Overview of Amana Financial Services

Amana Financial Services is a part of the esteemed Amana Capital Group. This international brokerage firm is duly authorized and regulated by the Financial Conduct Authority (FCA) since 2014. Based in London, United Kingdom, Amana Financial Services offers a diverse array of market instruments, encompassing Forex, Energies, Indices, Commodities, Precious Metals, and Share CFDs. Catering to various trading preferences, the broker provides three distinct account types - Classic, Active, and Elite - each tailored to different trading volumes and needs. Traders can access these instruments and manage their accounts through the popular and user-friendly MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

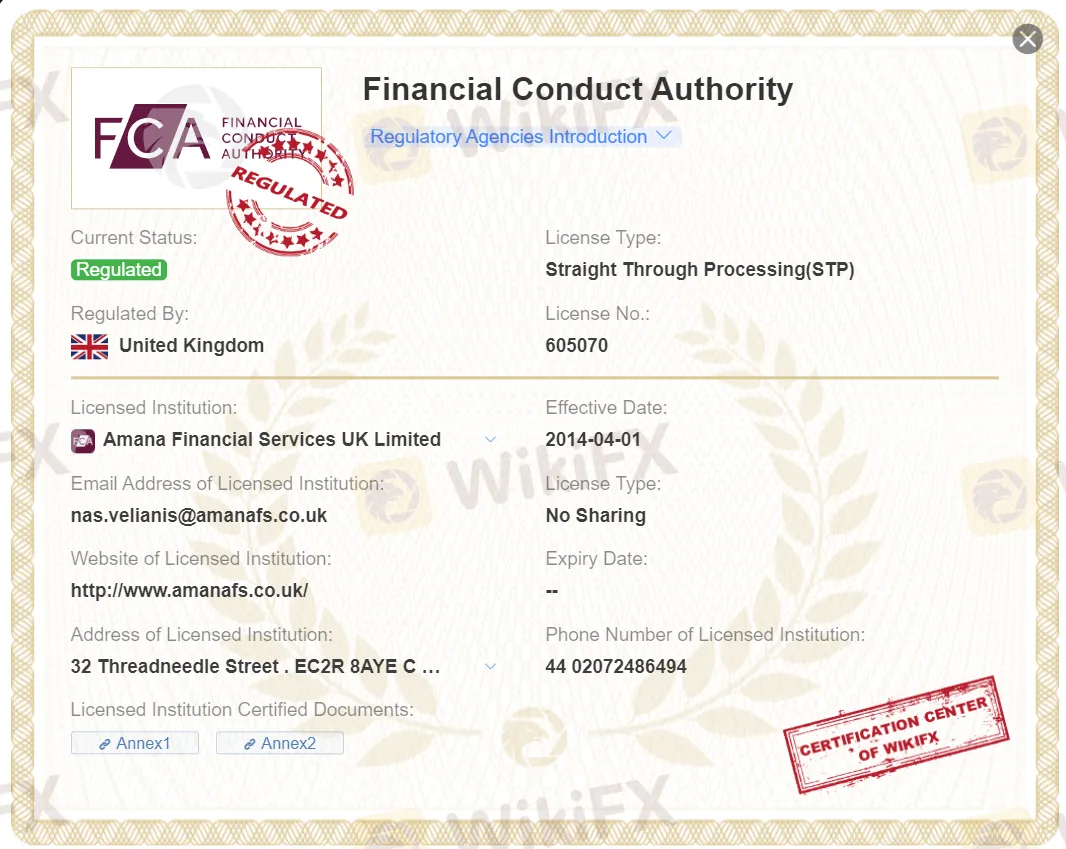

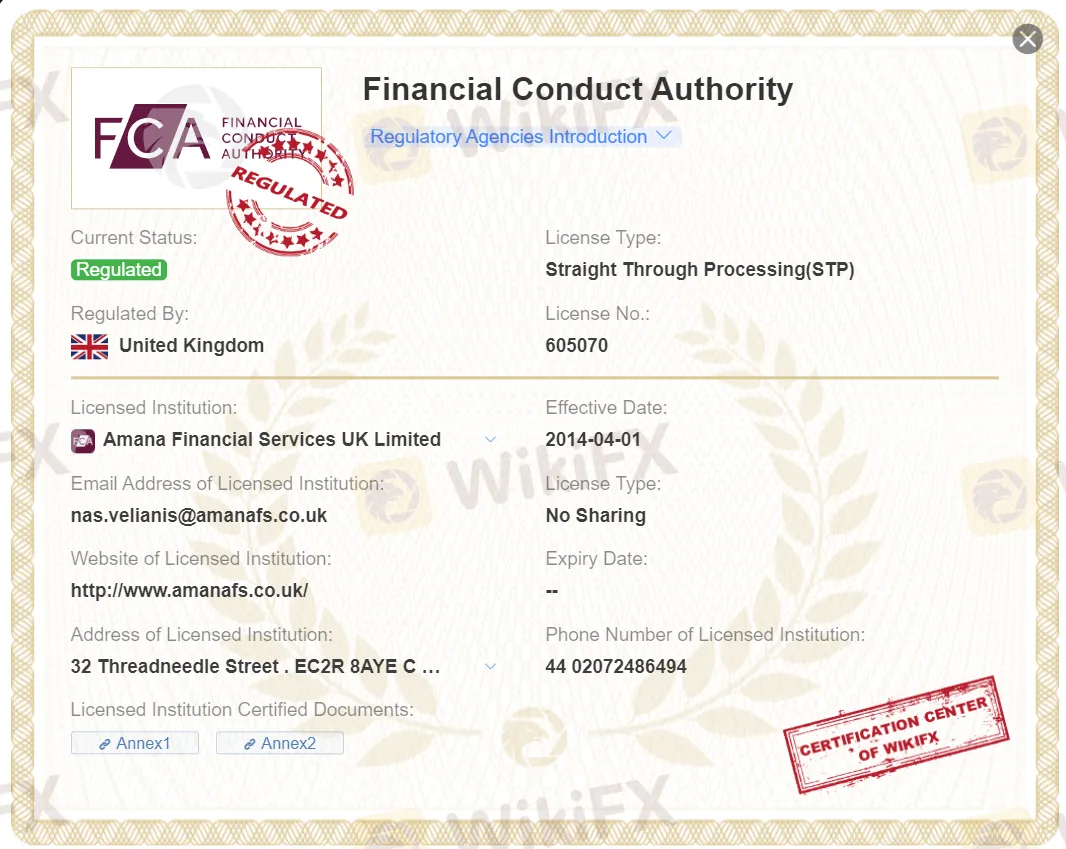

Is Amana Financial Services legit or a scam?

