Overview of Moonance

Moonance is a Saint Vincent and the Grenadines-based company operating for approximately 1-2 years. The broker offers forex trading with currency pairs like EUR/USD and GBP/JPY, as well as CFDs on assets such as stocks, cryptocurrencies, commodities, and indices like S&P 500 and FTSE 100. Traders can also speculate on precious metals and various commodities like gold, silver, oil, and natural gas. The platform facilitates share trading of companies like Apple Inc., Microsoft Corporation, and Toyota Motor Corporation.

Moonance provides three types of accounts: Classic, VIP, and RAW. The Classic account requires a minimum deposit of $100, while the VIP and RAW accounts demand higher deposits of $3,000 and $5,000, respectively. Traders can access leverage up to 1:500, with spreads starting from 1.5 pips for the Classic account, 1.1 pips for the VIP account, and 0.0 pips for the RAW account. Commission fees are applicable for the RAW account only, amounting to $5.

The broker offers two trading platforms: the Moonance Wallet, available on Apple Store and Google Play, which facilitates account management, deposits, and withdrawals; and the cTrader platform, available on Windows, iOS, and Android, providing access to global markets and advanced trading features. Moonance's customer support can be reached via email, and their company address is provided as well. However, the website's reliability may be questionable due to limited information and a malfunctioned website.

Pros and Cons

Moonance presents a mixed bag of pros and cons for traders. On the positive side, the platform offers a variety of forex and CFD instruments, as well as leverage options of up to 1:500, catering to different trading preferences. Additionally, Moonance provides various account types with distinct features and a free demo account for practice. Traders can also benefit from the referral promotion, earning rewards for bringing in new users. However, the lack of valid regulation raises potential risks for traders, and the limited information available on deposit and withdrawal methods can be concerning. The RAW account's commission fee of $5 may be a drawback for some, and the higher minimum deposit of $5,000 for the RAW account might be unaffordable for certain traders. Furthermore, customer support appears to be limited to email communication, which could impact responsiveness and assistance for users.

