Broker Information

中原期货股份有限公司

CENTRAL CHINA FUTURES

Regulated

Platform registered country and region

China

--

--

--

--

--

河南省郑州市郑东新区商务外环路10号中原广发金融大厦四楼

--

--

--

--

zyqh@ccnew.com

zyqhjyb@ccnew.com

Company Summary

China|5-10 years|

China|5-10 years| https://www.zyfutures.com/

Website

Influence

C

Influence index NO.1

China 3.49

China 3.49Single Core

1G

40G

| Company Name | Central China Futures (CENTRAL CHINA FUTURES) |

| Regulation | Regulated by China Financial Futures Exchange (CFFEX) |

| Location | Zhengzhou Area (Zhengdong) of Henan Pilot Free Trade Zone |

| Trading Products | Metals, Energy, Chemicals, Financial Instruments, Agricultural Commodities |

| Account Opening | Computer-Based and Mobile-Based Methods |

| Customer Support | Phone, Fax, Email, In-Person Visits |

| Emergency Reporting | Separate Numbers for General and Continuous Trading Emergencies |

| Physical Office | 4th Floor, Central China Guangfa Financial Building, No. 10 Business Outer Ring Road |

| Website | https://www.zyfutures.com/ |

Central China Futures, operating under the name CENTRAL CHINA FUTURES, is a regulated futures exchange based in Zhengzhou Area, within the Henan Pilot Free Trade Zone. It falls under the supervision of the China Financial Futures Exchange (CFFEX) and offers a diverse range of trading products spanning metals, energy, chemicals, financial instruments, and agricultural commodities. Clients can open accounts using both computer-based and mobile-based methods, while customer support is accessible through various channels, including phone, fax, email, and in-person visits to their physical office. Central China Futures provides separate emergency contact numbers for general and continuous trading emergencies, ensuring responsive assistance when needed. Their official website, https://www.zyfutures.com/, serves as a gateway for traders and investors seeking information and services.

Central China Futures (CENTRAL CHINA FUTURES) operates as a futures exchange in China, and it is regulated by the China Financial Futures Exchange (CFFEX). CFFEX plays a crucial role in overseeing and maintaining the integrity of the financial futures market in China. This regulatory oversight ensures that trading activities on CENTRAL CHINA FUTURES are conducted in a fair and transparent manner, protecting the interests of market participants and promoting financial stability. By adhering to CFFEX's regulations, CENTRAL CHINA FUTURES contributes to the development and growth of the futures market in Central China and beyond, offering a secure and reliable platform for investors and traders to engage in futures trading.

Central China Futures (CENTRAL CHINA FUTURES) offers several advantages, including regulation by CFFEX, a diverse range of trading products, and secure trading platforms. However, the manual deposit and withdrawal procedures, along with the comprehensive account opening process, may pose some challenges for clients. Additionally, while customer support is available through various channels, there is limited information on trading fees and commissions, and the platform does not mention educational resources or trading tools for clients.

| Pros | Cons |

| Regulated by China Financial Futures Exchange (CFFEX), ensuring fair and transparent trading practices. | Manual deposit and withdrawal procedures may be less convenient for some clients. |

| Offers a diverse range of trading products across various categories. | Limited availability of bank-futures transfer service for deposit and withdrawal. |

| Access to a wide spectrum of commodities and financial instruments. | Account opening process involves several steps and document requirements. |

| Provides secure and reliable platforms for futures trading. | Mobile-based account opening may require specific app downloads. |

| Customer support available through phone, email, fax, and in-person visits. | Limited information provided regarding trading fees and commissions. |

| Convenient physical office location in the Henan Pilot Free Trade Zone. | No mention of educational resources or trading tools for clients. |

