Overview of GMS

GMS INTERNATIONAL PTY LTD, operating in Australia for 2-5 years, lacks proper regulatory oversight, potentially posing risks for potential users. It offers a range of market instruments, including currency pairs, indices, commodities, Forex CFDs, and cryptocurrencies.

GMS provides various account types, each with distinct leverage ratios, spreads, and minimum deposit requirements. The account options include Standard, Micro, Cent, ECN, Islamic, Joint, Corporate, and Demo accounts.

The broker offers leverage ratios ranging from 1:100 to 1:2000, depending on the account type. Spreads vary from 0.0 pips on the ECN account to 7 pips on other accounts, with potential commissions on the ECN account.

Minimum deposit requirements range from $1 for the Cent account to $10,000 for the Corporate account. GMS supports various deposit and withdrawal methods, with varying limits.

GMS provides web and desktop trading platforms, offering real-time market data and charting capabilities. However, reviews on WikiFX raise concerns about scams, withdrawal issues, and trustworthiness associated with GMS, highlighting potential risks for users.

Pros and Cons

GMS offers a diverse range of trading instruments and multiple account types with varying features and leverage. Additionally, the broker provides spreads starting from 0.0 pips and offers multiple deposit and withdrawal methods. The user-friendly web trading platform enhances the trading experience, and some account types have low minimum deposit options. However, GMS faces challenges due to a lack of regulatory oversight, negative reviews and concerns on WikiFX, and a currently inaccessible main website. Traders should also be aware that commissions may apply on the ECN account, and there are limited contact channels for customer support. Furthermore, high leverage options may pose an increased risk to traders.

Is GMS Legit?

GMS, as of the latest information available, lacks proper regulatory oversight. This absence of regulation raises potential risks for those considering engaging with this broker. Caution is advised when dealing with unregulated entities in the financial industry.

Market Instruments

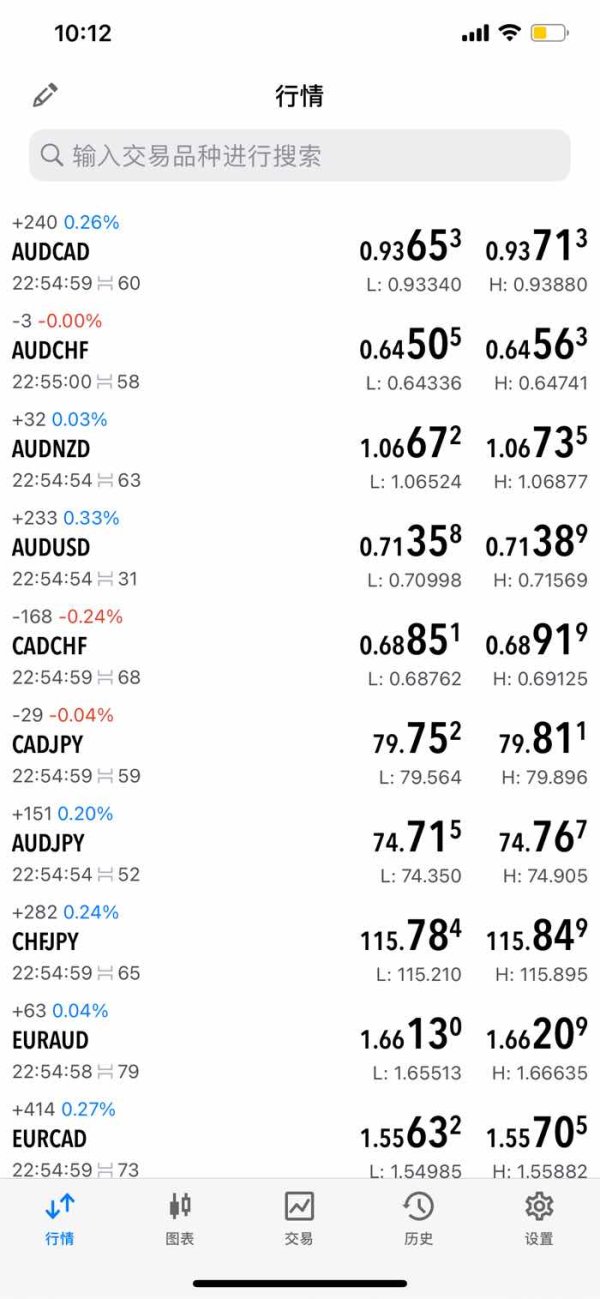

CURRENCIES:

GMS provides a range of currency pairs, including Majors like EUR/USD, USD/JPY, GBP/USD, AUD/USD, and NZD/USD. They also offer Minors such as EUR/GBP, EUR/CHF, USD/CAD, AUD/NZD, and EUR/CAD, along with Exotics like TRY/JPY, RUB/USD, ZAR/JPY, MXN/USD, and CNH/JPY.

