Score

BCS Markets

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://bcsmarkets.com/en/

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Russia 2.97

Russia 2.97Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesAccount Information

Users who viewed BCS Markets also viewed..

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

Website

bcsmarkets.com

Server Location

United Kingdom

Website Domain Name

bcsmarkets.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2017-08-12

Server IP

176.56.182.128

Company Summary

| Aspect | Information |

| Company Name | BCS Markets |

| Registered Country/Area | Saint Vincent and the Grenadines |

| Founded Year | 2018 |

| Regulation | Unregulated |

| Minimum Deposit | $1 |

| Maximum Leverage | up to 1:200 |

| Spreads | from 0.2pips to 1pips |

| Trading Platforms | MT4,MT5 |

| Tradable Assets | Forex, commodities,stock,indices |

| Account Types | Direct,NDD,PRO |

| Demo Account | Available |

| Customer Support | Phone:+44 8 800 500 10 70,email:support@bcsmarkets.com |

| Deposit & Withdrawal | Bank transfer,bank card,internet banking,SBP |

| Educational resource | Economic calendar,analysis |

Overview of BCS Markets

BCS Markets is a trading company established in 2018 and registered in Saint Vincent and the Grenadines. While it remains unregulated, it offers a range of trading services on platforms MT4 and MT5, catering to forex, commodities, stocks, and indices.

The firm has a minimum deposit requirement of $500 and provides leverage of up to 1:200, with spreads ranging from 0.2 to 1 pips. Clients can choose from various account types, including Direct, NDD, and PRO, and can also access a demo account.

BCS Markets offers an economic calendar and analysis as educational resources. They support transactions via bank transfer, bank card, internet banking, and SBP, and maintain a customer support line via phone and email.

Is BCS Markets Legit or a Scam?

BCS Markets is unregulated, indicating it is not governed or supervised by any financial regulatory body. This suggests that while BCS Markets facilitates trading in assets like forex, commodities, stocks, and indices, it might not conform to the specific legal or ethical standards set by any country or region for trading platforms.

Prospective traders should exercise caution and are advised to carry out thorough research or consult with a financial expert before transacting with unregulated entities.

Engaging with such platforms might carry risks due to the absence of regulatory oversight, such as potential difficulties in addressing conflicts, absence of compensation mechanisms in the event of the company's bankruptcy, and an increased risk of fraudulent operations.

Pros and Cons

Pros of BCS Markets:

Diverse Trading Platforms: BCS Markets offers both MT4 and MT5 platforms, which are widely recognized and popular among traders.

Variety of Tradable Assets: The company provides a broad range of assets for trading, including forex, commodities, stocks, and indices.

Competitive Spreads: With spreads ranging from 0.2 to 1 pips, BCS Markets offers competitive rates for traders.

Educational Resources: BCS Markets provides an economic calendar and analysis, which can be valuable tools for both new and experienced traders.

Demo Account Availability: Potential traders can get a feel for the platform and practice their strategies with the available demo account.

Cons of BCS Markets:

Unregulated: The company is not overseen by any financial regulatory authority, which can pose potential risks to traders due to the lack of accountability.

Higher Minimum Deposit: A minimum deposit of $500 may be considered steep for beginners or those wanting to start with a smaller investment.

Lack of Compensation Scheme: In the event of the platform's insolvency or other issues, there might be no compensation scheme in place to protect traders' funds.

Potential for Disputes: Without regulatory oversight, resolving potential disputes might be challenging.

Limited Deposit & Withdrawal Methods: While they offer several transaction methods, it might still be restrictive for some traders who prefer other payment methods not listed.