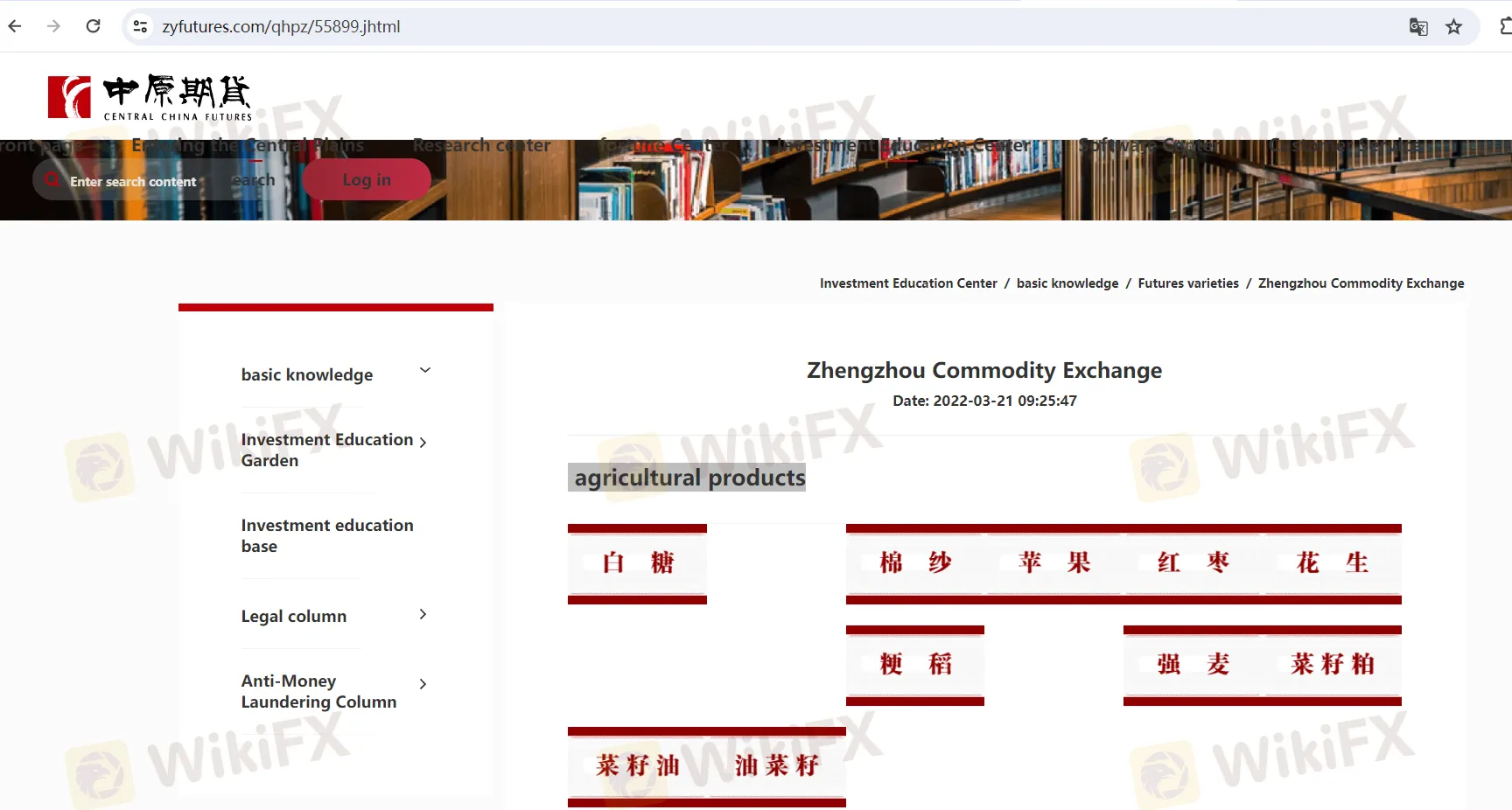

Central China Futures (CENTRAL CHINA FUTURES) offers a diverse range of trading products across various categories on the national futures market. These products can be categorized into five main classes: metals, energy, chemicals, financial instruments, and agricultural commodities. They are listed and traded on different Chinese futures exchanges, including Zhengzhou Commodity Exchange (ZCE), Dalian Commodity Exchange (DCE), Guangzhou Futures Exchange (GFE), Shanghai Futures Exchange (SHFE), Shanghai Energy Exchange (SSE), and China Financial Futures Exchange (CFFEX).

