Overview of KIWIBULL

KIWIBULL, established in 2018 and based in New Zealand, operates as an unregulated platform offering a range of financial instruments encompassing forex, commodities, indices, and more. The platform primarily features a Standard account type with a minimum deposit requirement of USD $20 and maximum leverage of up to 1:100. Competitive spreads starting from 0.3 pips aim to enhance cost-efficiency for traders.

Utilizing the widely recognized MetaTrader 4 platform, users can engage in trading activities, albeit with limited educational resources available. While deposit and withdrawal methods are facilitated through online banking, customer support is accessible via phone and email, albeit within restricted service hours.

Is KIWIBULL legit or a scam?

Regulatory details of KIWIBULL on the Financial Service Providers Register reveal a concerning status, labeled as a suspected clone without regulated licenses. Operating under the license type of Financial Service Corporate and under the regulation of New Zealand, the institution, identified as KB GROUP GLOBAL LIMITED, obtained its license on June 29, 2016. However, crucial contact details like email and website information are undisclosed, hinting at a lack of transparency. The license is set to expire on August 1, 2022, with the institution situated at Suite 3, 92 Rosedale Road Albany North Shore 0632, and can be reached at +64 21 1635789. This information underscores potential irregularities and the absence of essential licensing for KIWIBULL within the financial service sector.

Pros and Cons

Pros:

1.Wide Range of Trading Assets Available: KIWIBULL offers a diverse selection of trading assets, providing users with opportunities to trade various financial instruments like forex, commodities, and indices. This diversity allows traders to explore different markets and diversify their portfolios.

2. Multiple Banking Options for Deposits/Withdrawals: The platform supports various banking options for deposits and withdrawals, enhancing convenience for users. This flexibility allows clients to choose from a range of methods based on their preferences and geographic location.

3. Competitive Spreads: KIWIBULL provides competitive spreads, starting from low values, which can potentially reduce trading costs. Lower spreads mean less difference between the buying and selling price of assets, benefiting traders in their trading activities.

4. Easy to Use: The platform is designed to be user-friendly, catering to both novice and experienced traders. This ease of use simplifies navigation and the execution of trades, contributing to a smoother trading experience.

Cons:

1.Not Regulated: One of the notable drawbacks is the lack of regulation, which may raise concerns regarding the platform's oversight and adherence to industry standards. Regulation typically provides a level of security and assurance for users regarding their investments and the platform's operations.

2. Limited Educational Resources: KIWIBULL suffers from a scarcity of educational materials, such as comprehensive guides, tutorials, and webinars. This insufficiency can pose challenges for new users looking to learn about trading and the platform's functionalities, potentially hindering their trading success.

3. Limited Customer Support Hours: The platform's customer support operates within restricted hours, which might inconvenience users seeking immediate assistance or residing in different time zones. Limited availability can impact prompt issue resolution and support accessibility.

4. Not Available in Some Countries or Regions: KIWIBULL's services might not be accessible in certain countries or regions, limiting its availability to a global audience and potentially excluding interested traders based on their geographic location.

Market Instruments

KIWIBULL provides investors with a diverse selection of trading assets, encompassing an array of financial instruments. This includes a comprehensive range of forex currency pairs, allowing investors to engage in currency trading across various global markets. Additionally, KIWIBULL offers opportunities to trade precious metals, catering to those interested in assets like gold, silver, platinum, and others. Furthermore, the platform facilitates trading in Contracts for Difference (CFDs), enabling investors to speculate on the price movements of various financial instruments without owning the underlying assets. This comprehensive selection of trading assets caters to diverse investment preferences and strategies within the financial markets.

Account Types

KIWIBULL offers a all-in-one standard account type to meet distinct trading preferences.

The Standard account type stands as a versatile option, providing traders with leverage of up to 1:100. This leverage allows for amplified market exposure, empowering traders to potentially increase their positions compared to their initial investment. The spread for the Standard account type is variable, starting from a competitive 0.3 pips. Additionally, traders utilizing this account type incur a commission of USD $0.5 per side per lot, enabling transparent and manageable trading costs. The minimum deposit required to open a Standard account is set at USD $100, offering accessibility to traders of varying experience levels and capital sizes.

Furthermore, withdrawals from the Standard account are processed efficiently within 1-3 business days, ensuring prompt access to funds. For traders seeking to familiarize themselves with the platform or test trading strategies without financial risk, KIWIBULL provides a Demo Account option within the Standard account category. This Demo Account allows traders to practice trading in a simulated environment using virtual funds, aiding in skill development and strategy testing. Overall, the Standard account type offered by KIWIBULL presents a balanced and accessible option for traders seeking diversified and efficient trading opportunities.

