Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

ayung

Malaysia

many excuse was given by this broker said system hack , tomorrow said many requests withdrawal later said cyber attack,, please refund our fund this is the money we have

Exposure

2024-12-05

FX3660110926

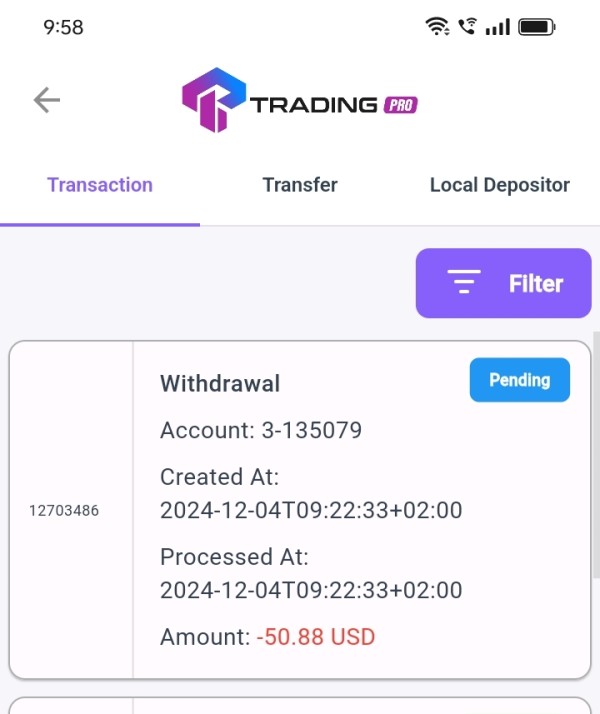

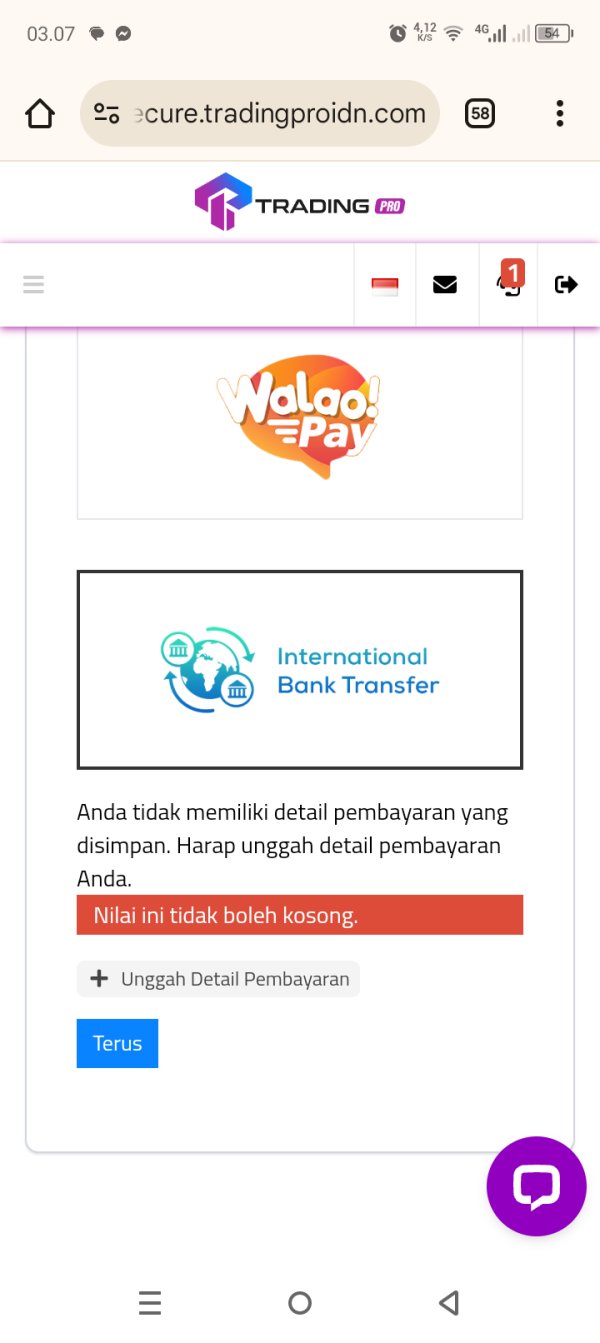

