General Information

TRADEHALL is a trading platform that was established in 2020 and is headquartered in Australia. It offers a wide range of tradable assets, including Forex, Indices, Shares, Crypto, Commodities, and ETFs, catering to the diverse needs of traders. With multiple account types available, such as Standard, ECN-PRO, and ECN-VIP, traders can choose an account that suits their trading preferences and capital requirements.

One of the notable features of TRADEHALL is its provision of popular trading platforms like MetaTrader 5, Web Trader, and a mobile trading platform. These platforms offer advanced trading tools, analysis features, and a user-friendly interface, enabling traders to execute trades efficiently and effectively. TRADEHALL also provides educational resources in the form of videos and articles, aimed at helping traders improve their trading skills and knowledge.

While TRADEHALL offers several advantages, there are some considerations to keep in mind. It is important to note that TRADEHALL is not authorized by the National Futures Association (NFA) in the United States, which may raise concerns for traders based in the US. Additionally, there is a lack of transparency regarding spreads, commissions, and non-trading fees, which can make it challenging for traders to evaluate the overall cost of trading. Lastly, the customer support options provided by TRADEHALL are limited to email and phone, which may be a drawback for traders who prefer more immediate or alternative methods of communication.

Is TRADEHALL Legit?

TRADEHALL is regulated by the Australia Securities & Investment Commission (ASIC) with the license number 001282038. However, it is important to note that TRADEHALL's regulatory status with the National Futures Association (NFA) in the United States is “Unauthorized” with the license number 0530678. Please be aware of the risk!

Pros and Cons

The followings are the pros and cons of TRADEHALL. Please note that it is important to thoroughly assess the advantages and disadvantages of any brokerage firm, including TRADEHALL, before opening an account to ensure it aligns with your specific investment needs and preferences.

Market Instruments

TRADEHALL provides a complete assortment of classes across the global financial markets including Forex, Indices, Shares, Crypto, Commodities, as well as ETFs.

Forex – EUR/USD, GBP/USD, AUD/CAD…

Indices – S&P500, DOW30, FTSE100…

Shares – Facebook, Tesla, Amazon…

Commodities – gold, silver, crude oil…

Crypto – BTC, ETH, XPR;

ETFs – SPDR Gold Trust, US Oil Fund…

Here is the comparison table of trading instruments offered by various brokers:

Accounts Types

TRADEHALL offers three different types of trading accounts: Standard, ECN-PRO, and ECN-VIP. The Standard account requires a minimum deposit of $100 and offers leverage of up to 500:1. It features variable standard spreads, a minimum trade size of 0.01 lot, and allows trading in forex, indices, commodities, shares, cryptocurrencies, and ETFs. The MetaTrader platform is available for this account on various operating systems, including Windows, Mac OS, Linux, and mobile apps.

The ECN-PRO account requires a higher minimum deposit of $3,000. It provides leverage of up to 200:1 and features variable raw spreads. The minimum trade size is also 0.01 lot, and it supports trading in forex, indices, commodities, shares, cryptocurrencies, and ETFs. Similar to the Standard account, the ECN-PRO account can be accessed through the MetaTrader platform on different operating systems.

The ECN-VIP account is the highest-tier account offered by TRADEHALL, requiring a minimum deposit of $20,000. It offers leverage of up to 100:1 and features variable raw spreads. The minimum trade size is 0.01 lot, and it allows trading in forex, indices, commodities, shares, cryptocurrencies, and ETFs. The MetaTrader platform is available for this account on various operating systems, including Windows, Mac OS, Linux, and mobile apps.

These different account types cater to traders with varying trading preferences and capital requirements, providing options for both beginner and advanced traders.

How to Open an Account?

Visit the TRADEHALL website. Look for the “OPEN ACCOUNT” button on the homepage and click on it.

2. Type your email & click, send verification code

3. Login your “Account” and verify your account by filling up the details

4. Proceed to deposit funds to your account

5. Download the platform and start trading

You can watch the video below to see the registration steps

Spreads & Commissions

Depending on the account type, TRADEHALLs spreads can either be variable standard or variable raw.

Standard implies there are no commissions while raw means the broker charges a certain amount per lot. The exact pip level wasn‘t disclosed. TRADEHALL just said they’re “competitive”.

Leverage

The leverage with TRADEHALL reaches 1:500. TRADEHALL offers leverage options for traders across its different account types. The leverage ratios available are as follows:

Standard Account: The Standard account provides leverage of up to 500:1. Traders can access this account with a minimum deposit of $100.

