Overview of SW MARKETS

SW Markets, founded in 2017 and based in Hong Kong, is regulated by the Vanuatu Financial Services Commission. It offers trading in Forex, indices, and commodities, with a maximum leverage of 1:100 and spreads as low as 10 points. The platform features an independent R&D platform, accessible via web and mobile versions, and provides 24-hour customer support through email, QQ, and online submission.

The platform's advantages include a detailed deposit and withdrawal process and a variety of educational resources like trading analysis and forecasts.

Is SW MARKETS legit or a scam?

SW Markets Global Ltd is regulated by the Vanuatu Financial Services Commission with an offshore regulatory status, holding a Retail Forex License (License No. 40357) since June 2, 2023. This regulation provides traders on the SW Markets platform with a certain level of oversight and regulatory compliance, which can influence trader confidence and security. The offshore regulatory nature also impact the range of services and protections available to traders compared to onshore regulations.

Pros and Cons

Pros of SW Markets:

Regulated by VFSC: Ensures legal compliance and a degree of security for traders.

Independent R&D Trading Platform with Download: Offers a proprietary trading platform, designed to meet specific trader needs.

24-Hour Customer Service: Provides round-the-clock support for user inquiries.

Daily Market Trend Analysis: Helps traders stay informed with up-to-date market trends.

Regular Monthly Promotional Activities: Offers potential benefits to traders through regular promotions.

Cons of SW Markets:

Market Instruments

SW Markets offers a range of trading assets in three primary categories:

Forex: This includes a wide array of currency pairs, allowing traders to engage in the global foreign exchange market.

Indices: Traders have access to various global indices, which represent different sectors and geographies, offering a way to trade on the overall performance of distinct market segments.

Commodities: This category provides options to trade in physical goods like metals, energy, and possibly agricultural products, enabling traders to diversify their portfolios with commodities.

How to Open an Account?

To open a real account with SW Markets, follow these three steps:

Open the registration page on the SW Markets website and choose your preferred registration method.

Fill in your personal information accurately and set a secure login password.

Click on the “Trade Now” button to finalize and complete the account opening process.

These steps are designed to streamline the account creation, making it straightforward for new users to start trading.

Leverage

SW Markets offers a maximum leverage of 1:100. This leverage ratio means that traders can control a larger position in the market with a relatively small amount of capital.

However, it's important for traders to understand that while higher leverage can amplify profits, it also increases the risk of significant losses. This level of leverage is suitable for traders who have a clear understanding of leverage risks and have strategies to manage them effectively. For more information, please visit the SW Markets website.

Spreads & Commissions

SW Markets offers a variety of spreads and commissions across different market instruments. For Forex, spreads vary by currency pair, with some pairs having spreads as low as 10 points. Indices trading offers floating spreads on various global indices, and commodities trading includes assets like USOIL and Gold with specific spreads for each.

SW Markets also features a commission structure set at zero, adding to the appeal for various types of traders. This zero commission policy, combined with the varying spreads across different market instruments, provides a cost-effective trading environment, particularly attractive to traders who execute a high volume of transactions.

Trading Platform

The trading platform of SW Markets has an intuitive and straightforward interface, allowing traders to operate independently based on their experience and preferences. It supports a variety of online trading options including foreign exchange, crude oil, precious metals, Hong Kong stocks, and US stocks. SW Markets emphasizes a customer-centric approach and provides a functional and user-friendly platform. It offers both a web version, accessible through browsers, and a mobile version available for download on the App Store and Google Play, enabling trading on multiple devices.

