Score

jimeiwo

Canada|2-5 years|

Canada|2-5 years| https://www.jimeiwo.com/

Website

Rating Index

Contact

Licenses

Licenses

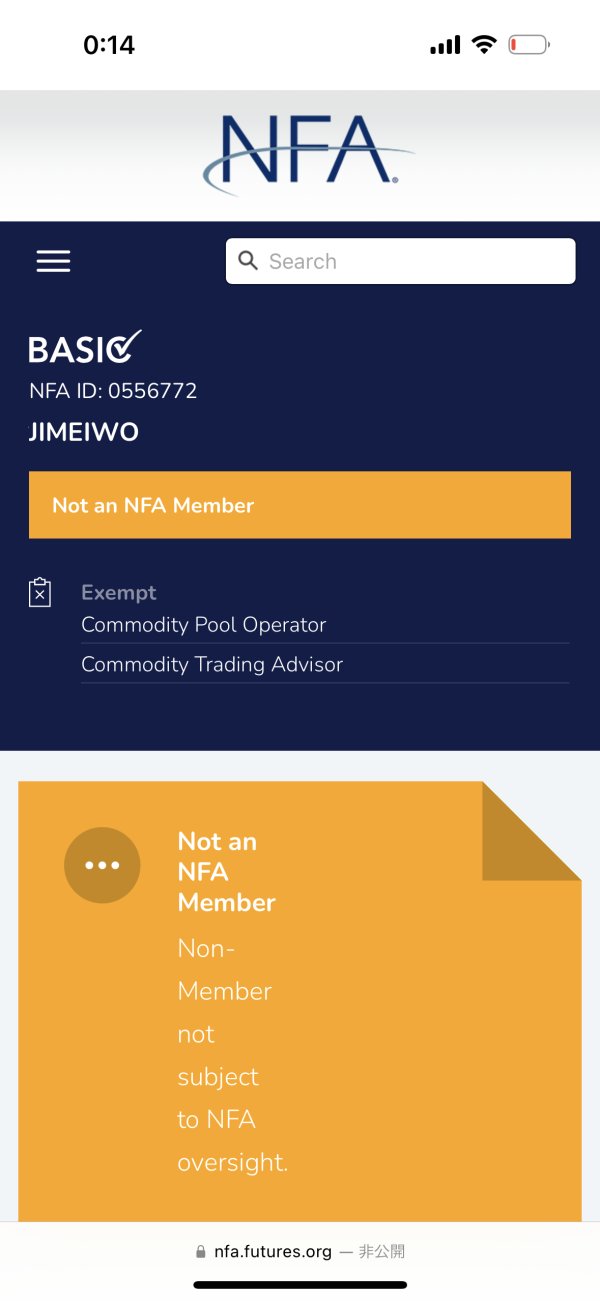

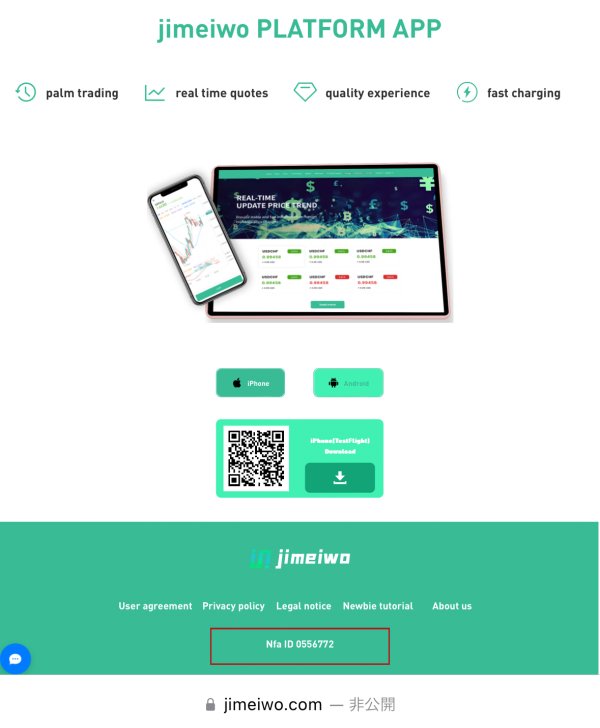

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Canada

CanadaUsers who viewed jimeiwo also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Decode Global

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

jimeiwo.com

Server Location

United States

Website Domain Name

jimeiwo.com

Website

WHOIS.VERISIGN-GRS.COM

Company

HICHINA ZHICHENG TECHNOLOGY LTD.

