Overview of CAPSTONE

Capstone, an Australian forex company established within the last 2-5 years, offers trading in Forex, CFDs, and Cryptocurrencies. Notably, it operates without regulatory oversight. The platform provides three account types: Standard, Pro, and VIP, requiring a minimum deposit of $500 and allowing a maximum leverage of $10,000.

What sets Capstone apart are competitive spreads, starting from 0.1 pips, ensuring cost-effective trading. Users can choose from popular platforms like MetaTrader 4, MetaTrader 5, and cTrader for their trading activities. Capstone also allows beginners to practice with a Demo Account.

Capstone recognizes the importance of education in trading and offers resources like the Trading Academy, Webinars, and Market Analysis to enhance users' skills. However, it's essential to note that Capstone operates without regulatory oversight, which users should consider when assessing their options in the competitive forex market.

Regulatory Status

CAPSTONE operates as an unregulated trading platform, meaning it does not fall under the oversight of any financial regulatory authority. Traders and investors should be aware that the absence of regulatory supervision may entail additional risk.

In unregulated environments, clients may have limited recourse and protection in the event of disputes or unforeseen issues. It's essential for individuals considering CAPSTONE to exercise caution and carefully assess their risk tolerance when engaging with an unregulated broker.

Pros and Cons

Pros:

Competitive Spreads: CAPSTONE offers competitive spreads on all of its instruments. This means that traders can keep their costs low and maximize their profits.

Wide Range of Market Instruments: CAPSTONE offers a wide range of market instruments to trade, including forex, CFDs, metals, and energies. This gives traders a variety of options to choose from and allows them to diversify their portfolios.

Three Popular Trading Platforms: CAPSTONE offers three of the most popular trading platforms in the industry, MetaTrader 4, MetaTrader 5, and cTrader. These platforms are known for their user-friendly interface and powerful features.

Variety of Account Types: CAPSTONE offers a variety of account types to suit different trading styles and needs. This includes micro accounts for beginners, standard accounts for experienced traders, and VIP accounts for high-volume traders.

Access to Fractional Trading: CAPSTONE offers fractional trading, which allows traders to purchase a fraction of a share of a stock or other asset. This can be beneficial for traders who have limited funds or who want to diversify their portfolios more effectively.

Cons:

Lack of Regulation: CAPSTONE is not regulated by a reputable financial regulator. This means that traders' funds and interests may not be as protected as they would be with a regulated broker.

High Maximum Leverage: CAPSTONE offers high maximum leverage, which can be risky for inexperienced traders. Leverage can magnify both profits and losses, so it is important to use it carefully.

Limited Educational Resources: CAPSTONE offers a limited number of educational resources compared to some other brokers. This could be a disadvantage for beginners who are looking for more guidance.

Minimum Deposit: CAPSTONE's minimum deposit for a Standard account is $500, which is higher than some other brokers. This could be a barrier for some traders.

Mixed Reviews of Customer Support: CAPSTONE's customer support has received mixed reviews from traders. Some traders have reported that the support is slow and unresponsive.

Market Instruments

CAPSTONE offers a wide variety of trading instruments, including Forex, CFDs, and Cryptocurrencies.

Forex (Foreign Exchange): Forex is like a giant global market where people trade different currencies. It's where you can exchange your money for another country's money. For example, you might trade U.S. dollars for euros. The goal is to figure out if one currency will get stronger or weaker compared to another. Forex is open 24/5, and it's used for various reasons, like business, travel, or investing. Just know, that while there's a chance to make money, it's important to be aware of the risks.

Contract for Difference (CFDs): CFDs, or Contracts for Difference, are a type of financial tool that lets you bet on the price changes of assets without actually owning them. You can trade on various things like stocks, commodities, and currencies. The cool part is you can make money whether the prices go up or down. Just be aware that CFD trading involves risks, including the chance of losing more money than you put in.

Cryptocurrencies: Cryptocurrencies are like digital money that uses computer codes to stay secure. They work on a system called blockchain, which is like a decentralized network making sure everything is safe and transparent. Bitcoin was the first one, but now there are many others like Ethereum and Litecoin. People use cryptocurrencies for transactions without needing banks. But remember, the prices of cryptocurrencies can change a lot, so it's important to be careful if you're thinking about buying or trading them.

Account Types

CAPSTONE offers three distinct account types to cater to a wide range of traders: Standard, Pro, and VIP. Each account type provides a unique blend of minimum deposit requirements, spread conditions, leverage options, and tradable products, tailored to suit specific trading styles and risk appetites.

