Score

FPR

United Kingdom|5-10 years|

United Kingdom|5-10 years| http://www.eufxpro.me/en/

Website

Rating Index

Contact

Licenses

Licenses

Licensed Entity:FXPRO FINANCIAL SERVICES LIMITED

License No. 477418

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United Kingdom

United KingdomUsers who viewed FPR also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Maker (MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

eufxpro.me

Server Location

Hong Kong

Website Domain Name

eufxpro.me

Server IP

103.94.103.218

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

| FPR | Basic Information |

| Company Name | FPR |

| Founded in | 2008 |

| Headquarters | United Kingdom |

| Regulations | Financial Conduct Authority (FCA) |

| Tradable Assets | Forex, Futures, Indices, Shares, Metals, Energy, Cryptocurrencies |

| Account Types | Micro Account, Standard Account, ECN Account, VIP Account, Corporate Account, Islamic Account, Demo Account |

| Minimum Deposit | Micro Account: $100 or equivalent, Standard Account: $500 or equivalent, ECN Account: $1000 or equivalent, VIP Account: $50,000 or equivalent |

| Maximum Leverage | Varies (e.g., up to 1:200 for Forex) |

| Spreads | Varies by account type and instrument (e.g., 1.1 pips for EUR/USD on Micro Account) |

| Commission | Varies by account type and instrument (e.g., $3.50 per lot for ECN Account) |

| Deposit Methods | Bank Wire Transfer, Credit/Debit Cards, Electronic Wallets (PayPal, Skrill, Neteller, UnionPay), Online Payment Systems (Webmoney, Netbanx, etc.), FasaPay |

| Trading Platforms | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader, FPR Edge, FPR Mobile Trading |

| Customer Support | Phone: +00442038072245, Email: FPRservice@126.com |

| Education Resources | Forex eBook, Video Tutorials, Webinars, Economic Calendar, Trading Tools |

| Bonus Offerings | None |

General Information

FPR, founded in 2008 and headquartered in the United Kingdom, is a trading platform that offers a wide range of trading assets and account types to accommodate traders with diverse needs and experience levels. Regulated by an undisclosed authority, FPR provides access to a variety of tradable instruments, including forex, indices, commodities, stocks, metals, energy products, and cryptocurrencies. This broad selection of assets allows traders to explore various financial markets within a single platform. FPR's account types cater to a wide audience, from beginners to advanced traders, offering flexibility in choosing the right account that suits individual preferences and strategies. While the platform emphasizes trader education through resources such as eBooks, video tutorials, webinars, and trading tools, there are some limitations in terms of the information provided, particularly regarding leverage and customer support details. Nonetheless, FPR presents itself as a versatile trading platform for those looking to engage in a wide range of financial instruments, but traders may need to seek further clarification on certain aspects before making their investment decisions.

Is FPR Legit?

FPR is regulated by the Financial Conduct Authority (FCA) in the United Kingdom. They hold a license as a European Authorized Representative (EEA), confirming their compliance with regulatory standards set by the FCA. This regulatory oversight ensures that FPR operates within the legal and regulatory framework established by the FCA, providing a level of confidence and security for its clients.

Pros and Cons

FPR comes with a mix of advantages and drawbacks. On the positive side, it offers a diverse range of tradable assets, providing traders with ample choices. The availability of multiple account types caters to various trading preferences and experience levels. Additionally, FPR supports trader education through a range of resources. However, it lacks specific information on leverage, which can be crucial for risk management, and provides limited details about customer support, leaving traders with uncertainties regarding assistance availability and hours.

| Pros | Cons |

|

|

|

|

|

Market Instruments

FxPro Financial Services Limited offers investors a range of financial instruments including Contracts for Difference (CFDs) on FX, spot metals, stocks, spot indices and spot energies.

1. Forex: FPR offers an extensive selection of over 70 currency pairs for forex trading. These pairs encompass major, minor, and exotic currencies, providing traders with a wide array of options to participate in the global forex market.

2. Futures: FPR enables traders to access futures contracts through Contract for Difference (CFD) instruments. These futures contracts cover a broad spectrum, including stock indices, commodities, and currencies. Traders can engage in speculative futures trading without the need for physical delivery.

3. Indices: FPR offers CFDs on stock indices from various global markets. This includes well-known indices like the FTSE 100, S&P 500, and NASDAQ 100, allowing traders to gain exposure to the performance of major stock markets.

