Score

TUBNOW

China|2-5 years|

China|2-5 years| https://www.tubnow.com/en/index.htm

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

China

ChinaUsers who viewed TUBNOW also viewed..

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Maker (MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

tubnow.com

Server Location

Japan

Website Domain Name

tubnow.com

Server IP

13.230.25.7

Company Summary

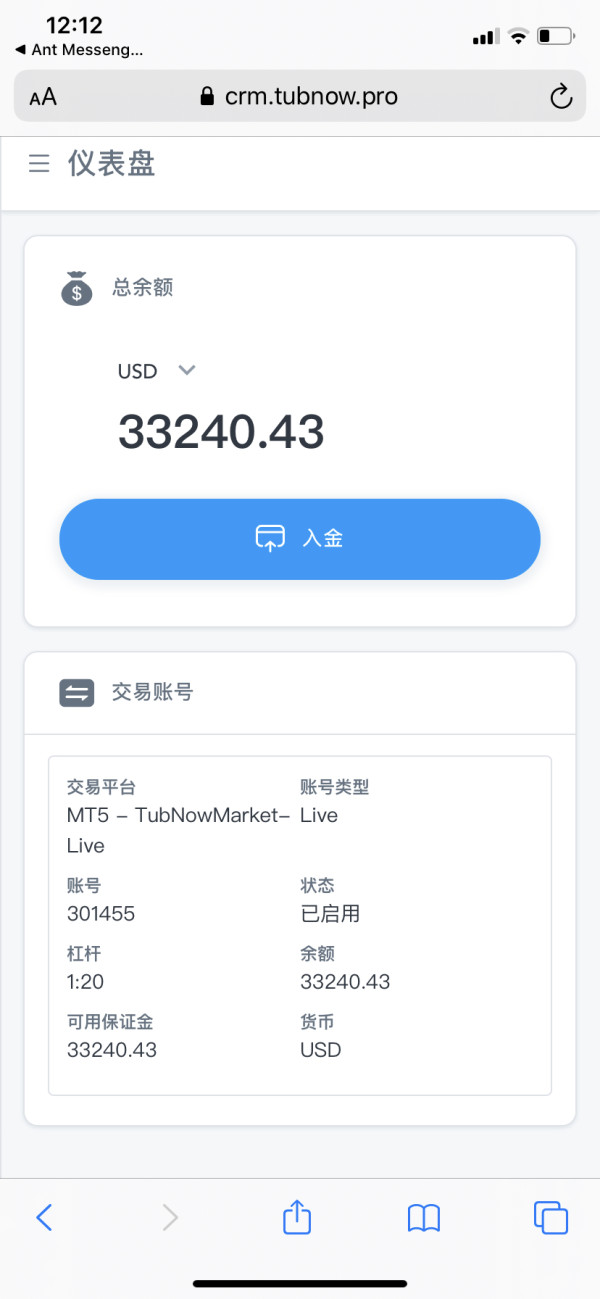

| Company name | TUBNOW |

| Registered in | China |

| Regulated by | Unregulated |

| Years of establishment | 1-2 years |

| Trading instruments | Forex, CFDs, cryptocurrencies |

| Account Types | Demo account, Standard account, VIP account |

| Minimum Initial Deposit | $250 |

| Maximum Leverage | 1:500 (Standard account), 1:1000 (VIP account) |

| Minimum Spread | 0.7 pips |

| Trading Platform | MetaTrader 4 |

| Deposit and withdrawal method | Credit cards, debit cards, bank transfers, e-wallets |

| Customer service | Available 24/7 through live chat, email, or phone |

Overview of TUBNOW

TUBNOW is a forex broker that was founded in China. The company is unregulated and has been in operation for 1-2 years. TUBNOW offers a variety of trading instruments, including forex, CFDs, and cryptocurrencies. The broker also offers a range of account types, including a demo account, a standard account, and a VIP account.

The minimum deposit amount is $250. TUBNOW offers high leverage limits, with the standard account offering a maximum leverage of 1:500 and the VIP account offering a maximum leverage of 1:1000. The average spread for EUR/USD is 0.7 pips. TUBNOW's trading platform is MetaTrader 4. The broker accepts a variety of deposit methods, including credit cards, debit cards, bank transfers, and e-wallets. Customer support is available 24/7 through live chat, email, or phone.

