Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

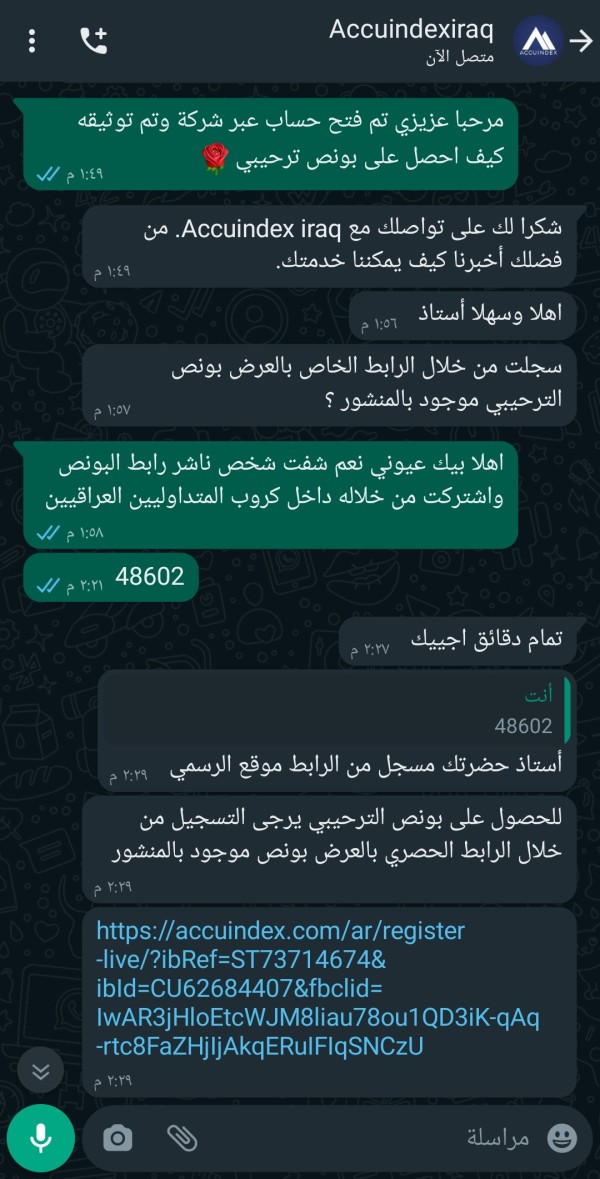

Mr2718

United States

I registered through the company and they gave me a $50 bonus. The condition was that I receive $100 in profits. After the profits reached $100, and without violating the conditions, they did not give me the profits under the pretext that I had another account. When I asked them to give me a statement of the bonus for my other account, they did not respond to my messages via WhatsApp.