Domain Effective Date

2016-06-27

Server IP

172.67.172.164

Company Summary

Note: jimeiwo's official website - https://www.jimeiwo.com/ is currently inaccessible normal.

| jimeiwo Review Summary | |

| Founded | / |

| Registered Country/Region | Canada |

| Regulation | Unregulated |

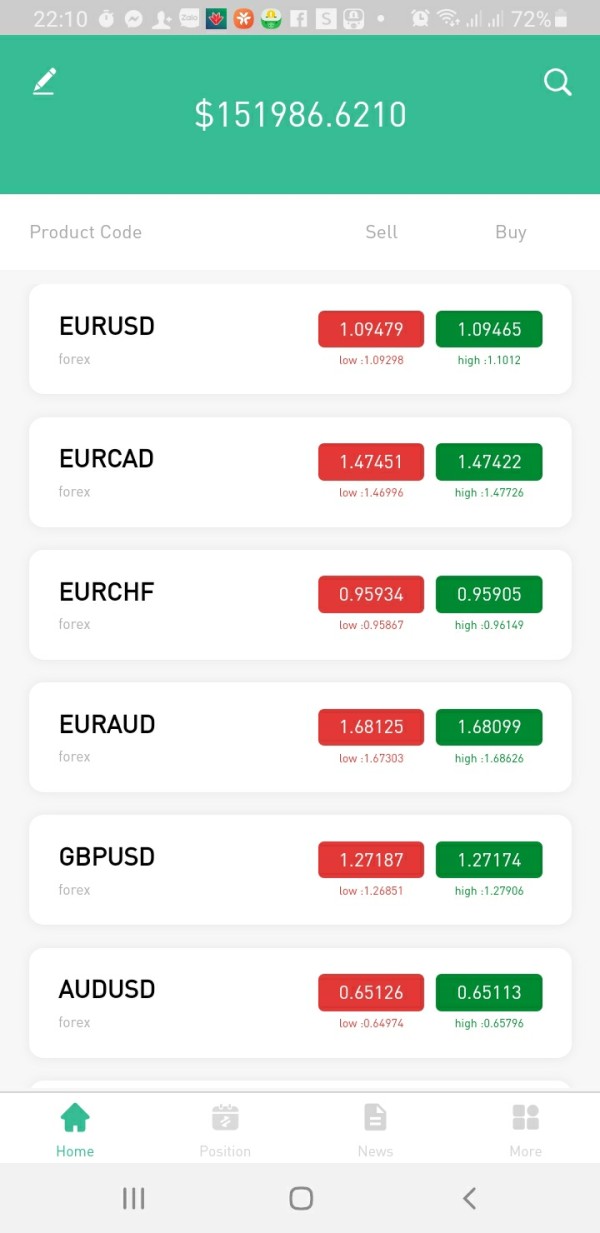

| Market Instruments | Forex, Shares, Indices, Commodities, Options |

| Demo Account | / |

| Leverage | Up to 1:100 |

| Spread | From 1.8 pips (Standard account) |

| Trading Platform | MT4, MT5 |

| Min Deposit | $100 |

| Customer Support | Company Address: 285-A AUGUSTA AVE TORONTO, ON, CANADA M5T2M1 |

Jimeiwo is an unregulated brokerage based in Canada. They primarily provide trading in Forex, Shares, Indices, Commodities, Options on the MetaTrader 4 and MetaTrader 5 platforms. The firm offers three account types: Standard, ECN, and VIP, with the minimum deposit requirement of $100.

