Score

IMF

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://www.imfspace1.net

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomUsers who viewed IMF also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Total Margin Trend

| VPS Region | User | Products | Closing time |

|---|---|---|---|

Taipei Taipei | 731*** | UKOil | 05-27 19:22:50 |

Shanghai Shanghai | 993*** | UKOil | 05-27 10:41:27 |

Taipei Taipei | 583*** | HangSeng | 05-27 09:01:32 |

Stop Out

1.58%

Stop Out Symbol Distribution

6 months

Website

imfspace1.net

Server Location

Hong Kong

Website Domain Name

imfspace1.net

Server IP

45.207.26.97

imfspace.vip

Server Location

United States

Website Domain Name

imfspace.vip

Server IP

34.102.136.180

imfspace.net

Server Location

United States

Website Domain Name

imfspace.net

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2019-09-07

Server IP

184.168.221.45

Genealogy

VIP is not activated.

VIP is not activated.Relevant Enterprises

Company Summary

| Aspect | Information |

| Registered Country/Area | United Kingdom |

| Founded Year | 2-5 years |

| Company Name | IMF Capital Limited |

| Regulation | Not regulated, flagged as unauthorized by NFA |

| Minimum Deposit | $1,000 |

| Maximum Leverage | Up to 1:500 for forex, 1:5 to 1:20 for equity CFDs |

| Spreads | Between 0.2 and 0.5 pips for major currency pairs |

| Trading Platforms | Meta Trader 4 (MT4) |

| Tradable Assets | Currency, Share Index, Index, Energy, Noble Metals, Commodities |

| Account Types | Current Account, Savings Account, ISA |

| Demo Account | Not mentioned |

| Islamic Account | Not mentioned |

| Customer Support | 24/7 via email, telephone, and fax |

| Payment Methods | Bank wire transfers, Visa and Mastercard debit/credit cards, PayPal |