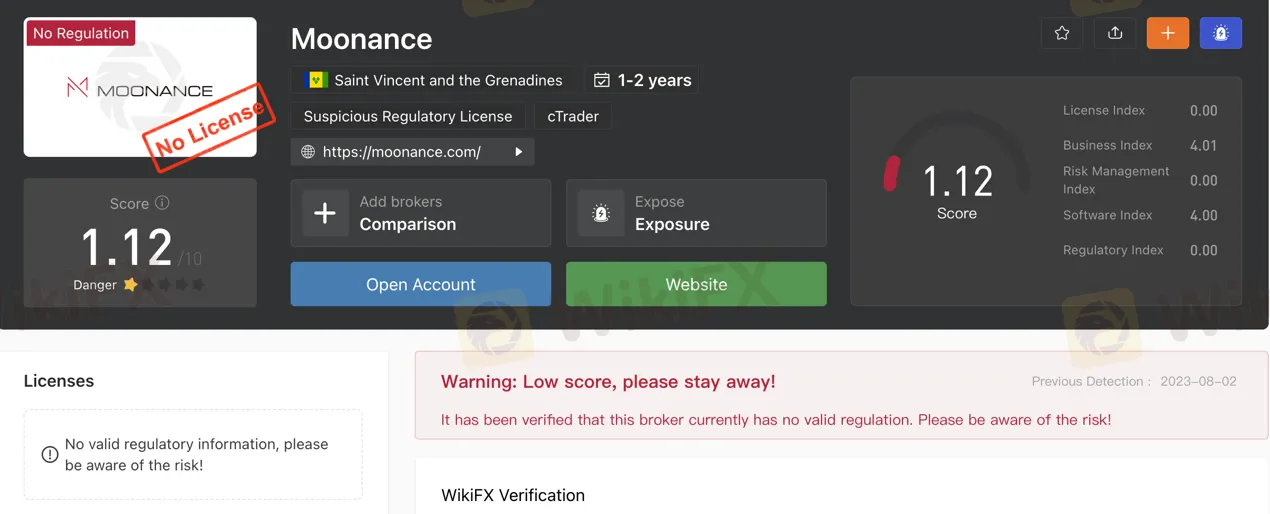

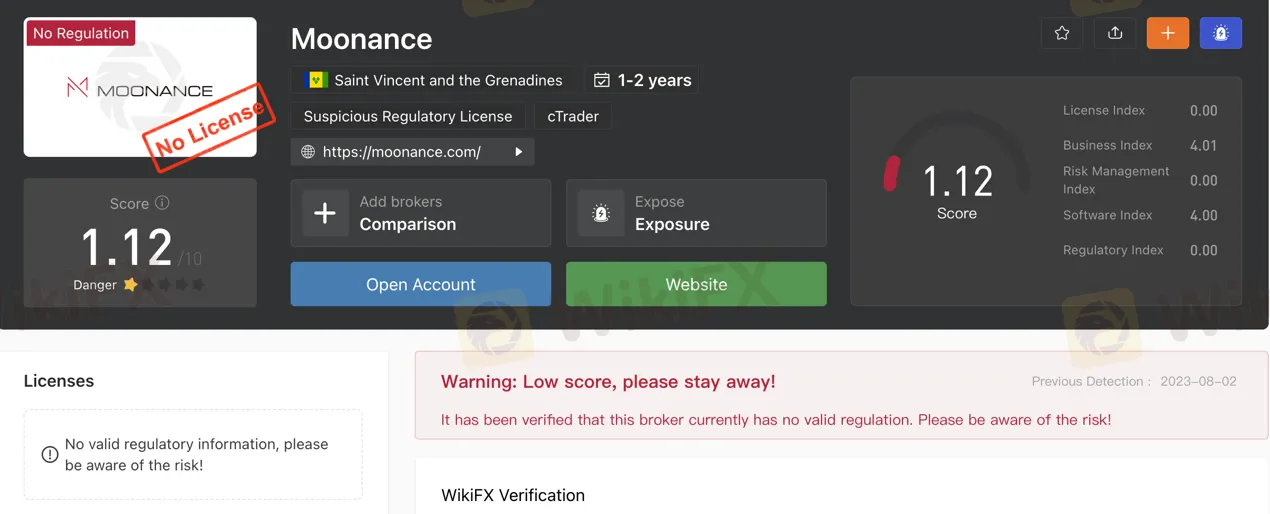

Is Moonance Legit?

Moonance lacks valid regulation, as confirmed by verifiable sources. Traders should exercise caution due to the absence of oversight, which may increase the associated risks.

Market Instruments

Forex: Moonance offers a range of forex instruments, allowing traders to engage in currency trading. These instruments involve the exchange of one currency for another at varying exchange rates. Examples include EUR/USD, GBP/JPY, and AUD/CAD.

CFDs: Moonance provides Contract for Difference (CFD) instruments, enabling traders to speculate on the price movements of various assets without owning the underlying asset. CFDs available on Moonance may cover stocks, cryptocurrencies, commodities, and indices, among others.

Indices: Traders on Moonance can access a selection of index instruments representing the performance of a group of stocks from a specific region or sector. Examples include S&P 500, FTSE 100, and Nikkei 225, which reflect the overall market conditions.

Metals: Moonance offers trading in precious metals, such as gold, silver, platinum, and palladium. These instruments allow traders to speculate on the price movements of these commodities without physically owning them.

Commodities: Moonance provides access to various commodity instruments, enabling traders to speculate on the price fluctuations of essential goods like oil, natural gas, coffee, and wheat.

Shares: Moonance allows traders to engage in share trading of companies listed on different stock exchanges. These instruments represent ownership in specific companies and can include shares of tech giants, banks, and other corporations across various industries. Examples encompass Apple Inc., Microsoft Corporation, and Toyota Motor Corporation.

Account Types

CLASSIC: The Classic account type offered by Moonance features spreads starting from 1.5 pips, with no commission charges amounting to $0. It provides access to a selection of 250+ assets, requiring a minimum deposit of $100 to open this account type.

VIP: Moonance's VIP account presents traders with lower spreads, commencing from 1.1 pips, and does not impose any commission fees, amounting to $0. Similar to the Classic account, it also grants access to a diverse range of 250+ assets. However, a higher minimum deposit of $3,000 is necessary to initiate this account.