Pros and Cons

| Pros | Cons |

| Diverse tradable assets | Unfunctional website |

| Multiple account types | No regulation |

| Commission-free accounts offered | No contact channel |

| MT4 and MT5 supported | |

| Popular payment options |

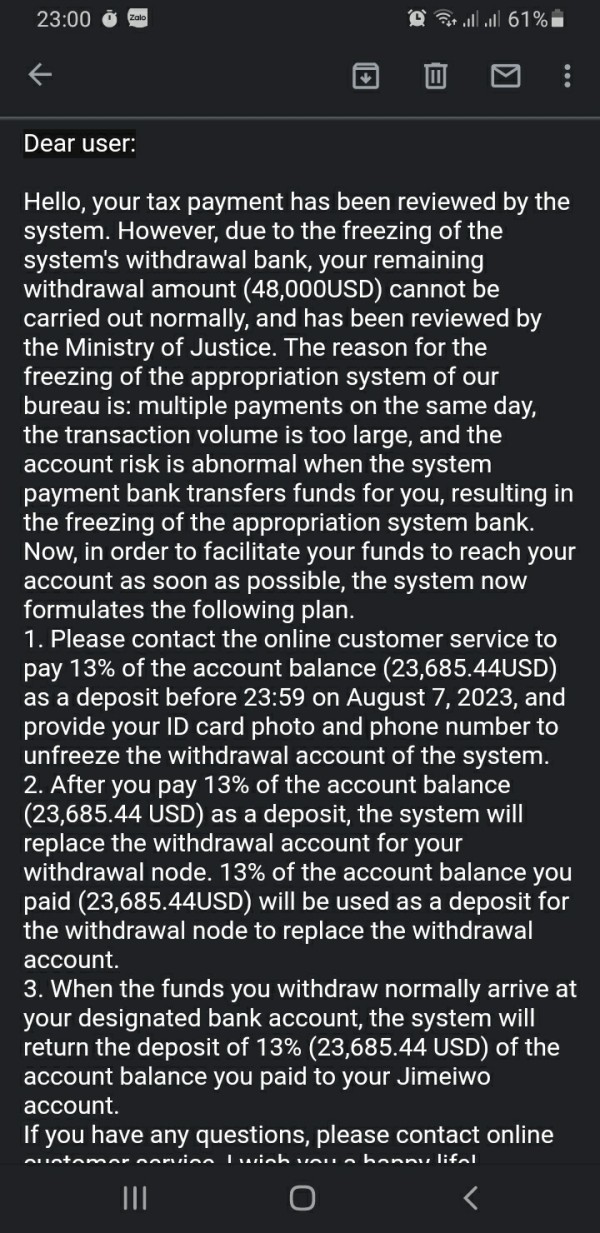

