Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

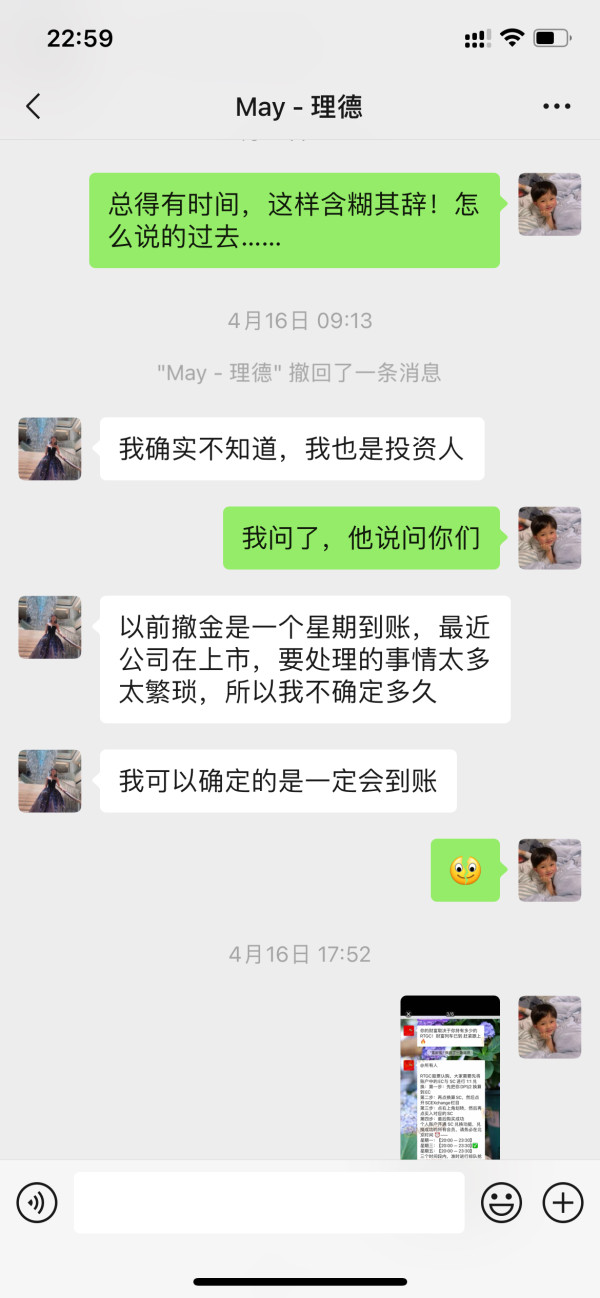

MY027

Hong Kong

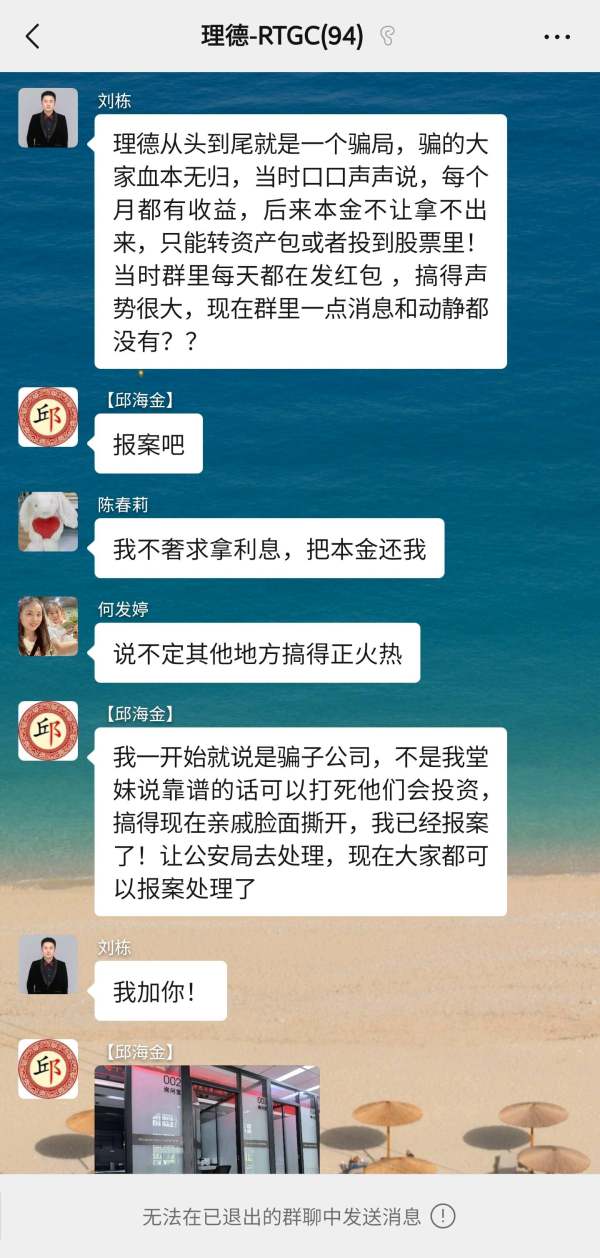

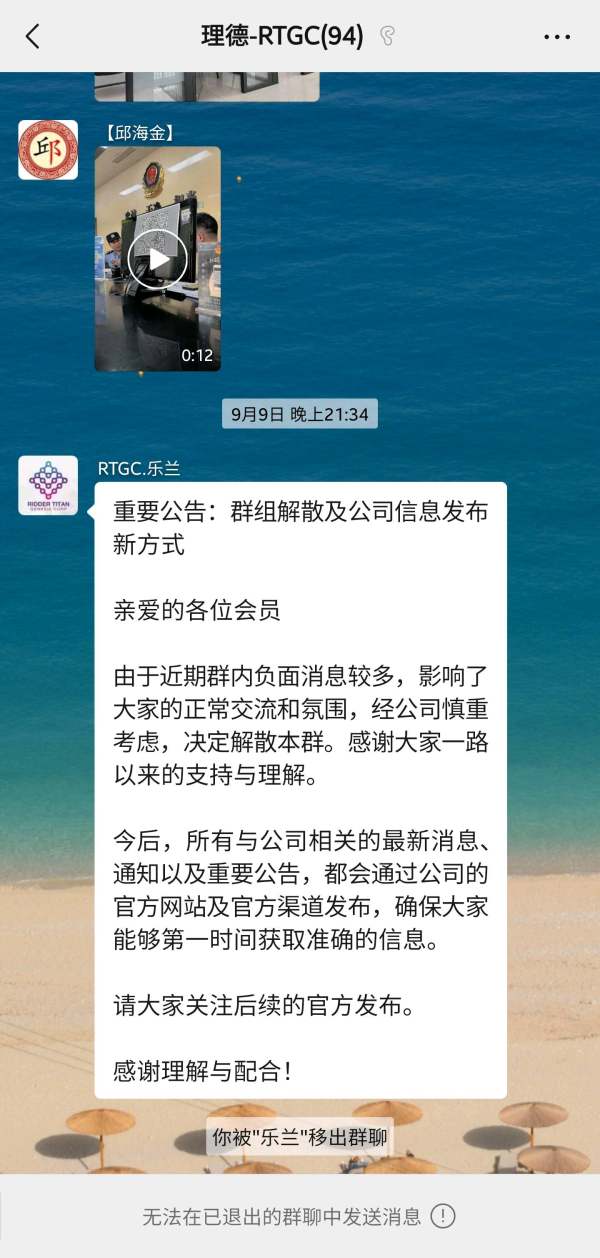

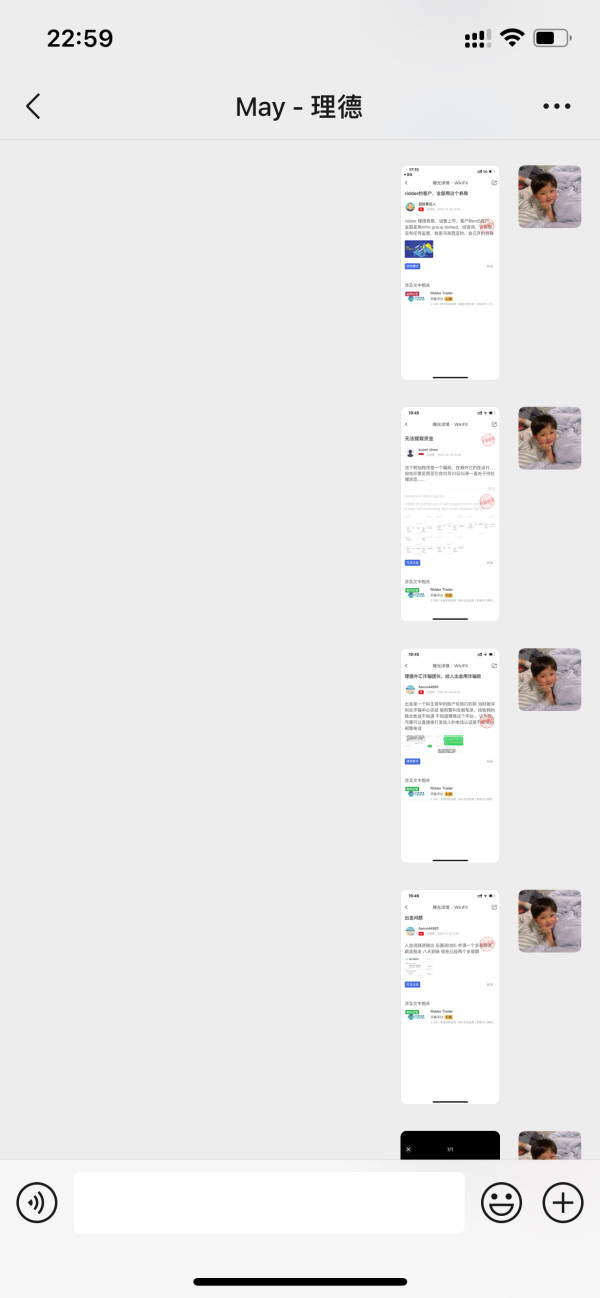

Unable to withdraw funds, the official has run away.

Exposure

2024-11-02

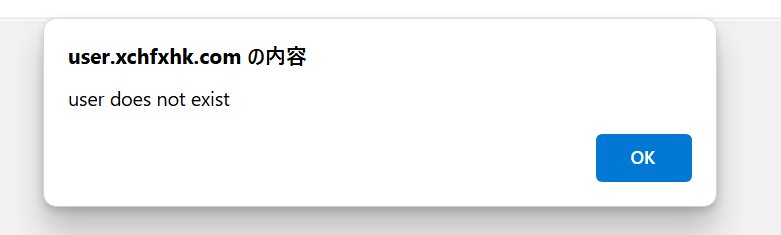

FX2273017097

Japan

Since around February 2024, I have been making withdrawal requests and have been exchanging emails several times. At the stage of June, I was told that the bank card would be ready within the next two weeks, and I have been waiting for it to be completed so that I can make the withdrawal. However, I have not received any contact, and despite reaching out multiple times afterwards, I have been completely ignored. In the midst of this, I tried to log in yesterday after a long time, but a message appeared saying that there is no account information, and I was unable to log in. (By the way, I am certain that there is no mistake in the login information as it is managed in Excel, etc.) I also tried to inquire about the situation of not being able to log in through the help, but that has also been ignored, and there is still no reply. Adrian Leong Ik (leongik.raiden@outlook.com) Although he seems to be in charge, he has been completely ignored since the email in June. For those who cannot make withdrawals, it would be a good idea to check if you can log in to your My Page.

