Overview of Capital Group

Capital Group is a regulated financial institution in Hongkong operating in the securities, futures, and options markets since its establishment in 1993. It is overseen by the Securities and Futures Commission (SFC) to ensure compliance with industry regulations. The company offers a diverse range of investment opportunities in securities, futures, and options, with trading fees varying depending on specific instruments, such as $50.00 for Hang Seng Index Futures during the day and $90.00 at night.

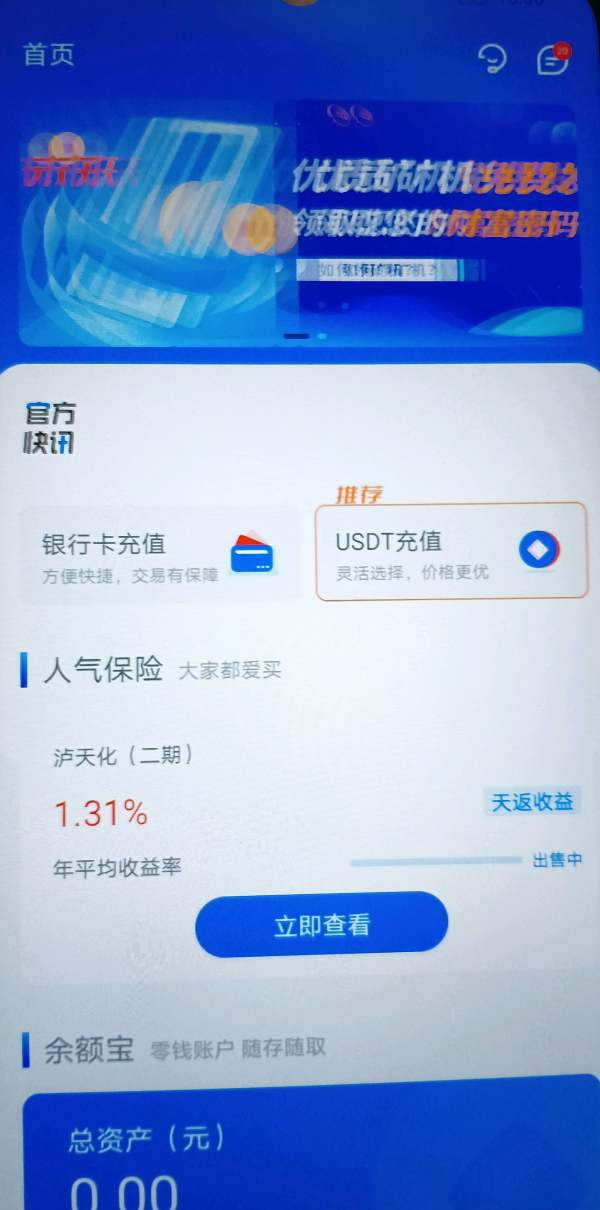

Clients can utilize trading systems like iTrader and Sharp Point's Futures Trading System for efficient trade execution and portfolio management. Capital Group accepts various payment methods, including cheque, promissory note, transfer, and telegraphic transfer (TT). Clients can conveniently reach out to the company via phone, online forms, or fax to inquire, manage their accounts, or seek assistance.

Is Capital Group legit or a scam?

Regulation plays a crucial role in ensuring the legitimacy of financial institutions like Capital Group when it comes to dealing in futures contracts. Being regulated by authorities such as the SFC (Securities and Futures Commission) provides a level of assurance to investors. The SFC, for example, oversees and regulates the securities and futures markets in Hong Kong, setting standards and enforcing rules to protect investors' interests.

By adhering to regulatory guidelines, Capital Group and other regulated entities are required to act in the best interests of their clients, provide accurate and transparent information, and operate in a fair and transparent manner. This regulatory oversight helps promote market integrity, mitigate risks, and safeguard the rights of investors.

For traders interested in futures contracts, it is advisable to prioritize trading with regulated entities. Dealing with regulated financial institutions provides an added layer of investor protection, as they are subject to specific rules and guidelines designed to promote fair and efficient trading practices.

Pros and Cons

Capital Group provide diverse market instruments, allowing clients to access a wide array of investment opportunities and cater to their specific preferences. Secondly, as a regulated entity, Capital Group ensures compliance with industry standards and provides investor protection. Thirdly, their commitment to research and educational resources equips clients with valuable insights and information to make informed investment decisions. Lastly, their comprehensive trading platforms offer a user-friendly interface and essential tools for efficient trading experiences.

However, there are some cons to consider. Capital Group lacks specific information on their leverage policies, which may be a concern for traders who rely on leverage in their investment strategies. Additionally, complex deposit and withdrawal procedures can create challenges for clients. Limited information on customer support response may affect the promptness of assistance, and while their resources cover a range of topics, they may not fully address all investor needs.

