Note: UEZ Markets official site - https://uezmarkets.com/ is currently not functional. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

What is UEZ Markets?

UEZ Markets is a forex broker that was founded in 2018. It is regulated by Australia Securities & Investment Commission (ASIC, No. 001300519). UEZ Markets offers a variety of trading instruments, including Forex, Metals, Energies, Crypto, and Indices through the MT5 trading platform.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

Overall, UEZ Markets is a relatively new broker that offers a variety of features and tools. It is regulated by a reputable financial authority and offers competitive spreads and no commissions. However, it is important to do your own research before opening an account with any broker, regardless of its regulation or reputation.

Is UEZ Markets Safe or Scam?

UEZ Markets is currently regulated by Australia Securities & Investment Commission (ASIC, No. 001300519), and holds a general registered United States National Futures Association (NFA, No. 0554185) license. The ASIC is a well-respected regulator, and its regulation means that UEZ Markets is subject to strict rules and regulations. The NFA is also a reputable regulator, but it does not have the same level of oversight as the ASIC.

However, UEZ Markets does not offer Guaranteed Funds, Segregated Accounts, and Negative balance protection. These are three important safety features that many reputable brokers offer to protect their clients' funds. The absence of these features could make UEZ Markets a riskier broker to trade with.

Overall, UEZ Markets appears to be a reputable forex broker. However, the absence of protection measures could make it a riskier broker to trade with. It is important to do your own research before opening an account with any broker, regardless of its regulation or reputation.

Market Instruments

UEZ Markets offers a variety of market instruments across different asset classes, including:

Forex: UEZ Markets offers over 100 currency pairs, including major, minor, and exotic pairs.

Precious metals: UEZ Markets offers trading in gold, silver, platinum, and palladium.

Energies: UEZ Markets offers trading in crude oil, natural gas, and other energy commodities.

Cryptocurrencies: UEZ Markets offers trading in a variety of cryptocurrencies, including Bitcoin, Ethereum, and Tether.

Indices: UEZ Markets offers trading in a variety of indices, including the S&P 500, the Dow Jones Industrial Average, and the NASDAQ Composite.

The specific instruments that are available to trade will vary depending on the UEZ Markets account type that you open. For example, the Standard account only offers trading in forex, while the Premium account offers trading in all of the instruments listed above.

Leverage

UEZ Markets offers a maximum leverage of 1:200 on forex majors. This means that for every $1 that a trader deposits, they can control a position worth $200. However, it is important to note that leverage is a double-edged sword. It can magnify profits, but it can also magnify losses. If a trade goes against the trader, they could lose more money than they deposited.

For this reason, it is important to use leverage carefully and to only trade with money that you can afford to lose. It is also important to understand the risks involved in trading before you start.

Spreads & Commissions

UEZ Markets offers spreads of around 1 pip on EURUSD, which is considered to be very competitive. However, it is important to note that spreads can vary depending on the market conditions and the trading instrument. For example, spreads may be wider during periods of high volatility.

UEZ Markets does not charge commissions on any of its trading instruments. This means that the only cost associated with trading with UEZ Markets is the spread.

Below is a comparison table about spreads and commissions charged by different brokers:

As you can see, UEZ Markets offers the lowest spread for EUR/USD trading, followed by RoboForex. IG and FXCM both offer slightly higher spreads, but they do charge commissions.

It is important to note that spreads and commissions can vary depending on the market conditions and the trading instrument. For example, spreads may be wider during periods of high volatility.

It is also important to consider other factors when choosing a broker, such as regulation, customer support, and trading platforms.

Ultimately, the best broker for you will depend on your individual needs and preferences. If you are looking for the lowest possible spread, then UEZ Markets or RoboForex may be a good choice for you. If you are willing to pay a slightly higher spread for a broker with a good reputation and a wide range of features, then IG or FXCM may be a better option for you.