Exposure

2024-01-31

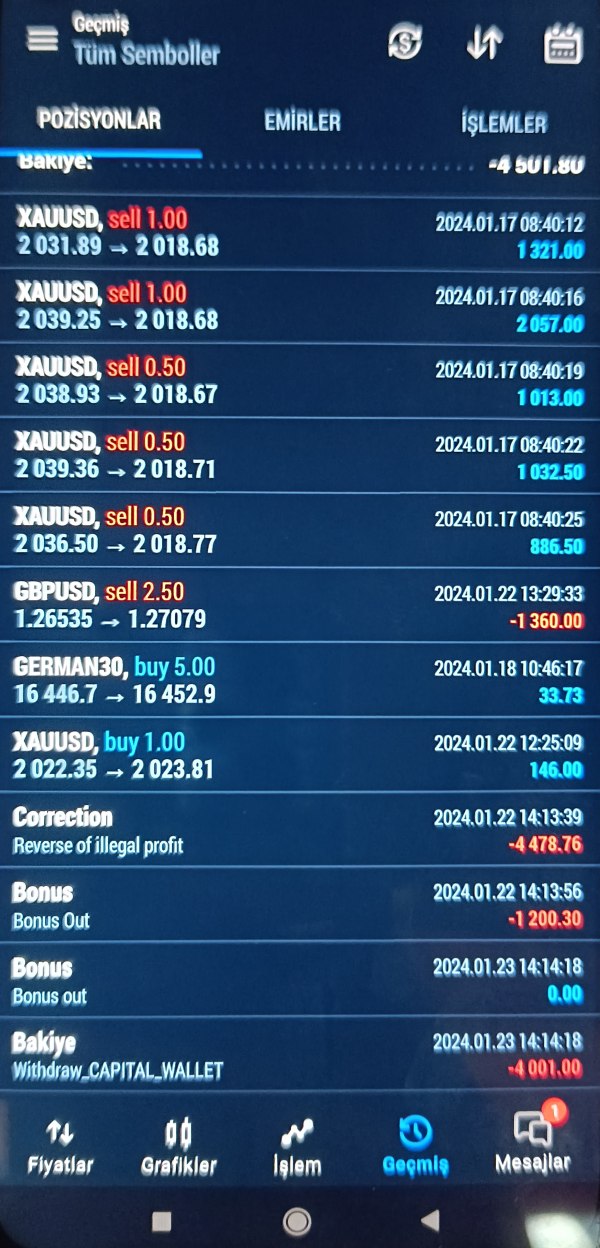

emine

Turkey

They don't give me the 3000 dollars I earned by working hard, they erased my profit and they don't send my money.

Exposure

2024-01-30

adıll

Turkey

meta no: 46627 They sent me an e-mail that the transactions I made in my account were illegal, and then they did not pay my money. There is no contact person now, no payment is made.

Exposure

2024-01-29

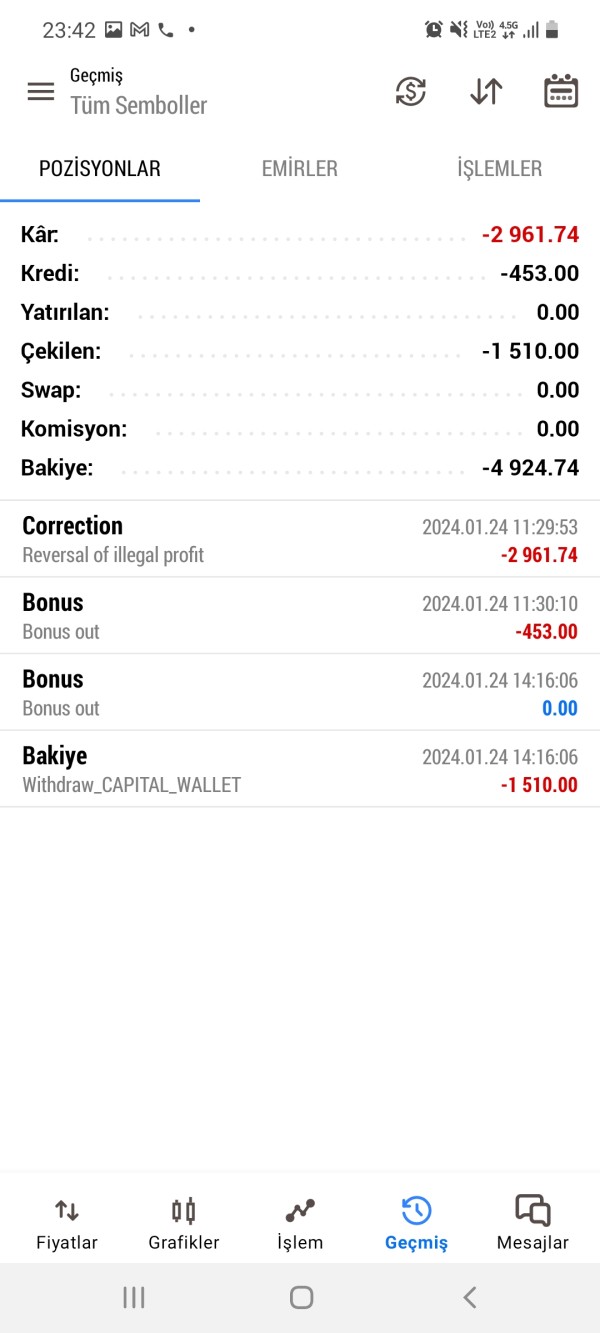

Vedat316

Turkey

There is no illegal gain in my transactions. I am sending you the screenshot of my transaction history, I want you to check it again and reload my balance.

