Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Dodi Kuswana Satriawan

Pakistan

Low spreads, no commission fees, but if you have any problems, you have to deal with everything yourself.

Neutral

2024-05-24

睿3852

Colombia

I am surprised that the company offers dozens of languages but does not include Spanish. To be safe, I will not be trading here as it does not appear to have any regulatory license.

Neutral

2022-12-15

FX1094944219

Spain

I must admit that the trading conditions offered by 360°Capital seem great to me... And extremely attractive! But when faced with security issues, these business terms should be put aside. After all, what's the point of having other trading terms if you've been scammed out of your money? So I won't deal with 360°Capital because they don't have any regulation.

Neutral

2022-12-02

Monicar

United States

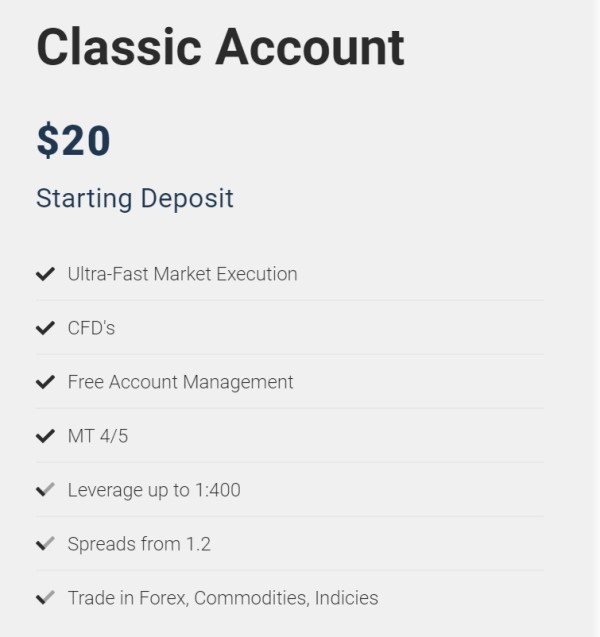

The low minimum deposit and tight spreads are both major draws, and the leverage levels are beginner-friendly! Hoping for a smooth and enjoyable trading experience here!

Positive

2024-07-26

Kim Min-su

South Korea

You would not believe that, a $20 Trading account offers such narrow spreads, below 1.5 pips on many major currency pairs. Plus, fast order execution, I cannot find the second.

Positive

2024-05-22

princess 6611

South Africa

Easy and friendly to use website. The leverage option on CFD trading make the potential earnings highly lucrative to those who have learnt a thing or two about trading. The option to copy successful traders also makes it something that those of us with little free time are able to do.

Positive

2023-11-08