How to Open an Account?

Here are six clear steps to open an account with KIWIBULL:

1.Visit KIWIBULL's Website: Access KIWIBULL's official website to begin the account opening process. Navigate to the 'Open an Account' or 'Sign Up' section prominently displayed on the homepage.

2. Choose Account Type: Select the desired account type that aligns with your trading preferences. Options may include Standard, Premium, or other account variations. Click on the chosen account type for further details.

3. Complete Registration Form: Fill out the registration form with accurate personal information, including full name, email address, country of residence, contact number, and any other required details. Ensure all information provided is correct.

4. Verification of Identity: Submit necessary identification documents as part of the account verification process. This usually involves uploading a government-issued ID (such as a passport or driver's license) and proof of address (like a utility bill or bank statement).

5. Fund Your Account: Once your account is approved and verified, proceed to fund it. KIWIBULL typically offers various funding methods like bank transfers, credit/debit cards, or electronic payment systems. Choose the most convenient method and make the initial deposit as per the account's minimum requirement.

6. Start Trading: Upon successful funding, you'll receive account login credentials. Download and install the provided trading platform, such as MetaTrader 4, and log in using your credentials. Begin trading by exploring the available financial instruments, utilizing the platform's tools, and implementing your trading strategies.

Remember, while opening an account, it's crucial to review all terms and conditions, including fees, leverage, and trading policies, to ensure a comprehensive understanding of the trading environment provided by KIWIBULL.

Leverage

The maximum leverage offered by KIWIBULL stands at 1:100. This leverage ratio signifies the maximum amount of exposure a trader can have concerning their initial investment. With a 1:100 leverage, traders can potentially amplify their positions up to 100 times the amount of their initial capital.

This level of leverage can significantly magnify both profits and losses, offering the opportunity for increased gains while also heightening the risk involved in trading. It's essential for traders to understand the implications of utilizing high leverage and employ risk management strategies to navigate market volatility effectively.

Spreads & Commissions

KIWIBULL's trading structure involves competitive spreads and transparent commissions. For the Standard account type, the spread starts from an impressively low 0.3 pips, providing traders with a favorable starting point for executing their trades. This narrow spread enhances the potential for cost-effective trading by minimizing the difference between the buying and selling prices of assets, allowing traders to enter and exit positions more favorably.

In addition to the spread, traders utilizing the Standard account incur a commission of USD $0.5 per side per lot. This commission structure ensures transparent trading costs and allows traders to calculate their expenses accurately. The fixed commission per lot simplifies cost calculations and provides clarity regarding the fees associated with each trade, contributing to a more transparent trading environment for KIWIBULL's clients.

Trading Platform

KIWIBULL operates its trading activities primarily through the MetaTrader 4 (MT4) platform, a renowned and widely used trading platform in the financial industry. MT4 is known for its user-friendly interface and comprehensive set of tools suitable for both novice and experienced traders. It offers an array of features including customizable charts, technical analysis tools, and a wide range of indicators facilitating in-depth market analysis.

The platform allows for various order types and execution modes, enabling traders to implement different trading strategies. Additionally, MT4 supports algorithmic trading through Expert Advisors (EAs), permitting automated trading based on predefined parameters. It provides access to a vast selection of financial instruments including forex, commodities, indices, and more, allowing traders to diversify their portfolios.

Furthermore, MT4's mobile version offers on-the-go trading capabilities, providing flexibility and accessibility to traders who prefer to monitor and execute trades from their mobile devices. Overall, the MT4 platform offered by KIWIBULL presents traders with a robust and widely recognized toolset for conducting their trading activities.

Deposit & Withdrawal

KIWIBULL Payment Methods

KIWIBULL offers a convenient and secure way to deposit and withdraw funds using online banking services of more than 20 different banks. This allows clients to directly deposit funds from their bank accounts without needing additional intermediary steps.

It's important to note that all non-US dollar deposits will be converted into US dollars upon entering the platform. This ensures consistent transaction processing and reduces potential currency fluctuations.

KIWIBULL Minimum Deposit

KIWIBULL offers a flexible minimum deposit amount of USD $20. This allows new clients to start trading with a minimal investment and explore the platform's features before committing to larger deposits.