| Pros | Cons |

| Diverse Trading Platforms | Unregulated |

| Variety of Tradable Assets | Higher Minimum Deposit |

| Competitive Spreads | Lack of Compensation Scheme |

| Educational Resources | Potential for Disputes |

| Demo Account Availability | Limited Deposit & Withdrawal Methods |

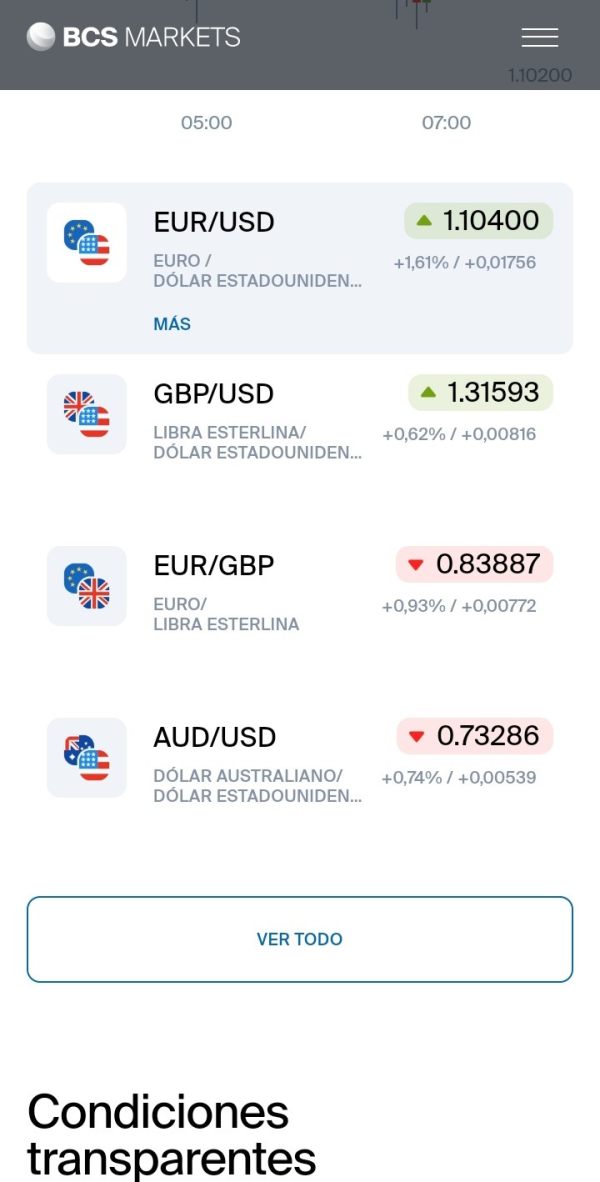

Market Instruments

BCS Markets offers a selection of market instruments, presenting traders with a diverse trading landscape spanning several asset classes. Lets delve deeper into the market instruments they provide:

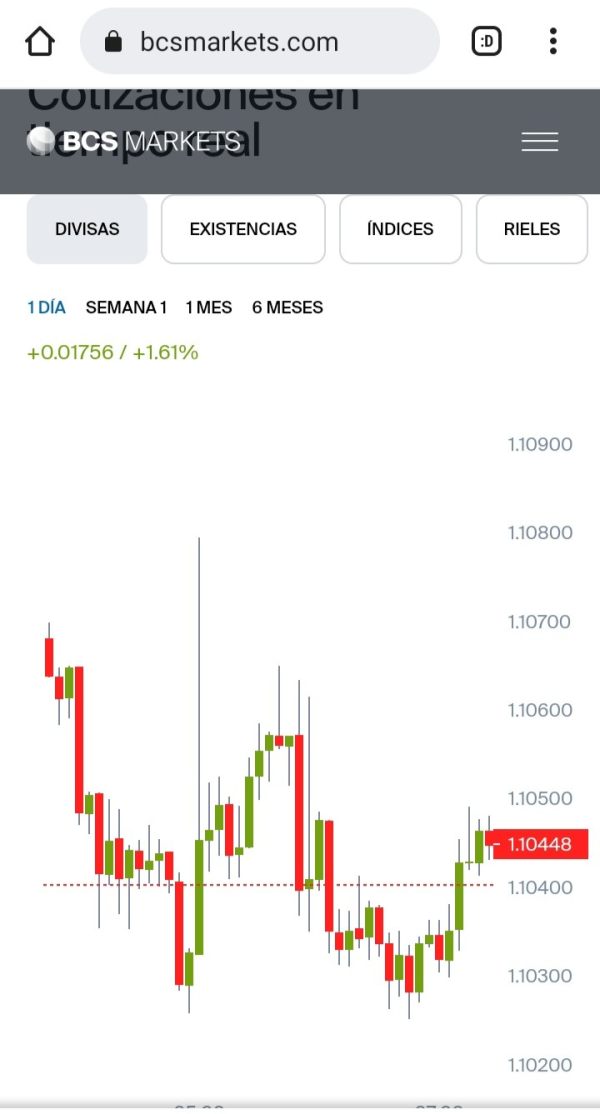

Forex (Foreign Exchange):