ECN-PRO Account: The ECN-PRO account offers leverage of up to 200:1. To open this account, traders need to deposit a minimum of $3,000.

ECN-VIP Account: The ECN-VIP account provides leverage of up to 100:1. Traders interested in this account must deposit a minimum of $20,000.

These different account types cater to traders with varying trading preferences and capital requirements, providing options for both beginner and advanced traders.

Non-Trading Fees

According to the information available on the TRADEHALL website, there are no charges associated with withdrawals. However, specific details about other non-trading fees, such as account maintenance fees, inactivity fees, and currency conversion fees, are not provided.

Trading Platforms

TRADEHALL provides traders with a choice of trading platforms, including the advanced MetaTrader 5, the web-based Web Trader, and the convenient mobile trading platform. These platforms cater to different preferences and trading styles, allowing traders to access the markets and trade effectively using their preferred devices.

Meta Trader 5: This section refers to the desktop version of MT5. Widely considered the greatest trading platform in the industry, MT5 set standards even higher than its predecessor MT4.

The platform offers algorithmic trading, live market reports, instant execution, in-depth market analysis and more, exerting the full potential of the MQL5 programming language. The download link can be found on the website.

Web Trader: TRADEHALL also offers a web-based platform. Keep in mind that WebTrader is nowhere near MT5. It doesnt have advanced tools and options.

Its main features are basic charts and graphs. As such, only absolute beginners can benefit from it.

Mobile Trading Platform: The mobile version of MT5 offers one-click trading. Its available for both Android and iOS operating systems.

Traders can utilize three chart types, 30 technical indicators, and the full trading history journal, according to the brokers website. The mobile version is great for trading on the go.

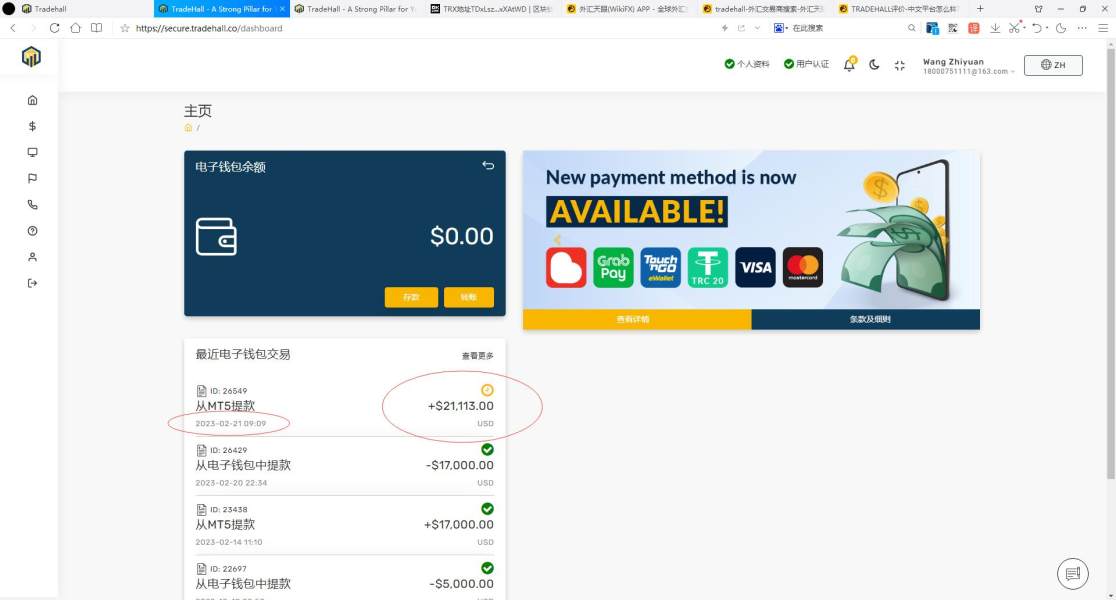

Deposit and Withdrawal Methods

TRADEHALL offers various payment options for both depositing and withdrawing funds, including Bank Wire, VISA, MasterCard, UnionPay, PayPal, Neteller, Skrill, Webmoney, and ePayments. The minimum deposit and withdrawal amount is $100, and there are no charges associated with withdrawals.

