Overview of Yescom Financial Limited

Yescom Financial Limited is an unregulated financial institution based in Hong Kong. It has been operating for 1-2 years and claims to offer trading services in forex, precious metals, stock indexes, and CFDs. However, it is important to note that Yescom Financial Limited does not possess a valid regulation and has an unauthorized status according to the National Futures Association (NFA) in the United States. There have also been several complaints against this broker in recent months, indicating potential risks associated with dealing with an unregulated entity.

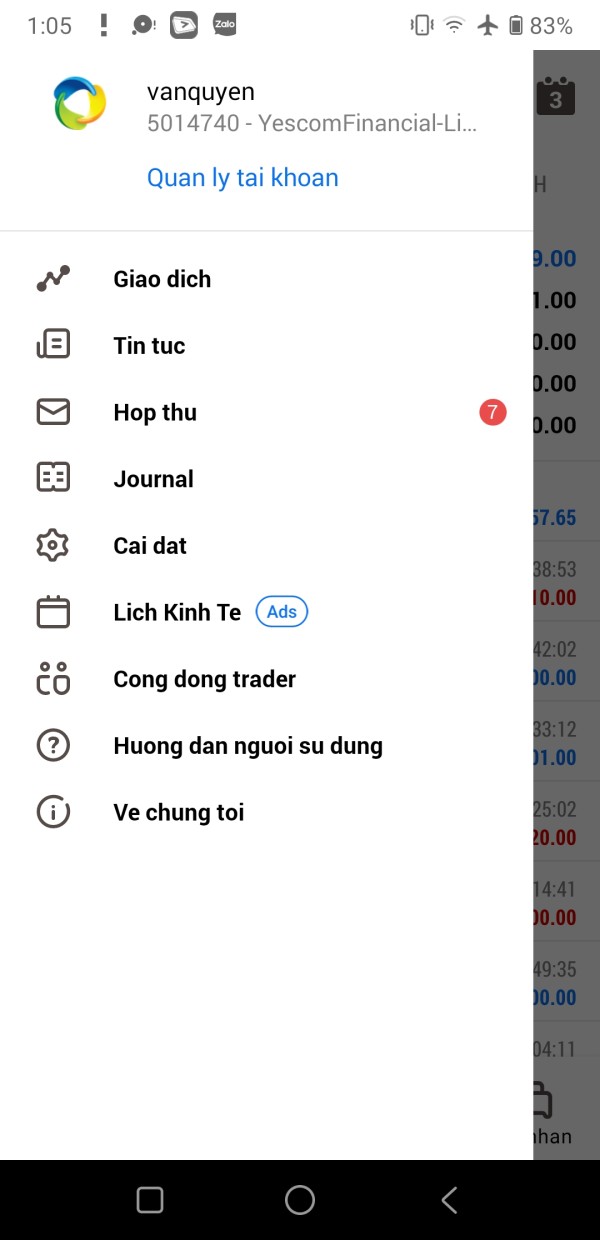

The broker offers three different account types: Classic, PRO, and ECN, catering to different levels of traders. Each account type has varying features, including leverage options and minimum deposit requirements. Yescom Financial Limited provides trading platforms such as Metatrader 5 (MT5) for desktop, IOS, and Android devices. These platforms offer features for technical analysis and order execution types. The company also claims to offer trading tools like an Economic Calendar and access to news updates to assist traders in making informed decisions.

However, it is crucial to consider the negative reviews and complaints regarding Yescom Financial Limited. These reviews highlight issues such as withdrawal difficulties, forced liquidation of positions, and fraudulent practices. Such reports raise concerns about the legitimacy and reliability of the broker. Traders should exercise caution and carefully evaluate the associated risks before engaging in any financial transactions with Yescom Financial Limited.

Pros and Cons

Reviews of Yescom Financial Limited on WikiFX highlight several concerns and negative experiences. Traders have reported withdrawal difficulties and forced liquidation of positions, indicating potential issues with the broker's operations. There are mentions of fraudulent practices, high fees, and position manipulation, which raise questions about the trustworthiness and reliability of Yescom Financial Limited. Additionally, the broker lacks transparency in providing information on spreads, commissions, and the list of market instruments available. Despite offering different account types, a demo account, various trading platforms, trading tools, and multiple payment methods, these negative reviews indicate significant drawbacks and potential risks associated with Yescom Financial Limited.

Is Yescom Financial Limited Legit?

Yescom Financial Limited is not regulated and has an unauthorized status according to the National Futures Association (NFA) in the United States. The broker does not possess a valid regulation and exceeds the business scope regulated by the NFA. Additionally, there have been four complaints against this broker in the past three months. It is important to be cautious and aware of the associated risks when dealing with an unregulated financial institution like Yescom Financial Limited.

Market Instruments

Forex: Yescom Financial Limited offers over 60 currency pairs for forex trading, making it the largest financial market worldwide. With leverage options of up to 400:1, investors have the opportunity to trade with higher positions. Forex trading is available 24 hours a day, five days a week, allowing for T+0 bilateral transactions.

Precious Metals (Gold/Silver): Yescom Financial Limited provides a popular hedge against market fluctuations with gold and silver trading. Investors can leverage their positions up to 100 times, and the transaction threshold is kept low, making it accessible to a wide range of traders.

Stock Index/Stock: Yescom Financial Limited offers trading on 20 major global stock indexes and a diverse range of well-known European and American listed stocks. With leverage options that surpass traditional stock markets, investors have the opportunity to trade on the performance of various industries.

CFD: Yescom Financial Limited provides a wide range of CFDs, offering investors more choices for diversifying their portfolios. These CFDs meet the asset allocation requirements of investors and allow for easy access to global markets.

Account Types

Yescom Financial Limited offers three different account types to cater to the varying needs of traders.

CLASSIC

The Classic account provides all the core features required for trading, with high leverage options available. Traders can start with a minimum deposit of $100 and have access to over 20 currency pairs and more than 50 potential CFDs. The Classic account also offers live support and a priority hotline for assistance.

PRO

The PRO account, on the other hand, is designed for more experienced traders. It includes all the core features like the Classic account but offers even higher leverage, up to 1:1000. The minimum deposit requirement for the PRO account is $1000. Traders can access over 20 currency pairs and more than 50 potential CFDs. What sets the PRO account apart is its lowest commission fee and scalable trading fees. Unlimited live support and a priority hotline are also provided to PRO account holders.

