General Information

Profitto is a brokerage firm registered in Saint Vincent and the Grenadines, and it is important to note that it is not regulated by any valid regulatory authority. This lack of regulation poses a significant risk to potential investors or traders considering using their services. WikiFX has reported four complaints against Profitto in the past three months, indicating potential issues experienced by clients.

Profitto offers a range of market instruments, including commodities, indices, and forex. Traders can access these markets but should carefully evaluate Profitto's regulatory status and reputation before engaging in any trading activities. It is crucial to be aware of the potential risks associated with trading through unregulated brokers.

Profitto provides three types of trading accounts: ECN Account, STD Account, and CENT Account. Each account type offers different trading conditions and features. However, considering Profitto's lack of regulation, traders should exercise caution and thoroughly review the terms and conditions before opening an account.

When opening an account with Profitto, it is generally recommended to visit their official website, complete the account registration process, provide accurate personal information, verify the account, choose the appropriate account type, fund the account, access the trading platform, and start trading. However, due to the risks associated with unregulated brokers, it is essential to carefully consider the choice of broker and prioritize safety and security.

It is crucial to note that the lack of regulation, high leverage ratios, and the presence of complaints against Profitto should be taken into consideration. Traders should thoroughly assess the risks involved and consider alternative regulated brokers with a strong reputation in the industry.

Pros and Cons

Profitto offers a number of advantages such as a diverse range of market instruments, low margin requirements, access to the popular MetaTrader 4 platform, and a wide range of payment methods. Traders can benefit from educational resources provided by the broker and choose from multiple account types to suit their preferences. However, it is important to note the significant drawbacks associated with Profitto. The lack of regulation raises concerns about the safety and security of funds, and there have been complaints reported against the broker. Additionally, the suspicious regulatory license and high potential risk further contribute to the overall negative assessment. Traders should exercise caution and carefully evaluate the risks before considering Profitto as their broker of choice.

Is Profitto Legit?

Profitto is a brokerage firm that operates in the financial industry. However, it is important to note that Profitto is not regulated by any valid regulatory authority. This lack of regulation poses a significant risk to potential investors or traders who may consider using their services.

It is also worth mentioning that there have been four complaints reported by WikiFX against Profitto in the past three months. These complaints indicate that there may be problems or issues experienced by clients who have interacted with this broker.

Given these warnings and the lack of regulatory information, it is strongly advised to exercise caution and avoid engaging with Profitto. It is crucial to choose a regulated and reputable broker that offers the necessary protections and safeguards for your investments.