Exposure

2024-07-31

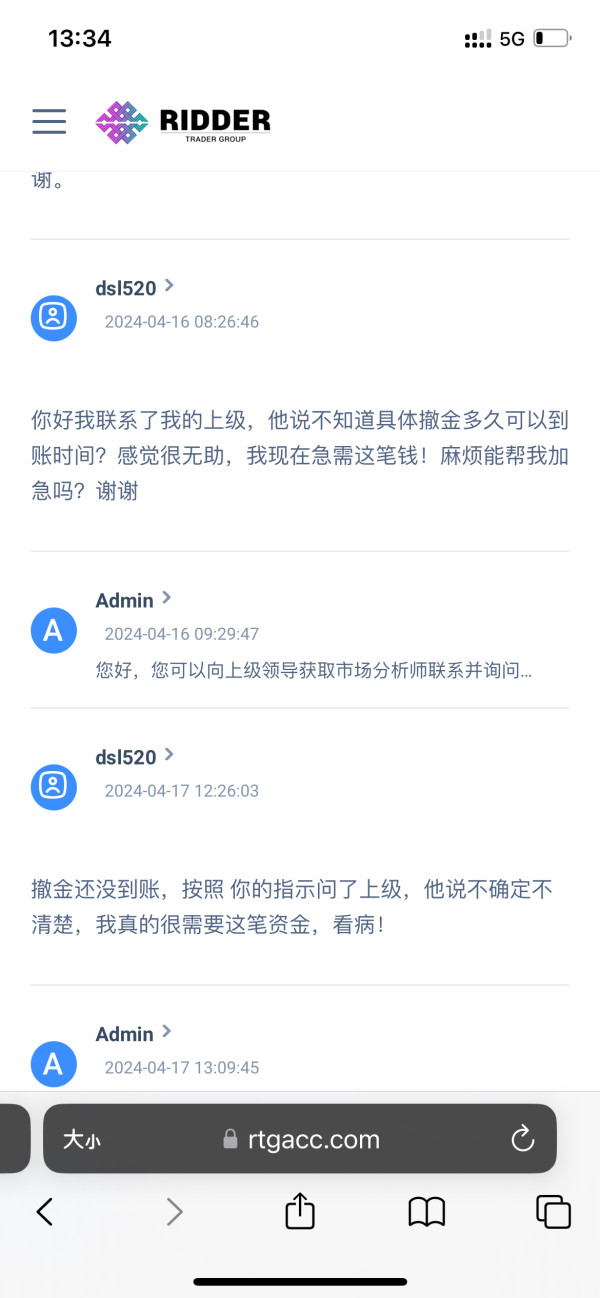

大山8056

Hong Kong

Since January, I have been unable to withdraw funds. Every month, the time keeps changing, and they just avoid it. I request the platform's assistance in withdrawing funds.

Exposure

2024-07-07

小海螺

Hong Kong

Trading stopped in April and I applied for withdrawal. Sometimes it is said that it will be a month, and sometimes it is said that there is no specific time. Now the call says it will take 3 to 6 months. Speechless! There was no announcement before the suspension of trading. There is no explanation, and no hope for the withdrawal...

