General Information

Fair Markets is an Australian-based forex and CFD broker that offers trading across a variety of markets including commodities, indices and cryptocurrencies. They are a regulated trading broker allowing clients to get access to the popular trading platforms like MT4 and MT5.

Fair Markets offers a variety of trading accounts for both international and Australian clients. For international clients, there are four types of trading accounts available: Standard Fixed (no deposit requirements), Standard Variable (no deposit requirements), VIP Variable (min. deposit of $5000), Zero Raw (no deposit requirements). For Australian clients, there are three types of trading accounts available: Aussie Premium, Standard and Pro Account.

The maximum leverage offered by FairMarkets is up to1:400, which means that for every dollar you deposit, you can trade up to $400 in the market. It is important to note that while leverage can increase your potential profits, it can also increase your potential losses. Therefore, it is important to use leverage wisely and manage your risk effectively.

Fair Markets offers both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) trading platforms. MT4 is a popular online trading platform that is used to trade forex, CFDs and futures markets. MT5 is the successor to MT4 and has additional features such as more advanced charting tools and more timeframes.

Regarding payment methods, FairMarkets accepts bank transfers, credit/debit cards and e-wallets such as Skrill and Neteller.

FairMarkets customer representatives are available for help during trading hours, 5/24 available. You can contact them via phone or email. In addition to phone, email and chat support, FairMarkets also provides an FAQ section on their website. This section contains answers to frequently asked questions about trading with FairMarkets. You can access the FAQ section by visiting their website and clicking on the “FAQ” link at the bottom of the page.

Is Fair Markets legit or a scam?

Fair Markets is a legitimate forex and CFD broker that is operated by Trading Pty Ltd., an Australian firm that is registered and regulated by the Australian Securities and Investments Commission (ASIC). ASIC is Australias corporate, markets and financial services regulator.

ASICs role is to enforce and regulate company and financial services laws to protect Australian consumers, investors and creditors. ASIC also ensures that financial markets are fair and transparent. This means that Fair Markets is held to high standards of transparency and accountability.

Fair Markets holds a license of Market Making (MM) under license number 424122. Market making is a trading strategy that involves providing liquidity to financial markets by buying and selling securities at quoted prices. In addition to its regulatory compliance, FairMarkets also offers a range of trading tools and resources to help traders make informed decisions. These include educational materials, market analysis, and trading signals.

Pros and Cons

Fair Markets, as a prominent brokerage firm, certainly brings a plethora of benefits to the table, alongside some areas of potential improvement. One of the most reassuring aspects about this broker is the stringent regulatory oversight it falls under. It is governed by the Australian Securities and Investments Commission (ASIC), a top-tier regulatory body known for its stringent standards and protective measures.

In terms of trading platforms, Fair Markets stands out by offering its clients access to both MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. Another commendable feature of FairMarkets is its flexibility when it comes to account types. It caters to a wide range of traders, from novices to professionals, by offering multiple trading accounts. Moreover, some of these accounts don't require a minimum deposit, allowing traders to step into the trading world with reduced financial constraints.

However, despite these advantages, FairMarkets does have room for improvement in certain aspects. One such area is the range of trading products it offers. The broker's portfolio of financial instruments is somewhat limited compared to industry peers.

Additionally, the absence of social trading features is another drawback. Finally, the lack of 24/7 customer support is a limitation, especially for traders who operate in different time zones or those who prefer trading during off-market hours.

Market Instruments

While Fair Markets does offer a selection of financial instruments, the scope and diversity may not meet the needs of all traders, which mainly cover forex, indices, stocks, Commodities.

Forex: Forex trading is available, which means participants can engage in currency exchanges; however, this market is known for its high volatility and risk, which might not be suitable for all, especially those who are risk-averse or inexperienced.

Stock CFDs: FairMarkets offers a wide selection of stock CFDs from the UK, US, and European companies.

Indices:Trade CFDs on the most popular indices such as S&P 500, DAX30, and Dow Jones. We are offering you the chance to trade leading companies' stocks as a group. You can deal with US 30, UK 100, S&P 500, DAX 40, FRA 40, JPN 225, HK50, and NASDAQ 100 besides ASX 200 shares.