Markets Instruments

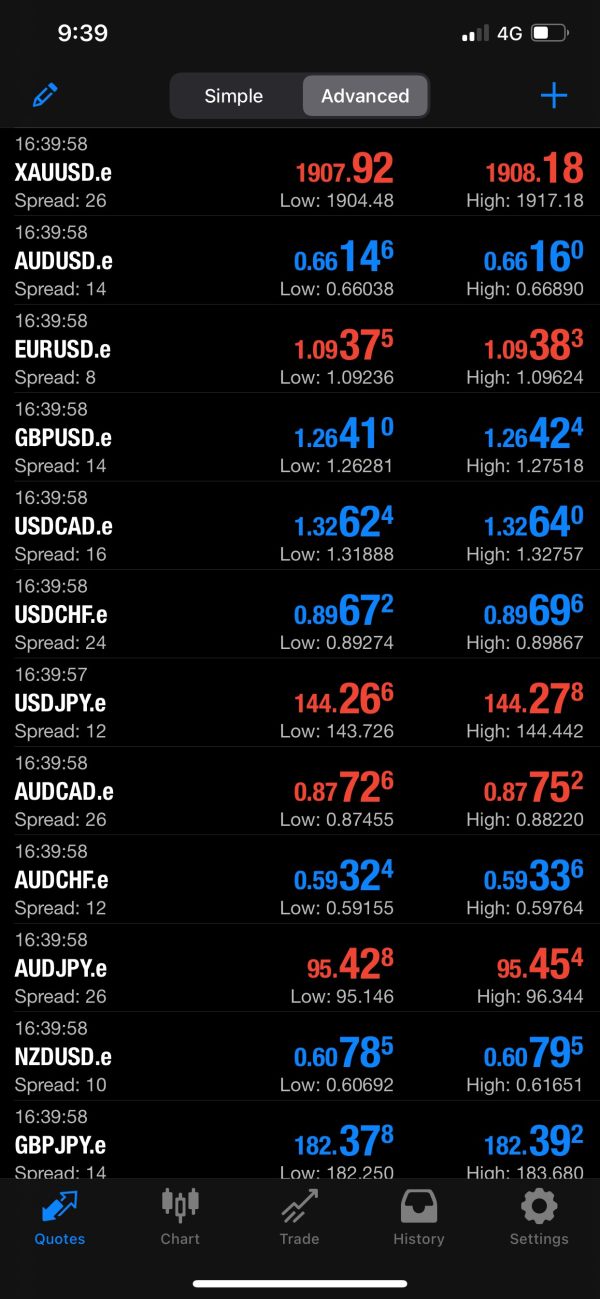

Profitto offers a diverse range of market instruments for traders to explore. Among these instruments are commodities, indices, and forex. Each of these markets presents unique opportunities and potential for profit. It is important to note that while Profitto provides access to these markets, it is crucial for traders to carefully evaluate the broker's regulatory status and reputation before engaging in any trading activities.

Commodities:

Profitto provides the opportunity to trade CFDs on a diverse range of commodities from various sectors, including energy, industrial, precious metals, financial, and agricultural. These commodities form the foundation of the global economy, and traders can gain exposure to products like copper, coffee, silver, and soybeans. Profitto offers low spreads and margin requirements that are relatively modest.

Indices:

Profitto allows traders to engage in trading global indices, which are weighted indexes of the top shares on specific exchanges. Examples include the US30 (Dow Jones 30) and the New York Stock Exchange. With a Profitto account, traders can access a wide range of global indices with no overnight financing costs and low margin requirements. The platform offers tight spreads on indices such as the UK 100, US 30, US 500, DE 30, and more.

Forex:

Forex, also known as foreign exchange or FX, is the largest and most actively traded market globally, with a daily turnover exceeding $5.5 trillion. Profitto offers coverage for over 100+ spot instruments in the forex market, providing low leverage and financing costs. As a highly liquid market, forex allows for high-volume trades with minimal slippage. Mini accounts on Profitto's platform have guaranteed stop-loss orders during trading hours, ensuring risk management for traders.

Account Types

Profitto offers three types of trading accounts: ECN Account, STD Account, and CENT Account.

ECN ACCOUNT:

The ECN Account offered by Profitto provides access to a wide range of instruments, including forex, precious metals, indices, commodities, and CFDs. With a maximum leverage of 1:1000 and a minimum spread of 0.1. Each trade executed through the ECN Account incurs a commission fee of $3. The margin stop out level is set at 30%. Margin requirements vary with forex and precious metals at 100, and indices and commodities at 50. Traders using the ECN Account can utilize the popular MetaTrader 4 trading platform. The account can be opened with a minimum initial deposit of $10.

STD ACCOUNT:

Profitto's STD Account also offers access to forex, precious metals, indices, commodities, and CFDs. It provides a maximum leverage of 1:1000 and a minimum spread of 0.1. However, unlike the ECN Account, there are no commission fees charged for trades executed through this account type. The margin stop out level remains at 30%. Margin requirements are set at 100 for forex and precious metals, and 50 for indices and commodities. Traders using the STD Account can also utilize the MetaTrader 4 trading platform. The account can be opened with a minimum initial deposit of $10.

CENT ACCOUNT:

The CENT Account offered by Profitto grants access to forex, precious metals, indices, commodities, and CFDs. It provides a maximum leverage of 1:1000, but has a slightly higher minimum spread of 1.5. Unlike the ECN Account, no commission fees are charged for trades executed through this account type. The margin stop out level remains at 30%. Margin requirements are set at 100 for forex and precious metals, and 50 for indices and commodities. Traders can make use of the MetaTrader 4 trading platform with the CENT Account. The account can be opened with a minimum initial deposit of $10.

How to Open an Account?

To open an account with Profitto, you can follow these general steps:

Visit the Profitto website: Go to the official website of Profitto to begin the account opening process. Ensure that you are accessing the official website.

Account Registration: Look for “Start Trade Now” button on the website. Click on it to start the registration process.

3. Provide Personal Information: Fill in the required information accurately in the registration form. This typically includes your full name, email address, phone number, and country of residence. You may also need to create a username and password for your account.

4. Account Verification: After submitting the registration form, you may be required to verify your account. This verification process usually involves providing additional documentation such as proof of identity (e.g., passport or ID card) and proof of address (e.g., utility bill or bank statement). Follow the instructions provided by Profitto to complete the verification process.