Trading Platforms

UEZ Markets offers MetaTrader 5 (MT5) as its trading platform. MT5 is a popular trading platform that is used by millions of traders around the world. It offers a wide range of features and tools, including:

Real-time market data: MT5 provides real-time market data for all of the instruments that UEZ Markets offers to trade.

Charting tools: MT5 includes a variety of charting tools that traders can use to analyze market data and make trading decisions.

Order execution: MT5 allows traders to place orders to buy and sell market instruments.

Risk management tools: MT5 includes a variety of risk management tools that traders can use to protect their capital.

Expert advisors: MT5 allows traders to use expert advisors, which are automated trading programs that can help traders to make trading decisions.

Copy trading: MT5 allows traders to copy the trades of other traders, which can be a great way to learn from more experienced traders.

MT5 is a powerful trading platform that offers a wide range of features and tools. It is a good option for traders of all experience levels.

See the trading platform comparison table below:

As you can see, all four brokers offer MetaTrader 4 (MT4) as a trading platform. MT4 is a popular platform that is used by millions of traders around the world. It offers a wide range of features and tools, including real-time market data, charting tools, order execution, risk management tools, and expert advisors.

In addition to MT4, IG and FXCM also offer MetaTrader 5 (MT5). MT5 is a newer platform that offers some additional features and tools, such as algorithmic trading and copy trading.

RoboForex also offers its own proprietary platform, R Trader. R Trader is a relatively new platform that offers a wide range of features and tools, including real-time market data, charting tools, order execution, risk management tools, and copy trading.

Ultimately, the best trading platform for you will depend on your individual needs and preferences. If you are familiar with MT4, then any of the four brokers would be a good choice. If you are looking for a newer platform with more features, then IG or FXCM may be a better option for you. And if you are looking for a platform that is specifically designed for algorithmic trading or copy trading, then RoboForex may be a better option for you.

Deposits & Withdrawals

EZ Markets offers several deposit and withdrawal methods, including:

Wire transfer: Wire transfers are a secure and reliable way to deposit and withdraw funds. However, they can be slow and expensive.

E-wallets: E-wallets are a convenient and fast way to deposit and withdraw funds. However, they may not be as secure as wire transfers.

Here are some of the pros and cons of each deposit and withdrawal method:

UEZ Markets minimum deposit vs other brokers

The minimum deposit requirement for UEZ Markets is $10. The withdrawal fee is $25+. Deposits and withdrawals typically take 2-5 business days to process.

Customer Service

UEZ Markets only offers email support and some social networks. More details can be found below:

Email: contact@uezmarkets.com

Twitter: https://twitter.com/uezmarkets

Facebook: https://www.facebook.com/uezmarkets

Instagram: https://www.instagram.com/uezmarkets/

YouTube: https://www.youtube.com/channel/UCWTcFbOmPu_3E5AurW8PQ0Q

Note: These pros and cons are subjective and may vary depending on the individual's experience with UEZ Markets 's customer service.

Conclusion

Overall, UEZ Markets is relatively new and not as well-known as some other brokers. This means that there may be less information available about the broker online, and it may be more difficult to find reviews from other traders.

Ultimately, the decision of whether or not to open an account with UEZ Markets is up to you. If you are comfortable with the risks involved and you think the broker's features and offerings are a good fit for your trading needs, then you may want to consider opening an account. However, if you are not sure, it is always best to do more research and compare UEZ Markets to other brokers before making a decision.

