Score

EURSWISS

United States|2-5 years|

United States|2-5 years| https://eurswiss.com

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

United States

United StatesUsers who viewed EURSWISS also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

PU Prime

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Maker (MM) |

- MT4 Full License

Website

eurswiss.com

Server Location

United States

Website Domain Name

eurswiss.com

Server IP

172.67.149.41

Company Summary

Note: EURSWISS' official website - https://eurswiss.com/ is currently inaccessible normally.

| EURSWISS Review Summary | |

| Founded | 2020 |

| Registered Country/Region | St. Vicent and Grenadines |

| Regulation | No regulation |

| Market Instruments | Forex, CFDs |

| Demo Account | ✅ |

| Spread | From 0 pips |

| Leverage | Up to 1:1000 |

| Trading Platform | MT4, Sirix |

| Min Deposit | 0 |

| Customer Support | Tel: 8 800 575-14-22 |

| Email: kz@eurswiss.com, china@eurswiss.com | |

| Address: Saint Vincent and the Grenadines & Office 1003, Floor 10, Block 4B, Business Centre “Nurly Tau”, Al-Farabi 17 Avenue, Almaty Kazakhstan | |

EURSWISS Information

EURSWISS is a brokerage company who founded in 2020 and currently does not maintain functional website that we can only get limited information about this company on Internet.

The broker offers trading services for forex and CFDs, and does not require minimum deposit to open an account with them. Spread is tight from 0 pips.

What's worse, the broker even leaves no window for customer service and operates without any valid regulation, implying possible less compliance to industry and customer protection. Usually we don't recommend you to trade with such unrealiable broker.

Pros and Cons

| Pros | Cons |

| Demo accounts | Inaccessible website |

| Multiple account types | No regulation |

| MT4 platform | Wide spreads |

| No minimum deposit requirement | Withdrawal fee charged |

| Inactivity fees charged |

Is EURSWISS Legit?

Regulation is a crucial aspect of evaluating the legitimacy and reliability of a brokerage firm, and in the case of EURSWISS, the broker operates without any valid regulatory oversight. The absence of a regulatory framework raises huge concerns regarding the broker's adherence to industry standards, financial transparency, and the protection of client interests.

What Can I Trade on EURSWISS?

| Tradable Instruments | Supported |

| Forex | ✔ |

| CFDs | ✔ |

| Bonds | ❌ |

| Options | ❌ |

| ETFs | ❌ |

Account Type

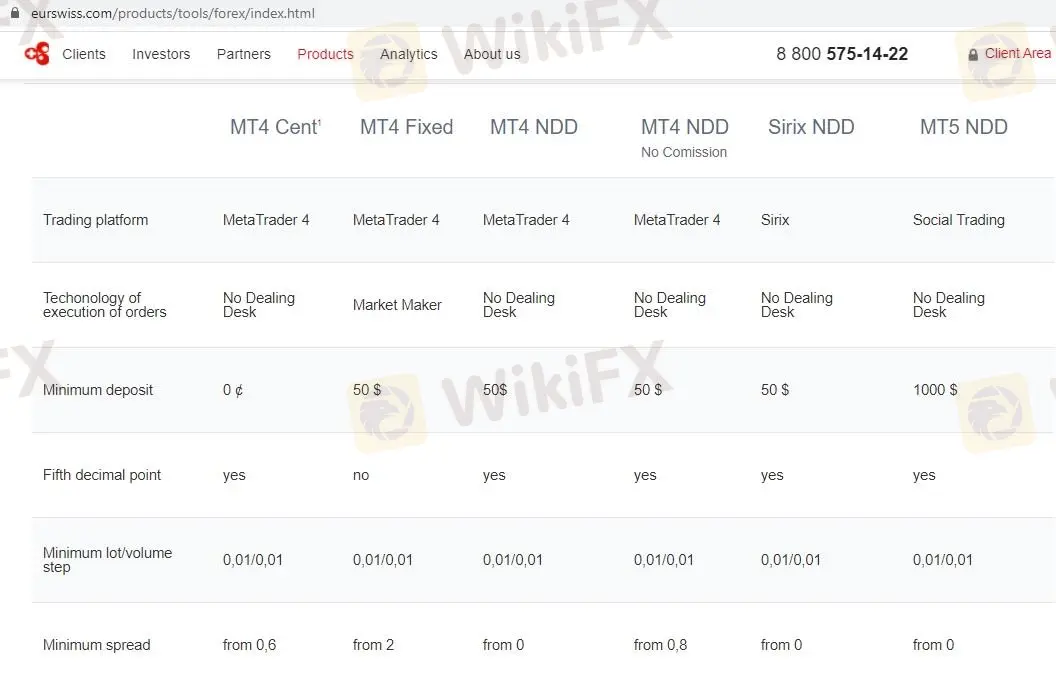

EURSWISS offers 6 types of trading accounts, namely MT4 Cent, MT4 Fixed, MT4 NDD, MT4 NDD (no commission), Sirix NDD and MT5 NDD.

The minimum initial deposit amount is as low as $0 for the MT4 Cent account, while $50 for MT4 Fixed, MT4 NDD, MT4 NDD (no commission) and Sirix NDD accounts, and $1,000 for the MT5 NDD accounts.

Spread is tight from 0 pip in MT4 NDD, Sirix NDD and MT5 NDD accounts, a little wider from 0.6 pips and 2 pips in MT4 Cent and MT4 Fixed accounts, respectively.

While we only know that MT4 NDD (no commission) account does not charge any trading commissions, the costs for other accounts remain unknown.

| Account Type | Min Deposit | Spread | Commission |

| MT4 Cent | $0 | From 0.6 pips | / |

| MT4 Fixed | $50 | From 2 pips | |

| MT4 NDD | From 0 pips | ||

| MT4 NDD (No Commission) | ❌ | ||

| Sirix NDD | / | ||

| MT5 NDD | $1,000 |

Leverage

EURSWISS offers leverage up to 1:1000, meaning that you can control a position 200 times of your initial deposits. However, we always suggest you to use leverage prudently due to significantly amplified losses at the same time as gains.

Trading Platform

EurSwiss claims to offer the Sirix and MetaTrader4 (MT4) trading platforms. However, when the tester downloaded the MT4 on its website, the page directs to an unbranded version of the MT5 instead.

Deposit and Withdrawal

EURSWISS accpets payments by credit card, Paysafecard, CashU, QIWI Walletand Bitcoin.

Minimum withdrawal amount for bank transfer is $80 and the withdrawal processing time takes around 2 to 5 business days.

For withdrawal via credit card, the maximum amount is 3,000 EUR per 24 hours or not more than 10,000 EUR per month.

The commission is 2.5% on the withdrawal amount plus 1.5 EUR.

Fees

EURSWISS charges a dormant account maintenance fee of up to $5 if an account stays inactive for over 90 days.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Comment 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now