How to Open an Account?

Opening an account with CAPSTONE is a straightforward process that can be completed online in a matter of minutes. Here's a breakdown of the steps involved:

Choose your account type: CAPSTONE offers three account types, each tailored to different experience levels and trading needs.

Visit the CAPSTONE website and click “Open Account.”

Fill out the online application form: The form will request your personal information, financial details, and trading experience. Be sure to have your identification documents (passport or ID card) and proof of address handy for uploading.

Fund your account: CAPSTONE offers various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Choose your preferred method and follow the instructions to complete the deposit.

Verify your account: Once your account is funded, you'll need to verify your identity and address. This typically involves submitting scanned copies of your ID documents and proof of address.

Start trading: Once your account is verified, you're ready to explore the CAPSTONE trading platform and start making trades.

Leverage

CAPSTONE offers up to 1:10,000 leverage on all account types. Leverage allows traders to control a larger position size with a smaller amount of margin. For example, if you have a leverage of 1:100, you can control a position of $1,000,000 with a deposit of $100.

Leverage can amplify your profits, but it can also amplify your losses. It is important to use leverage wisely and to understand the risks involved.

Spreads & Commissions

CAPSTONE prides itself on transparent and competitive spread conditions, offering diverse options tailored to different trading styles. Here's a detailed breakdown of their spread conditions and additional fees across their account types:

Trading Platform

CAPSTONE provides traders with a choice of three distinct trading platforms, each tailored to meet diverse trading styles and preferences.

MetaTrader 4 (MT4): a widely acknowledged and versatile trading interface. MT4 is renowned for its user-friendly design, advanced charting tools, and extensive customization options. Its popularity among forex traders is attributed to its comprehensive technical analysis capabilities and robust support for automated trading through Expert Advisors (EAs).

MetaTrader 5 (MT5): the successor to MT4, introduces advanced features tailored to meet the evolving needs of traders. It supports an expanded range of financial instruments, encompassing stocks, commodities, cryptocurrencies, and more. MT5 offers enhanced charting tools and timeframes for in-depth technical analysis. Traders benefit from an integrated economic calendar and news features to stay informed about market events. With the MQL5 programming language, MT5 allows the development of sophisticated trading algorithms and Expert Advisors, offering greater flexibility in strategy implementation.cTrader: a sophisticated and user-friendly trading platform designed for forex and CFD trading. Known for its intuitive interface and advanced functionality, cTrader caters to both novice and experienced traders. The platform offers a seamless trading experience with real-time market data and a range of tools to enhance decision-making. Traders can execute orders with precision, benefit from quick order execution, and access a wide range of financial instruments. cTrader also provides advanced charting tools, technical analysis features, and algorithmic trading capabilities for those who prefer automated strategies. The platform's user-centric design and customizable layout make it a popular choice among traders seeking a powerful and flexible trading environment.

Deposit & Withdrawal

CAPSTONE makes it simple to move your money from place to place. They provide a range of account funding and account withdrawal options in multiple base currencies.

Deposits:

Withdrawals:

Customer Support

CAPSTONE prioritizes responsive and accessible customer support, and offers two primary channels: email and contact number. While different in their approach, both channels efficiently address customer inquiries and provide valuable assistance.

Email: Users can reach out to CAPSTONE's support team via email at info@fxcg.com. This provides a formal channel for communication, allowing users to detail their concerns or inquiries.

Phone: CAPSTONE offers phone support in Chinese (Simplified) (+61 731 235 133), allowing users to contact the customer support team directly. This direct communication channel is beneficial for resolving complex issues or seeking personalized assistance.

Educational Resources

CAPSTONE goes beyond simply providing a trading platform; it also empowers its clients with a comprehensive suite of educational resources. These resources cater to diverse learning styles and levels of experience, allowing traders to gain valuable knowledge and develop their skills.

Trading Academy: This online learning platform provides a comprehensive curriculum covering various trading topics, from fundamental analysis and technical indicators to risk management and advanced trading strategies. It caters to traders of all levels, with beginner-friendly courses and more in-depth material for experienced traders.

Webinars: CAPSTONE regularly hosts live and on-demand webinars conducted by industry experts. These webinars cover current market trends, trading strategies, and specific asset classes. They provide valuable insights and offer a platform for Q&A sessions with experienced professionals.

Market Analysis: CAPSTONE offers daily and weekly market analysis reports prepared by their team of experienced analysts. These reports provide valuable insights into current market conditions, identify potential trading opportunities, and offer risk assessments. They help traders make informed decisions based on comprehensive market information.

