Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

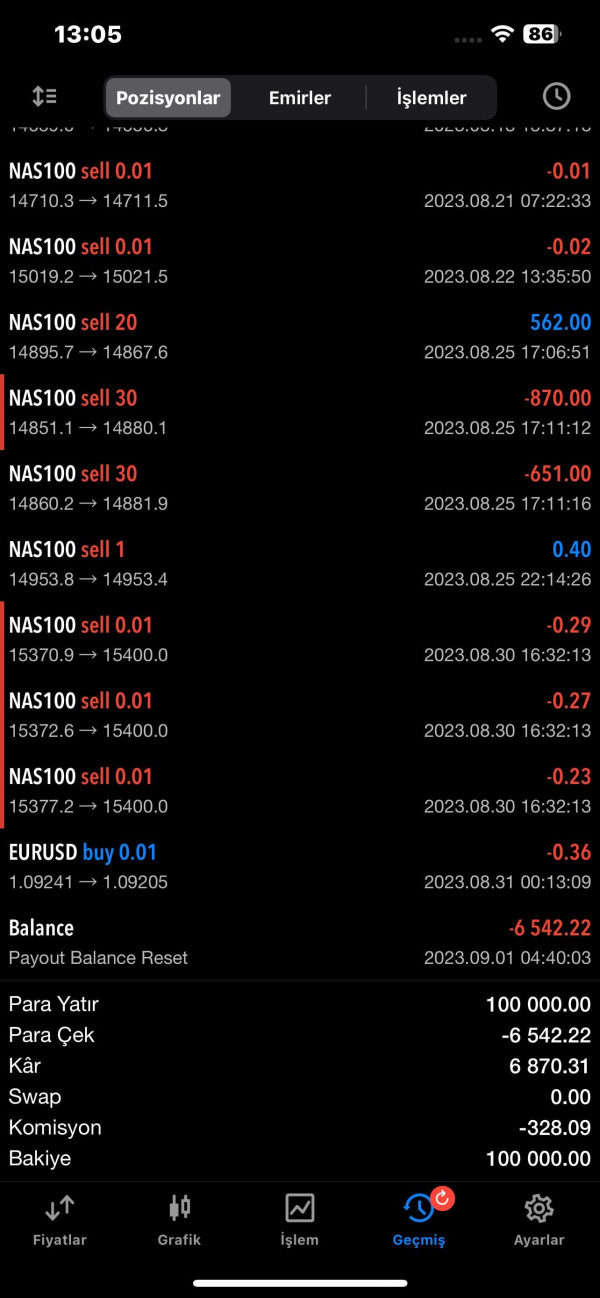

kapitano

Turkey

they don't send my money

Exposure

2023-12-05

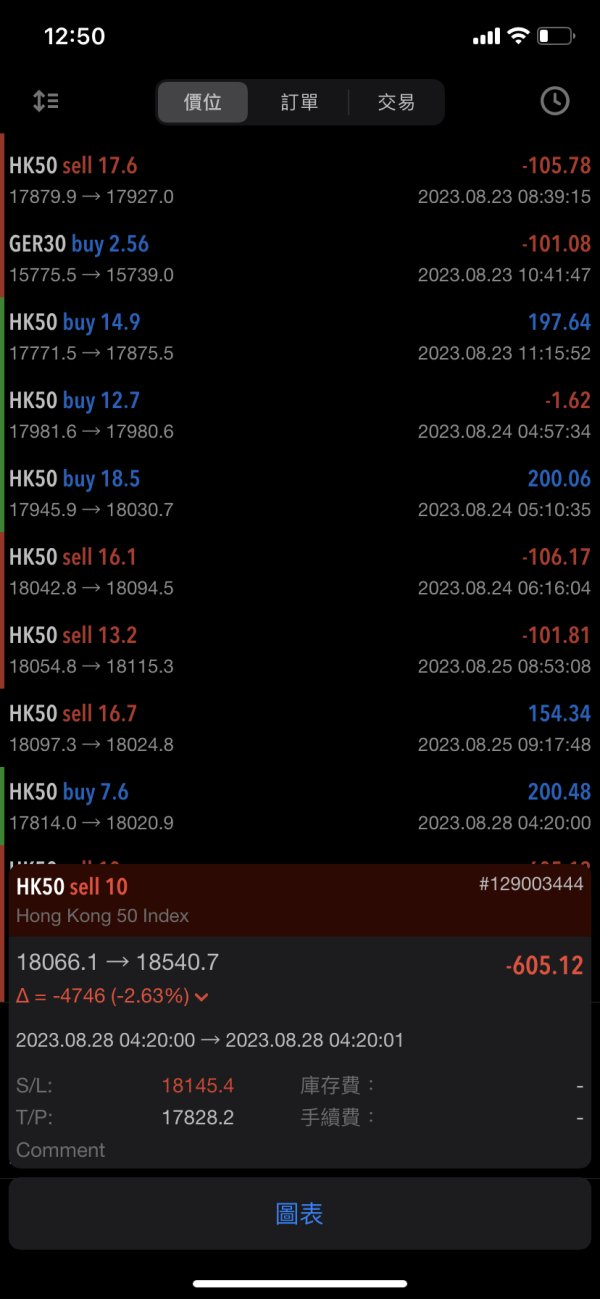

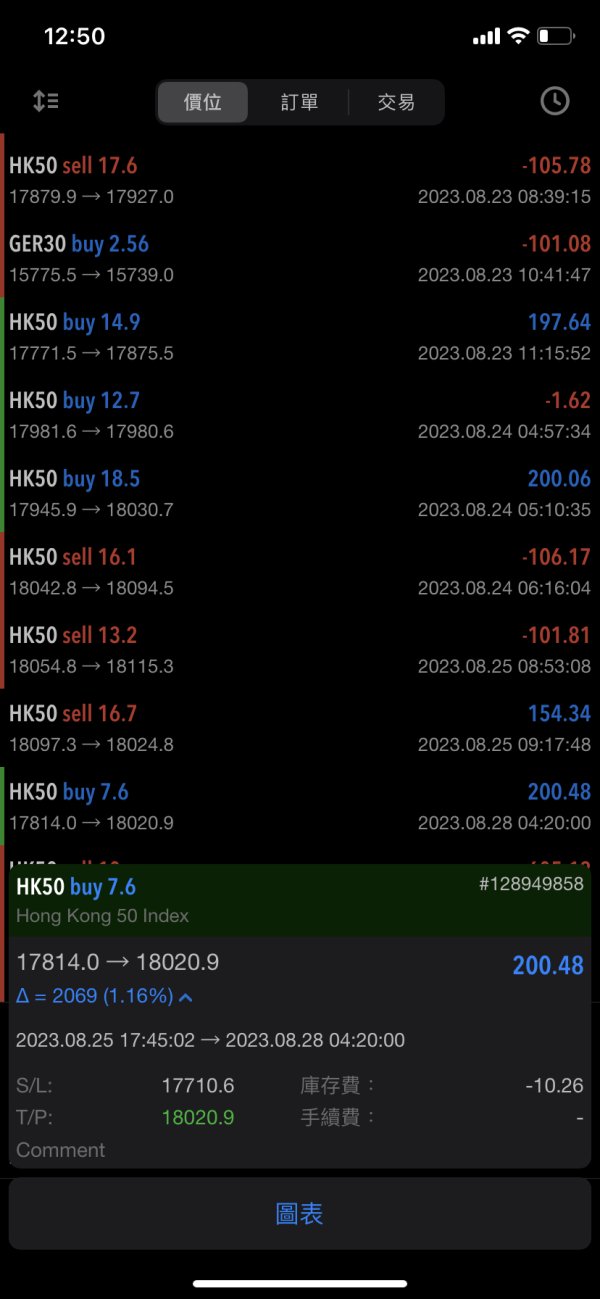

Sam5629

Hong Kong

非常無恥的AI打盤,注意下方圖的成交時間有買升過市單止盈的,有買跌不能取消的訂單,各位看結果 MFF的回覆 It seems you are mistaking two concepts - traded price and liquidity. The price of the instrument, is the currently traded price, where sellers and buyers agree to a certain value of the asset, and exchange happens. Liquidity is a different aspect. You can think of it as "counter orders". For a trade to open or close, it must have ability to be filled with the liquidity. If you want to close or open position at certain price, but it cannot get filled with liquidity, a slippage happens - the position opens/closes at first price there is possibility for it to get filled. Even if X price is currently not the one where exchange of asset is taking place, it does not mean there is no liquidity there (buy/sell orders). This is not something unreasonable - this is how orderbook and real markets work. It is neither something, for which losses we can rectify, since it is not related to our company, this is purely natural occurence when trading on real market conditions, where there is no such thing as unlimited liquidity. I understand your frustration, but slippage is simply one of the risks while trading. 各位認為合理嗎?

Exposure

2023-08-29

FX1218511020

Netherlands

After looking through its official website, I am much sure that this broker is a scammer. They kept inviting me to put me my money here. Speechless and ridiculous…

Neutral

2023-02-21

雅稚

New Zealand

Funny! They used bonuses to tempt me, saying I can immediately get large profits once I made a deposit. I am not a fool, ok? I am writing this review to tell you guys that don’t trade with this broker.

Neutral

2022-12-19

向阳花59325

Hong Kong

This is a complete scam platform without any supervision. I paid $200 in Bitcoin, but they didn't give me any account information. I asked their customer service staff and they ignored me at all. Don't message their lies, it's all fake.

Neutral

2022-12-13

黄玫

Venezuela

This forex broker is a PROP platform, so it does not have any regulatory license, because its users do not need to use their own money to trade, but use the platform's money... Of course, the support has a certain threshold. , you have to be tall enough to make them a registered user.

Positive

2022-12-16