4. Shares: FPR provides CFDs on shares from more than 100 exchanges worldwide. Traders can access a diverse portfolio of shares, including those listed on prominent stock exchanges like the London Stock Exchange, New York Stock Exchange, and Nasdaq.

5. Metals: Precious and base metals trading is facilitated by FPR through CFDs. Clients can trade metals such as gold, silver, copper, and platinum, capitalizing on price movements in these valuable commodities.

6. Energy: FPR extends its CFD offerings to energy commodities, including oil and natural gas. Traders can engage in energy markets, speculating on price changes in these critical resources.

7. Cryptocurrencies: FPR allows traders to participate in the cryptocurrency market through CFDs on digital assets like Bitcoin, Ethereum, and Litecoin. This provides exposure to the evolving world of cryptocurrencies without the need for ownership of the underlying assets.

Here is a comparison table of trading instruments offered by different brokers:

| Product | FPR | IG Group | Just2Trade | Forex.com |

| CFDs | Yes | No | No | Yes |

| Forex | Yes | Yes | No | Yes |

| Indices | Yes | Yes | No | Yes |

| Commodities | Yes | Yes | No | Yes |

| Futures | Yes | Yes | Yes | Yes |

| Cryptocurrencies | Yes | Yes | No | Yes |

| ETFs | No | Yes | Yes | No |

| Options | No | Yes | Yes | Yes |

| Spread Betting | No | Yes | No | No |

| Stocks | No | No | Yes | Yes |

| ADRs | No | No | Yes | No |

| Bonds | No | No | Yes | No |

| Shares | Yes | Yes | No | No |

Accounts

FPR offers multiple account types to accommodate various trading needs:

1. Micro Account: Suited for beginners or those with limited budgets, featuring modest minimum deposits and spreads.

2. Standard Account: Common among FPR traders, providing a middle ground between spreads and commissions.

3. ECN Account: Designed for experienced traders seeking tight spreads and swift execution, accompanied by trade-based fees.

4. VIP Account: Tailored for high-volume traders, granting access to deep liquidity, tighter spreads, and lower commissions.

5. Corporate Account: Aimed at businesses, with features such as segregated accounts, hedging options, and customized reporting.

6. Islamic Account: Compliant with Sharia law, these accounts are swap-free, free from interest charges on overnight positions.

7. Demo Account: A risk-free choice for practice and strategy development.

Minimum deposit requirements vary, with the Micro Account starting at $100, the Standard at $500, the ECN at $1000, and the VIP Account requiring $50,000. These options cater to traders with different preferences and budgets.

Leverage

FPR offers a variety of leverage options to suit different trading styles and needs. Leverage allows traders to control larger positions with a smaller deposit. However, it is important to note that leverage can also amplify losses.

The maximum leverage that FPR offers depends on the trading instrument and the client's residency. For example, clients in the UK are limited to a maximum leverage of 1:30 for forex trading and 1:200 for other trading instruments.

Here is a comparison table of maximum leverage offered by different brokers:

| Broker | FPR | IG Group | IC Markets | RoboForex |

| Maximum Leverage | 1:200 | 1:30 | 1:500 | 1:2000 |

Spreads & Commissions

The spread for EURUSD is 1.3 pips, EURJPY 1.8 pips, USDJPY 1.3 pips. cTrader commissions for Forex are $45/million upon opening and upon closing a position.

Spreads: Spreads, the gap between buying and selling prices, are present across all account types and trading instruments at FPR. The brokerage strives to maintain spreads at levels consistent with industry norms, although they can fluctuate. For instance, on the Micro Account, which is one of their offerings, traders may encounter average spreads such as 1.1 pips for EUR/USD, 1.3 pips for GBP/USD, 1.2 pips for USD/JPY, and 1.5 pips for AUD/USD. These spreads represent the cost traders incur during trading.

Commissions: Commissions, fees for opening and closing trades, apply to select account types and trading assets at FPR. Most account types do not incur commissions, except for ECN accounts and cTrader accounts used for FX and metals trading. ECN accounts are subject to a commission of $3.50 per lot, while cTrader accounts come with commissions calculated at $35 per $1 million traded. These commissions are additional expenses that traders need to consider when selecting their trading account.

FPR's fee structure provides traders with options to choose the account type and trading assets that best align with their trading strategies and cost preferences, taking into account spreads and potential commissions.