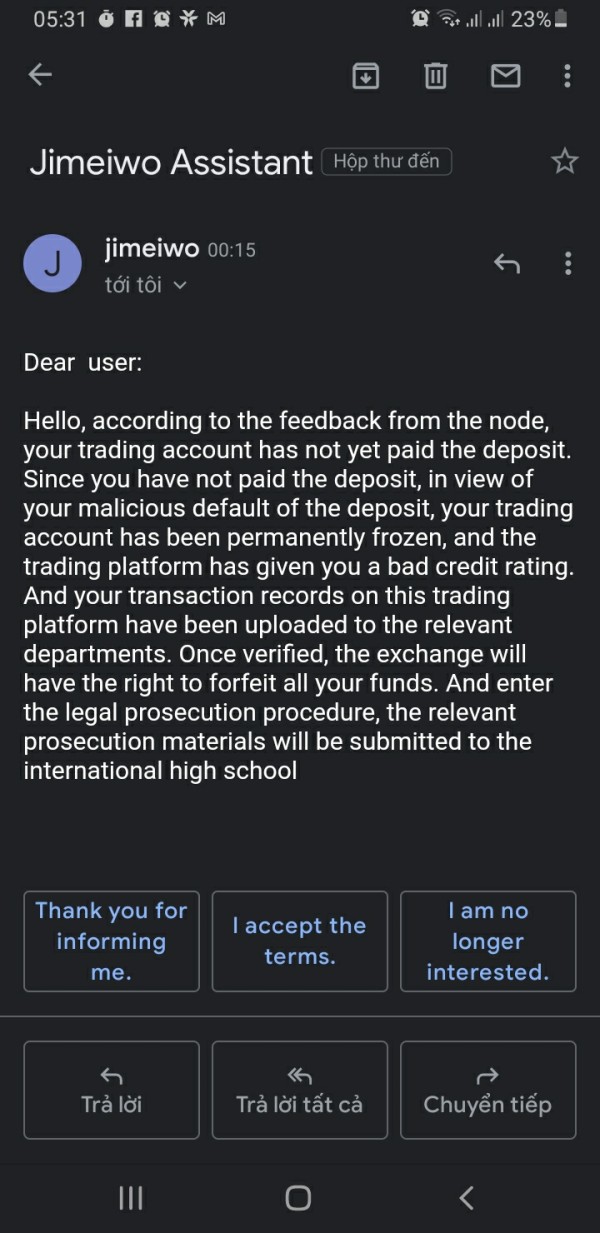

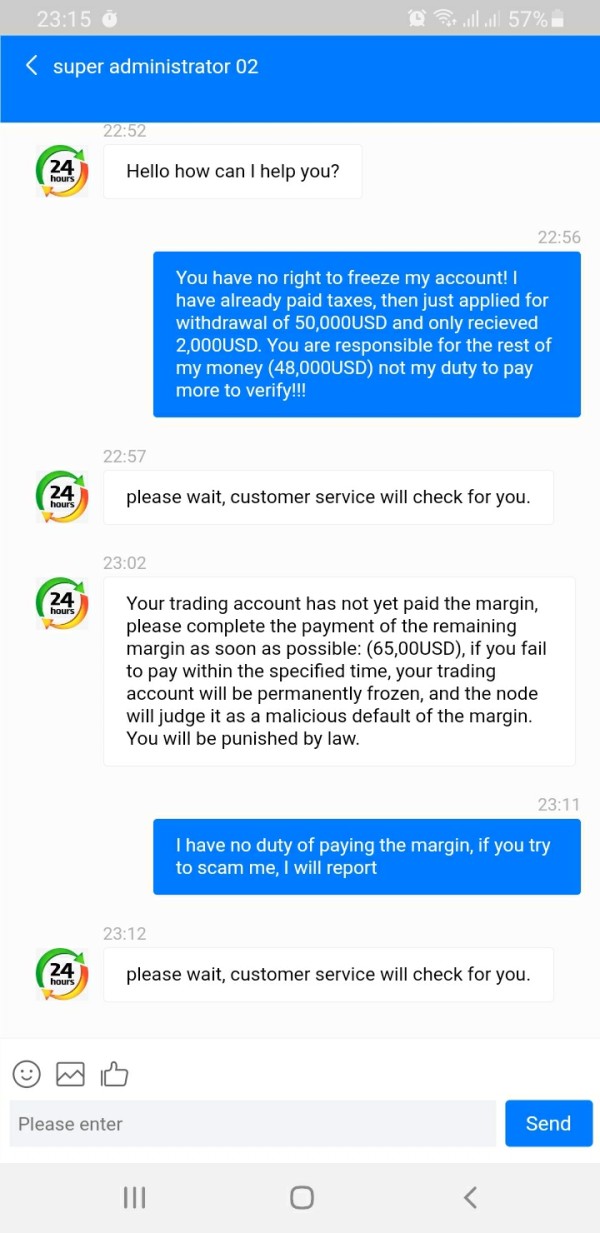

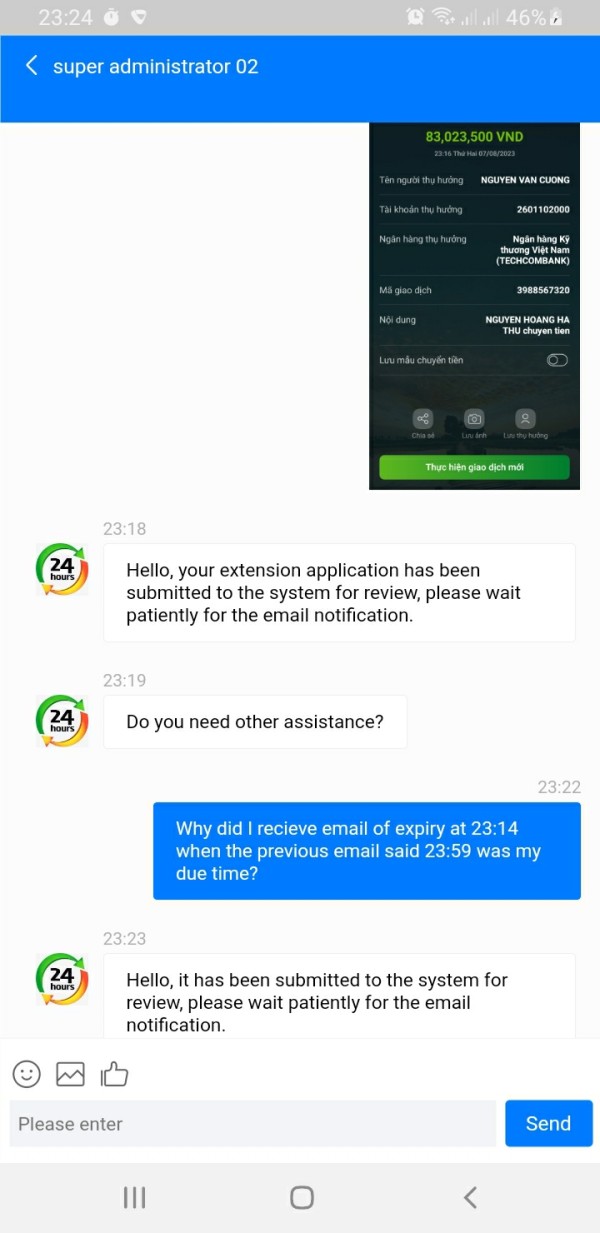

Is Jimeiwo Legit?

