Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

Popular Regulators

Its products

MoreBroker selection

Filter and present a comprehensive evaluation of multiple brokers. You can view regulatory information, company services, deposits and withdrawals, spreads, news, user reviews, complaints, and more. Our search filters help you learn more about brokers and their information, assisting you in selecting high-quality brokers for account opening or information verification.

Broker comparison

Choose comprehensive information pages for two or more brokers to compare their regulations, deposits and withdrawals, spreads, reviews, complaints, and other details. By making a comprehensive assessment of the brokers, you can analyze their strengths and weaknesses, helping you select a quality broker that meets your current requirements.

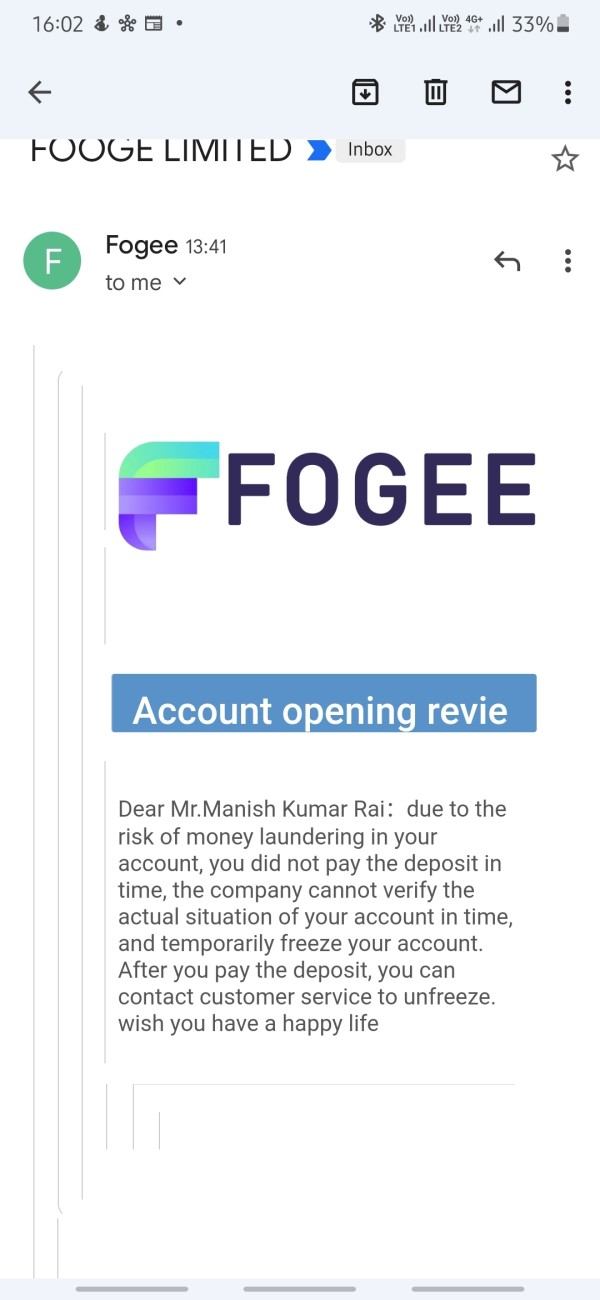

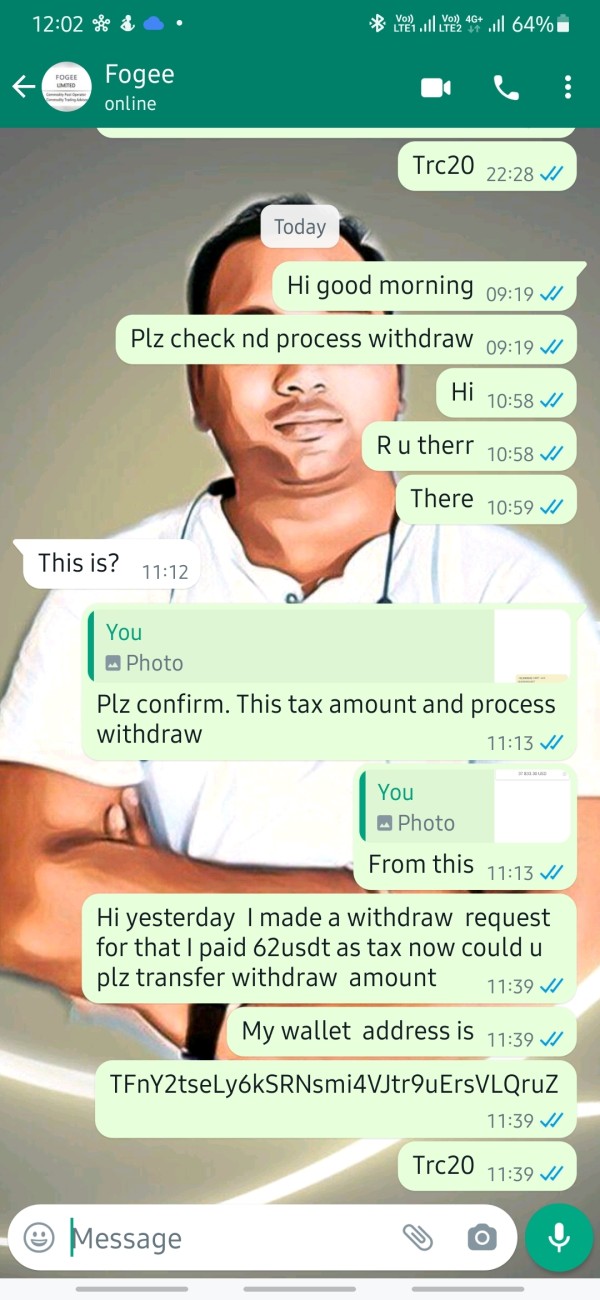

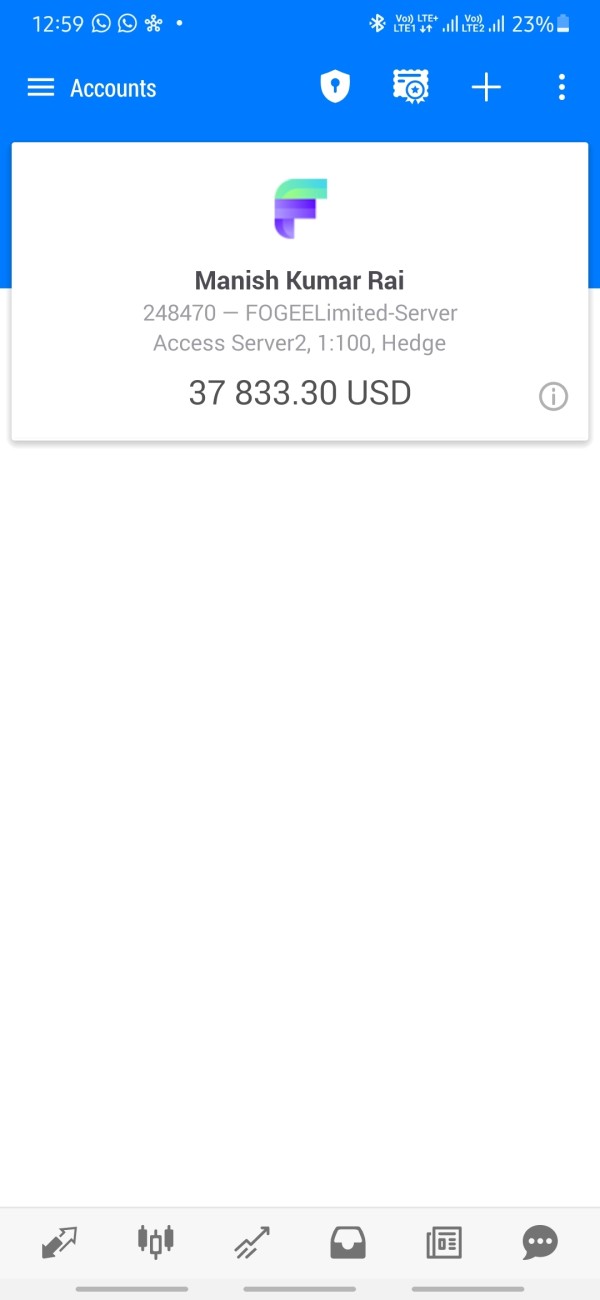

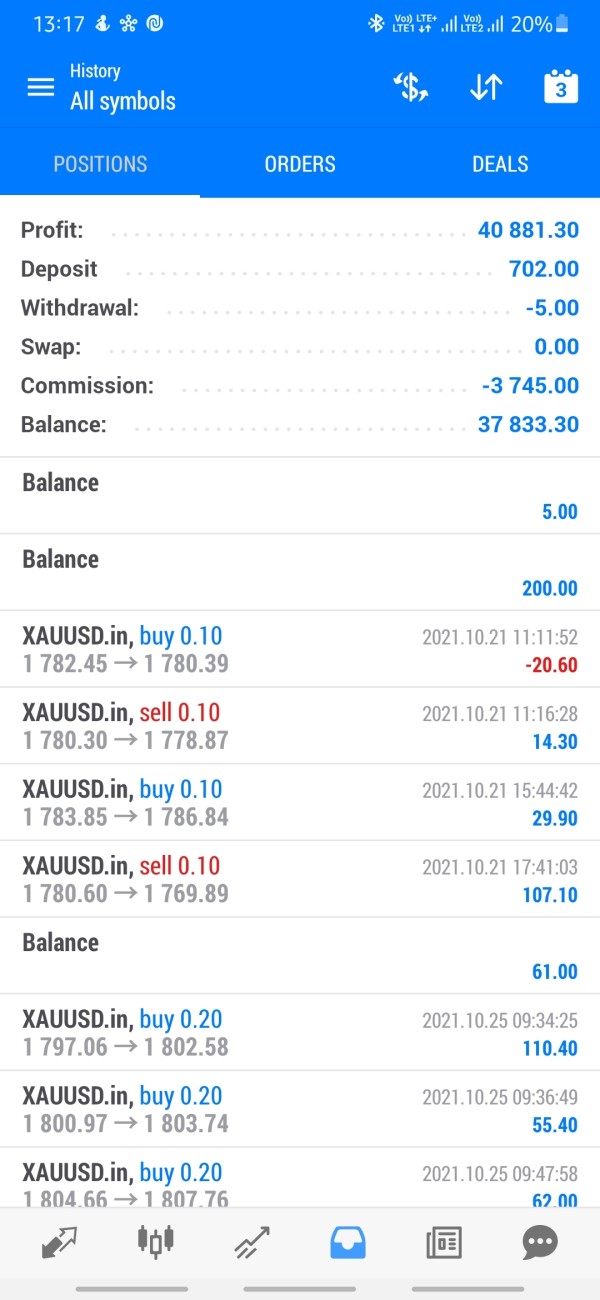

Manish Kumar Rai

India

I get whatsapp msg from other country no and after that she started chatting and after some time she told me for financial help and I installed mt5 and than started trading on Fogee in few days I earned 37833usd when I raised a withdrawn request she shared me a customer service manger no and that Manager ask me to deposit 30% as tax I negotiate with him and ask for 200usd withdrawn only further I transfer 62usdt as tax after that they refuse for fund received and freeze my account now.

Exposure

2021-11-10

gustavo_fring

Malaysia

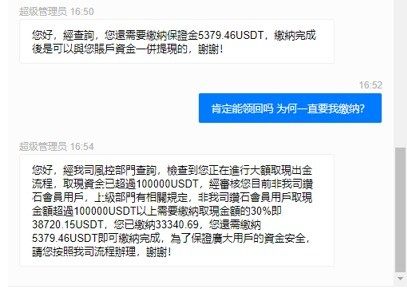

If I can't pay 30%, they will deduct 5% EVERDAY from my MT5 account. I have paid USD33,340.69, balance USD5,400 yet to pay. I have not enough money to pay into it. I can't even get back my money from MT5 to pay back my loan. They're still holding my money. I have balance of 162k USD in my MT5 account. I paid a lot. Now want to withdraw they asked me to settle that 30% deposit then only release my money to my Binance account. How can I claim back my money?