Frequently Asked Questions (FAQs)

wmm

Hong Kong

Unscrupulous company, absconding and unable to withdraw money, ask for assistance to reduce losses

Exposure

2023-07-28

活在当下9649

Hong Kong

UEZ Markets traders have absconded, asking for assistance to get back the principal

Exposure

2023-07-28

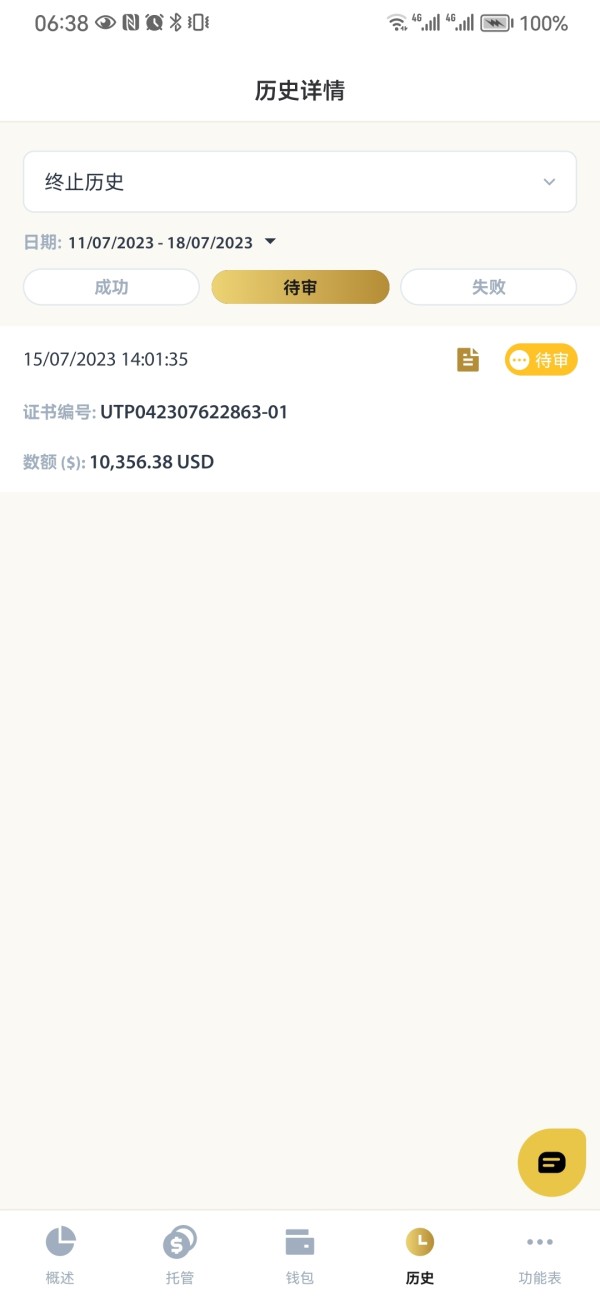

FX2032506852

Hong Kong

On 18th of July 2023, the company had announced that their system had been hacked, all the figures on their platform are incorrect, including our investment amount etc. While on MT5, a record shows that there is 1 huge amount of trade which turns out to have been liquidated. All these seems very fishy as there is no solid evidence of such event, and that it is impossible there is no back up servers for their data, or their trading servers. There has been no representative from the company to provide further assistance on this matter.