Deposits & Withdrawals

The recommended minimum deposit for FxPro Financial Services is $1000 or equivalent. The following methods are used for deposits and withdrawals: Bank wire transfer, Debit or credit cards, PayPal, Neteller and Skrill.

Deposit Methods: To fund your trading account, you can choose from various deposit options:

1. Bank Wire Transfer: You can transfer funds directly from your bank to your FPR trading account. This method is secure and widely accepted.

2. Credit/Debit Cards: FPR accepts deposits made through major credit and debit cards, including Visa, MasterCard, and Maestro. This method allows for quick and easy transactions.

3. Electronic Wallets (e-Wallets): Popular e-wallets like PayPal, Skrill, Neteller, and UnionPay are accepted by FPR. These digital payment solutions offer fast and efficient fund transfers.

4. Online Payment Systems: FPR also supports various online payment systems, making it convenient for traders to deposit funds. Options may include Webmoney, Netbanx, and more.

5. FasaPay: This payment method is available for traders in certain regions and provides a secure way to fund accounts.

Withdrawal Methods: Withdrawing funds from your FPR trading account is straightforward:

1. Bank Wire Transfer: Withdrawals can be made via bank wire transfer, providing a direct and secure way to receive your funds.

2. Credit/Debit Cards: If you deposited funds using a credit or debit card, you can typically withdraw the same amount back to the same card. Any remaining funds can be withdrawn via bank transfer.

3. Electronic Wallets (e-Wallets): Withdrawals to e-wallets like PayPal, Skrill, Neteller, and UnionPay are processed quickly, providing traders with flexibility in accessing their funds.

4. Online Payment Systems: Depending on your region, you may be able to withdraw funds using various online payment systems, such as Webmoney or Netbanx.

Trading Platform

FPR provides a range of trading platforms designed to cater to different trading styles and preferences.

1. MetaTrader 4 (MT4): MT4 is a widely recognized and popular trading platform known for its user-friendly interface and powerful features. It offers a comprehensive suite of tools for technical analysis, automated trading through Expert Advisors (EAs), and a wide selection of trading instruments. MT4 is suitable for both beginner and experienced traders.

2. MetaTrader 5 (MT5): Building upon the success of MT4, MT5 offers additional features and capabilities. It supports a broader range of assets, including stocks and commodities, and provides more timeframes and technical indicators. Traders who require a more extensive asset selection and advanced analysis tools may prefer MT5.

3. cTrader: cTrader is a platform known for its intuitive design and features geared towards ECN trading. It offers advanced charting, Level II pricing, and one-click trading. cTrader is favored by traders who prefer a transparent and direct market access environment.

4. FPR Edge: FPR Edge is a proprietary web-based platform developed by FPR. It offers a user-friendly interface, real-time market data, and a selection of trading instruments. FPR Edge is designed for traders who prefer a streamlined and accessible trading experience.

5. FPR Mobile Trading: FPR offers mobile trading apps compatible with both iOS and Android devices. These apps allow traders to stay connected to the markets and manage their positions on the go. They offer features such as real-time quotes, interactive charts, and order execution.

Customer Support

The Customer Support of FxPro Financial Services provides assistance in more than 17 languages. Customer service can be contacted by email or phone. Users can also chat live with a representative or request a phone call. Help is available 24 hours a day on business days.

Educational Resources

FPR offers a range of educational resources to assist traders in enhancing their knowledge and skills in the financial markets. These resources are designed to provide valuable insights and support to traders of various experience levels.

1. Forex eBook: FPR provides a comprehensive Forex eBook that covers essential topics related to forex trading. This eBook offers insights into technical and fundamental analysis, risk management strategies, and trading psychology. It serves as a valuable reference for traders looking to build a strong foundation in forex trading.

2. Video Tutorials: FPR offers a series of video tutorials that cater to different aspects of trading. These tutorials cover topics such as platform navigation, order execution, and trading strategies. Visual learners can benefit from these informative videos, gaining practical knowledge to apply in their trading activities.

3. Webinars: FPR conducts webinars on various trading subjects, featuring expert speakers and market analysts. These live webinars provide traders with the opportunity to engage directly with industry professionals, ask questions, and gain insights into current market conditions and trading strategies.

4. Economic Calendar: FPR offers an economic calendar that tracks important economic events and announcements from around the world. Traders can use this calendar to stay informed about events that may impact financial markets, enabling them to make informed trading decisions.

5. Trading Tools: FPR provides a range of trading tools, including calculators and economic indicators. These tools can assist traders in analyzing potential trade outcomes, managing risk, and staying updated on market data.

