Overview of SV Markets

SV Markets is a financial company based in the United States, established in 2023, and regulated by FinCEN. Specializing in Forex and CFDs, the company offers market analysis to aid traders in making informed decisions.

SV Markets boasts competitive spreads starting as low as 1 point, with no quotes, and provides leverage of up to 1:500. The trading platform, SV Markets Tradingweb, facilitates efficient trading experiences. For users looking to test their strategies, the company offers a demo account with virtual capital of up to $100,000.

Is SV Markets Legit or a Scam?

SV Markets is unregulated by any regulatory authorities. The absence of regulatory approval raises concerns about the entity's adherence to financial regulations and consumer protection standards.

Pros and Cons

Pros of SV Markets

- Lower Transaction Costs: Traders opt for SV Markets due to the advantage of lower transaction costs. The competitive handicap and dynamic variable financing leverage offered by SV Markets empower traders to maximize their trading income, contributing to a more cost-effective trading experience.

- Comprehensive Investment Market: SV Markets provides access to a comprehensive investment market, allowing traders to invest in global mainstream markets, including stocks, gold, crude oil, Bitcoin, and currency pairs. This diversity in investment options appeals to traders seeking a wide range of opportunities within a single platform.

- Competitive Product Spreads and Fast Execution: SV Markets offers product spreads significantly lower than the industry average, providing traders with a cost-effective trading environment. The platform also ensures fast execution, with the fastest execution speed being less than 40 milliseconds. This commitment to efficiency is reinforced by partnering with the world's top banks and liquidity quotes, facilitated through the top-tier server NY4.

Cons of SV Markets

- Limited Operational History: Founded in 2023, SV Markets has a relatively short operational history compared to some other financial entities. Traders will prefer companies with a longer track record for added stability and reliability.

- Email-Only Customer Support: The reliance on email as the primary customer support channel will pose limitations in terms of real-time assistance. Some traders will prefer more immediate communication channels, such as live chat or phone support.

- Limited Deposit and Withdrawal Options: While SV Markets supports credit cards, debit cards, and bank transfers, a more extensive range of deposit and withdrawal options could enhance flexibility for users with varying preferences.

- No Quotes for Spreads: While the absence of quotes for spreads will appeal to some traders, others will prefer a more transparent pricing structure with visible quotes.

- Risk of Unauthorized Trading: Traders need to exercise caution when dealing with entities that operate without proper authorization.

Market Instruments

SV Markets offers 100+ tradable assets.

Forex:

SV Markets provides a robust suite of Forex trading services. Through Forex trading, users can engage in the buying and selling of currency pairs, taking advantage of fluctuations in exchange rates. This offers opportunities for traders to capitalize on the movements of major currencies such as the US Dollar, Euro, Japanese Yen, and others.

CFDs:

SV Markets provides access to a diverse range of CFDs, including those linked to global mainstream markets, stocks, commodities such as gold and crude oil, and popular cryptocurrencies like Bitcoin. This broad range of CFD options enables traders to diversify their portfolios and capitalize on market opportunities across different asset classes.

Commodities:

SV Markets provides a gateway for traders to access the commodities market, specifically metals. Traders can engage in the trading of precious metals such as gold, silver, and other commodities.

This allows users to diversify their portfolios and capitalize on price movements in the commodities market.

Cryptocurrencies:

SV Markets further extends its product and service portfolio to include cryptocurrencies,meeting the growing interest in digital assets. Traders can invest in popular cryptocurrencies like Bitcoin, participating in the dynamic and evolving world of digital finance.

Demo Account

SV Markets provides traders with a user-friendly and risk-free introduction to its trading platform through the demo account feature on Tradingweb. Offering a quick and free sign-up process, the demo account allows users to practice trading with an unlimited amount of virtual funds.

Traders can access and familiarize themselves with the platform's extensive features, including powerful charting tools with over 50 technical indicators and intraday analysis tools.

With a quick and free sign-up process, the demo account provides users with up to $100,000 in virtual capital.

Leverage

SV Markets meet diverse trading preferences by providing a range of leverage options from 1:100 to 1:500.

This flexibility empowers traders to finely calibrate their risk exposure and tailor their positions according to individual strategies.

