Overview of Trustgates

Trustgates, established in 2021 and based in Germany, is an unregulated trading company offering a diverse range of market instruments, including Forex, bonds, stocks, commodities, ETFs, and indices. With a minimum deposit requirement of $250, it provides both individual and joint account options.

Notably, Trustgates features competitive trading conditions with spreads as low as 0 pips and zero commissions. The platform supports popular trading platforms like MT4 and MT5 and also offers a demo account for practice trading.

Customer support is accessible via email at support@trustgates.net and phone at +49 307 001 07 424. For financial transactions, the platform accepts bank transfers and credit/debit cards. Additionally, Trustgates enriches its users' trading experience with educational resources, including webinars and seminars.

Is Trustgates Legit or a Scam?

Trustgates operates as an unregulated trading entity, meaning it does not fall under the supervision of any financial regulatory authority.

This lack of regulation is a significant aspect for potential clients to consider, as regulatory oversight often provides a layer of protection for traders, ensuring adherence to certain standards and practices.

The absence of regulation can imply increased risks, such as lesser accountability and transparency in operations, potentially affecting the security of investments and the recourse available to traders in dispute scenarios.

Therefore, while engaging with Trustgates, traders should exercise caution and conduct thorough due diligence, considering the implications of trading with an unregulated platform.

Pros and Cons

Pros of Trustgates:

Diverse Market Instruments: Trustgates offers a wide range of trading options, including Forex, bonds, stocks, commodities, ETFs, and indices, catering to various investment interests and strategies.

Competitive Trading Conditions: The platform boasts spreads as low as 0 pips and zero commissions, making it financially attractive for traders looking to maximize their investment returns.

Advanced Trading Platforms: It supports MT4 and MT5, which are among the most popular and advanced trading platforms, known for their robust features and user-friendly interfaces.

Demo Account Availability: Trustgates provides a demo account option, allowing traders to practice and hone their trading skills without risking real money.

Educational Resources: The platform offers educational resources like webinars and seminars, which can be highly beneficial for both novice and experienced traders in enhancing their trading knowledge and skills.

Cons of Trustgates:

Unregulated: The lack of regulation presents risks such as limited protection for traders, potential for less transparency, and fewer safeguards against malpractices.

Higher Minimum Deposit: With a minimum deposit of $250, it might be less accessible for beginners or those looking to start with a smaller capital investment.

Limited Customer Support Channels: While it offers email and phone support, the absence of instant support options like live chat could lead to slower response times.

Potential Risks for Investors: As an unregulated entity, the risks associated with market volatility and trading practices might be higher compared to regulated platforms.

Geographical Restrictions: Being based in Germany and operating under its specific legal framework might impose certain restrictions or limitations for traders from other jurisdictions.