ECN

For those seeking even more customization and control, Yescom Financial Limited offers the ECN account. It provides all the core features and allows traders to set their own leverage based on their preferences. The minimum deposit requirement for the ECN account is $1000. Traders can access over 20 currency pairs and more than 50 potential CFDs, while benefiting from the lowest commission fee. Live support and a priority hotline are also available for ECN account holders.

Yescom Financial Limited also provides clients with a demo account, offering a simulated trading environment where users can practice trading strategies, explore platform features, and familiarize themselves with trading tools and instruments.

How to Open an Account?

To open an account with Yescom Financial Limited, follow these steps:

Visit their website and click on the “Trade Now” button.

2. Fill in the required information, including your name, email address, and mobile phone number.

3. Verify your email address by entering the mailbox verification code sent to your registered email.

4. Provide a password for your account and confirm it.

5. Click on the “Register” button to complete the account registration process.

Leverage

Yescom Financial Limited offers varying leverage options across its account types to provide traders with different levels of trading power. The leverage ratios available range from high to even higher, depending on the chosen account type. Traders can benefit from leverage up to 1:1000 in the PRO account, enabling them to amplify their trading positions. The ECN account allows traders to set their preferred leverage according to their individual preferences. By offering a range of leverage options, Yescom Financial Limited aims to accommodate the diverse trading strategies and risk appetites of its clients.

Minimum Deposit

Yescom Financial Limited has a minimum deposit requirement for its different account types. The Classic account allows traders to begin with a minimum deposit of $100, providing access to a variety of currency pairs and potential CFDs. The PRO account, designed for more experienced traders, requires a higher minimum deposit of $1000. The ECN account, offering advanced customization options, also necessitates a minimum deposit of $1000. The minimum deposit requirement serves as an entry point for traders to access the features and benefits associated with each account type.

Fees

Yescom Financial Limited does not charge any account opening fees, allowing traders to begin their trading journey without incurring any initial expenses.

Deposit & Withdrawal

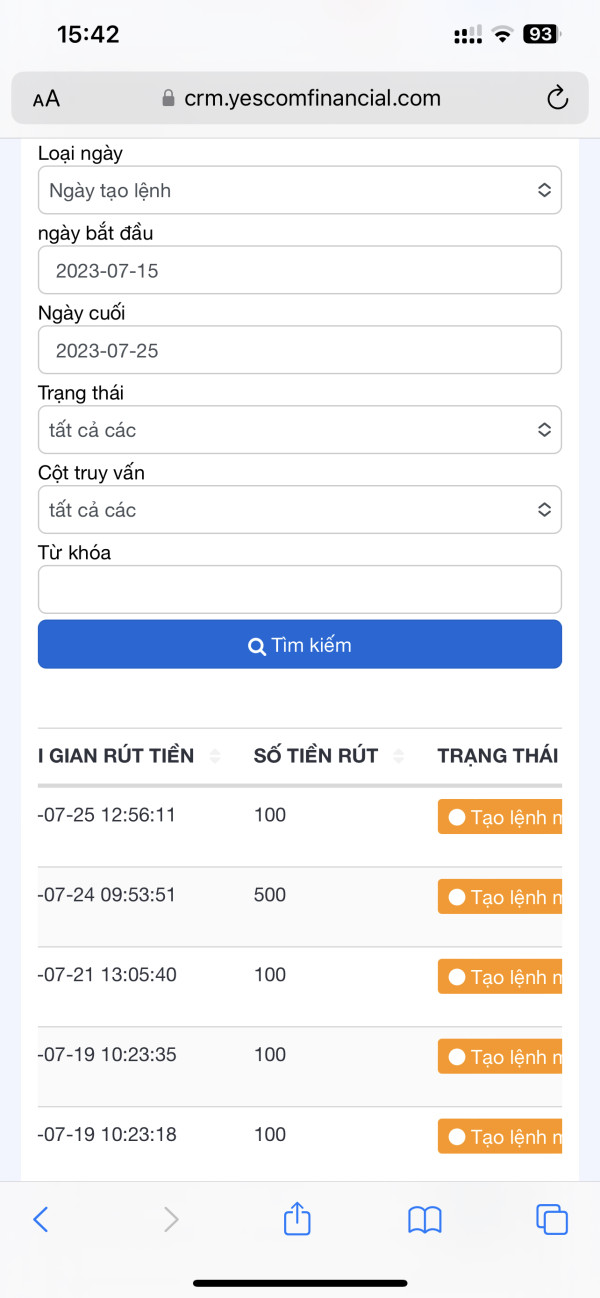

Yescom Financial Limited allows for the withdrawal of funds even if there are open positions in your account, with the condition that the remaining funds outside the position deposit requirements can be withdrawn. However, it's important to consider the transaction risks associated with this process, as withdrawing funds will further reduce the available deposits for open positions.

When it comes to transferring money, it is mandatory that the name on the transfer funds matches the name on the transaction account. Third-party transfers are not permitted to ensure the security and integrity of the transactions.

Deposits and withdrawals from your trading account should follow the requirements set by Yescom Financial Limited's approved dealer. The processing time for deposit and withdrawal instructions typically takes around 1-2 business days. There are no limitations on the number of withdrawals or the withdrawal amount. Upon receiving a withdrawal request, Yescom Financial Limited aims to arrange the transfer within one working day, and the funds usually arrive within two to seven business days. To initiate a withdrawal, you can easily submit an application through the official website and contact your account manager for assistance throughout the withdrawal process. It's important to ensure that your account is certified for a smooth and successful transaction.

Trading Platforms

Yescom Financial Limited offers a range of trading platforms to cater to different needs. One of their platforms is Metatrader 5 (MT5), which provides a comprehensive analysis tool. With over 50 indicator tools and the ability to choose from nine time quotes, traders can analyze the market and make informed decisions on when to buy or sell. The platform also supports various order execution types. Additionally, the embedded graphic design and alarm tool help users track price movements and identify favorable entry and exit points, making the MT5 platform a valuable tool for implementing effective trading strategies.

For traders using IOS systems, Yescom Financial offers a dedicated trading platform compatible with these devices. The MT5 platform is highly popular worldwide and provides full-featured forex trading and technical analysis capabilities. With this platform, traders can access the financial market and manage their accounts from anywhere.

