Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information

What is TP Trades?

TP Trades is an online broker, operated by TP Trades Holding Limited, a company registered in Hong Kong. TP Trades advertises that it serves retail and institutional customers from over 180 countries in Europe, Asia, the Middle East, Africa and Latin America.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

TP Trades offers a decent selection of trading instruments, different account types, and leverages. Their MT4 trading platform is popular and user-friendly. However, TP Trades is not available for all residents all the world.

It's important to note that the lack of a valid regulatory license and unclear withdrawal fees/payment methods are significant cons that may outweigh some of the other pros. Traders should exercise caution when considering TP Trades as a potential broker.

TP Trades Alternative Brokers

There are many alternative brokers to TP Trades depending on the specific needs and preferences of the trader. Some popular options include:

FXCM - offers a wide range of trading instruments and educational resources, but its high minimum deposit and variable spreads may not be suitable for all traders.

Swissquote - provides a comprehensive range of trading instruments, advanced trading platforms, and strong regulatory oversight, but its high fees and minimum deposit may not be suitable for beginner traders.

Vantage FX - offers competitive trading conditions, multiple account types, and a wide range of trading instruments, but its limited regulatory oversight and lack of negative balance protection may not be suitable for all traders.

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is TP Trades Safe or Scam?

TP Trades has been registered with the National Futures Association (NFA) under regulatory license no. 0556682, which could give traders some trading confidence when trading with this broker.

Market Instruments

As a forex and CFD broker, TP Trades offers a range of more than 50 tradable instruments across several markets, including forex, spot metals, CFDs, and spot indices. Forex trading is available on major, minor, and exotic currency pairs, while spot metals trading allows clients to invest in gold and silver. CFD trading includes various products such as indices, commodities, and shares. TP Trades also offers spot indices trading that allows clients to invest in several indices, including the S&P 500, NASDAQ 100, DAX 30, and FTSE 100. Overall, TP Trades offers a relatively diverse range of instruments for traders to choose from.

