Overview of ATFX

ATFX is a trading provider headquartered in the United Kingdom. The company was founded in 2017 and offers a range of tradable assets including forex, metals, cryptocurrencies, indices, and share CFDs. Clients can access these markets through the MetaTrader 4 (MT4) trading platform, available for Windows, iPhone, Android, and WebTrader.

While ATFX claims to be regulated by the United Kingdom's Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CYSEC), there are suspicions that these claimed regulations could be clones or invalid. This raises concerns about the broker's regulatory compliance and the level of security it can offer to clients.

ATFX offers a Premium account type, which is only available for professional traders who meet certain qualifications. The minimum deposit requirement is $250, and the maximum leverage offered is 1:200. Spreads start from 0.6 pips, and there are no commissions charged for trades. The broker provides customer support through phone and email, and offers educational resources such as the Forex Education Centre, e-books, trading courses, guideline videos, and seminars.

It's important for potential clients to conduct thorough research, independently verify the broker's regulatory status, and seek advice from trusted sources before considering trading with ATFX. The uncertainties surrounding its regulatory status make it crucial to exercise caution and be aware of the associated risks.

Is ATFX Legit?

ATFX is an unlicensed broker, and it is risky trading with it. The claimed regulations by ATFX include the United Kingdom's Financial Conduct Authority (FCA) with license number 760555 and the Cyprus Securities and Exchange Commission (CYSEC) with license number 285/15. However, there are suspicions that these claimed regulations could be clones or invalid.

Given the uncertainties surrounding ATFX's regulatory status, it is crucial for potential clients to be cautious and aware of the associated risks. Regulation plays a significant role in ensuring the safety of funds, fair trading practices, and proper handling of client complaints. The lack of valid regulation raises concerns about the level of security and accountability that ATFX can offer.

When considering a broker, it is important to conduct thorough research, independently verify their regulatory status, and seek advice from trusted sources. This will enable potential clients to make informed decisions and mitigate potential risks associated with trading with a broker whose regulatory status is uncertain.

Pros and Cons

ATFX is a trading provider that offers a range of tradable assets and access to the popular MetaTrader 4 (MT4) platform. However, it is important to note that there are suspicions regarding the broker's regulatory status, with claims of being a suspected fake clone. As a result, the pros and cons table for ATFX is unfortunately skewed, with no pros listed due to the uncertainty surrounding its legitimacy. Potential clients should exercise caution and conduct thorough research before considering trading with ATFX. It is crucial to ensure the broker's regulatory compliance and seek advice from trusted sources to make informed decisions and mitigate potential risks associated with trading with a broker whose regulatory status is uncertain.

Trading Instruments

ATFX offers a diverse range of trading instruments, allowing clients to engage in various financial markets. Clients can speculate on different assets, including:

Forex: ATFX provides access to 44 different currency pairs, including major, minor, and exotic pairs. The forex market is available 24/5, allowing clients to participate in global currency trading.

Metals: ATFX offers trading in precious metals, including London Silver and London Gold, through spot contracts. The market for precious metals is open 23/5, providing clients with opportunities to trade these assets. Day traders can leverage their positions up to 1:20.

Oil: Clients can trade crude oil and commodity-based oil ETFs, taking advantage of price fluctuations in the oil market.

Indices: ATFX provides access to 13 variations of share indices from the US, Europe, and Asia. Clients can trade spot indices with low spreads and margin requirements, allowing them to take positions on the performance of broader market trends.

Cryptocurrency CFDs: Clients can also trade cryptocurrency CFDs, including popular cryptocurrencies such as Bitcoin, Bitcoin Cash, Ethereum, and more. This allows clients to participate in the growing cryptocurrency market without owning the underlying assets.

Share CFDs: Clients can trade over 170 major share CFDs from Germany, Spain, the UK, and the US. The ATFX viewer supports these share CFDs, providing clients with opportunities to profit from price movements in the stock market.

Here is a comparison table of trading instruments offered by different brokers:

Account Types

ATFX offers three types of accounts: Standard, Edge, and Premium.

The Standard account requires a minimum balance of £$€500 and offers a benchmark spread currency pair of 1.0 pips. This account is suitable for traders who prefer a lower initial investment and standard trading conditions.

The Edge account is designed for more experienced traders with a minimum balance requirement of £$€5,000. It offers a benchmark spread currency pair of 0.6 pips, providing tighter spreads compared to the Standard account. The Edge account is suitable for traders who require enhanced trading conditions and have a higher trading volume.

The Premium account is available to professional traders who meet the qualification criteria. It requires a minimum balance of £$€10,000 and offers a benchmark spread currency pair of 0.0 pips. This account type allows for higher leverage on all instruments. Traders must provide evidence of their professional trader status when applying for the Premium account.

