Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

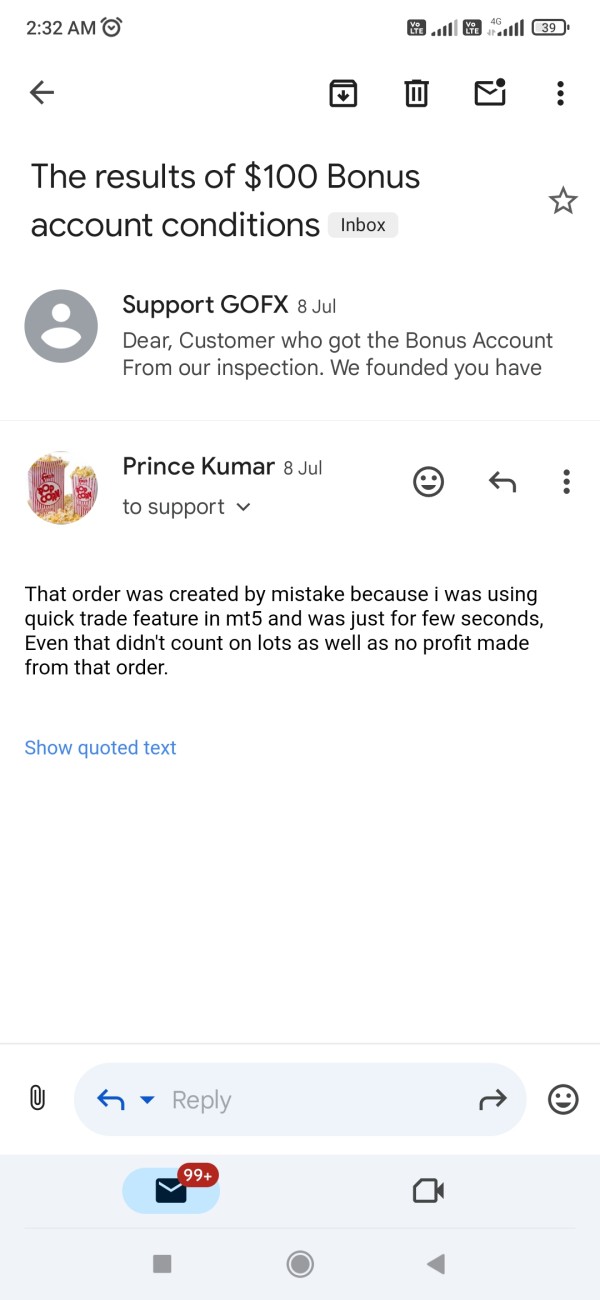

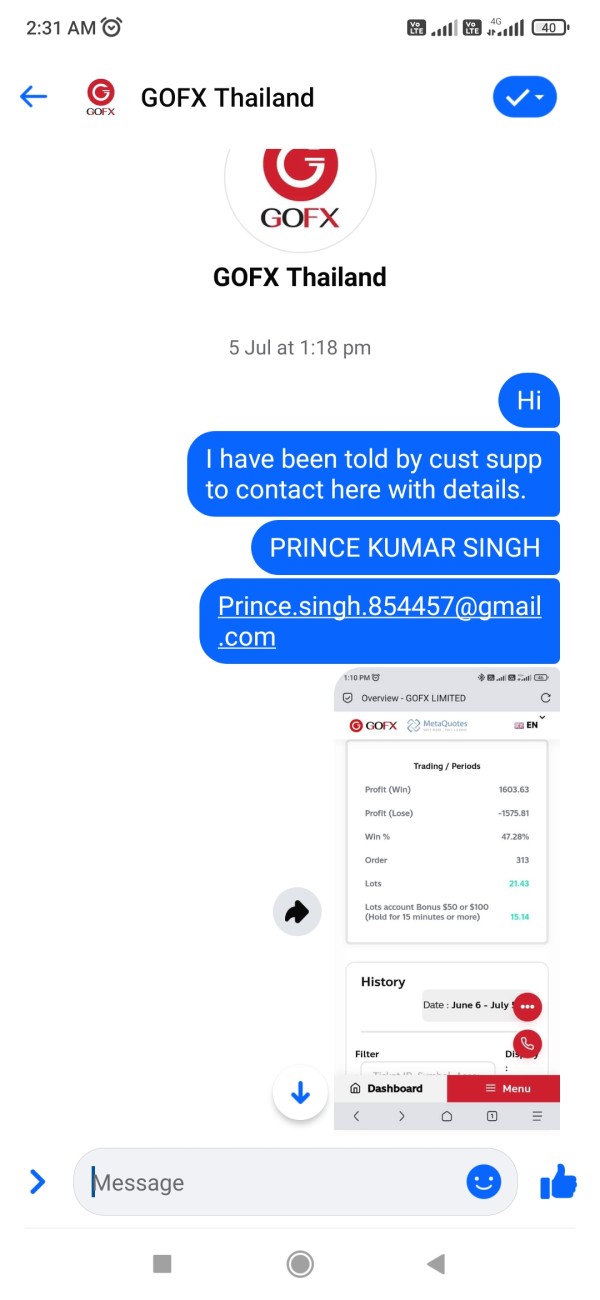

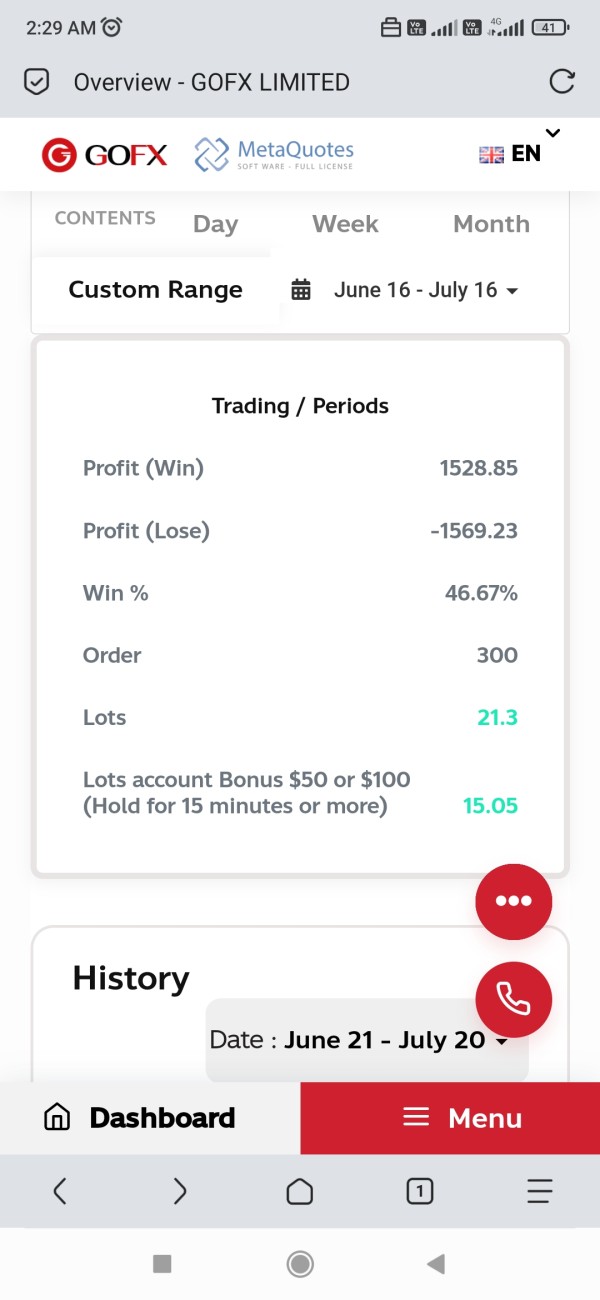

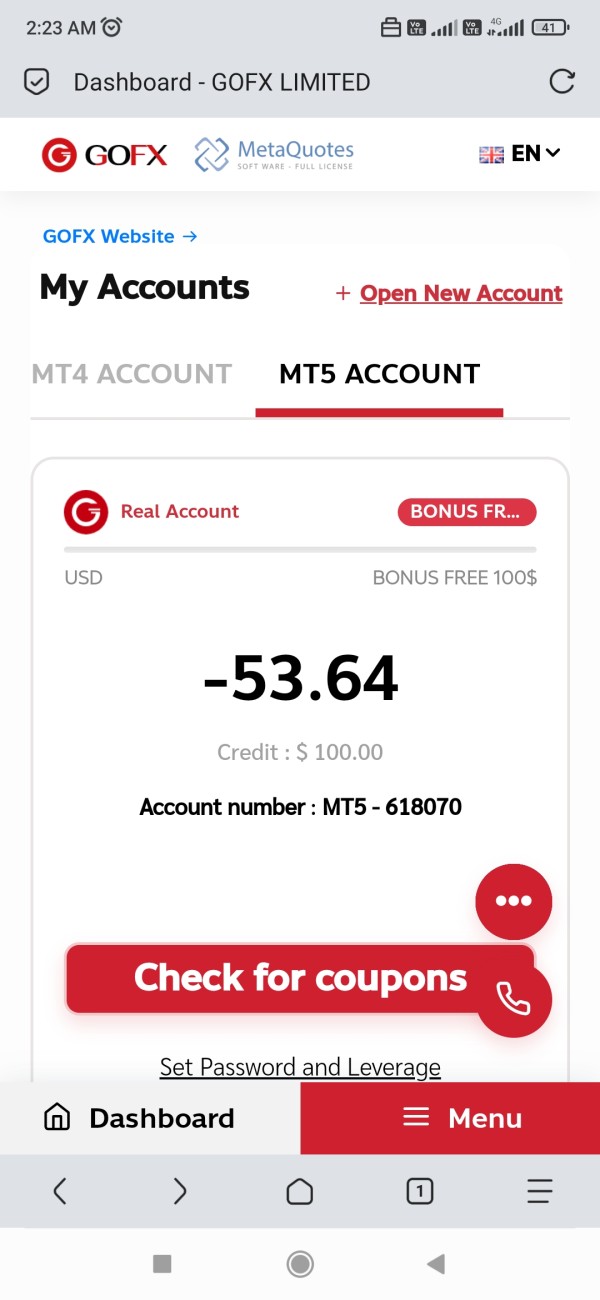

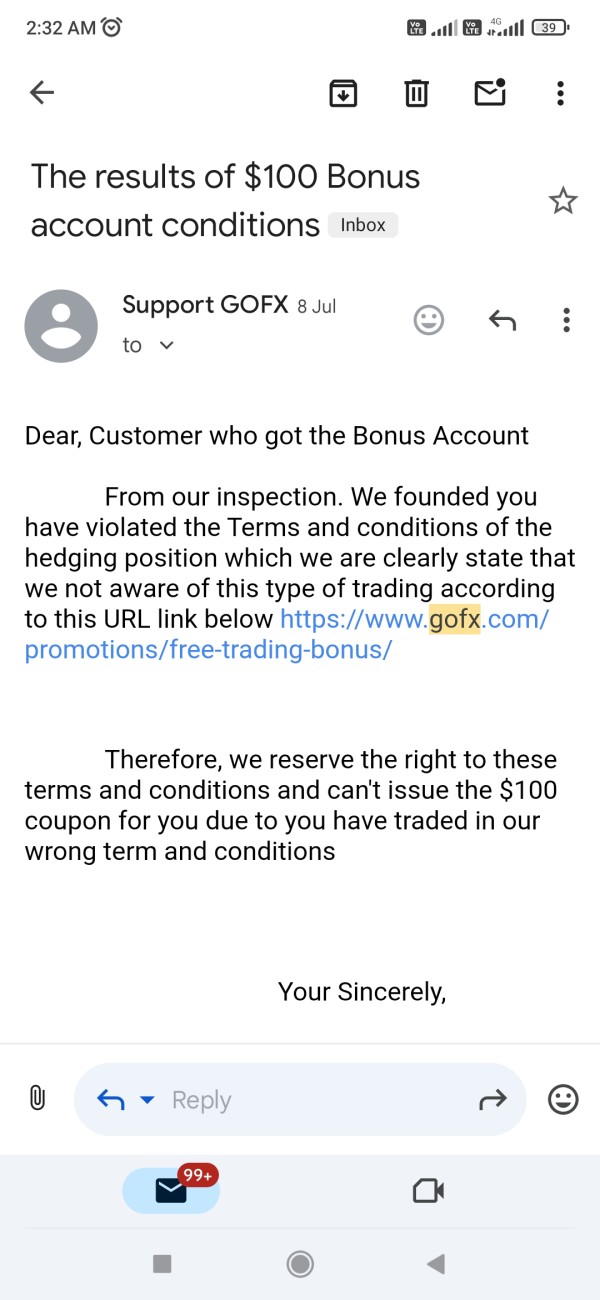

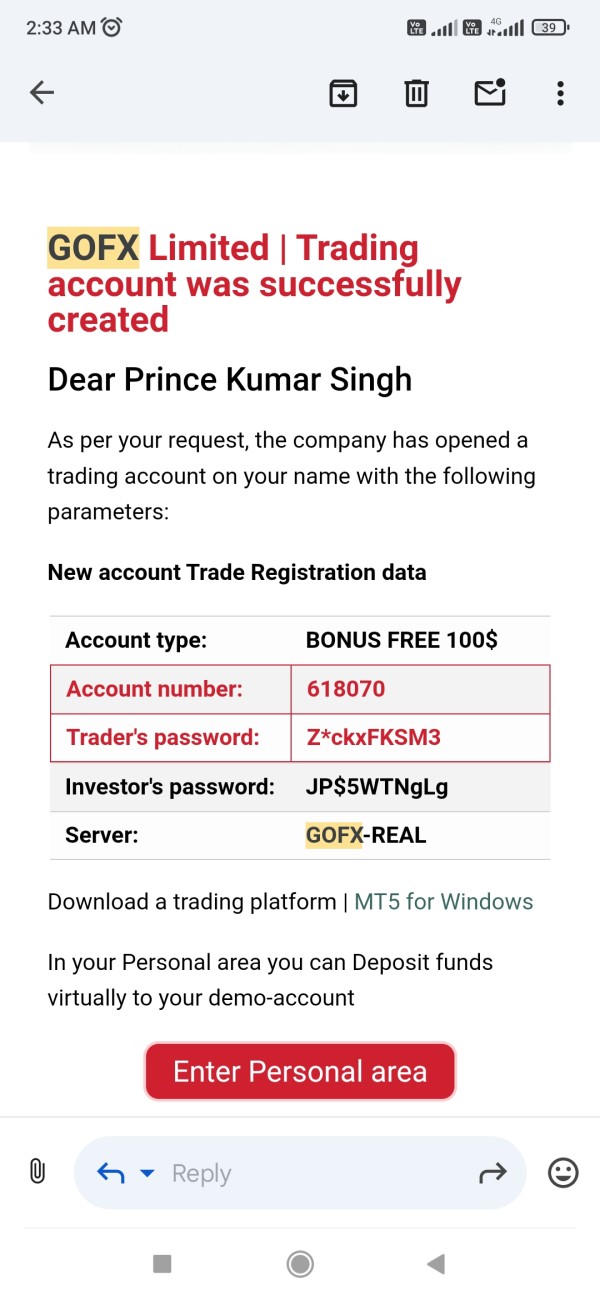

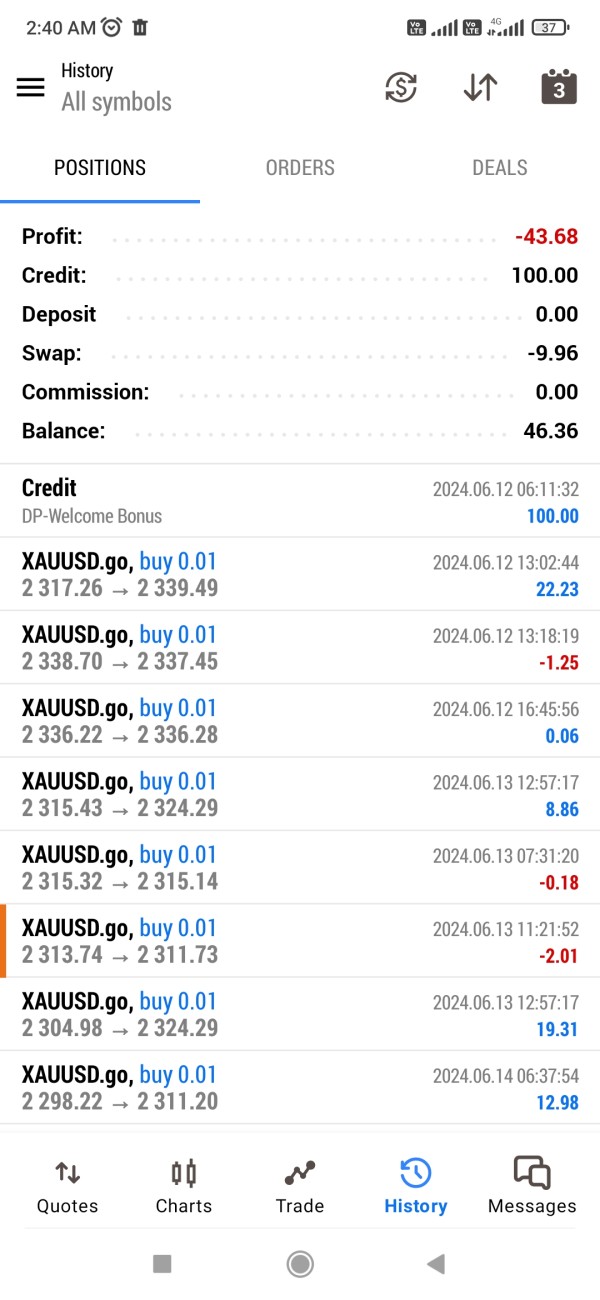

FX2000015930

India

Hello everyone, I am Prince Kumar Singh. I have received $100 ndb bonus by GoFx as a new customer and completed 15 lots by holding each trade 15 min which is almost impossible to do in 30 day, Which i did trading day and night, after asked them to review and approve reward coupon of $100 as acc to t&c 15 lots in 30 calender days irrespective of any profit made or loss in xauusd pair only. This broker never intended to reward anybody just saying t&c violated as an excuse not to approve.Their cust service is very poor, never able to chat with them on website and even didnot reply on mail and also ignoring on messenger.