Commodities: Finally, FairMarkets includes Commodities in its offering. While commodities can serve as a hedge against inflation and a way to diversify a portfolio, they can also be highly volatile and influenced by hard-to-predict factors such as weather conditions, geopolitical tensions, and changes in supply and demand.

Account Types

It seems that Fair Markets understands the diverse needs of its clients and thus offers a wide array of account types tailored to suit traders of varying experience levels and trading objectives, both for international and Australian clients.

International clients have the option to choose from four different account types, each with its own unique features and benefits. The Standard Fixed account, as the name suggests, offers fixed spreads and has no deposit requirements, making it an attractive option for traders who prefer to know their trading costs upfront. Similarly, the Standard Variable account also doesn't require any initial deposit, but it offers variable spreads that can widen or narrow depending on market conditions. These two accounts cater to beginners and those who prefer not to commit a significant amount of capital upfront.

For more experienced traders or those with a larger capital, the VIP Variable account could be a more suitable choice. This account requires a minimum deposit of $5000, and in exchange, clients can enjoy more competitive spreads. Additionally, it may come with other benefits such as a dedicated account manager and priority customer service.

The Zero Raw account is also available for traders preferring near-zero spreads. This account type typically charges a commission per trade but offers the benefit of trading with raw spreads that can be as low as zero during certain market conditions.

For Australian clients, Fair Markets has designed three distinct account types. The Aussie Premium, Standard, and Pro Accounts. While the specifics of these accounts may differ, they are likely designed to comply with Australian financial regulations and to cater to the particular needs of Australian traders.

Fair Markets Leverage

When it comes to the provision of trading leverage, Fair Markets manifests a clear understanding of its diverse client base and tailors its offerings accordingly. The firm provides different leverage ratios for its Australian and international clients, factoring in the unique regulatory environments and risk considerations pertinent to each group.

For its Australian clientele, Fair Markets offers a maximum trading leverage of up to 1:400. This relatively high leverage ratio allows traders to control larger positions with a relatively small amount of invested capital.

On the international front, Fair Markets provides a differentiated leverage approach for retail and professional clients. Professional clients can access a leverage ratio of up to 1:500 for major forex pairs. Conversely, for retail clients, the firm applies a more protective leverage limit of up to 1:30 for major forex pairs. This is in line with the leverage restrictions imposed by several regulatory bodies worldwide to protect retail traders from excessive risks associated with high leverage.

How to open an account ?

The process of opening an account with Fair Markets is a streamlined and uncomplicated endeavor, which aims to provide a smooth onboarding experience for traders.

1. First, you need to visit the broker's website and click on the 'Open Account' button.

2. Then, you will then be directed to a page where you need to fill out a registration form with your personal information, including your full name, email address, phone number. You will also need to create a unique username and password.

3. Once you have submitted your registration form, you will be prompted to verify your email address by clicking on a verification link that will be sent to your inbox. After verifying your email, you can then proceed to complete the verification process by providing additional information, such as your ID and proof of address.

4. To trade Forex and other CFDs, you need to deposit a certain amount of investment as a margin. You can deposit the amount you want to trade into your FairMarkets account balance easily via several methods.

5. After funding your account, you can then start trading by logging into the FairMarkets trading platform with your account credentials. If you are new to trading, it is recommended that you first practice on the demo account to get a feel of how the platform works before risking your real money.

Spreads & Commissions

Fair Markets tailors its fee structure according to the account type held by a trader.

For international clients, you have several options. The Standard Fixed, Standard Variable, and VIP Variable accounts all offer trading with no commission. However, the spreads, vary for each account. The Standard Fixed account has spreads starting at 1.8 pips. If you opt for the Standard Variable account, you'll see spreads starting from 1.2 pips, while the VIP Variable account offers even lower spreads starting from 0.6 pips. For those who choose the Raw Zero account, the trading environment is a bit different. This account provides very competitive spreads that can go as low as 0.0 pips. However, unlike the other accounts, there is a commission fee of $10 per lot for this account.