Trading Platform

SV Markets presents Tradingweb, an all-in-one CFD trading platform that has garnered popularity with over 330,000 active clients.

This platform supports the trading of 100+ assets, providing a versatile environment for investors. Tradingweb stands out for its powerful charting tools, offering over 50 technical indicators and intraday analysis tools.

Tradingweb facilitates trading in various assets, including forex, synthetic indices, stocks, stock indices, and cryptocurrencies, all within a unified interface.

It operates 24/7, enabling traders to access integrated data and execute trades around the clock, even on weekends.

Customer Support

SV Markets prioritizes customer support with a dedicated team reachable at support@svmarketsltd.com. For additional assistance, traders can also connect with the support team via email.

The company also provides customer sthrough a physical presence, with a listed address at 96 WADSWORTH BLVD NUM 127-3255, LAKEWOOD, CO 80226, U.S.A.

FAQs

What trading instruments are available on SV Markets?

SV Markets offers a diverse range of trading instruments, including Forex, CFDs, commodities (such as metals), stocks, stock indices, and cryptocurrencies.

What is the leverage offered by SV Markets?

SV Markets provides flexible leverage options, ranging from 1:100 to 1:500. .

How does the demo account work on SV Markets?

SV Markets' demo account allows users to practice trading with up to $100,000 in virtual capital. .

What is the customer support process at SV Markets?

SV Markets offers customer support through email at support@svmarketsltd.com. Additionally, a physical address is provided at 96 WADSWORTH BLVD NUM 127-3255, LAKEWOOD, CO 80226, U.S.A. for further assistance.

