Score

CICC Futures

China|5-10 years|

China|5-10 years| http://www.ciccfutures.com.cn/

Website

Rating Index

Contact

Licenses

Licenses

Licensed Entity:中金期货有限公司

License No. 0172

Basic Information

China

ChinaUsers who viewed CICC Futures also viewed..

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

ciccfutures.com.cn

Server Location

China

Website Domain Name

ciccfutures.com.cn

ICP registration

青ICP备16000059号-1

Website

WHOIS.CNNIC.CN

Company

北京国旭网络科技有限公司

Domain Effective Date

2006-08-10

Server IP

210.12.242.177

Company Summary

| CICC Futures Review Summary | |

| Founded | 2004 |

| Registered Country/Region | China |

| Regulation | CFFEX |

| Market Instruments | Commodities, stocks, indices etc. |

| Demo Account | Available |

| Minimum Deposit | Variable |

| Trading Platforms | Boyi Cloud Trading software, Jinshida econsign (look-through), Polar Star (look-through) |

| Customer Support | Phone, fax |

What is CICC Futures?

CICC Futures, established in 2004 and based in China, offers a comprehensive range of trading opportunities across various market instruments. Regulated by CFFEX, this broker provides access to commodities, stocks, indices, and more. Clients have the option to explore their trading strategies using a demo account. While the minimum deposit requirement may vary, CICC Futures offers multiple trading platforms, including Boyi Cloud Trading software, Jinshida econsign (look-through), and Polar Star (look-through). Client support is readily accessible through phone and fax. With its diverse offerings and regulatory oversight, CICC Futures aims to cater to a broad spectrum of traders.

Pros & Cons

| Pros | Cons |

| • Strong shareholder background | • Restricted access in certain countries |

| • Advanced trading system | • Unclear fee structure |

| • Professional services |

Pros:

Strong Shareholder Background: CICC Futures is backed by China International Capital Corporation (CICC), which is its sole shareholder. CICC has a long-standing commitment to providing high-quality financial value-added services and has built a comprehensive business structure, including research, investment banking, equity sales and trading, fixed income, wealth management, and investment management. This strong backing provides robust support to CICC Futures.

Advanced Trading System: The company utilizes the various econsign trading systems, which are interconnected with various domestic futures exchanges and futures margin monitoring centers. This ensures secure and speedy trading and settlement. Investors can engage in synchronized trading with futures exchanges using various methods like written orders, phone orders, and self-service orders.

Professional Services: CICC Futures boasts a high-quality service team with professionalism, integrity, and innovation. They offer continuous professional investment advice and high-quality customer service to both institutional and individual investors. The Sales Department can educate clients about the principles of futures trading, trading processes, methods, and market dynamics, helping clients understand the futures market and mitigate trading risks.

Cons:

Restricted Access to Overseas: CICC Futures may have limitations in providing services to overseas clients. This restricted access could potentially limit opportunities for international investors looking to engage in futures trading through the platform.

Unclear Fee Structure: The fee structure of CICC Futures is not transparent or well-defined. This lack of clarity can make it challenging for traders to understand the costs associated with their trading activities, potentially leading to unexpected expenses.

Is CICC Futures Safe or Scam?

When considering the safety of a financial company like CICC Futures or any other platform, it's important to conduct thorough research and consider various factors. Here are some steps you can take to assess the credibility and safety of a financial company:

Regulatory sight: CICC Future operates with a “Future License” license, CICC Futures is regulated by the China Financial Futures Exchange (CFFEX) in China. This indicates a favorable regulatory status. However, it's important to remember that experience alone doesn't necessarily guarantee absolute security and dependability of financial institutions.

Security measures: CICC Futures has established a privacy policy as a protective measure, thereby securing user data and inspiring trust among its global clientele.

In the end, the choice of whether or not to engage in trade with CICC Futures is a personal one. It's crucial to carefully balance the potential risks and advantages before coming to a decision.

As with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

Market Instruments

CICC Futures offers a diverse range of market instruments, providing traders with opportunities to engage in various types of financial assets. These instruments include commodities, stocks, indices, and more. This broad selection allows traders to diversify their portfolios and participate in different segments of the financial markets, catering to a wide range of investment strategies and preferences. Whether you are interested in trading commodities, tracking stock performance, or exploring market indices, CICC Futures aims to provide a comprehensive platform for your trading needs within the Chinese financial landscape.