Exposure

2024-04-25

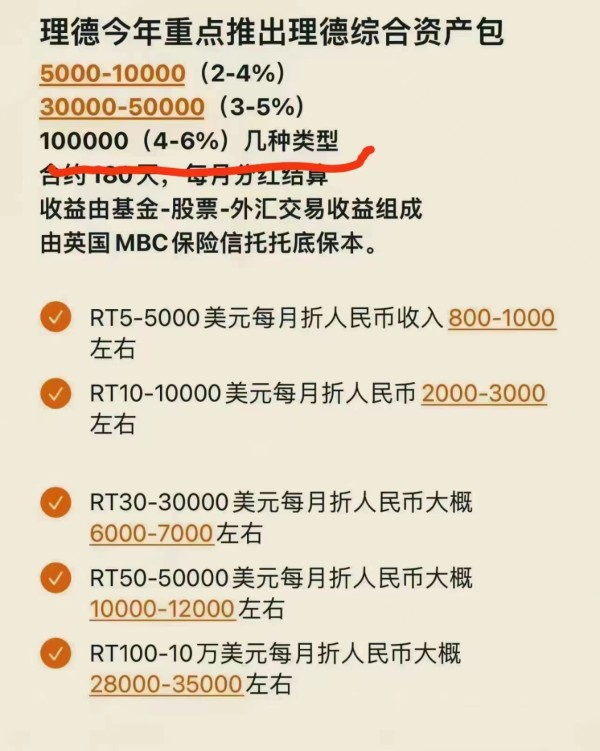

大山8056

Hong Kong

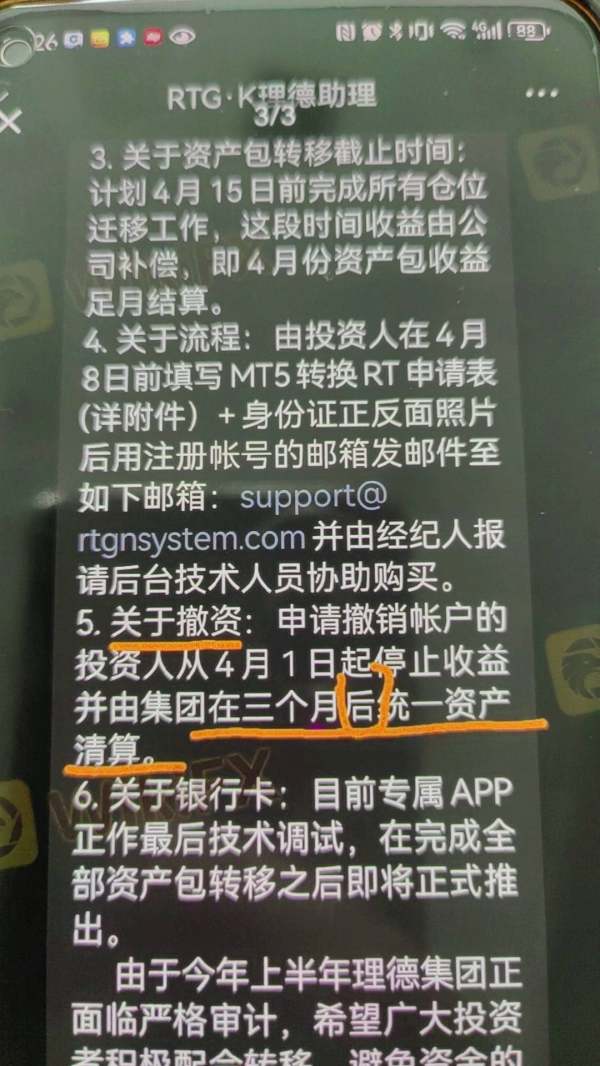

I haven’t been able to withdraw money from January to now. The rules are constantly changing, including asset packages and listings, for various reasons. All withdrawals were canceled in the background, and there was still no news about the asset package. The principal will be locked for 180 days. Please deal with it.