Zhengzhou Commodity Exchange (ZCE):

Cotton, Cotton yarn, Rapeseed oil, Rapeseed meal, Rapeseed, Apples, Red dates, White sugar, Peanuts, Early Indica rice, Late Indica rice, Japonica rice, Wheat, Strong gluten wheat,Ordinary wheat, Purified terephthalic acid (PTA), Short fiber, Glass, Soda ash, Methanol, Urea, Silico-iron, Ferrosilicon, Thermal coal

Dalian Commodity Exchange (DCE):

Soybean No. 1, Soybean No. 2, Soybean meal, Soybean oil, Palm oil, Corn, Cornstarch, Indica rice, Eggs, Live pigs, Plastics, Polypropylene (PP), Polyvinyl chloride (PVC), Styrene, Ethylene glycol, Liquefied petroleum gas (LPG), Coke, Coking coal, Iron ore, Fiberboard, Plywood

Shanghai Futures Exchange (SHFE):

Copper, Aluminum, Zinc, Nickel, Lead, Tin, Gold, Silver, Rebar steel, Hot-rolled coil, Stainless steel, Wire rod

Fuel oil, Asphalt, Rubber, Pulp

Shanghai Energy Exchange (SSE):

Crude oil, Low-sulfur fuel oil, International copper, Rubber No. 20

Guangzhou Futures Exchange (GFE):

Industrial silicon

China Financial Futures Exchange (CFFEX):

SSE 300 Stock Index, SSE 50 Stock Index, CSI 500 Stock Index, CSI 1000 Stock Index, 2-year government bonds, 5-year government bonds, 10-year government bonds

These trading products offered by CENTRAL CHINA FUTURES cover a wide spectrum of commodities and financial instruments, providing investors and traders with diverse opportunities to manage risk and speculate on price movements in the Chinese futures market.

To open an account with Central China Futures, you can choose between two methods: computer-based (A) or mobile-based (B). Below are the steps for both options:

A. Computer-Based Account Opening:

Before You Begin:

Required Documents:

Your valid Chinese ID card.

A handwritten signature.

A bank card from one of the following banks: Industrial and Commercial Bank of China (ICBC), Agricultural Bank of China (ABC), Bank of China (BOC), China Construction Bank (CCB), Bank of Communications (BOCOM), Industrial Bank (兴业银行), China Minsheng Banking Corp (民生银行), Shanghai Pudong Development Bank (浦发银行), China Everbright Bank (光大银行), China Citic Bank (中信银行), or China Merchants Bank (招商银行).

Environmental Requirements:

Choose a location with a stable internet connection.

Ensure adequate lighting.

Opt for a relatively quiet environment.

Equipment Needed:

A computer with internet access.

A webcam.

A microphone.

Account Opening Steps:

Visit the Account Opening Webpage:

Use the Internet Explorer 11 browser to open the account opening page: https://zyqh.cfmmc.com/.

Registration and Login:

Enter your ID card number and the captcha code.

Next, input your mobile phone number and receive a verification code.

Upload ID Card and Signature:

Ensure all four corners of your ID card are visible, and the card information is clear.

Provide your handwritten signature on a white paper using a black pen.

Fill in Basic Information:

Complete the required fields with accurate personal information.

Bind Settlement Account:

Upload an image of your bank card with all four corners visible, ensuring that the card details are clear.

Provide the detailed name of your bank branch.

Select Investor Type:

Choose your investor type.

Complete Risk Assessment Questionnaire:

Answer the risk assessment questionnaire based on your personal circumstances.

Review your risk level, and if correct, proceed to the next step.

Choose Account Type:

Select the relevant account types for trading in commodity futures on the Shanghai, Dalian, Zhengzhou, and Guangzhou exchanges.

Read Agreements:

Carefully read and agree to the terms and conditions by selecting “I have read and agreed to all the agreements and business rules.”

Video Verification:

Choose a well-lit, quiet location.

Prepare your ID documents.

Ensure your webcam and microphone are working properly.

Follow the instructions provided by the staff to complete the video verification.

Install Digital Certificate:

Set a 6-8 digit digital certificate password and remember it.

Sign Agreements:

Fully read the relevant agreements.

Select “I have read and agreed to all the agreements and business rules.”

Click “Sign Agreement,” enter your digital certificate password, and confirm.

Online Interview:

Complete the online interview questionnaire independently and diligently.

Submit Application:

After submitting your application, wait patiently for the account opening team to review your application.

Once your account is successfully opened, you will receive a text message with your futures account information and password.