Overview of IMF

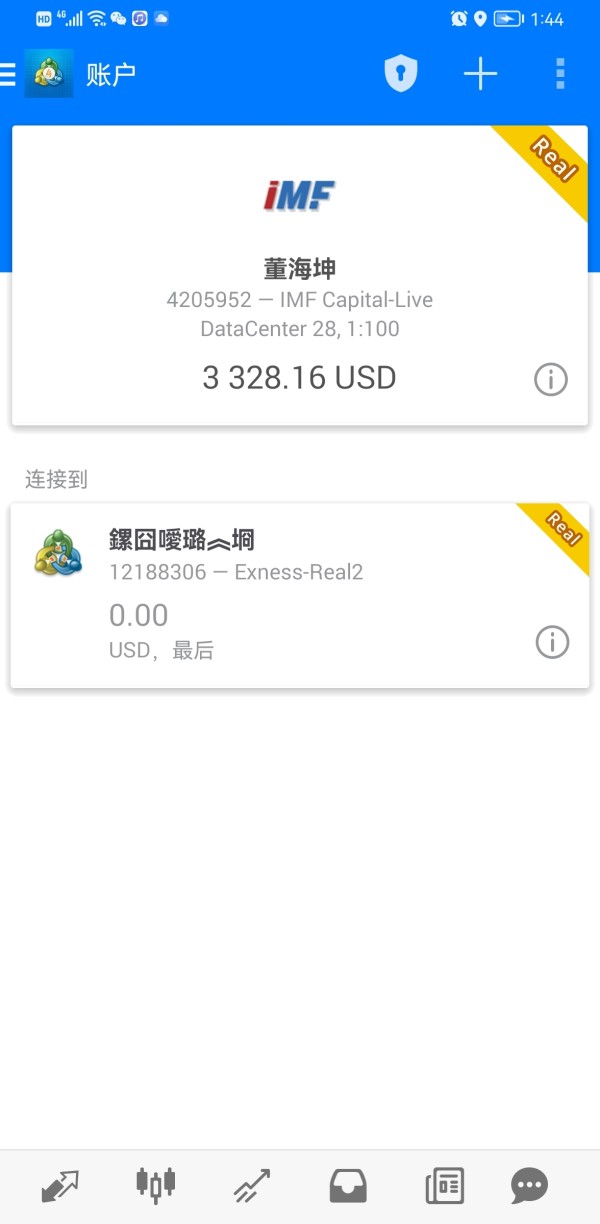

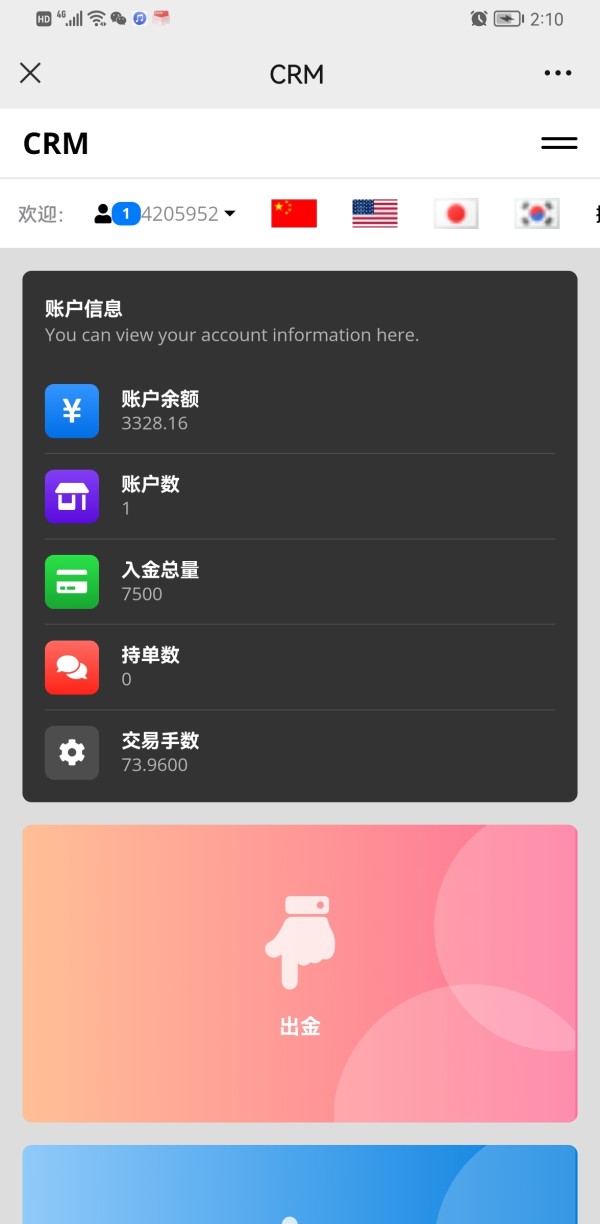

IMF CAPITAL LIMITED is an unregulated brokerage firm based in the United Kingdom, offering various financial instruments for trading. While it provides opportunities to trade major and emerging market currencies, share indices, energy-related instruments, noble metals, and commodities, potential customers should exercise caution due to its lack of regulation. The company's legitimacy has been questioned by the United States National Futures Association (NFA), which lists IMF CAPITAL as unauthorized and abnormal, warning against potential scams.

The company offers different account types, including current and savings accounts, with varying features and interest rates. Additionally, IMF CAPITAL provides tax-free Individual Savings Account (ISA) options to help customers save money. However, leverage options are available, which can amplify gains but also increase the risk of substantial losses, necessitating cautious risk management.

IMF CAPITAL LIMITED utilizes the widely used Meta Trader 4 platform, allowing for real-time trading and automated trading through expert advisors. However, customer reviews have expressed concerns about difficulties in withdrawing funds, delays in processing requests, and challenges in contacting customer support. Given the company's unregulated status and negative feedback, potential clients should conduct thorough research and carefully consider the associated risks before engaging with IMF CAPITAL LIMITED.