Deposit & Withdrawal

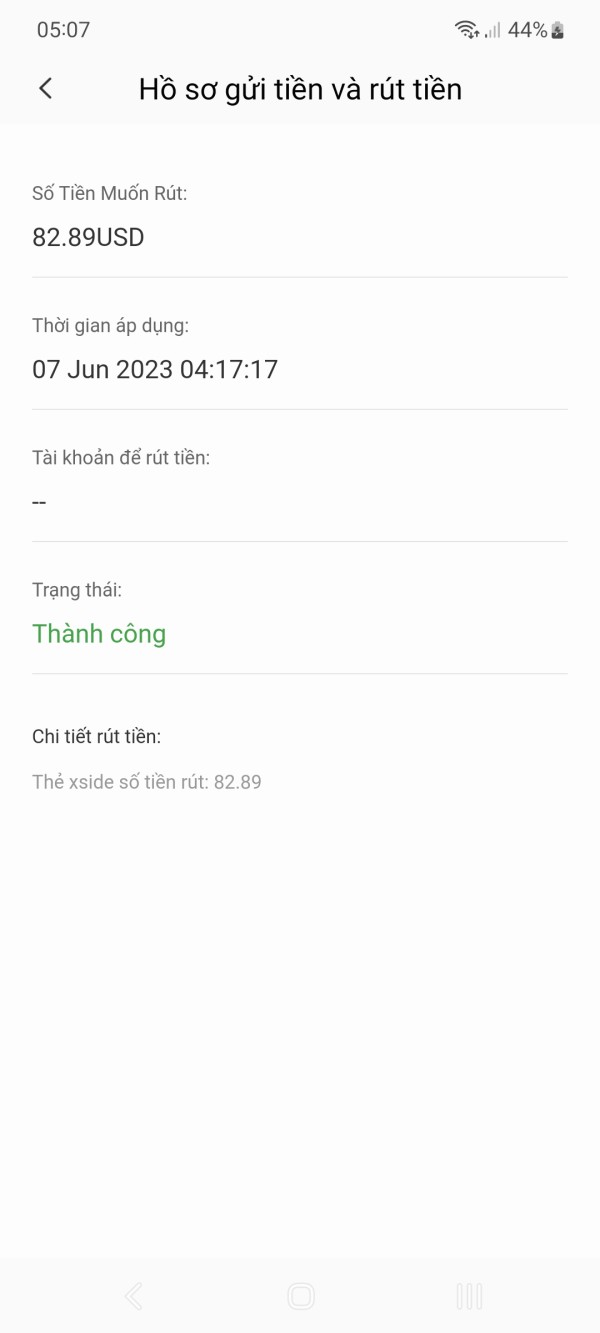

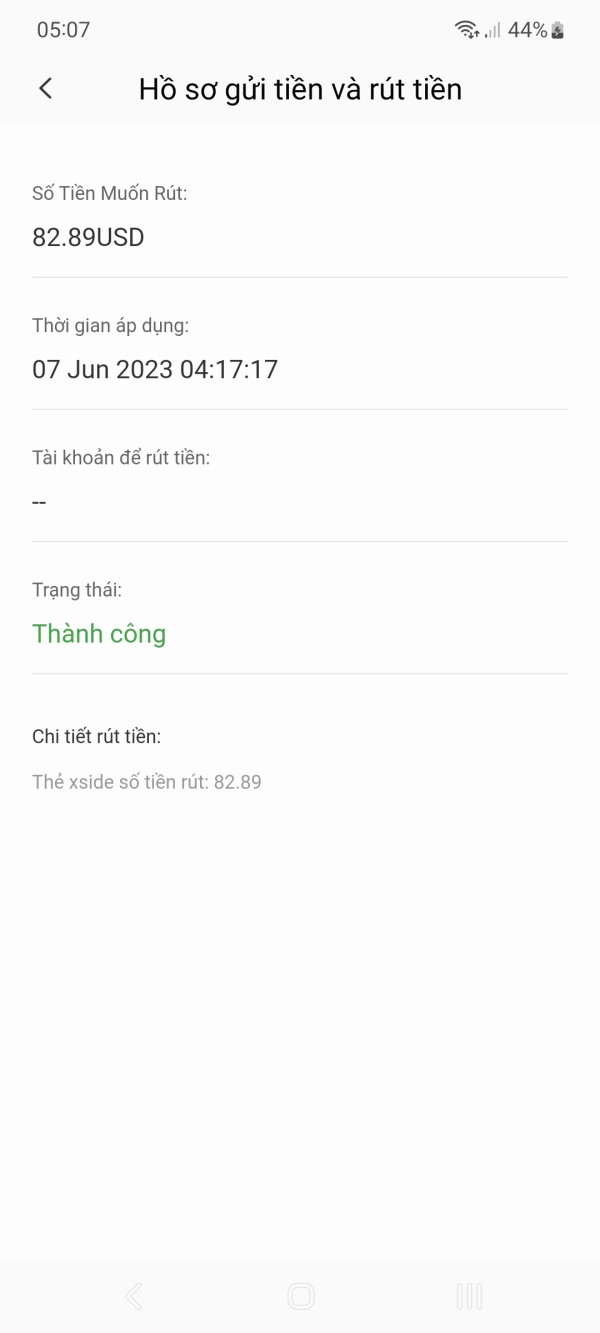

At SW Markets, the deposit process involves logging into the “User Center,” selecting the deposit option, choosing a payment channel, entering the amount, and confirming the payment.