Accepted Countries

FxPro Financial Services Limited does not offer Contracts for Difference (CFDs) to residents of certain jurisdictions such as the United States of America and the Islamic Republic of Iran.

Risk

Contracts for Difference (CFDs) are complex financial products that are traded on margin. Trading CFDs carries a high level of risk since leverage can work both to your advantage and disadvantage. As a result, CFDs may not be suitable for all investors because you may lose all your invested capital. Past performance of CFDs is not a reliable indicator of future results. Most CFDs have no set maturity date.

Conclusion

In conclusion, FPR offers traders a diverse range of tradable assets and multiple account types, accommodating both beginners and experienced traders. The availability of educational resources further enhances its appeal. However, there are notable drawbacks, including the lack of specific leverage information and incomplete customer support details, leaving traders with some uncertainties. While FPR presents opportunities for diversified trading, potential users should consider seeking additional information and clarity on these aspects before fully committing to the platform.

FAQs

Q: Is FPR regulated?

A: Yes, FPR is regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

Q: What trading instruments are available on FPR?

A: FPR offers a wide range of trading instruments, including forex, futures, indices, shares, metals, energy commodities, and cryptocurrencies.

Q: What are the account types offered by FPR?

A: FPR provides multiple account types, including Micro, Standard, ECN, VIP, Corporate, Islamic, and Demo accounts.

Q: How can I contact FPR's customer support?

A: You can reach FPR's customer support team via phone +00442038072245 or email FPRservice@126.com.

Q: Does FPR offer educational resources?

A: Yes, FPR offers educational resources such as a Forex eBook, video tutorials, webinars, an economic calendar, and trading tools to support traders' learning and decision-making processes.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- United Kingdom European Authorized Representative (EEA) Revoked

- High potential risk

Comment 7

Content you want to comment

Please enter...

Comment 7

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX9827004772

Taiwan

Unable to withdraw funds, the current website cannot be clicked in, and it is not possible to contact the broker at all

Exposure

2021-06-21

尼瑪

Taiwan

Supplement, original bank code. Ask us to change it the same day! Don’t be cheated by this easy trick!