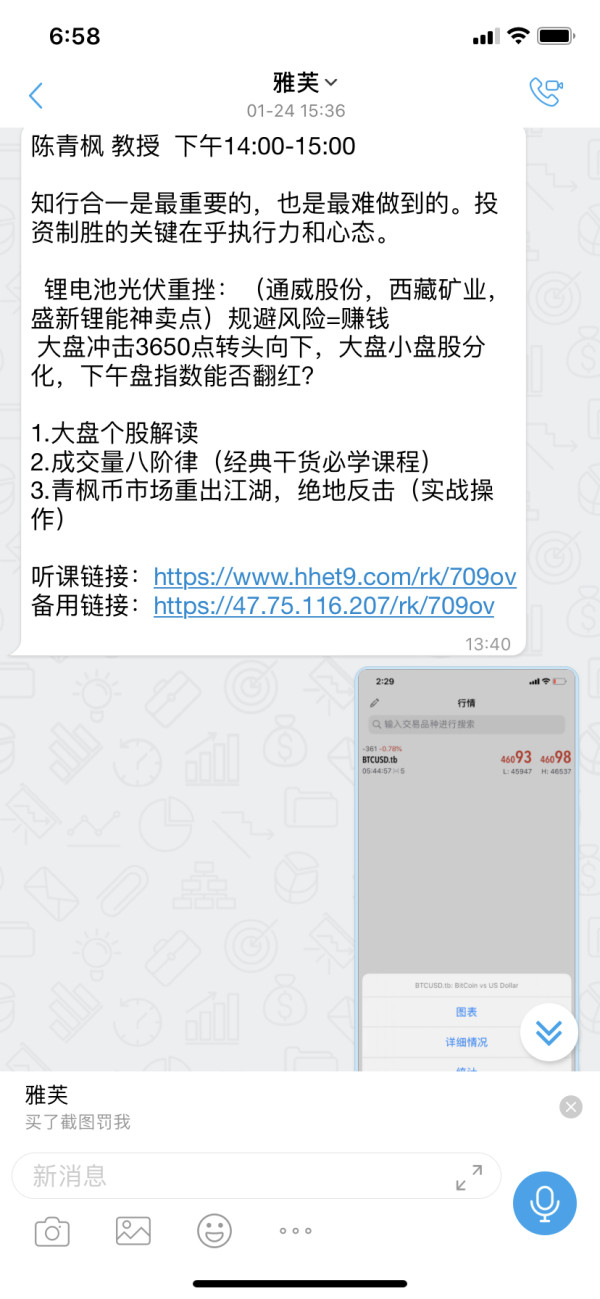

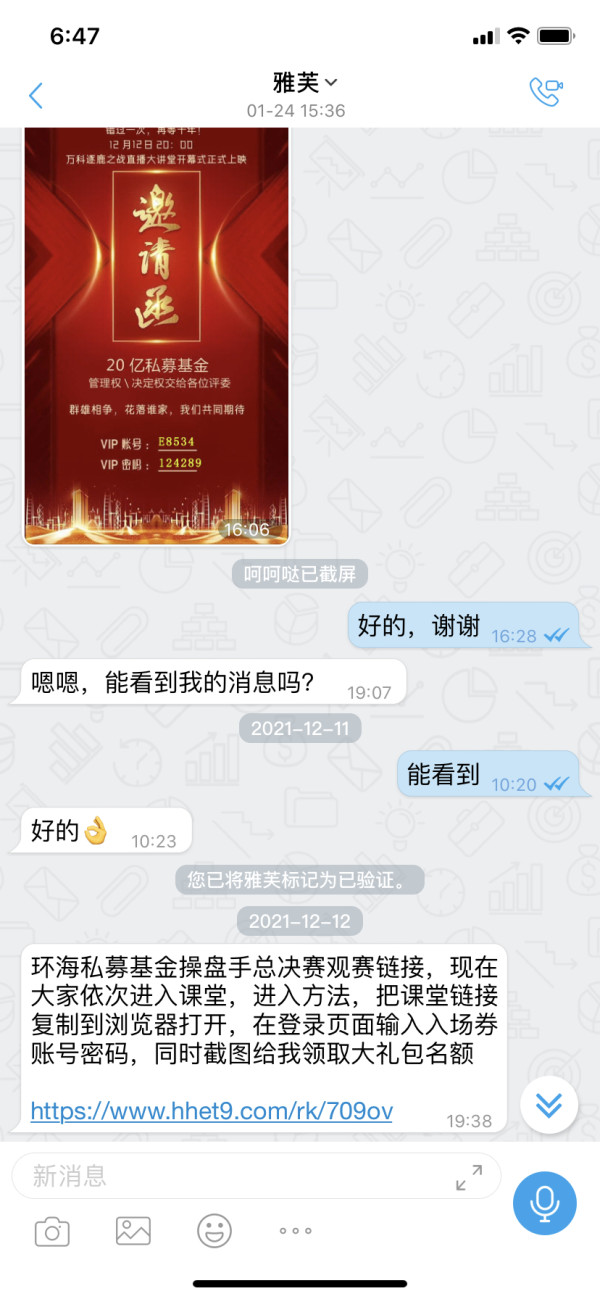

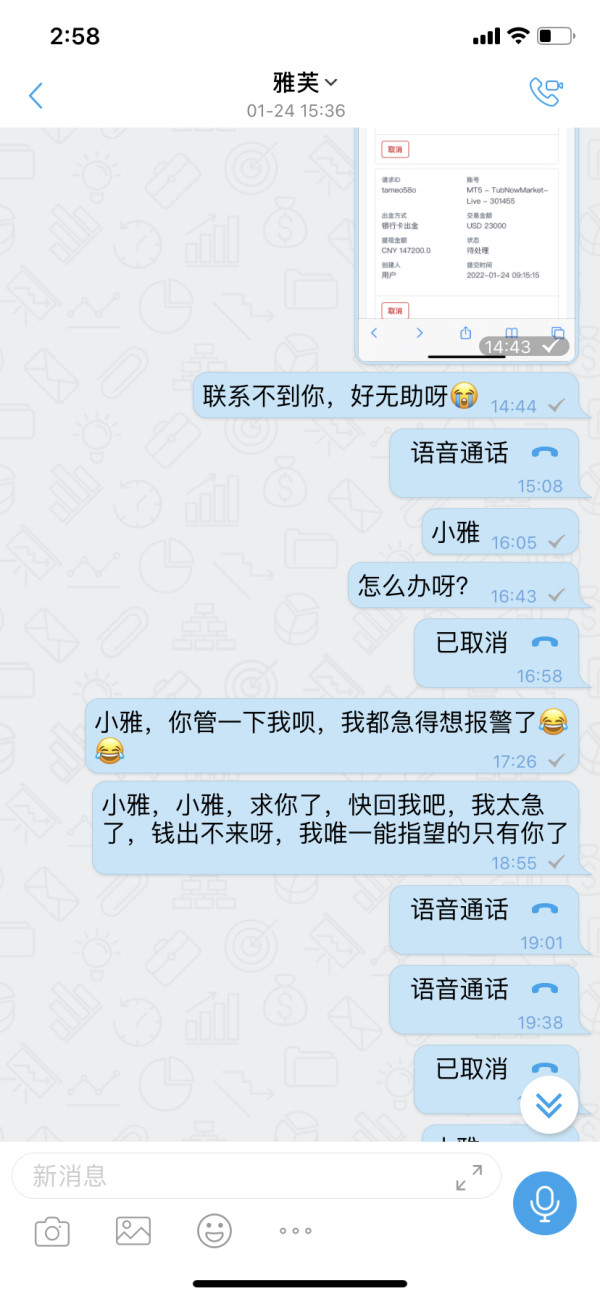

Is TUBNOW legit or a scam?

Unregulated brokers, like TUBNOW, operate without oversight from a reputable financial regulator, such as the Financial Services Authority (FSA) in Seychelles. The absence of proper regulation raises concerns about the broker's legitimacy and credibility.

The regulation provides a layer of protection for traders, ensuring that brokers adhere to strict financial standards, maintain segregated client funds, and operate transparently. Unregulated brokers may lack proper risk management practices, leading to potential mishandling of client funds or unfair trading conditions. Moreover, without regulation, traders may have limited recourse in case of disputes or issues with the broker, making it riskier to trade with an unregulated entity.

Choosing a regulated broker is essential for traders' peace of mind and protection of their investments. Regulated brokers are subject to regular audits and oversight, ensuring that they comply with industry standards and maintain a high level of transparency and security. Clients of regulated brokers have access to mechanisms for dispute resolution, and their funds are typically kept in segregated accounts, separate from the broker's operating funds, adding an extra layer of security.

Pros and Cons

TUBNOW offers several advantages that attract traders to its platform. Firstly, the broker provides a wide variety of trading instruments, including forex, CFDs, and cryptocurrencies, allowing traders to access diverse financial markets and opportunities. Additionally, TUBNOW offers high leverage, with a maximum leverage of 1:500 for the standard account and 1:1000 for the VIP account. High leverage can amplify potential profits, making it appealing to traders looking to maximize their gains.

Furthermore, the broker boasts competitive spreads, with an average spread of 0.7 pips for EUR/USD, which can help reduce trading costs for clients. The availability of the popular MetaTrader 4 trading platform further enhances TUBNOW's appeal, as it is well-known for its user-friendly interface and powerful trading tools. Moreover, the broker's 24/7 customer support ensures that traders can seek assistance at any time, helping to address concerns and inquiries promptly.