5. Choose an Account Type: Profitto may offer different types of accounts with varying features and benefits. Select the account type that best suits your trading preferences and objectives.

6. Fund Your Account: Once your account is verified and approved, you will need to deposit funds into your trading account. Profitto usually provides various payment methods, such as bank transfers, credit/debit cards, or electronic payment processors. Choose the preferred method and follow the instructions to make a deposit.

7. Platform Access: Profitto may provide a trading platform, such as MetaTrader 4, for you to access and manage your trades. You will typically receive login credentials to access the platform.

8. Start Trading: With your account funded and the trading platform accessible, you can begin exploring the available markets, analyzing market conditions, and executing trades according to your trading strategy.

Leverage

Profitto provides an absurd amount of leverage – 1:1000. Note that such amounts are simply banned in the States, as well as most of the rest of the world. Regulators have seen them as too dangerous for retail investors and sought to limit their exposure to them. However, as unlicensed brokers like Profitto are not subject to any kind of regulation, they still provide the high amounts, seeking to attract clients.

Spreads & Commissions

Profitto offers different account types with varying spreads and commission structures. It is important to note that while the following information is provided, traders should consider other factors and thoroughly review Profitto's terms and conditions to gain a comprehensive understanding of the trading costs involved.

ECN Account:

The ECN Account at Profitto offers spreads as low as 0.1 pip. Traders using this account type are charged a commission fee of $3 for each trade executed.

STD Account:

Profitto's STD Account provides a minimum spread of 0.1. Unlike the ECN Account, no commission fees are charged for trades executed through this account type.

CENT Account:

The CENT Account at Profitto has a slightly higher minimum spread of 1.5. Similar to the STD Account, no commission fees are charged for trades executed with this account type.

Trading Platform Available

Profitto offers trading platforms for various devices, including smartphones and tablets. The mobile versions of MetaTrader 4 are available for both Android and Apple iOS devices, allowing traders to access the financial markets while on the go. These mobile platforms provide full support for trading functions and offer a range of analytical capabilities, including technical indicators and graphical objects. Traders can enjoy accessing these features from anywhere in the world, 24 hours a day.

For desktop trading, Profitto provides the MT4 Desktop platform. This trading platform is widely recognized and popular in the industry. Its strength lies in its simplicity, making it user-friendly and easy to navigate. With powerful analytical tools, traders can perform in-depth analysis of the markets. Whether traders are interested in automated trading or customizing their own setups with add-ons, the MT4 platform offers a community of traders who share signals, indicators, and oscillators to enhance their trading strategies. Profitto has optimized its MT4 offering over the years, leveraging its experience as one of the early providers of the platform. Traders can expect an ideal trading experience that aims to deliver results.