Accounts

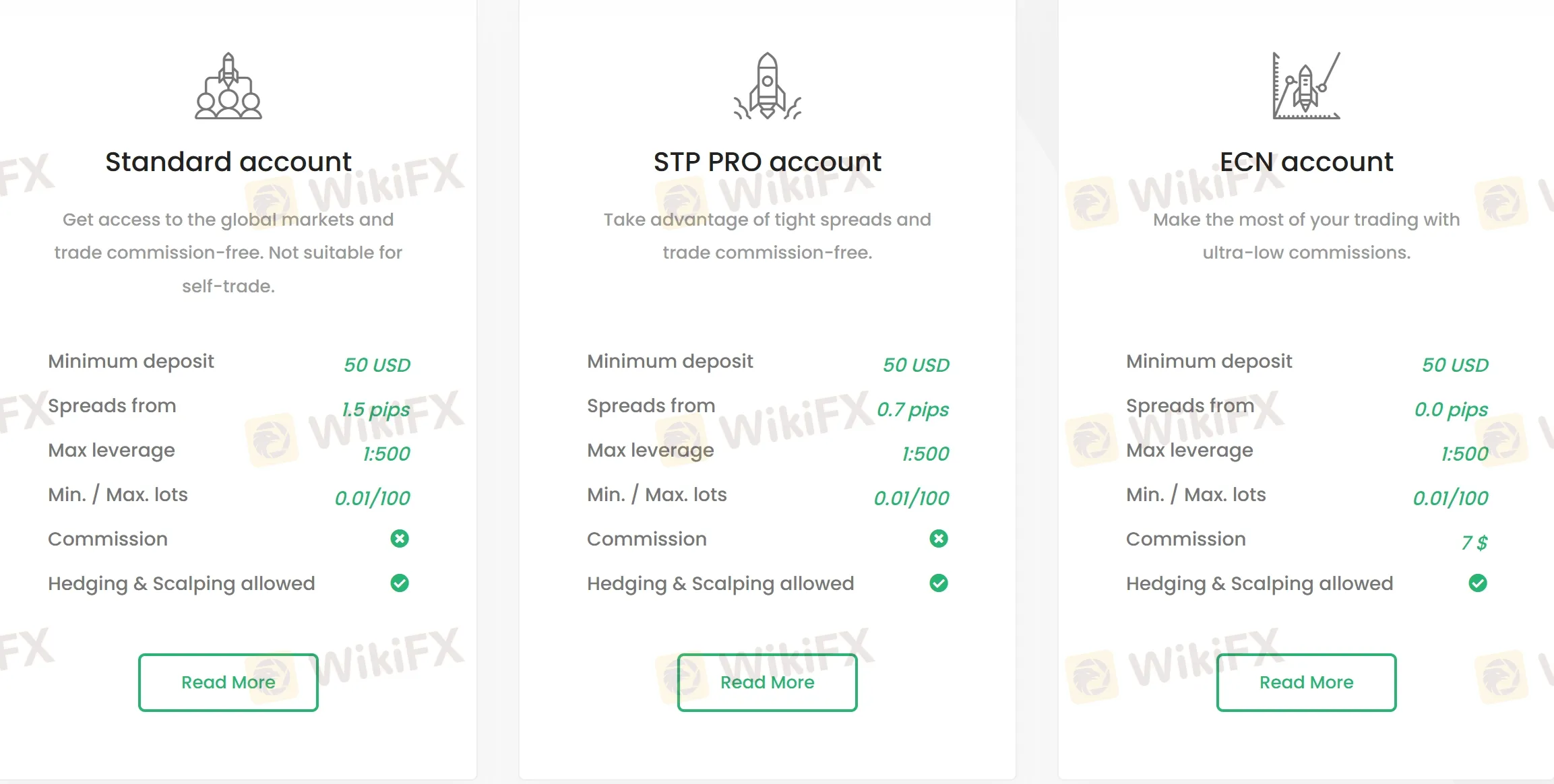

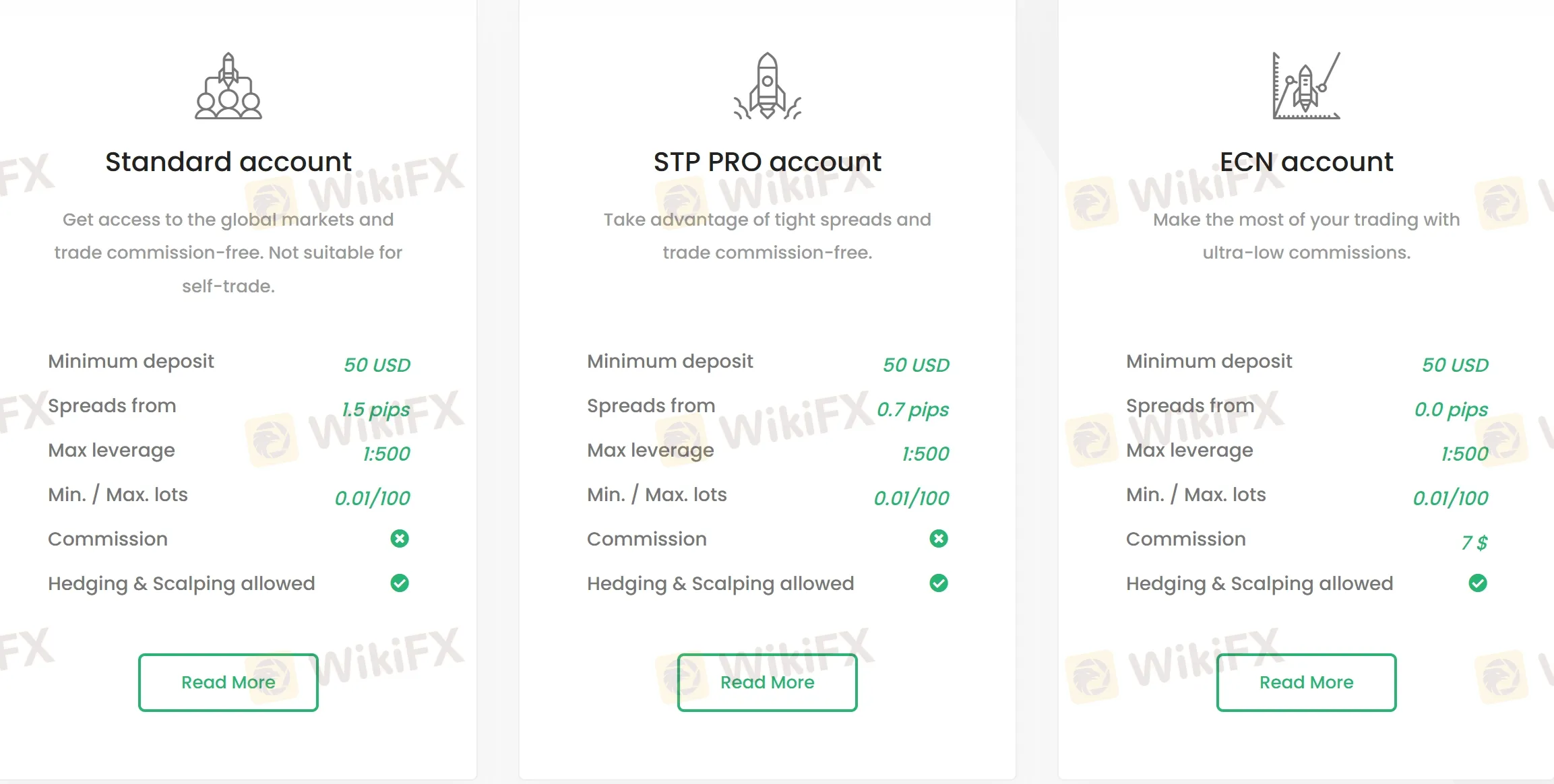

There are three trading accounts on offer: Standard, STP Pro and ECN accounts, with the minimum initial deposit for three accounts all as low as $50. Despite the low initial deposit, traders are not advised to open accounts here given the fact that TP Trade is unregulated.

Leverage

While TP Trades offers different leverage ratios for different account types, excessive leverage can increase the risk of losses. The leverage ratios offered by TP Trades are 1:500 for forex, 1:300 for metals, 1:200 for CFDs, and 1:7 for cryptocurrencies.

It is important for traders to carefully consider the appropriate leverage ratio for their trading strategy and risk management. It is recommended to use lower leverage ratios for inexperienced traders or those who are not comfortable with high levels of risk.

Spreads & Commissions

Spreads and commissions vary depending on various trading accounts. The minimum spreads on the Standard accounts start from 1.5 pips, from 0.7 pips in the STP Pro account, both with no commissions charged. However, ECN accounts charge a commission of $7 per lot with a minimum spread of 0.0 pips. It is essential to note that traders should consider these costs when making their trading decisions, as they can affect profitability.

Below is a comparison table about spreads and commissions charged by different brokers:

Note that the actual spreads and commissions charged by each broker may vary depending on various factors, including the account type and market conditions.