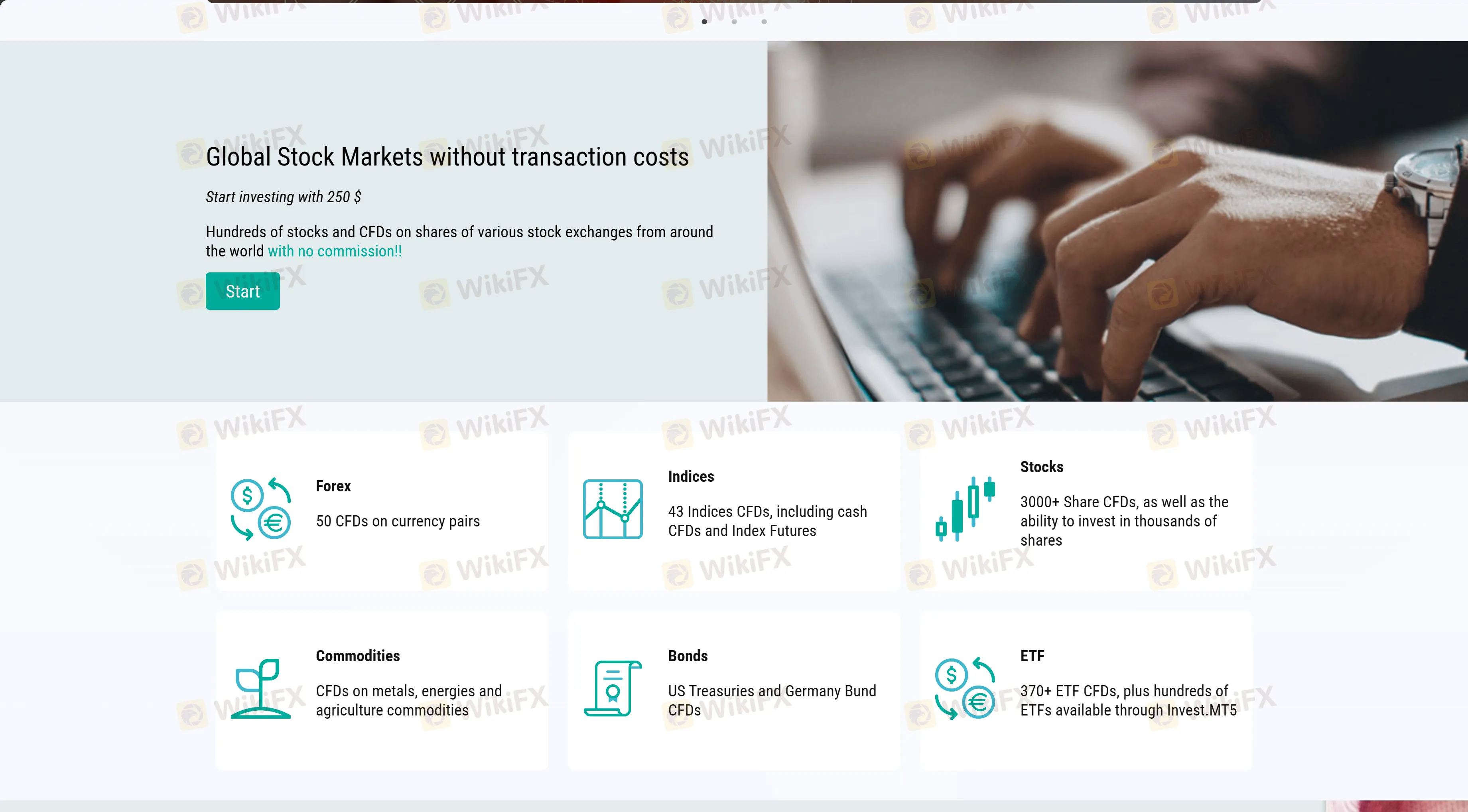

Market Instruments

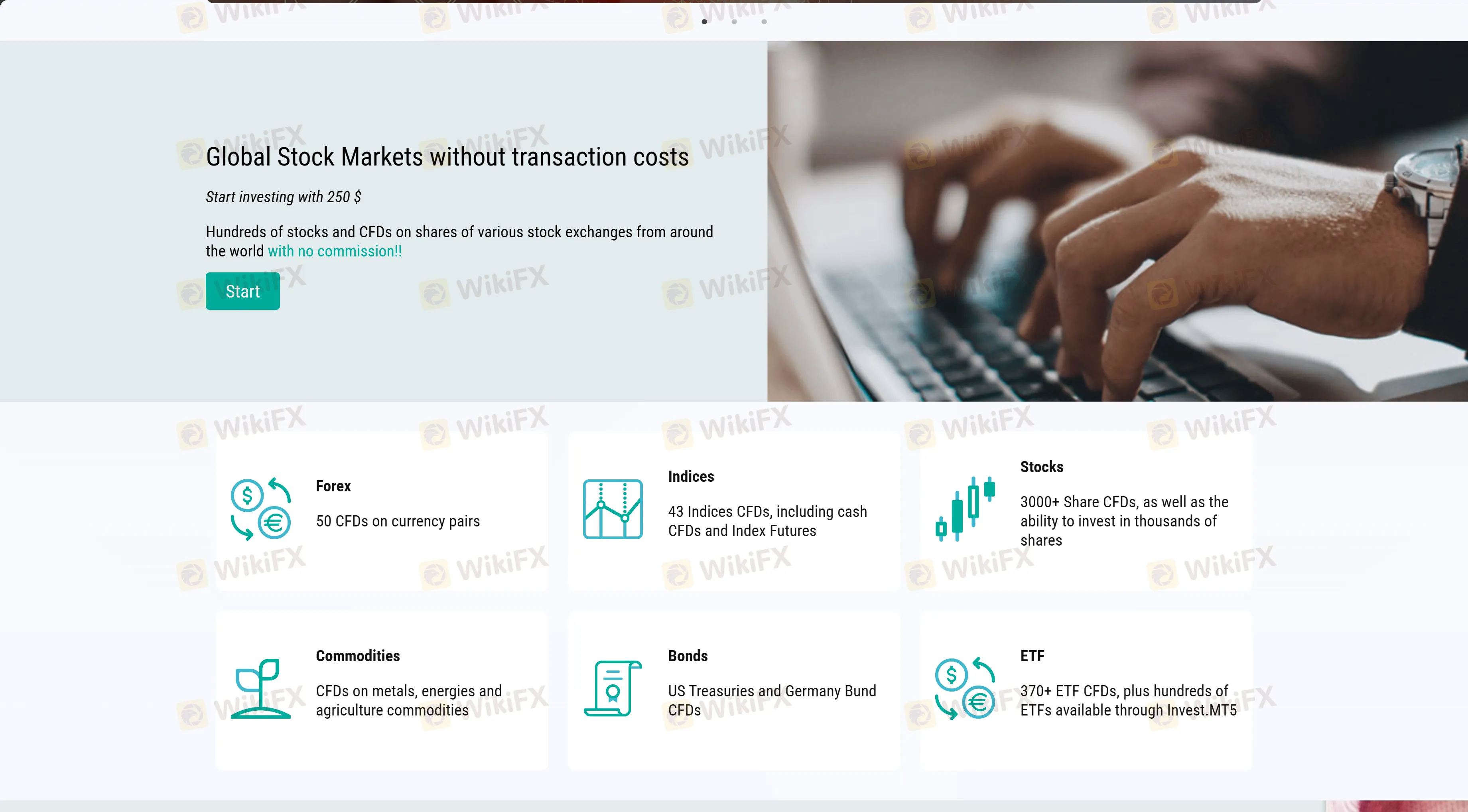

Trustgates offers a diverse array of market instruments, enabling traders to expand their investment portfolios across various asset classes:

Forex (Foreign Exchange):

Trustgates provides a platform for trading in various currency pairs, encompassing major, minor, and exotic pairs. This allows traders to engage in the dynamic and potentially lucrative forex market, leveraging the fluctuations in global currency exchange rates.

Bonds:

The platform offers the opportunity to trade in bonds, which are fixed-income investments representing loans made by an investor to a borrower. Bond trading at Trustgates might include government, municipal, and corporate bonds, offering a way to diversify investment portfolios and potentially reduce risk.

Stocks:

Trustgates enables trading in a range of stocks, allowing investors to buy shares in various companies. This can include stocks from different sectors and regions, providing opportunities for equity investments and capital growth.