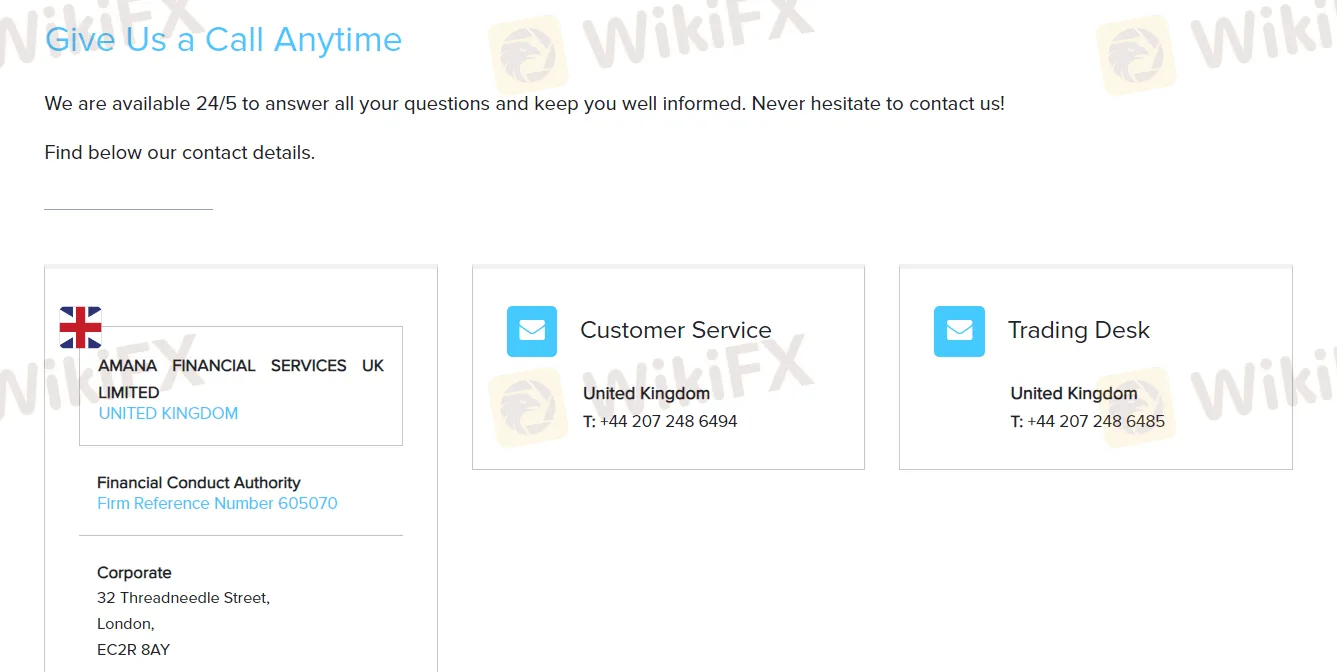

Amana Financial Services UK Limited is a reputable financial institution, regulated by the UK's Financial Conduct Authority (FCA) under license number 605070. With a focus on Straight Through Processing (STP), the company ensures direct and transparent order execution for clients. Since its establishment on April 1, 2014, Amana Financial Services has maintained a commendable track record of regulatory compliance and operational integrity.

Operating from the prominent financial district at 32 Threadneedle Street, London, Amana Financial Services demonstrates its credibility and accessibility. The institution's regulated status, extended experience, and commitment to ethical standards, as overseen by the FCA, solidify its position as a trusted and legitimate broker. Clients can confidently engage with Amana Financial Services, knowing they are dealing with a well-regulated and established financial partner.

Pros and Cons

Amana Financial Services presents traders with several advantages. They are regulated by the Financial Conduct Authority (FCA), instilling confidence in their legitimacy and adherence to industry standards. Their diverse range of market instruments, including Forex, Energies, Indices, Commodities, Precious Metals, and Share CFDs, provides ample trading opportunities. Moreover, their accessible customer support through various channels and the availability of the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms contribute to a user-friendly trading experience. Additionally, the broker's dedication to providing educational resources, such as webinars, empowers traders with valuable insights to enhance their trading skills.

However, there are a few drawbacks to consider. While Amana Financial Services offers a range of market instruments, the spread compared to other brokers is slightly higher, which might impact overall trading costs. Additionally, some traders might find the absence of certain features or services, such as an official Instagram presence, as a minor limitation. As with any trading platform, there could be potential risks involved, particularly when trading CFDs and Forex, which may expose traders to significant losses.

Market Instruments

Amana Financial Services offers a diverse range of market instruments, catering to the varied trading preferences of its clients. Traders can delve into the dynamic world of Forex, capitalizing on fluctuations in currency pairs to potentially profit from the global financial markets. Additionally, the broker provides opportunities to trade Energies, Indices, and Commodities, allowing traders to tap into the commodities and energy sectors for potential gains or hedging strategies.

Precious Metals, a popular choice for safe-haven investments, are also available, offering traders the chance to trade assets like gold and silver. Furthermore, Amana Financial Services extends its offerings to Share CFDs, enabling traders to speculate on the price movements of prominent company shares without the need for physical ownership.

Account Types

Amana Financial Services offers a comprehensive range of account types designed to cater to the diverse needs of traders, providing tailored features and benefits for varying trading preferences and volumes.

Classic Account: This is for beginners with a minimum $50 deposit. You can trade on MT4/MT5 platforms with low spreads and up to 1:30 leverage. No extra fees for FX and cash CFDs, and you can use Expert Advisors for automated trading.

2. Active Account: If you deposit $25,000 and trade $100 million per month, you get an Active Account. It has even lower costs with reduced spreads, and you can use API trading for automation. You also get advanced trading signals and a personal relationship manager.

3. Elite Account: For high-volume traders with $250,000 or more, the Elite Account offers top-notch benefits. This includes personalized coaching, 24/5 trading, reduced fees, and a dedicated trade desk team. You also get exclusive tools for better trading decisions.

