Score

Interactive Brokers

United States|2-5 years|

United States|2-5 years| https://ibkrk.com

Website

Rating Index

Contact

Licenses

Licenses

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United States

United StatesUsers who viewed Interactive Brokers also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

ibkrk.com

Server Location

United States

Website Domain Name

ibkrk.com

Server IP

66.29.141.37

Relevant Enterprises

Thomas Pechy Peterffy

Others

Start date

--

Status

Employed

INTERACTIVE BROKERS GROUP, INC.(Delaware (United States))

Milan Galik

Others

Start date

--

Status

Employed

INTERACTIVE BROKERS GROUP, INC.(Delaware (United States))

Paul Jonathan Brody

Others

Start date

--

Status

Employed

INTERACTIVE BROKERS GROUP, INC.(Delaware (United States))

Company Summary

| Aspect | Information |

| Company Name | Interactive Brokers |

| Registered Country/Area | United States |

| Founded year | 1978 |

| Regulation | Suspicious Clone under ASIC, FCA, CBI, MAS |

| Market Instruments | Stocks, ETFs, forex, bonds, options, futures, CFDs, cryptocurrencies, warrants, structured products |

| Minimum Deposit | $0 |

| Customer Support | Social media (Twitter, Facebook, Instagram, YouTube, LinkedIn) |

Overview of Interactive Brokers

Interactive Brokers, founded in the United States, offers a wide array of trading assets including stocks, ETFs, forex, bonds, options, and futures, providing traders with various opportunities across global markets.

However, risks have been raised about its legitimacy, with reports of the platform being identified as a suspicious clone. Traders are directly impacted by the platform's regulatory status, influencing oversight, transparency, and legal protections. Adherence to regulatory standards instills confidence among traders regarding the platform's reliability and security, while any suspicion or regulatory ambiguity may undermine trust and deter participation, emphasizing the importance of due diligence.

Is Interactive Brokers legit or a scam?

Interactive Brokers is identified as Suspicious Clone under various regulatory bodies such as the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA) in the United Kingdom, the Central Bank of Ireland (CBI), and the Monetary Authority of Singapore (MAS).

However, the presence of “Suspicious Clone” designations in some regions suggests potential regulatory risks. Traders on the platform are directly impacted by the regulatory status, as it influences the level of oversight, transparency, and legal protections afforded to their investments.

Adherence to regulatory standards instills confidence among traders regarding the platform's reliability and security, while any suspicion or regulatory ambiguity may undermine trust and deter participation. Thus, traders are likely to favor jurisdictions where Interactive Brokers maintains clear and reputable regulatory standing, ensuring a safer trading environment.

What are Clone Brokers?

The prevalence of clone brokers is increasingly alarming, as deceptive entities exploit the names of reputable firms to lure unsuspecting clients into believing they are trading with regulated forex firms.

These fraudulent companies go to great lengths, even utilizing the license numbers of legitimate brokers, to deceive traders into opening accounts with them. Remaining vigilant is paramount to avoid falling prey to such scams. Additionally, these unscrupulous entities resort to aggressive tactics, akin to boiler room operations, pressuring clients into opening accounts or increasing their deposits.

It's crucial to heed the adage: if something sounds too good to be true, it likely is. Traders must exercise caution and conduct thorough research before engaging with any brokerage firm to safeguard their investments and financial security.

Pros and Cons

| Pros | Cons |

| Wide range of tradable assets | Identify as Suspicious Clone |

| Access to global markets | Limited customer support options |

| Potential for technical glitches | |

| Risk of exposure to scams |

Pros:

Wide range of tradable assets: Interactive Brokers offers an extensive selection of tradable assets, including stocks, ETFs, forex, bonds, options, and futures. This diversity provides traders with ample opportunities to diversify their portfolios and explore various investment strategies, catering to different risk appetites and objectives.

Access to global markets: The platform grants users access to a broad range of global markets, enabling them to trade securities and currencies from around the world. This global reach allows traders to capitalize on international market trends, economic developments, and geopolitical events, enhancing their trading flexibility and potential for profit.