The withdrawal process is similar, requiring login, account verification, amount entry, and submission for processing.

Customer Support

SW Markets provides customer support through various channels. Customers can contact support via QQ at 8377339471 for immediate assistance. Additionally, there's an option to reach out through email at info@swmarkets.com.

The platform also offers an online submission form for inquiries or issues, enabling users to communicate their concerns directly through the website. This multi-channel approach meets different preferences and needs, ensuring accessible and responsive customer service. For more detailed information or to contact customer support, please visit the SW Markets website.

Educational Resources

SW Markets provides educational resources including “Trading Analysis” and “Trading Forecast,” which offer insights and predictions for various markets. They also feature “News” updates, giving traders information on current market events. “Sentiment” analysis is available, helping traders understand market mood and trends. Additionally, an “Economic Calendar” is provided, listing important economic events that can impact the markets.

Conclusion

SW Markets, regulated by the VFSC, offers a unique trading experience with its independently developed trading platform. Its 24-hour customer service and regular market trend analysis support traders in making informed decisions. The platform's regular promotional activities add value for its users.

However, SW Markets does not provide detailed information about account types and lacks clarity on withdrawal fees, which could affect traders seeking specific account features or cost transparency. Overall, the platform combines innovative technology and customer support, balanced by some gaps in detailed financial information. For more details, visit the SW Markets website.

FAQs

Q: What is SW Markets?

A: It's a trading platform regulated by the VFSC.

Q: What trading assets does SW Markets offer?

A: Forex, indices, and commodities.

Q: What are the trading platform features of SW Markets?

A: It includes an independent R&D platform with 24-hour customer service and daily market trend analysis.

Q: Are there promotional activities on SW Markets?

A: Yes, there are regular monthly promotional activities.

Q: How does one open an account with SW Markets?

A: Through a simple process involving registration, personal information entry, and confirmation.

Q: What is the maximum leverage offered by SW Markets?

A: The maximum leverage is 1:100.