Accounts

CICC Futures does not provide clear information regarding account opening procedures on their official website. To initiate the account opening process, investors are advised to directly contact the company for guidance and assistance.

However, it's worth noting that CICC Futures does offer demo trading accounts and competitions, providing aspiring traders with an opportunity to practice their skills in a risk-free environment. These demo accounts can be valuable tools for honing trading strategies and gaining familiarity with the platform's features before committing to live trading.

Deposits & Withdrawals

CICC Futures does not provide clear information regarding deposits and withdrawals and specific requirement varies. For instance:

The guarantee deposit for the 30-year Treasury Bond futures standard contract is outlined as follows: The contract is based on a notional ultra-long-term government bond with a face value of 1 million RMB and a nominal interest rate of 3%. Eligible deliverable government bonds should have an issuance term not exceeding 30 years, with a remaining term of no less than 25 years on the first day of the contract's expiry month. Quotations are provided in terms of net price per hundred yuan, and the minimum price movement is 0.01 yuan.

Trading Platforms

CICC Futures offers various versatile trading platforms, here are some notable ones:

Boyi Cloud Trading Version (Look-Through): This platform supports commodity options and conditional orders. Boyi Master is a prominent software for displaying real-time data in the futures, securities, and forex markets. It provides live quotes and charts for domestic and international futures, financial indices, forex, and options markets.

Jinshida Point Gold 2.0 (Look-Through) (Official Environment): Jinshida Point Gold 2.0 is a futures trading terminal developed by Jinshida. It offers futures and options trading and includes features such as options calculators, options profit/loss curves, and technical analysis tools. It is a fast trading platform; however, it does not support conditional orders or stop-loss orders.

Jinshida Econsign (Look-Through) (Official Environment): Jinshida Econsign is a feature-rich trading platform known for its ease of use and user-friendly operations. It is popular among traders and aligns with common trading practices. It supports commodity options, conditional orders, and stop-loss orders. The platform does have a limitation as it can only display six selected contracts.

Polar Star (Look-Through): Polar Star is a PC trading software introduced by Zhengzhou Yisheng Company. It offers high-speed order placement, supports both domestic and foreign arbitrage trading, multi-account login, and provides various plugins for functions like position transfer and spiral arbitrage. It's suitable for traders using multiple display screens.

Simulation - Jinshida Point Gold 2.0: This platform is a simulation version of Jinshida Point Gold 2.0. It is suitable for simulating trading activities on the Zhengzhou Commodity Exchange, China Financial Futures Exchange, and Dalian Zhengzhou Commodity Exchange. It supports displaying all contracts for simulation purposes.

These platforms offer diverse options for traders to choose from based on their trading preferences and requirements. Choose the platform that suits your trading style and access a wide range of assets with competitive spreads, all in a secure trading environment.

Customer Service

Customers can visit their office or get in touch with customer service lines using the information provided below: Customer service hotline: 400-650-1763

CICC Futures Limited (Beijing)1th Floor, Tower 2, International Trade Office Building, No. 7 Jianguomenwai Street, Chaoyang District, Beijing 100022Tel: 010-85679888Fax: 010-85679293CICC Futures Limited (Xining)21F, Sapphire Hotel, No.18 Shengli Road, Chengxi District, Xining City, Qinghai 810000Tel: 0971-8231959Fax: 0971-8235900

CICC Futures' commitment to investor education sets it apart in the industry. They provide valuable resources and educational materials aimed at enhancing investors' understanding of futures and options trading.

Conclusion

In conclusion, CICC Futures emerges as a reputable player in the financial industry, boasting a solid backing from China International Capital Corporation (CICC) and a commitment to providing investors with advanced trading technology through platforms like Boyi Cloud and Jinshida econsign. With a focus on education and professional service, they strive to empower both institutional and individual investors in the complex world of futures and options trading. CICC Futures remains a formidable choice for those seeking to navigate the commodities, stocks, and indices markets in China, leveraging their expertise and technological prowess.