INDICES:

For those interested in indices, GMS offers access to popular options, including the Dow Jones Industrial Average (DJI), S&P 500 (SPX), Nasdaq 100 (NDX), FTSE 100 (UKX), and Nikkei 225 (JP225).

COMMODITIES:

Commodity trading options on GMS include Crude Oil (WTI), Brent Crude Oil, Gold (XAU/USD), Silver (XAG/USD), and Copper (HG/USD).

FOREX CFDS:

GMS caters to Forex CFD trading with a diverse selection of currency pairs. This includes Majors like EUR/USD, USD/JPY, GBP/USD, AUD/USD, and NZD/USD, as well as Minors such as EUR/GBP, EUR/CHF, USD/CAD, AUD/NZD, and EUR/CAD. Additionally, they provide Exotics like TRY/JPY, RUB/USD, ZAR/JPY, MXN/USD, and CNH/JPY.

CRYPTOCURRENCIES:

Cryptocurrency enthusiasts can engage in trading with GMS, which offers options like Bitcoin (BTC/USD), Ethereum (ETH/USD), Tether (USDT/USD), and Binance Coin (BNB/USD).

Pros and Cons

Account Types

STANDARD ACCOUNT:

The Standard account offers leverages ranging from 1:100 to 1:500, with spreads varying between 1.2 pips to 1.8 pips. A minimum deposit of $100 is required, and it provides access to a variety of instruments including Forex, CFDs, metals, energies, and indices.

MICRO ACCOUNT:

With a leverage of 1:1000, the Micro account offers spreads that range from 2.5 pips to 3.5 pips. Traders can get started with a minimum deposit of $50 and have access to Forex, CFDs, metals, energies, and indices.

CENT ACCOUNT:

The Cent account offers high leverage of 1:2000 and spreads that vary from 5 pips to 7 pips. It has an exceptionally low minimum deposit requirement of just $1, providing access to Forex, CFDs, metals, energies, and indices.

ECN ACCOUNT:

The ECN account offers leverage ranging from 1:100 to 1:500 and features spreads starting from 0.0 pips. It requires a minimum deposit of $1000 and provides access to a wide range of instruments, including Forex, CFDs, metals, energies, and indices.

ISLAMIC ACCOUNT:

The Islamic account offers swap-free trading with leverage options from 1:100 to 1:500. Spreads start from 1.2 pips, and the minimum deposit required is $100. It grants access to Forex, CFDs, metals, energies, and indices.

JOINT ACCOUNT:

The Joint account allows two or more individuals to jointly open and manage the account. It offers leverages from 1:100 to 1:500, spreads starting from 1.2 pips, and a minimum deposit of $100 per person. It provides access to Forex, CFDs, metals, energies, and indices.

CORPORATE ACCOUNT:

Designed for businesses and institutions, the Corporate account offers customizable leverage, spreads, and trading conditions. It requires a substantial minimum deposit of $10,000 and provides access to Forex, CFDs, metals, energies, and indices.

DEMO ACCOUNT:

The Demo account is a risk-free way to practice trading, using virtual funds to simulate real-world trading conditions. It doesn't require any deposit and offers access to Forex, CFDs, metals, energies, and indices.

Leverage

GMS offers leverage options for traders, with varying levels depending on the account type. Leverage ratios range from 1:100 to 1:2000, providing traders with different degrees of trading capital amplification based on their chosen account type.

Spreads & Commissions

GMS offers spreads starting from 0.0 pips on their ECN account, with spreads ranging between 1.2 pips to 7 pips on other account types. Commissions may apply on the ECN account, while other accounts generally do not incur additional commissions.