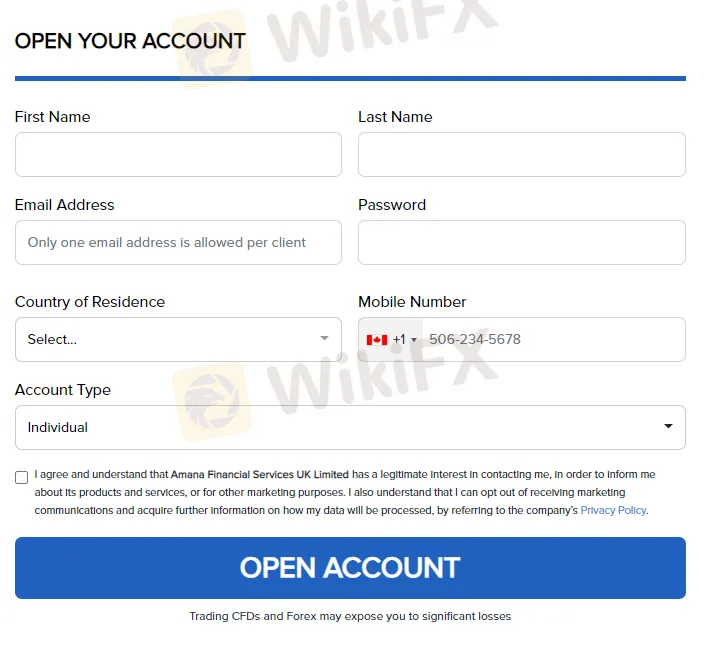

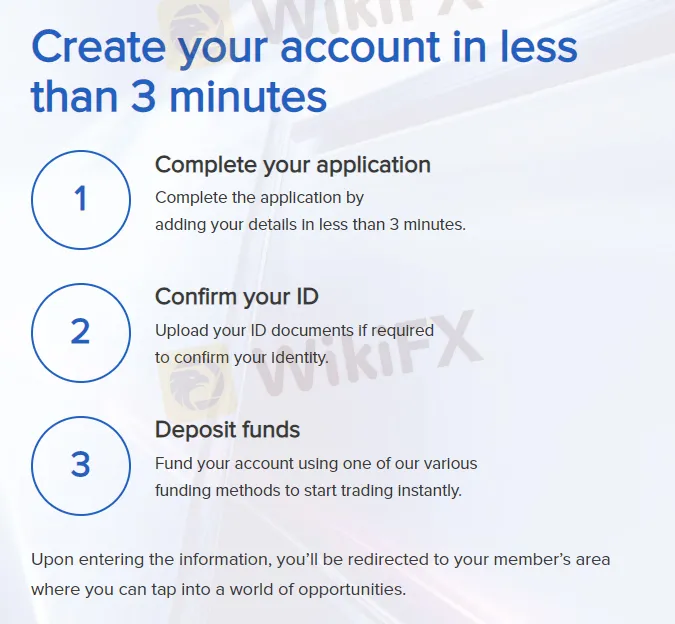

How to open an account in Amana Financial Services?