For Australian clients, Aussie Premium spreads start from 0.0, and standard spreads start from 0.6 pip. Although Aussie Premium charges a $1 commission with spreads starting from 0.0 pips. Aussie Premium accounts offers spreads starting from 0.0, only $1commision per side, but zero commission on FX pairs of AUD crosses, Brent and WTI, gold and silver, and the ASX 200 index.

Standard accounts also offer spreads starting from 0.6 and no commission.

Trading Platform

Fair Markets caters to the diverse needs of its clients by providing them access to two of the most popular trading platforms in the industry: MetaTrader 4 (MT4) and MetaTrader 5 (MT5). These platforms, developed by MetaQuotes Software, are recognized for their robust functionality, user-friendly interfaces, and comprehensive suite of tools and features.

Traders using FairMarkets have the flexibility to choose between MT4, with its established reputation and wide acceptance among forex traders, and MT5, which offers extended features such as additional time frames, more types of orders, economic calendar integration, and a larger number of technical indicators. Both platforms support automated trading through the use of Expert Advisors (EAs) and allow comprehensive charting and analysis, making them suitable for both novice and experienced traders alike.

Moreover, both MT4 and MT5 are available in various versions, including desktop applications for Windows and Mac, web-based platforms accessible from any browser, and mobile apps for iOS and Android devices. This multi-platform support enables traders with FairMarkets to monitor the markets, conduct technical analysis, and execute trades anytime and from anywhere, thereby offering significant flexibility and convenience.

Trading Tools

Fair Markets provides access not only to the highly popular MT4 and MT5 trading platforms, but also to a suite of additional trading tools. These tools, integrated alongside the primary trading platforms, can greatly assist traders in their market analysis, strategy development, and order execution.

An essential tool offered by Fair Markets is the MT4 and MT5 Booster, designed to amplify the features of these already robust platforms. The Booster pack comprises a range of utilities, from advanced trade execution and management tools to sophisticated charting and analysis features. It can provide significant advantages to traders, enabling more precise control over trades and a deeper understanding of market trends and patterns.

Another notable tool provided by Fair Markets is Trading Central, a globally recognized financial research provider that delivers comprehensive market insights and analysis. With Trading Central, traders gain access to expert market commentary, advanced technical analysis, and actionable trade ideas.

Additionally, Fair Markets offers a Virtual Private Server (VPS) service to its clients. A VPS can be particularly beneficial for traders who use automated trading strategies or Expert Advisors, as it ensures uninterrupted operation, even if the trader's own computer is switched off or experiencing connectivity issues.

Furthermore, FairMarkets equips traders with an Economic Calendar, a crucial tool for any trader who wants to keep a pulse on significant market events, announcements, and economic indicators that might impact the markets.

Deposits & Withdrawals

Fair Markets provides several methods for account funding, although it's worth noting these may not cover all possible preferences and could have their own limitations.

Credit cards and bank transfers are accepted by FairMarkets. Credit card payments can be convenient due to their instant transfer capability. However, not all cards may be accepted, and there could be additional charges applied by the credit card company.

Bank transfers, on the other hand, are typically slower than other methods and could take several days to process, which might delay trading activities.

FairMarkets accepts payments through e-wallet payment such as Skrill and Neteller. While these platforms can offer fast transaction times and easy online access, they might also have transaction limits and fees. Additionally, accessibility to these platforms can vary in different regions, which might limit their use for some clients.

Any questions or needs, the clients could email at support@fair.markets , or make call at +61 2 8607 8364 between 06:00 and 15:00 GMT Monday through Friday. If the clients have a problem with compliance, send us an email at compliance@fair.markets.

It is also necessary for clients leave massages on the website of Contact Us | Trading Support | FairMarkets through messages or whatsapp real timely.

Educational Resources

Fair Markets provides a selection of basic educational resources tailored to equip both new and experienced traders with essential trading knowledge and skills.

One of these resources is market analysis, a crucial tool for traders seeking to understand the current state of the markets and potential future trends.

Besides, FairMarkets also provides a glossary. This resource demystifies complex trading terminology, offering clear definitions and explanations of common trading terms and phrases.