Exposure

2024-07-20

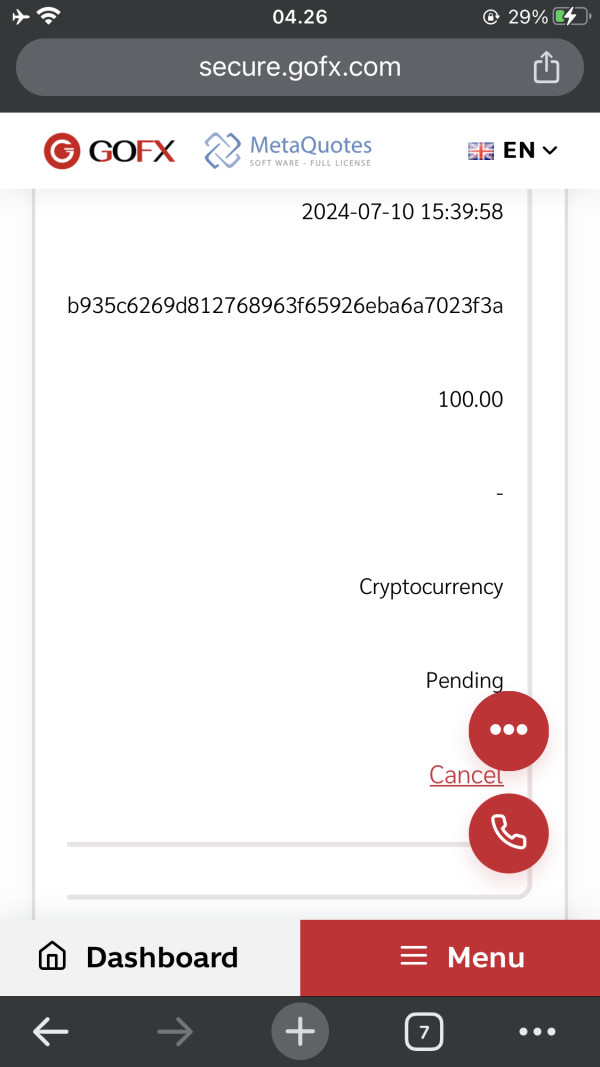

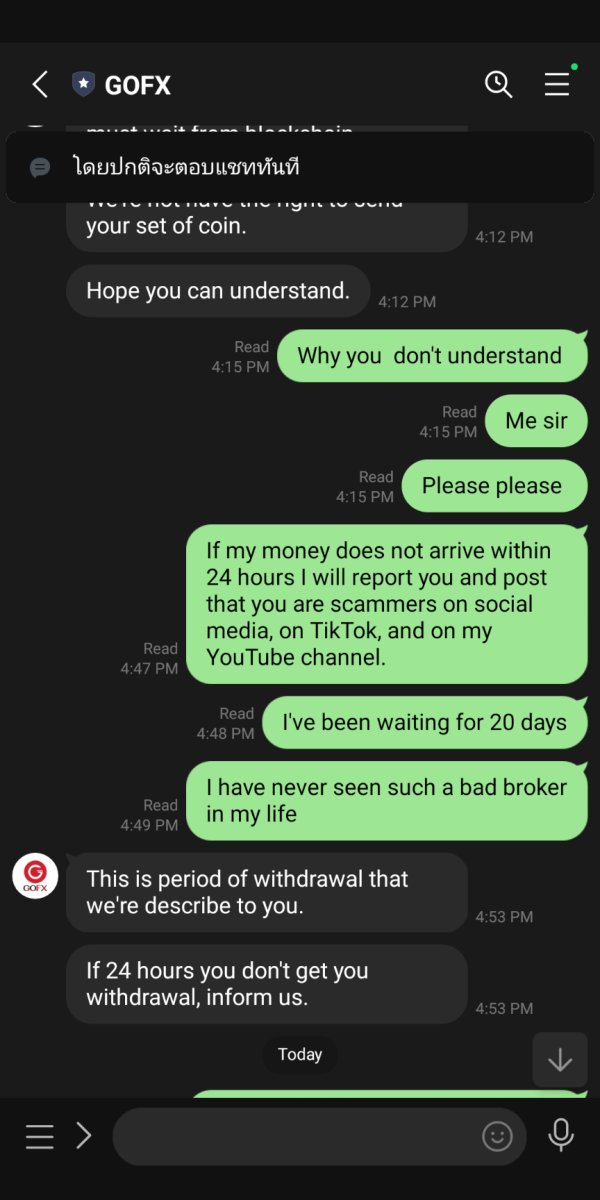

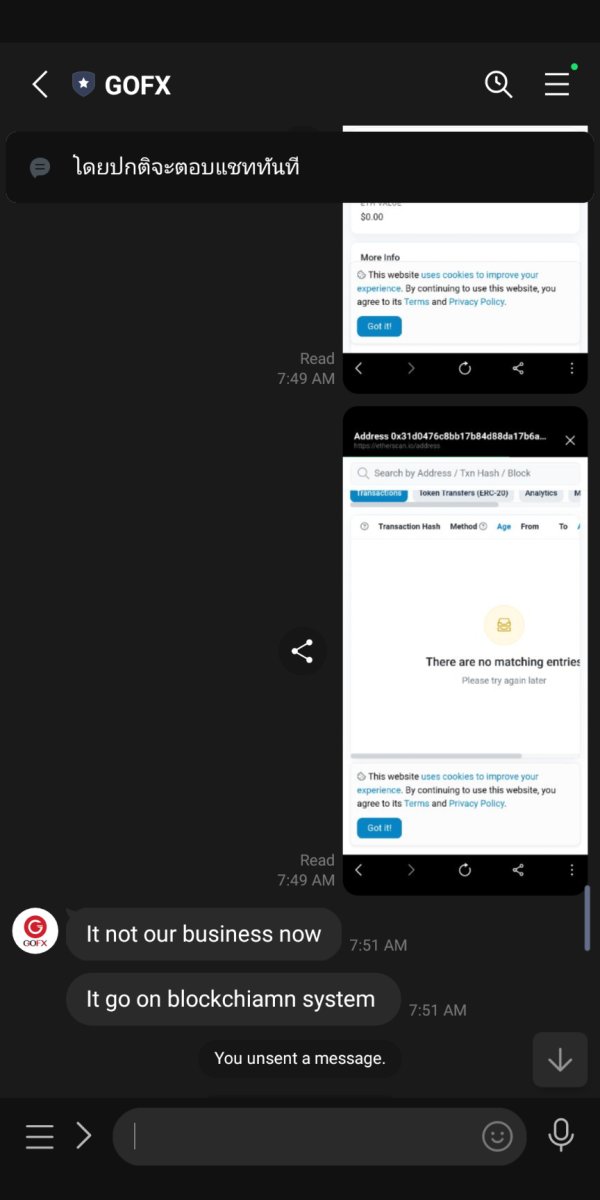

raka257

Indonesia

I make a withdrawal on 07-10-2024 and I haven't received it until now

Exposure

2024-07-17

FX1689221982

Indonesia

Last month, Gofx held an NDB promo with various conditions. If the customer meets the requirements, the customer is entitled to a $100 coupon. Gofx stated that the $100 coupon is made for 7 days and can only be sent to customers who meet the conditions. This is the problem. It's been more than 7 days since Gofx hasn't sent the coupon, not just 1 or 2, but many customers haven't received the coupon.