Exposure

2024-04-18

大山8056

Hong Kong

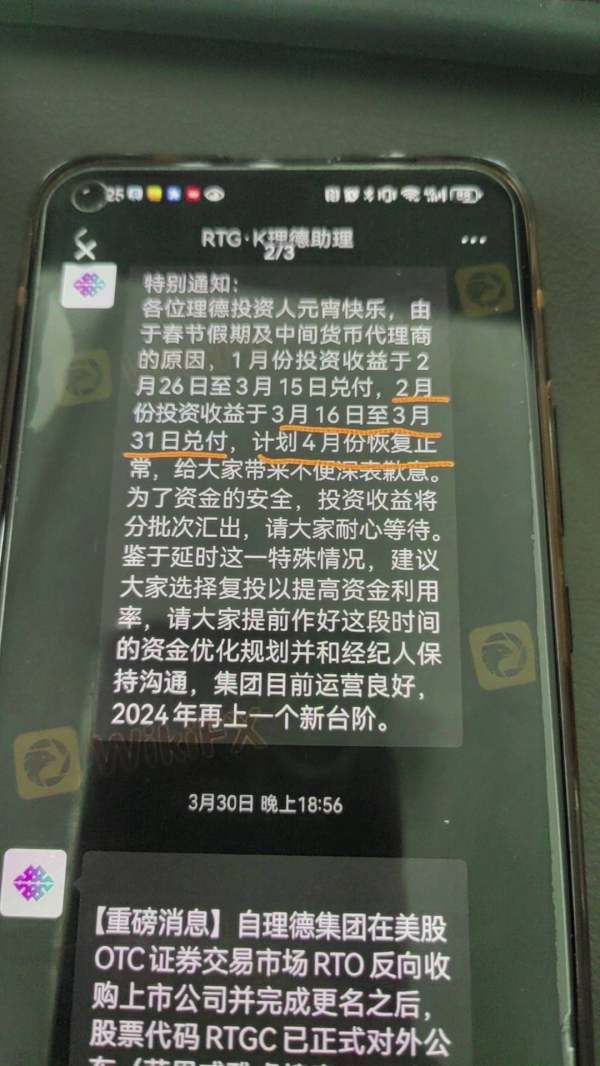

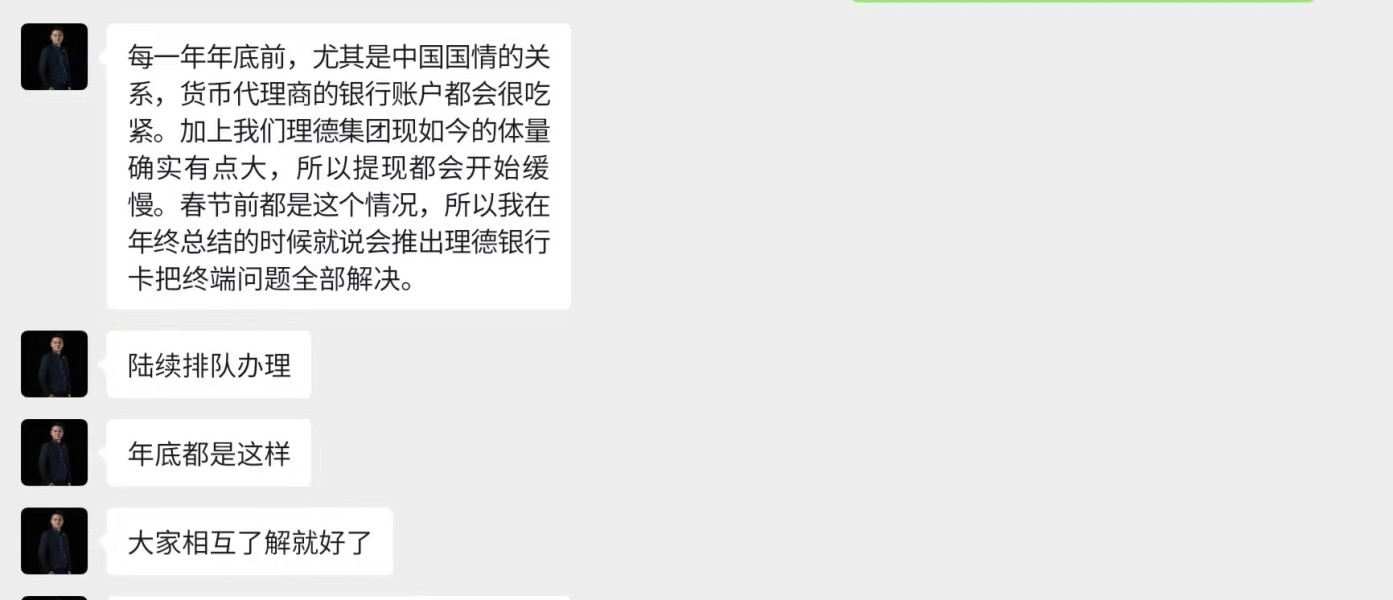

I haven't been able to withdraw funds since January. The company said it would be back to normal after Chinese New Year. They asked me to wait until March. In March, I still couldn't withdraw money. They made an asset package in April, but it hasn't been done yet. It keeps changing and no accurate time. Please help me withdraw money.