Android users can take advantage of Yescom Financial's MT5 Android trading platform. This platform offers mobility, allowing traders to engage in foreign exchange trading anytime and anywhere using their Android smartphones. With the ability to trade on the go, users are no longer restricted to their computers and can easily access their trading accounts, enabling them to fully participate in the foreign exchange market.

Yescom Financial Limited also utilizes automation technology analysis tools on their trading platform. This award-winning feature scans the market conditions, identifies favorable trading opportunities, and predicts future price movements for hundreds of financial products. By leveraging advanced graphics recognition engines, traders can receive tips on trading opportunities and make more informed decisions based on real-time market data. This automation technology analysis enhances the overall trading experience and assists traders in maximizing their potential returns.

Trading Tools

Yescom Financial Limited offers a range of trading tools to assist traders in staying informed and making informed decisions. One of these tools is an Economic Calendar, which provides users with important economic events, announcements, and data releases. This tool allows traders to stay updated on market dynamics and seize opportunities as they arise. By keeping track of key economic indicators, traders can anticipate market movements and make strategic trades.

Another valuable tool provided by Yescom Financial Limited is access to News updates. This feature enables traders to stay up-to-date with the latest news and developments that impact the financial markets. The news covers a wide range of topics, including currency exchange rates, central bank decisions, geopolitical events, and market analysis. By having access to real-time news updates, traders can make informed decisions based on current market conditions and trends.

Payment Methods

Yescom Financial Limited offers a variety of payment methods, including Vietcombank, Mastercard, VISA, Skrill, NETELLER, Perfect Money, and Union Pay. These options cater to different preferences and allow clients to manage their funds.

Customer Support

Yescom Financial Limited requires a minimum deposit amount to open an account, although the specific value is not provided in the information provided. For customer support, Yescom Financial Limited offers various contact options. Traders can reach out to the company via email at info@yescomfinancial.com or through phone numbers: +852 274 378 91 and +8428 627 047 36. Additionally, traders can connect with Yescom Financial Limited via Skype using the handle “yescom.financial.limited”. The company has physical office addresses located at RM4, 16/F, HO KING COMM CTR, 2-16 FAYUENST, MONGKOK, KOWLOON, HONG KONG, and L2-43.09 Vinhomes Apartment, 720A DIEN BIEN PHU street, 22 Ward, Binh Thanh District, Ho Chi Minh City, Viet Nam.