Exposure

2024-07-16

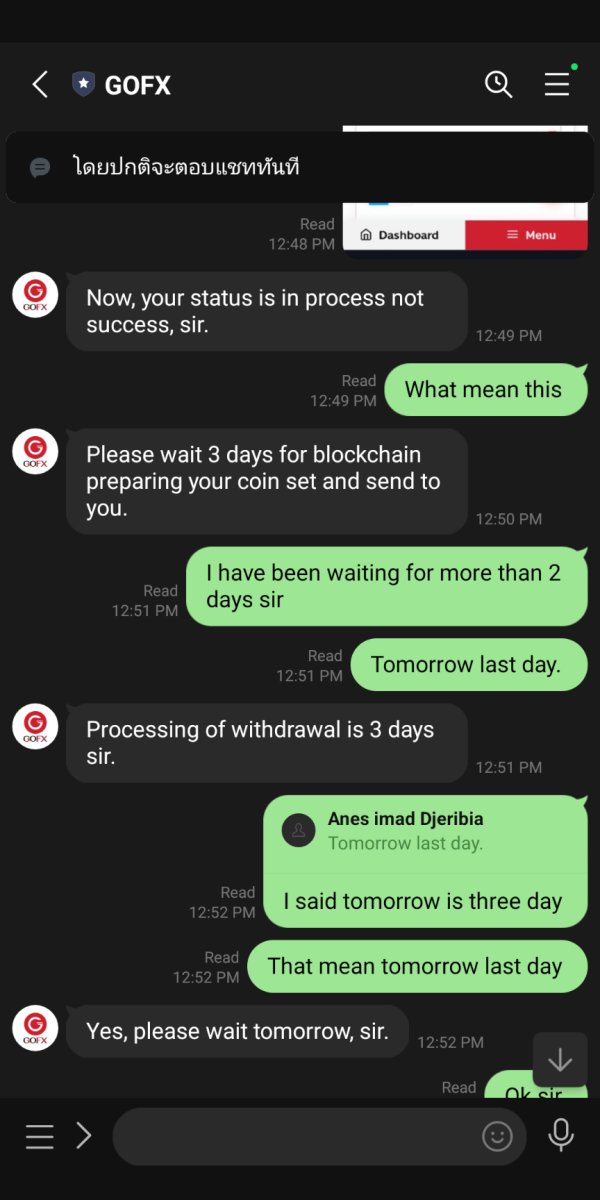

FX4206525456

Algeria

Scammers beware. I couldn't withdraw my money and whenever I spoke to support, they always waste my time and make me wait.