However, it is essential to consider the downsides of trading with TUBNOW. The broker's lack of regulation is a significant concern. Regulation plays a crucial role in protecting traders' interests, ensuring fair and transparent practices, and safeguarding client funds.

Additionally, some complaints about TUBNOW's customer support indicate potential issues with the broker's responsiveness or quality of service. Efficient customer support is vital for traders, especially in a fast-paced market like forex, where timely assistance can make a difference in trading outcomes.

| Pros | Cons |

| Variety of trading instruments | Unregulated |

| High leverage limits | Some complaints about customer support |

| Competitive spreads | |

| MetaTrader 4 platform | |

| 24/7 customer support |

Trading Instruments

TUBNOW offers a wide range of trading instruments, including forex, CFDs on stocks, commodities, indices, and cryptocurrencies. This diversity allows traders to access various financial markets, providing them with multiple opportunities to diversify their trading strategies and potentially increase their profit potential. By offering popular and emerging cryptocurrency pairs alongside traditional assets, TUBNOW caters to both experienced and new traders interested in the digital asset market.

Account Types

TUBNOW provides three distinct account types, catering to different trader preferences and experience levels. The availability of a demo account is an excellent feature for new traders or those wanting to test the platform before committing real funds. The standard account caters to most traders with its basic features, while the VIP account offers additional benefits, such as higher leverage limits and dedicated customer support, appealing to more seasoned traders seeking personalized services.

Leverage

One of the advantages TUBNOW offers is high leverage limits, particularly with the VIP account, where the maximum leverage reaches 1:1000. While high leverage can magnify potential profits, it also comes with increased risk. As a responsible broker, TUBNOW should ensure that it educates its clients about the risks associated with high leverage trading and implement measures to protect traders from overleveraging and potential losses.

Spreads and Commissions

Competitive spreads, like the average spread of 0.7 pips for EUR/USD, are attractive to traders, as narrower spreads can lower trading costs and enhance profitability. However, traders should also consider the broker's commission of $3 per lot, as it contributes to the overall transaction costs. Transparent and reasonable spreads and commissions are essential for a broker's reputation and long-term relationship with its clients.

Trading Platform

TUBNOW's decision to offer MetaTrader 4 (MT4) as its trading platform is a testament to its commitment to providing traders with a powerful and widely recognized trading solution. MetaTrader 4 is one of the most popular and respected platforms in the forex industry, and its widespread adoption by millions of traders worldwide speaks to its efficiency and reliability.

One of the key reasons for MT4's popularity is its user-friendly interface, making it suitable for both experienced traders and beginners. The platform's intuitive layout allows users to easily navigate through various features and tools, making it accessible to traders with varying levels of expertise. Additionally, MT4 offers a wide range of technical indicators, charting tools, and customizable templates, empowering traders to conduct in-depth technical analysis and implement various trading strategies.

Customer Support

While TUBNOW's customer support is available 24/7, there have been some complaints about its responsiveness or efficiency. Prompt and helpful customer support is crucial in the forex industry, as traders may encounter issues that require immediate attention. TUBNOW should address these complaints seriously and take steps to improve its customer support services to ensure a satisfactory trading experience for all clients.

Educational Resources

TUBNOW's commitment to providing educational resources, such as webinars, articles, and tutorials, demonstrates its efforts to support traders in their journey. These resources can be invaluable to both beginners and experienced traders looking to enhance their skills and stay informed about the latest market trends and strategies. By continuously updating and expanding its educational content, TUBNOW can empower its clients to make more informed trading decisions.

Conclusion

TUBNOW is an unregulated forex broker based in China, offering trading services for approximately 1-2 years. While the broker provides a variety of trading instruments and account types to cater to different traders, its lack of regulation raises concerns about its legitimacy and transparency. Trading with an unregulated broker carries inherent risks, as clients may not have the same level of protection and oversight compared to regulated brokers. Traders should exercise caution and carefully evaluate the potential risks and benefits before choosing to trade with TUBNOW or any unregulated broker. It is advisable for traders to prioritize their safety and consider alternative options with proper regulation to ensure a secure and reliable trading experience.

FAQs

Q: What is the minimum deposit amount?

A: $250.

Q: What are the leverage limits?

A: 1:500 (Standard account), 1:1000 (VIP account).

Q: What are the spreads and commissions?

A: The average spread for EUR/USD is 0.7 pips. The broker also charges a commission of $3 per lot.

Q: What trading platform does TUBNOW use?

A: MetaTrader 4.

Q: How can I contact customer support?

A: You can contact customer support through live chat, email, or phone.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Comment 2

Content you want to comment

Please enter...

Comment 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now