Score

51Markets

China|2-5 years|

China|2-5 years| https://www.51markets.com/en

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic Information

China

ChinaUsers who viewed 51Markets also viewed..

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

PU Prime

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT5 Full License

AvaTrade

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

51markets.com

Server Location

Hong Kong

Website Domain Name

51markets.com

Website

GRS-WHOIS.HICHINA.COM

Company

ALIBABA CLOUD COMPUTING (BEIJING) CO., LTD.

Domain Effective Date

2020-09-24

Server IP

143.92.58.21

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

| Aspect | Information |

| Registered Country/Area | China |

| Founded Year | 2019 |

| Company Name | 51Markets |

| Regulation | Not regulated |

| Minimum Deposit | Silver: $500<br>Gold: $5,000<br>Platinum: $25,000 |

| Maximum Leverage | Up to 1:400 |

| Spreads | Silver: From 1.5 pips<br>Gold: From 1.0 pip<br>Platinum: From 0.5 pips |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex, Commodities, Indices, Precious Metals, Cryptocurrencies |

| Account Types | Silver, Gold, Platinum |

| Customer Support | Slow response times, inconsistent quality, and complaints |

| Payment Methods | Bank Wire, Credit Card, Cryptocurrency |

| Educational Tools | Not provided |

| Website Status | Reported website issues and allegations of scam or fraud |

| Reputation (Scam or Not) | Concerns about legitimacy and safety due to lack of regulation and reported issues |

Overview

51Markets, a company based in China, operates in a regulatory gray area as it is not regulated by any recognized financial authority. Founded in 2019, it offers a range of account types with varying minimum deposits, but concerns about legitimacy and safety loom large due to the absence of regulation. While it boasts a high maximum leverage of up to 1:400 and competitive spreads, issues with customer support, including slow response times and inconsistent quality, have marred the overall trading experience. Furthermore, allegations of website problems and scam-related concerns add to the skepticism surrounding this broker. Educational tools are notably absent from their offerings. In summary, 51Markets raises significant red flags, making it a risky choice for traders seeking a secure and reputable trading environment.

Regulation

51Markets is not regulated by any recognized financial authority, which raises concerns about the legitimacy and safety of this broker. Regulation is crucial for ensuring that brokers adhere to strict standards and practices to protect the interests of traders and investors. The absence of regulation means that there may be limited oversight and accountability for the company's operations, potentially putting traders at risk of fraud or other unethical practices. It is advisable to exercise caution when considering 51Markets as a broker and to explore regulated alternatives to ensure a higher level of security and protection for your investments.

Pros and Cons

51Markets, an unregulated broker, offers a range of market instruments and account types to traders. However, it lacks educational resources and faces issues with customer support responsiveness. Additionally, the reported website problems and allegations of fraud raise concerns about its credibility and safety.

| Pros | Cons |

|

|

|

|

|

|

|

|

In summary, 51Markets offers a variety of trading options and account types, but its lack of regulation and limited educational support pose significant concerns for traders. Issues with customer support responsiveness further hinder the overall trading experience, while allegations of fraud and website problems add to doubts about its credibility and safety. Traders should exercise caution and explore regulated alternatives for a more secure and supportive trading environment.

Market Instruments

51Markets offers a diverse range of market instruments to cater to various trading preferences and strategies. These instruments encompass:

Forex: 51Markets provides access to the foreign exchange market, allowing traders to engage in currency trading. This includes major currency pairs like EUR/USD, GBP/USD, and USD/JPY, as well as numerous minor and exotic currency pairs.

Commodities: The broker offers commodities trading, allowing traders to speculate on the price movements of physical commodities. This may include popular commodities like gold, silver, crude oil, and agricultural products like wheat or corn.

Indices: 51Markets offers access to various stock market indices from around the world. Traders can participate in index trading, which involves speculating on the overall performance of stock market indices such as the S&P 500, NASDAQ, or FTSE 100.

Precious Metals: Traders can engage in precious metals trading, which includes metals like gold and silver. Precious metals are often considered safe-haven assets and can be used for portfolio diversification and hedging against economic uncertainty.