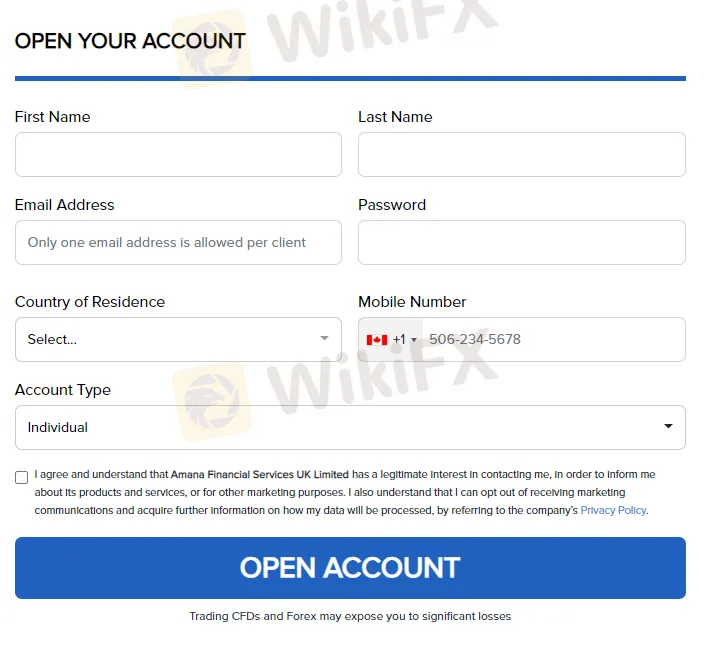

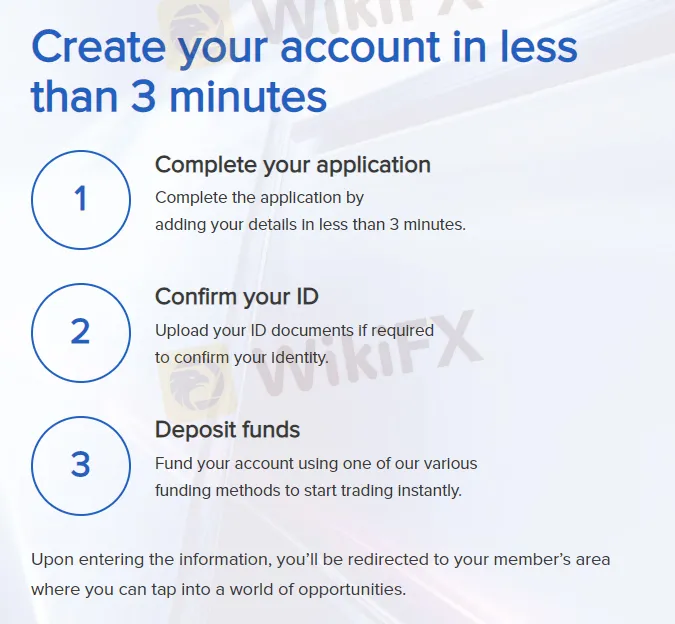

Opening an account with Amana Financial Services UK Limited is a straightforward process that unlocks a world of trading opportunities in less than 3 minutes. Here's how you can get started:

Begin by entering your basic details, including your first name, last name, email address, password, country of residence, and mobile number (+1).

Fill out your application by providing your details.

Upload your identification documents to verify your identity.

Fund your account using a variety of funding methods to start trading immediately.

After submitting your information, access your member's area to explore a diverse range of trading options.

Spread and Commission Fees

Amana Financial Services offers a diverse range of trading instruments with specific trading specifications. In the Classic account, the account with the lowest minimum requirement, the EURUSD pair features a minimum spread of 1.3 pips. This spread represents the difference between the bid and ask price, allowing traders to enter and exit positions efficiently.

In the Active account offered by Amana Financial Services, a different commission structure applies compared to the Classic account. While the Classic account does not charge any commissions on FX trades, the Active account features commission charges on FX trades. Specifically, for the EURUSD pair, traders using the Active account are subject to a commission fee of $30 per 1 million traded. It's important to note that different account types may have varying spread and commission structures, so traders should review the specific account type details that best suit their trading preferences and goals.

Leverage

Amana Financial Services offers maximum leverage of up to 1:30 for both its Classic and Active trading accounts. This means that traders can control a position size of up to 30 times their trading capital. Leverage can be a valuable tool for amplifying potential gains, but it's crucial for traders to exercise prudent risk management due to its potential to magnify losses as well.

By providing this maximum leverage, Amana Financial Services allows traders to tailor their trading strategies to their risk tolerance and market outlook while emphasizing the importance of responsible and informed trading practices.

Trading Platform

Amana Financial Services presents traders with the versatile MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms, available for both PC and mobile devices. On the PC front, both MT4 and MT5 provide a user-friendly interface equipped with real-time market data, customizable charts, and automated trading capabilities through expert advisors (EAs). This empowers traders to execute strategies, manage positions, and analyze markets efficiently.

For those on the move, Amana's MT4 and MT5 mobile apps offer a convenient solution. With compatibility for iOS and Android, these apps allow traders to engage in real-time trading, monitor market developments, and manage accounts while on the go. The apps ensure access to essential trading tools and features, bringing the power of trading to the palm of traders' hands.

Deposit & Withdrawal

Amana Financial Services simplifies financial transactions for its clients by offering a range of deposit and withdrawal methods, including bank transfers, VISA, Mastercard, Skrill, Neteller, and UnionPay.