Exposure

2021-09-20

雨田lei

Hong Kong

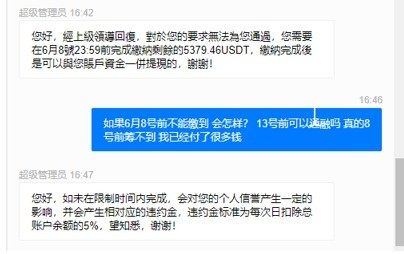

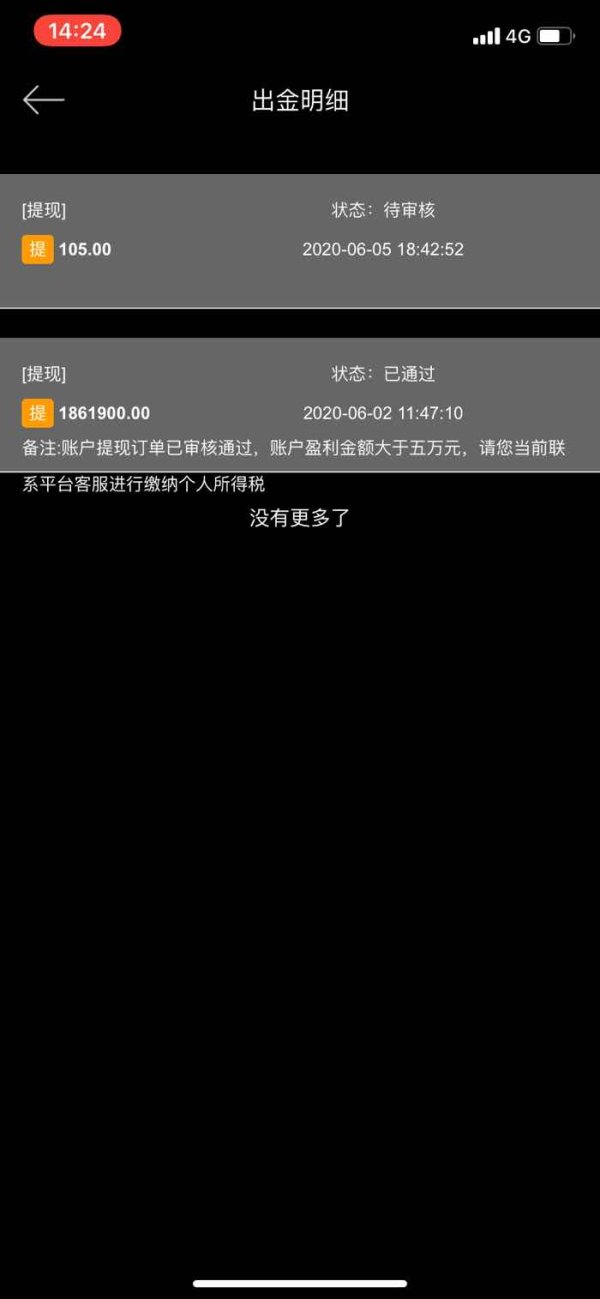

On a friend’s recommendation, I downloaded the 11 APP and deposited 150 thousand. She asked me to download MI Chat and added the teacher 30 minutes before the operation. During that time, I added 50 thousand when there was a cocking market. The teacher claimed that my account is at risky. Then I added 132 thousand to do hedging, making a profit of 1.8 million or so. When it came to withdrawal, I was asked to pay a 20% margin, i.e., 300 thousand or so, at which time, I doubted whether I has been cheated.

Exposure

2020-06-09

刘涧

Hong Kong

My principal and the commission have not been withdrawn. RIFA is a scam. It delay the payment from last year to the present. They have not solved it for me. Finally, their salesman directly sent me a channel business license and then there is no message.

Exposure

2019-02-14

FX7269453295

Hong Kong

On December 8th,2018,I was induced by Zhang Xiankui of RIFA to transfer 25 thousand RMB to the account 6236681210001745012 through China Construction Bank Corporation Shanghai Futures Branch.It equaled $3333.33 with the rate 1:7.5.The salesman said that the platform invited two elite teacher Liu Gudu and Li.Especially,teacher Liu, who can profit 180 pips within 2 hours to earn money by 16 times,is a professional analyst.They all operate for who has large fund.I was in small fund with high risk.He said that these two teacher is the profit guarantee.Since december 10th,2018,the salesman has became the customer service,who asked me to delete the posts online,saying that this is slander.He told that as long as I follow them,I would get back my fund.I appeal more person to avoid the fraud platform.