Reviews

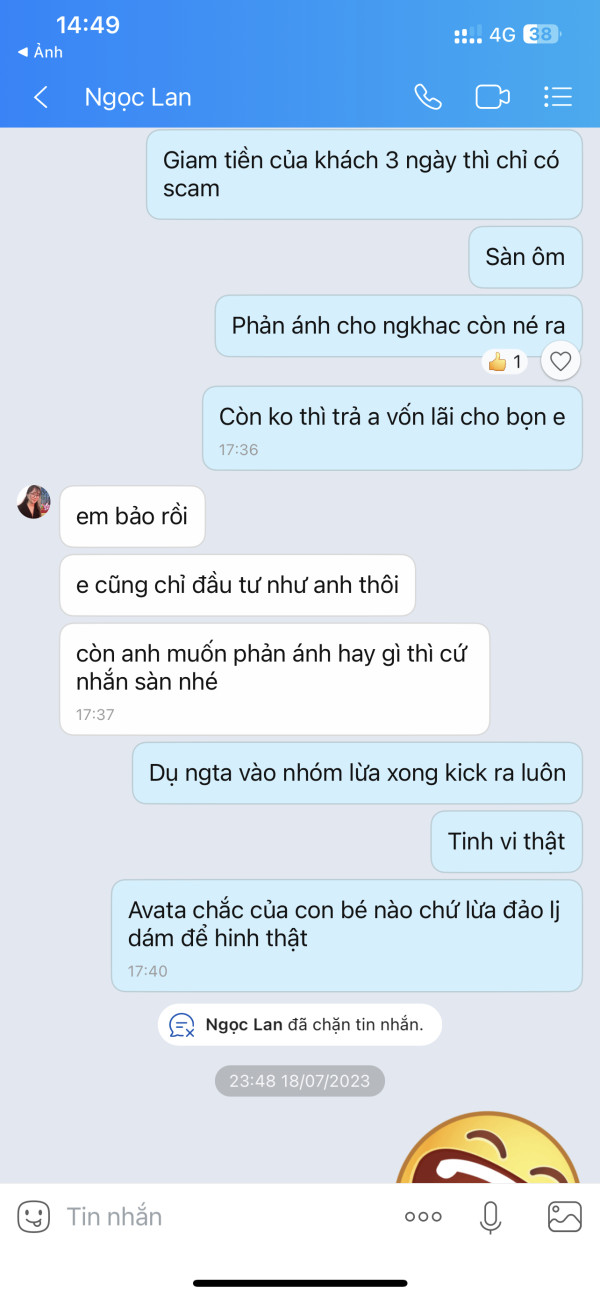

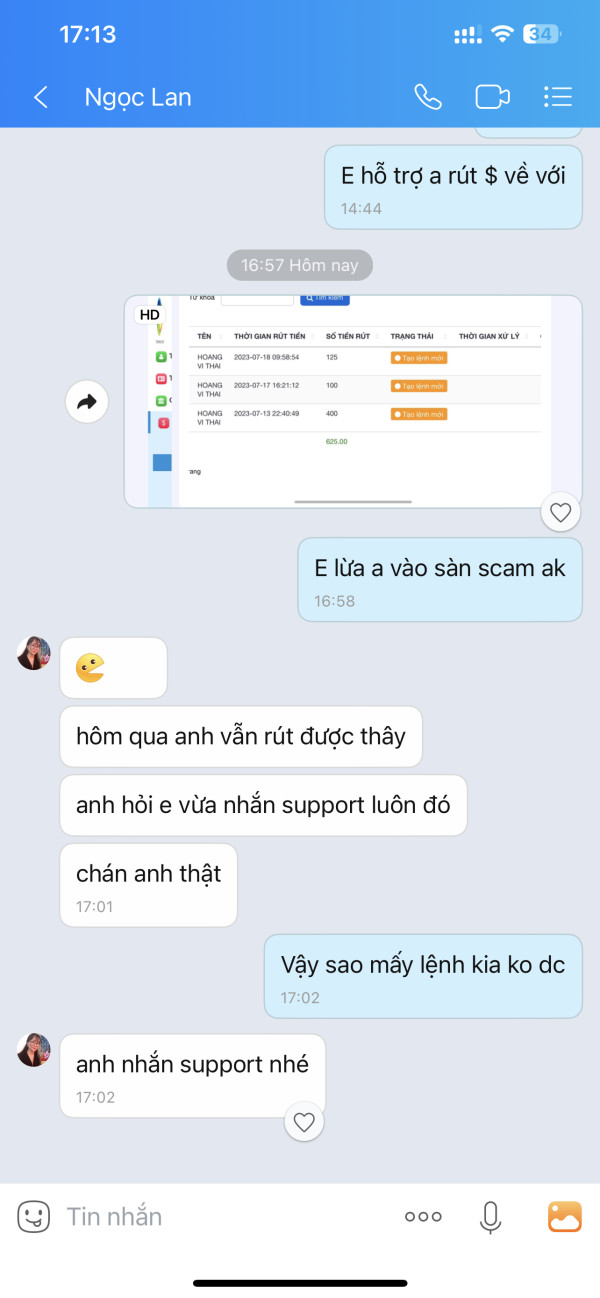

Reviews of Yescom Financial Limited on WikiFX highlight issues related to withdrawal difficulties and forced liquidation of positions. Traders have reported being unable to withdraw funds, with their accounts becoming invalid or blocked. Some reviews mention fraudulent practices, where teachers or groups induce traders to open accounts, deposit money, and then disappear. High handling fees and manipulation of positions are also mentioned, indicating a lack of trustworthiness. These reviews raise concerns about the legitimacy and reliability of Yescom Financial Limited as a trading platform.

Conclusion

In conclusion, Yescom Financial Limited operates without proper regulation and has an unauthorized status according to the National Futures Association (NFA) in the United States. The broker has received several complaints within a short period of time, indicating potential issues with their services. While they offer a range of market instruments such as forex, precious metals, stock indexes, and CFDs, specific details about their trading conditions are not provided. Yescom Financial Limited offers different account types to cater to the needs of traders, but the legitimacy and reliability of the company are questionable based on negative reviews highlighting withdrawal difficulties, forced liquidation of positions, fraudulent practices, and high handling fees. Traders should exercise caution and consider the associated risks when dealing with an unregulated financial institution like Yescom Financial Limited.

FAQs

Q: Is Yescom Financial Limited a regulated company?

A: No, Yescom Financial Limited is not regulated and has an unauthorized status according to the National Futures Association (NFA) in the United States.

Q: What are the market instruments offered by Yescom Financial Limited?

A: Yescom Financial Limited offers forex, precious metals (gold/silver), stock index/stock, and CFD trading options.

Q: What are the account types offered by Yescom Financial Limited?

A: Yescom Financial Limited offers Classic, PRO, and ECN account types, catering to different trading needs.

Q: What leverage options are available with Yescom Financial Limited?

A: Yescom Financial Limited offers varying leverage options, with the PRO account allowing leverage up to 1:1000 and the ECN account allowing traders to set their preferred leverage.

Q: What is the minimum deposit requirement for Yescom Financial Limited?

A: The minimum deposit requirement is $100 for the Classic account and $1000 for both the PRO and ECN accounts.

Q: What are the available payment methods with Yescom Financial Limited?

A: Yescom Financial Limited offers payment methods such as Vietcombank, Mastercard, VISA, Skrill, NETELLER, Perfect Money, and Union Pay.

Q: How can I contact customer support at Yescom Financial Limited?

A: You can reach Yescom Financial Limited via email, phone numbers, Skype, or visit their physical office addresses.

Q: Are there any reviews or concerns about Yescom Financial Limited?

A: Yes, there are concerns raised in reviews regarding withdrawal difficulties, forced liquidation of positions, and fraudulent practices, indicating a lack of trustworthiness.