Frequently Asked Questions (FAQs)

| Q 1: | Is CICC Futures regulated? |

| A 1: | Yes. It is regulated by CFFEX. |

| Q 2: | How can I join the trading competition? |

| A 2: | You need to have a trading account and submit personal information. |

| Q 3: | Does CICC Futures offer demo accounts? |

| A 3: | Yes. |

| Q 4: | Can I have an account in any currency? |

| A 4: | You can open the account in Chinese yuan. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 5-10 years

- Regulated in China

- Futures License

- Suspicious Scope of Business

Comment 5

Content you want to comment

Please enter...

Comment 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Amarilys Mejias

Venezuela

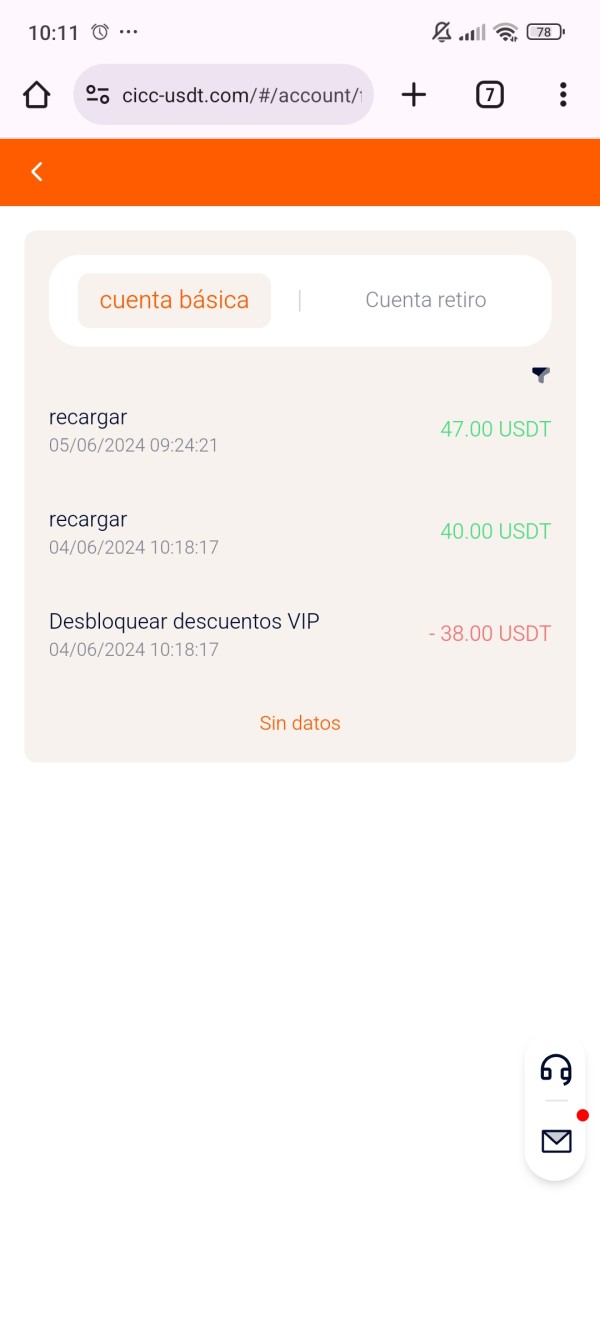

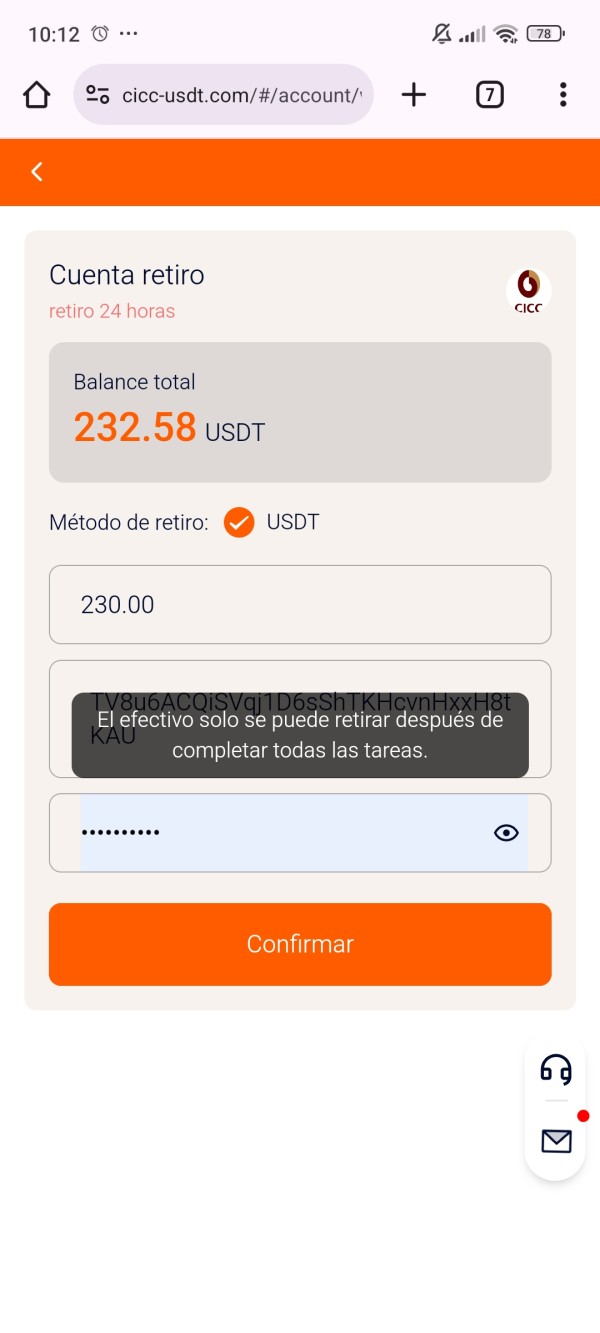

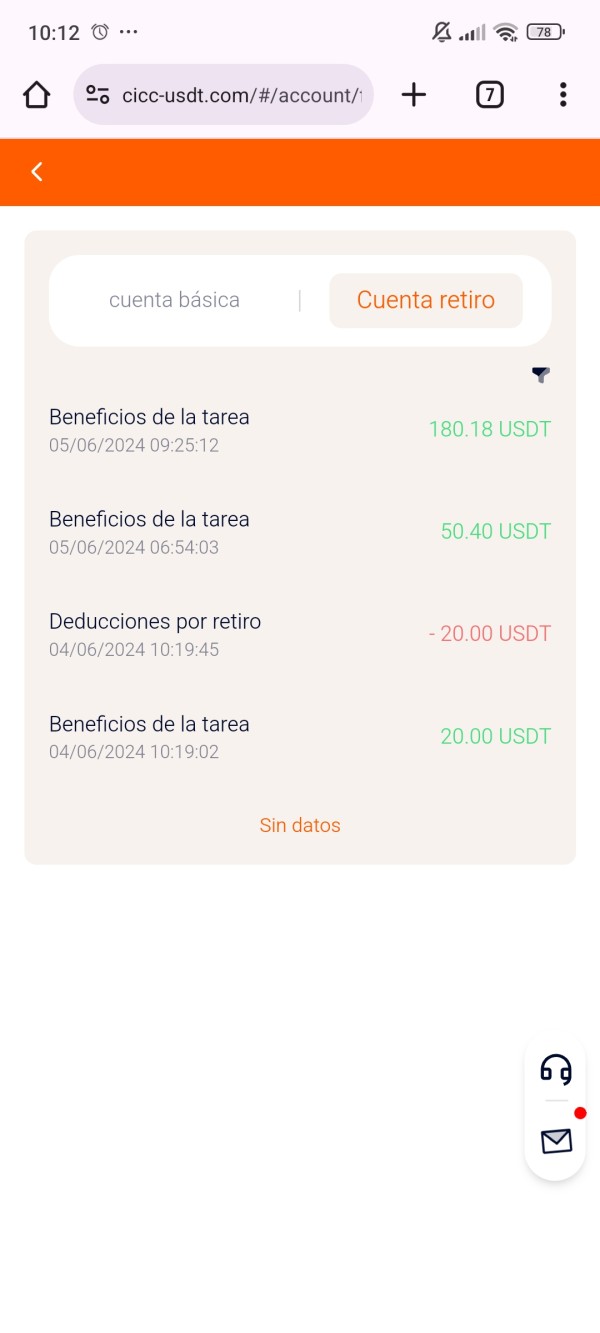

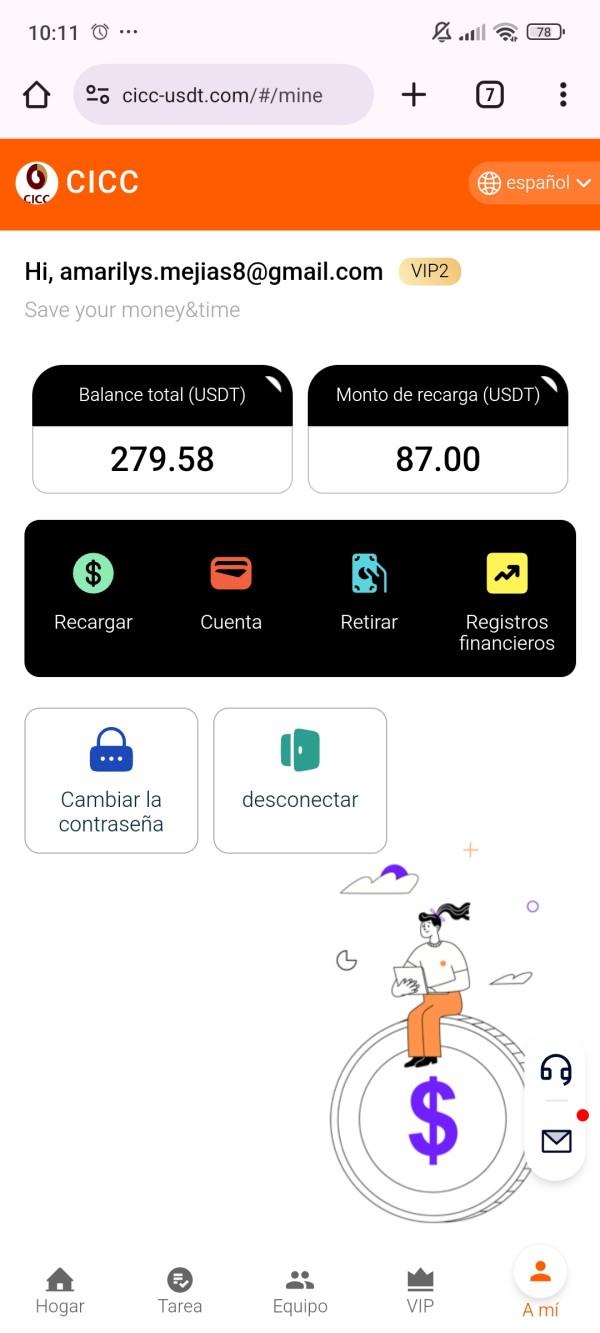

Today I want to present my case because yesterday I invested $40 in this app. I was able to withdraw only $20, today I wanted to do the task to withdraw another $20 and it won't let me. It asked me for a recharge of $47 to be able to withdraw, I recharged, the "task" was done and I can't withdraw my money. In total I invested $87 in this app and I only withdrew $20. If you can help me to recover the investment, I would be very grateful. I also leave the images where you can see the link to which one makes the transfer through binance.