Exposure

2023-07-27

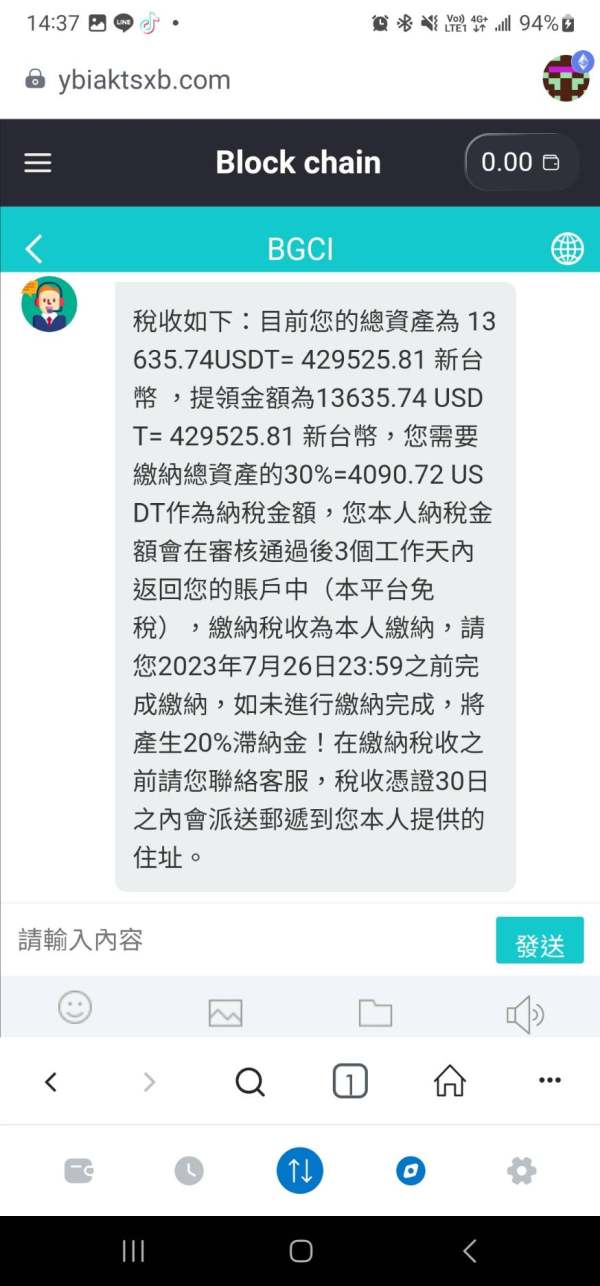

佳佳14

Taiwan

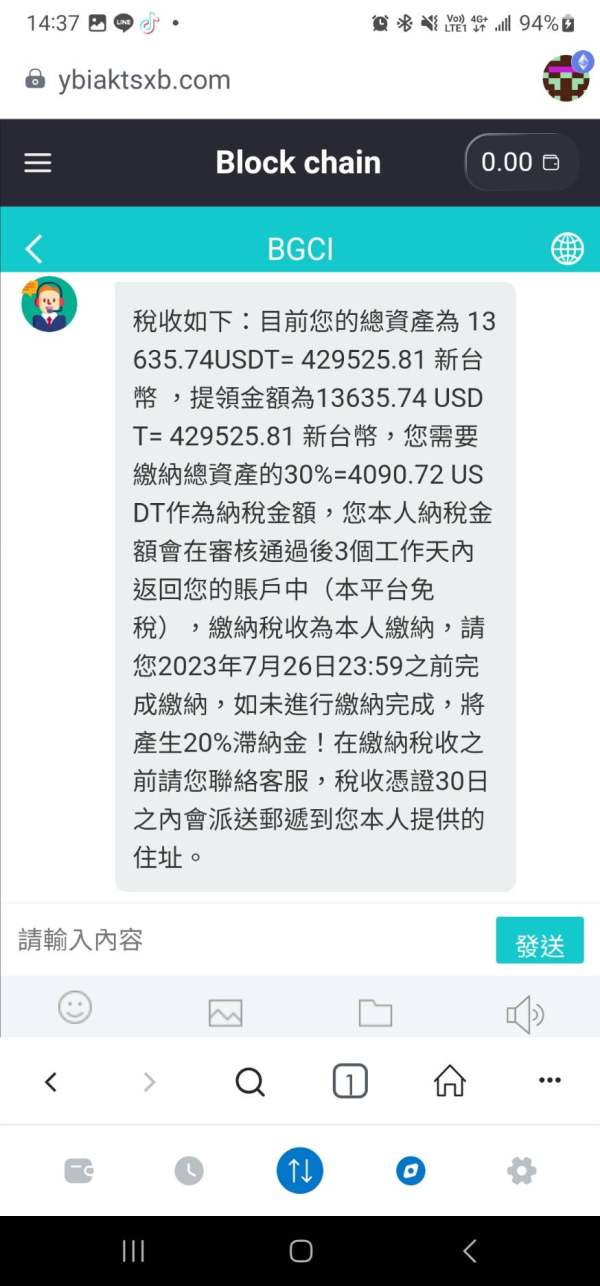

When you want to withdraw 13635.74USDT, that is 429225.81 Taiwan dollars. However, the platform said that it needs to make up 30% tax of the total assets. That's about 4090.72USDT. If the taxes are not made up within the time limit, a 20% late fee will be charged. When your amount is more than the tax amount, the backstage will not withdraw due to the amount differ.