Cons:

Identified as Suspicious Clone: Some users have reported instances where Interactive Brokers was identified as a suspicious clone, potentially raising risks about the platform's legitimacy and trustworthiness. Such allegations can undermine user confidence and deter participation in trading activities.

Limited customer support options: Interactive Brokers may offer limited options for customer support, which can lead to delays in addressing user inquiries, resolving issues, or providing assistance when needed. This lack of robust support channels may frustrate users and hinder their overall trading experience.

Potential for technical glitches: Like any online platform, Interactive Brokers is susceptible to technical glitches or system failures, which can disrupt trading activities, cause delays in order execution, or lead to inaccuracies in account information. These technical issues may impede users' ability to trade effectively and impact their overall experience on the platform.

Risk of exposure to scams: Users may face the risk of exposure to scams or fraudulent activities associated with Interactive Brokers, such as clone brokers attempting to deceive traders. Falling victim to such schemes can result in financial losses and damage to one's reputation, highlighting the importance of vigilance and due diligence when engaging with the platform.

Market Instruments

Interactive Brokers offers a wide range of tradable financial instruments on its platform.

Traders can access a variety of assets including Stocks, ETFs, Forex, Funds, Bonds, Options, Futures, CFDs, Cryptocurrencies, Warrants, and Structured Products.

This extensive selection provides traders with opportunities to diversify their investment portfolios and pursue different trading strategies across global markets.

With access to such a broad array of instruments, traders have the flexibility to capitalize on market opportunities and manage risk effectively.

Deposit & Withdrawal

Interactive Brokers offers a variety of payment methods to fund your account:

Bank wire transfer: This is the most common and preferred method. It's free for most currencies.

ACH transfer: This is another electronic transfer option available for US accounts. It's also free.

Check: You can mail a check to Interactive Brokers. However, there may be processing fees and delays associated with this method.

Wire transfer from another brokerage: You can transfer funds from another brokerage account to your Interactive Brokers account. This may be subject to fees from both brokers.

Bill pay: This option is available for US accounts only. It allows you to pay your Interactive Brokers account from your bank's online bill pay service.

Third-party deposits: Interactive Brokers generally discourages and rejects third-party deposits due to potential fraud and money laundering risks.

There is no minimum deposit required to open an Interactive Brokers account. This makes it a good option for beginners who want to start with a small amount of money.

Customer Support

Interactive Brokers provides the following contact information for customer support:

Twitter: @IBKR

Facebook: Interactive Brokers

Instagram: Interactive Brokers

YouTube: Interactive Brokers

LinkedIn: Interactive Brokers

These social media platforms serve as channels for reaching out to Interactive Brokers for support and assistance. However, Interactive Brokers' customer support lacks efficiency and responsiveness. Traders often encounter significant delays in receiving assistance, with support tickets remaining unresolved for extended periods. Communication channels such as Twitter, Facebook, Instagram, YouTube, and LinkedIn are available, but their effectiveness in addressing customer risks is questionable.