Exposure

2024-07-12

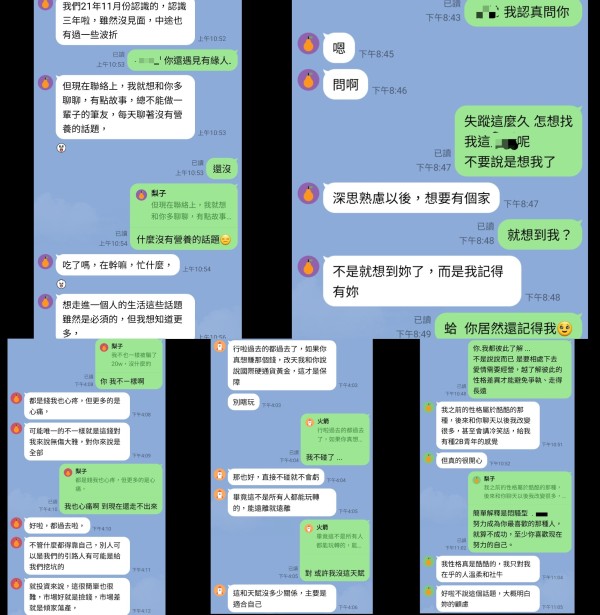

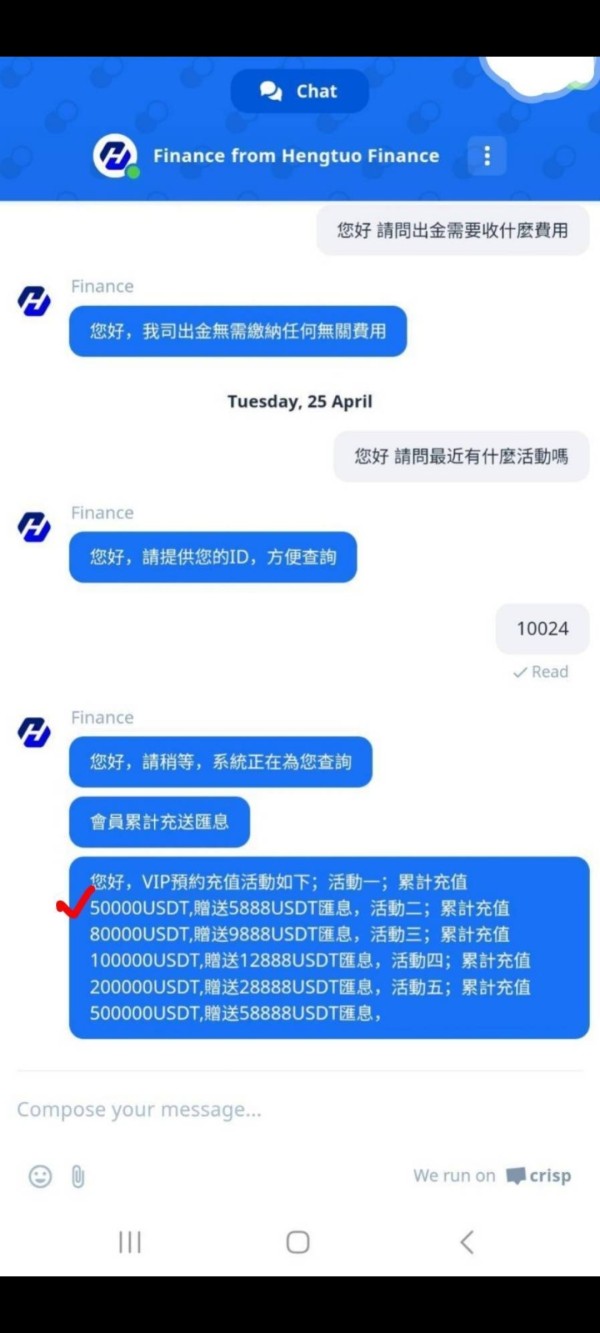

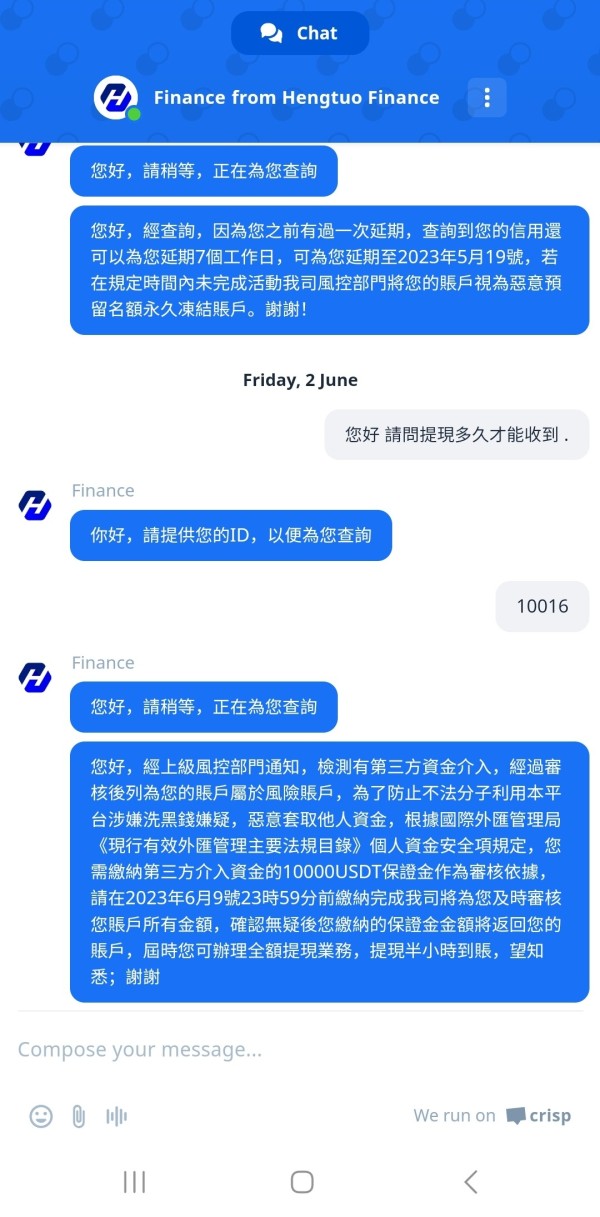

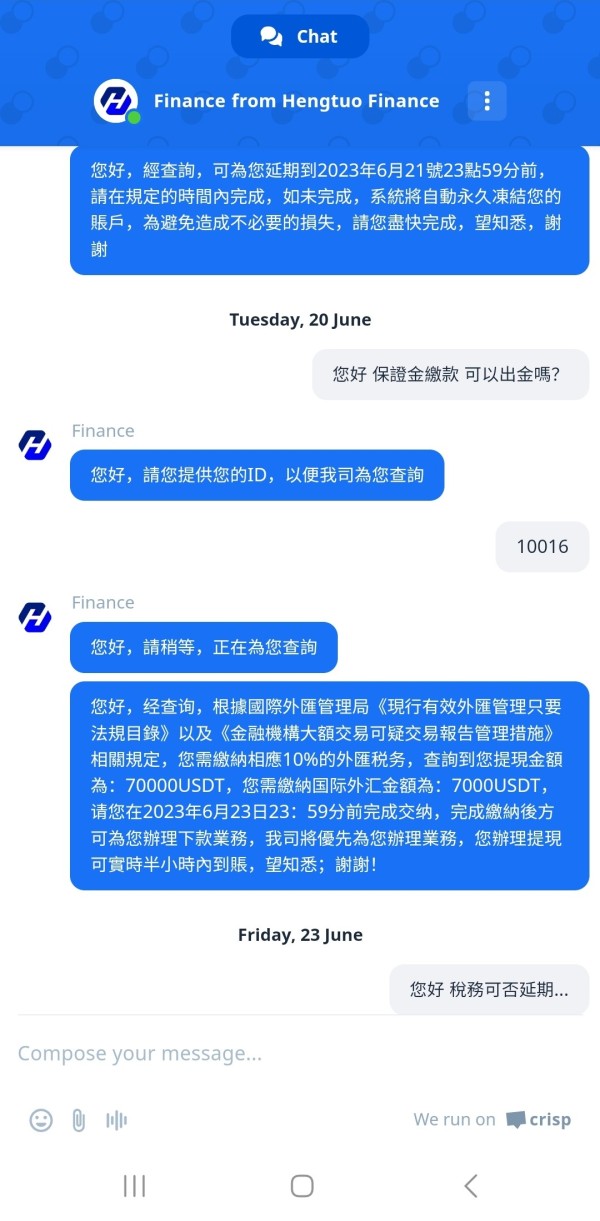

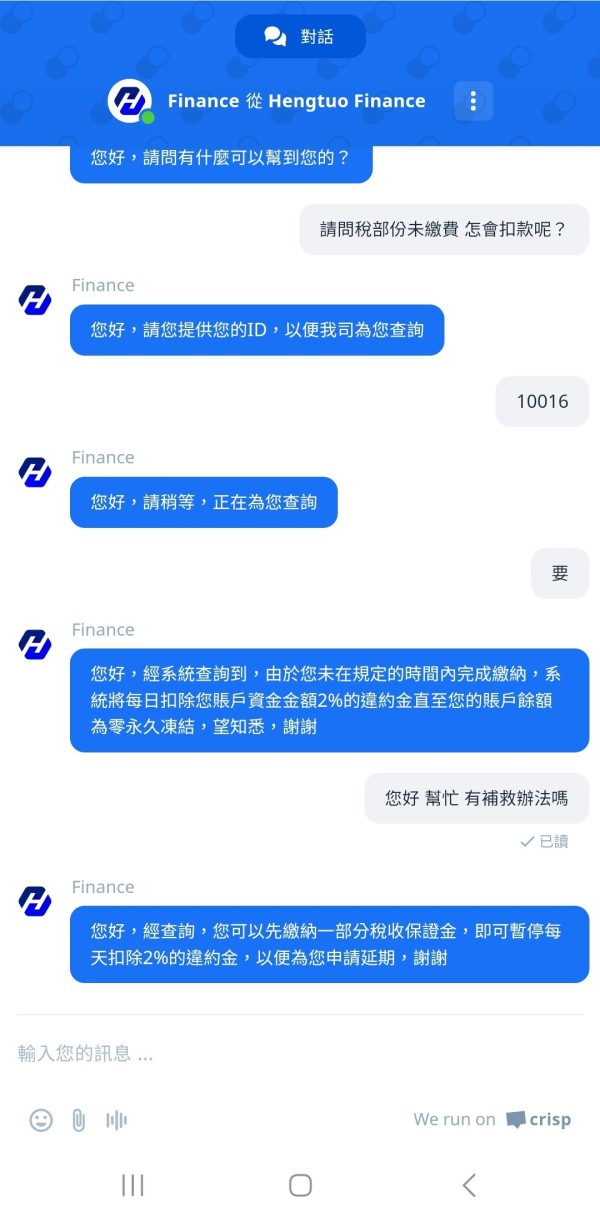

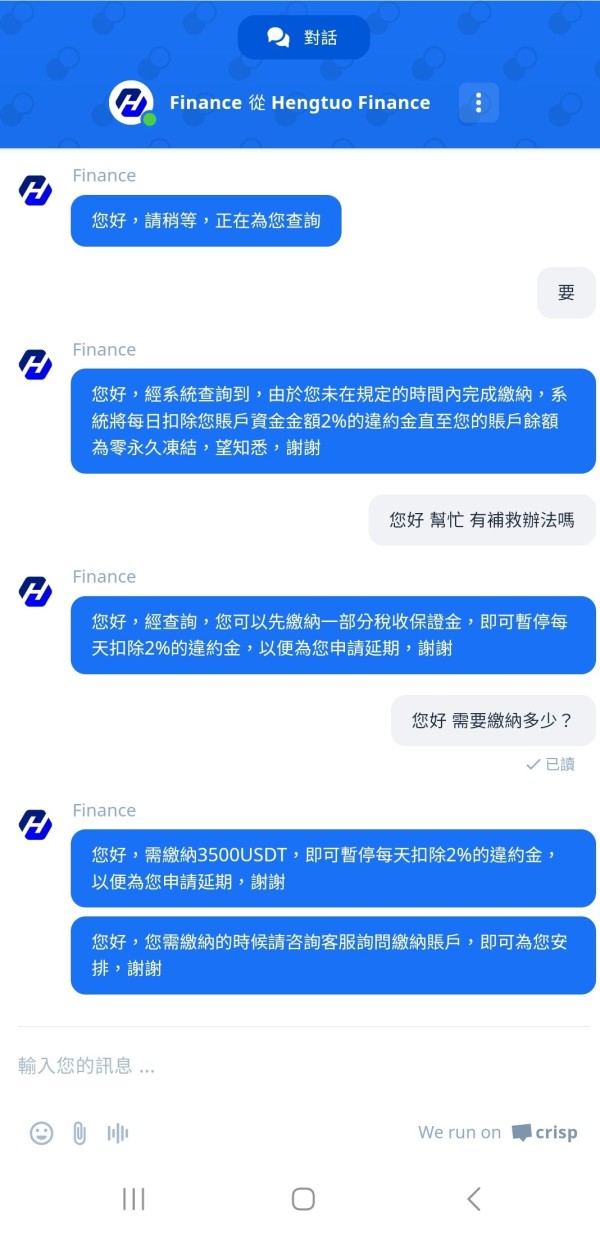

晴漾

Taiwan

IG has known him for three years. The contact was cut off for a year. In the end, the contact has warmed up from friend to love recently. There are a lot of care and greetings every day. He said that more income will be better for him in the future. You can try. But Don't overdo it. I also said that you need to know the importance of money... I said that I have been cheated before. I don't want to touch investment... I started to make a small investment and made a profit. Later, I was very opposed to and angry when I was encouraged to sign up for an event and deposit.. . A friend said, to be brave within the tolerance range? Be bold? Take that step. You are so worried and afraid. I will help you if you have unnecessary doubts. Because of this matter, there are loans and mistakes. I am also impatient... He finally helped me with a part of the money. It took a month for the activity to be completed. It was hard to withdraw money. After asking customer service, a bunch of people refused to withdraw money under my name... We had to pay a third-party intervention fund deposit. Finally got together and paid a lot of deposits. There is also foreign exchange tax. I really can't pay it. The customer service also said that 2% will be deducted every day, and the liquidated damages will be paid out. Then it will be reset to zero and permanently frozen! ! !