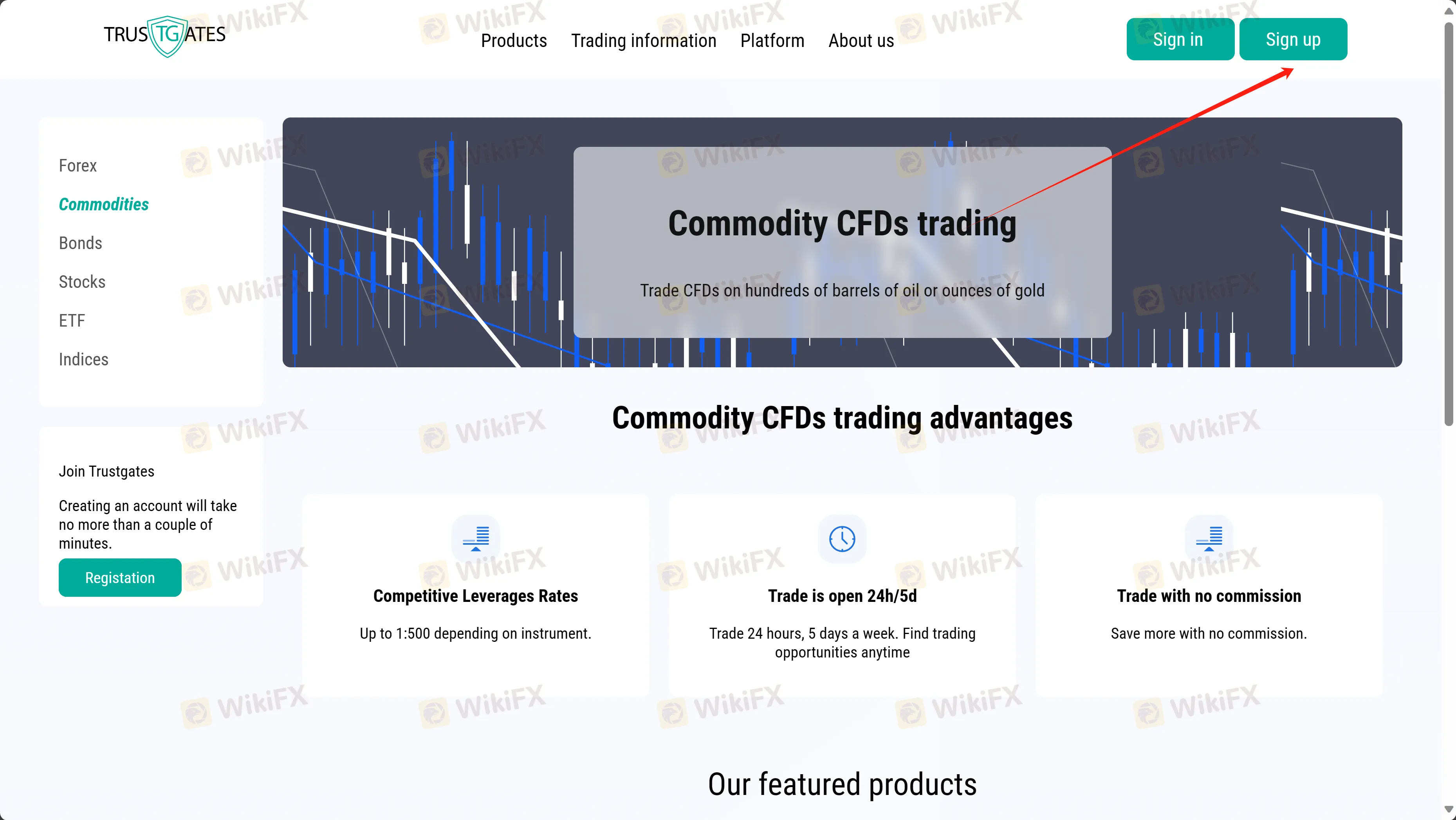

Commodities:

The platform offers trading in commodities, which may include both hard commodities (like metals and energy) and soft commodities (such as agricultural products). Commodities trading can be a way to hedge against inflation and diversify investment strategies.

ETFs (Exchange-Traded Funds):

Trustgates provides access to ETFs, which are investment funds traded on stock exchanges, similar to stocks. ETFs typically track an index, a commodity, or a basket of assets, offering diversified exposure to various markets.

Indices:

The platform also offers trading in various global indices, which can include major stock market indices. This allows traders to speculate on or invest in broader market movements and trends.

These market instruments offer Trustgates' users a broad spectrum of trading options, catering to different trading styles and goals, from direct equity investments to diversified portfolio strategies.

Leverage

Trustgates offers competitive leverage rates across various types of CFD (Contract for Difference) trading, which can significantly amplify a trader's potential profits, but also their risks. The leverage rates provided by Trustgates vary depending on the specific instrument being traded:

Commodity CFDs:

Leverage rates of up to 1:500 are available for trading commodity CFDs. This high level of leverage can enhance trading capabilities in commodities markets but also increases exposure to risk.