picnic

South Korea

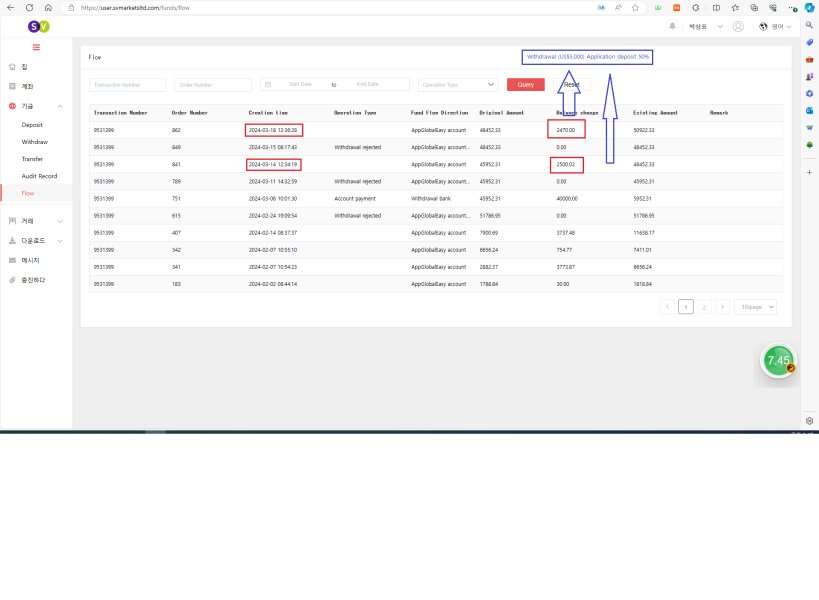

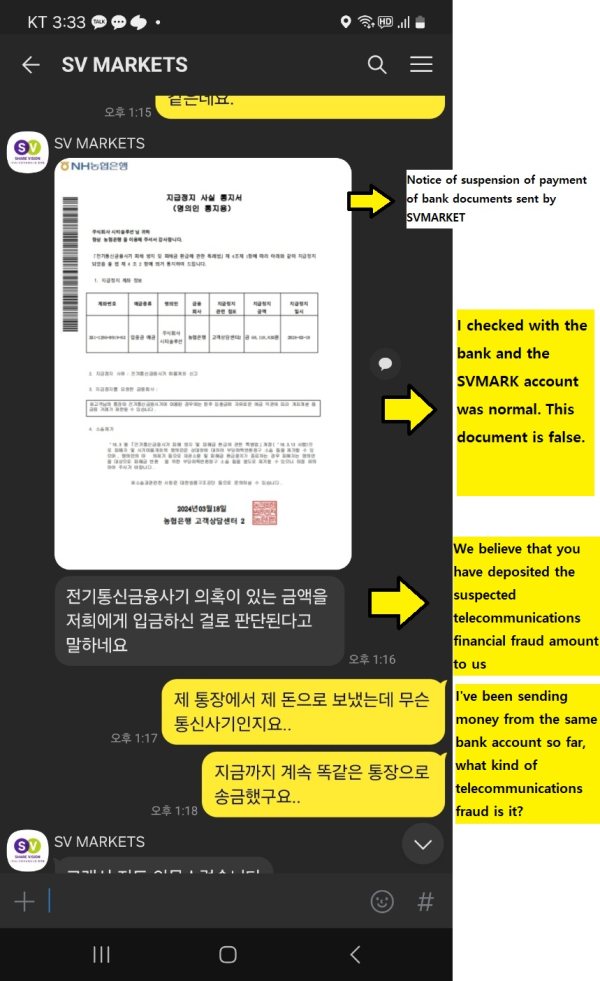

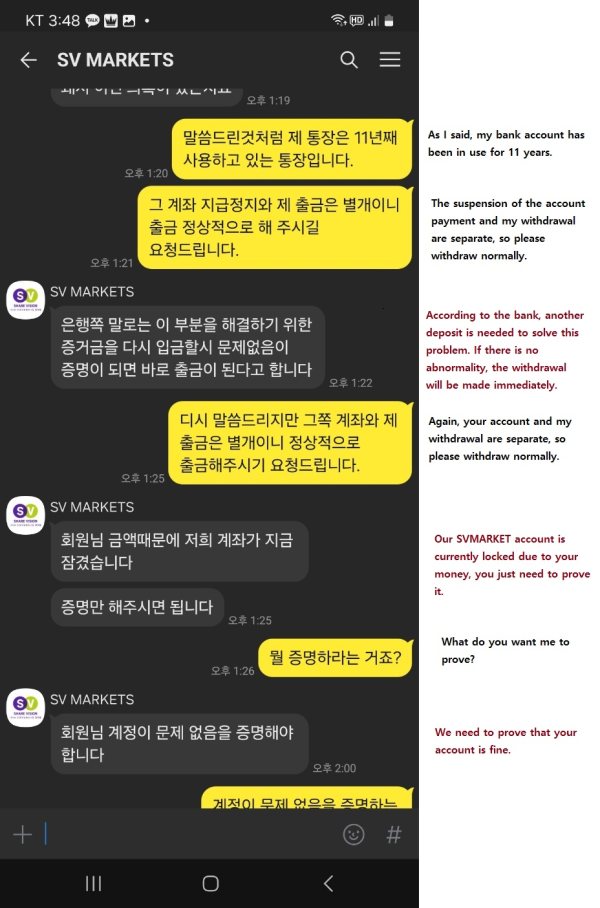

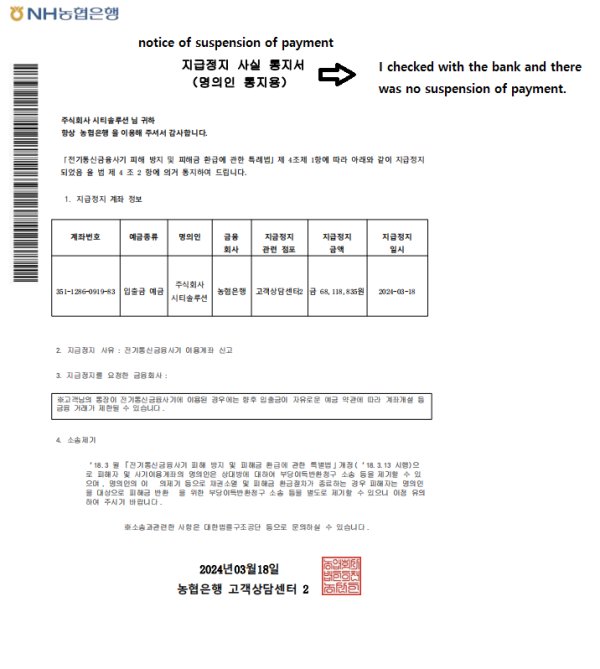

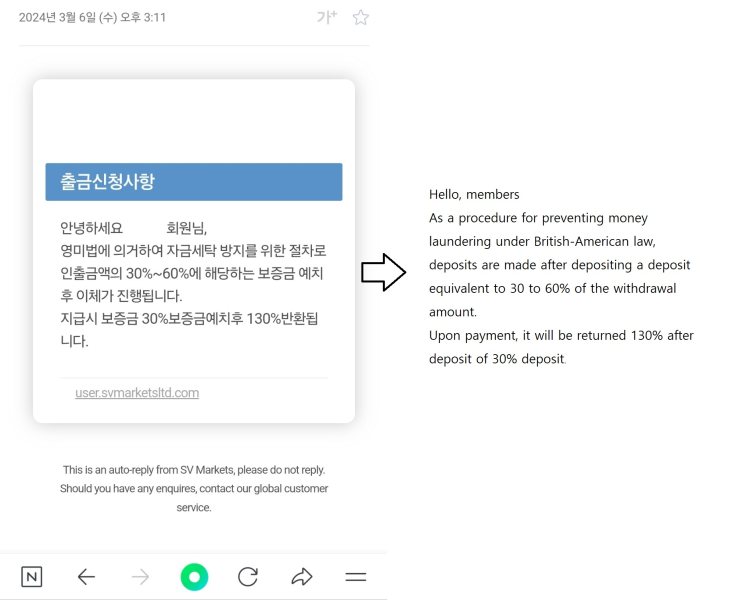

I applied for a $5,000 withdrawal on March 11th, but I made a deposit because I had to deposit 50% of the withdrawal amount as a deposit to make the withdrawal.However, the withdrawal was rejected due to an error in the withdrawal account number, and on March 18, I applied for a $5,000 withdrawal, but I demanded a 50% deposit of the withdrawal amount again.I deposited the 50% deposit again, but now my company's bank account has been suspended from payment, so I sent a suspension of payment issued by the bank, saying that I can't withdraw.But When I checked my suspended bank account, the payment was not suspended. I think it was a deliberate scam that lied to me and refused to withdraw.I'm already asking for a second help.I want to have a good memory of SVMARKET.Please help me make the withdrawal.