Pros and Cons

The International Monetary Fund (IMF) offers access to various market instruments, including currencies, share indices, energy, noble metals, and commodities, providing investors with diverse investment options. It also offers different account types, such as current accounts, savings accounts, and ISAs, catering to different investment needs. Traders can utilize leverage options of up to 1:500 for potential higher gains in their trades. Operating on the Meta Trader 4 platform, IMF ensures a widely-used trading environment. However, the IMF's unauthorized status by the United States National Futures Association (NFA) and lack of regulation raise concerns about its legitimacy and oversight. Negative reviews highlight issues with fund withdrawals and customer service delays. Moreover, the $1,000 minimum deposit requirement may deter some potential investors. Lack of transparency regarding deposit and withdrawal processes and limited access to the official website further raise doubts about its credibility. Additionally, users should be aware of potential inactivity and other fees. Customer support appears inadequate with limited information available for assistance. These pros and cons encompass the complex considerations when dealing with the IMF.

| Pros | Cons |

| Provides access to various market instruments like currencies, share indices, energy, noble metals, and commodities. | Not regulated and listed as unauthorized by the United States National Futures Association (NFA). |

| Offers a range of account types, including current accounts, savings accounts, and ISAs. | Numerous negative reviews highlighting difficulties in withdrawing funds and delays in customer service response. |

| Provides leverage options for potential higher gains in trading, up to 1:500 | Minimum deposit requirement is $1,000. |

| Offers Meta Trader 4 platform | Limited information on deposit and withdrawal |

| Minimum deposit requirement is $1,000. | Lack of access to the official website |

| Spreads start from 0.2 pips | Inactivity fee and other fees may apply. |

| Basic deposit and withdrawal methods, including bank wire transfers, Visa/Mastercard, and PayPal. | Limited information on customer support |

Is IMF Legit?

IMF CAPITAL LIMITED, as mentioned in the provided information, is not regulated and is listed as unauthorized by the United States National Futures Association (NFA). The company holds a Common Financial Service License, but it has been verified that they currently do not have valid regulation. Therefore, potential customers should be cautious and aware of the risks associated with dealing with this unregulated broker. The NFA has flagged the regulatory status as abnormal and unauthorized, advising individuals to exercise caution and be aware of potential scams.