Bond CFDs:

For bond CFD trading, Trustgates offers leverage rates of up to 1:200. This allows traders to potentially increase their investment power in the bond markets.

Stock CFDs:

When trading stock CFDs, leverage rates go up to 1:20. This leverage is relatively moderate compared to commodities and bonds, reflecting the different risk profiles associated with stock trading.

ETF CFDs:

Similar to stock CFDs, trading ETF CFDs on Trustgates also provides leverage rates of up to 1:20. This offers traders the opportunity to trade on margins in the ETF market.

Index CFDs:

For index CFDs trading, leverage can go as high as 1:500. This allows traders to trade on broad market movements with a significantly leveraged position.

It's important to note that while leverage can increase the potential for high returns, it also comes with an increased risk of losses, especially in volatile market conditions.

Account Types

Trustgates offers 2 types of accounts, each tailored to different trading needs and preferences:

Individual Account:

This account type is tailored for solo traders. It's designed for individuals who prefer managing their investments independently. An individual account at Trustgates allows a trader complete control over their trading decisions and portfolio management, suitable for those with specific investment strategies and preferences.

Joint Account:

The joint account option is intended for two or more individuals who wish to manage a trading account collectively. This is often utilized by partners, family members, or friends who want to combine their financial resources and decision-making in trading. It's a good choice for those looking to leverage shared trading strategies or diversify their investment risks through collaboration.

Both these account types are accessible with a minimum deposit of $250, making them suitable for a range of investors, from those just starting out to more experienced traders.

How to Open an Account?

Opening an account with Trustgates is a straightforward process that can be completed in a few simple steps:

Visit the Trustgates Website or App:

Start by navigating to the Trustgates website or downloading their trading app. This is where you'll begin the process of setting up your account.

Select Account Type:

Choose between an individual or joint account, depending on your trading needs and preferences. Consider the features and requirements of each person to make an informed decision.

Complete the Registration Form:

Fill in the registration form with your personal details, such as your name, contact information, and any other required financial information. Ensure all the details you provide are accurate to facilitate a smooth verification process.

Fund Your Account:

After your account is set up, make a deposit to start trading. Trustgates requires a minimum deposit of $250. You can use one of the supported payment methods, like bank transfer or credit/debit card

Spreads & Commissions

Trustgates offers highly competitive trading conditions in terms of spreads and commissions. The platform boasts spreads as low as 0 pips, which is particularly advantageous for traders who engage in high-frequency trading or those who prefer strategies that require tight spreads. This feature can significantly reduce the cost of trading and potentially increase net profits.

Additionally, Trustgates operates on a 0 commission model, meaning that traders are not charged any commission fees on their trades. This absence of commission fees further enhances the financial attractiveness of the platform, making it a cost-effective option for both novice and experienced traders.

However, traders should remain mindful of other potential costs or fees that might be applicable, such as overnight fees, account inactivity fees, or charges related to deposits and withdrawals.

Trading Platform

Trustgates offers its traders the ability to use two of the most renowned and advanced trading platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

MT4 (MetaTrader 4):

MT4 is widely recognized for its user-friendly interface and robust functionality. It is particularly favored for forex trading but also supports other instruments. Key features include advanced charting tools, a range of technical indicators, automated trading capabilities through Expert Advisors (EAs), and customizable trading scripts. MT4 is suitable for traders of all levels, offering a balance between simplicity and advanced trading features.

MT5 (MetaTrader 5):

MT5 is the successor to MT4 and offers additional features and extended capabilities. It supports more types of market orders and has an enhanced number of technical indicators and graphical objects. MT5 also provides access to more financial markets, including stocks and commodities, on top of forex. Its advanced trading system with more timeframe options, economic calendar integration, and improved strategy tester for EAs makes it a preferred choice for advanced traders looking for a comprehensive trading experience.

Both platforms are known for their stability, comprehensive analysis tools, and automated trading capabilities, making them suitable for a wide range of trading strategies.