Exposure

2023-07-25

sa6434

Hong Kong

This company has run off, how can I apply for assistance? A total of one million RMB was invested in the Sichuan market, and the profit is unable to withdraw, let alone the principal.

Exposure

2023-07-24

自若

Hong Kong

The account is received from the 1st to the 16th of each month, but so far no money has been received.

Exposure

2023-07-24

hieurobin

Vietnam

Suddenly my money was deducted and I don't know why.

Exposure

2023-07-22

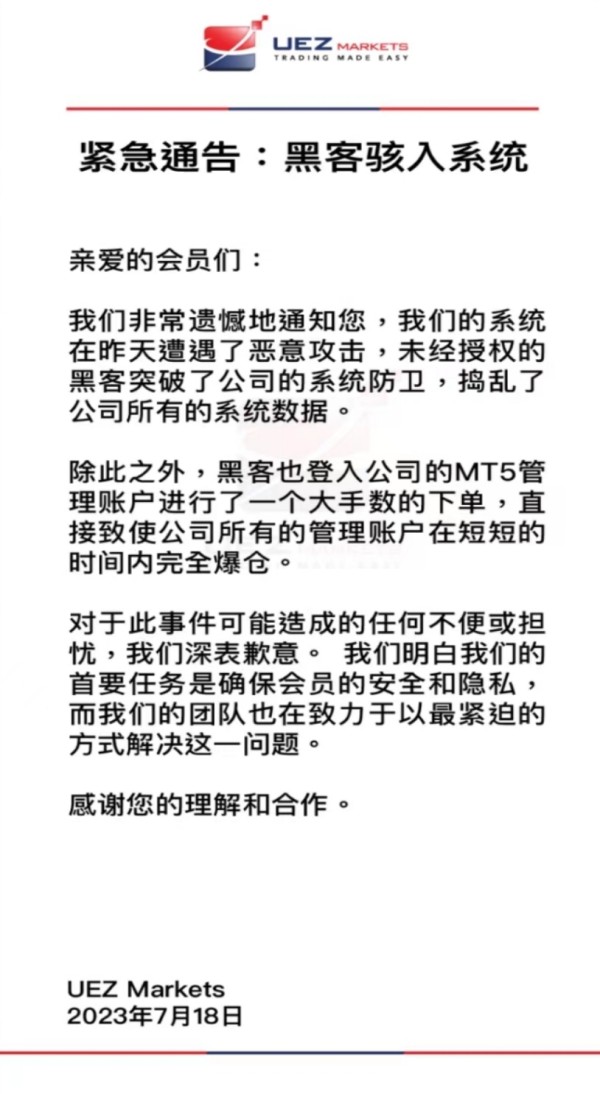

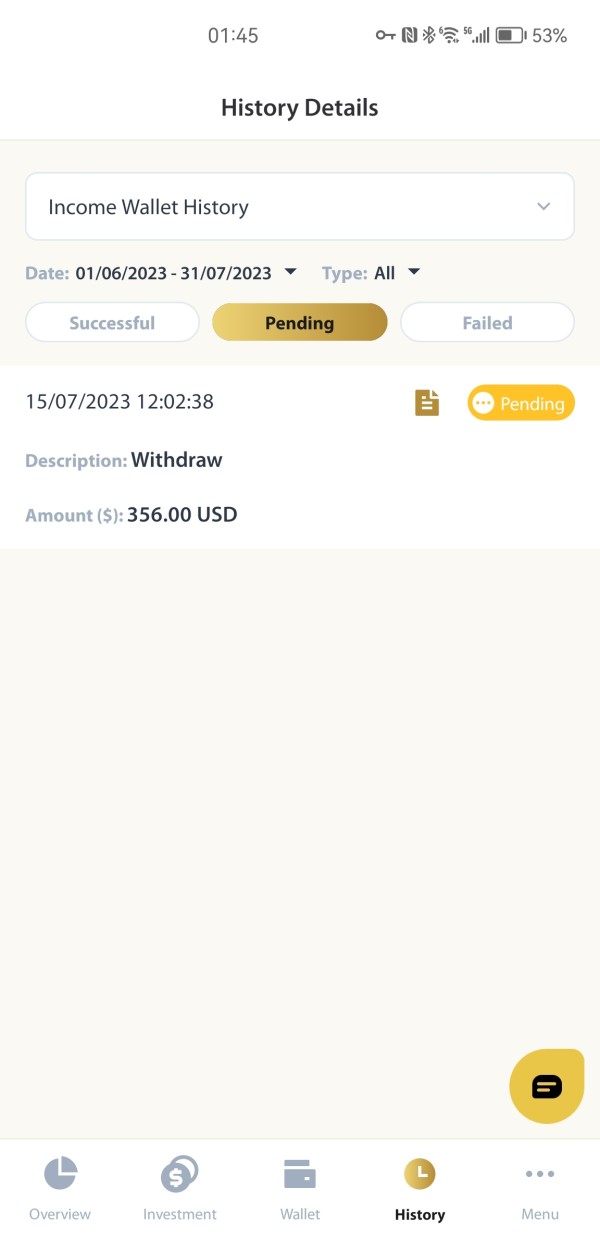

FX1526212682

Malaysia

Please put aware to this Broker and they status every 15th and 1st of the month can withdraw, but this 15th of July, we unable to withdraw and we can't log in to our account, but some account can log in, then they come out with this notice about the system get hacked, and this broker are running pyramid scheme, please aware to the public and lowest their point, thank you

Exposure

2023-07-22

Bdollar

Nigeria

UEZ Markets Malaysia company has collapse as a result of self manipulations and disappeared with Investors fund in a huge way.

Exposure

2023-07-21

Jackylin

Taiwan

An announcement posted on the official website on 18th July: Hackers hacked into the system, leading to complete liquidation in an instant, and could not withdraw funds.

Exposure

2023-07-21

活在当下9649

Hong Kong