Customer Support

KIWIBULL ensures responsive customer support, available for inquiries and guidance via phone at +64 9 2812656 or through email at cs@kiwibulls.com. Service hours from Monday to Friday, 8:00 am to 11:00 pm, accommodate various time zones for client convenience. Whether seeking assistance or addressing concerns, clients can expect prompt and personalized consultations from knowledgeable representatives via email or phone, contributing to a supportive and accessible client service experience.

Educational Resources

KIWIBULL faces a shortfall in educational resources, posing challenges for newcomers aiming to navigate the platform and delve into cryptocurrency trading. Missing elements encompass a comprehensive user guide, instructional video tutorials, live webinars, and informative blogs, among others. This dearth impedes new users' learning curve, potentially resulting in errors and financial setbacks, thus deterring their enthusiasm for trading. The absence of robust educational materials hampers skill development and undermines user confidence, accentuating the need for enriched resources to foster a more supportive and informed trading environment for newcomers.

Conclusion

KIWIBULL presents a platform with notable strengths, including a diverse range of trading assets, multiple banking options for deposits and withdrawals, competitive spreads, and user-friendly interfaces.

However, its lack of regulation raises concerns about oversight and user protection. The platform's limited educational resources and customer support hours pose challenges for new users, potentially hindering their learning curve and access to timely assistance. Additionally, its unavailability in certain regions limits its global accessibility, potentially excluding interested traders. While offering competitive features, addressing regulatory concerns, enhancing educational resources, extending support hours, and expanding accessibility could significantly bolster its appeal and trustworthiness among traders.

FAQs

Q: Is KIWIBULL regulated?

A: No, KIWIBULL lacks regulation, which can raise concerns regarding oversight and user protection.

Q: What deposit methods does KIWIBULL offer?

A: KIWIBULL provides multiple banking options for deposits and withdrawals, offering flexibility to users.

Q: Are there educational resources available on KIWIBULL?

A: Unfortunately, KIWIBULL has limited educational resources, such as guides or tutorials, for users.

Q: Does KIWIBULL offer 24/7 customer support?

A: No, KIWIBULL's customer support operates within limited hours, potentially impacting immediate assistance.

Q: What trading assets can I access on KIWIBULL?

A: KIWIBULL offers a wide range of trading assets, including forex, commodities, and indices for users to trade.

Q: Is KIWIBULL available worldwide?

A: KIWIBULL might not be available in certain countries or regions, limiting its global accessibility.