Nguyên Thu Trà

Vietnam

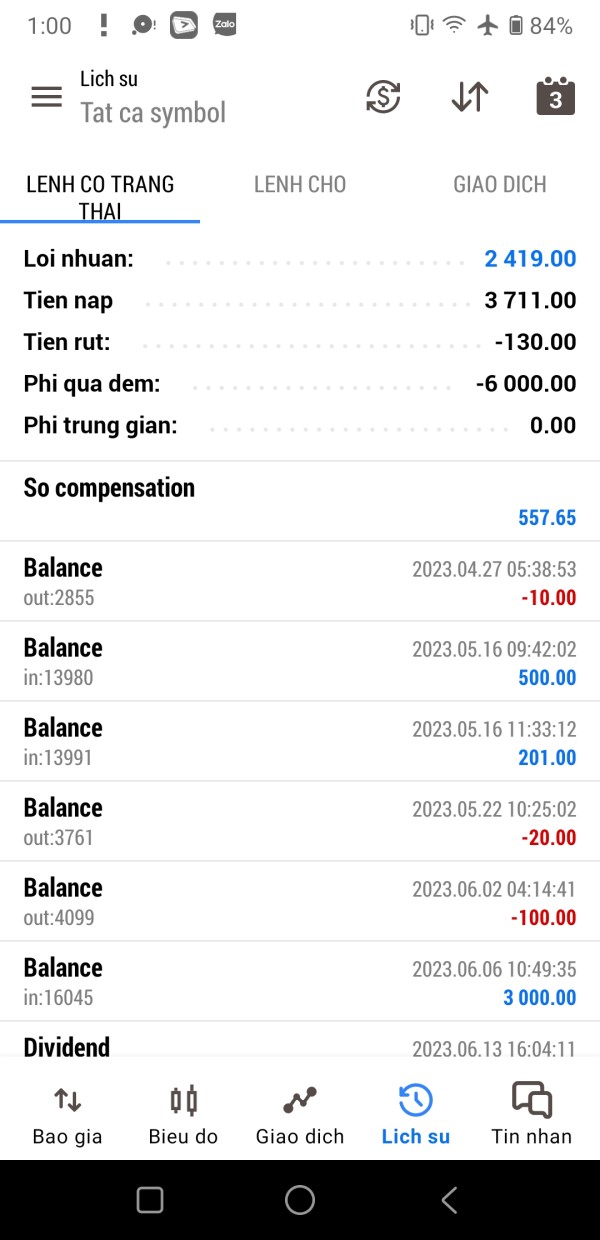

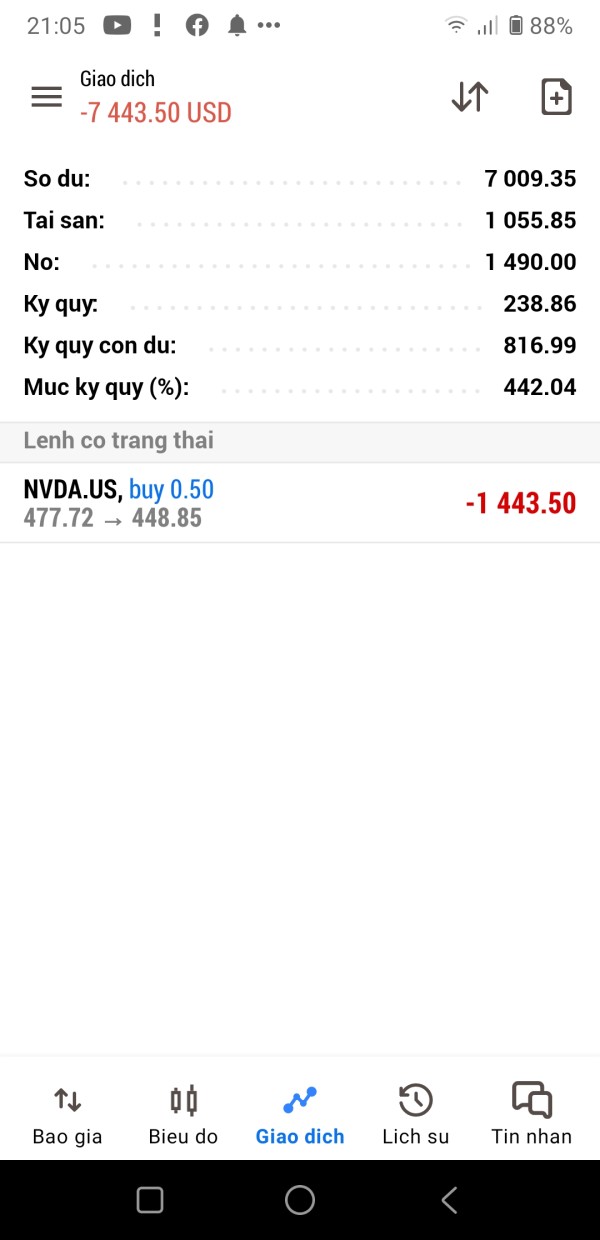

On the night of July 5, 2023, in the early morning of July 6, 2023, the exchange intentionally placed an order that burned my account (almost $1,400).

Exposure

2023-12-24

Đầu bùn

Vietnam

This whole month I can't withdraw principal and interest. The amount is $3400. Fraud platform. Phone number and address are fake. Ib and sp support reply that they are also victims. Scam Platform

Exposure

2023-07-26

FX1765885867

Vietnam

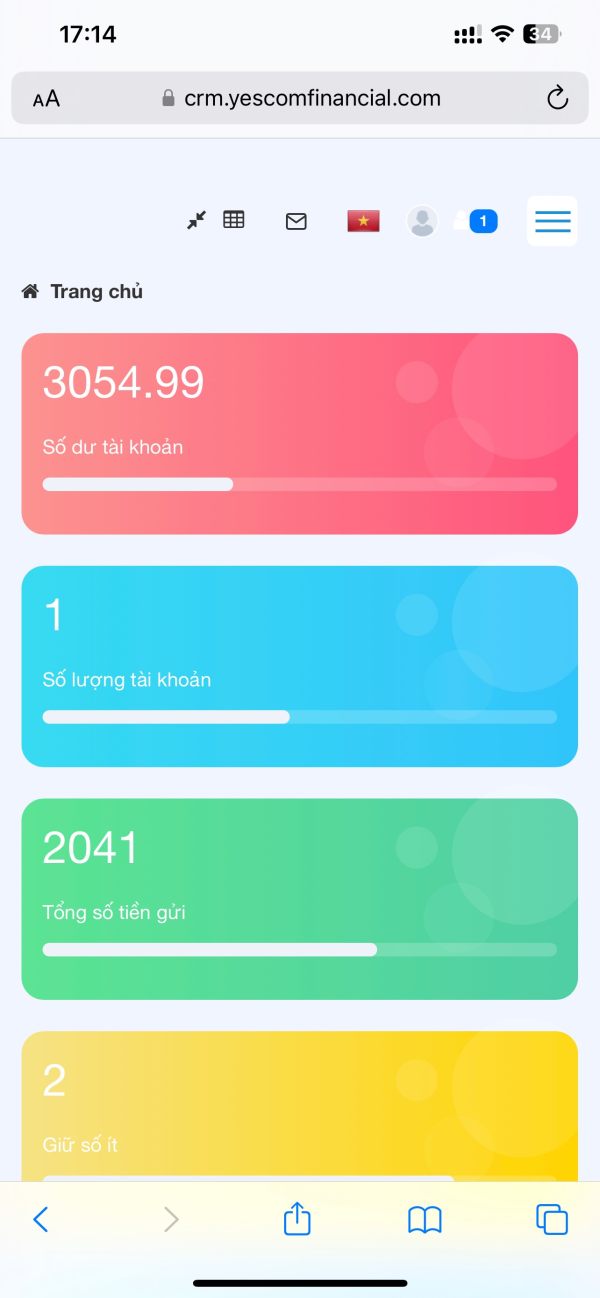

This exchange scammed me, I lost 7000 dollars, it withdraws customers' money by itself.