Exposure

2024-04-17

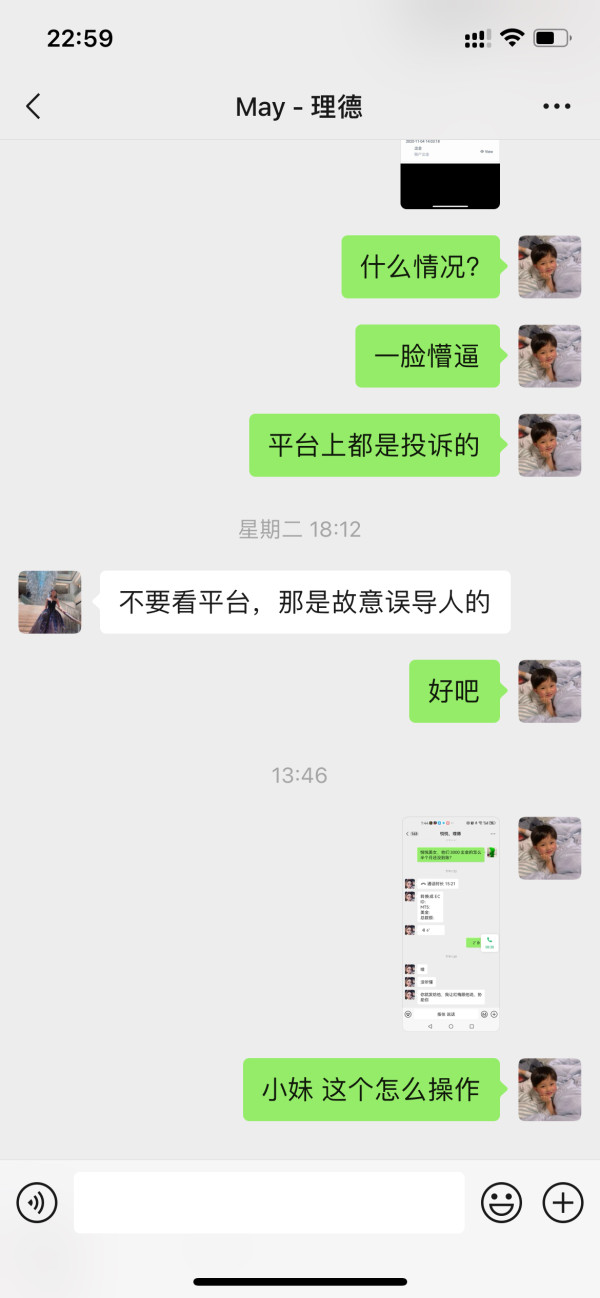

外汇小白003

Hong Kong

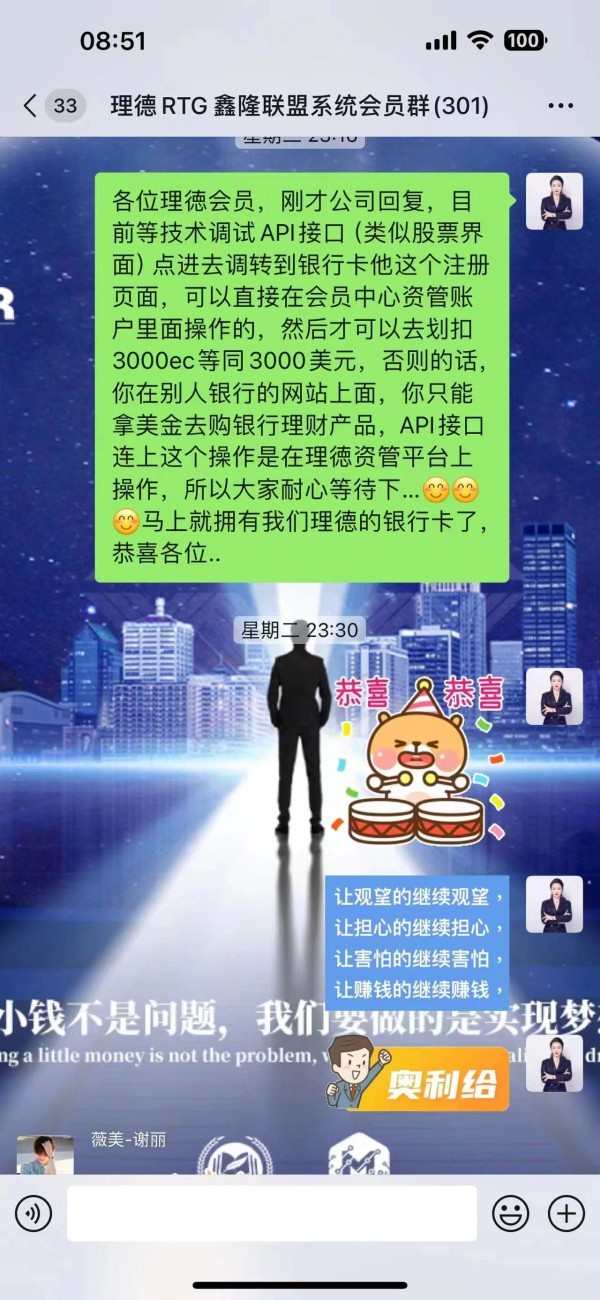

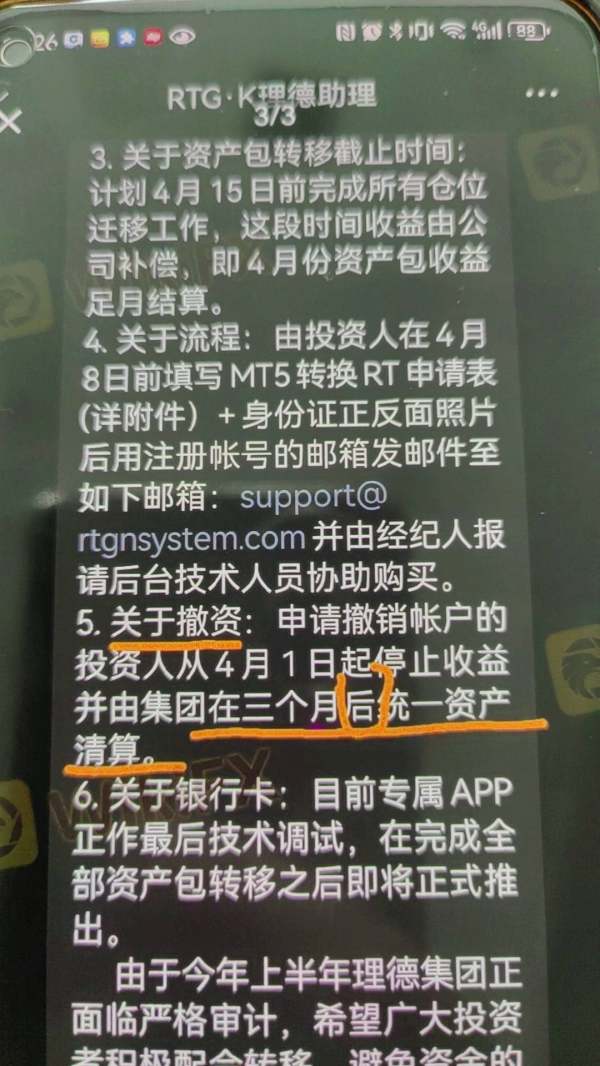

Now the platform has not run single, wants to transition. The notice said that you can not withdraw, to buy the company's stock, lock position 180 days. And wait for the company to be listed before withdrawing.

Exposure

2024-04-09

akanina

Hong Kong

The withdrawal has been delayed for more than 3 months, and now the withdrawal will continue to be delayed.