Webinars: The broker hosts webinars featuring expert traders, covering a wide range of topics and providing clients with the opportunity to ask questions and interact with other traders. Webinar (fair.markets)

Blogs: The broker offers a range of topics such as trading technical analysis, and trading strategies. FairMarkets Australia Blog

Conclusion

Fair Markets, a regulated broker, provides a well-rounded trading environment that caters to both beginners and experienced traders. The brokerage offers several account types, which gives traders the flexibility to choose an account that best suits their trading preferences and financial circumstances. They also offer access to the globally recognized MT4 and MT5 platforms, known for their user-friendly interfaces and comprehensive analytical tools, catering to various trading strategies.

An additional advantage of FairMarkets is the array of supplementary trading tools they provide, including MT4 and MT5 Booster, Trading Central, and VPS, all designed to enhance trading efficiency. Moreover, their educational resources, including webinars, blogs, and market analysis, are beneficial to traders wishing to continuously develop their trading knowledge.

However, Fair Markets does have areas where it might not fully meet some traders' expectations. While they offer a variety of payment methods, the specific fees and processing times associated with these might vary, and not all methods may be available or convenient for all traders. Plus, although they offer several educational resources, these are relatively basic and may not satisfy traders looking for more advanced or comprehensive learning materials.

FAQs

Q: Is Fair Markets a regulated broker?

A: Yes, it is a company registered and regulated in Australia by ASIC (Australian Securities and Investments Commission) and holding AFS license number 424122 ACN 159166739.

Q: What trading instruments are available at Fair Markets?

A: It offers our clients Forex, Index CFDs, Commodities, and Precious Metals, all with low spreads and multiple account types to choose from based on your needs.

Q: Does Fair Markets offer a demo account?

A: Yes, it offers a demo account that allows clients to practice trading in a risk-free environment with virtual funds.

Q: What payment methods does Fair Markets accept?

A: It accepts a wide range of payment methods, including bank transfers, credit cards, and e-wallets.

Q: What trading platforms does Fair Markets offer?

A: It offers several trading platforms, including MetaTrader 4, MetaTrader 5, WebTrader 4, WebTrader 5.

Q: Does Fair Markets offer educational resources for traders?

A: Yes, it offers a range of educational resources for traders, including webinars, and blogs.

弃我而去

Hong Kong

I heard from a friend that there is a 100 bonus for answering questions on this platform, so I immediately registered and participated in the answering activity of "Learning to Get Rich". I registered on August 17, 2023, and have not been reviewed since then. The activity was canceled suddenly during the review period, and it took 5 days to complete the review. The bonus was not given, so I sent an email saying that the event will end on the 16th. Then I am speechless, when I registered at 17, the homepage clearly showed this event. Isn't this a fraud? Don't go to this kind of untrustworthy platform. I registered for nothing and used my ID card and driver's license. I don't know if this kind of unscrupulous platform will be used to do bad things. Resolutely expose that there should be a "Learn to Get Rich" answering activity in the lower column of their interface, and it will be canceled at any time, and it will be handled without a trace.

Exposure

2023-08-22

ojbk110

Hong Kong

Withdrawal of 50,000 US dollars will charge me a channel fee of 900 US dollars. Funding was also delayed by a month. I don't know why the channel fee is so expensive.