Here is the comparison table of minimum deposits required by four different brokers:

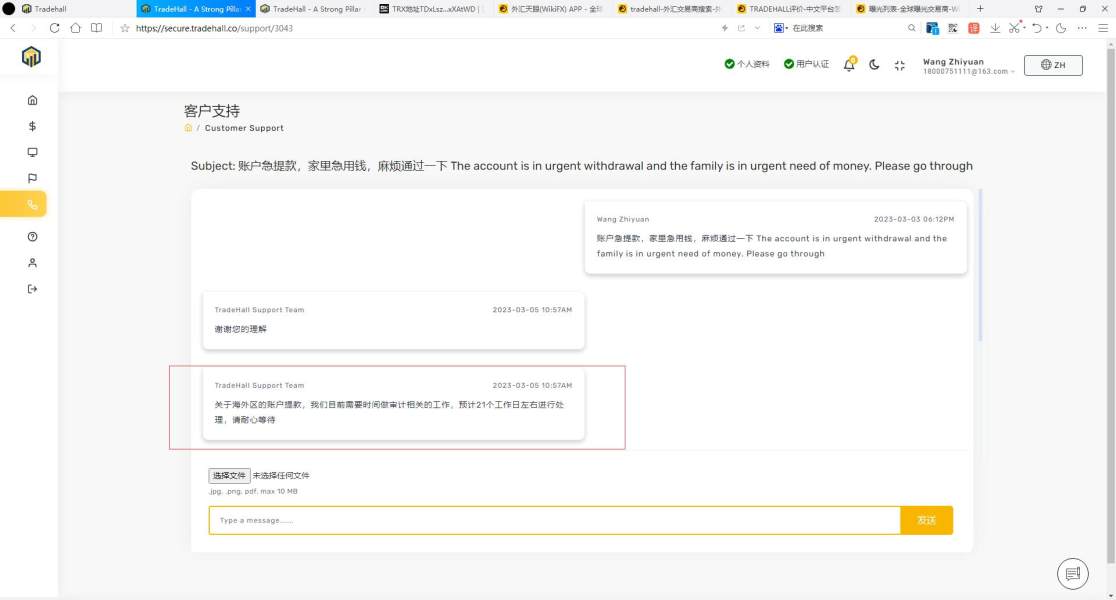

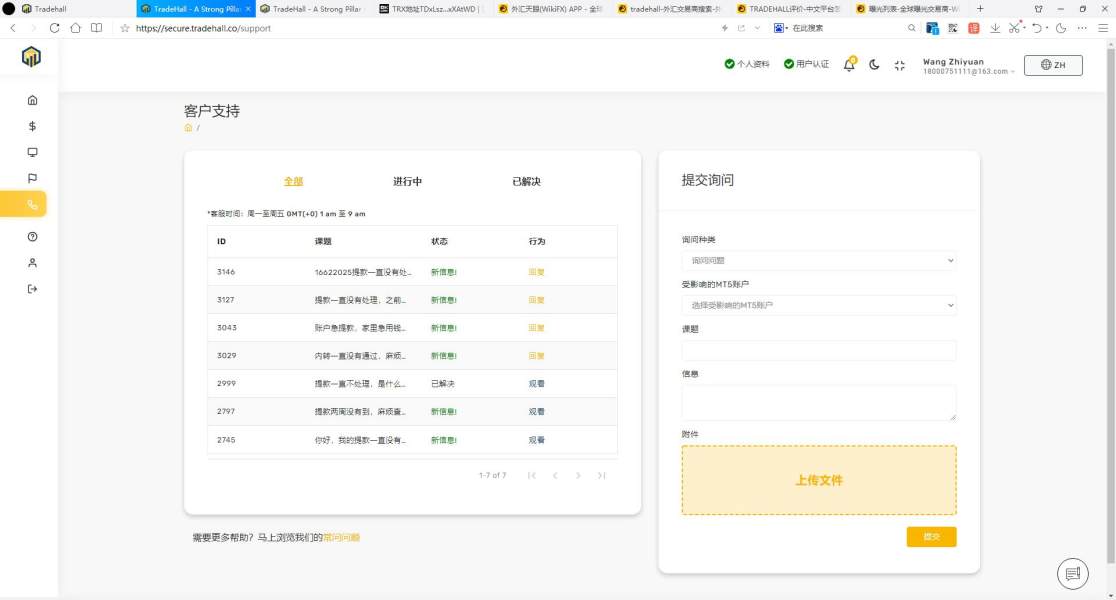

Customer Support

TRADEHALL offers customer service support through various channels, including email and phone. Traders can contact their support team by emailing support@TRADEHALL.co or calling their Asia office at +603 48169431. Additionally, traders can leave a message on TRADEHALL's official website and expect a response from the support team. The customer service team is available 24/7 to assist traders with their inquiries and provide necessary support.