RAW: Moonance offers the RAW account type with spreads starting from 0.0 pips. While this account type requires a commission fee of $5, it provides access to the same diverse range of 250+ assets. To open a RAW account, a minimum deposit of $5,000 is required.

Moonance also offers a free demo account option, providing traders with a virtual balance of $10,000 for practice and testing purposes.

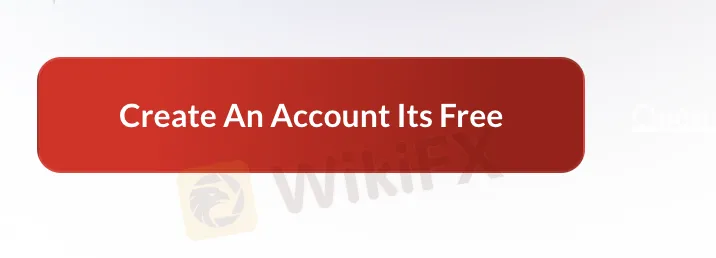

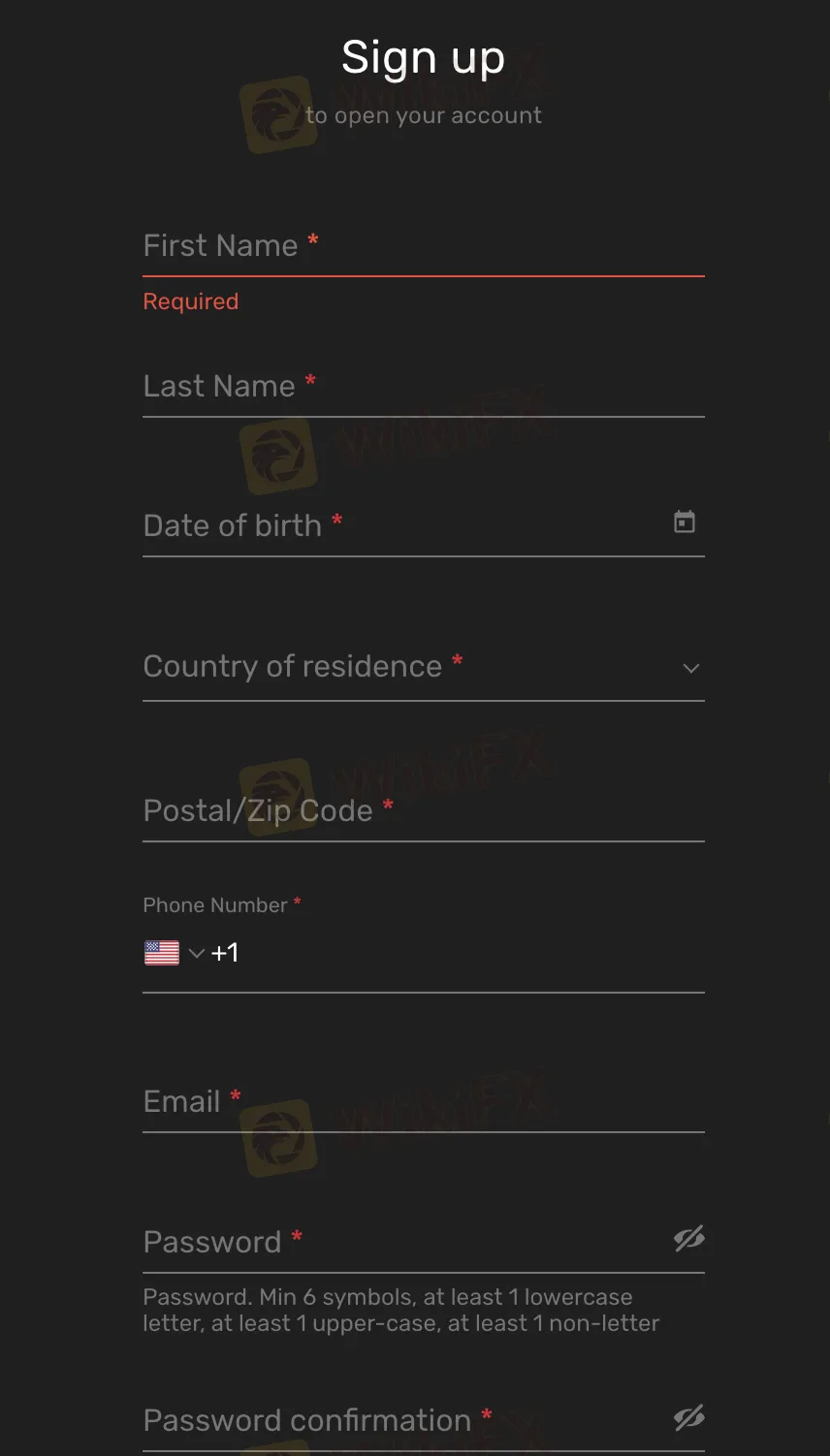

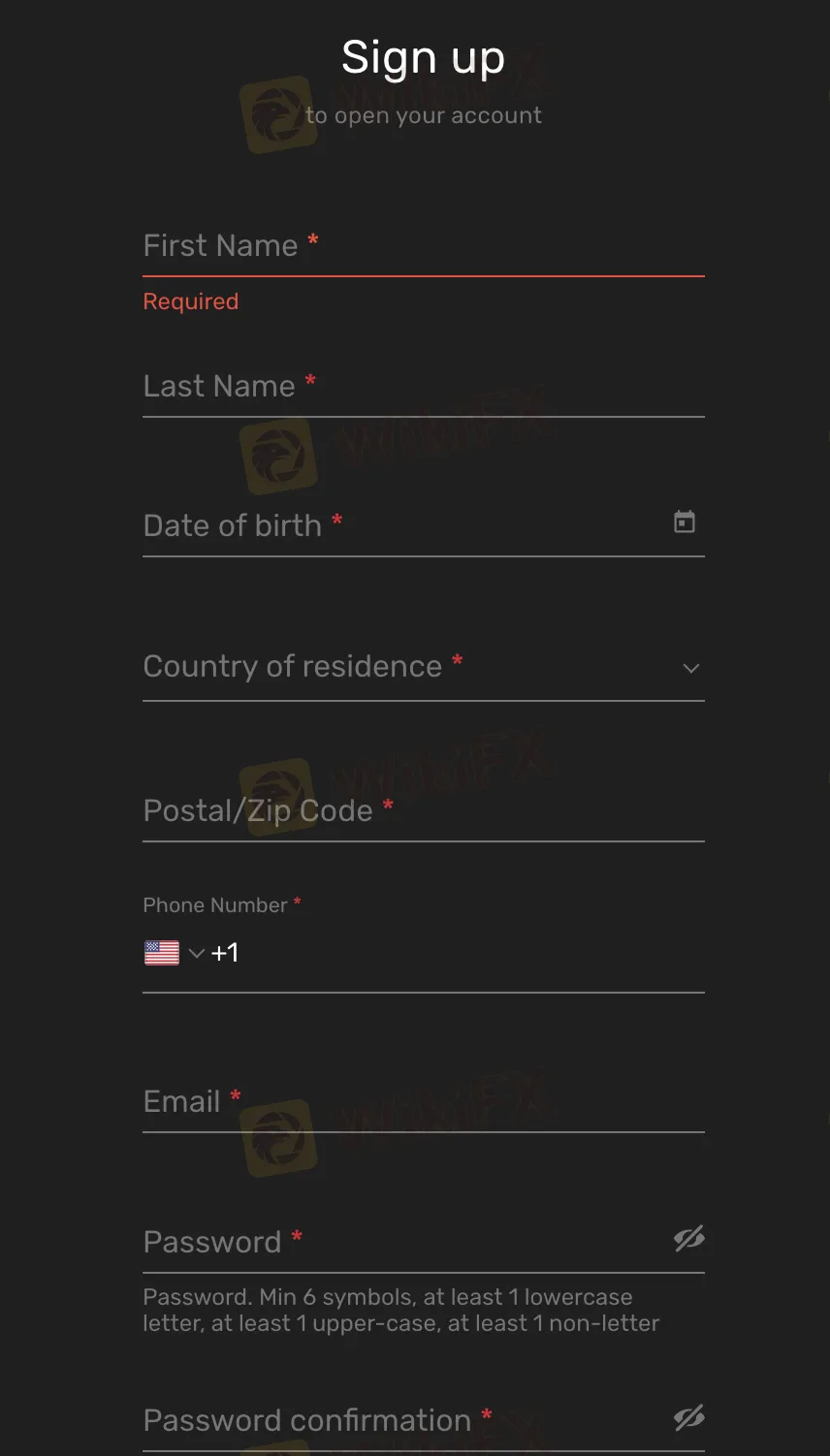

How to Open an Account?