Currencies: BCS Markets grants traders the chance to navigate the vast forex terrain, facilitating trade across major, minor, and potentially exotic currency pairs. This enables traders to leverage the ebbs and flows of the global currency sectors.

Commodities:

Assorted Resources: BCS Markets ensures access to the commodities market, which might include a mix of hard commodities like metals and energy resources. There might also be opportunities in soft commodities, including agricultural items, offering an avenue for a well-rounded trading portfolio.

Stocks:

Equity Markets: Traders can immerse themselves in the stock market with BCS Markets, allowing for investments in a multitude of companies from various sectors and potentially from different regions, tapping into the dynamic nature of equity movements.

Indices:

Market Benchmarks: BCS Markets provides avenues to invest in market indices, representing a composite value derived from a set of related stocks or other investment vehicles. This gives traders an opportunity to speculate on the overall direction of a particular market or sector.

BCS Markets, therefore, equips traders with the tools to investigate and invest across a spectrum of financial arenas, fostering an environment for varied trading methodologies.

Account Types

Finap Trade offers 3 types of account for its users.

DIRECT Account Type:The DIRECT account type operates on the MT5 trading platform. It offers a floating spread type starting from 0.7 pips for the EURUSD pair. The leverage provided ranges between 1:1 and 1:200. With a minimum lot size of 0.01, this account accepts deposit currencies in USD, EUR, and RUB. Interestingly, the minimum deposit required to open this account is set at a very accessible amount of 1USD.

NDD Account Type:The NDD account type can be accessed on both the MT4 and MT5 trading platforms. Featuring a floating spread type, it offers a competitive spread starting from 0.2 pips for the EURUSD currency pair. A unique aspect of this account type is its commission for currency pairs, which is set at 0.003%. Like the DIRECT account, it provides a leverage range between 1:1 and 1:200 and has a minimum lot size of 0.01. It also supports deposit currencies in USD, EUR, and RUB, and the minimum deposit is again set at 1USD.

PRO Account Type:Designed specifically for the MT4 trading platform, the PRO account comes with a fixed spread type, set at 1 pip for the EURUSD pair. It provides traders with leverage options ranging from 1:1 to 1:200. The minimum lot size stands at 0.01, and deposit currencies supported are USD, EUR, and RUB. Those interested in opening a PRO account need to make a minimum deposit of 1USD.

How to Open an Account?

Opening an account on a trading platform in BSC typically involves several standard steps. Heres a step-by-step guide:

Visit the Official Website: Begin by navigating to the official BCS Markets website. Typically, there will be a prominent “Sign Up” or “Open an Account” button on the homepage. Click on this button to start the registration process.

Complete the Registration Form: Once redirected to the registration page, you'll be prompted to fill out a form. This usually requires personal details such as your full name, email address, phone number, and country of residence. Ensure you provide accurate and up-to-date information.

Submit Identification Documents: To comply with financial regulations and for security purposes, you'll likely need to provide identification documents. This might include a scanned copy of your passport or national ID, a recent utility bill or bank statement (for address verification), and possibly additional documentation depending on the jurisdiction and the platform's policies.

Choose an Account Type: Based on the information you've researched (like the account types mentioned earlier: DIRECT, NDD, PRO), select the one that best suits your trading needs and preferences.

Deposit Funds: Once your account is approved and activated, you can proceed to deposit funds. Navigate to the “Deposit” section of your account dashboard. Choose your preferred deposit method (e.g., bank transfer, bank card, internet banking) and follow the instructions to fund your account. Remember to ensure that you meet the minimum deposit requirement for your chosen account type.