Exposure

2023-07-22

Đầu bùn

Vietnam

A scam. Unable to withdraw funds

Exposure

2023-07-18

dungtran

Vietnam

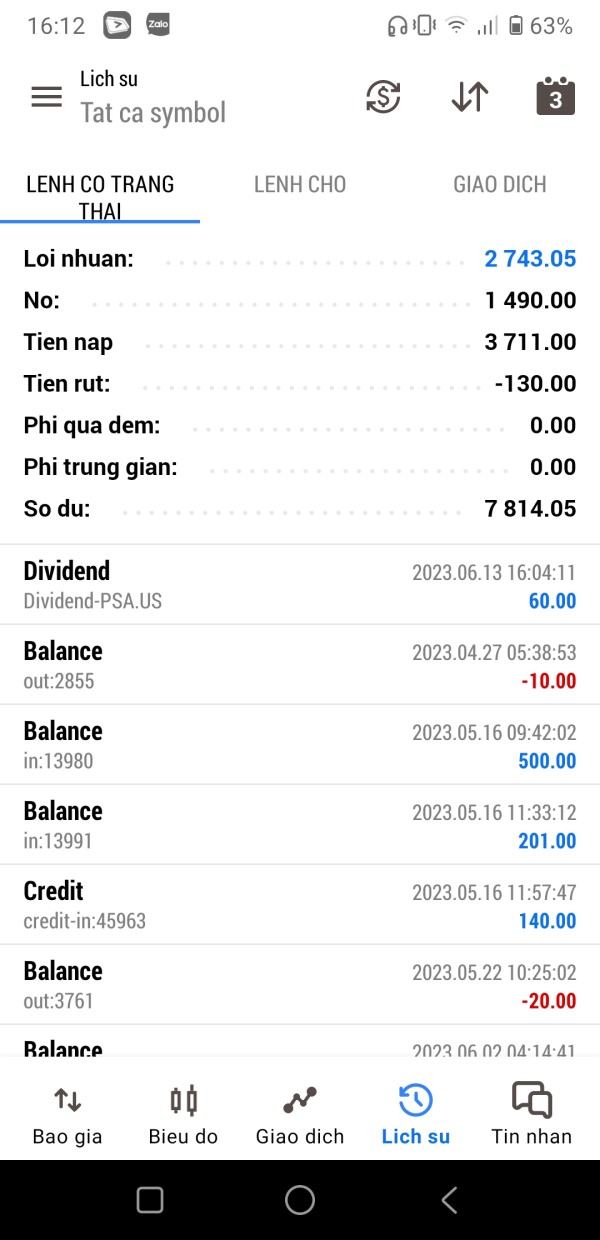

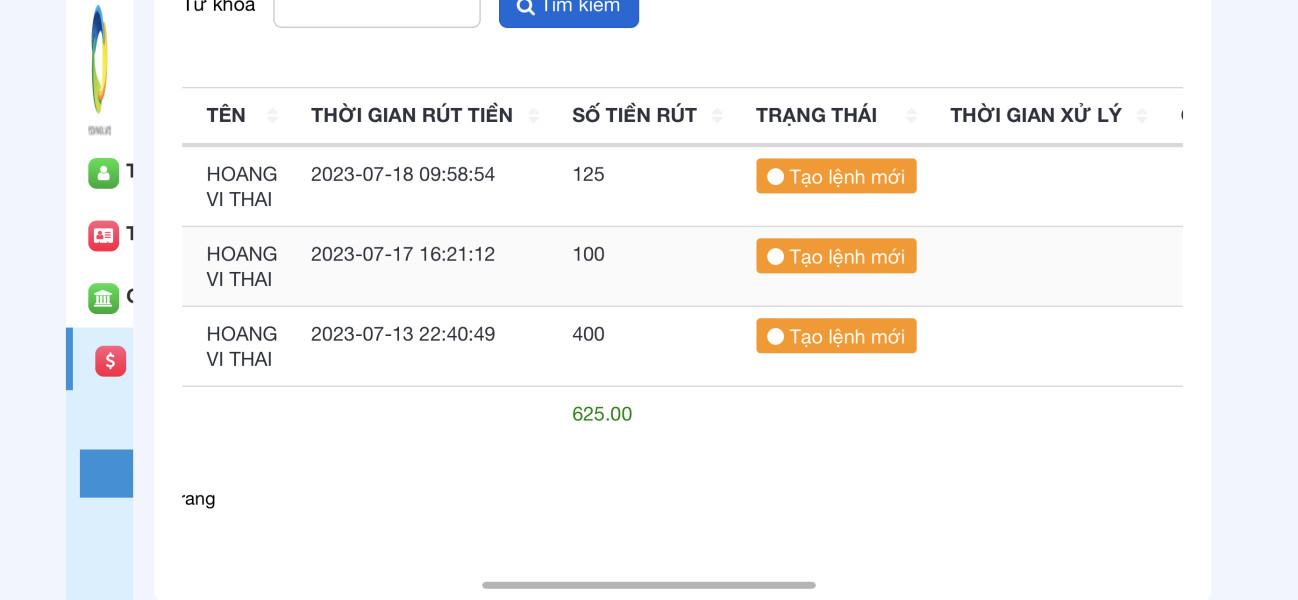

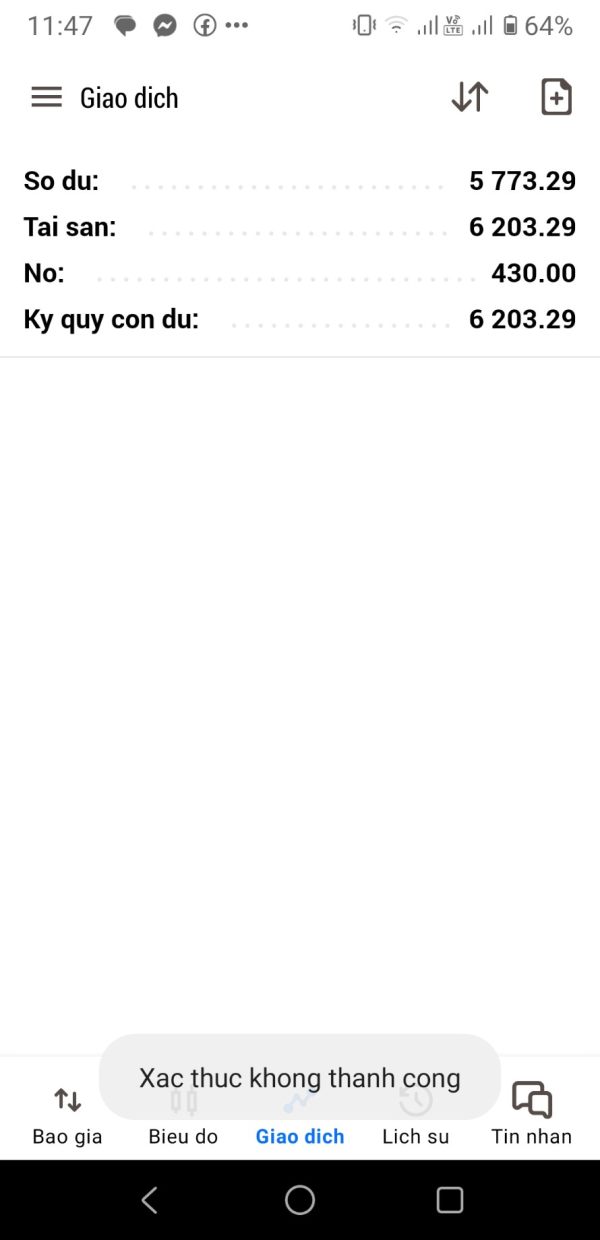

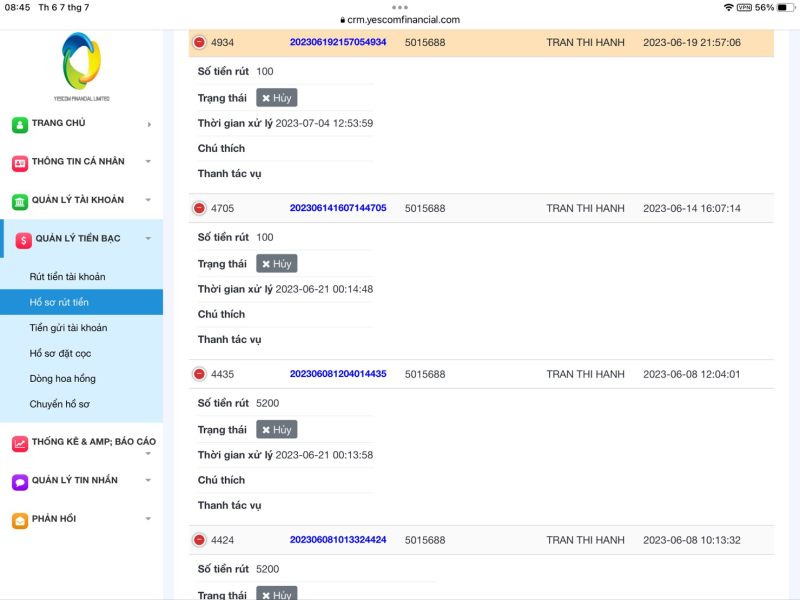

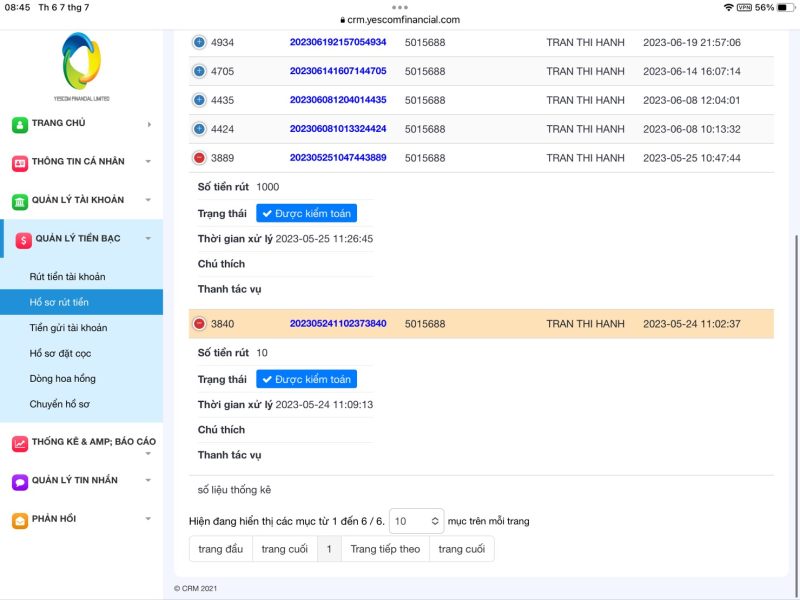

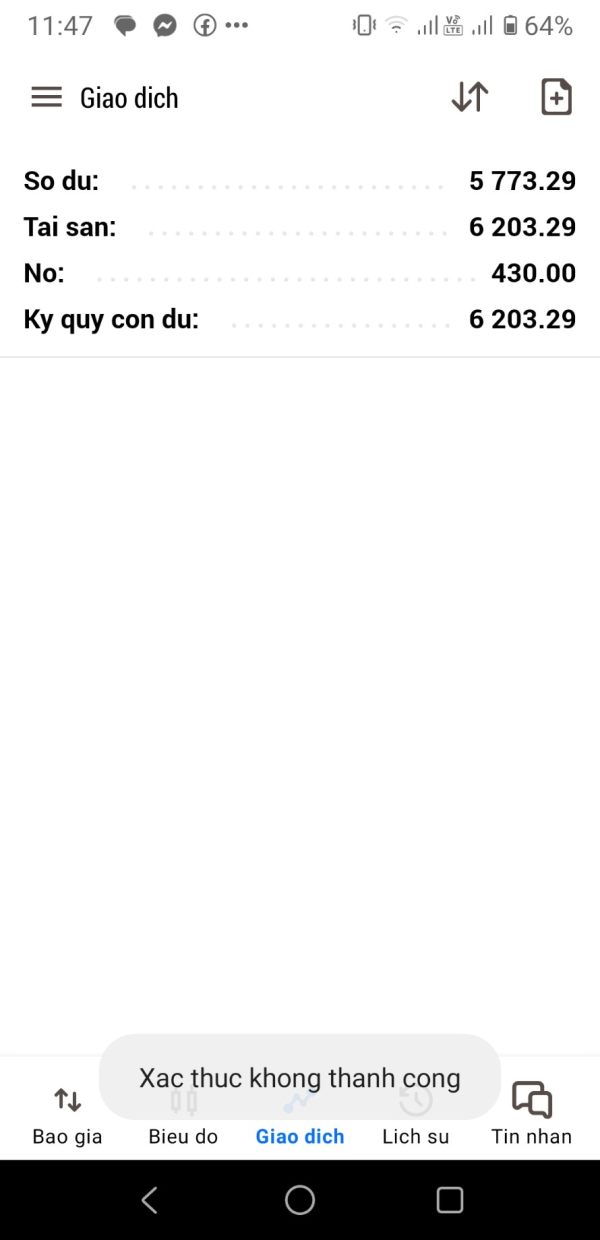

Hello Yescomfinancial! My name is Tran Thi Hanh, I have an account at Yescomfinancial anhtran410@gmail.com and MT5 ID: 5015688. I have tried depositing and withdrawing on 1010 on nagyf 24/5/2023, after 1 hour money returned to my account but then I nap 4,300 on it. The above account traded on June 8, 2023, I made a withdrawal order of 5,200, then exchange canceled, all my withdrawal orders for current time 6/7/2023, no money into my account. While I was writing mail, there was no response on the web. Currently, when I go to my account, my Mt5 cannot be authenticated, when I withdraw my account, the balance is 0 dong, while my withdrawal order is cancelled. So expect the floor to clearly explain this is an act of appropriating property. If the floor does not solve it for me, I will follow same case to the authorities for support when I have no violations in the floor. So I hope social network will help the authorities to step in to clarify this behavior. Below I have a picture of evidence for above information.

Exposure

2023-07-07

Gà4053

Vietnam

I have 5 sell and buy orders. I don't understand why the sell and buy prices go up and down suddenly. while the market price is still moving sideways, causing my account to burn. 10 am 20/06/2023

Exposure

2023-06-20

Quí 5957

Vietnam

I have opened mt5 account number 5015213 on yescom financial limited platform. Currently the balance on the account is $4231.88, I placed a withdrawal order but the exchange has not approved. I placed an order to withdraw $4000 from 19/05/2023 to 22/05/2023 I canceled this order. On May 22, 2023, I created a withdrawal order of $4000 and $200 until May 23, 2023, still not approved. At that time I contacted ib support, then the order was not approved but canceled, yet I did not cancel these 2 withdrawal orders. I changed my account password, someone claiming to be the account manager said to temporarily block my account for 15 days because I revealed my password or logged in with another device. I confirm that I do not reveal my password to anyone and do not log in with another device. After many times creating withdrawal orders still not approved by the exchange. I hope the exchange will approve my withdrawal order.