Market Instruments

Capital Group offers a diverse range of market instruments to cater to the needs of its clients. Through its securities brokerage business, clients can access major stock exchanges worldwide, allowing them to invest in a wide variety of stocks and securities. The company also provides margin financing, enabling clients to leverage their investments and potentially amplify their returns. Additionally, Capital Group's investment banking services encompass capital and financial planning, IPO sponsorship, securities issuance, M&As, and spin-offs. This includes assisting companies in listing on exchanges such as Singapore, Hong Kong, and Australia.

Moreover, the company's research and development business focuses on designing new financial products, hedging tools, formulated trades, and electronic trading systems. These instruments are tailored to meet the specific investment goals and market conditions of clients, ensuring a comprehensive and customized approach to investing.

Account Types

Capital Group offers a diverse range of investment accounts, including the Securities Account and the Futures & Options Account.

Securities Account:

The securities account offered by Capital Group is a versatile investment account that enables individuals and institutions to trade a wide range of securities, including stocks, bonds, and mutual funds. This account type grants investors the opportunity to participate in financial markets, with the potential to achieve capital appreciation and generate income. Securities within this account can be registered in the investor's name or held in a nominee name, ensuring secure and transparent ownership.

Futures & Options Account:

Capital Group's Futures & Options account provides investors with exposure to derivative instruments like futures contracts and options. Futures contracts involve an agreement to buy or sell an underlying asset at a predetermined price and date in the future, while options grant the right (but not the obligation) to buy or sell an asset at a specified price within a certain timeframe. By offering access to the global futures and options markets, this account type allows investors to engage in hedging, speculation, and risk management strategies.

How to Open an Account?

To open an account with CSC Securities (HK) Limited for securities trading, new clients can follow a simple process. First, they need to visit the company's website and download the Customer Trading Agreement and other relevant account opening documents. These documents can be printed and filled out by the client. The completed forms should then be signed and sent to CSC Securities (HK) Limited at the provided address: Units 3204-7, 32/F., Cosco Tower, Grand Millennium Plaza, 183 Queen's Road Central, Hong Kong, Attention: Sales Department. Once the forms are received, a licensed account executive will be assigned to the client to complete the remaining account opening procedures. Alternatively, clients can choose to visit the company's office in person for the account opening process. They can make a reservation by calling (852) 2530-9966 or sending an email to fund_dl@e-capital.com.hk.

For opening a futures and options trading account with CSC Futures (HK) Limited, the process is similar. New clients can download the Customer Trading Agreement and other relevant account opening documents from the company's website. After printing and completing the forms, they need to sign them and return them to CSC Futures (HK) Limited at the provided address: Units 3204-7, 32/F., Cosco Tower, Grand Millennium Plaza, 183 Queen's Road Central, Hong Kong, Attention: Sales Department. A licensed account executive will be assigned to the client to finalize the account opening procedures. Alternatively, clients can opt to visit the company's office in person by making a reservation through the phone number (852) 2530-9966 or via email at fund_dl@e-capital.com.hk.

Leverage

There is no real-time information or specific details about the maximum leverage offered by Capital Group. Leverage policies can vary among financial institutions and may be subject to change over time based on various factors.

Spreads & Commissions

The spreads and commissions are related to derivatives trading, specifically futures and options contracts.

Spreads: The spreads mentioned represent the difference between the bid price and the ask price of a particular futures contract. For example, in Hang Seng Index Futures, the spread is $50.00 during the day and $90.00 at night.

Commissions: The commissions specified are the fees charged for executing trades on futures and options contracts. There are different commission rates based on the method of trading, whether via phone or internet.

Commission via phone: The commission per contract per side for phone trading varies depending on the specific contract. For example, in Hang Seng Index Futures, it is $40.00 during the day and $80.00 at night.

Commission via internet: The commission per contract per side for internet trading also varies based on the contract. For instance, in Hang Seng Index Futures, it is $10.00 during the day and $10.00 at night.

Trading Platform

Capital Group's trading platforms, including Itrader and Sharp Point's Futures Trading System, offer users a comprehensive and user-friendly interface to access a wide range of financial markets and execute trades with confidence.

Itrader:Itrader is a trading platform offered by Capital Group that provides individuals with a robust and user-friendly platform to engage in various financial markets. This platform offers a comprehensive range of features and tools designed to enhance the trading experience. With Itrader, users can access a wide selection of tradable instruments, including stocks, commodities, currencies, and indices, allowing them to diversify their portfolios and capitalize on market opportunities.

The Itrader platform is known for its intuitive interface, making it suitable for both novice and experienced traders. It offers real-time market data, advanced charting capabilities, and technical analysis tools to aid in making informed trading decisions. The platform also provides access to research and analysis from Capital Group's team of experts, allowing users to stay updated on market trends and insights. Additionally, Itrader offers order management features, including limit orders, stop orders, and trailing stops, enabling users to execute trades based on their preferred strategies.