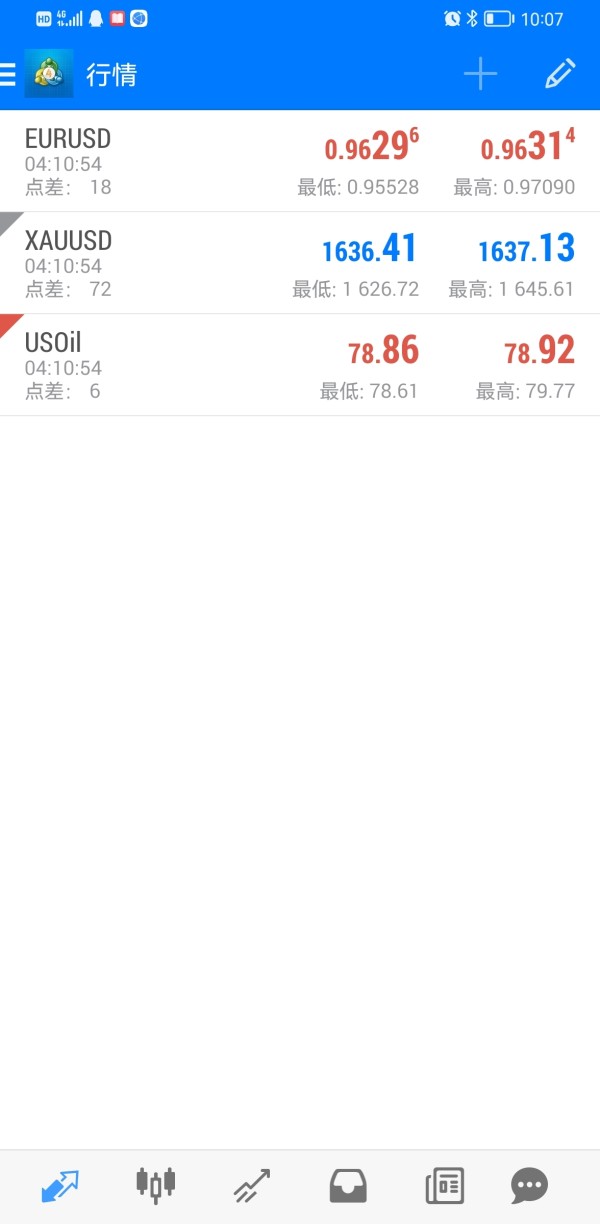

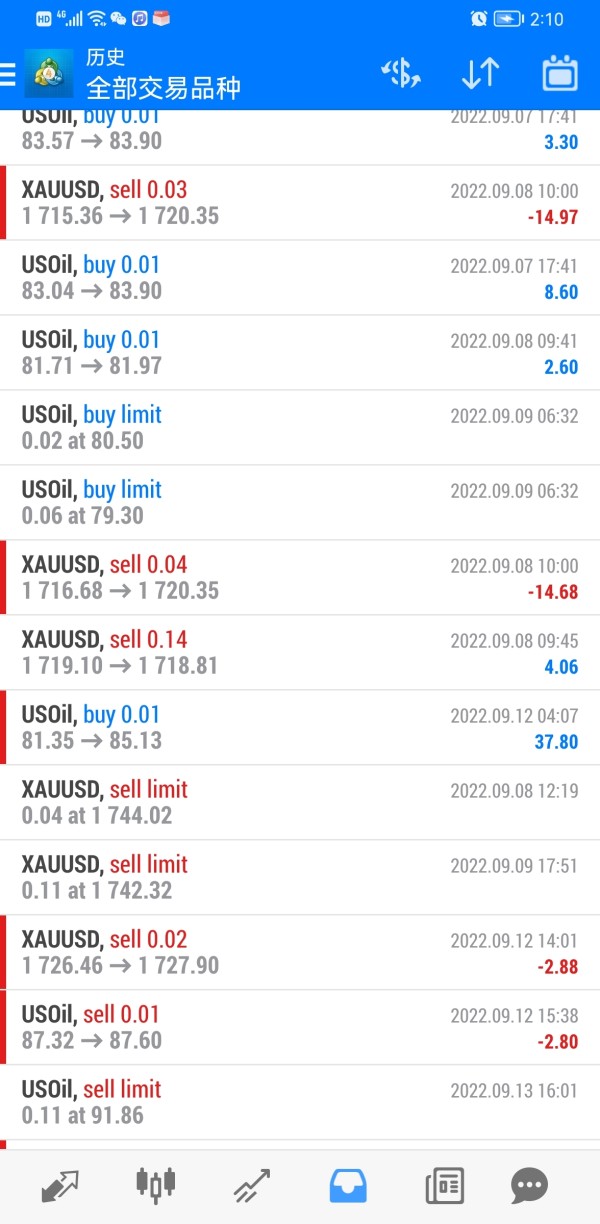

Market Instruments

CURRENCY TRANSACTION: IMF CAPITAL facilitates currency transactions, allowing clients to buy and sell foreign currencies. Examples include major currencies like USD, EUR, GBP, JPY, and emerging market currencies such as INR, BRL, and ZAR.

SHARE INDEX: The company provides access to share index instruments, enabling clients to invest in a group of stocks representing a specific market or sector. Examples include popular indices like the S&P 500, FTSE 100, Nikkei 225, and DAX.