Exposure

2023-08-16

828

Hong Kong

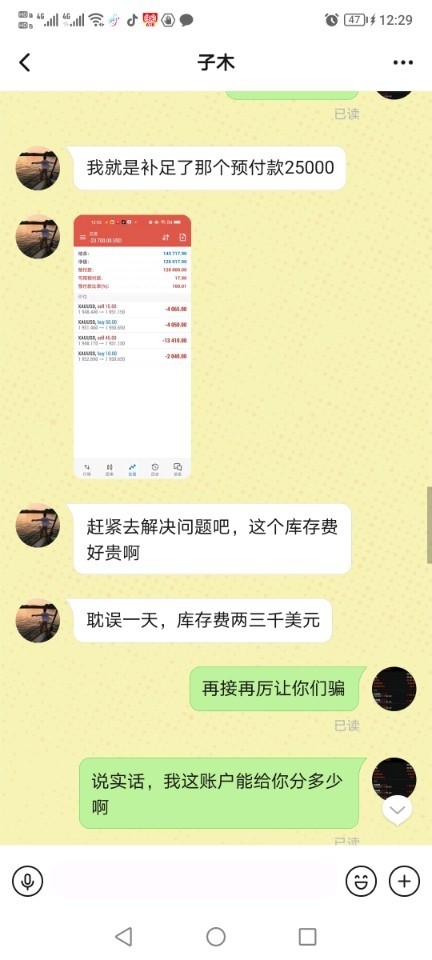

Now the scammer's TikTok account is still active. I hope everyone will not be tricked again! These two are members of the scam gang, everyone pay attention!

Exposure

2023-07-23

jj6935

Hong Kong

Account 63120265 has been frozen and cannot be withdrawn. Now the platform has been closed. Wang Tiancheng, Qiao Feng, Manager He has no news.

Exposure

2023-07-16

jj6935

Hong Kong

Unable to withdraw, the fraud gang headed by Wang Tiancheng, Jun, Qiao Feng, Manager He, and Zhou Ziyang deceived people into making stock index gold, using so-called large funds and small positions to operate for people's full positions, constantly deceiving and misleading people into virtual trading. In the end, for various reasons, the US dollar will not be certified and will not be withdrawn from account.

Exposure

2023-07-06

随心1431

Hong Kong

Unable to withdraw money from my account, unable to log in to 63120232, only after recharging to improve score can the money be given out, unfreezing, unreasonable.

Exposure

2023-07-05

随心1431

Hong Kong

There was a woman who added friends on QQ and asked me to download WeChat after a while, and they pulled me into a group. At the beginning, I recommended individual stocks, and slowly they induced me to do international markets, indexes, and gold. I asked Manager He to open an international account. I opened it on May 30. Qiao and Wang in the group took everyone to buy up and down, and said that on June would be profitable. After doubling back, I transferred a total of 379,500 yuan to the account designated by Manager He. Due to loss, I didn’t want to do and plan to withdrawal my money on June 20th. I found that I couldn’t withdraw it. He said that the score of mine was insufficient and I needed to recharge to improve the score. I found out that it was a scam, and now I only ask for a refund of my money of 379,500 yuan, hoping to solve it!

Exposure

2023-07-03

ojbk110

Hong Kong

My money was withdrawn from June 26, 2023 to July 3, but it still hasn't arrived. The salesman didn't respond, just said to wait for company to deal with it.

Exposure

2023-07-03

55668323

Hong Kong

At the beginning, I used WeChat group to attract popularity. Wang Tiancheng, the group leader, said that the international gold market doubled his steady profit. He asked me to find Manager He to open an international account. He gave me a download URL. Ri find He to open an account, operate the account by himself, listen to Wang Tiancheng in the group, Qiao Feng commanded operation to buy up and buy down, Wang Tiancheng said that in June, the account funds can be directly doubled, so on June 12, the Japanese entrusted the account to Wang Tiancheng. Tiancheng operation. During this period, Wang has been inducing large funds to operate and earn more. He has injected 76,000 US dollars into the account, which is equivalent to RMB 532,000. Wang operated the account until early morning of June 20, and my account was locked and frozen. I couldn’t close the position. On 21st, the king asked me to find He and told me to recharge 25,000 US dollars to unfreeze and close the position. What about software and hardware problems, the prepayment ratio needs to exceed 130% to unfreeze and close the position, and you need to recharge 2 dollars, I said I have no money, and introduced the so-called Zhou Zixiang of the China Banking Regulatory Commission, let me loan usury, How did all deposits and withdrawals be operated? At this time, I feel that I have been cheated. The account has a total of 1,190.23 million U.S. dollars, which is equivalent to 833,161 yuan. The account has been frozen and cannot be withdrawn.