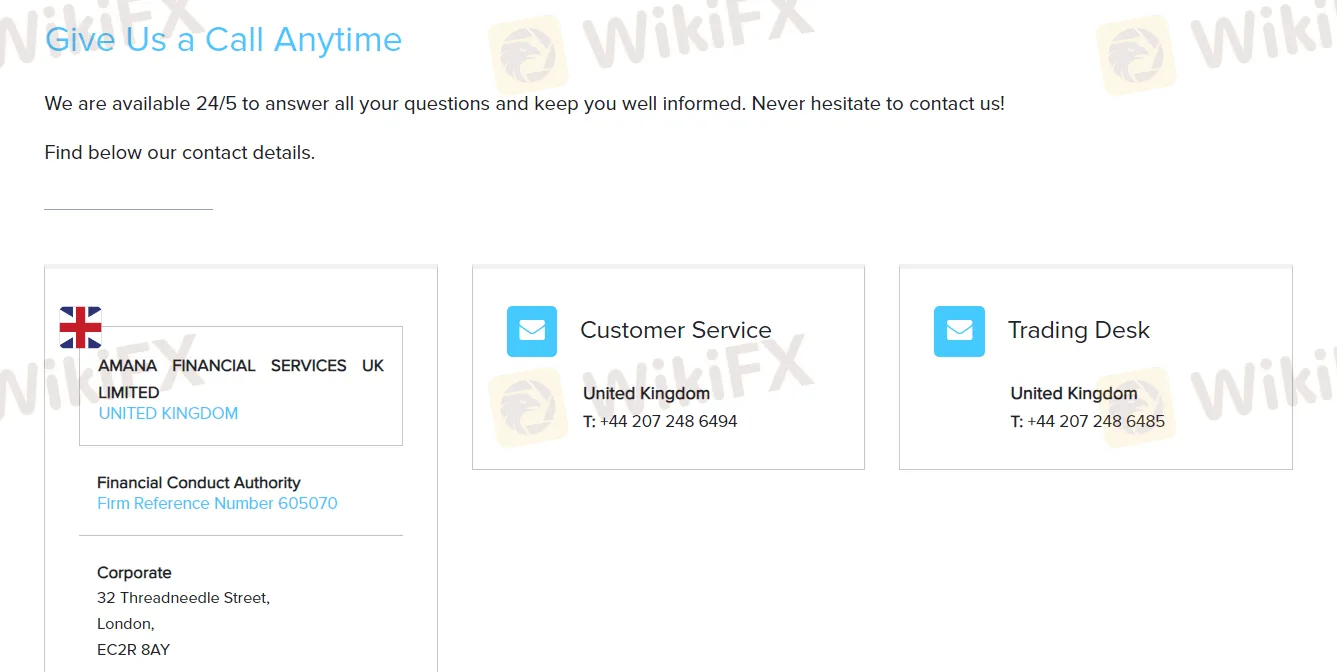

Customer Support

Amana Financial Services delivers customer support through various accessible channels. Traders can reach out for assistance through the company's website, with comprehensive information available about their services. Direct support is also provided via phone at +44 207 248 6494.

The company maintains an active presence on social media platforms, including Twitter and Facebook, where traders can engage, receive market updates, and stay connected. Amana Financial Services enriches traders' knowledge through its informative YouTube channel and professional networking on LinkedIn. For direct inquiries or concerns, traders can utilize the dedicated customer service email address (support@amanafs.co.uk).

Educational Resources

Amana Financial Services empowers traders with valuable educational resources to enhance their trading knowledge and skills. Through their Home Education section, traders can access a range of educational materials and tools designed to support their trading journey. The broker offers insightful webinars covering a spectrum of topics, including Forex Trading and CFD Trading. These webinars provide traders with in-depth insights, strategies, and market analysis to help them make informed trading decisions.

Conclusion

Amana Financial Services is a regulated brokerage, overseen by the Financial Conduct Authority (FCA), which lends credibility and assurance to its operations. The broker offers an array of trading instruments, encompassing Forex, Energies, Indices, Commodities, Precious Metals, and Share CFDs. Their commitment to education is evident through webinars and the availability of the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, which cater to both PC and mobile users.

However, one potential concern stems from the slightly higher spreads compared to certain other brokers, impacting trading costs. It's essential to exercise caution, particularly in CFD and Forex trading, as these ventures carry inherent risks that may lead to substantial losses.

FAQs

Q: What is the regulatory status of Amana Financial Services?

A: Amana Financial Services is regulated by the Financial Conduct Authority (FCA) in the United Kingdom.

Q: What is the maximum leverage offered by Amana Financial Services?

A: The broker offers maximum leverage of up to 1:30.

Q: How is customer support accessible?

A: Customer support can be reached through various channels, including phone (+44 207 248 6494), email (support@amanafs.co.uk), and active social media profiles.

Q: What trading platforms are available?

A: Amana Financial Services offers the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms for both PC and mobile devices.

Q: What market instruments can I trade with Amana Financial Services?

A: Amana Financial Services provides a diverse range of market instruments, including Forex, Energies, Indices, Commodities, Precious Metals, and Share CFDs.