Minimum Deposit

GMS has varying minimum deposit requirements for its account types, ranging from $1 for the Cent account to $10,000 for the Corporate account, with options in between such as $50 for the Micro account and $100 for the Standard, Islamic, and Joint accounts. The Demo account doesn't require a deposit.

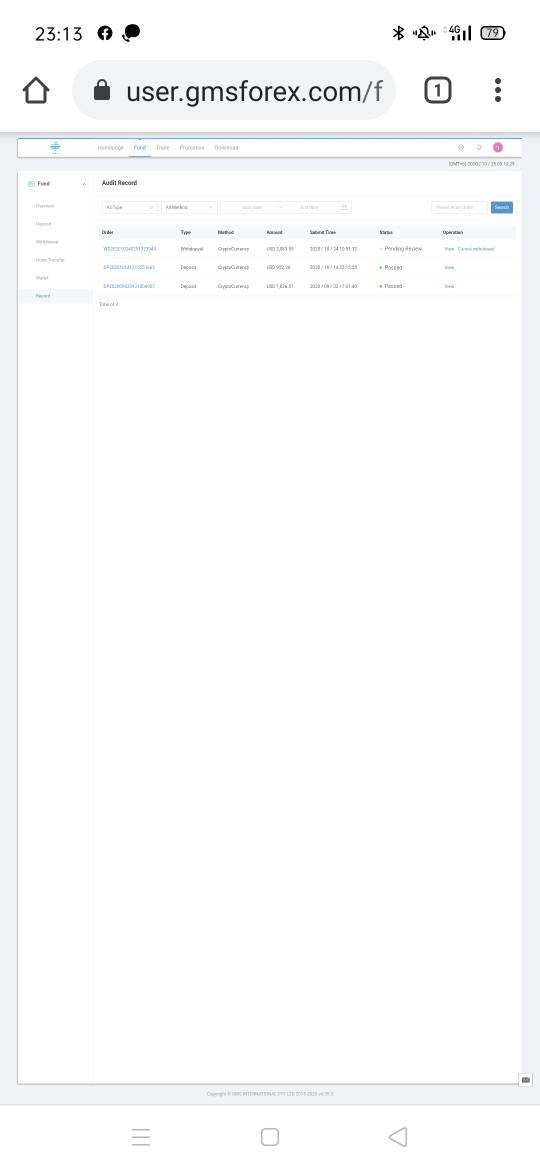

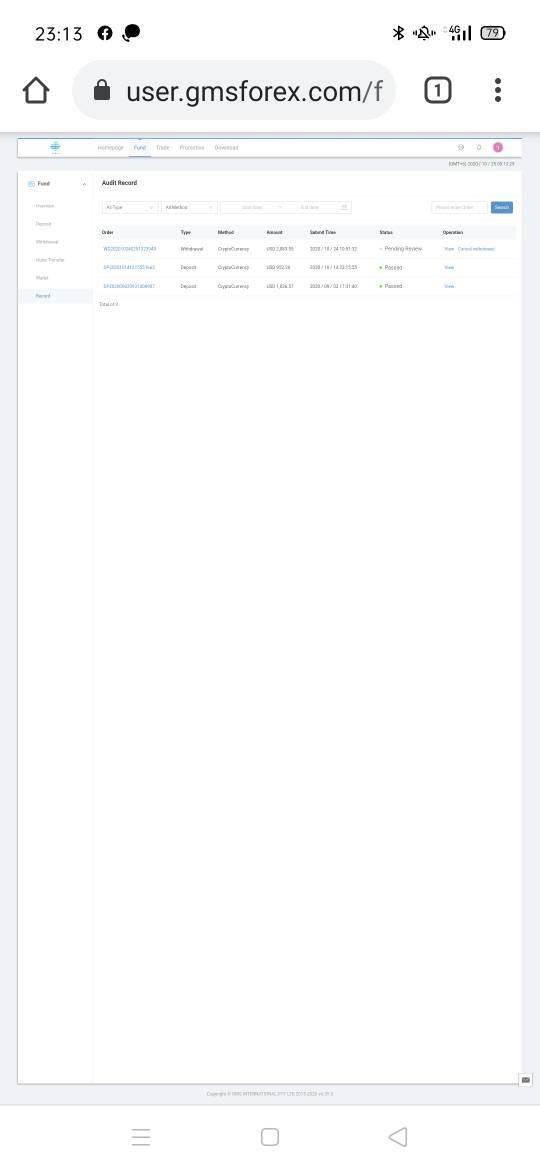

Deposit & Withdrawal

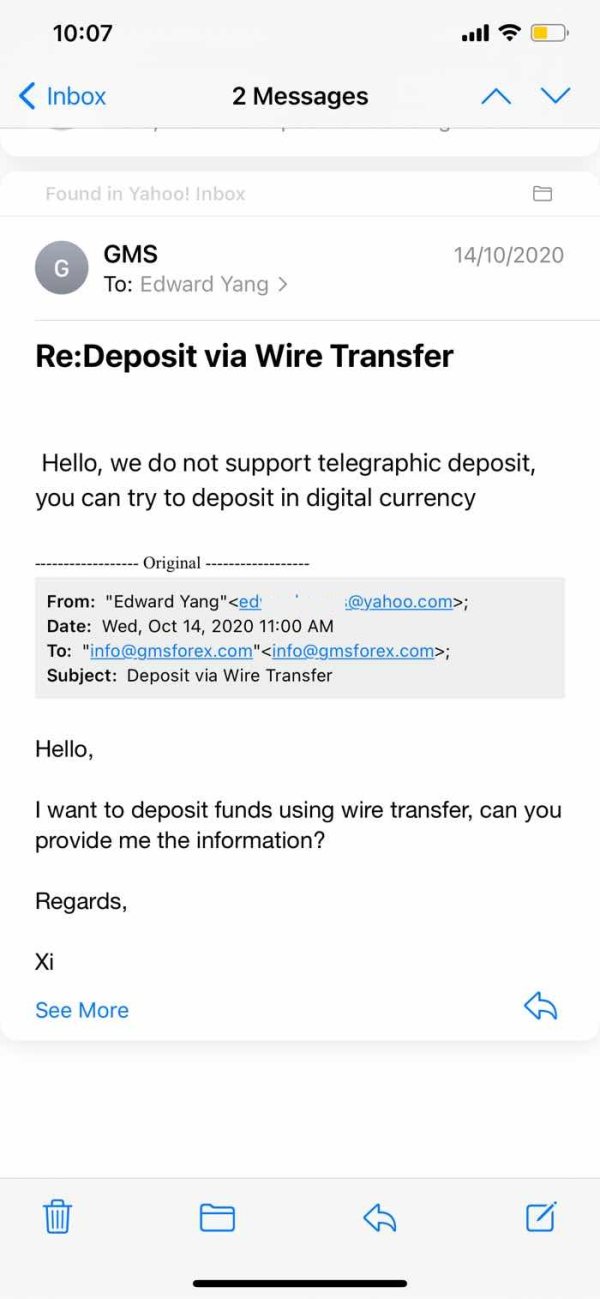

GMS offers a variety of deposit and withdrawal methods, including bank transfers, credit/debit cards, and e-wallets. The maximum deposit varies depending on the payment method. The minimum withdrawal is $50, and the maximum withdrawal also varies depending on the payment method.

Trading Platforms

WEB TRADING PLATFORM

GMS's web trading platform is a versatile tool, offering real-time market data and charting capabilities. It facilitates order execution through multiple liquidity providers and includes advanced trading tools and indicators. Traders can access comprehensive risk management features while navigating the user-friendly interface from any web browser. Although it lacks some of the advanced options of other platforms, it serves as a solid entry point for those seeking a straightforward online trading experience.

DESKTOP TRADING PLATFORM

GMS's desktop trading platform delivers a more robust and customizable experience. It boasts multiple order types and execution strategies, advanced charting, and backtesting tools. With support for multiple trading accounts and automated trading capabilities, it caters to seasoned traders. The platform's customizable workspace ensures traders can tailor it to their specific needs, providing a comprehensive trading environment.

Customer Support

GMS provides customer support via email at info@gmsforex.com and services@gmsforex.com. These are the designated contact channels for addressing inquiries and assistance.