Exposure

2023-07-01

5536

Hong Kong

Start to operate stocks with orders. When the stock market is not in a good mood, it is their fake trick to join the international market to open an account. Use bubble chat groups to lead everyone to operate. It is a drag. When everyone’s morale is up, start to engage in activities and add more gold. Finally, harvest . At first, it took me to trade stocks with their set orders. They induced me to open an account and trade in the global markets once the stock market was depressive, which was its fake trick. It took you to trade with the group named PaoPao, in which were shills. It started to carry out activities for strip-mining more of your principal when you were in high sprits.

Exposure

2023-06-25

800824

Hong Kong

I'm a trading user of FAIRMARKETSLTD. According to netizen, it's a standard, reliable and ASIC regulated platform. Also because I believe this is a legitimate platform, I registered on the platform on May 30, and I haven't made any deposit yet. I followed the exchange group for a day and saw two so-called teachers guiding everyone on the buying and selling prices. Still others help conduct account custody and management. Many people in the group cheered to buy, increase positions, and then make a lot of money. Maybe it can be entrusted. On May 31, two teachers in the group induced that they transferred in June. In the case of making more money, I recommended a manager He who claimed to work in a bank. The person who handled the deposit and withdrawal for us was to exchange US dollars to buy international gold. So I started the purchase transaction. At first I didn't dare to buy more, because I didn't understand, so I went in and bought a little at the price recommended by the teacher in the group. I bought according to the ratio of 0.1-0.5, and then got a little profit, but very little. However, I was very satisfied. Because of the price recommended by the teacher Qiao Fengqiao, I could control a stable income every day until June 12, so that everyone can enter boldly and make money. However, I bought a short order, and then it continued to rise to a high level. Seeing that the account was losing more and more money, I asked the teacher to solve the problem. The so-called teacher Qiao, said that my account funds were too small to operate. I add up to $100,000 and let him do it. On the one hand, I was also worried about the risk of charging too much, so I gave up. I invested a total of 25,000 US dollars, plus a profit of 5,000, there would be 30,000 in total. I wanted to roll with existing funds. I also didn't want to save money. Later I found Mr. Wang who called himself Wang Tiancheng. He also said that my position was too small and asked me to increase my position to 50,000 to help me operate. I thought my position was the same as 50,000. The difference was not big, and the profit point of daily operation was also fast. There was still a price difference of about 5,000, so I borrowed 25,000 from my sister, and the credit card cash was 30,000 to recharge directly. On June 16, I asked him to help me with the problem. There was no income guarantee. How much moneywas the key to solve the problem. He said that professional things should be done by professional people. After the account was handed over to Wang Tiancheng, he made a lot of money on the first day. When I saw the account for the first time, the profit was over 4,000. But after refreshing, it was more than 11,000. I was a little surprised. The prepayment ratio was relatively safe, so I didn't ask too much. It was refreshed again around 10:00 in the evening, with a profit of more than 25,000. I panicked because I felt like my account was being swiped maliciously. At 12 o'clock, I refreshed again and found that the account showed that 30 short orders were placed and 30 long orders were hedged. The advance payment rate was 91%. I was terrified then. It was precisely because of the malicious heavy position operation that the account was blocked and the position could not be closed. On the morning of June 17th, I sent him a screenshot saying what exactly happened, and Wang Tiancheng said there was no problem. He told me to ask Manager He how to solve it, and I told Manager He the problem. Manager He said that my prepayment ratio was lower than 130%, and the platform automatically blocked my account. The position needed to be covered at the bottom before the position could be closed normally. That was to say, I needed to add more than 130,000 to get in, and basically all my money was put in, and there was also a loan. It was said that if the prepayment ratio was lower than 30%, the position would be liquidated. The platform would automatically close the position and asked me to make up the prepaid basic position of 19,000 as soon as possible. However, I was really out of money. I asked him whether the system would be automatically unlocked at 130% and could be traded normally, he said: Yes. So I also felt a little hopeful at the time, just waiting for the next day's rise. I noticed that my prepayment ratio also went up with the rising of gold price. On the third day, the ratio was 45%, which was still below 30%. That was to say, the account would not blow up. However, on the third day, the platform automatically froze it for me, saying that it was because I did not make up the bottom line in time. Would not it blow up if the ratio was higher tahn 30%? Why my account was frozen now. Even if it went up or down, it had nothing to do with me, and then the inventory fee would increase every day, and it would double on Thursday. I calculated that the inventory fee had been as high as 20,000 these days. This was clearly a scam. I had no choice in the future, and I kept looking for Manager He, and communicated with the two teachers to see if they could help me. And then Manager He, who helped me with withdrawal and deposit, recommended a person who claimed to be the Banking Regulatory Commission to help me deal with it, and then assisted me to contact the official to solve the problem. Later, it said that the capital flow needed to be 100,000. It was also reported that the money was not transferred to the platform, but to the account of the China Banking Regulatory Commission, otherwise the money would be returned within 30 seconds after the transfer. I asked him to show his ID and work pass to prove his identity. I asked for a video to show if the ID and work ID were the same person, but he didn't help me to verify. Then I checked the ID card and work permit, and they were all fake. Without this ID card, it could not be verified, and I have also raised my vigilance. Later, I knew about the situation of forex trading in this model, and found that many victims, like me, lost everything overnight. Relevant departments and platforms should pay attention to it. The money was hard earned for many years. I only need to get back the principal, and I don’t want other profits. Those accounts with high inventory fees have been frozen and are increasing every day, which is really unreasonable.