It's important to note that ATFX currently accepts only professional traders, so the Premium account is the only account type available. The Premium account offers competitive trading conditions and is suitable for experienced traders looking for optimal trading terms.

Leverage

ATFX offers different leverage levels for various trading instruments. The default leverage levels are:

- Oil: Up to 1:100

- Forex: Up to 1:50

- Shares CFDs: Up to 1:20

- Silver and gold: Up to 1:200

- Cryptocurrencies: Up to 1:5

- Indices: Up to 1:100 or 1:50 for USDX

Traders can use leverage to control larger positions in the market with a smaller amount of capital. However, it's important to understand that higher leverage increases both potential profits and losses. Traders should assess their risk tolerance and use leverage responsibly to manage their trading risks.

Here is a comparison table of maximum leverage offered by different brokers:

Spreads and Commissions (Trading Fees)

ATFX offers spreads and does not charge commissions to traders. For spread betting, there are no UK stamp duty or capital gains tax. The spreads for ATFX start from as low as 0.6 pips, making them one of the most competitive platforms available for professional investors. Traders can take advantage of the maximum margin of 1:30 to speculate on falling or rising markets.

The minimum deposit for spread betting accounts is £100, and there are no rejections or requotes. Traders can use Expert Advisors (EAs) and employ hedging strategies. The platform allows for market order execution, where orders are forwarded to the market and executed at the market's tradeable price. The execution price is influenced by liquidity from banks.

ATFX provides a range of order types, including pending orders such as Sell Stop, Sell Limit, Buy Stop, and Buy Limit. These orders are connected to company instructions residing within the server. Traders can set Stop Loss or Take Profit levels to close any pending orders. When the market price reaches the set point, pending orders are triggered, transacted, and executed as market orders.

Non-Trading Fees

ATFX does not charge any account fees or inactivity fees. This means that traders can maintain their accounts without worrying about additional charges for account maintenance or inactivity. This can be beneficial for traders who may have periods of inactivity or who prefer to manage their accounts without incurring any extra fees. By not having these non-trading fees, ATFX aims to provide a more cost-effective trading experience for its clients. However, it's always a good idea to review the latest fee schedule or contact ATFX directly to confirm the absence of any fees and ensure a clear understanding of the fee structure.