Educational Resources

TRADEHALL provides a range of educational resources to support traders in their journey. One of their key offerings is a series of educational videos that are designed to cater to traders of all levels, particularly beginners. These videos serve as an excellent starting point for those new to trading, providing valuable insights and knowledge about various trading concepts and strategies. With these short yet informative videos, traders can learn at their own pace and gradually enhance their trading skills.

In addition to the educational videos, TRADEHALL also offers other educational materials, such as articles, that cover the basics of forex trading. These resources aim to provide traders with a solid foundation and understanding of the forex market, enabling them to make more informed trading decisions. By utilizing these educational resources, traders have the opportunity to progress from being a novice to becoming knowledgeable and skilled forex traders.

User Experience and Additional Features

TRADEHALL offers a PAMM (percentage allocation money management) service where investors can entrust their accounts to skilled fund managers. These managers execute trades on behalf of the investors, and profits are shared based on a 70:30 agreement. This feature provides convenience and allows investors to benefit from the expertise of professional traders while maintaining control over their investments.

Bonus

TRADEHALL offers a deposit bonus program where traders can earn 50% of their deposit back as an extra trading fund. This bonus is available to traders who register for a TRADEHALL Live Account and deposit a minimum of $100. The deposit bonus can be used for trading in a real live account and is also withdrawable.

Conclusion

In conclusion, TRADEHALL offers a comprehensive trading experience with a wide range of assets, multiple account types, popular trading platforms, and educational resources. However, traders should carefully consider the platform's regulatory status, transparency, and customer support options before deciding to trade with TRADEHALL.

FAQs

Q: Is TRADEHALL a legitimate brokerage company?

A: Yes, TRADEHALL is a legitimate brokerage company regulated by the Australia Securities & Investment Commission (ASIC). However, it is important to note that it is not authorized by the National Futures Association (NFA) in the United States.

Q: What trading instruments are available on TRADEHALL?

A: TRADEHALL provides a variety of trading instruments, including Forex, Indices, Shares, Crypto, Commodities, and ETFs.

Q: What types of trading accounts does TRADEHALL offer?

A: TRADEHALL offers three types of trading accounts: Standard, ECN-PRO, and ECN-VIP. Each account has different minimum deposit requirements, leverage ratios, and features to cater to various trading preferences and capital requirements.

Q: What leverage options does TRADEHALL provide?

A: TRADEHALL offers leverage options of up to 500:1 for the Standard account, up to 200:1 for the ECN-PRO account, and up to 100:1 for the ECN-VIP account.

Q: What are the spreads and commissions on TRADEHALL?

A: TRADEHALL offers variable spreads, depending on the account type. The Standard account has variable standard spreads, while the ECN-PRO and ECN-VIP accounts have variable raw spreads. The exact pip levels and commissions are not disclosed.

NIODay

Hong Kong

Tradehall withdrawals have not been processed for 6 months. The platform will reply within 21 days. Until August, there is still no reply, no processing

Exposure

2023-08-16

Stanley Yeoh Boon Hwa

Malaysia

Simmi Goh’s own platform, I have used it before, the cost is higher than other platforms, and I can only use MT5. I don’t like MT5, and I can’t use many indicators. I can only use her own Vtrade and other Basic Indicators.

Neutral

2023-01-08

!95555

United Kingdom

No tiered trading accounts provided, hmmm, makes me slightly disappointed. I’d love to try different account types, and this is the source of excitement i have been playing in the forex industry.

Neutral

2022-12-19

程程20434

United States

TRADEHALL has a lot to show for and offer both beginners & experienced traders around the world. This broker stands out as one of the best online brokers out there.

Positive

2023-02-28

天天贸易

Japan

The company TRADEHALL looks great, but I don’t know why wikifx shows that its NFA license is not authorized. Can anyone tell me?

Positive

2022-12-15

Xingo

Japan

I have been trading with TRADEHALL for three or four months and I am very satisfied so I would like to recommend it to you! The speed of the transaction is great, and there is no serious slippage or secondary quotation. The deposit and withdrawal are also ok, so you can trade with confidence!

Positive

2022-12-14