Exposure

2023-06-25

街角陌路

Hong Kong

The person named Qiao Feng is the head of the scam. They are a scam gang. They started recommending stocks in a group and slowly induced us to enter the international market. They induces us to give them our accounts so that they can invest for us. They blocked our accounts later. I was unable to close the position and the account was banned. I knew I was cheated. Now I am really desperate. I hope the relevant departments will deal with it.

Exposure

2023-06-25

5536

Hong Kong

At the beginning, it led investors to speculate in stocks and won the trust of the masses. After that, it started to lure people to open an international account to speculate in gold. Various promotions were issued to lure people to recharge and exchange for US dollars. The operation made you unable to close the position. The account was made impossible to close the position. I have put all my life's money in it. This is killing me. Please help.

Exposure

2023-06-25

800824

Hong Kong

Wang Tiancheng is from Xiamen. He said that his child has just been admitted to Fudan University and he wants to buy an apartment for him in Shanghai. What I want to say is that this is our hard-earned money. He asked me to give him my account, saying that he could help me double my profit. I didn't expect to make much money, but my account got blocked after a night of operations. I asked a person claiming to be staff of the China Banking Regulatory Commission to help me deal with it, and waas told to pay more than 100,000. He said that there was a record of account changes. I also hope that the platform can handle the problem as soon as possible and return the principal to me. It's all hard-earned money. It cannot be ignored. The child's tuition fees for the next semester are included in it. Hope the platform handles it as soon as possible.

Exposure

2023-06-25

VXbanqvxiansha

Hong Kong

I was told about gold investment. Wang Tiancheng operates the lock position. Non-agricultural market said double is possible. Margin is required after lock-up. After replenishing the deposit, it said that the credit score was not enough. Do not allow cash withdrawals, just recharge money.

Exposure

2023-06-25

街角陌路

Hong Kong

A brother in the group used me, cheated my trust, and took the account to me for playing fees. He couldn’t close the position, and induced me to take a loan to recharge it. After closing the position, it returned to normal. After closing the position, he said that the account was frozen and needed to charge more than 110,000 to fill the bank statement. The trap was too covert.

Exposure

2023-06-24

5536

Hong Kong

The platform induces you to invest and help you operate your account, but you will not be able to close the position later, and you will not be able to withdraw money after you add money to liquidate the position.

Exposure

2023-06-24

800824

Hong Kong

Now no one can help me to solve it, they said that you must charge money to enter, I was afraid it is a routine.

Exposure

2023-06-23

800824

Hong Kong

Now my account has been frozen by the platform , and my child's tuition fees are all in it, and I can't withdraw my money . Please solve the trouble as soon as possible.

Exposure

2023-06-23

828

Hong Kong

Someone seduces you into joining in a group chat. You invests but later your account can't be logged in. Nor can you withdraw any money. It is total scam. I just got deceived.

Exposure

2023-06-21