Deposit & Withdraw Methods

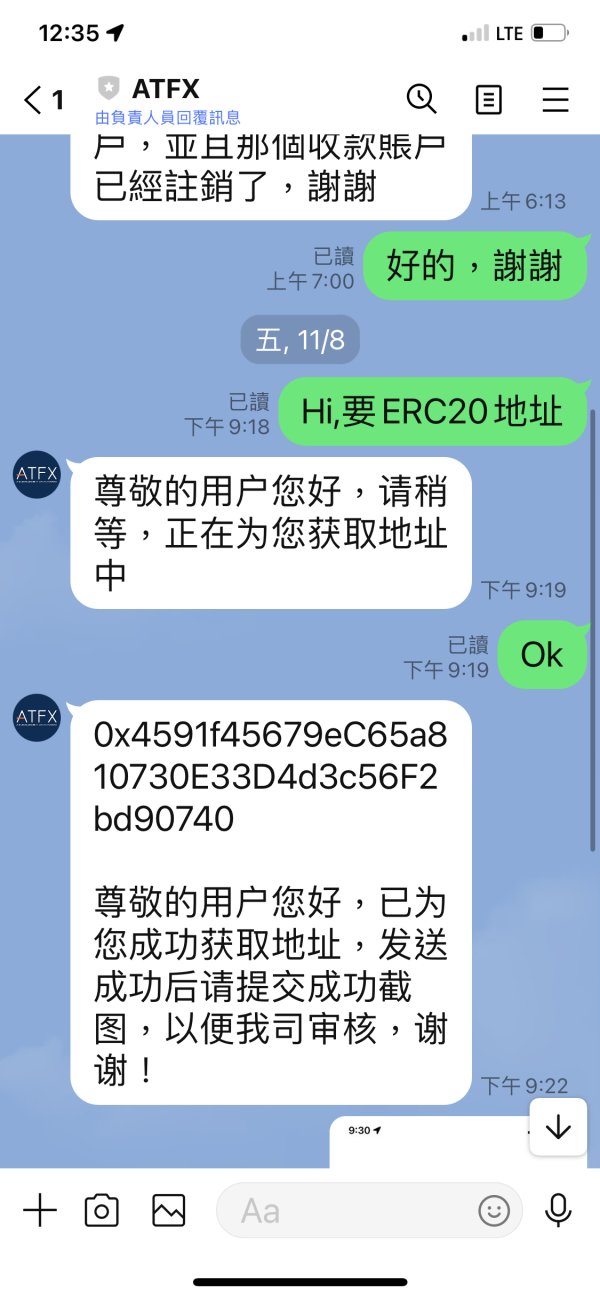

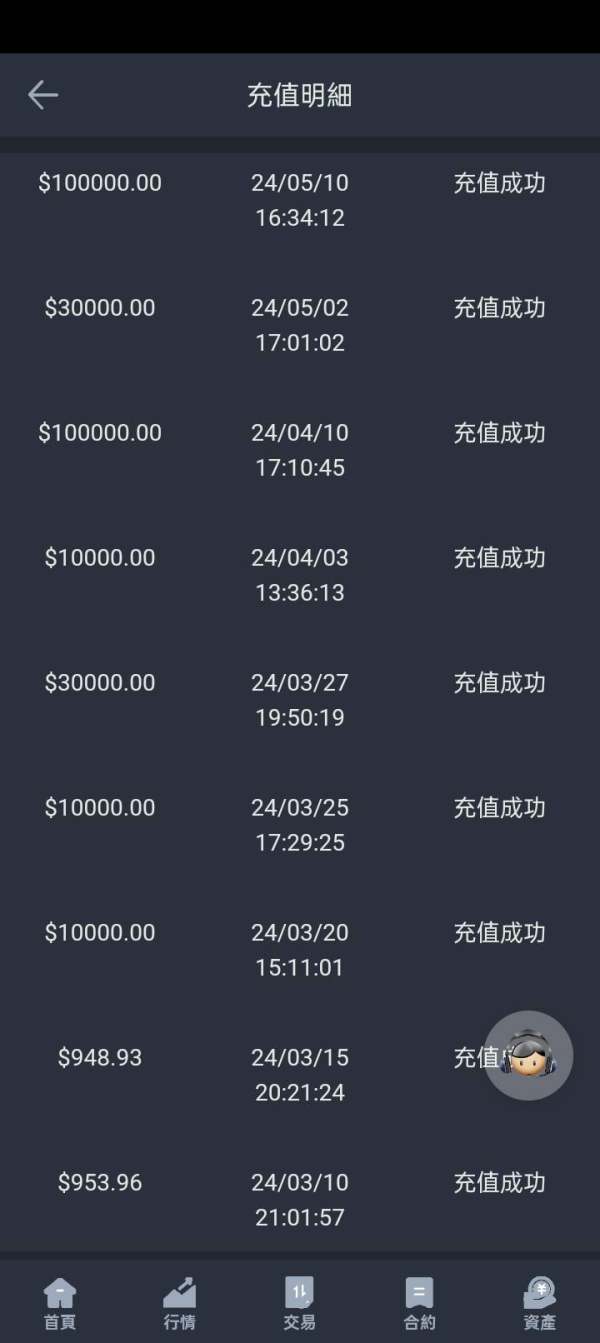

ATFX offers a variety of deposit and withdrawal methods for clients to conveniently fund and withdraw funds from their trading accounts. Deposits can be made using debit or credit cards, e-wallets, or bank transfers. The accepted currencies are EUR, GBP, and USD. ATFX does not charge any fees for deposits, and most deposit methods are processed within 30 minutes, except for bank transfers which may take up to one working day.The minimum deposit requirement at ATFX is $250, which is the initial amount that clients need to fund their trading accounts.

When it comes to withdrawals, ATFX does not charge any fees, and clients can choose to withdraw funds to their debit or credit cards, e-wallets, or bank accounts. Withdrawal requests are typically processed within one working day. Bank wire transfers may take around two to five working days to complete, and funds will be credited to the trading account once they have cleared.

It's important to note that for security purposes, the user's bank account needs to be fully verified before a withdrawal can be initiated. Additionally, ATFX UK only accepts payments and deposits from the client's personal account and does not accept any third-party payments. This ensures compliance with regulatory requirements and helps maintain the security and integrity of the trading process.

Trading Platforms

ATFX provides traders with the popular MetaTrader 4 (MT4) trading platform, which offers a comprehensive set of advanced features and fast execution. With MT4, traders can access a range of trading instruments and utilize various tools to enhance their trading experience.

For Windows users, ATFX offers the MT4 Desktop platform, which provides access to multi-currency and multilingual trading support. Traders can download and install the platform on their Windows devices to enjoy user-friendly features, advanced charting capabilities, and the ability to automate trades using Expert Advisors (EAs).