INDEX: IMF CAPITAL offers various index products that allow clients to track the performance of specific financial markets or segments. Examples include bond indices like Bloomberg Barclays Global Aggregate Index and equity indices such as MSCI World Index.

ENERGY: Clients have the option to invest in energy-related instruments, giving exposure to commodities like crude oil, natural gas, and heating oil. These instruments provide opportunities to hedge or speculate on energy price movements.

NOBLE METALS: The company provides instruments related to noble metals like gold, silver, platinum, and palladium. Clients can participate in these markets to diversify their portfolios or take advantage of precious metal price fluctuations.

COMMODITIES: IMF CAPITAL facilitates trading in various commodities, including agricultural products like corn, wheat, and soybeans, as well as industrial metals like copper and aluminum. Investing in commodities allows clients to gain exposure to global supply and demand dynamics.

Pros and Cons

| Pros | Cons |

| Currency transaction facilitation | Unauthorized status by the United States National Futures Association (NFA) |

| Access to share index instruments | Difficulties in withdrawing funds and delays in customer service response |

| Various index products available | Limited information on deposit and withdrawal processes |

Account Types

CURRENT ACCOUNT

IMF CAPITAL LIMITED provides several current account options to cater to different customer needs. The IMF Current Account is a basic offering with standard features like online banking and bill pay. For those looking for a more cost-effective option, the IMF Basic Current Account provides similar services but with fewer features compared to the standard current account. On the other hand, the IMF Premier Current Account is a premium option that comes with additional benefits such as travel insurance and cashback on purchases.

SAVINGS ACCOUNT

For customers looking to save money and earn interest, IMF CAPITAL LIMITED offers various savings account choices. The IMF Savings Account is a basic option that provides an interest rate. For those seeking higher returns, the IMF High-Interest Savings Account offers a more interest rate compared to the standard savings account. Additionally, parents can open the IMF Junior Savings Account for their children, which not only offers a low interest rate but also provides parental controls for added security.

ISA (Individual Savings Account)

IMF CAPITAL LIMITED offers a range of Individual Savings Account (ISA) options to help customers save money while earning tax-free interest. The IMF ISA is a general ISA that allows individuals to invest in a diverse range of assets. The IMF Junior ISA is designed specifically for children, enabling them to save money while enjoying tax benefits. Furthermore, the IMF Help to Buy ISA is a specialized account intended to help customers save for their first home's deposit with the added advantage of tax-free interest earnings.

| Pros | Cons |

| Various account options | Limited features in Basic Current Account |

| Savings options with interest | Limited parental controls in Junior Savings Account |

| Tax-free interest in ISAs | Limited focus on specific financial goals (e.g., retirement) |

Leverage

IMF CAPITAL LIMITED provides leverage options for clients, with ratios varying based on the financial instrument and account type. Leverage can be as high as 1:500 for forex trading and between 1:5 to 1:20 for equity CFDs. While leverage can amplify potential gains, it also increases the risk of substantial losses, necessitating cautious use and risk management.

Spreads & Commissions

IMF CAPITAL LIMITED's spreads are typically between 0.2 and 0.5 pips for major currency pairs. The commission is typically $1 for a standard lot size. Other fees, such as a deposit fee, withdrawal fee, and inactivity fee, may also apply.

Minimum Deposit

The minimum deposit requirement at IMF CAPITAL LIMITED is $1,000.