Sharp Point's Futures Trading System:Sharp Point's Futures Trading System is a specialized trading platform offered by Capital Group specifically designed for futures trading. This platform caters to the needs of professional traders and offers a wide range of features tailored for futures markets. With Sharp Point's Futures Trading System, users can trade futures contracts on various asset classes, such as commodities, currencies, stock indices, and interest rates.

The platform provides users with real-time market data, including price quotes, order book depth, and trading volume, allowing for accurate and timely decision-making. It offers advanced order types, such as limit orders, stop orders, and market orders, enabling users to execute trades with precision. Additionally, the platform incorporates advanced charting and technical analysis tools, empowering traders to analyze price patterns, identify trends, and develop effective trading strategies.

Deposit & Withdrawal

To facilitate fund deposits, clients of CSC Securities (HK) Limited and CSC Futures (HK) Limited have multiple options available. Deposits can be made through methods such as cheque, promissory note, transfer, or telegraphic transfer (TT). For depositing funds into the designated bank account, clients are not required to notify the company. Alternatively, clients can deliver or fax the bank pay-in slip to the Sales Department, along with the customer's name and account number. In the case of a telegraphic transfer, clients need to fax the remittance notice to the Sales Department.

For fund withdrawals, clients are required to notify their account executive before 11 am on Monday to Friday. Instructions received after 11 am will be processed on the next business day. In the case of a securities account, upon receiving the withdrawal instruction, CSC will issue a crossed cheque or arrange a telegraphic transfer (TT) on the same day. The cheque will be deposited directly into the client's bank account in their own name, or they have the option to collect the cheque in person. For futures accounts, clients can expect to receive the funds no later than the next working day through the same method chosen for the withdrawal, be it depositing into the client's bank account or remitting to their bank account in their own name.

Customer Support

Capital Group located at 3/F., FWD Financial Centre, 308 Des Voeux Road Central, Hong Kong, clients can reach out to the support team via telephone at (852) 2530-9966 or send a fax to (852) 2104-6006. These contact details ensure that clients have multiple channels to connect with the support team for any queries, concerns, or assistance they may require.

In addition to traditional contact methods, Capital Group also offers an online form for clients to submit their inquiries or requests electronically. This online form provides a convenient and efficient means for clients to reach out to the Customer Support team.

Educational Resources

The educational resources provided on the official website of Capital Group encompass a range of informative and valuable materials aimed at enhancing the knowledge and understanding of investors.

The “Hong Kong News” section provides up-to-date news articles and market insights specific to Hong Kong, offering readers a comprehensive understanding of local market trends, regulatory changes, and economic developments.

Capital Group's commitment to research is evident in the “Research” section, where investors can access in-depth reports, analysis, and research publications covering various asset classes and markets. These research materials provide valuable insights into investment trends, market dynamics, and investment strategies, allowing investors to gain a deeper understanding of specific industries or investment opportunities. By leveraging this research, investors can make more informed decisions aligned with their investment goals.

Additionally, the “Daily Market Update” section offers a concise overview of the market's performance and key events, helping investors stay abreast of market movements and make timely investment decisions. The “IPO Summary” and “Individual Stock Report” sections provide detailed information on initial public offerings (IPOs) and individual stocks, respectively, enabling investors to evaluate potential investment opportunities and assess the performance and prospects of specific companies.

Lastly, Capital Group's unique perspective and insights are shared in the “CSC's View” section. Here, investors can access expert commentary, market outlooks, and investment strategies from Capital Group's professionals, gaining valuable insights and guidance to inform their investment decisions.

Conclusion

Capital Group is a regulated financial institution that provides investors with a wide range of investment and trading services. With diverse market instruments, comprehensive trading platforms, and valuable educational resources, they aim to meet the needs of their clients and empower them to make informed investment decisions. While there are certain limitations such as the lack of specific information on leverage policies and complex deposit and withdrawal procedures, the overall legitimacy and commitment of Capital Group to regulatory compliance, investor protection, and market integrity provide reassurance to investors.

FAQs

Q: What market instruments are available for trading with Capital Group?

A: Capital Group offers stocks, bonds, mutual funds, and margin financing.

Q: How can I open an account with Capital Group?

A: To open an account, download the required forms, fill them out, and submit them to Capital Group.

Q: How are trading fees determined for specific instruments?

A: Trading fees vary depending on the specific instruments being traded. For example, Hang Seng Index Futures may have a fee of $50.00 during the day and $90.00 at night.

Q: What are the deposit and withdrawal methods with Capital Group?

A: Deposit methods include cheque, transfer, and telegraphic transfer (TT). Withdrawals can be made through cheque or telegraphic transfer.

Q: How can I contact customer support at Capital Group?

A: You can reach customer support at Capital Group through telephone or by submitting an online form.