A friend introduced that UEZ foreign exchange hosting is good. After trying it, I realized that it is a black platform and a fraudulent platform.

Exposure

2023-07-20

hieurobin

Vietnam

My account is suddenly lost.

Exposure

2023-07-19

活在当下9649

Hong Kong

From the supervision of the company to the exhibitions in various countries, it seems so formal, but it blackmails our principal and profits. I hope the platform can find it back, thank you!

Exposure

2023-07-19

hoathieugia

Vietnam

the account has random money fluctuations

Exposure

2023-07-18

hoangtungua1990

Vietnam

I am not allowed to make any withdrawals. Many people seem to speak highly of this broker so I invest as well, but I end up losing money. I think the broker is deceiving investors.

Exposure

2023-07-18

FX8662613922

Hong Kong

I tried to withdraw money on the 15th, but I still haven't received it till the 17th. I heard that the broker has run away. I don't know if it is true.

Exposure

2023-07-18

FX2678740642

Taiwan

I applied for a withdrawal at the beginning of the month, but they didn't process now, please help me to deal with it.

Exposure

2023-07-18

平安是福7354

Hong Kong

Trust, affection and money are cheated away, direct divestment! !

Exposure

2023-07-18

FX8891891012

Malaysia

The withdrawal has not arrived, and the firm can't find anyone.

Exposure

2023-07-18

WQ6332

Malaysia

Unable to withdraw money.The platform display error and liquidation.The data was confused.

Exposure

2023-07-18