B. Mobile-Based Account Opening:

Before You Begin:

Required Documents:

Your valid Chinese ID card.

A handwritten signature.

A bank card from one of the supported banks mentioned earlier.

Environmental Requirements:

Choose a location with a stable internet connection.

Ensure adequate lighting.

Opt for a relatively quiet environment.

Using the App:

Register and Log In:

Download the Central China Futures app, “中原赢富通,” or the “开户云五期” app from the Chinese Futures Market Monitoring Center.

Register and log in.

Select Account Opening:

Within the app, navigate to the account opening section.

Follow the Steps:

Follow the same steps as mentioned for the computer-based account opening, including providing your ID and bank card information, completing risk assessments, reading and signing agreements, and conducting video verification.

Submit Application:

After completing all the required steps, submit your application and wait for the account opening team to review it.

Once your account is successfully opened, you will receive a text message with your futures account information and password.

These steps outline how to open an account with Central China Futures, whether using a computer or a mobile device. Make sure to have all the necessary documents and follow the instructions carefully for a smooth account opening process.

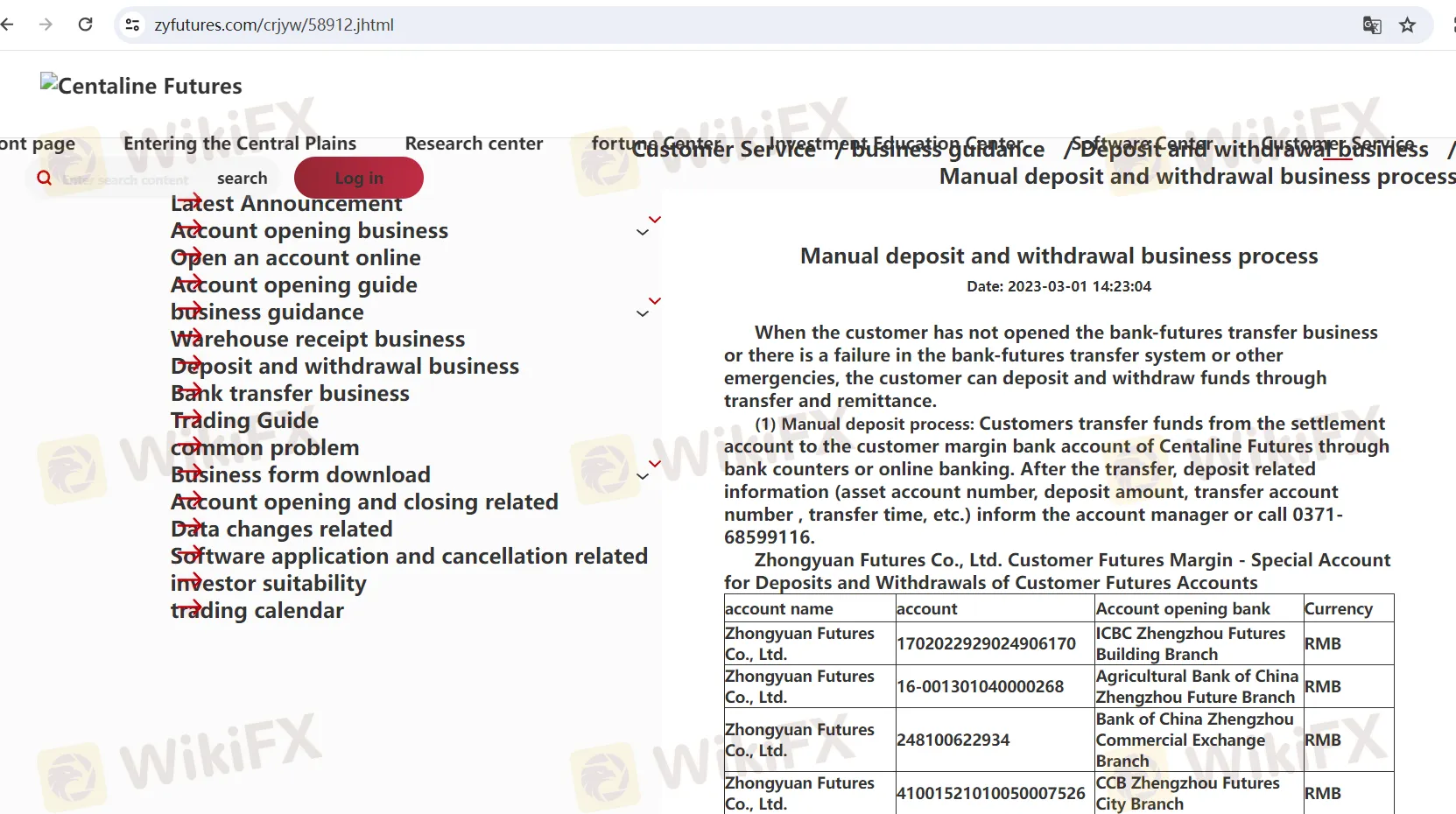

The deposit and withdrawal process for Central China Futures can be done manually when clients do not have access to the bank-futures transfer service or when there are urgent situations. Here is a breakdown of the deposit and withdrawal procedures:

Manual Deposit (入金) Process:

Client Initiation:

Clients transfer funds from their settlement account to Central China Futures' dedicated customer margin bank account through bank counters or online banking, either via intrabank transfer or same-bank transfer.

Notification:

After making the transfer, clients need to notify their account manager or call 0371-68599116, providing relevant information such as asset account number, deposit amount, transfer account number, and transfer time.

Central China Futures' Dedicated Customer Margin Bank Accounts:

| Account Name | Account Number | Bank | Currency |