To open an account with Moonance, follow these steps:

Click on the “Create an Account Its Free” button.

Sign up by providing your First Name, Last Name, Date of birth, Country of residence, Postal/Zip Code, Phone Number, and Email.

Set a password that meets the criteria of at least 6 symbols, including at least 1 lowercase letter, 1 uppercase letter, and 1 non-letter character.

Confirm the password.

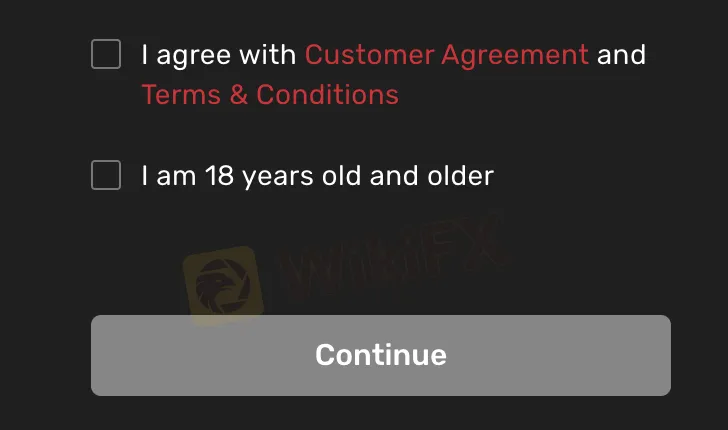

Agree to the Customer Agreement and Terms & Conditions.

Confirm that you are 18 years old or older.

Click on “Continue” to proceed with the account opening process.

Leverage

Moonance provides leverage options of up to 1:500 for traders.

Spreads & Commissions

Moonance offers spreads starting from 1.5 pips for the Classic account, 1.1 pips for the VIP account, and 0.0 pips for the RAW account. Commission fees are $0 for Classic and VIP accounts and $5 for the RAW account.

Minimum Deposit

Moonance's minimum deposit varies across its account types: $100 for Classic, $3,000 for VIP, and $5,000 for RAW.

Deposit & Withdrawal

The deposit and withdrawal information for Moonance cannot be located or accessed from the provided sources.

Promotions

Moonance offers a referral promotion where traders can bring their friends on board. By referring a friend, they have the opportunity to earn up to $200 for themselves and provide their referred friend with $50.