These resources collectively contribute to a holistic educational approach, catering to users at different levels of expertise within the financial realm.

Conclusion

In summary, CAPSTONE positions itself as a brokerage with competitive spreads and an extensive array of market instruments, offering traders flexibility and opportunities for diversification. With access to three popular trading platforms, including MetaTrader 4, MetaTrader 5, and cTrader, CAPSTONE caters to traders of various experience levels. The provision of different account types, including micro, standard, and VIP accounts, further enhances its appeal to a diverse range of traders. Additionally, the introduction of fractional trading enables accessibility for those with limited funds. However, challenges include the absence of regulation, potentially impacting the security of traders' funds. The availability of high leverage poses risks, especially for inexperienced traders, and a limited range of educational resources may be a drawback for those seeking comprehensive guidance. Furthermore, the minimum deposit requirement for a Standard account at $500 and mixed reviews about customer support responsiveness are aspects that prospective traders should carefully consider.

FAQs

Q: What types of trading instruments does CAPSTONE offer?

A: CAPSTONE provides a wide range of trading instruments, including forex, CFDs, metals, and energies.

Q: What trading platforms are available on CAPSTONE?

A: CAPSTONE offers three popular trading platforms: MetaTrader 4, MetaTrader 5, and cTrader.

Q: Are there different account types on CAPSTONE?

A: Yes, CAPSTONE offers various account types to cater to different trading styles and needs, including micro accounts for beginners, standard accounts for experienced traders, and VIP accounts for high-volume traders.

Q: Does CAPSTONE support fractional trading?

A: Yes, CAPSTONE allows fractional trading, enabling traders to purchase a fraction of a share of a stock or other asset.

Q: Is CAPSTONE regulated by a financial authority?

A: No, CAPSTONE is not regulated by a reputable financial regulator.

Q: What is the minimum deposit requirement for a Standard account on CAPSTONE?

A: The minimum deposit for a Standard account on CAPSTONE is $500.

Q: How is customer support on CAPSTONE?

A: Customer support on CAPSTONE has received mixed reviews, with some traders reporting slow and unresponsive support.

自律3732

Hong Kong

Unable to withdraw nor open the webstie. Is there anyone who can help to solve it?

Exposure

2021-12-12

FX2554756172

Nigeria

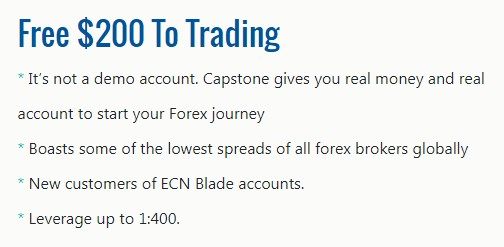

I'm searching on internet I came across this capstone broker where they saying it free investment they will give new registered user 200 to start trading but actually it's not like that now I lost my money 200$