Exposure

2023-06-14

thang6719

Vietnam

It does not allow automatic withdrawal to the customer's account!!!

Exposure

2023-06-13

FX4174781806

Vietnam

tk id 5015343 the platform automatically pushes the price down to 1930 even though the price on the trading view and the price chart of the exchange is not available, please help me, my account is currently negative

Exposure

2023-05-22

huyền2510

Vietnam

I created tk Yescom under my ID and provided the following information. After a while, I traded from $2000 to $2980. Today, 16.5.2023. I sold Gbp/jpg for 107.304 in 2 minutes. My account fell from 170.3 points to 172.8 points, almost 3000 points, without any news Even platforms like Exness or Trading View do not have this phenomenon. I have sufficient evidence to suggest that virtual dragging can burn customer accounts and only drag orders that I am running. Especially other platforms or networks do not have this phenomenon.

Exposure

2023-05-19

Tuấn9329

Vietnam

Before I withdraw about 15-20 minutes, the money came back, now I withdraw it, what's wrong with the money for almost 1 day?

Exposure

2023-05-17

Minh Diệu

Vietnam

I am not allowed withdrawals, manually enter orders to liquidate my account

Exposure

2023-04-22

Minh Diệu

Vietnam

No withdrawals. It requires many new interventions to reduce a part. From February to now, when I make withdrawal orders, they cancel my orders without any reason.

Exposure

2023-04-11

Dương 788

Vietnam

The platform arbitrarily entered the order to burn my account. Then compensate the deposit and ask to trade enough 180lot to withdraw. When I trade enough exchanges, they still won't let me withdraw and lock my account

Exposure

2023-03-16

Dương 788

Vietnam

The yescom platform itself entered the order to burn the tk. then compensate and ask to hit enough 180lot to withdraw. When I trade enough as required and make a withdrawal order, the floor will not let me withdraw and lock my account

Exposure

2023-03-16

FX3154388109

Vietnam

Making it difficult for investors, not allowing withdrawals, trading only for 20% of the volume compared to the outgoing order. The whole policy of driving customers, giving the bonus after saying it, can't use the bonus to make a profit. Ng opened tk nch roundabout pushing responsibility for sm floor. Does anyone have a hotline on this floor for me please

Exposure

2023-03-15

花菜8418