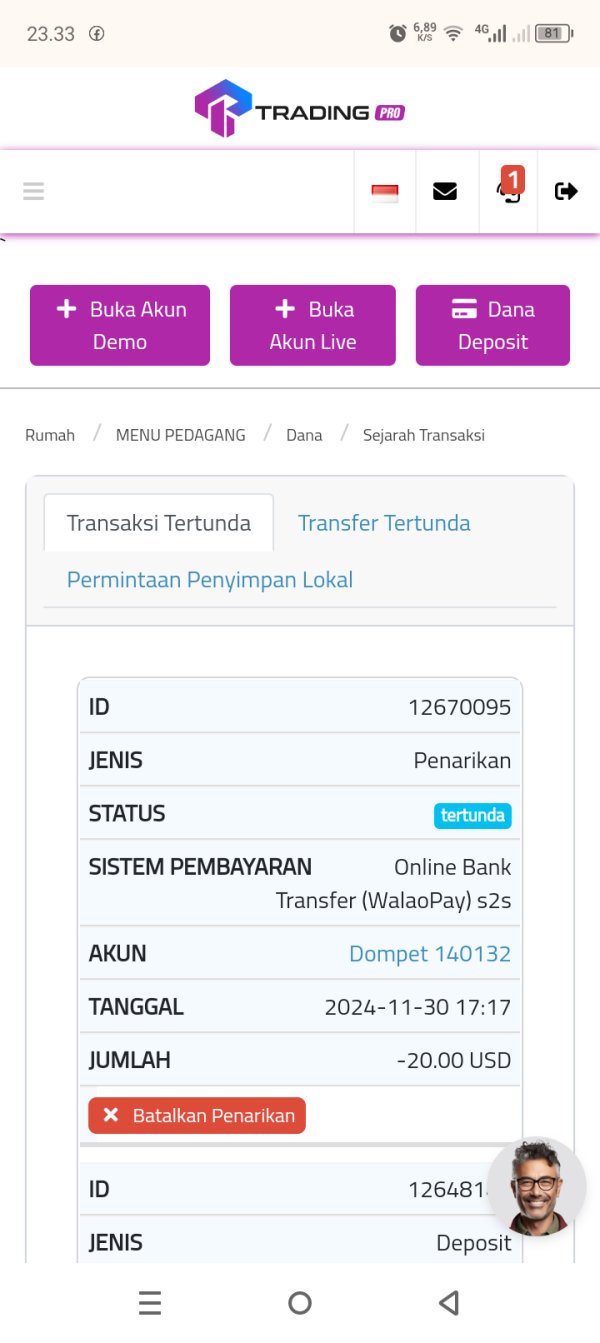

Indonesia

Please confirm the withdrawal of my funds as soon as possible. It has been 2 days and the funds have not been credited yet.

Exposure

2024-12-01

FX1411091207

Indonesia

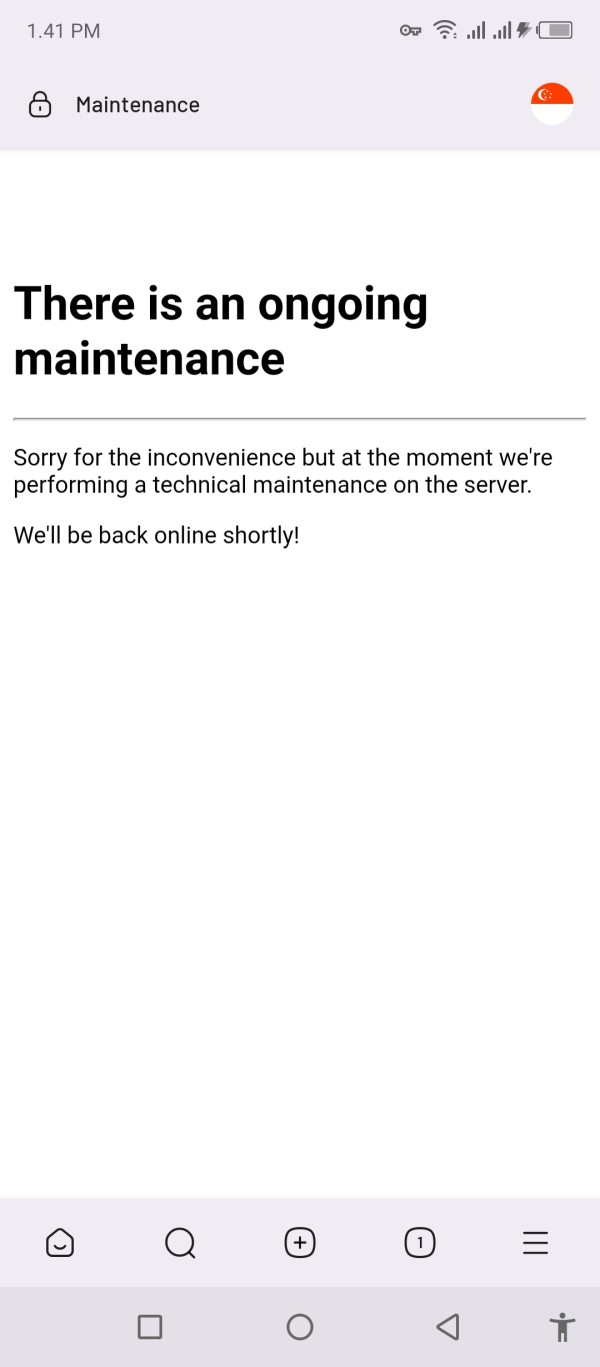

Why can't Trading Pro on November 17, 2024 at 1:43 pm access its website???