Reviews

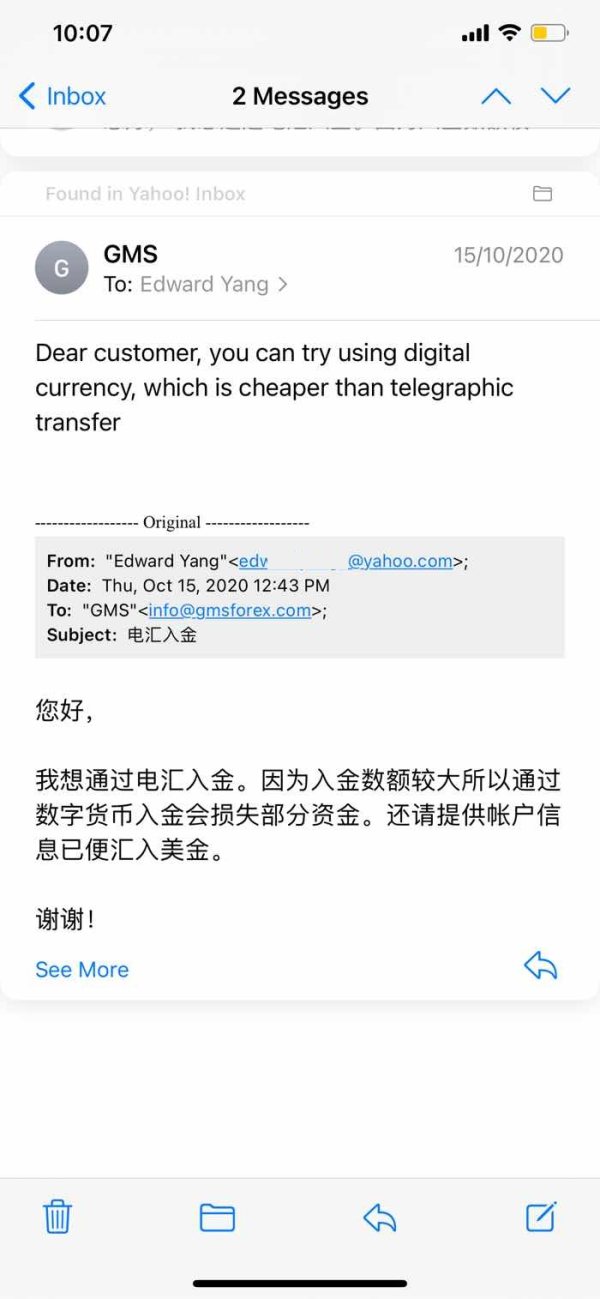

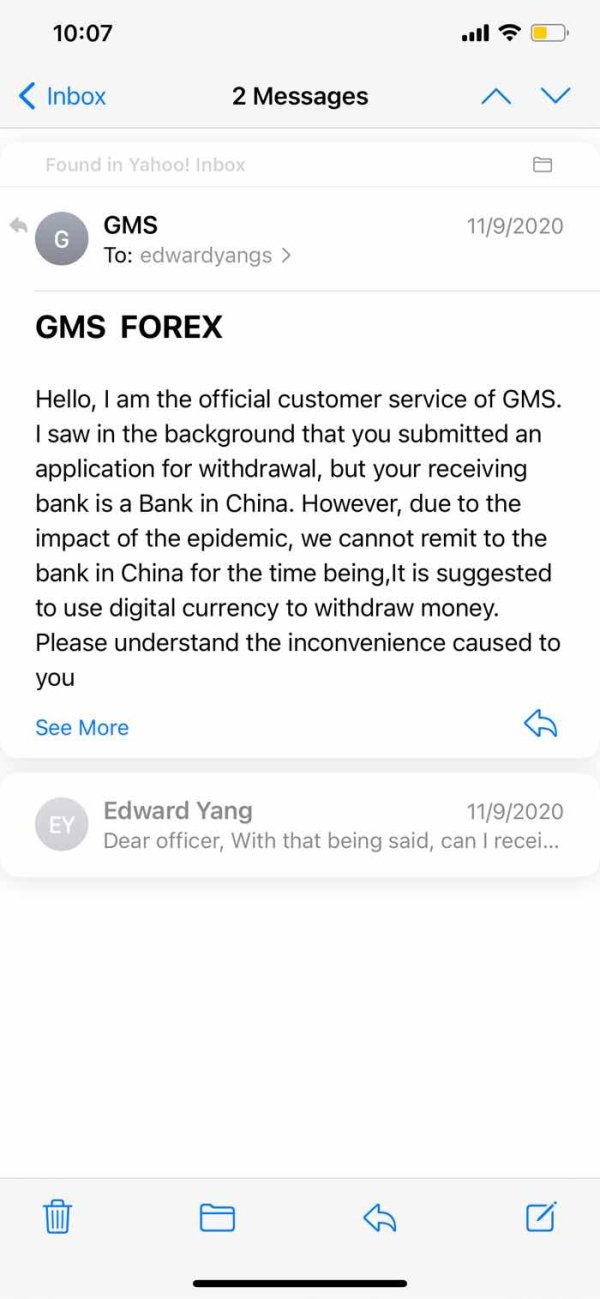

Reviews of GMS on WikiFX have raised serious concerns, with multiple reports of scams and withdrawal issues. Users have reported pyramid scheme complaints, exposure to scams, and difficulties in withdrawing their funds. Many have expressed frustration over the inability to contact GMS administrators and the loss of their deposited money. Additionally, some users mentioned suspicious activities, such as being encouraged to deposit virtual money only, and experiencing unexplained freezes in their trading accounts. These reviews collectively suggest a lack of trustworthiness and reliability associated with GMS as a trading platform.

Conclusion

In conclusion, GMS International Pty Ltd presents both advantages and disadvantages for potential traders. On the positive side, GMS offers a diverse range of market instruments, including currencies, indices, commodities, Forex CFDs, and cryptocurrencies, catering to various trading preferences. They also provide different account types with varying leverage options, allowing traders to choose based on their risk appetite. Additionally, GMS offers a choice of trading platforms, including web and desktop versions, which may suit different trading styles. However, it's essential to exercise caution when considering GMS due to the absence of proper regulatory oversight, as this raises potential risks for traders. Furthermore, negative reviews and reports of scams and withdrawal issues from users on platforms like WikiFX raise concerns about the trustworthiness and reliability of GMS as a trading platform. Therefore, thorough research and due diligence are advised before engaging with GMS for financial activities.

FAQs

Q: Is GMS a legitimate company?

A: GMS lacks proper regulatory oversight, which raises potential risks for those considering engaging with this broker. Caution is advised when dealing with unregulated entities in the financial industry.

Q: What trading instruments does GMS offer?

A: GMS provides a range of instruments, including currencies, indices, commodities, forex CFDs, and cryptocurrencies.