For traders who prefer trading on the go, ATFX offers MT4 Mobile for iPhone and Android. With these mobile platforms, traders can access the markets anytime, anywhere, and trade forex, CFDs, and more with ease and convenience.

For those who prefer a web-based trading solution, ATFX offers MT4 WebTrader. With this platform, traders can access their accounts and trade directly from their web browsers, without the need for downloading or installing any software. MT4 WebTrader is compatible with popular browsers like Internet Explorer, Google Chrome, Microsoft Edge, Opera, Safari, and Mozilla Firefox, providing a seamless trading experience.

MT4 WebTrader offers the same features and functionalities as the desktop and mobile versions of MT4, allowing traders to analyze the markets, execute trades, manage their positions, and utilize a wide range of technical indicators and charting tools.

Customer Support

ATFX aims to provide excellent customer support to assist traders with their inquiries and concerns. Traders can contact the customer support team through various channels to seek assistance or obtain information.

For phone support, ATFX provides an international phone number, +44 203 957 7777, which traders can use to directly contact the customer support representatives. By reaching out via phone, traders can speak directly with a support agent who can address their questions or concerns promptly.

Traders can also contact ATFX through email. The global email contact for sales inquiries is sales.uk@atfx.com. By sending an email to this address, traders can reach out to the relevant department and expect a response from the customer support team.

It's important to note that the provided address, 1st Floor, 32 Cornhill, London EC3V 3SG, is the physical address of ATFX's office in the United Kingdom. However, it's advisable to contact the customer support team through the provided phone number or email for inquiries, as visiting the office may not be necessary or suitable for all types of support requests.

Overall, ATFX strives to provide responsive and helpful customer support to ensure that traders have a positive experience and receive the assistance they need.

Educational Resources and Community Support

ATFX provides traders with a variety of educational resources to enhance their trading skills. The broker's Forex Education Centre offers free resources such as e-books, in-depth trading courses, guideline videos for the MT4 platform, and trading strategies. These resources are designed to help traders improve their understanding of the forex market and develop effective trading strategies.

In addition to the educational materials, ATFX also hosts educational seminars. These seminars cover various topics aimed at enhancing traders' knowledge and skills. Some of the learning outcomes of these seminars include spotting changes in market volatility, trading intraday swings in the market, using volatility to identify the best trades, combining time frames for optimal entry points, and employing a clear set of rules for confident intraday trading.

The availability of educational resources and seminars demonstrates ATFX's commitment to supporting traders in their trading journey. By providing access to valuable educational materials and organizing educational events, ATFX aims to empower traders with the knowledge and tools they need to make informed trading decisions.

Conclusion

ATFX, a trading provider headquartered in the United Kingdom, offers a range of tradable assets and access to the MetaTrader 4 (MT4) platform. However, it's important to note that there are suspicions regarding the broker's regulatory status, with claims of being a suspected fake clone. This uncertainty surrounding its legitimacy poses a significant disadvantage and raises concerns about the level of security and accountability that ATFX can offer. On the positive side, ATFX provides a diverse range of trading instruments, competitive spreads, and various deposit and withdrawal methods. Additionally, they offer customer support and educational resources to assist traders. Nonetheless, potential clients should exercise caution, conduct thorough research, and seek advice from trusted sources before considering trading with ATFX to mitigate the risks associated with its uncertain regulatory status.

FAQs

Q: Is ATFX a regulated broker?

A: ATFX claims to be regulated by the United Kingdom's Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CYSEC). However, there are suspicions and concerns regarding the legitimacy of these claimed regulations. It is important to conduct thorough research and independently verify their regulatory status before trading with ATFX.

Q: What assets can I trade with ATFX?

A: ATFX offers a wide range of tradable assets, including forex, metals, cryptocurrencies, indices, and share CFDs. This allows you to diversify your trading portfolio and take advantage of various market opportunities.

Q: What trading platform does ATFX provide?

A: ATFX provides the popular MetaTrader 4 (MT4) trading platform, which offers advanced features, comprehensive charting tools, and fast execution. You can access the MT4 platform on Windows, iPhone, Android, and WebTrader, allowing for flexibility and convenience in your trading activities.

Q: What is the minimum deposit required to open an account with ATFX?

A: The minimum deposit requirement for opening an account with ATFX is $250. This initial deposit allows you to start trading and gain access to the various trading instruments and features provided by the broker.

Q: Does ATFX offer educational resources for traders?

A: Yes, ATFX provides educational resources to help traders enhance their knowledge and skills. They offer a Forex Education Centre, which includes e-books, trading courses, guideline videos for the MT4 platform, and seminars. These resources aim to empower traders with valuable insights and strategies to improve their trading abilities.