Exposure

2024-11-17

FX2742355029

Malaysia

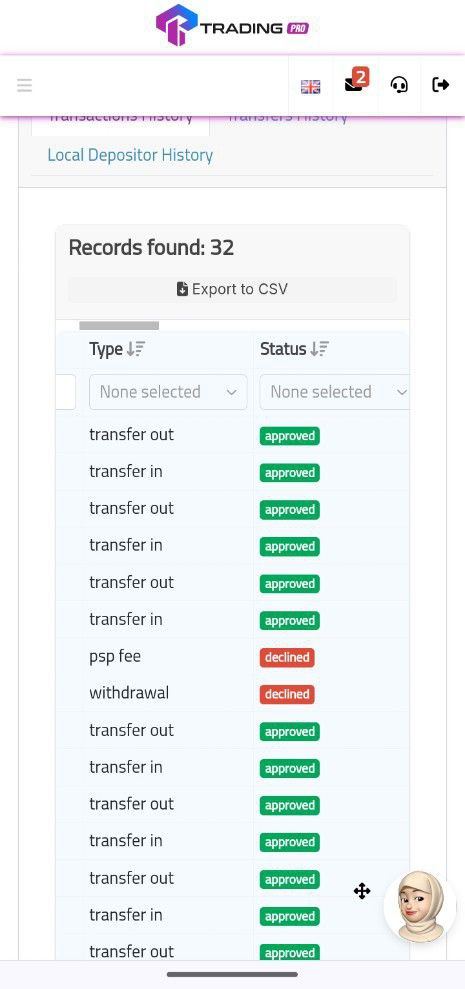

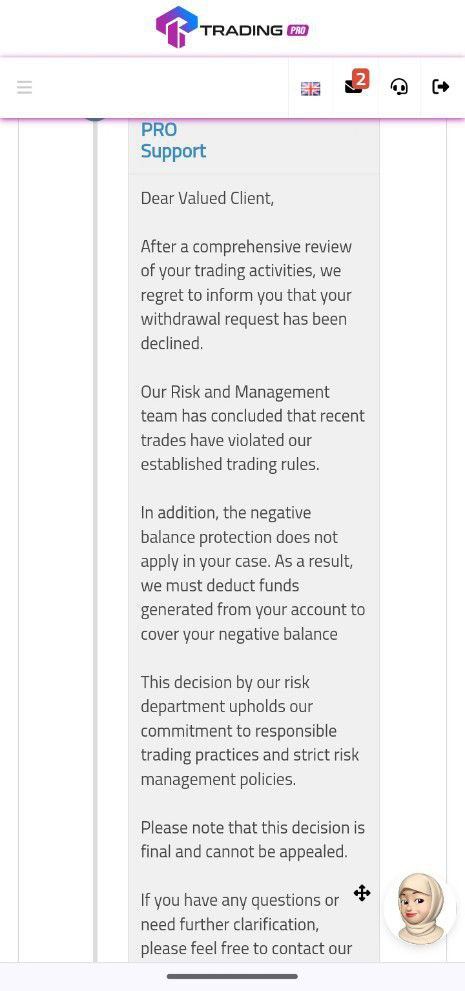

I applied for a withdrawal but it was rejected, and then the platform deducted the funds from my account.

Exposure

2024-08-15

shaheer 8539

Malaysia

My acct hanging 1 our until mc.. Fck pls go away frm this broker.. Always hanging... Mt5 hanging

Exposure

2024-01-16

Nur7725

Indonesia

USDCHF price miraculously and shockingly fell to 0.00001. This event occurs on cent accounts.

Exposure

2023-04-26

wally6125

Argentina

I can't get in touch with the person who set up the account and I can't withdraw my money, I changed the password.

Exposure

2023-04-05

FX1220611114

Argentina

I have been trading with Trading Pro for two years, and I must say this broker is excellent. Trading pro offers competitive spreads, 1:2000 trading leverage, swap-free options… No problems with withdrawals. I totally recommend it.

Neutral

2023-02-22

Aiman3527

United Kingdom

2nd time experience of slippage mse high impact news with this broker since he changed the broker name from xsocio to trading pro...everything else is ok, no problem

Neutral

2022-12-20

FX3534677370

Japan

I have been trading with TradingPro for two years, the trading conditions are one of the best in the forex market, the withdrawal of profits is prompt, usually within 15 minutes, I withdraw through crypto. The execution of trades is good, although pending orders are slightly worse during news releases. I recommend this broker.

Positive

03-30

FX3534677370

United Arab Emirates

Best broker. I have been working with them for two years. The best conditions in the forex market, low commissions, swap-free accounts, cashback, tight spreads. My trading style involves holding positions in the market for a long time, so the absence of swaps is of great importance. Deposits and withdrawals are faster than drinking a cup of coffee, I work through cryptocurrency. I attach a screenshot of recent withdrawals. I recommend the broker.

Positive

2024-09-08

JohnPiranhaPips

Malaysia

No issue. Best broker i've been using. Fast deposit withdrawal. The best spread ever. THANKS.

Positive

2023-02-01

Shah5437

Malaysia

The best lowest spread worldwide which offer 0.0pips with lowest commission $3USD per lot! fast withdrawal safe and secure!

Positive

2022-11-11