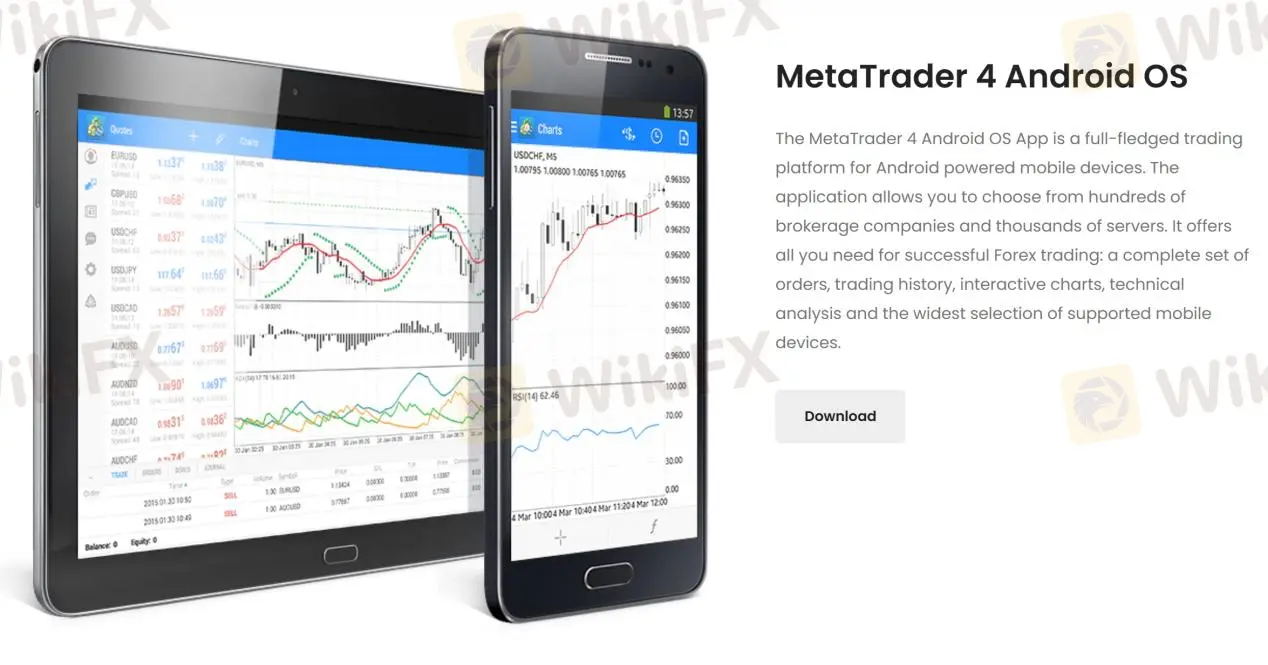

Trading Platforms

When it comes to trading platform available, what TP Trade offers is the White Label MT4 trading platform, available for Windows, iPhone/iPad, Android iOS. The MT4 platform is a well-known and widely-used trading platform in the industry, offering advanced charting tools, technical analysis, and a range of order types. The platform also supports automated trading through expert advisors (EAs) and allows for customization of indicators and charting tools. The availability of the MT4 platform on multiple devices allows for flexibility and convenience for traders who prefer to trade on-the-go.

See the trading platform comparison table below:

Deposits & Withdrawals

TP Trades does not clarify payment methods it supported, but provides some deposit and withdrawal details. Withdrawal less than $5,000.00 shall be made within 24 hours, for the amount more than $5,000.00 shall be made within 5 working days. Besides, the company reserves the right to allow minimum withdrawal of $10 each time and the maximum daily limit of $20,000, the amount exceed the limit will be handle on case by case basis.

TP Trades minimum deposit vs other brokers

See the deposit/withdrawal fee comparison table below:

Please note that the above information is subject to change and you should always refer to the broker's official website for the most up-to-date information.

Customer Service

The TP Trades customer support team can be reached 24/7 though live chat, email (support@tptrades.com) and online messaging. However, the broker does not have a phone number listed for customer service. Additionally, there is limited information available on their website about their customer service team and their qualifications. It is always recommended to exercise caution when dealing with brokers that do not have a clear and transparent customer service policy.

Note: These pros and cons are subjective and may vary depending on the individual's experience with TP Trades' customer service.

Conclusion

TP Trades is broker with various trading instruments and account types, but lacks transparency in certain areas such as payment methods. The company offers competitive spreads and commissions for its accounts, and provides a reliable trading platform in the form of the MT4.

Frequently Asked Questions (FAQs)

new1864

Thailand

The manager asked me to keep depositing money. I found that there was something wrong with their quotes. They intervened in the market quotes. I suspect that they are fraudulent brokers. I have lost 23,000$, this is a Scam

Exposure

2023-05-22

Marshall111

New Zealand

TP Trades platform's functionality is, like, a total letdown—clunky interface, and it crashes more often than my old laptop! And don't get me started on the trading variety; it's so limited, I felt like I was trading with one hand tied behind my back.

Neutral

2024-04-28

JC老姜

Nigeria

TP Trades is a great broker! I used to trade with its ECN account for three months and I can prove that spreads on this platform are nearly raw, especially for the eur/usd pair. Withdrawals have no problems too. But I feel that they can attract more people if they provide real-time communication channels.

Neutral

2023-03-20

FX2945530265

Thailand

I have been using this broker for more than 1 year. The deposit and withdrawal system is better than other brokers

Positive

02-12

joe6358

Thailand

I feel at ease when trading here, convenient deposits and withdrawals and very fast including stable spreads during news announcements and a support team that provides services 24 hours a day, every day

Positive

2024-11-03

FX3210039978

Thailand

Hey they are great . there support team is also good and they do your work very fast if you want them to do anything according to your account needs. There spreads are good . Withdrawal is really fast . I got money within 10 sec.

Positive

2024-08-06

FX8458155842

Thailand

support conversational interactions rather than chatbots.

Positive

2024-08-05

FX3210039978

Thailand

It is a reliable broker. They have license and offer fast transactions. Deposit and withdrawal is really fast. They have many activities such as competition and rewards🌈 , everything else has been smooth and hassle-free.

Positive

2024-08-05

FX1686198408

Cyprus

A very trustworthy broker. As always when you run into problems there won't be big issues since the helpdesk and the support team will be ready to assist when needed(They always do)

Positive

2024-06-14

未来集市店主:5232848

Singapore

I had a good experience. It is the best platform to invest and also learn and take care of your finances. I would recommend it to anyone willing to take that step.

Positive

2022-12-16