Exposure

2023-07-10

FX2072602232

Thailand

No transparency. Can't trade or withdraw funds

Exposure

2024-01-26

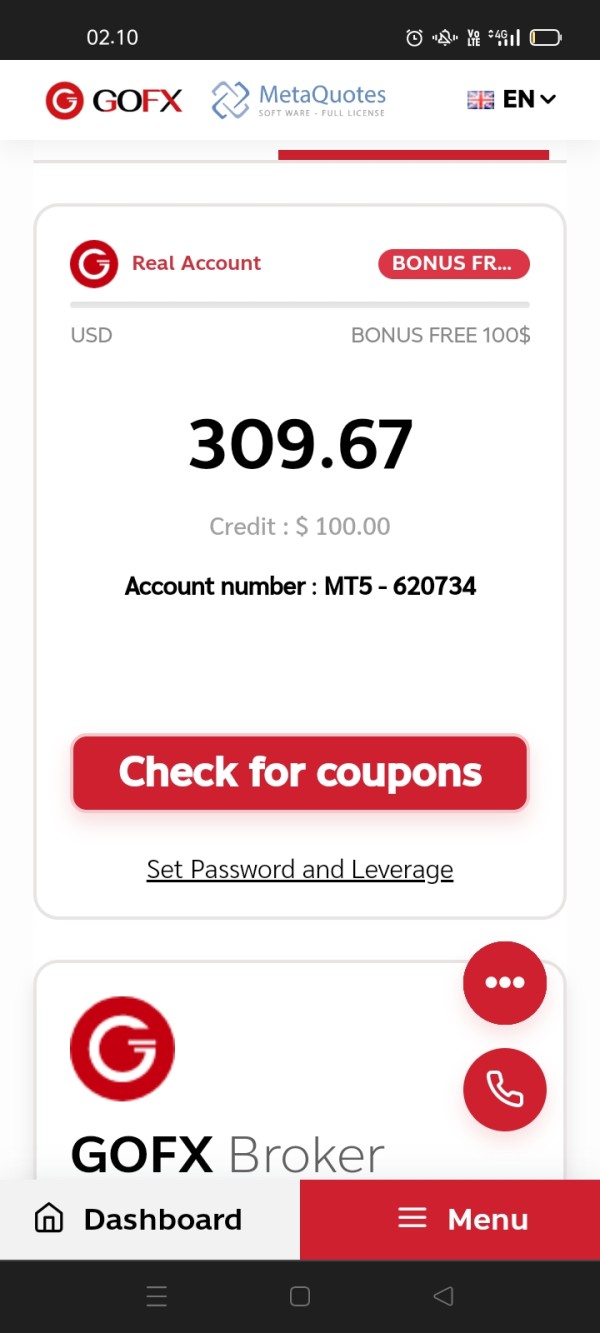

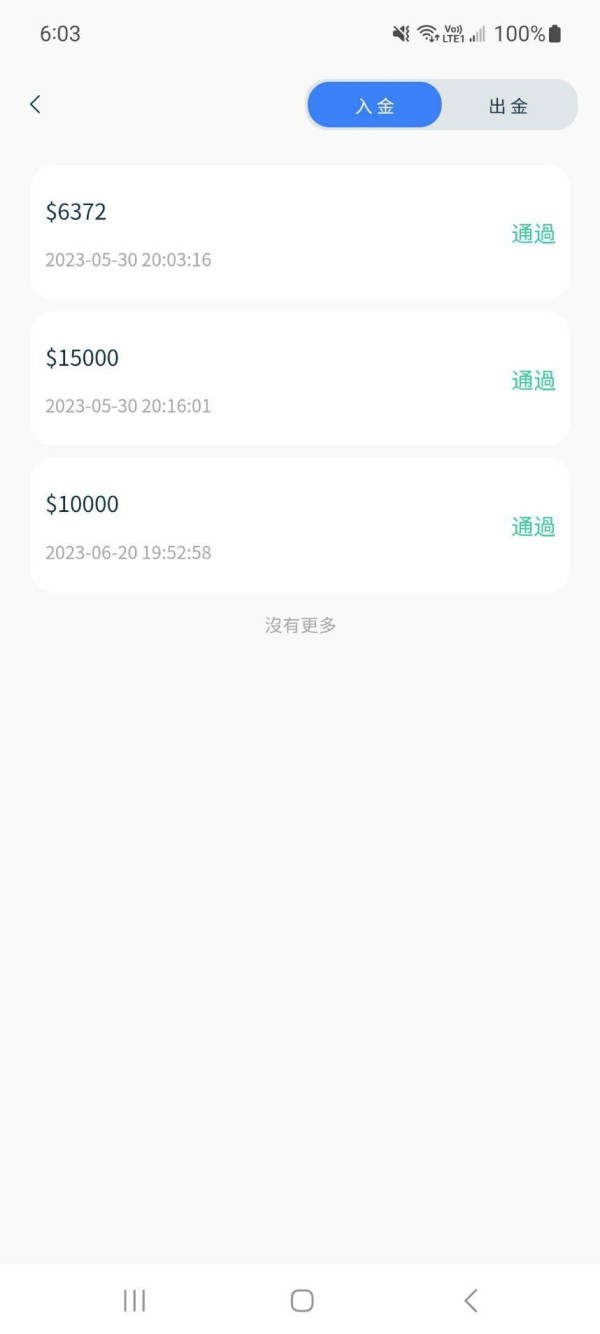

FX2233842042

Thailand

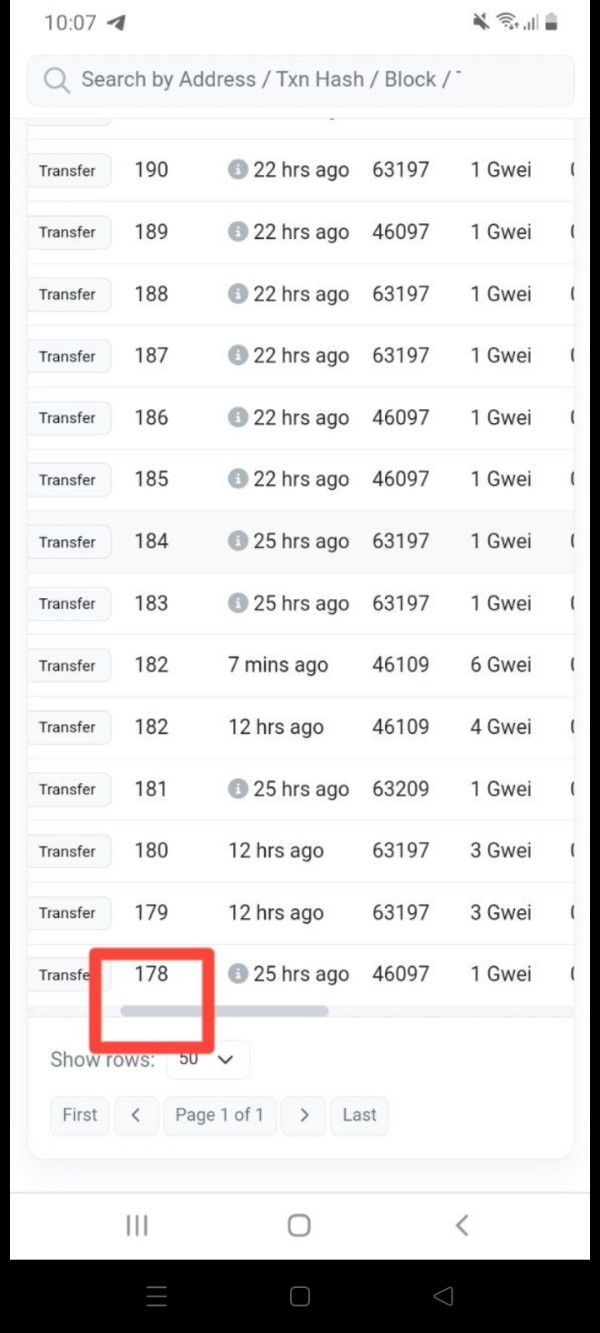

According to the first photo, I should have profited.

Exposure

2024-01-26

LaLa123

Netherlands

My experience with GOFX has been quite an interesting journey. One of the main positives are the low spreads, starting from 0.2 pips, and a range of tradable assets that includes Forex, commodities, and indices. The available account types have been diverse, catering to different traders.

Neutral

2023-12-13

Jacob Wilson Duke

Australia

Initially, ZIVEST's high leverage, up to 3000x and low minimum deposit, made me suspicious. However, after using their platform for 6 months, I am sure this one is a good broker.

Positive

2024-06-28

Mr. Dong25218

Malaysia

Very pleasant and willing support, thanks to the GOFX initiative I got my account in order. You can see that they care about their customers.

Positive

2024-06-20