Exposure

2024-04-04

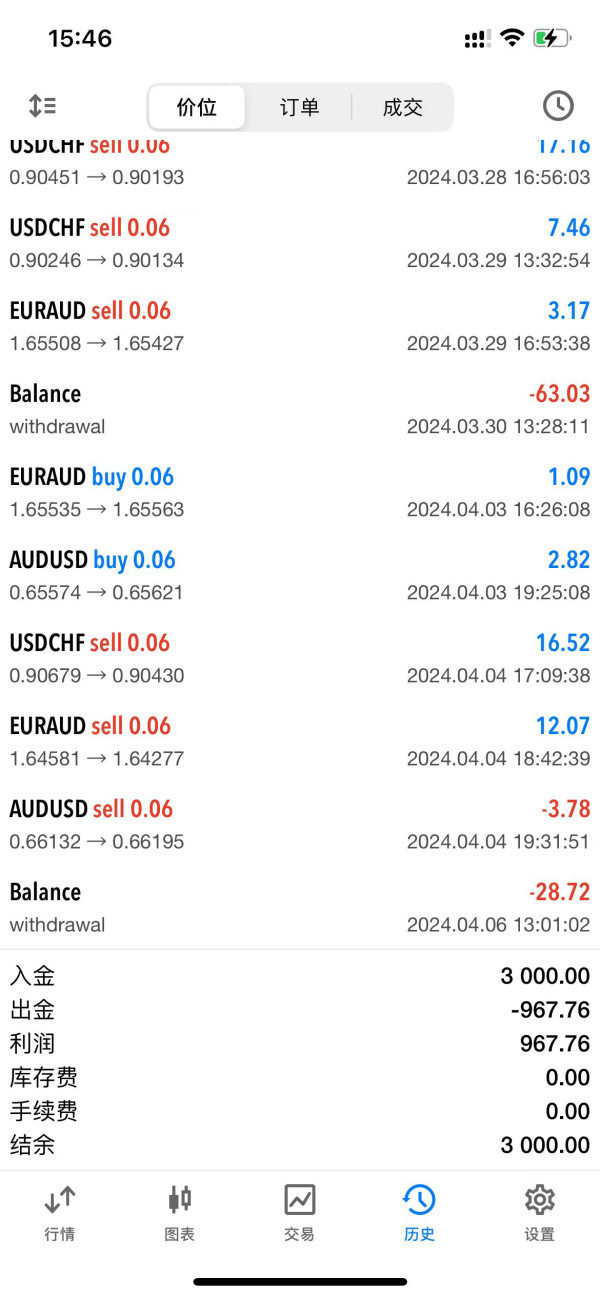

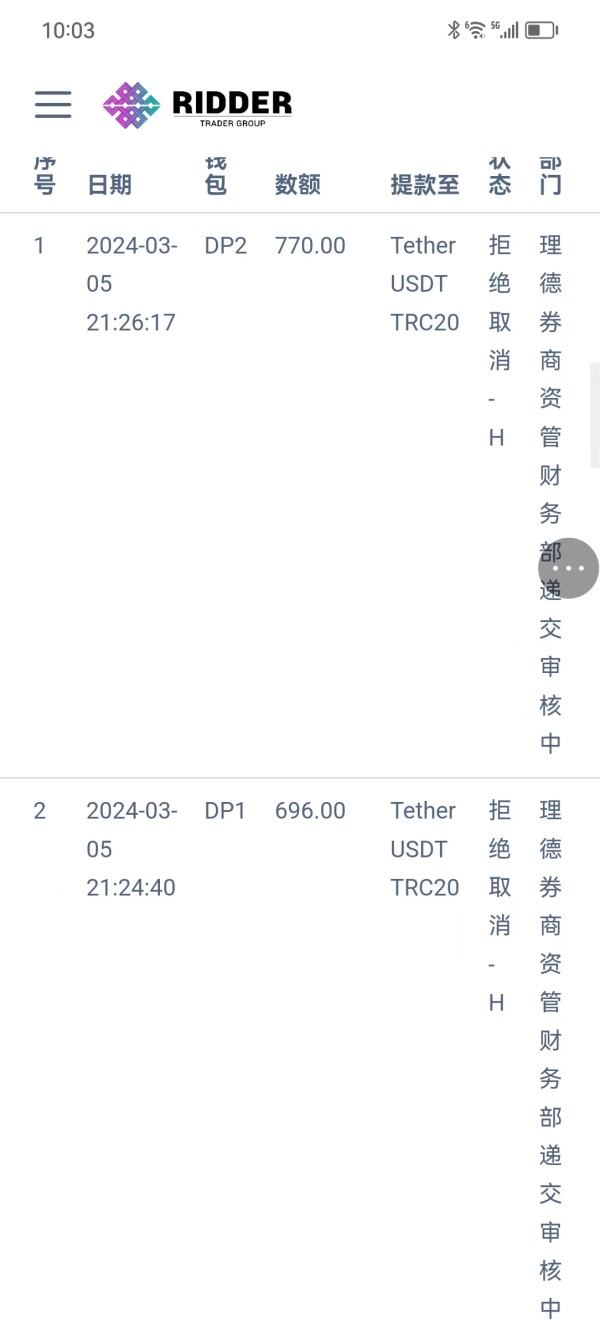

快乐出发5533

Hong Kong

1. The profit withdrawal in February has not been received yet. At first, it was said that it would be completed before March 25th. Now it is said that I need to apply for a bank card, and it has to be before April 25th. 2. Since April, the account transactions on MT5 have been stopped. , and also said that he would buy financial asset packages instead, and the rules were often changed.