Exposure

2024-03-19

picnic

South Korea

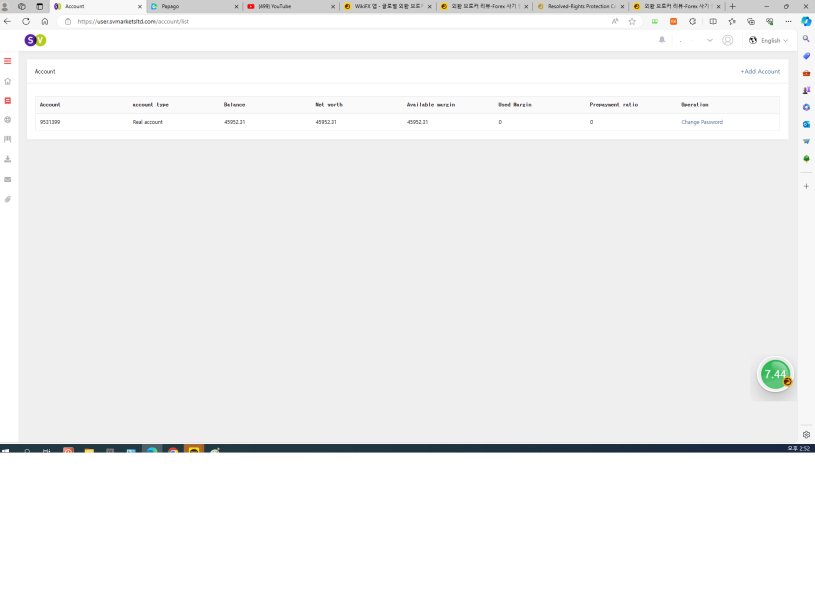

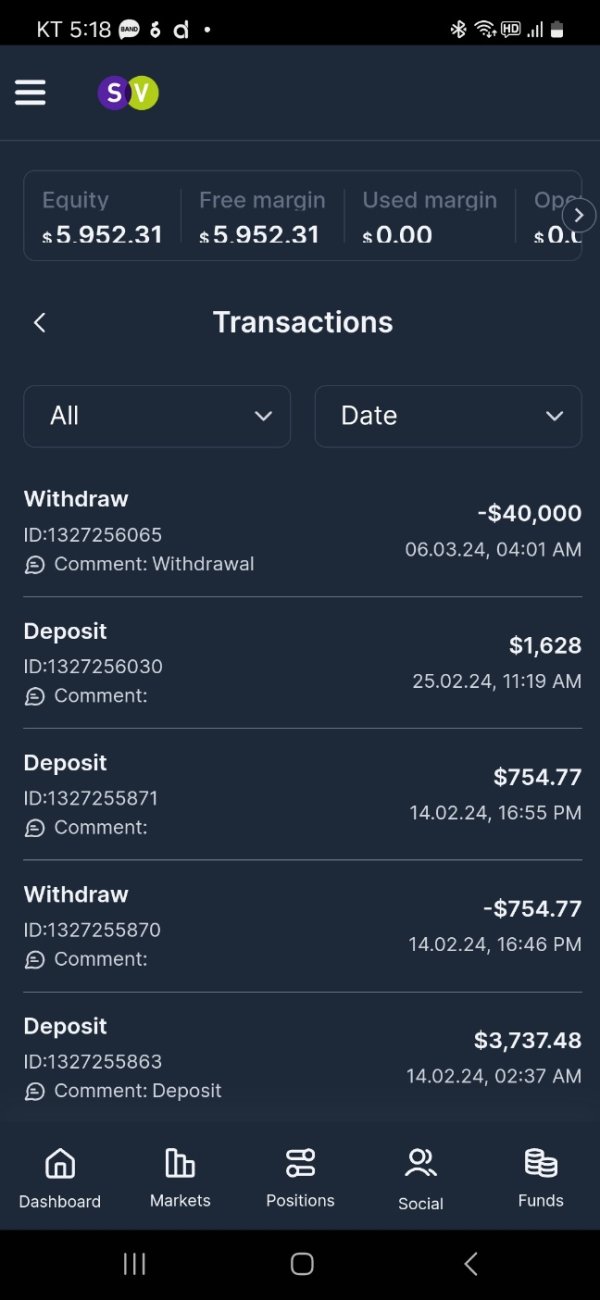

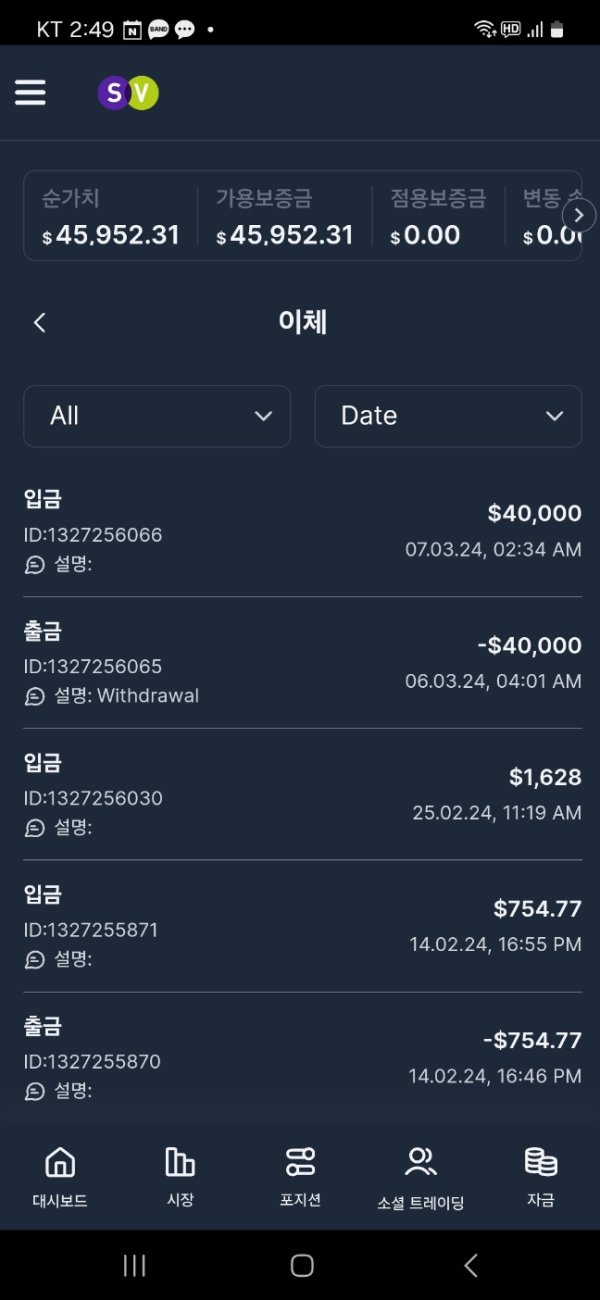

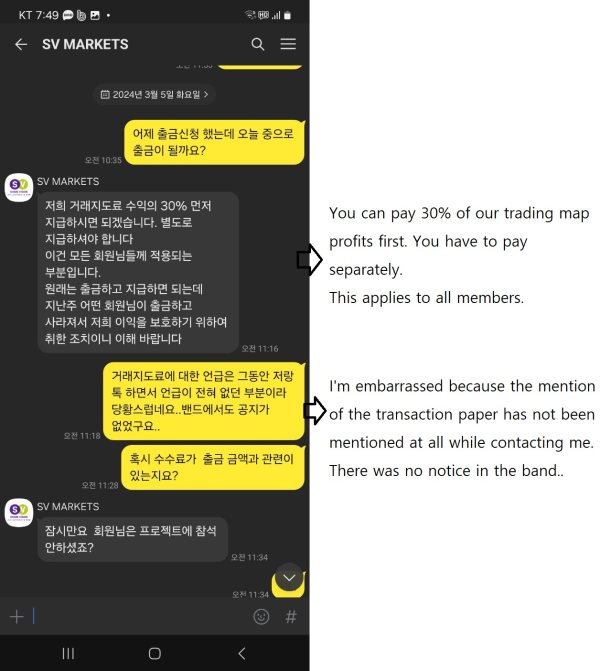

SVMARKES requested a withdrawal of $40,000 on March 4th, and $40,000 was withdrawn from SVMARKES account on the afternoon of the 4th. However, the withdrawal amount was not deposited in my account, so I asked the person in charge to deposit it. The person in charge requested 30% of the transaction information fee in advance. When I refused, I filled $40,000 back into SVMARKES account on March 7th.According to the person in charge, 30% of the total amount of the account should be deposited with the full withdrawal, but it is because of the anti-money laundering law. I haven't been able to withdraw for 5 days, so please solve it.

Exposure

2024-03-08

gsuwijk

Australia

This broker is alright, spreads are low and commissions aren't ridiculous. Only two things that stops it from being a top tier in my book. 1-withdrawals take 24 hours (72 hours on weekends) which is not ideal. 2- there's no Zero spread accounts the ideal account type for expert advisors

Neutral

2024-08-28

FX1QQKW

Mexico

Your system is fantastic, it is the most in depth mobile trading app i have seen. The reason why I only put 4 stars is because your services are not offered in Canada. Without a doubt you are my favorite broker, your platform is hands down the best mobile trading app around, hopefully you will cater to Canadian clients in the near future.⭐⭐⭐⭐

Positive

2024-05-29

FX1494133242

United Kingdom

As a trader, I could appreciate their highly competitive spreads, with Forex trades going as low as 0.2 pips. Their zero-commission policy across all account types was also a notable benefit.

Positive

2024-05-15

beyond__devil

Malaysia

A great broker, they have good spreads, leverage and order opening speed. The only thing I feel they need to do is to modify their social trading app interface. It does not have a search area to search for a specific trader you want and it's also not so user friendly like other social trading apps I've tried E.g FBS Copytrade.

Positive

2024-04-26