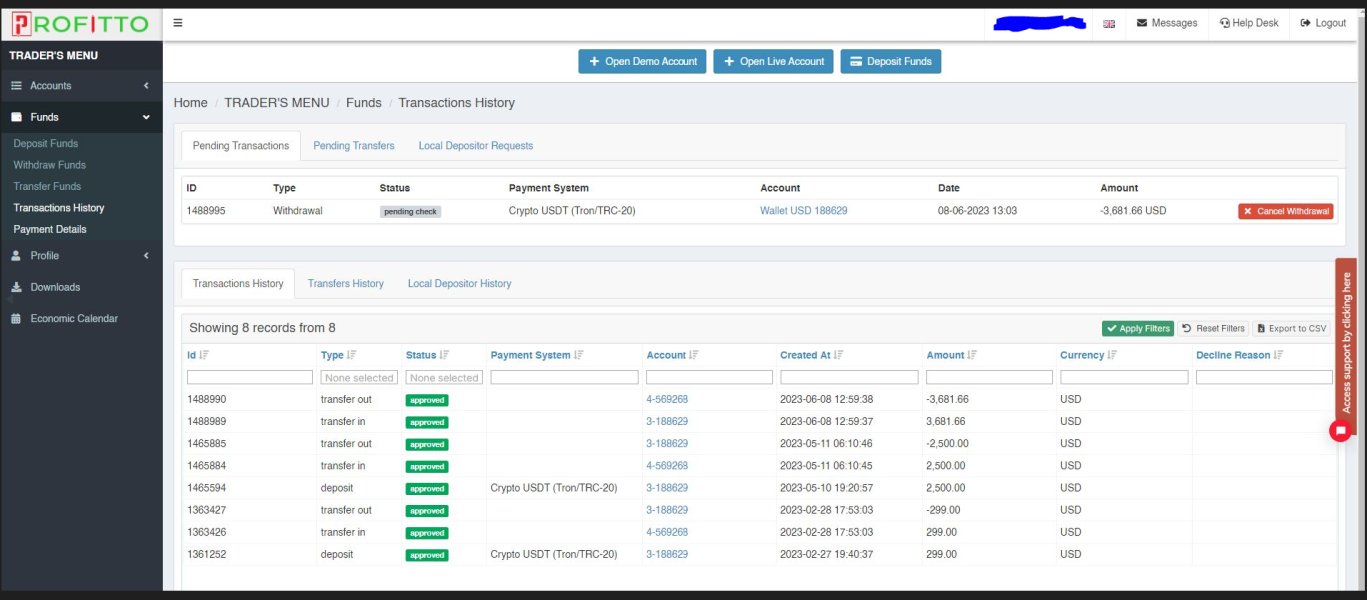

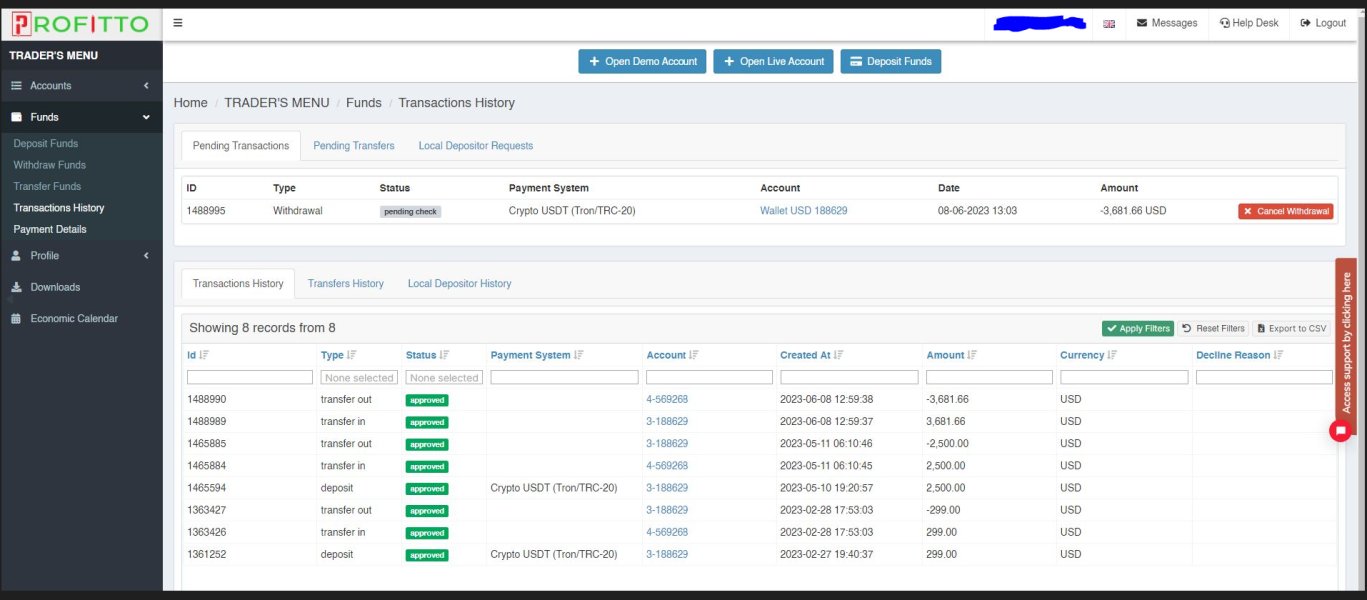

Deposit& Withdrawal

To deposit funds into your Profitto trading account, the process is quick and straightforward. First, log in to the Client Area, then navigate to the 'Deposits' section. From there, select the trading account you want to deposit funds into and choose from the available payment methods. Please note that certain payment methods may have additional charges, and if you deposit funds in a currency different from your bank funds, you may incur exchange rate fees. Profitto does not cover these charges.