Hong Kong

I, Zhu Danli, in October 2022 or so, in the WeChat group made acquaintance with the WeChat signal xp-617 netizen, he just started very enthusiastic every day to send me the stock code, and said he likes to make friends, asked for my address, also sent a box of Xiamen specialties to my home, and we got closer, he asked me how much money on hand can come into the stock market, he helped me do the asset He asked me how much money I had on hand to enter the stock market, and he helped me to do the asset allocation so that I could get a higher return. I examined the stocks he sent for a period of time, it is true that they are all rising, he pulled me into the stock group, which will have a teacher every day to share how to choose stocks, the teacher inside will also live classes every day, 2 to 3 live a day. The micro signal xp-617 netizen greeted me every day around 9:10 pm on time to say hello, he would share with me the live content of the teacher in the group, as well as the teacher sent the stock code. Every day to get close to me, share things in life, set my words, the situation of my family members, economic income. In early December 2022, several teachers in the group King Yu, Hanlin, bull, began to sing the short stock market, and began to induce to do foreign exchange, introduced a Asia-Pacific manager pulled to the group, open an account into the gold. On January 5, 2023, I revealed to my WeChat friend xp-617 that I wanted to give the principal to the gold, Xu Peng advised me that the exchange rate is now low, and it would be better to wait for the dollar to go up before withdrawing the gold. The first thing you need to do is to get a good idea of what you are getting into. Afterwards, the bull admitted that he had gambled wrong and said he would bring me back later. The actual fact is that you can find a lot of people who have been in the business for a long time, and they've been in the business for a long time. The actual fact is that you can't get in touch with the actual people that you've been working with.

Exposure

2023-02-26

haidang255

Vietnam

I waited for two months but didn't get the money.

Exposure

2023-02-20

haidang255

Vietnam

Don't let customers take money, but also want to burn customers, and also want to lock up the money to do fake and inferior business

Exposure

2023-02-20

FX1538484522

Hong Kong

Focibly liquidate the position and close the position when I still have more than 1000 dollars.

Exposure

2023-02-19