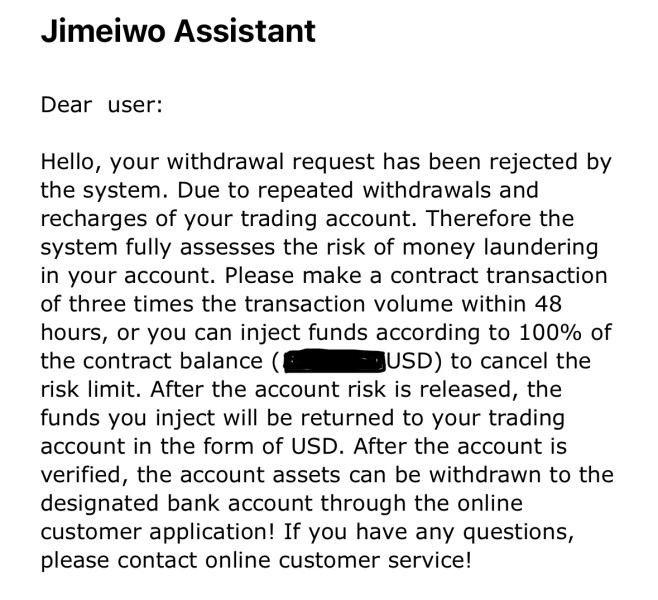

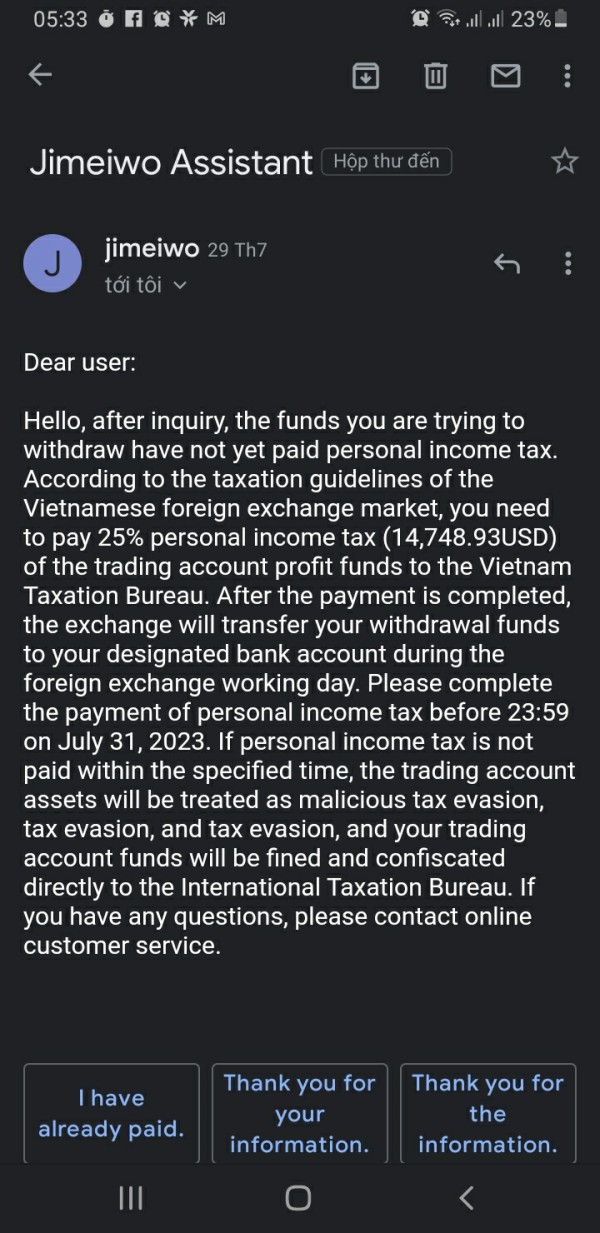

Jimeiwo is currently an unregulated broker, which means that investors' funds cannot be compensated and protected if the broker illegally misappropriates customer funds or faces bankruptcy.

What Can I Trade on Jimeiwo?

Jimeiwo offers a comprehensive range of market instruments, including Forex, Shares, Indices, Commodities, and Options.

| Trading Asset | Available |

| forex | ✔ |

| commodities | ✔ |

| indices | ✔ |

| shares | ✔ |

| options | ✔ |

| cryptocurrencies | ❌ |

| bonds | ❌ |

| ETFs | ❌ |

Account Type/Fees

Jimeiwo offers three distinct account types—Standard, ECN, and VIP.

| Account Type | Spread | Commission |

| Standard | From 1.8 pips | / |

| ECN | From 0.0 pips | $7 |

| VIP | From 0.0 pips | $5 |

Leverage

Jimeiwo offers varying leverage ratios based on the market instruments. For the forex market, traders can access leverage ratios of up to 1:100.

| Trading Asset | Max Leverage |

| Forex | 1:100 |

| Stocks | 1:50 |

| Indices | 1:20 |

| Commodities | 1:10 |

| Cryptocurrencies | 1:50 |

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Trading Platform

Jimeiwo provides traders with the option of two popular trading platforms: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). Both platforms are recognized for their intuitive interfaces and extensive features.

| Trading Platform | Supported | Available Devices | Suitable for |

| MT4 | ✔ | Desktop, Mobile, Web | Beginners |

| MT5 | ✔ | Desktop, Mobile, Web | Experienced traders |

Deposit and Withdrawal

Jimeiwo accepts deposits and withdrawals via bank transfers, wire transfers, credit cards/debit cards, and PayPal.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 2

Content you want to comment

Please enter...

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now