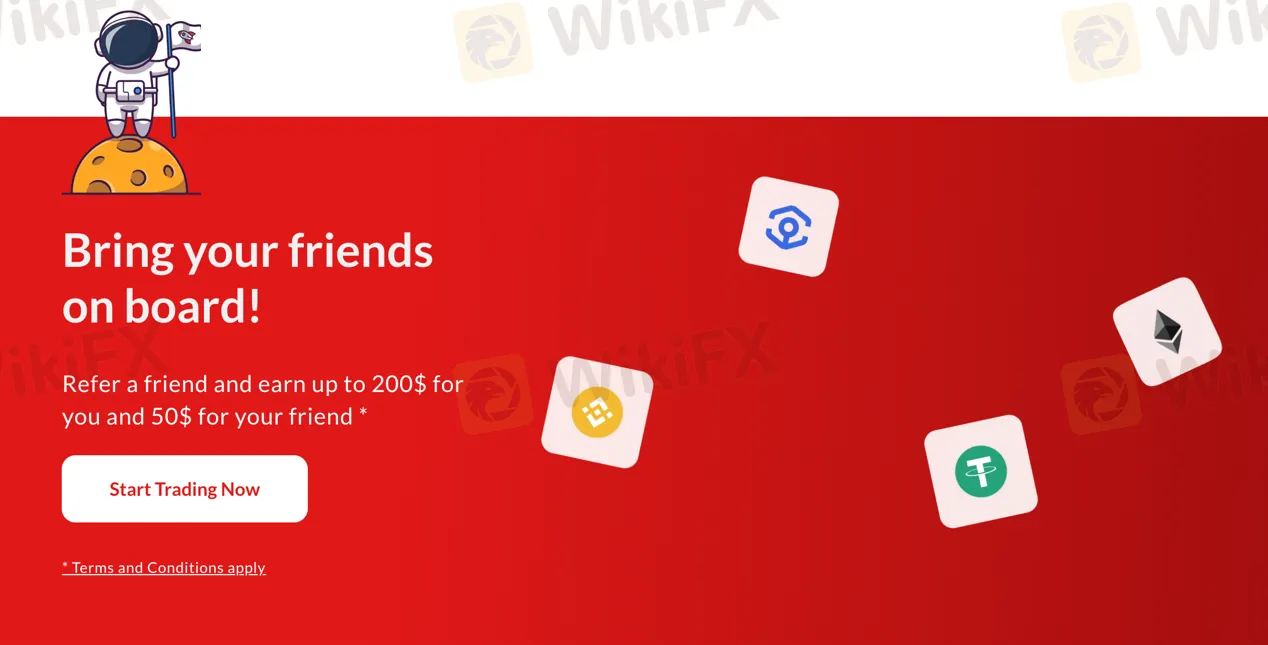

Trading Platforms

Moonance offers two trading platforms for its users. The first is the Moonance Wallet, which provides the option of managing trading accounts, making deposits, transferring funds, and withdrawing earnings. This mobile app supports various payment methods and is available for download on both Apple Store and Google Play.

For a more advanced trading experience, users can opt for the cTrader platform offered by Moonance. With the cTrader platform, traders can start trading within minutes. The platform provides a modern browser-based Web Trader, allowing quick access to global markets with just a few clicks. Additionally, users can download the cTrader app tailored for IOS and Android devices, offering dynamic and sophisticated performance to meet their trading needs. The cTrader platform is available for download on Windows as well.

Customer Support

Moonance provides customer support through their designated email address: support@moonance.com. Additionally, their company address is located on the First Floor of the First St Vincent Bank Ltd Building, James Street, Kingstown, St. Vincent and the Grenadines.

Conclusion

In conclusion, Moonance, a company based in Saint Vincent and the Grenadines, offers a variety of trading instruments, including forex, CFDs, indices, metals, commodities, and shares. However, it is essential to exercise caution as the company lacks valid regulation, potentially increasing associated risks for traders. Moonance provides three account types with different spreads and minimum deposit requirements. Leverage of up to 1:500 is available. The platform offers two trading options: the Moonance Wallet mobile app and the cTrader platform for a more advanced experience. While Moonance provides a referral promotion and email support, the limited information available and the absence of deposit and withdrawal details might be a concern for potential users.

FAQs

Q: Is Moonance a legitimate broker?

A: Moonance lacks valid regulation, posing risks due to the absence of oversight.

Q: What market instruments are available on Moonance?

A: Moonance offers Forex, CFDs, Indices, Metals, Commodities, and Shares.

Q: What are the account types on Moonance?

A: Moonance offers Classic, VIP, and RAW accounts, as well as a free demo account option.

Q: What leverage does Moonance offer?

A: Moonance provides leverage options of up to 1:500 for traders.

Q: What are the spreads and commissions on Moonance?

A: Spreads start from 1.5 pips for Classic, 1.1 pips for VIP, and 0.0 pips for RAW, with $0 commission for Classic and VIP and $5 for RAW.

Q: What is the minimum deposit on Moonance?

A: The minimum deposit varies across account types: $100 for Classic, $3,000 for VIP, and $5,000 for RAW.

Q: What are the available trading platforms on Moonance?

A: Moonance offers Moonance Wallet and cTrader, available on mobile and desktop devices.

Q: How can I contact customer support at Moonance?

A: You can reach Moonance's customer support via email at support@moonance.com, and their company address is located in St. Vincent and the Grenadines.