Exposure

2018-11-13

FX7269453295

Hong Kong

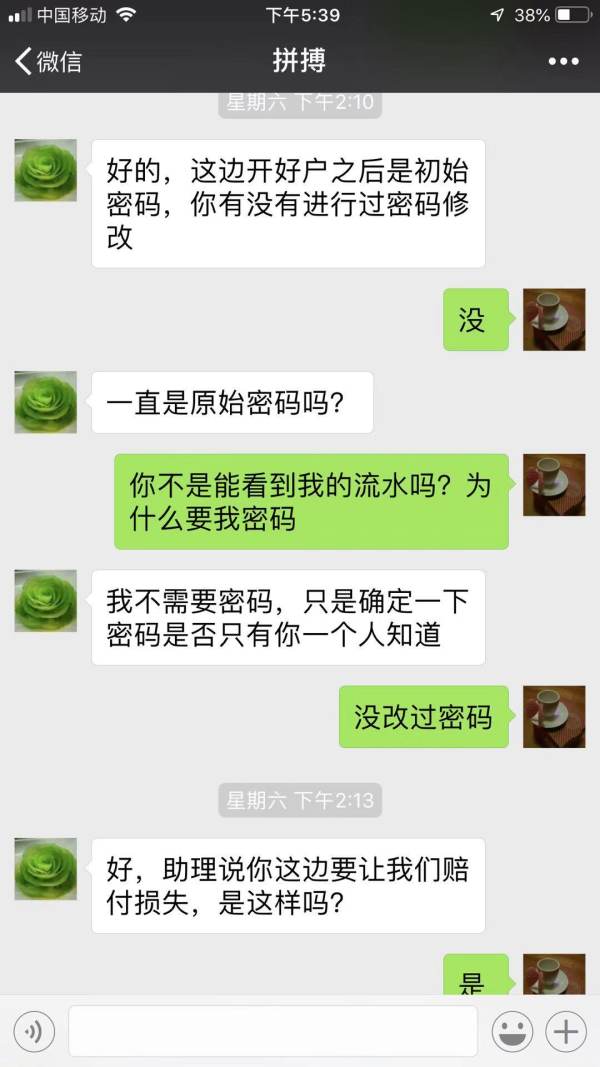

I think RIFA must compensate me, for the following reasons: 1, They showed me profit evidence to induce me. They induced me to trade directly without any investment education. I lost money all because I believed their bullshit. 2, The platform is a clone, which promoted fake news. They said they have professional instructors to make money for you. Later I found their license in Hong Kong has no right to trade forex. What’s more, it is a clone license. They made their server and system crash all the time to make us lose money. 3, The government is controlling strictly the financial market. RIFA’s business mode is exactly the same with the scam mode exposed by banks. I have all the evidence. In September 2018, a salesman of RIFA added me on Wechat whose name is Wang Baoqiang. He asked me to trade on RIFA, saying it is a legit platform.

Exposure

2018-11-09

FX9879385547

Hong Kong

On April 16th,2018,a salesman of RIFA called me and said that they had cooperation Trade Xia.I had account in it,thus they could acquire my number.They recommended the analyst(zhang Yidong,Mobile phone:18221091431 QQ:997005573),saying that he was a professional analyst whose clients were all owning large fund(400 thousand RMB).The salesman sent me constant message.I said that I had only several tens thousand yuan and had no time to pay attention to the market.They said that they would like to help me follow it and fill the application.With his help.I opened an account and deposited 42000 RMB.At that night,I was told to trade,profiting several hundred US dollars.I asked whether I should close position,he asked me to wait.But the order was closed.I told him about my thoughts.He told me to have a long insight.I was suspicious of him.Then he told me to trade Der Dax ang Heng index,saying that the market would be volatile.Only by trading one lot can I recover the losses.I was amazed.He told me to buy long even the market was going down.I argued with him.Then he said the market was strange.Then I was to go to bed.With his lobbying,I bought a short order of Heng index,resulting in a loss.I was mad.Didn’t he know the market?I made a loss of $3000 overnight.The next morning,he called me and told me to go short of Heng Index.The result was the same.During the trading process,his thoughts was contradict with mine.I deposited 17000 RMB again,then my account became forced liquidation.After that, I found the right protection team and made a complaint on the platform.The salesman called me and said that they would give me $3,000 and asked me to withdraw the case immediately as long as I delete the complaint.I did not agree and said that I must receive it first.On the third day, I received the order voucher (4,200 yuan) by the acquiring institution (Yin Ying Tong).I pondered for a few days and finally found out the flaws. I checked the express number online and figure out that the express was different.I asked the staff,they said that the company asked them to do so.I list the reasons why RIFA and Yinyingtong must give me compensation: 1. It doesn’t give me any risk explanation No one has done any virtual market for me, and asked me to get started. No one told me about any risk and forced liquidation. I just believe that the platform is legit and follow the teachers’ instruction. 2. Fake publicity. Before opening an account, I said that I didn't have time to pay attention to the market, and I didn't understand it. They made me rest assured. Later, I checked the type of license on the WikiFX. It shows that their license(Registration NO.: AAA537)was overrun. 3. RIFA acts as the counterparty with investors.If members make money, they must let the investors lose money. It is a dealing-desk broker.The behavior is prohibited by the 38th civilized order of the State Council. 4. The strength of the CSRC this year is so great that the state attaches great importance to it and is severely cracked. The entire trading system provided by the member units is exactly the same as the pseudo-futures trading model prompted by the CSRC. I have collected a list of QQ order recommendations, bank bills and trading software of the member.

Exposure

2018-08-03