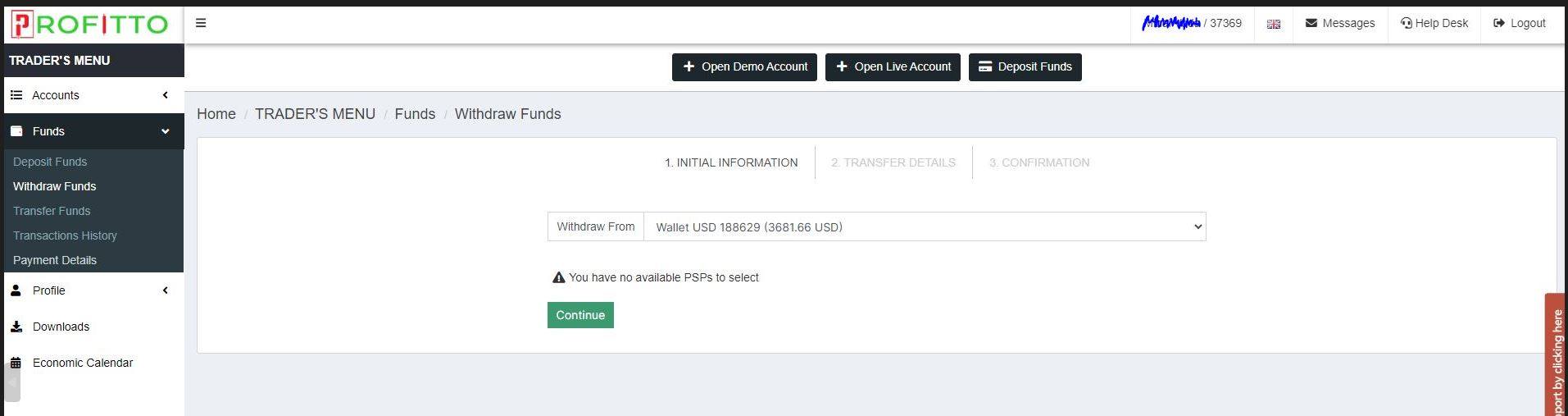

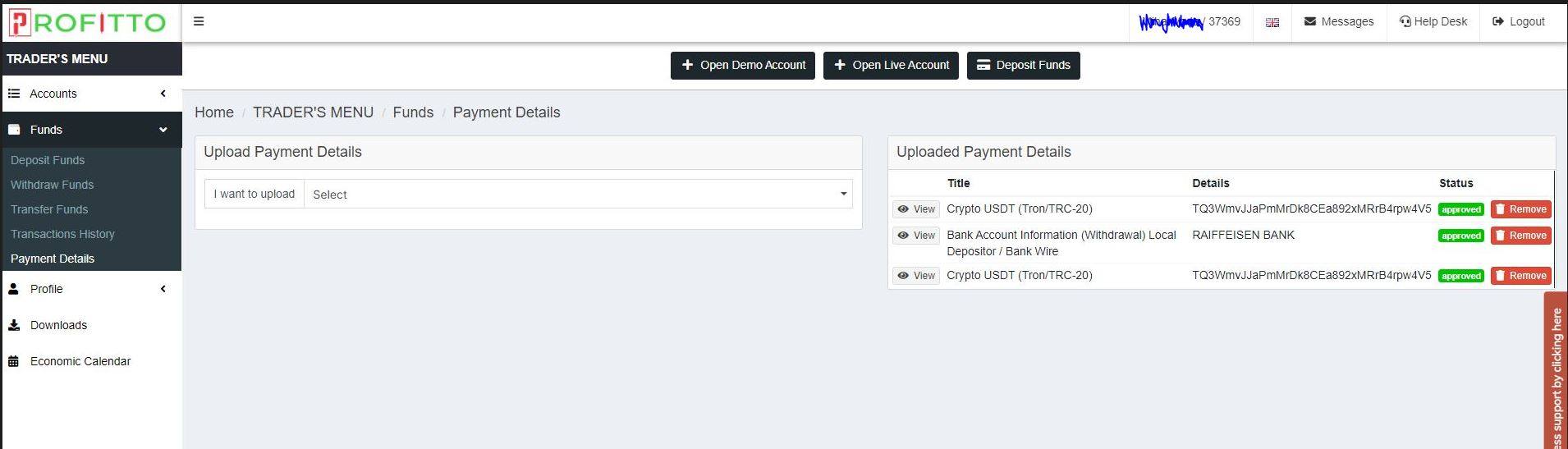

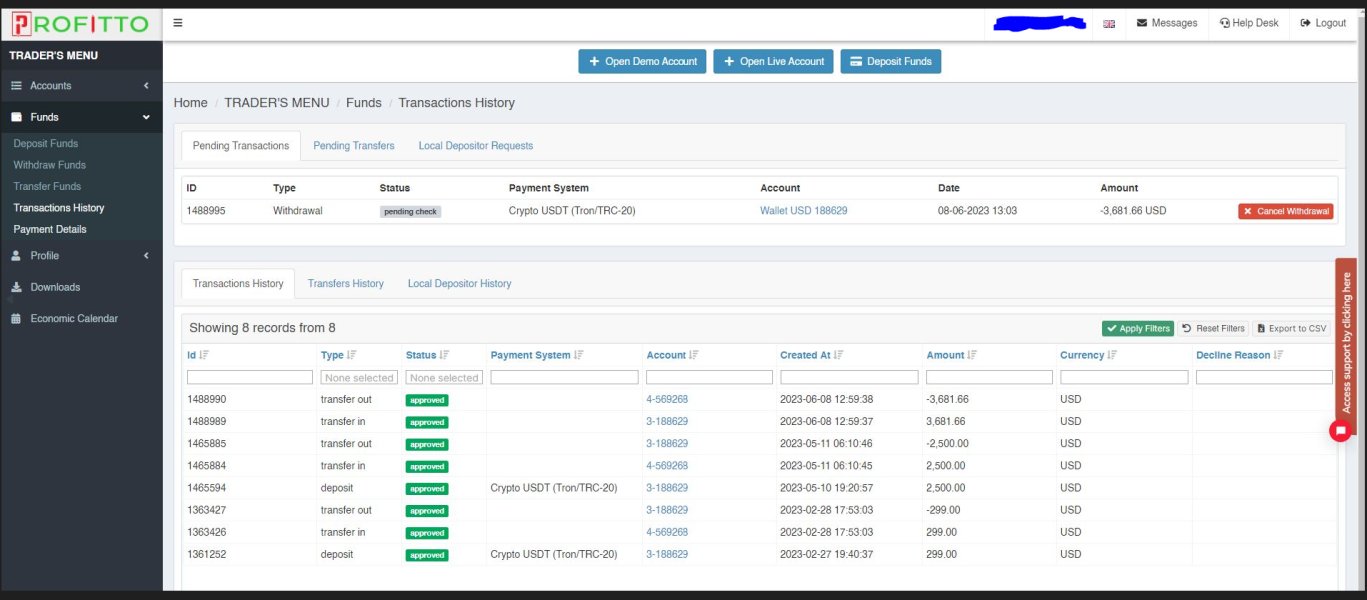

Withdrawing funds from your Profitto account follows a similar procedure. Log in to the Client Area and go to the 'Withdrawal' section. Select the trading account you wish to withdraw funds from and choose from the provided payment methods.

The time it takes for withdrawals to be processed depends on the withdrawal amount. For withdrawals below $1,000, the payment will typically be settled within 24 hours. Withdrawals ranging from $1,000 to $5,000 usually take 3 to 5 working days to process. Withdrawals exceeding $5,000 also generally take 3 to 5 working days to be settled.

Profitto offers various payment methods for both deposits and withdrawals, including VISA, FPX, helo2Pay, Mastercard, and Zaaspay. These methods provide different options for clients to manage their funds. However, it's important to remember that the lack of regulation raises concerns about the overall security and reliability of the deposit and withdrawal processes with Profitto.

Customer Support

The customer support of Profitto can be reached via email at support@profittoltd.com. They also provide an additional email address for inquiries related to social trading at socialtrading@profittoltd.com. Furthermore, they have provided a physical address for correspondence, located at Suite 305, Griffith Corporate Centre, Beachmont P.O.Box 1510, Kingstown, St. Vincent and the Grenadines.

Educational Resources

Profitto offers various educational resources to its clients. One of these resources is the BBMA Road Tour, which provides participants with the opportunity to learn about the basics of BBMA structure and entry points. Clients who join this class also gain exclusive access to a special support group where any questions or concerns can be addressed. Additionally, participants receive a free Profitto jersey and stay updated on the tools used in BBMA through live Zoom sessions and post-class support.

Another educational offering is the GHG (Learn Practice Repeat) class, taught by an expert called Master Oma Ally. GHG has a reputation for helping traders make profits with low pip counts, starting from 3000 pips for various entries. The class covers topics such as Fibonacci retracements, which are believed to predict about 70% of market movements, as well as the importance of drawing support and resistance levels accurately to find profitable trades.