Q: What are the different account types offered by GMS?

A: GMS offers various account types, including Standard, Micro, Cent, ECN, Islamic, Joint, Corporate, and Demo accounts.

Q: What levels of leverage are available with GMS?

A: GMS offers leverage options ranging from 1:100 to 1:2000, depending on the account type.

Q: How can I contact GMS for customer support?

A: You can reach GMS customer support via email at info@gmsforex.com and services@gmsforex.com.

Q: Are there any concerns or issues reported by users about GMS?

A: Yes, there are serious concerns and negative reports about GMS, including pyramid scheme complaints, withdrawal issues, and difficulties in contacting administrators, suggesting a lack of trustworthiness and reliability.

Q: What trading platforms does GMS offer?

A: GMS provides web and desktop trading platforms, each with its own set of features and capabilities.

FX1206490431

Australia

A strange Chinese girl introduced the forex platform to me . She asked me to deposit using the virtual money all the time. In fact, the staff of GMS claimed that they only accepted the virtual money. The market which my MT5 account showed didn't fluctuate anymore several weeks ago, I found that my account may be frozen. And the login page can't be shown.

Exposure

2020-11-07

FX3696348132

Thailand

You can’t scam. I deposited here but I can’t withdraw. The money was gone.

Exposure

2020-10-28

FX3696348132

Thailand

I have been informed of withdrawal for a very long time, but no action has been taken. Including losing contact Cannot contact the administrator of the GMS even once. There have been several denouncements from customers that they have been cheated

Exposure

2020-10-27

FX1158050654

Hong Kong

A beautiful woman on a social network recommended me this platform, saying that as long as I trade on it, I can definitely make money. I invested $2,000 in two installments, both of which ended in losses. However, their staff continued to let me make deposits, saying that this time I would definitely win back the previous ones. I don't believe their nonsense anymore, I am a liar.

Neutral

2022-12-13