Overview of Global GT

Established in 2015, Global GT is an online forex broker based in South Africa. With a minimum deposit requirement of $5, Global GT offers accessibility to traders of various levels. Traders can benefit from maximum leverage of up to 1:1000 and variable spreads, starting from 0 pips on their ECN account. The trading platform available is MT5, enabling users to execute trades efficiently. Global GT provides a wide range of tradable assets, including currency pairs, cryptocurrency pairs, synthetic crypto pairs, commodities, index CFDs, and equity CFDs. Various account types, such as Cent, Mini, Standard, ECN, and Islamic/Swap-Free, cater to diverse trading preferences. The company offers 24/7 customer support via email, webform, and live chat. Although specific educational resources are not specified, Global GT aims to provide a comprehensive trading experience for its clients.

Is Global GT legit or a scam?

Global GT does not have regulatory oversight. It is important for traders to be aware of this fact and exercise caution when engaging in trading activities with unregulated brokers. Lack of regulation means that there is no external authority overseeing the operations of the company, which can expose traders to potential risks such as fraudulent activities, unfair trading practices, and inadequate client fund protection.

Pros and Cons

Global GT, as an online forex broker, offers several advantages including accessibility with a low minimum deposit requirement, a wide range of tradable assets, high leverage options, competitive spreads, and a secure trading environment. However, there are also drawbacks to consider such as the lack of regulatory oversight, limited educational resources, potential fees, limited deposit/withdrawal options, and the absence of phone support. Traders should carefully evaluate these pros and cons to make an informed decision when choosing a broker.

Market Instruments

Global GT provides a range of forex trading products, as well as other trading options. Here's a brief introduction to some of the offerings:

1. Forex: Forex, short for foreign exchange, involves the trading of currencies. Global GT allows traders to participate in the forex market, where they can speculate on the price movements of currency pairs.

2. Precious Metals: Global GT also offers trading opportunities in precious metals such as gold, silver, platinum, and palladium. Traders can speculate on the price movements of these metals and potentially profit from their changing values.

3. Energies: Global GT provides trading options in energy commodities such as crude oil and natural gas. Traders can take advantage of price fluctuations in these energy resources, which are influenced by factors such as supply and demand dynamics, geopolitical events, and market sentiment.

4. Equity Indices: Equity indices represent a basket of stocks that track the overall performance of a specific market or sector. Global GT offers trading opportunities in various equity indices, such as the S&P 500, Dow Jones Industrial Average, NASDAQ, FTSE 100, and more. Traders can speculate on the direction of these indices by analyzing market trends and events that affect the underlying stocks.

5. Stocks: Global GT provides access to a wide range of individual stocks from different global exchanges. Traders can buy and sell shares of companies listed on major stock exchanges, including but not limited to the New York Stock Exchange (NYSE), London Stock Exchange (LSE), Tokyo Stock Exchange (TSE), and others.