Profitto also organizes success trading seminars featuring speakers and motivators like Mr. Rohaizad Hassan, who emphasizes the need for intentional change in order to navigate the challenges of trading. The seminar aims to address the financial mindset and help participants understand how to make positive changes in their trading approach.

In conclusion, Profitto presents itself as a brokerage firm operating in the financial industry. However, there are significant disadvantages and risks associated with this platform. Firstly, Profitto lacks regulation from any valid regulatory authority, which poses a substantial risk to potential investors and traders. Additionally, the broker has received complaints reported by WikiFX, indicating potential issues with their services. On the positive side, Profitto offers a range of market instruments such as commodities, indices, and forex, providing opportunities for traders. They also offer different types of trading accounts with varying features and leverage ratios. However, it is strongly advised to exercise caution and choose a regulated and reputable broker that offers the necessary protections and safeguards for investments, as Profitto's lack of regulation and reported complaints raise concerns about the safety and reliability of their services.

FAQs

Q: Is Profitto a regulated brokerage firm?

A: No, Profitto is not regulated by any valid regulatory authority. This lack of regulation poses a significant risk to potential investors or traders.

Q: Are there any complaints against Profitto?

A: Yes, there have been four complaints reported by WikiFX against Profitto in the past three months. These complaints indicate potential problems or issues experienced by clients who have interacted with this broker.

Q: What markets can I trade with Profitto?

A: Profitto offers trading opportunities in commodities, indices, and forex markets. However, it is crucial to carefully evaluate the broker's regulatory status and reputation before engaging in any trading activities.

Q: What types of trading accounts does Profitto offer?

A: Profitto offers three types of trading accounts: ECN Account, STD Account, and CENT Account.

Q: What is the leverage offered by Profitto?

A: Profitto offers a maximum leverage ratio of 1:1000, which is considered extremely high. Traders should be aware of the risks associated with high leverage before engaging in trading activities.

Q: What are the spreads and commissions with Profitto?

A: The spreads and commissions vary depending on the account type. The ECN Account has spreads as low as 0.1 pip and charges a commission fee of $3 per trade. The STD Account has a minimum spread of 0.1 but does not charge commission fees. The CENT Account has a slightly higher minimum spread of 1.5 and no commission fees.

Q: How can I deposit and withdraw funds with Profitto?

A: Profitto offers various payment methods for deposits and withdrawals, including VISA, Mastercard, and electronic payment processors. The process can be done through the Client Area on the website, but it's important to note that the lack of regulation raises concerns about the overall security and reliability of these processes.

Q: What trading platforms does Profitto provide?

A: Profitto offers the MetaTrader 4 (MT4) trading platform for both desktop and mobile devices. The MT4 platform is widely recognized and provides powerful analytical tools and a user-friendly interface.

Q: Does Profitto provide educational resources?

A: Yes, Profitto offers educational resources such as the BBMA Road Tour and GHG (Learn Practice Repeat) classes, as well as success trading seminars. These resources aim to enhance traders' knowledge and skills.

Q: How can I contact Profitto's customer support?

A: Profitto's customer support can be reached via email at support@profittoltd.com. They also provide an additional email address for inquiries related to social trading at socialtrading@profittoltd.com. Additionally, they have a physical address for correspondence in St. Vincent and the Grenadines.

mvtrade2010

Romania

Scammer Broker, I was trading with Proffito till FEB 2023 when I wanted to withdraw my money and even now after 9 months they are refusing to accept my withdrawal for my depositDo not ever deposit with Proffito because they are acting like scammers