Exposure

2020-11-25

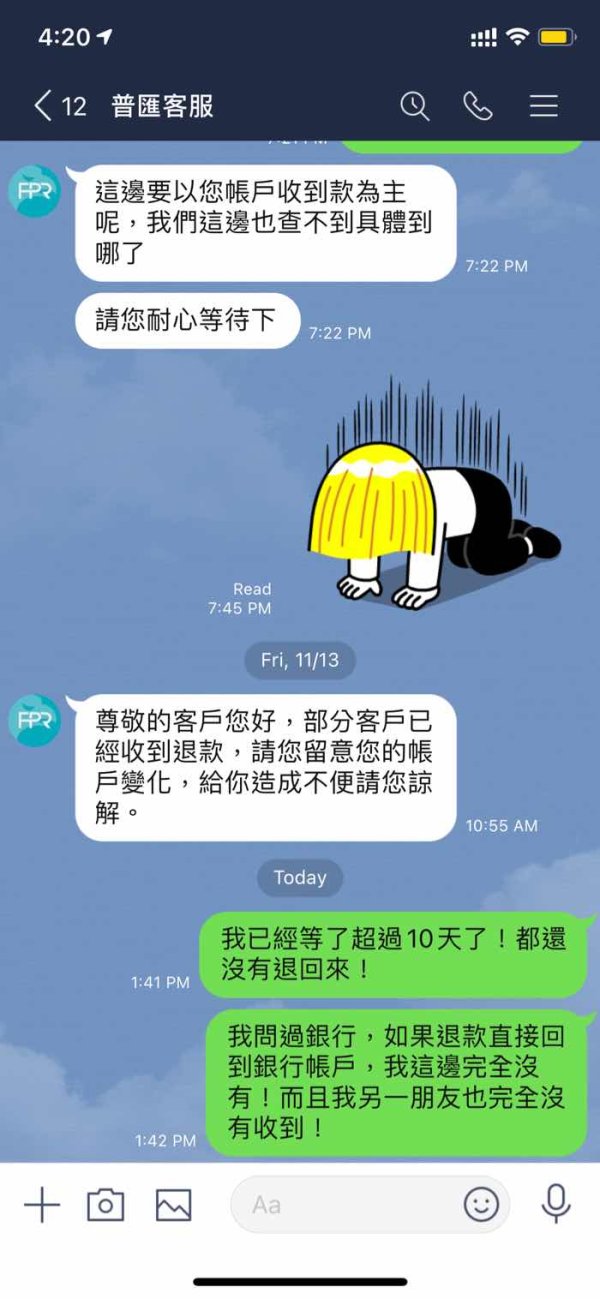

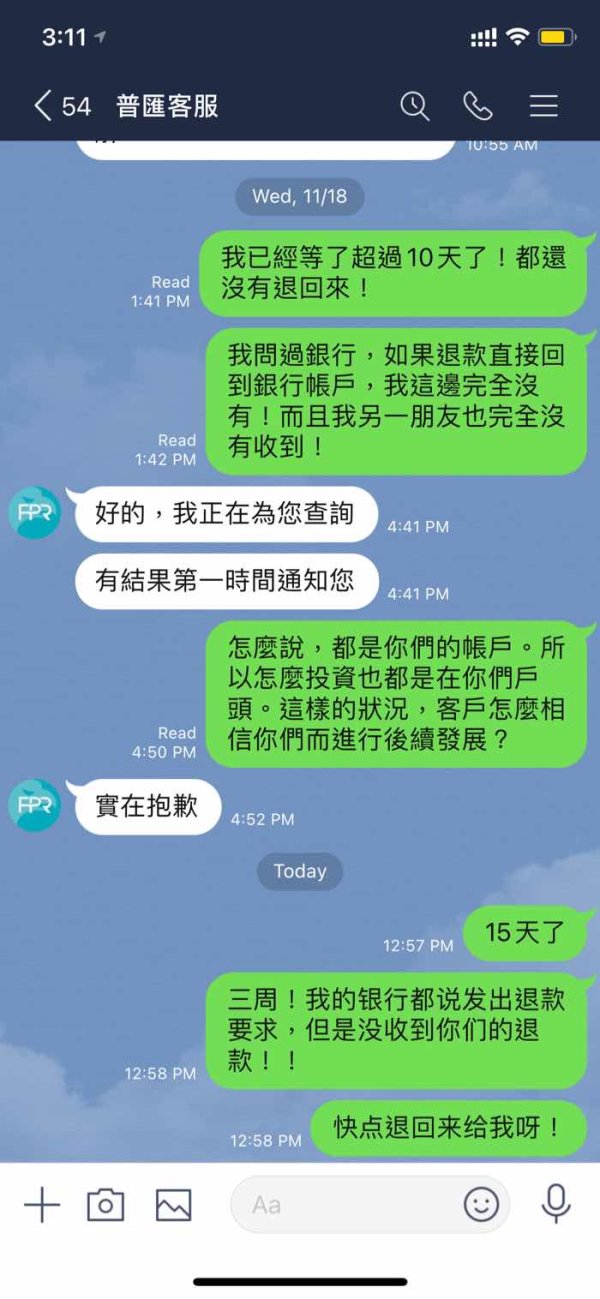

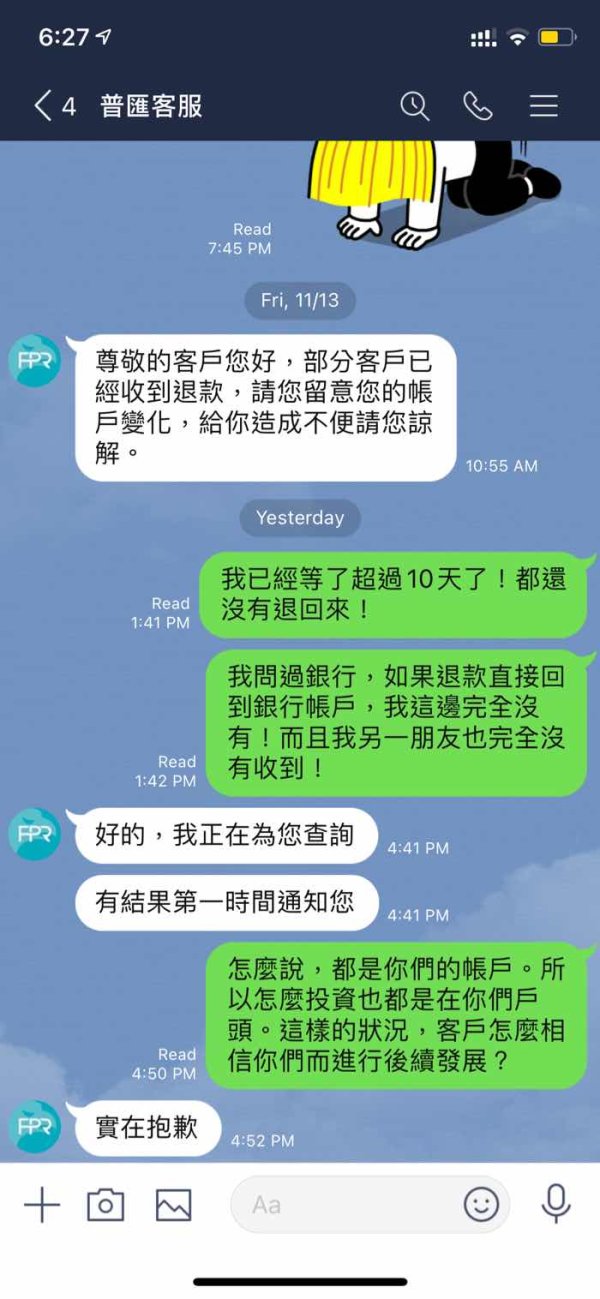

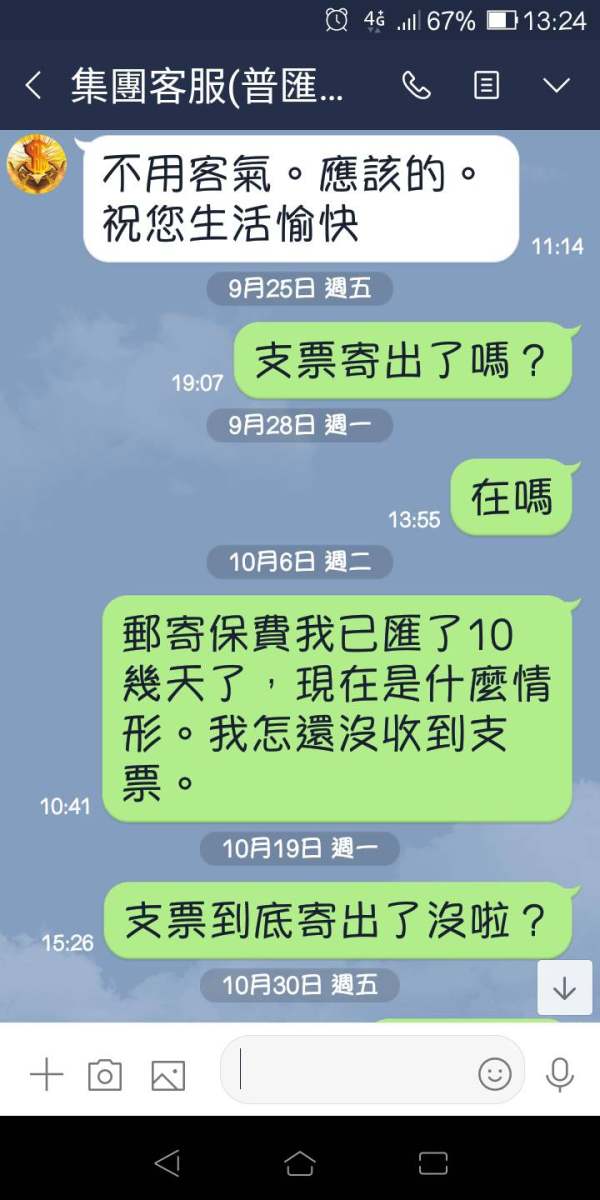

尼瑪

Taiwan

The customer service said the bank account was changed in half an hour after I deposited funds and asked customer to contact the bank by themselves. I contacted the bank, and the bank said the money was transferred already. But the customer service didn’t return the money! While they spread the news that customers receive money in succession! My friends who deposited too haven’t received, either!

Exposure

2020-11-25

FX9827004772

Taiwan

Unable to withdraw

Exposure

2020-11-07

FX9827004772

Taiwan

Change the customer service photo. Unable to withdraw. Fraud

Exposure

2020-11-05

FX9827004772

Taiwan

FPR in Hong Kong is a fraud group. Can't withdraw.

Exposure

2020-10-30

南宫逸风

Singapore

FPR has been established for more than 15 years, and now the website can't be opened? When I choose a foreign exchange broker, I always try to choose a long-established broker. I really didn't expect this kind of thing to happen.

Neutral

2023-02-28