FX1207611416

Hong Kong

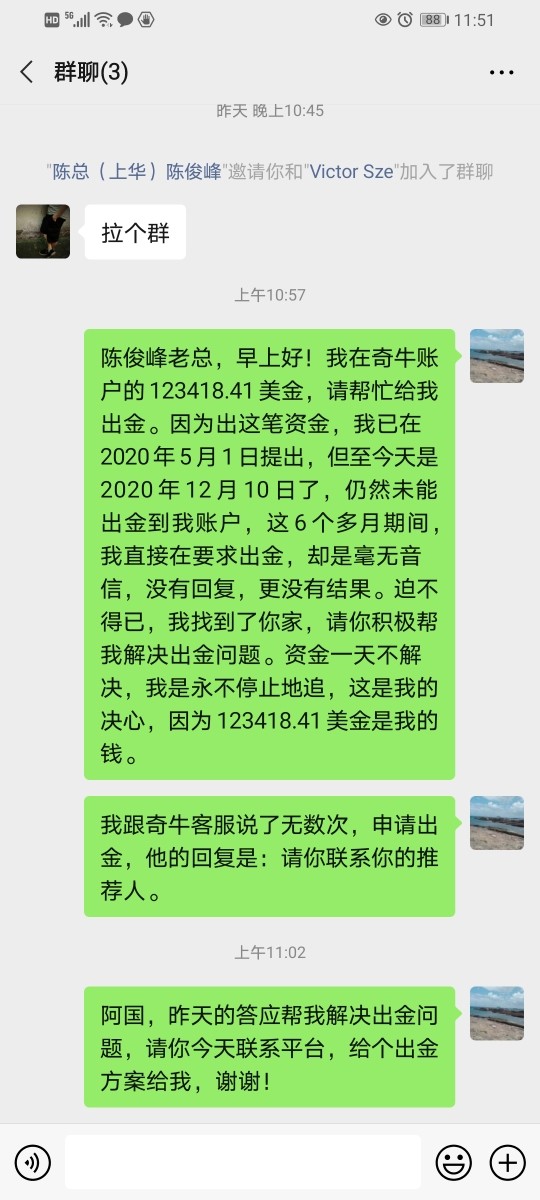

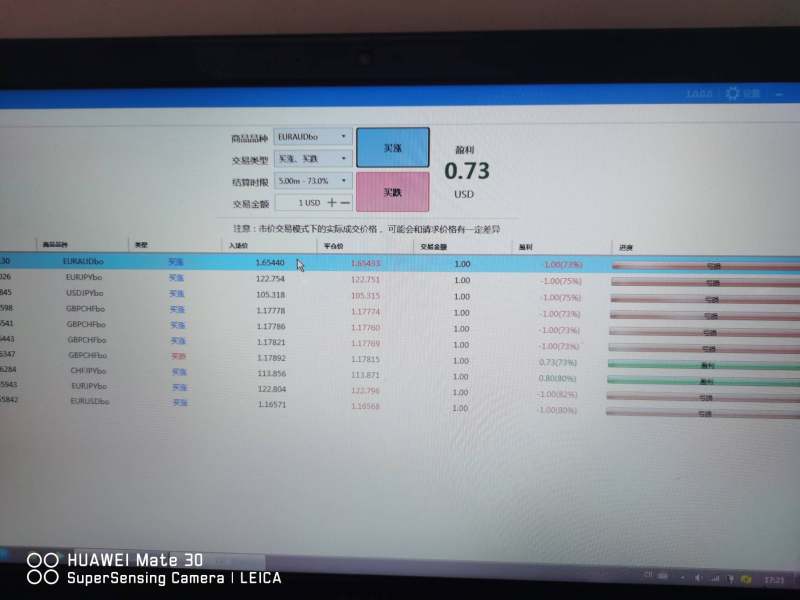

The platform has run away and cannot withdraw funds. All binary options are hedging. I advise you not to do it.

Exposure

2022-02-08

浓咖啡

Hong Kong

It controlled the market and led you to losses. When you were about to gain, it changed the statics. Beware of this fraud platform. They were the group of scammers. Attention.

Exposure

2021-10-12

凤5895

Hong Kong

Prevent me from withdrawing funds with varied excuses. And my account is blocked

Exposure

2020-12-10

萬一

Hong Kong

The data in KBFX was different from other platform’s when doing the same order. It’s truly a fraud platform. You’ll lose here

Exposure

2020-09-25

FX2870210155

Hong Kong

Manipulated my charts. With the same market trend, comparing three different brokers, other two platforms were consistent and able to be profitable; only KIWIBULL brought losses. When complaining, I was told that only their platform was formal, and the other two were all frauds, which is really disgusting.

Exposure

2020-07-08

凤5895

Hong Kong

According to the regulation No., the company inline with the No. FSP502408 was named KIWIBULL GROUP LIMITED, without FMA derivative license. The FSP isn’t a regulation license. Now my 100 thousand dollars is doomed. I tried to withdraw $1000, while KBFX banned my account.

Exposure

2020-06-05

凤5895

Hong Kong

Shanghua Investment Company and Haoren Technology Company are fraud companies. My withdrawal is unavailable for 25 days. It is simply a phony platform.

Exposure

2020-06-04

凤5895

Hong Kong

KBFX helped me open account and deposit fund. Now it claimed I was operating illegally and banned my account. My 100 thousand dollars or so was doomed. I caution you against it. Website: https://www.kiwibull.com/index

Exposure

2020-06-02

FX4001977044

Hong Kong

When the market of USD/JPY plummeted, KBFX would closed your scalping trading and the candlestick would continue to go down. Sometimes, it even manipulated the market for half hour!

Exposure

2020-06-01

凤5895

Hong Kong

KBFX “publicized” my account and transferred my fund into private accounts and gave no access to the withdrawal!

Exposure

2020-05-29

FX3886574399

Malaysia

I have recently introduce to a forex BROKER company call REX CAPITAL ... THEIR OFFICE is at HARTAMAS ... after listening to their leader doing presentation ... I felt something is fishy ... they CALLED THEIR group KBFX ... I google and found a lot of negative statement ... calling them a SCAMMER ... I also FOUND OUT THAT THEIR BROKER LICENSE IS FREEZE ...

Exposure

2019-11-13

萬一

Hong Kong

The situation takes place when placing the similar kind of order.I am speechless.Please trade in a legit platform.

Exposure

2019-04-22

FX3701613756

Hong Kong

This platform is the fraud platform, binary options trading is particularly severe, profit into a loss, the next larger single will be controled, who play have to lose money, remind everyone to stay away from the platform!

Exposure

2019-04-19