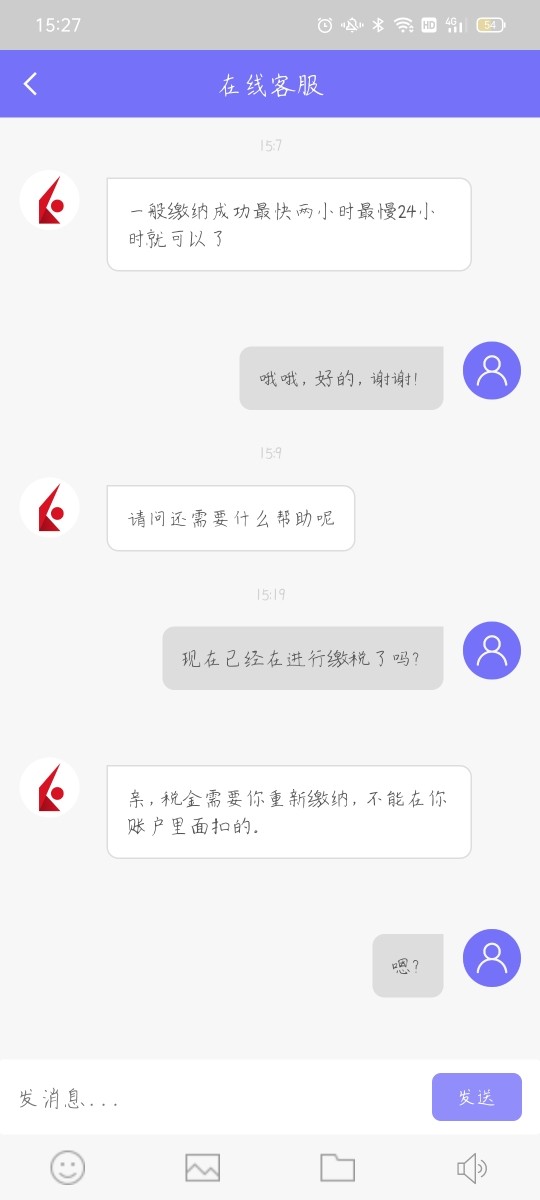

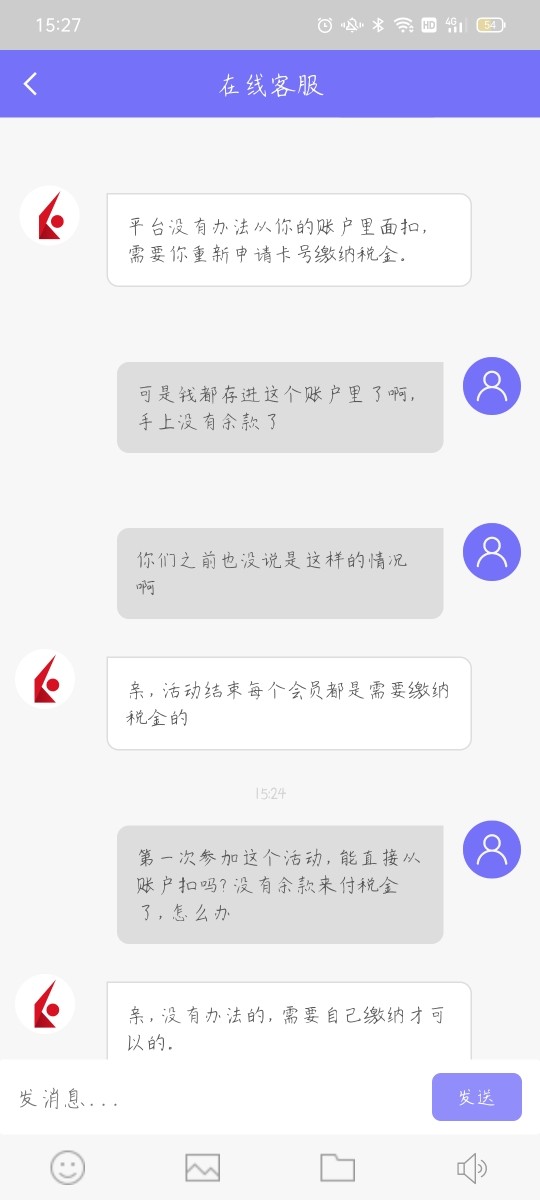

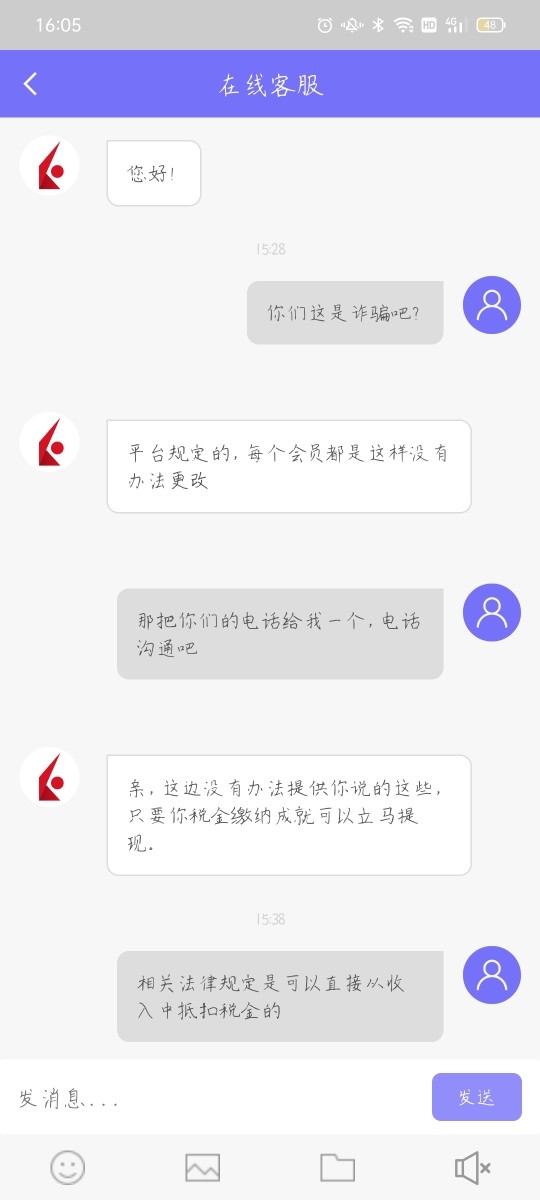

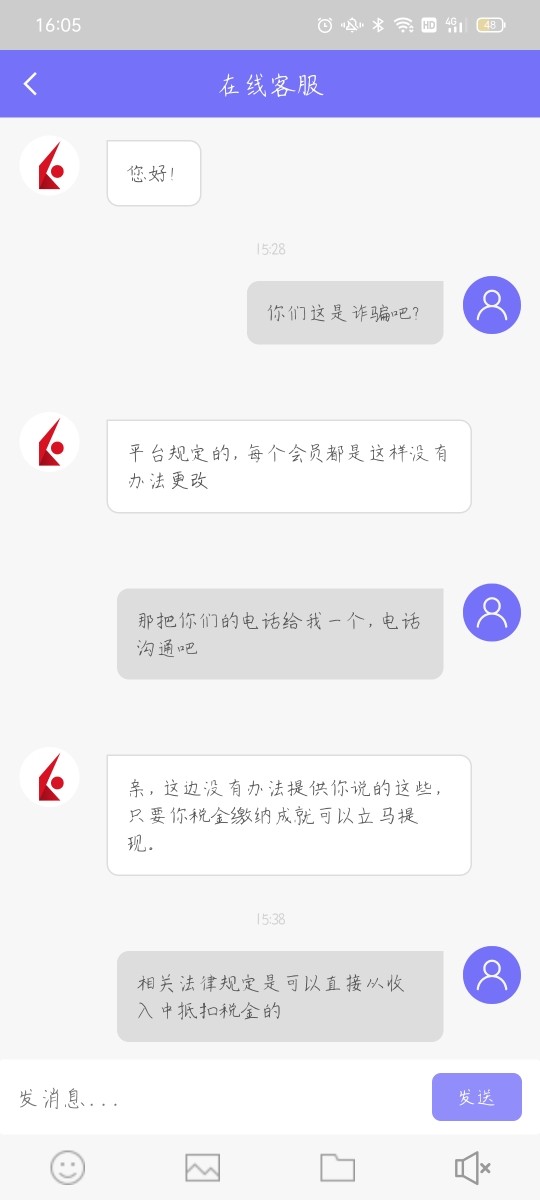

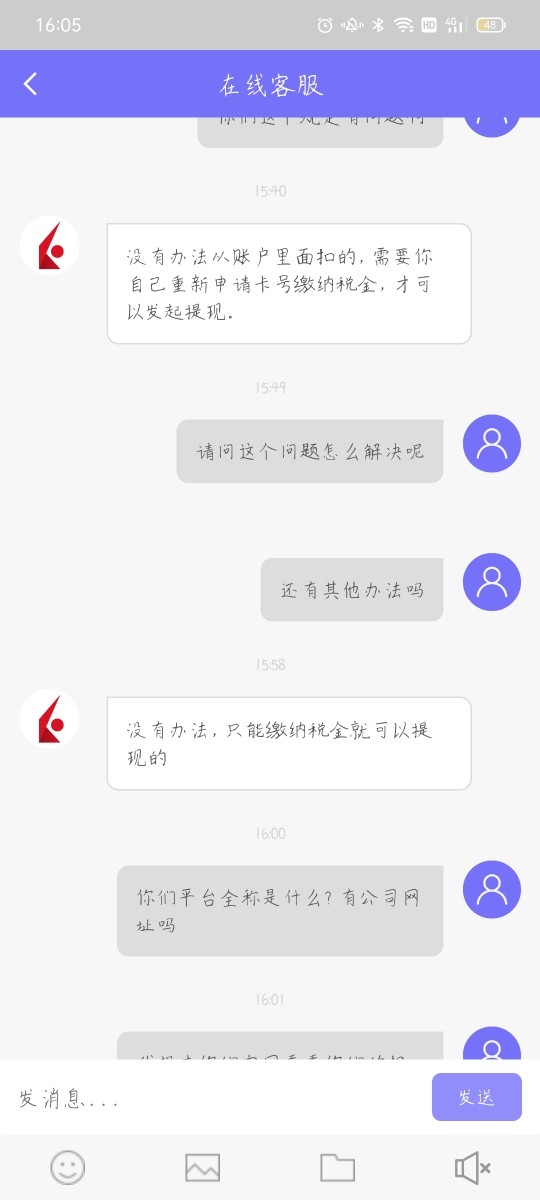

Exposure

Users have reported a single instance of exposure related to a pyramid scheme complaint, which unveiled a potential scam on the Interactive Brokers platform.

The complaint alleges that the platform induced clients to participate in activities, promising withdrawal options upon event completion. However, upon attempting to withdraw profits, users encountered obstacles, including unexpected tax requirements not deducted from the platform. The inability to access funds and unresponsive customer service exacerbates the situation for affected users. Such exposure to fraudulent activities undermines trust and confidence in the platform, potentially dissuading traders from engaging in further transactions.

Conclusion