Exposure

2024-04-03

外汇小白003

Hong Kong

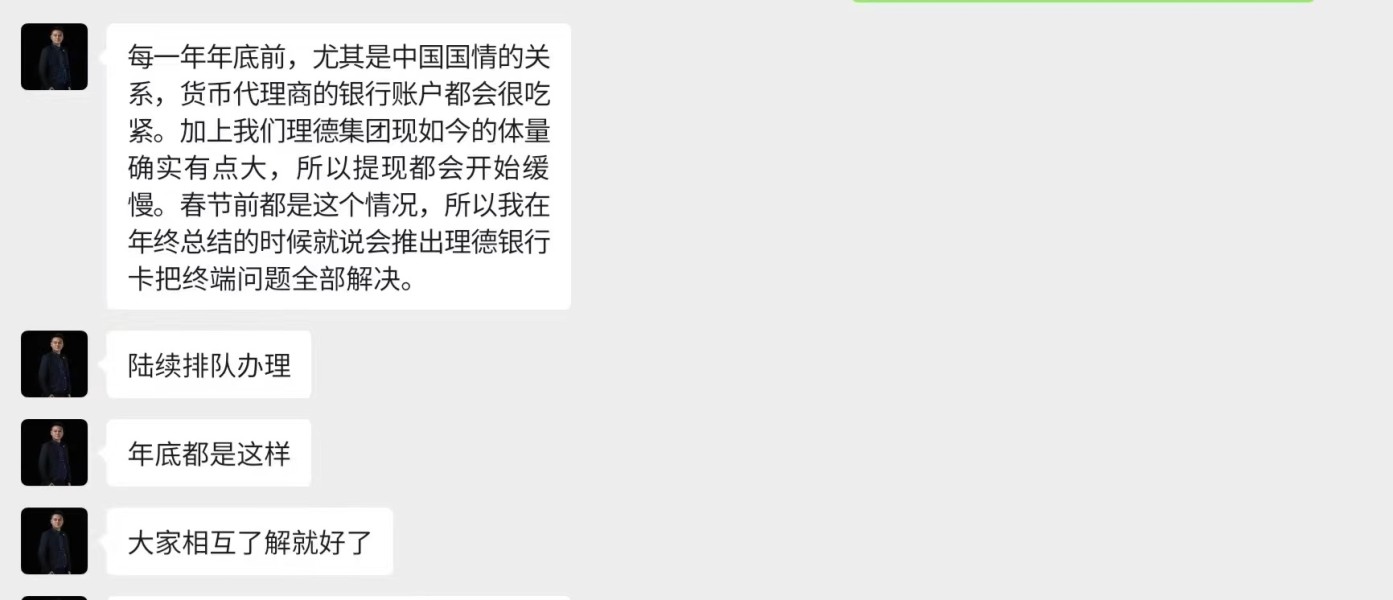

Withdrawals from 2024 to now have not arrived. When I consulted customer service, they said they had been submitted to a currency agent for processing. In the past, it took about 5 working days to arrive in the account. Since the withdrawal of the current period in December 2023, it took almost a month to arrive, but it has not arrived since 2024. At first, it was said to be a regulatory issue, and money agents were restricted in transfers. They said 3 It returned to normal in the month, but now it's starting again in April and it hasn't been resolved yet.

Exposure

2024-04-01

FX2500187321

Japan

Originally, I was told that the money would arrive in a week at the latest. Indeed, until December, I received the money in one week. From December to February, it may take a month due to the Lunar New Year, but things will return to normal in March. For those who applied at the beginning of February, the money was received at the beginning of March. However, I applied as soon as March was expected to recover, but as of March 29th, I have not received the money. I inquired last week, but the answer was that it had been submitted to a money exchanger. Even into March, there are still delays. It hasn't been decided that I can't withdraw money, but I feel anxious about the delay. Basically, companies that disappear start with delayed withdrawals.

Exposure

2024-03-29

joy132

Hong Kong

Deposit in 2023, and I am not be able to withdraw from December 2023. Request quick withdrawal.

Exposure

2024-03-14

susan chow

Indonesia

This ridder is a scam, overseas it's still running but in Indonesia, it's been pending since October 23...

Exposure

2024-02-22

超级赛亚人

Hong Kong

ridder brokerage, said to be listed, the client's mt5 account, all with mfm group limited, after inquiries, the brokerage has no regulation, is Malaysia, their own brokerage firms

Exposure

2023-10-06

FX3674671002

Hong Kong

I showed the information of the fraud in order that you can avoid being cheated by him.The process of the scam is so dramatic, he used many different identities to induce others to invest and made other people reach the point of no return. The so-called teacher in the stock group focuses on customers who made a loss and recommend shares, futures or other investments to you. That’s a scam. The teacher has many different QQ in the name of analysis teacher, investment consultant of future, businessman or top operator. Let you profit, then let you lose money again and again.Torment you by inch. And you will lose all the money in the end without noticing the scam.Please polish your eyes, don’ be cheated like me, my whole family has been ruined. I wish the fraud’s conscience smote him(It’s impossible). I don't know how many people have been cheated like me. Maybe they don't know there is such a scam. Don’t cheat others anymore. Your benefit is based on others’ agony, even lives. You will pay for it!!!

Exposure

2021-01-13

Aaron44993

Hong Kong

I received the money from the account named Peihua Wang. But the money was frozen by Shenzhen Anti Fraud Center. And I was interviewed. If you think I slander this platform, you can call the one who messaged me and ask him whether he is criminal police

Exposure

2021-01-04

Aaron44993

Hong Kong

They said I can deposit and withdraw freely when I deposited. But later, my application for withdrawal has been pending for over two weeks

Exposure

2020-11-19

L33724

South Africa

Your transaction delay because i made a transaction sometime ago it was processed within 23 working days why????

Neutral

2024-04-26

Anastasia Beauchamp

United Kingdom

Okay folks, here's my two cents on Ridder Trader. The platform is easy as pie, and their resources for beginners? Top notch! The account types cater to just about every kind of trader, from the fresh beans to the big guns. And the spreads and fees? Pretty reasonable, nothing to worry your wallets. But when it comes to their customer service, it's a bit like spinning a roulette wheel - sometimes you hit the jackpot, other times it's a dry run. But for those just dipping their toes in trading, it's a good starting block!

Neutral

2023-12-01

Curiosity

Australia

The account types cater to just about every kind of trader, from the fresh beans to the big guns. And the spreads and fees? Pretty reasonable, nothing to worry your wallets. But when it comes to their customer service, it's a bit like spinning a roulette wheel - sometimes you hit the jackpot, other times it's a dry run. As for the trading instruments, well, they could do with some ramping up. So, if you're a seasoned trader with a taste for variety, Ridder Trader might seem a bit lean. But for those just dipping their toes in trading, it's a good starting block!

Neutral

2023-11-30