Cryptocurrencies: 51Markets provides the opportunity to trade cryptocurrencies, including popular options like Bitcoin (BTC), Ethereum (ETH), and other altcoins. Cryptocurrency trading allows traders to speculate on the price movements of digital assets.

It's important to note that while these market instruments can offer opportunities for profit, they also come with risks. Traders should conduct thorough research, have a clear trading strategy, and consider risk management practices when engaging in trading activities with 51Markets or any other broker. Additionally, due diligence should be performed to ensure the legitimacy and regulatory status of the broker.

Account Types

51Markets provides a range of account types to cater to traders with different preferences and experience levels.

Silver Account:

The Silver Account is designed as an entry-level option, requiring a minimum deposit of $500. It offers competitive spreads starting from 1.5 pips, with leverage of up to 1:100. Traders with a Silver Account have access to the popular MetaTrader 4 (MT4) trading platform, making it suitable for both beginners and intermediate traders. Customer support is available during standard business hours, and traders receive basic market analysis and research reports. Additionally, Silver Account holders receive daily market updates via email, helping them stay informed about market developments.

Gold Account:For traders seeking more advanced features, the Gold Account is an excellent choice. It requires a minimum deposit of $5,000 and provides tighter spreads starting from 1.0 pips. Leverage is increased to a maximum of 1:200, allowing for greater trading flexibility. Gold Account holders can utilize both the MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. They benefit from priority customer support with extended hours and receive comprehensive market analysis, including daily trading signals. Gold Account holders also have access to a personal account manager who can assist with trading strategies and inquiries.

Platinum Account:

The Platinum Account at 51Markets is the ultimate choice for experienced and high-net-worth traders. It requires a minimum deposit of $25,000 and provides the tightest spreads starting from 0.5 pips. Traders can access leverage of up to 1:400, enabling them to take advantage of larger positions. This account level offers multiple trading platforms, including MetaTrader 4 (MT4), MetaTrader 5 (MT5), and a proprietary trading platform tailored for advanced trading strategies. Platinum Account holders enjoy dedicated 24/7 premium customer support, ensuring that assistance is available whenever needed. They receive exclusive market insights and trading signals, granting them a competitive edge in their trading activities.

Leverage

This broker offers a maximum trading leverage of up to 1:400, allowing traders to control a more substantial position size relative to their capital. However, high leverage increases both potential profits and losses, necessitating responsible use and effective risk management strategies. Leverage levels can vary between brokers and may be subject to regulatory limits in some regions. Traders should always be aware of their broker's leverage terms and employ prudent risk management practices.

Spreads and Commissions

Spreads:

Silver Account: The Silver Account offers competitive spreads starting from 1.5 pips. These spreads represent the difference between the buying (ask) and selling (bid) prices for trading instruments. The 1.5 pips spread suggests that traders can expect a moderate cost of trading, making it suitable for those looking for a balance between cost-efficiency and trading conditions.

Gold Account: The Gold Account provides tighter spreads starting from 1.0 pip. This indicates that traders may benefit from more favorable pricing compared to the Silver Account. The tighter spread of 1.0 pip can potentially reduce trading costs and is attractive to traders who prioritize cost-efficiency.

Platinum Account: The Platinum Account offers the tightest spreads starting from 0.5 pips. These extremely tight spreads are designed to benefit experienced and high-net-worth traders. The 0.5 pips spread indicates that traders at this level can access highly competitive pricing, which can be especially advantageous for large-volume trading activities.

Commissions:

Silver Account: The description does not specify any commissions for the Silver Account. This suggests that the Silver Account may operate on a spread-only pricing model, where traders pay no separate commissions, and the cost of trading is included in the spreads. This simplicity can be appealing for traders who prefer a straightforward fee structure.

Gold Account: Similar to the Silver Account, there is no mention of specific commissions for the Gold Account. This suggests that the Gold Account may also operate on a spread-only pricing model, where the cost of trading is incorporated into the spreads. Traders benefit from potentially tighter spreads without additional commission charges.

Platinum Account: The description does not explicitly state any commissions for the Platinum Account. However, given the highly competitive spreads of 0.5 pips and the focus on experienced and high-net-worth traders, it's possible that commissions may be involved in addition to the spreads. The absence of commission information suggests that traders should contact the broker or refer to official documentation for precise commission details.