Deposit & Withdrawal

Trustgates accommodates its financial transactions, including both deposits and withdrawals, through a couple of standard and widely accepted payment methods, ensuring a smooth process for its users:

Payment Methods:

Bank Transfers: Trustgates allows for both deposits and withdrawals through bank transfers. This method is commonly used and trusted, offering a secure way to transfer large sums of money. However, traders should be aware of potential processing times and any fees that their banks might charge.

Credit/Debit Cards: The platform also supports transactions via credit and debit cards. This method is known for its convenience and speed, allowing for quicker deposit and withdrawal processes compared to bank transfers. It's a popular choice among traders for its ease of use and immediate fund availability, especially for deposits.

Minimum Deposit:

Customer Support

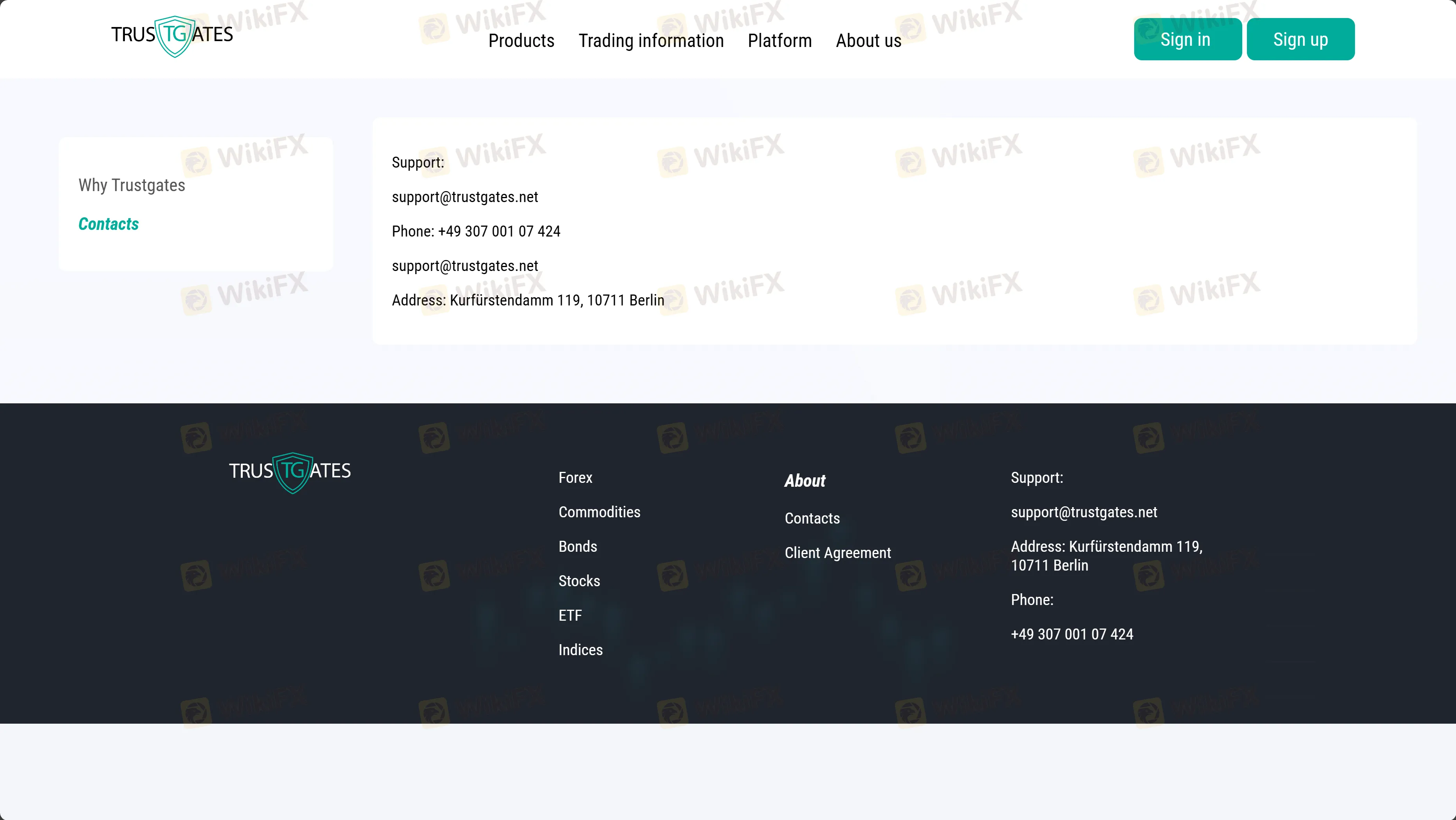

Trustgates offers a comprehensive customer support system to assist its clients with any inquiries or issues they may encounter.

Clients can reach out to their support team via email at support@trustgates.net for detailed assistance on various matters related to the platform and trading activities. For those preferring verbal communication or needing immediate assistance, Trustgates provides phone support at +49 307 001 07 424, enabling direct and real-time interaction with their support representatives.

Additionally, Trustgates has a physical presence with an office located at Kurfürstendamm 119, 10711 Berlin, Germany, which can be relevant for official correspondence or direct inquiries.

This multi-channel approach to customer support ensures that clients have various options to seek help, be it through digital communication or direct phone contact, enhancing the overall user experience and support efficacy.

Educational Resources

Trustgates places a strong emphasis on trader education and analytics, offering a comprehensive suite of educational materials and tools designed to enhance trading knowledge and decision-making skills.

This includes a variety of programs such as webinars and seminars, tailored to teach trading techniques and elucidate the financial opportunities available within Forex and CFD markets. In addition to live educational sessions, Trustgates provides a selection of educational books and brochures, available in multiple languages and distributed internationally.

These resources are part of an ever-expanding collection aimed at empowering traders of all levels. Furthermore, Trustgates complements its educational offerings with an array of analytical tools, featured in a dedicated section on their platform.