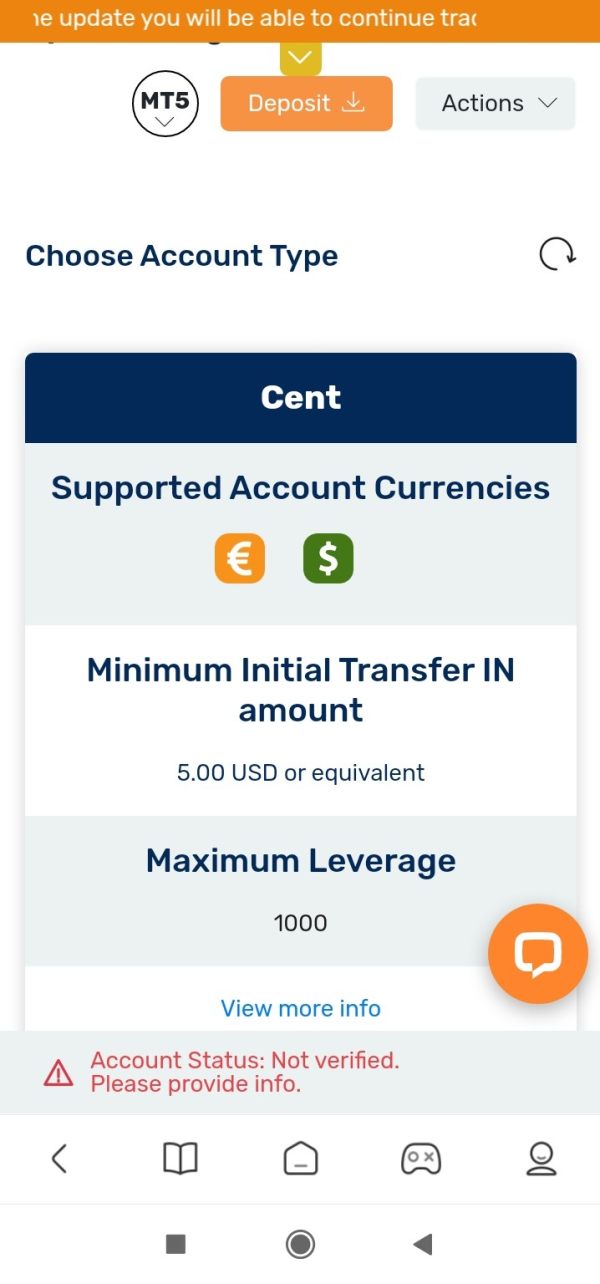

Account Types

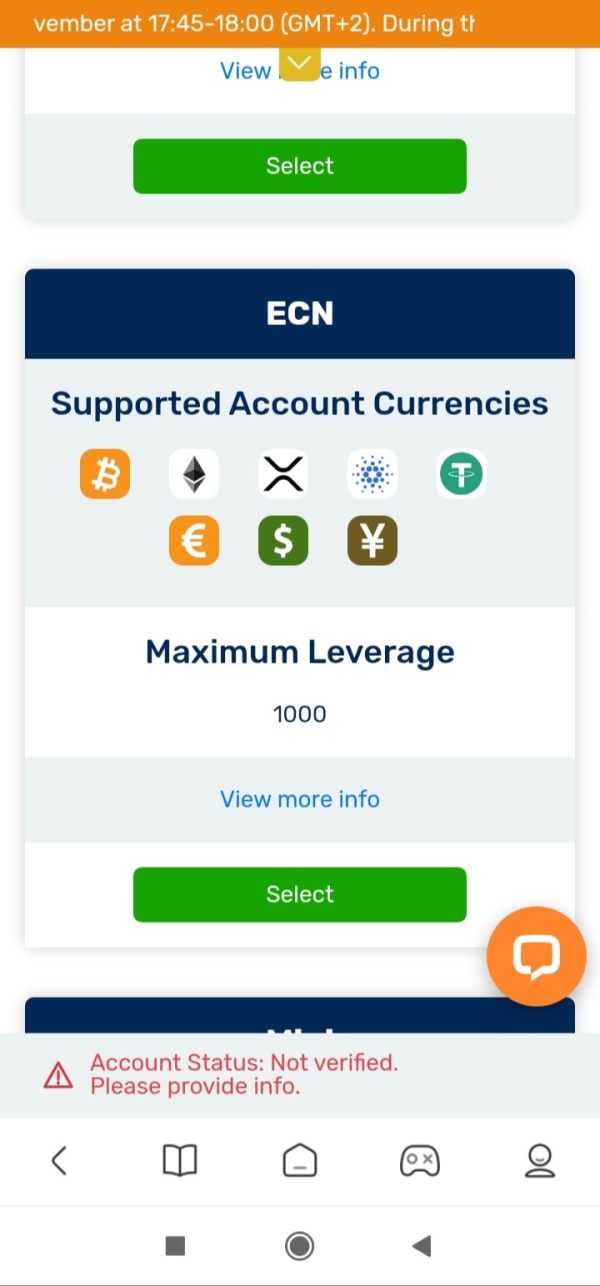

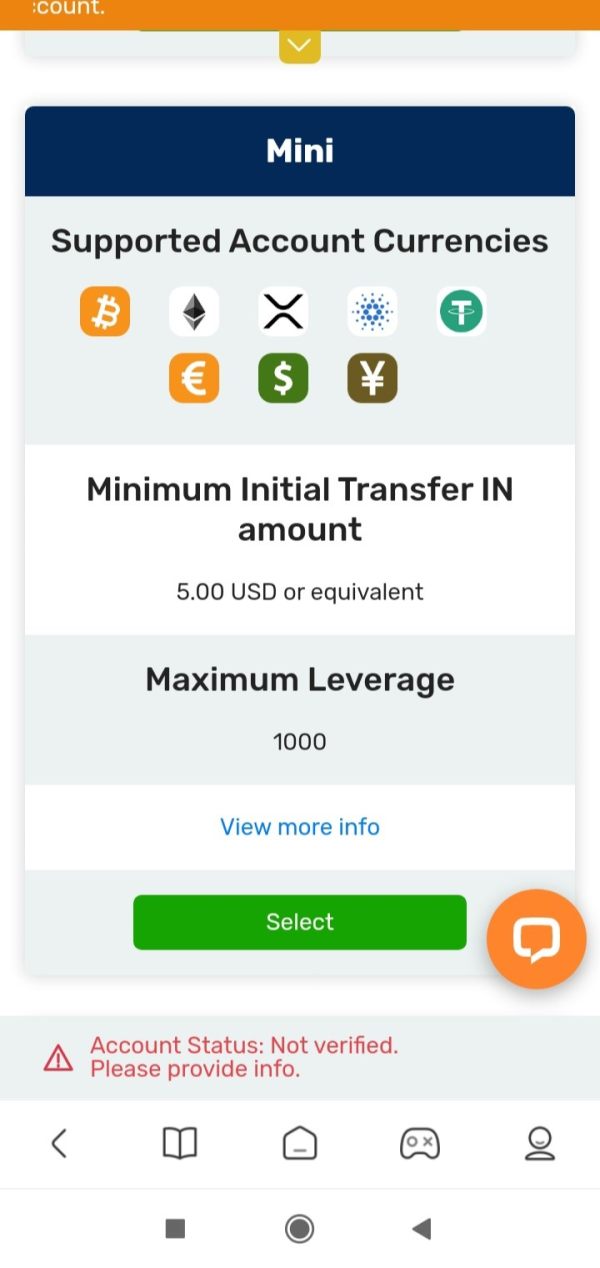

Global GT offers the following account types: Cent accounts, Mini accounts, Standard accounts, and ECN accounts, as well as an Islamic or swap-free account. Some prefer the ECN account the most of all the account types on offer at Global GT as it provides the lowest trading costs, All GT Global accounts require only a $5 minimum deposit amount to start trading, except the ECN account which requires a $250 deposit, but traders can then enjoy the lowest spreads.

Accounts can be opened in a few different currencies including USD, EUR, BTC, ETH, XRP, USDT, ZAR (even Cryptos as a base one), allowing easy money transfers to or from the account and avoiding conversion fees.

Cent accounts require a minimum of $5 deposit, allows leverage up to 1:1000, spreads from 1 pip, and $0 commission.

Mini accounts can be opened with a minimum of $5 deposit, allows leverage up to 1:1000, spreads from 1 pip, and does not charge commission.

Standard accounts require a minimum of $5 as deposit, offer leverage up to 1:1000, spreads from 0.5 pips and no commission charged.

ECN accounts need a minimum of $250 deposit, allows leverage up to 1:1000, spreads from 0 pips, and charge a $10 commission.

The Global GT account type that you choose will depend on your trading strategy. Traders who use strategies that require tight spreads may look to open an ECN account but if you are not too concerned with the spread, you may consider a commission-free account.

How to Open an Account?

To open an account with Global GT, please follow these steps:

1. Visit the Global GT website: Go to https://globalgt.com.

2. Locate the account opening section: Look for a button or link on the website that says “Open Account,” “Sign Up,” or something similar. This is typically found in the top navigation menu or on the homepage.

3. Click on the account opening link: Once you find the appropriate link, click on it to proceed to the account registration page.

4. Fill out the registration form: You will be presented with a registration form that requires you to provide personal information. This information may include your full name, email address, phone number, country of residence, and any other required details.

5. Choose an account type: Global GT may offer different types of accounts, such as individual accounts, joint accounts, corporate accounts, etc. Select the account type that suits your needs and preferences.