Deposit & Withdrawal

IMF CAPITAL LIMITED offers a variety of deposit and withdrawal methods for its clients. These include bank wire transfers, Visa and Mastercard debit and credit cards, and PayPal, depending on the type of account being opened.

| Pros | Cons |

| Variety of deposit methods (bank wire, Visa, Mastercard, PayPal) | Lack of transparency in deposit and withdrawal processes |

| Diverse withdrawal options | Potential delays in fund withdrawals and customer service response |

Trading Platforms

IMF CAPITAL LIMITED offers the Meta Trader 4 platform, a renowned trading solution utilized by millions of traders globally. MT4 provides access to a wide range of financial instruments, including forex, commodities, and indices. MT4 grants traders the ability to analyze markets with 30 technical indicators and 9 timeframes. Moreover, it enables automated trading through expert advisors, supporting real-time trading and historical data analysis. Available for Windows PC, iPhone, and Android, IMF's MT4 provides a fast and secure trading environment for traders worldwide.

| Pros | Cons |

| Utilizes Meta Trader 4 platform | Lack of regulatory oversight and unauthorized status by NFA |

| Access to various financial instruments | Difficulties in fund withdrawals and slow customer service response |

| Supports automated trading and technical analysis | Limited information on deposit/withdrawal processes |

Customer Support

IMF CAPITAL LIMITED offers 24/7 customer support via email at support@imfspaces.com, telephone at 0044-752-5662181, and fax at 0044-207-1826949.

Reviews

IMF CAPITAL LIMITED has received a total of 66 reviews on WikiFX, with several clients expressing concerns and negative experiences. Some of the common issues raised include difficulties in withdrawing funds, delays in processing withdrawal requests, inability to log in to the platform or official website, and challenges in contacting customer service. There were also reports of losses due to server failures and suspicion of fraudulent activities. Traders have expressed frustration with the lack of responsiveness from the company and the inability to access their funds or operate normally on the platform.

Conclusion

In conclusion, IMF CAPITAL LIMITED offers a range of financial instruments and account options to its clients. The company provides access to various market instruments, including currency transactions, share indices, energy-related instruments, noble metals, and commodities. IMF also offers different account types, such as current accounts, savings accounts, and Individual Savings Accounts (ISAs), each with its own set of benefits. Leverage options are available, but potential clients should be cautious as it can amplify risks. The trading platform offered is Meta Trader 4, which allows for execution and analysis of markets. However, it is essential to note that IMF CAPITAL LIMITED is not regulated and has received negative reviews, with clients expressing concerns about difficulties in withdrawing funds, server failures, and suspicion of fraudulent activities. Therefore, potential customers should exercise caution and carefully consider the associated risks before engaging with this unregulated broker.

FAQs

Q: Is IMF CAPITAL LIMITED a regulated company?

A: No, IMF CAPITAL LIMITED is not regulated and is listed as unauthorized by the United States National Futures Association (NFA).

Q: What market instruments does IMF CAPITAL offer?

A: IMF CAPITAL facilitates currency transactions, share index instruments, various index products, energy-related instruments, noble metals, and commodities.

Q: What are the account types available at IMF CAPITAL?

A: IMF CAPITAL offers current accounts, savings accounts, and Individual Savings Accounts (ISA) with different features and benefits.

Q: What is the leverage offered by IMF CAPITAL?

A: IMF CAPITAL provides leverage ranging from 1:500 for forex trading to 1:5 to 1:20 for equity CFDs.

Q: What are the spreads and commissions at IMF CAPITAL?

A: Spreads for major currency pairs are typically between 0.2 and 0.5 pips, and the commission for a standard lot size is $1.

Q: What is the minimum deposit requirement at IMF CAPITAL?

A: The minimum deposit requirement at IMF CAPITAL is $1,000.

Q: Which trading platform does IMF CAPITAL offer?

A: IMF CAPITAL offers the Meta Trader 4 platform, allowing access to various financial instruments and supporting automated trading.

Q: How can I contact customer support at IMF CAPITAL?

A: You can reach IMF CAPITAL's customer support 24/7 via email, telephone, or fax.

Q: Are there any reviews or feedback about IMF CAPITAL?

A: IMF CAPITAL has received mixed reviews on WikiFX, with some clients expressing concerns and negative experiences, including difficulties in fund withdrawals and platform issues.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 67

Content you want to comment

Please enter...

