was necessary since virtual currencies are not yet regulated in my country. I requested a refund. They only reimbursed me to the CICC account but they did not allow me to make the withdrawal nor to the payment account, which would be the most logical thing. My friend tried to help me with 1000usd that I deposited into the CICC direct account making a total investment + taxes + the deposit that my friend made on account of the 5000usd, a total of 8215.95usd which they do not allow me to withdraw without first making the payment of the 5000usd (throughout the process they have requested payments and more payments, the account grew a lot and I decided not to make more payments since a lot of money was gone and this is really a scam since deposit and payment after payments will not allow me to make my withdrawal). I need help to get my money back please!!!

Exposure

2023-11-15

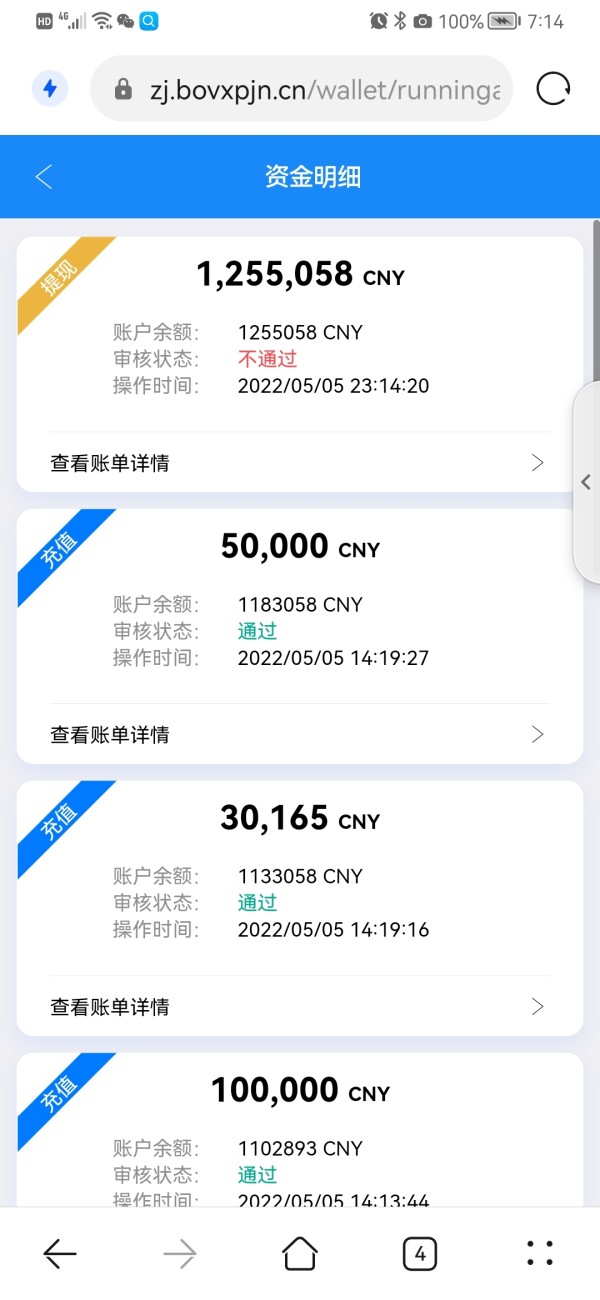

静4528

Hong Kong

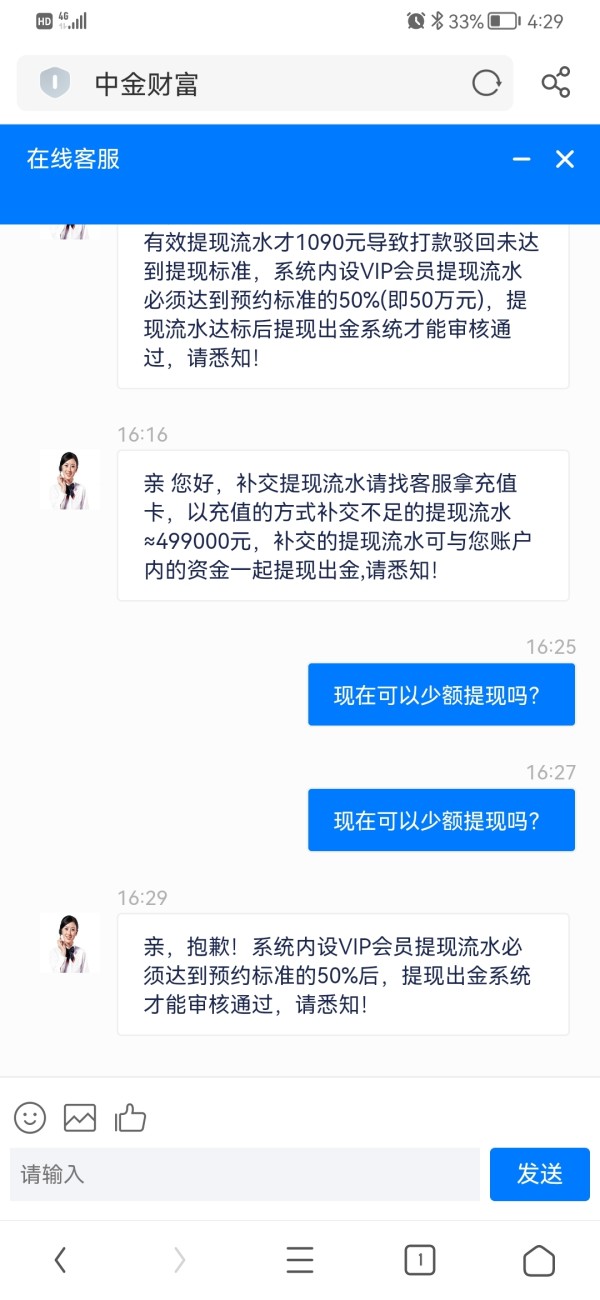

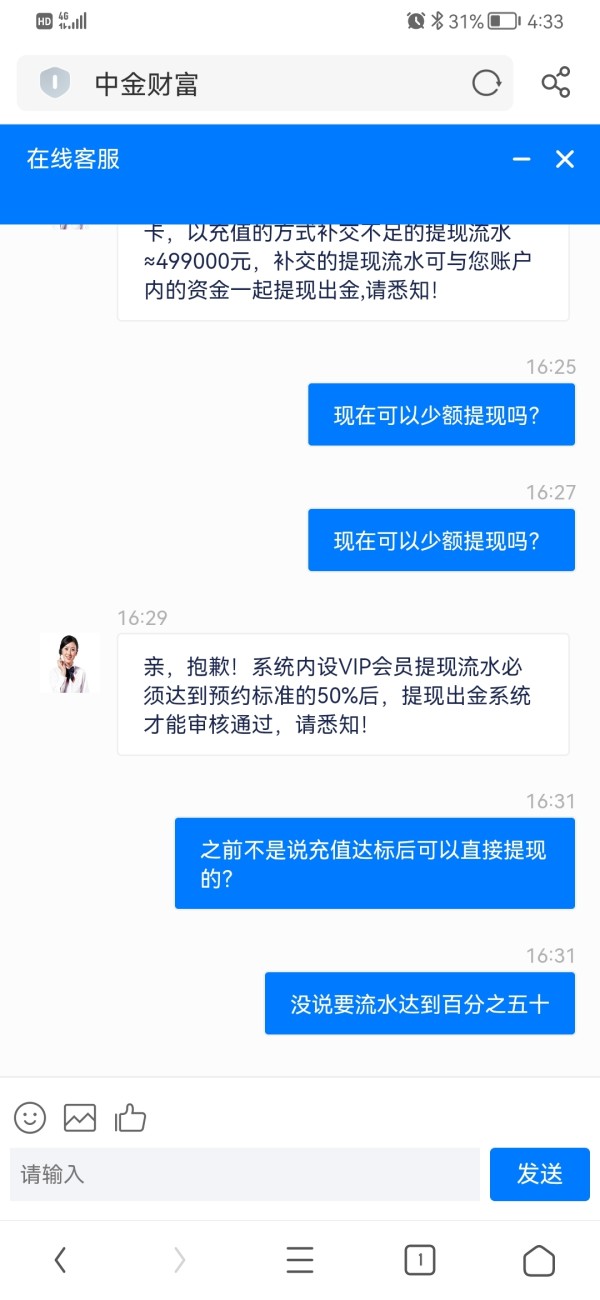

On the foreign exchange platform of CICC, CICC said that there will be a rebate activity after deposit 1 million, and said that after the deposit reaches the standard, you can withdraw cash immediately, but now you say that the cash flow is not enough, and you will not pass it. I have to get another five hundred thousands cash flow to withdraw. Well, I was deceived and now I can't withdraw a penny! Hope you can help me get my money back