Leverage

Leverage in trading refers to the ability for traders to control larger positions with a smaller amount of actual capital deposited. It's often expressed as a ratio, such as 1:100, meaning that for every $1 of a trader's capital, they can control a position worth $100. BCS Markets offers a leverage range from 1:1 to 1:200 across its different account types. This means that a trader can potentially amplify their position size up to 200 times the amount they have in their account. While leverage can magnify potential profits, it also carries the risk of amplifying losses. As such, traders need to use leverage judiciously, understanding both its advantages and inherent risks.

Spreads & Commissions

Spreads:BCS Markets offers various spreads depending on the account type chosen. In the DIRECT account, traders can expect a floating spread starting from 0.7 pips for the EURUSD currency pair. The NDD account, accessible on both MT4 and MT5 platforms, features a more competitive floating spread starting from just 0.2 pips for the same currency pair. Lastly, the PRO account, tailored for the MT4 platform, comes with a fixed spread set at 1 pip for EURUSD. Spreads represent the difference between the buying and selling price of an asset, and lower spreads can potentially result in reduced trading costs for the trader.

Commissions:For the DIRECT and PRO accounts, there's no specific commission mentioned for currency pairs, which suggests that the trading costs for these accounts are mainly incorporated within the spreads. However, the NDD account has a unique feature regarding commissions. Traders using the NDD account are charged a commission of 0.003% for currency pairs. Commissions are fees taken by the broker for facilitating the trade, and it's essential for traders to be aware of these costs as they can impact the overall profitability of their trading activities.

Trading Platform

BCS Markets provides its traders with access to two of the industry's most renowned trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MetaTrader 4 (MT4):MT4 is widely recognized for its user-friendly interface, robust technical analysis tools, and the ability to incorporate automated trading strategies using Expert Advisors (EAs).

The platform is suitable for both novice and experienced traders, offering a comprehensive charting package, multiple timeframes, and a vast marketplace for trading tools and indicators.

With its built-in programming language, MQL4, traders and developers can design custom indicators and automated trading robots. BCS Markets' integration of MT4 means traders can leverage all these features while trading on the platform.

MetaTrader 5 (MT5):MT5, often considered the successor to MT4, encompasses all the functionalities of its predecessor and introduces additional features to cater to more advanced trading needs.

MT5 offers more timeframes, more order types, an economic calendar built directly into the platform, and support for more asset classes.

Another significant distinction is its integration with MQL5, an enhanced programming language that facilitates more sophisticated algorithmic trading strategies. BCS Markets' offering of MT5 ensures that traders seeking a more advanced platform have their needs met.

Both platforms are available across various devices, including desktop, mobile, and web versions, ensuring traders have seamless access to the markets regardless of where they are.