This instance of Interactive Brokers is suspected to be a clone operated by a company known as Interactive Brokers Group, Inc. Notably, this particular iteration of Interactive Brokers lacks regulation, posing potential risks for traders. Therefore, it is advisable for traders to refrain from engaging with this broker.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

News

News Interactive Brokers Introduces Cryptocurrency Trading For UK Clients

Interactive Brokers has announced the official launch of cryptocurrency trading in the United Kingdom as a new feature on its platform.

2024-05-15 19:34

News Definition of Year-Over-Year (YOY)

Year-over-year (YOY), also known as year-on-year, is a popular financial comparison used to compare two or more quantifiable events over a year.YOY performance may be used to determine if a company's financial performance is increasing, stable, or decreasing. For example, you may read in financial reports that a certain company's sales grew on a year-over-year basis in the third quarter for the past three years.

2022-04-22 16:09

News Jill Bright has Joined the Board of Directors of Interactive Brokers

Jill Bright has been named an independent director of Interactive Brokers (Nasdaq: IBKR), an electronic trading platform in the United States. She will serve on the board of the company.

2022-04-22 12:05

News The Easiest Ways to Become Rich in the Stock Market

Investing in the stock market is one of the finest methods to build money around the globe. One of the stock market's key advantages is that there are several methods to benefit from it.

2022-04-21 15:00

News DARTs were 2% lower than in February.

Interactive Brokers (Nasdaq: IBKR), a major American electronic trading platform , has released on Friday some monthly operating metrics for March, noting a decrease in the Daily Average Revenue Trades (DARTs).

2022-04-04 09:45

News Interactive Brokers Reports 22% YoY Rise in November DARTs

The DARTs for the month came in at 2.793 million.

2021-12-02 16:24

Comment 3

Content you want to comment

Please enter...

Comment 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now