Deposit & Withdrawal

Deposit and Withdrawal Methods:

Bank Wire:

Traditional method.

Deposits: Takes 1-5 business days.

Withdrawals: Transfers funds to your bank.

Suitable for large deposits and withdrawing profits or balances.

Credit Card:

Deposits: Instant or a few hours.

Withdrawals: Less common, broker-dependent. Check with the broker for details.

Suitable for smaller to medium-sized deposits.

Cryptocurrency:

Deposits: Processed in minutes.

Withdrawals: Transfers to your private wallet.

Suitable for digital asset enthusiasts.

Trading Platforms

51Markets offers the MetaTrader 4 (MT4) trading platform, known for its user-friendly interface, advanced charting capabilities, and comprehensive trading tools. Traders can utilize features such as automated trading with Expert Advisors (EAs), custom indicators, one-click trading for rapid order execution, risk management tools, real-time news and alerts, and the ability to trade multiple asset classes, including forex, commodities, indices, and cryptocurrencies. MT4's popularity and extensive community support make it a versatile and powerful platform for traders of all levels, whether they seek to execute trades, perform technical analysis, or engage in algorithmic trading strategies.

Customer Support

The customer support provided by support@51markets.com falls short in several ways. Response times to inquiries are often frustratingly slow, leaving traders waiting for extended periods to receive assistance. Moreover, the quality of the support provided can be inconsistent, with some representatives lacking the knowledge and expertise required to address complex trading issues effectively. Additionally, there have been complaints of unresponsiveness and lack of empathy towards traders' concerns, making the overall customer support experience subpar. Overall, improvements are needed in terms of response times, training for support staff, and overall responsiveness to enhance the customer support offered by support@51markets.com.

Educational Resources

Unfortunately, 51Markets lacks in providing educational resources, which is a significant drawback for traders looking to enhance their knowledge and skills. The absence of educational materials such as tutorials, webinars, and articles hinders traders from acquiring valuable insights and improving their understanding of the financial markets. This deficiency leaves traders on their own to seek external sources for learning, making it a less-than-ideal choice for those who value comprehensive educational support from their broker.

Summary

51Markets presents a concerning picture for traders. Notably, the broker lacks regulation, raising doubts about its legitimacy and safety. This absence of oversight may expose traders to potential risks, including fraud and unethical practices. While it offers a range of market instruments and account types, the limited educational resources provided hinder traders' ability to improve their skills. Moreover, the customer support experience has been marred by slow response times and inconsistent assistance. To exacerbate matters, the reported website issues and allegations of scam or fraud further erode confidence in this broker's credibility. All in all, 51Markets presents a worrying proposition for traders seeking a secure and supportive trading environment.

FAQs

Q: Is 51Markets a regulated broker?

A: No, 51Markets is not regulated by any recognized financial authority.

Q: What are the account types offered by 51Markets?

A: 51Markets provides Silver, Gold, and Platinum account types with varying minimum deposits and features.

Q: Does 51Markets offer educational resources for traders?

A: Unfortunately, 51Markets does not provide educational materials such as tutorials or webinars.

Q: What is the maximum leverage offered by 51Markets?

A: 51Markets offers a maximum trading leverage of up to 1:400.

Q: What deposit and withdrawal methods are available?

A: Traders can use bank wire, credit card, and cryptocurrency methods for deposits and withdrawals with varying processing times.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

View More

Review 14

Content you want to comment

Please enter...

Review 14

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX3294282515

Hong Kong

If you make a profit, you can't withdraw money. They said you did something illegal, and you won’t be able to trade. After a few months, your account will be deleted.