Exposure

2023-11-08

fxvo2200

Romania

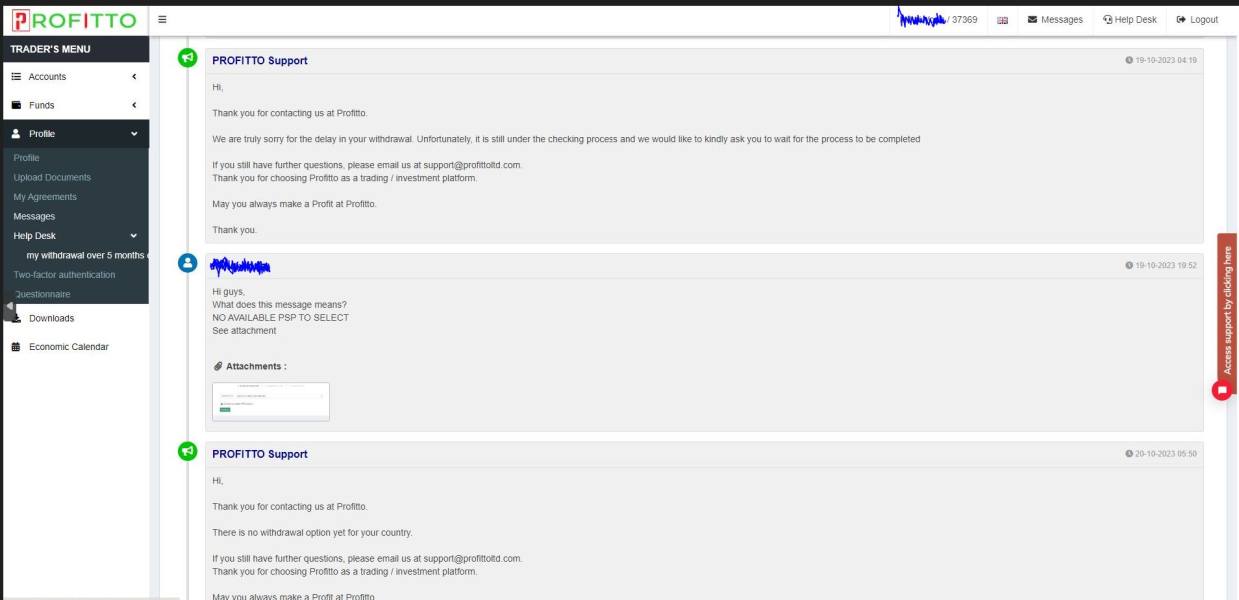

I was creating a withdrawal request with PROFITTO over 4 months ago and they still didn`t approve it. It's been over 4 months since I placed my withdrawal and they keep telling me that my withdrawal is under checking. They don`t even want to give my deposit back. So far all I can say is that the broker is not accepting withdrawals. Avoid PROFITTO if you don`t want to lose your money!

Exposure

2023-08-31

fxvo2200

Romania

The broker does not approve any withdrawalsI was creating a withdrawal request with PROFITTO over 3 months ago and they still didn`t approve it. It's been over 3 months since I placed my withdrawal and they keep telling me that my withdrawal is under checkings. They don`t even want to give my deposit back. So far all I can say is that the broker is not accepting withdrawals. Avoid PROFITTO if you don`t want to lose your money!

Exposure

2023-08-16

fxvo2200

Romania

I was creating a withdrawal request with PROFITTO over 2 months ago and they still didn`t approve it. It's been over 2 months since I placed my withdrawal and they keep telling me that my withdrawal is under checkings. They don`t even want to give my deposit back. So far all I can say is that the broker is not accepting withdrawals. Avoid PROFITTO if you don`t want to lose your money!

Exposure

2023-07-26

karimerr

Malaysia

always playing with spread. even using ecn account. stay away this broker

Exposure

2023-06-28

karimerr

Malaysia

movement candle stick stuck and have a gap. and when i want close my entry profit trade was disabled like in a picture

Exposure

2022-12-06

FX1127767192

Malaysia

opening gap 180pips beware this broker No action support,we trade oil not us stock market, iD MT4 505554, scam broker,

Exposure

2022-02-17

Sinh Hoàng

Singapore

You should be careful cause you can't withdraw funds here

Exposure

2020-11-25

威廉吴

Malaysia

I profited and operated normally. But he said I didn’t obey their rules. So I can’t withdraw my funds.

Exposure

2020-11-24

威廉吴

Malaysia

The former withdrawal was so fast, I received my withdrawal about ten hours. The same cryptocurrency address. And it can be quicker using the cryptocurrency to transfer. The customer service said I have to wait 24 hours. But I've been waiting for four days.

Exposure

2020-11-02

Apr.Li

Indonesia

My journey with Profitto has led me to share a few notable insights. Based in the picturesque Saint Vincent and the Grenadines and being a relatively new enterprise with no official regulation, it demands a sense of cautious optimism. Their platform supports the globally acclaimed MT4 trading platform. This, along with a maximum leverage of 1:1000, creates a well-curated environment for decisive maximization of trading opportunities. While their educational tools like seminars seem promising for attaining sharper trading acumen, the lack of specifics on certain elements like a demo account and Islamic account does create room for further clarity.

Neutral

2023-12-01

FX1283767917

India

Truly, I felt uncomfortable with Profitto’s trading platform, outdated and simple. It always lost connection when I was going to sell or buy order. God save me.

Neutral

2023-02-24