Comment 67

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

太阳初升70755

Hong Kong

The funding channels cannot be opened, and the official website cannot be opened. The platform could not be opened for more than a month. A classic fraud platform.

Exposure

2022-11-05

太阳初升70755

Hong Kong

The deposit efficiency is faster than the rocket, and the withdrawal efficiency remains unchanged. The review has not passed for more than a month,. The new request has not changed for half a month

Exposure

2022-09-23

Qi4101

Hong Kong

The imf deposit speed is very fast, but it is impossible to withdraw mmediately. The money from the account that has passed the audit is also deducted, but the account is not accounted for. It has been more than a month.

Exposure

2022-08-09

MeLo21361

Hong Kong

The fraud platform has absconded. It is a hedging platform that specializes in deceiving rookie to deposit. Now they have absconded

Exposure

2022-08-04

Qi4101

Hong Kong

The review of withdrawal has passed and the money has been deducted, but they do not make the transfer. The customer service phone is also fake

Exposure

2022-08-01

少管我

Hong Kong

The withdrawal issued on the 1st of July will not be withdrawn on the 20th of July, for various reasons. It has not been passed or failed. IMF platform does not address nor response. Ponzi scheme.

Exposure

2022-07-21

岳31131

Hong Kong

After withdrawing 200 USD today, I can no longer withdraw the money. It shows that the balance is insufficient and cannot withdraw, but the account has more than 2900 USD and there is no order in the account.

Exposure

2022-07-13

Qi4101

Hong Kong

Withdrawal review is passed and deduction is made, but it does not arrive.

Exposure

2022-07-13

岳31131

Hong Kong

There is more than 3000 dollars in account, but I can only withdraw 200. It shows that the balance is insufficient if you withdraw again.

Exposure

2022-07-13

张瑞航

Hong Kong

Forced liquidation even for the locked position. The phone is empty and cannot contact the platform.

Exposure

2022-07-06

岳31131

Hong Kong

Due to the failure of the server and the inability to operate, I got a large loss, the platform company cannot be contacted. I hope that the IMF platform can provide the contact information of the local agency company and make up for the loss of about 1,900 US dollars.

Exposure

2022-07-06

幸.

Hong Kong

On June 17, 2022, I applied for the withdrawal of 901, and no funds have been withdrawn so far.

Exposure

2022-07-04

Hong Kong

The website cannot log in to the account, resulting in the inability to operate the withdrawal. The trading software cannot be logged in either. The official phone number is empty now. My balance is 390.67 dollars. Please help. Thank you.

Exposure

2022-07-04

岳31131

Hong Kong

MT4 cannot be logged in. I can log in at 6 AM, but not over 8 AM. I cannot withdraw from official website either.

Exposure

2022-07-04

岳31131

Hong Kong

Cannot log in mt4 or open trading account. Cannot trade normally.

Exposure

2022-07-04

岳31131

Hong Kong

The official website is a transfer of scam advertiment and cannot be opened. The opened website is imfspace1.net

Exposure

2022-06-17

平安73752

Hong Kong

I applied for withdrawal for several months, but no one deal with it. Now, I cannot even open the official website.

Exposure

2022-06-05

滞

Hong Kong

The withdrawal was made on May 10th, and the withdrawal was successful on the 11th, but it was delayed for a long time. The customer service call was either hung up or unable to get through. In addition, the comparison trend of the two softwares at the same time is completely different, and the slippage is serious compared to the old brands such as Forex.com.

Exposure

2022-05-31

优宠猫舍

Hong Kong

I personally applied for an imf account and operated it for half a month, but I couldn't withdraw. I applied for the withdrawal on May 10, 2022. On the 5.11, it showed that the money had been withdrawn, but on the 5.13, it did not show that the account was received. I contacted the background, but there is no reply.

Exposure

2022-05-12

Mr.Zhang47341

Hong Kong

Unable to withdraw nor contact the customer service. All the websites cannot be logged in.

Exposure

2022-05-04