These tools are intended to assist traders in better understanding and navigating the complexities of the financial markets, ultimately helping them to make more informed and strategic trading decisions.

Conclusion

In conclusion, Trustgates is a comprehensive trading platform based in Germany, offering a range of market instruments like Forex, bonds, stocks, commodities, ETFs, and indices. Despite being unregulated, it attracts traders with competitive features such as low spreads, zero commissions, and leverage rates up to 1:500 depending on the instrument.

Trustgates supports advanced trading platforms like MT4 and MT5 and requires a minimum deposit of $250. It emphasizes trader education through various resources, including webinars, seminars, and analytical tools. For customer support, Trustgates provides email and phone options, as well as a physical address in Berlin.

The platform's blend of trading options, educational resources, and customer support mechanisms makes it an appealing choice for traders, but its unregulated status necessitates a cautious approach from potential clients.

FAQs

Q:Is Trustgates regulated?

A:No, Trustgates is currently unregulated. This means it operates without the oversight of financial regulatory authorities.

Q:What is the minimum deposit required to start trading on Trustgates?

A:The minimum deposit required to start trading on Trustgates is $250.

Q:What trading platforms does Trustgates support?

A:Trustgates supports the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms.

Q:Does Trustgates offer a demo account?

A:Yes, Trustgates offers a demo account for traders to practice and familiarize themselves with the platform before engaging in live trading.

Q:How can I contact Trustgates customer support?

A:Trustgates customer support can be contacted via email at support@trustgates.net, by phone at +49 307 001 07 424, or by visiting their office at Kurfürstendamm 119, 10711 Berlin, Germany.

Q:What educational resources does Trustgates provide?

A:Trustgates offers various educational resources, including webinars, seminars, educational books, and brochures in several languages, along with a range of analytical tools to help traders make informed decisions.

Q:What are the deposit and withdrawal methods available on Trustgates?

A:Trustgates accepts deposits and allows withdrawals through bank transfers and credit/debit cards.

Q:What are the advantages of trading with Trustgates?

A:The advantages of trading with Trustgates include competitive leverage rates, trading opportunities in various market instruments with low spreads and zero commissions, and access to educational resources and analytics to enhance trading knowledge and skills.