Exposure

2024-06-05

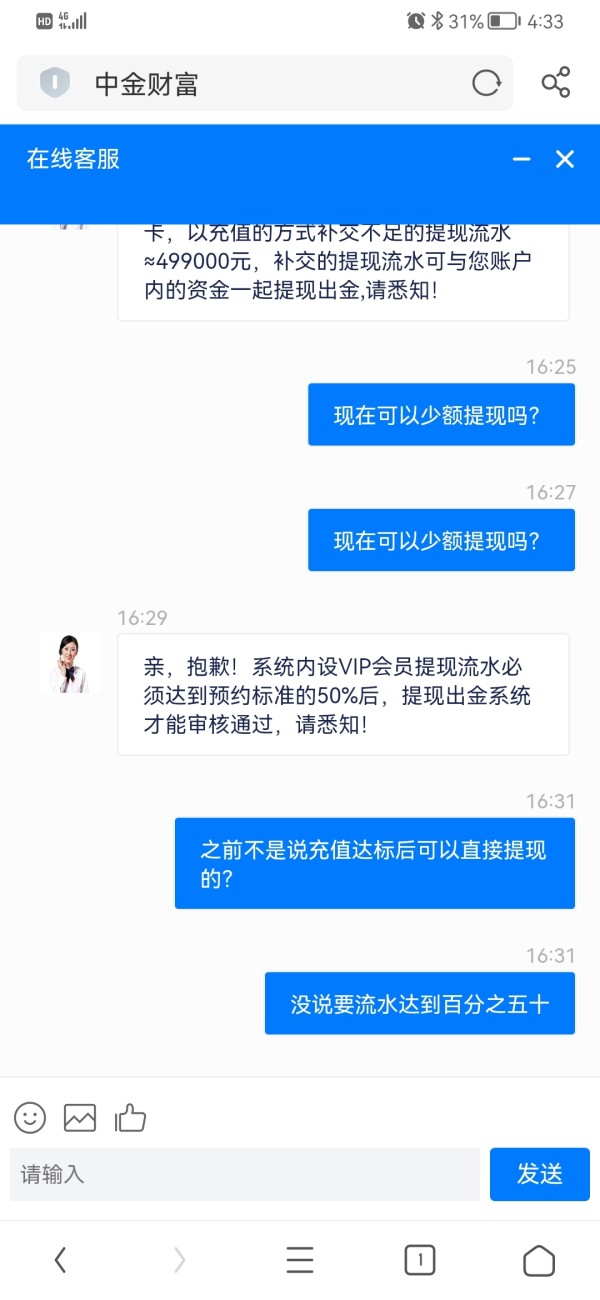

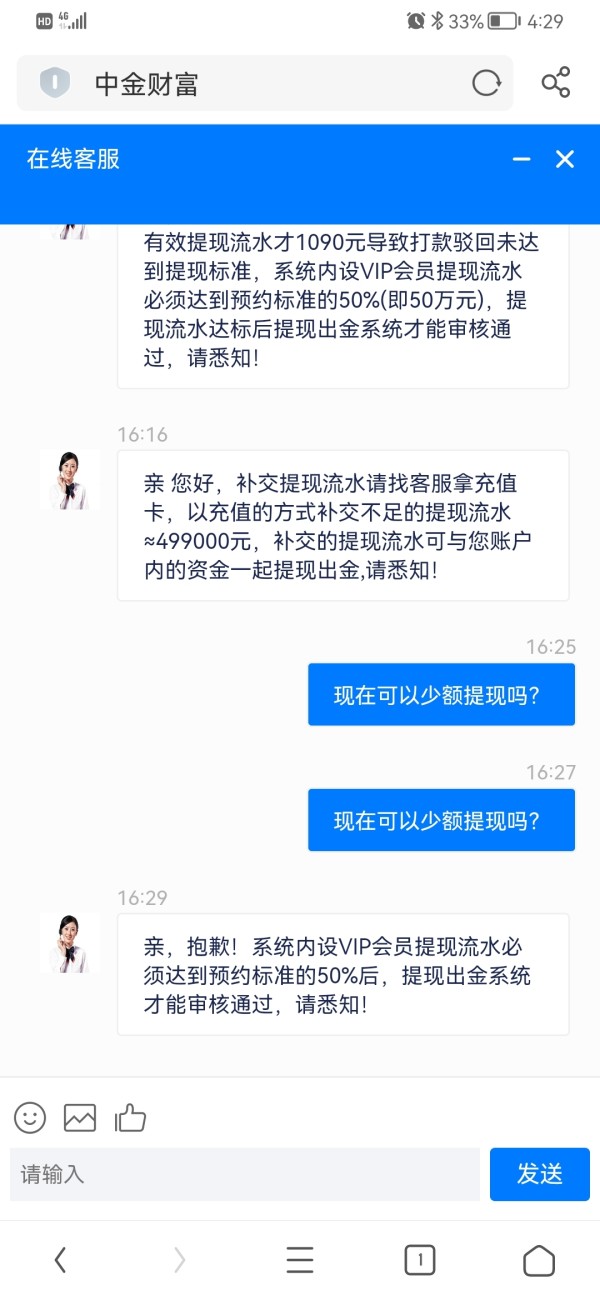

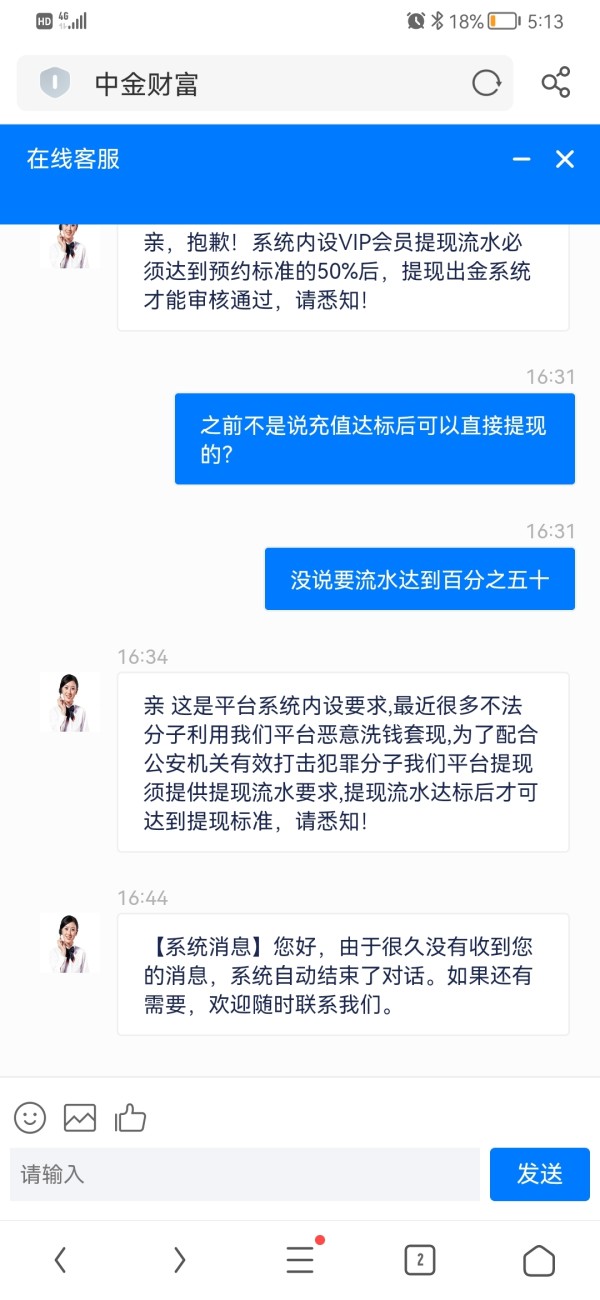

静4528

Hong Kong

I deposit 1 million for Vip and said I could withdraw it immediately, but the withdrawal did not pass after the deposit reached the standard. They said that the cash flow was not enough, and I was also asked to deposit another 500,000 for cash flow before I could withdraw. They did not inform it before. It said that I can withdraw immediately after reaching the requirements. I feel I was cheated.

Exposure

2022-05-06

FX3792673861

Hong Kong

A stranger called me, recommending some stock. Since I trade stock in daily, I passed his friend’s request. Then he pulled me into a group, in which the teacher gave stock analysis and recommendation. The teacher added me, saying that he was doing research on a bull stock, and told me to follow him. Though the result wasn’t as exaggerated as expected, I didn’t suffer losses. Following him, I made some profits. Then he recommended CICC Futures and encouraged us to follow him. Having seen many members profiting, I joined and deposited 50000 RMB. Within half month, I earned a lot. I added 500000 RMN or so to profit more, however, I made a loss of over 300000 RMB within 2 days. The teacher comforted me and promised to recover the losses for me. He said that I could sell my share by high price, while the funding channel was always stuck. He pretended to be telling the trader to control the price, at which time, I realized that the market could be manipulated. While I made a withdrawal, it was unavailable.

Exposure

2019-12-10

dgsrg

Morocco

I deposited 36,000 for VIP status at CICC Futures, anticipating an immediate withdrawal upon meeting the specified requirement. However, once the deposit reached the threshold, they claimed insufficient cash flow and insisted on an additional 18,000 deposit for withdrawal. This unexpected demand and deviation from the promised terms felt deceptive and left me dissatisfied.

Neutral

2023-12-20

Hugo Feng

Mexico

CICC Futures is a well-known financial company in China. It offers a variety of financial products such as futures. It is well regulated, which is the most important factor in my opinion. After all, what's the point of having other terms of treatment if you've been scammed out of your money?

Positive

2022-11-22