Exposure

2024-02-02

ip888999

Hong Kong

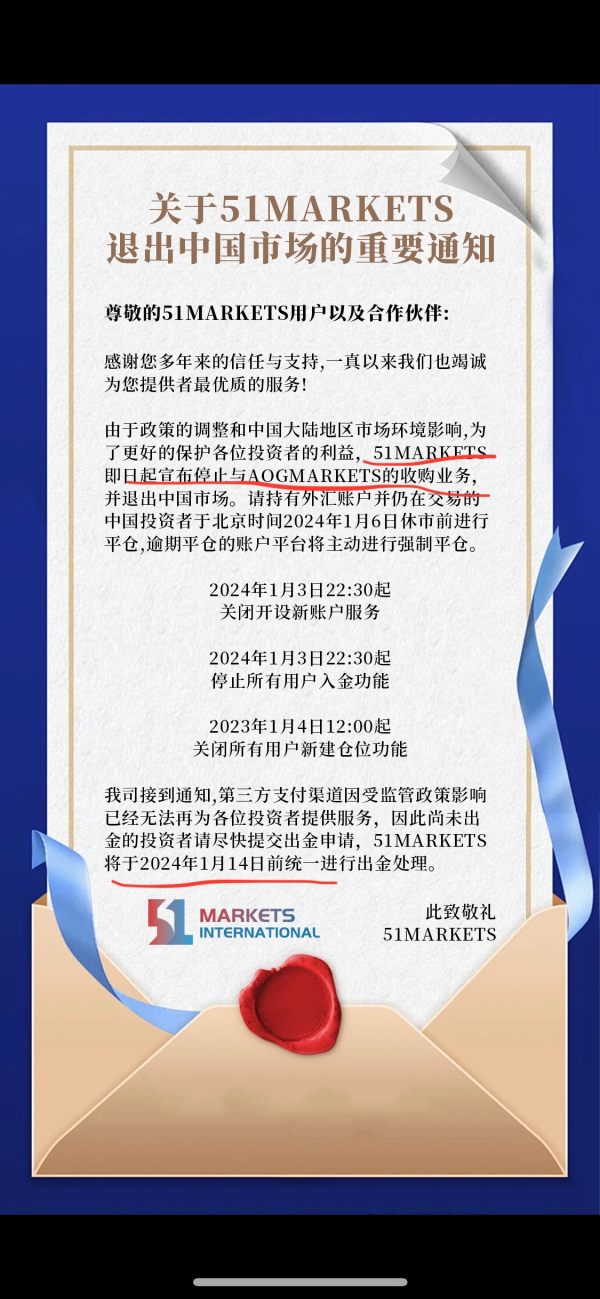

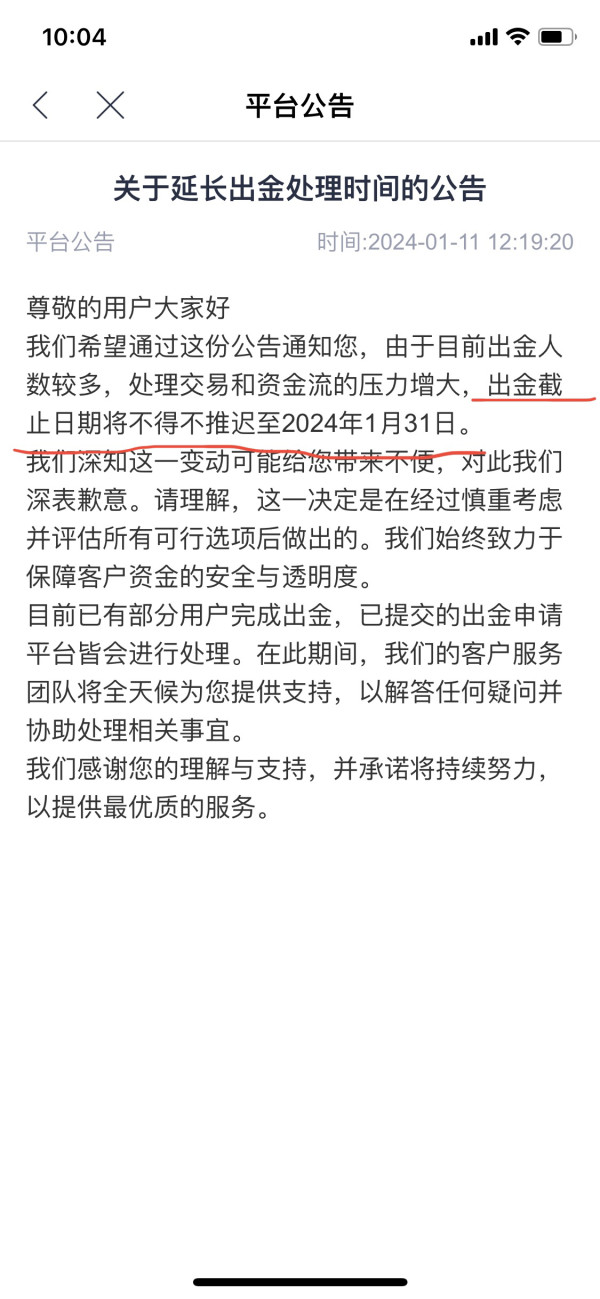

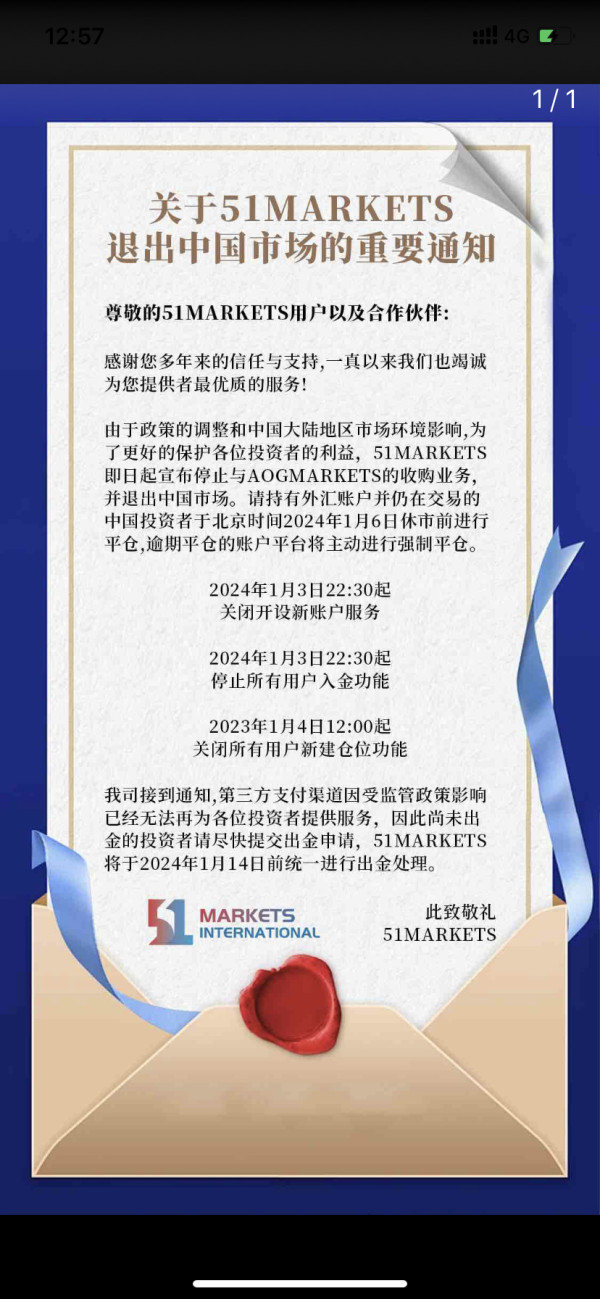

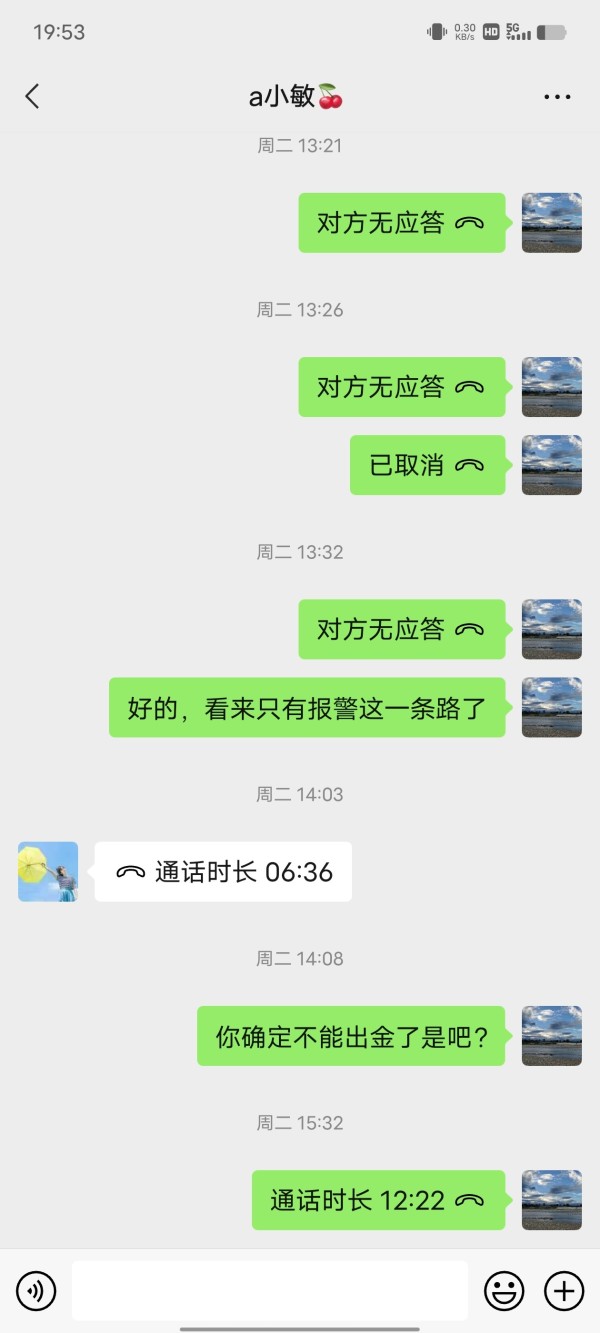

After January 3rd, not a cent of the withdrawal money was received. The platform said that withdrawals would be unified before January 14th, but now it has been changed to January 31st. Every day passed, and when I contacted customer service, I was asked to wait without giving any money. Now I can’t even open the app, and the black platform has taken away the money.

Exposure

2024-01-19

小松哥

Hong Kong

The platform said it would quit from the Chinese market on January 3, 2014, and promised that all deposits would be made before the 14th. I waited until the 19th and still no payment was made, and the customer service did not reply. Did they run away?

Exposure

2024-01-19

FX3306923192

Hong Kong