Exposure

2024-01-24

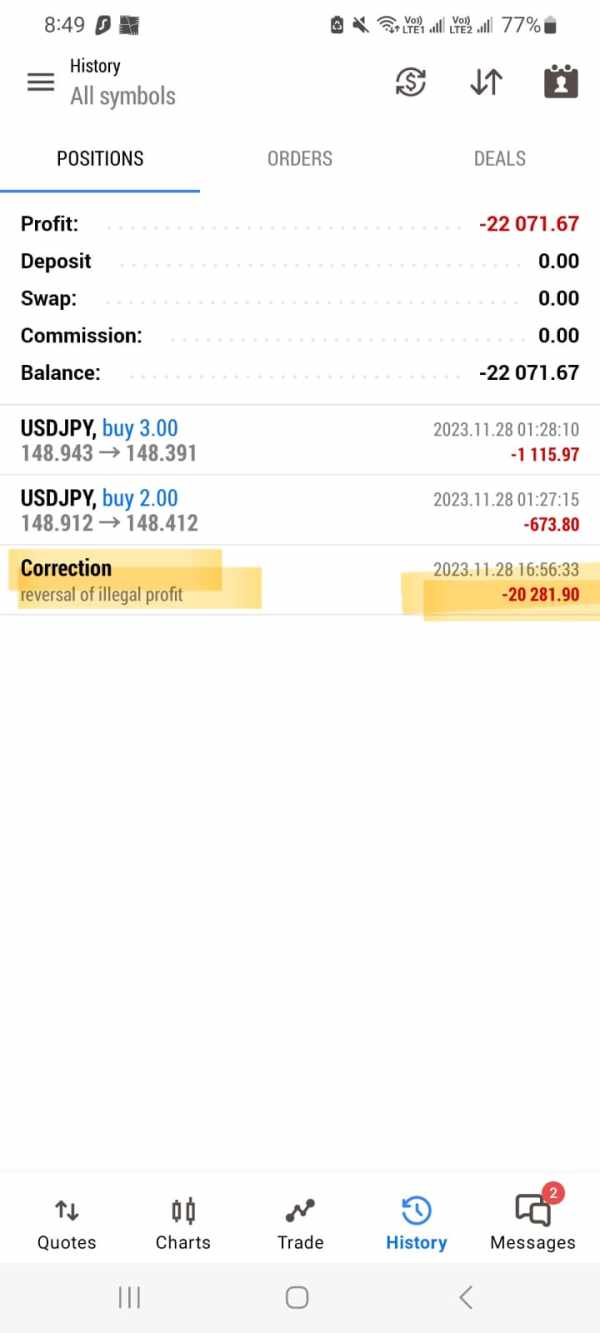

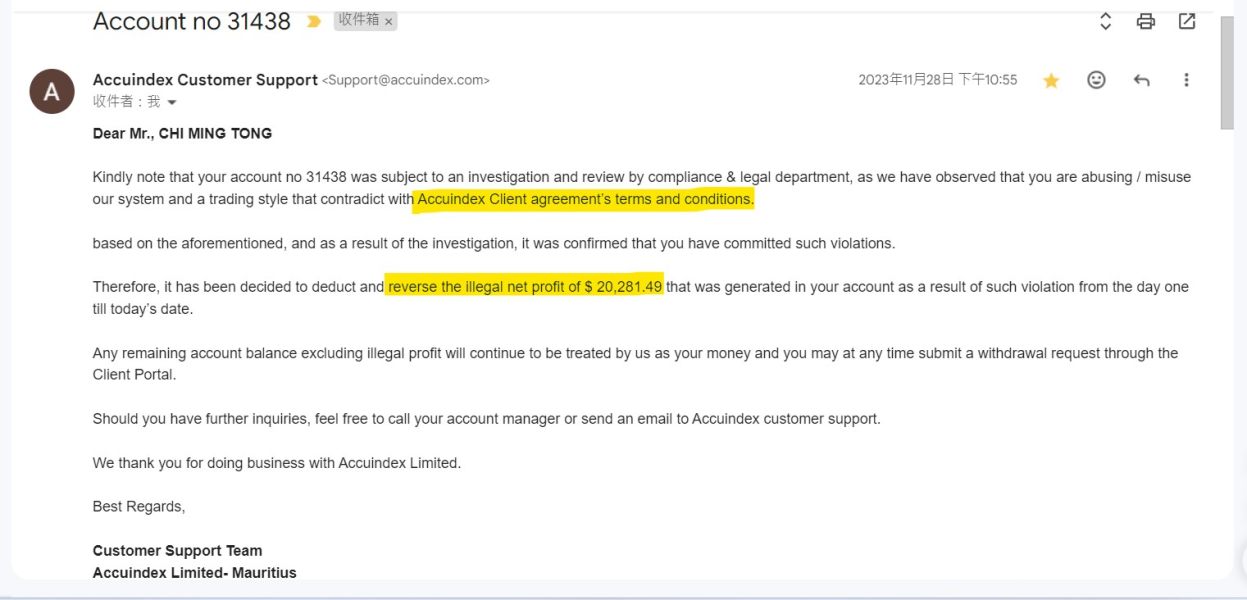

FX6195528120

Hong Kong

I made same small profit in the first few months and can withdraw easily.But later I made big profit and then they told me it is ILLEGAL PROFIT AND EAT MY PROFIT. I email them for one month but no one replyhttps://my.accuindex.com/

Exposure

2024-01-23

Monsef6835

Morocco

I get 50 USD bonus, I trade with it, I get 100 usd profit, when I ask for withdraw 100 usd profit, they refuse and delete all profit, account n 47140

Exposure

2024-01-19

kuten

Vietnam

floor AccuIndex can't access my portal account and trading account (trade mt5). i contacted support but they didn't process it. i can't trade or withdraw the money i have in there. initially, i deposited money to trading on mt4 software but then they abandoned mt4 software and switched to mt5. don't let me withdraw money.

Exposure

2023-12-21

FX6633391092

Hong Kong

I traded on this platform and started to lose money. Everything was normal. Later, after the transaction made a profit, my withdrawal was rejected, and then it was said that the transaction was illegal, and even the principal was not given. It is simply unreasonable. Everyone must be careful on this black platform!

Exposure

2023-07-14

gh5479

Hong Kong

All profits are canceled, saying illegal transactions, the principal has not been credited to the account for several days, and there is still less money in the account

Exposure

2023-04-07

futureee

Singapore