Exposure

2021-09-14

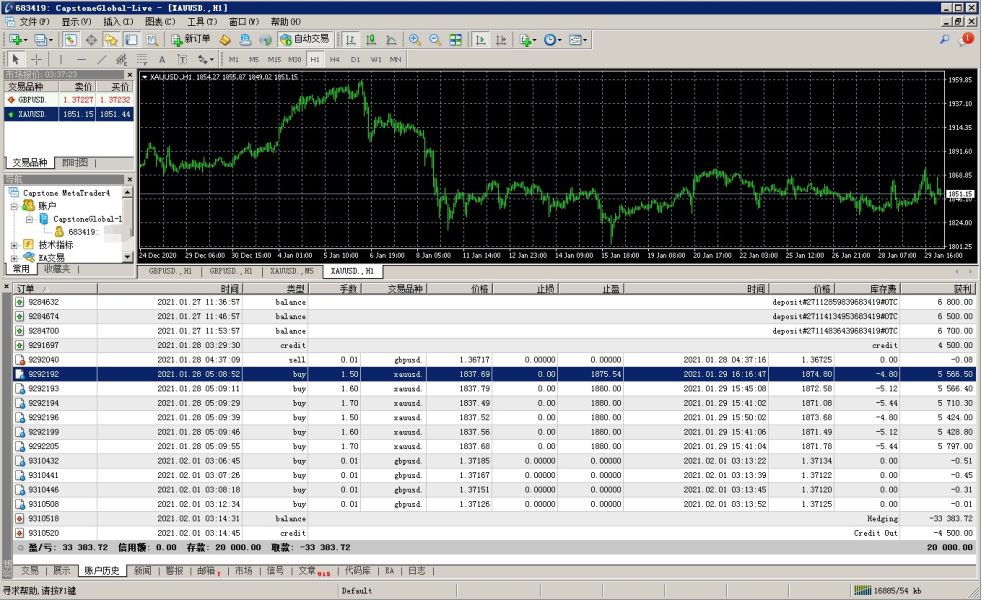

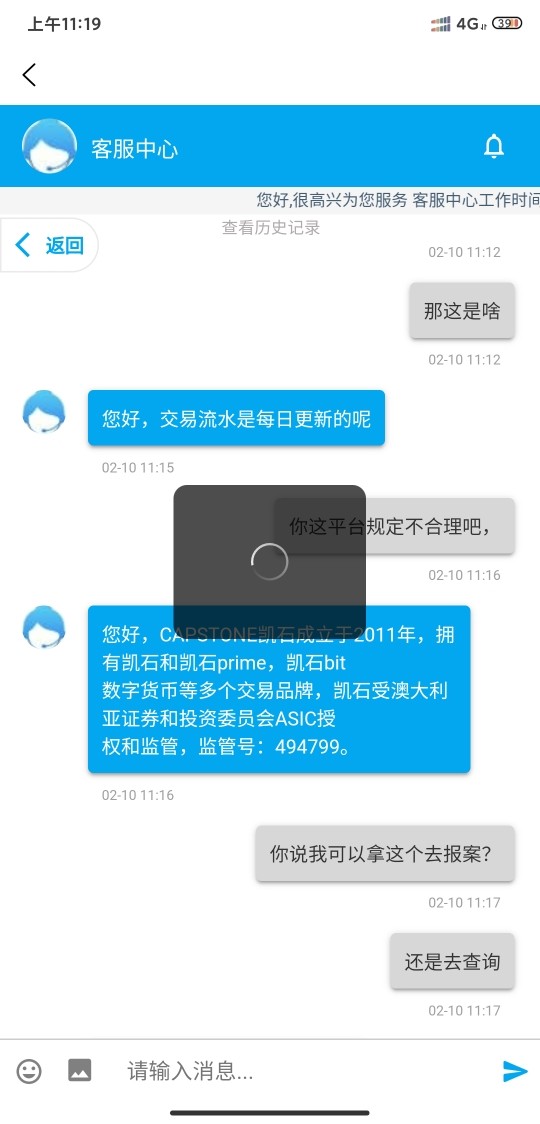

渣渣辉

Japan

Capstone deducted my profits and froze my account in February. I hope that 111 could return my profit of $33,383.72

Exposure

2021-03-19

弓长HM

Hong Kong

The platform said that the user can withdraw cash only if the user has a turnover. It is not clear that the cash can be withdrawn on the day of the turnover. The money will become a number when it was deposited. It is particularly unreliable and all fake.

Exposure

2021-02-10

胡广生

Hong Kong

Can deposit but can't withdra funds. It is a phishing platform. Keep asking u to deposit funds with campaigns. But prevent u from withdrawing funds.

Exposure

2021-02-08

我怎么办

Hong Kong

How can the withdrawal be so difficult? The money is required even though I just make a mistake once.

Exposure

2021-01-18

10.1

Hong Kong

Can't withdraw funds before depositing ¥170,000. This must be a scam. What if I can't withdraw funds after topping up ¥170,000? Can I recover my principal under such circumstance?

Exposure

2021-01-14

我怎么办

Hong Kong

Can’t log in let alone withdraw funds. Why? Give me a reason!

Exposure

2021-01-12

我怎么办

Hong Kong

I though I can be relieved cuz it was regulated. But I was cheated

Exposure

2021-01-10

我怎么办

Hong Kong

Ask us to deposit funds but can't withdraw it

Exposure

2021-01-09

我怎么办

Hong Kong

I can't withdraw funds even if there is some money in my account

Exposure

2021-01-08

我怎么办

Hong Kong

Unable to withdraw

Exposure

2021-01-07

FX3787271011

Hong Kong

At first, it’s said that there will be bonus if deposit 300,000. I tried to deposit 70,000 and withdrew funds, but I can’t/ The customer service said I have to finish the campaign to withdraw funds. After the campaign, I was punished for I tried to withdraw funds once during the campaign or I have to add 150,000 to become golden member. I realized I was scammed. Can I get my money back?

Exposure

2020-12-31