The platform reported that it wants to quit the Chinese market. There is no reasonable way to deal with users who hold positions. If the users themselves do not close their positions, the platform will force them to close their positions. On January 3, 2024, they also said that the platform was acquired and needed to be migrated. In the evening, they said they would withdraw from the market. They were not responsible for users at all. Customer service could not be contacted and emails were not replied. This is a Ponzi scheme! ! ! !

Exposure

2024-01-04

不走寻常路5818

Hong Kong

I have been using it for several years, but I have never had much money. This time, when I have more money, they started to mess with me. After deleting the account, the customer service immediately blocked me!

Exposure

2023-11-17

维权!

Hong Kong

Several of our colleagues used their mobile phones to place orders for several months. Recently, when we made money, the platform directly deleted our accounts and did not refund the principal.

Exposure

2023-11-09

多幸运55543

Hong Kong

Maliciously increased inventory fees, forced liquidation, about 150,000 RMB are gone!

Exposure

2023-03-02

FX3294282515

Hong Kong

Do not trade on this platform. They will suspend your account if you have lots of profit or principal, and do not let you trade or withdraw. You cannot make comment there either

Exposure

2023-02-24

FX3294282515

Hong Kong

Fraud platform. Withdraw for many days, but the customer service said taht my transaction is abnormal and tell me to wait. Then, my trading is restricted within an hour and the withdrawal is banned. The customer service blocked me.

Exposure

2023-02-24

小魔王36644

Hong Kong

Platform cannot be opened nor withdrawn. Everyone be careful

Exposure

2022-08-25

中华39104

Hong Kong

The platform cannot log in or withdraw. The customer service keeps delaying and lying to us.

Exposure

2022-07-04

Bōmëoκ

Hong Kong

The platform deduct my profit adn do not withdraw it for me. It is a legit fraud platform.

Exposure

2022-06-06