Exposure

2022-05-06

一缕阳光83611

Hong Kong

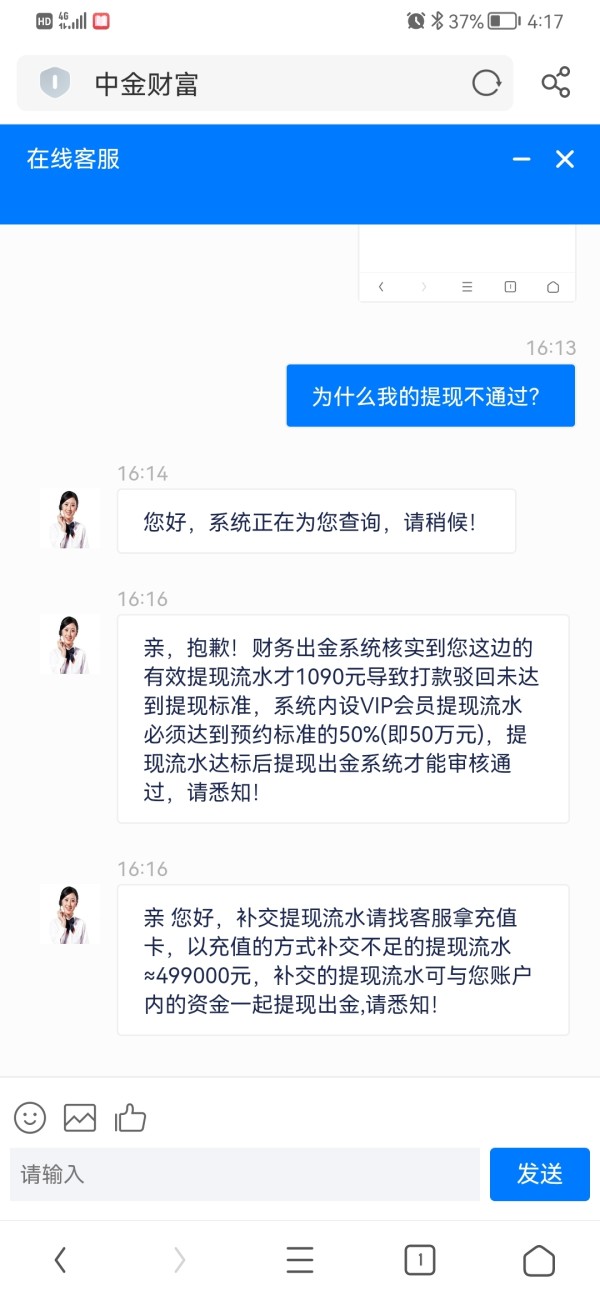

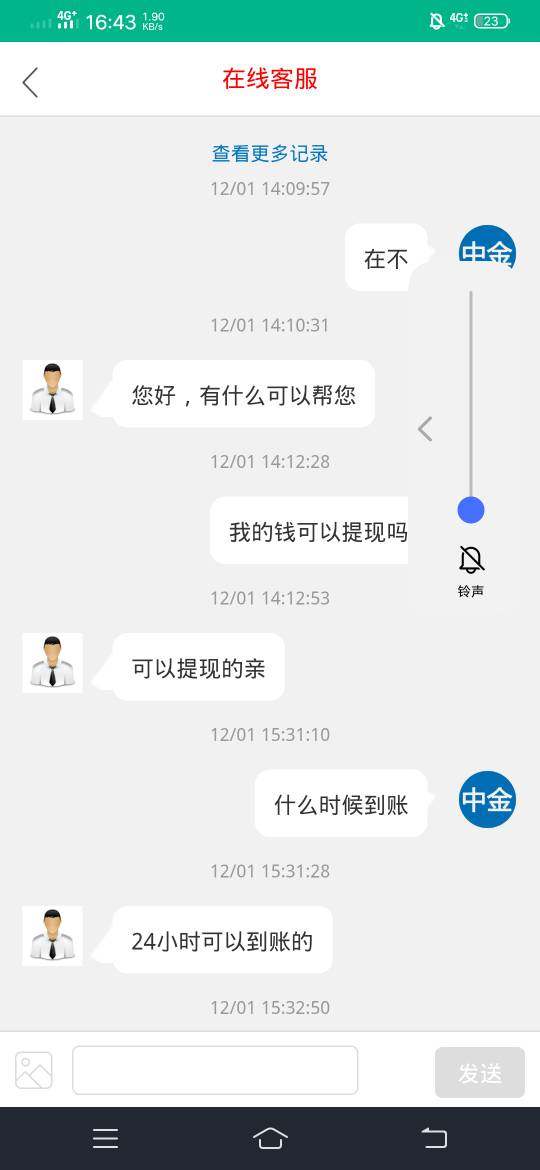

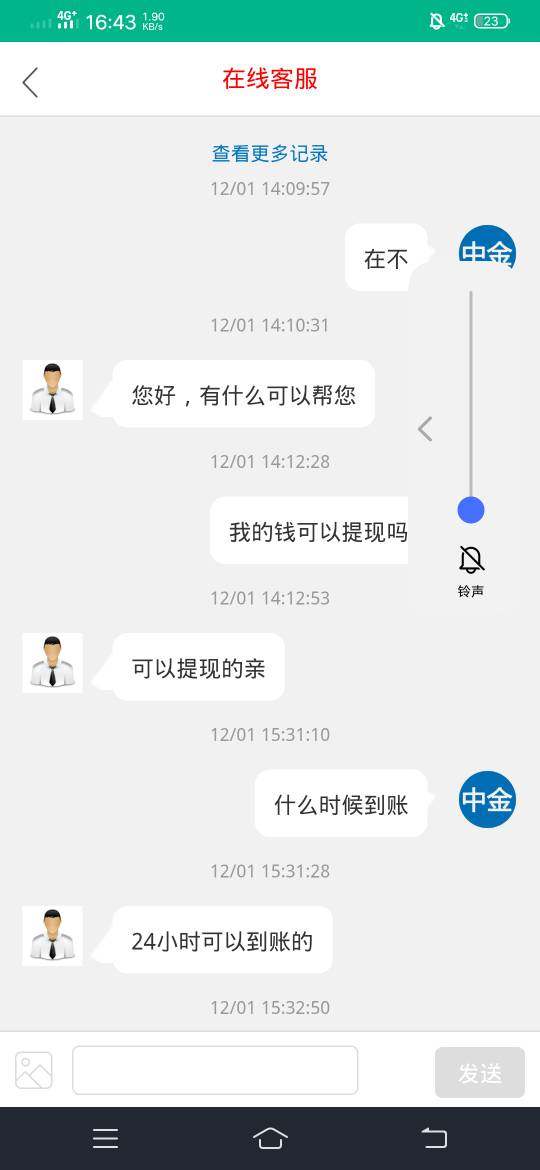

The withdrawal hasn’t been received in 24 hours. The customer service doesn’t reply to me.

Exposure

2019-12-09

一缕阳光83611

Hong Kong

The forex broker gave no access to withdrawal and still urged clients to add fund. The fund-receiving account wasn’t the same.

Exposure

2019-12-08

樊少凡

Hong Kong

I am impressed by their company’s professional customer service, and I have decided to make some investment plans here. Several friends also recommend me this company. Time to have a try.

Neutral

2023-03-13