Hello, all! I've been riding the trading wave with AccuIndex for a good part of the decade. They're based in Mauritius, but don't let that fool you, they've got their ducks in a row with CYSEC at the helm. Keeps me on my toes, the sheer number of market instruments on offer. Made good use of the demo account when I first started out, and I've got to say, it was a lifesaver. And them spreads, especially the EUR/USD at 1.4 pips - absolutely brilliant. Navigated my funds in and out without a hitch - so many options to choose from.

Positive

2023-12-01

forest1

South Africa

Hey there! Yours truly has been dabbling in the trading game with AccuIndex for a bunch of years now. Love that they're all regulated by CYSEC, gives you that sense of security, you know. They've got a bountiful variety of market instruments; forex, indices, metals, energies, and stocks - you name it. I was over the moon when I found out their demo account option - perfect for newbies like me at the start. The trading platforms are pretty straightforward too, MT4/5 offers just the right blend of simplicity and sophistication. Adding and withdrawing funds is a breeze with all the different methods on offer. A bit of a damper - the minimum deposit stretching my budget at $100. Apart from that, they're a great outfit!

Positive

2023-11-30

FX1104839593

New Zealand

This company AccuIndex looks so attractive, I want to open a demo account to try it out. Has anyone traded here and can tell me how the company is doing?

Positive

2022-12-08