| 中原期货股份有限公司 (ICBC) | 1702022929024906170 | 工行郑州期货大厦支行 | 人民币 |

| 中原期货股份有限公司 (ABC) | 16-001301040000268 | 农行郑州未来支行 | 人民币 |

| 中原期货股份有限公司 (BOC) | 248100622934 | 中行郑州商交所支行 | 人民币 |

| 中原期货股份有限公司 (CCB) | 41001521010050007526 | 建行郑州期货城支行 | 人民币 |

| 中原期货股份有限公司 (BOCOM) | 411060700018001246926 | 交行河南省分行期货大厦支行 | 人民币 |

| 中原期货股份有限公司 (CIB) | 462090113471008860 | 兴业银行郑州金水东路支行 | 人民币 |

| 中原期货股份有限公司 (CMBC) | 8111101413100053878 | 中信银行郑州分行营业部 | 人民币 |

| 中原期货股份有限公司 (CMSB) | 646000884 | 民生银行郑州商鼎路支行 | 人民币 |

| 中原期货股份有限公司 (SPDB) | 760801538080088050 | 浦发银行郑州期货大厦支行 | 人民币 |

| 中原期货股份有限公司 (CMB) | 755929851610206 | 招商银行郑州分行内环路支行 | 人民币 |

| 中原期货股份有限公司 (CEB) | 773001880001171310088 | 光大银行会展中心支行 | 人民币 |

Important Notes:

Clients must transfer funds directly from their futures settlement account to Central China Futures' dedicated customer margin bank account. Cash withdrawals or transfers from other bank accounts are not allowed.

Funds must be transferred between the same bank, i.e., ICBC to ICBC, ABC to ABC, etc.

Clients should indicate their name and bank account number in the payer information section and specify their asset account number and “期货保证金” (Futures Margin) in the remarks section of the bank transfer document.

Manual Withdrawal (出金) Process:

Client Initiation:

Clients send a withdrawal instruction in the form of a “中原期货股份有限公司客户出金单” to the company.

Processing:

Company staff processes the request and transfers the requested funds from the customer margin account to the futures settlement account.

Withdrawal by Clients Themselves (Mobile App):

Login to the App:

Clients can log in to the Central China Futures app (中原赢富通) and select “出金申请” (Withdrawal Application).

Upload Documents:

Clients need to upload photos of their ID card (front and back) and a handwritten signature.

Identity Verification:

Verify your identity based on the uploaded documents.

Select Withdrawal Type:

Choose the withdrawal type, bank, and amount.

Confirmation:

Confirm the withdrawal details.

Submit:

Click “Submit” to complete the withdrawal process.

Important Note for Manual Withdrawal:

Institutional clients need the signature and seal of the fund allocator, while individual clients must sign on the withdrawal form.