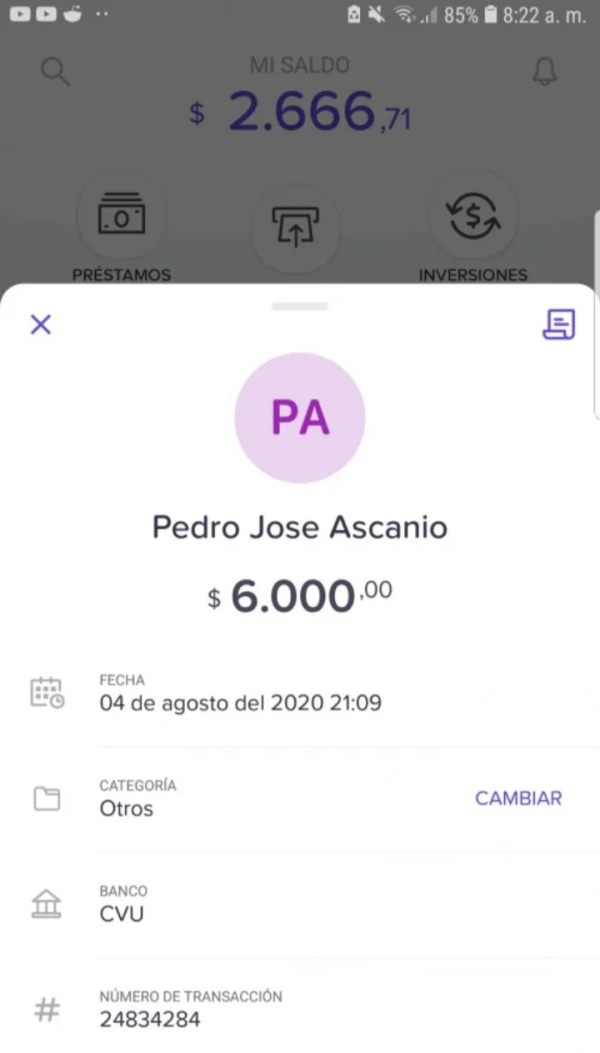

Deposit & Withdrawal

BCS Markets offers a range of options for both depositing and withdrawing funds, ensuring flexibility and convenience for its traders.The minimum deposit amount is 1 usd dollar.

Deposit Methods:

Bank Transfer: This traditional method allows traders to transfer funds directly from their bank account to their BCS Markets trading account. While secure, bank transfers might take a few business days to process.

Bank Card: A commonly used method, depositing through credit or debit cards typically ensures funds are credited to the trading account relatively quickly.

Internet Banking: An alternative to traditional bank transfer, internet banking offers a digital method of transferring funds through online banking portals. It's often faster than standard bank transfers.

SBP: While the exact nature of this method isn't specified in the provided details, SBP likely refers to a specific banking or payment service. Users would need to check the platform or consult BCS Markets' customer support for more details on how to use this deposit method.

Withdrawal Methods:The exact withdrawal methods aren't explicitly. However, it's common practice for trading platforms to offer withdrawals using the same methods available for deposits.

Educational resource

This comprehensive educational resource on BCS Markets offers a thorough insight into this brokerage and financial services provider within the Forex market. It encompasses the historical journey and commitment of BCS Markets, highlights its wide range of market participants and the appeal of its technology-driven, customer-centric approach.

It explains the relevance of exchange rates, provides a reference list of world currencies and their codes, elucidates currency pairs, and delves into margin trading, trading mechanics, and risk management strategies tailored to BCS Markets.

Additionally, it introduces the role of Contracts for Difference (CFDs) within BCS Markets' trading portfolio, making it an indispensable guide for traders, both novice and experienced, aiming to navigate the world of Forex trading with this reputable brokerage.

Customer Support

BCS Markets Limited offers robust customer support through multiple channels. Clients can email us at support@bcsmarkets.com for assistance with various inquiries, including account management and technical issues. Additionally, Russian-speaking clients can reach us directly at +44 8 800 500 10 70 or +7 499 677 10 70 for real-time assistance. We encourage clients to use these contact options prudently and exercise due diligence, given our registration in Saint Vincent and the Grenadines, to ensure a secure trading experience. For more information, please visit our website at https://bcsmarkets.com.

Conclusion

BCS Markets, registered in Saint Vincent and the Grenadines, offers a comprehensive trading environment that caters to a diverse clientele since its inception in 2018.

With a range of account types, from DIRECT to NDD and PRO, the platform ensures flexibility in trading terms, such as spreads and commissions. Leveraging the power of both the MT4 and MT5 trading platforms, BCS Markets provides tools and functionalities suited for both beginners and seasoned traders.

The broker also emphasizes accessibility and convenience, demonstrated by its variety of deposit and withdrawal methods. While its wide-ranging offerings are commendable, potential traders should note its unregulated status and, as always, proceed with due diligence.

FAQs

Q: What trading platforms does BCS Markets offer?

A: BCS Markets provides its traders with access to two prominent platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Q: What are the different account types available at BCS Markets?

A: BCS Markets offers three primary account types: DIRECT, NDD, and PRO, each with distinct features tailored to various trading needs.

Q: What are the deposit methods available at BCS Markets?

A: The platform accepts deposits via bank transfer, bank card, internet banking, and SBP.

Q: Is BCS Markets a regulated broker?

A: BCS Markets operates as an unregulated broker, meaning it does not fall under the oversight of any specific financial regulatory authority.

Q: What's the minimum deposit requirement to start trading with BCS Markets?

A: The minimum deposit requirement for BCS Markets is set at just 1 USD.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Comment 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now