6. Submit your application: Once you have completed the registration form and agreed to the terms and conditions, submit your application by clicking the “Submit,” “Open Account,” or similar button on the page.

7. Fund your account: Once your account is successfully opened and verified, you will receive instructions on how to fund your account. Global GT may offer various deposit methods, such as bank transfers, credit/debit cards, or digital payment platforms.

Leverage

All four account types offered by this broker provide a maximum dynamic leverage of 1:1000. It is important to note that high leverage can amplify both profits and losses, making it a high-risk strategy for traders. Thus, traders should carefully consider their risk tolerance and choose an appropriate amount of leverage, as well as using appropriate risk management strategies when trading with high leverage.

Fees of Global GT

The cost of trading with Global GT is influenced by several factors, including commissions, spreads, and margins. Global GT operates on a floating or variable spread basis, where the spread varies according to market conditions. The company's variable spreads can start from as low as 0 pips on the ECN account, offering competitive pricing for traders.

During periods of high market volatility, major economic news releases, and weekend gaps, spreads may widen beyond the usual range. The extent of spread widening during these times depends on Global GT's liquidity providers.

In addition to spreads, swap fees are applicable for traders who hold positions overnight, unless they opt for Swap-Free or Islamic accounts, which are designed to adhere to Islamic principles.

Global GT also incurs non-trading fees, such as an inactivity fee of $10 per month if the trading account remains unused for an extended period. However, it is worth noting that deposit and withdrawal fees may or may not be charged depending on the region in which the trader is registered.

Overall, Global GT offers competitive spreads, accommodating various trading instruments, and provides a satisfactory solution for traders. While some fees may apply, such as swap fees and potential inactivity fees, the absence of deposit and withdrawal fees (depending on the region) adds to the appeal of trading with Global GT.

Trading Platform

Global GT offers clients the out-of-the-box MT5 trading platform. It features a better user interface and improved trading functions, though it lacks backward compatibility with MT4, which is a shame. MT5 supports automated trading solutions, and Global GT has no restrictions on trading strategies. New traders without existing trading solutions, EAs, and custom indicators will have no problem with this.

Deposit & Withdrawal

Traders may use cryptocurrencies and Skrill as deposit and withdrawal methods. Global GT intend to add credit/debit cards, SticPay, and Neteller soon, which will be welcome as the choice of methods right now is not extensive. The minimum amounts and processing times depend on the payment processor. While Global GT does not charge internal fees, third-party payment processor costs apply with all options.

Customer Support

Global GT offers 24/7 multilingual customer support via e-mail, webform, or live chat. Live chat is available in Arabic, English, and Spanish. Regrettably, a phone number is not listed, making the live chat the best method of contact. Traders can access it from each page.

Email: support-za@globalgt.com

Conclusion

In conclusion, Global GT is an online forex broker based in South Africa, founded in 2015, with a minimum deposit requirement of $5 and maximum leverage of up to 1:1000. Traders can access a wide range of tradable assets and choose from various account types to suit their preferences. The trading platform provided is MT5, offering efficient trade execution. However, it is important to note that Global GT lacks regulatory oversight, which exposes traders to potential risks. Traders should exercise caution and consider the potential consequences of trading with an unregulated broker. It is recommended to prioritize safety by opting for regulated brokers that offer transparency and client fund protection.

FAQs

Q: Is Global GT a legitimate forex broker or a scam?

A: Global GT lacks regulatory oversight, which means it operates without the supervision of financial authorities.

Q: What types of trading accounts are available on Global GT?

A: Global GT offers Cent accounts, Mini accounts, Standard accounts, ECN accounts, and Islamic/Swap-Free accounts to cater to different trading preferences and strategies.

Q: What is the minimum deposit required to open an account with Global GT?

A: Global GT has a minimum deposit requirement of $5 for most account types.

Q: What leverage options are available on Global GT?

A: Global GT offers a maximum leverage of up to 1:1000 across all account types.

Q: What trading platform does Global GT offer?

A: Global GT offers the MT5 trading platform, which provides an improved user interface, automated trading solutions, and compatibility with various trading strategies.

Q: How can I contact customer support at Global GT?

A: Global GT offers 24/7 customer support through email, webform, and live chat.