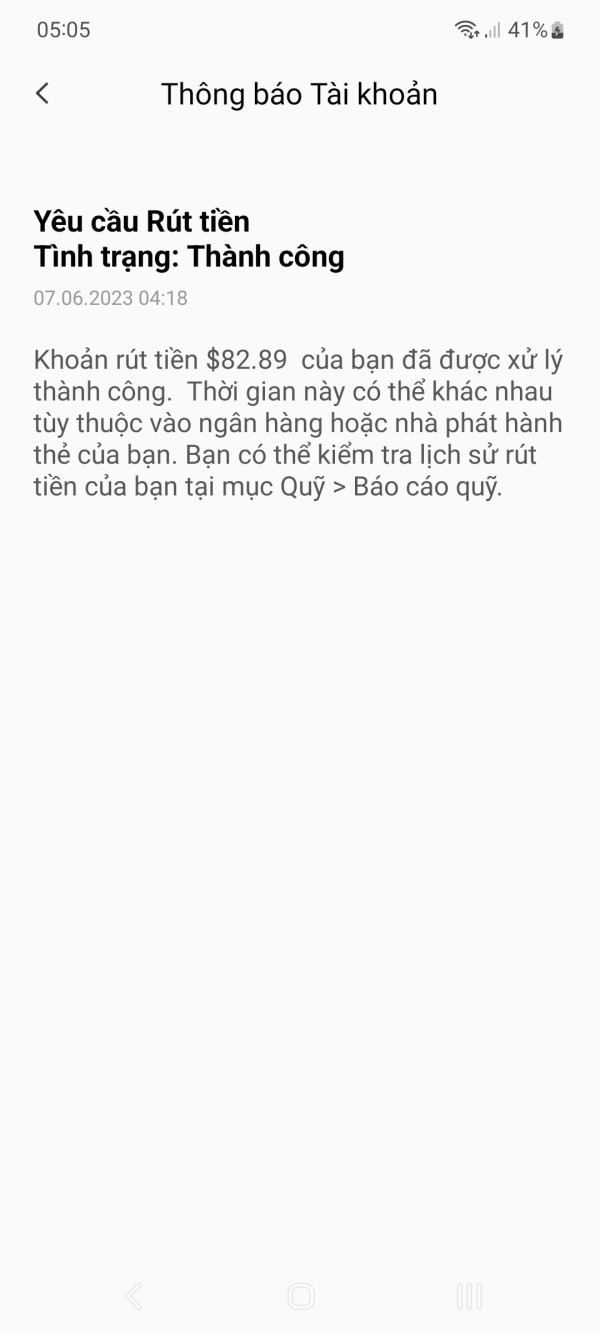

NGUYỄN XUÂN KIÊN

Vietnam

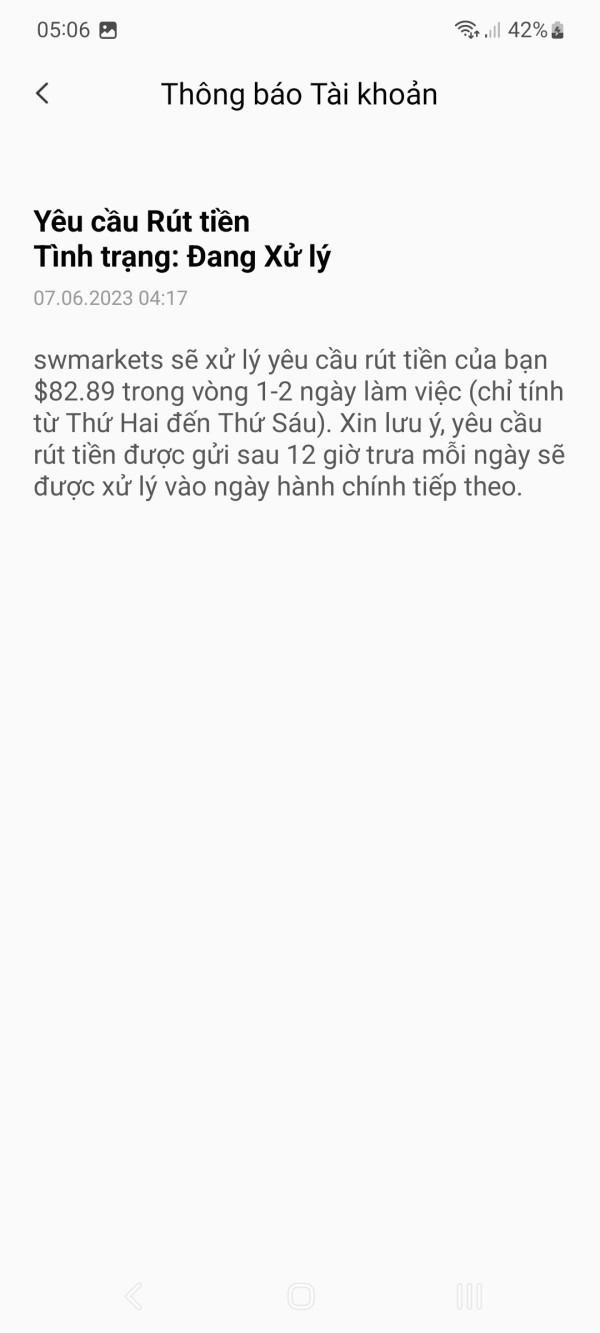

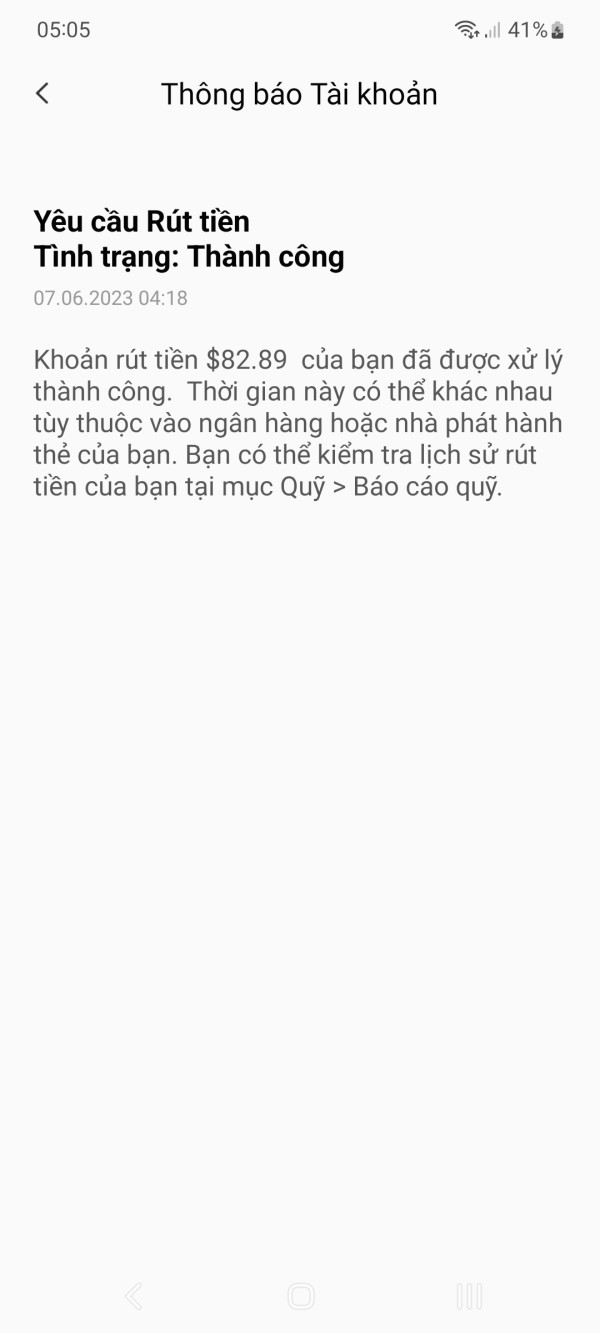

I once set up an account on SW markets and was given $30 for trading. When I used that 30 dollars to trade until 4 am, the profit was 52.89 dollars. Total is 82.89 dollars. At that time, it was also time for the exchange to close. And at 5am when the exchange returned, I re-entered my account and found that there was no money left and the system sent me a message that the withdrawal request was successful. While I haven't made any withdrawals and haven't even linked my bank account yet. At that time I thought it was a mistake to find support on the floor but there was only online support and it said that the online support system was not available, and there was no other way for me to contact and support. complaints. then I know this is a scam platform. I went to chplay to see their app and saw all fake comments, not real people, there was only 1 comment that was a real person and it cost him $100 like me. So I wrote this article to hope that everyone would be alert and avoid this platform, so don't download and recharge to avoid losing money.

Exposure

2023-06-07

NGUYỄN XUÂN KIÊN

Vietnam

I have created an account and was given 30 dollars to trade. When I trade until 4 am my profit + principal is 82.89 dollars. and at 5 am when the floor reopens, I go back and see my account. I have no money left. I was surprised at the network error and logged out and checked again, only to see that the system side sent me a message that successfully requested a withdrawal of $ 82.89 while I did not request a withdrawal and even my account. I am not linked to my bank account yet.

Exposure

2023-06-07

Aldam

Taiwan

The trader has its own trading APP, which I think is very convenient to trade through.However, its leverage level is not very flexible to people like me who pursue high profits.

Neutral

2024-07-01

A+

Cambodia

While this broker don't have the widest selection of trading products - just forex, commodities, and indices - their trading environment is super transparent and their tools are really useful. I always feel comfortable trading on their platform, which is easy to navigate and has a bunch of cool features. If you're looking for a trustworthy and user-friendly broker, I'd definitely recommend giving SW MARKETS a shot.

Neutral

2023-03-29

金融狂人

Hong Kong

SWmarkets trading platform was lagging on its web version. But I feel great when using mobile app, totally different feelings. It does not have much trading assets, but spreads on forex trading are quite tight. I can give it three stars.

Neutral

2023-03-07