Deposit and Withdrawal Timings:

Manual deposits can be made on trading days between 8:30 AM - 11:30 AM and 1:30 PM - 4:00 PM.

Manual withdrawals can be made on trading days between 9:10 AM - 11:30 AM and 1:30 PM - 4:00 PM.

For nighttime special deposit business, clients can call 0371-68599122.

Large Amount Pre-scheduled Withdrawal (大额预约出金):

Clients can perform pre-scheduled withdrawals by selecting “特色服务—预约服务” (Special Services - Appointment Service) within the Central China Futures app or by calling 0371-68599116 to make arrangements.

Please note that these procedures are for manual deposit and withdrawal with Central China Futures and follow specific guidelines to ensure secure and accurate fund transfers.

Central China Futures provides customer support through various channels to assist clients with their inquiries and trading needs. Here's an overview of their customer support options:

Contact Information:

Phone: Clients can reach Central China Futures' customer support team at 4006-967-218. For emergency orders, there are separate phone numbers for regular and continuous trading emergencies: 0371-68599128, 0371-68599168.

Fax: The company can be reached via fax at 0371-68599136.

Email: Clients can contact the customer support team via email at zyqhjyb@ccnew.com.

Address:

Central China Futures' physical office is located at:

Address: 河南自贸试验区郑州片区(郑东)商务外环路10号中原广发金融大厦四楼

Translation: 4th Floor, Central China Guangfa Financial Building, No. 10 Business Outer Ring Road, Zhengzhou Area (Zhengdong) of Henan Pilot Free Trade Zone

Emergency Reporting:

Central China Futures has dedicated numbers for emergency reporting:

For general emergencies, clients can call 0371-68599128, 0371-68599168.

For continuous trading emergencies, there is a separate line at 0371-68599168.

Central China Futures' customer support aims to provide assistance and address clients' concerns promptly and efficiently. Clients can contact them through the provided phone numbers, fax, email, or visit their physical office for in-person support. The company's address is conveniently located in the Henan Pilot Free Trade Zone in Zhengzhou, China, making it accessible for clients seeking assistance or conducting business in person.

Central China Futures (CENTRAL CHINA FUTURES) is a regulated futures exchange in China, overseen by the China Financial Futures Exchange (CFFEX), ensuring fair and transparent trading practices. They offer a wide range of trading products across various categories such as metals, energy, chemicals, financial instruments, and agricultural commodities on different Chinese futures exchanges. Opening an account with them is possible through both computer-based and mobile-based methods, with detailed steps provided for each. Manual deposit and withdrawal procedures are available for clients who need an alternative to bank-futures transfers, and customer support is accessible through phone, fax, email, and in-person visits at their office in the Henan Pilot Free Trade Zone, offering assistance for various inquiries and trading needs.

Q1: How can I open an account with Central China Futures?

A1: You can open an account with Central China Futures by following their computer-based or mobile-based account opening procedures, which include providing necessary documents and completing the required steps.

Q2: What are the available trading products on Central China Futures?

A2: Central China Futures offers a diverse range of trading products, including metals, energy, chemicals, financial instruments, and agricultural commodities, listed and traded on different Chinese futures exchanges.

Q3: What are the deposit and withdrawal options for clients?

A3: Clients can deposit and withdraw funds manually when bank-futures transfers are not available. They can do this by transferring funds from their settlement account to Central China Futures' dedicated customer margin bank account, following specific guidelines.

Q4: How can I contact Central China Futures' customer support?

A4: You can reach their customer support team by phone at 4006-967-218 or through email at zyqhjyb@ccnew.com. For emergency orders or continuous trading emergencies, separate phone numbers are provided.

Q5: Where is Central China Futures' physical office located?

A5: Central China Futures' office is situated at 4th Floor, Central China Guangfa Financial Building, No. 10 Business Outer Ring Road, Zhengzhou Area (Zhengdong) of Henan Pilot Free Trade Zone. Clients can visit the office for in-person support or inquiries.

中原期货股份有限公司

CENTRAL CHINA FUTURES

Regulated

Platform registered country and region

China

--

--

--

--

--

河南省郑州市郑东新区商务外环路10号中原广发金融大厦四楼

--

--

--

--

zyqh@ccnew.com

zyqhjyb@ccnew.com

Company Summary

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now