Overview of M.C.

M.C., also known as Magic Compass New Zealand Limited, is a financial entity based in Hong Kong. With a history spanning 5-10 years, M.C. operates in the realm of financial market instruments, including futures, options, swaps, forwards, and CFDs. It offers various account types, such as Standard, Premium, and VIP, each with specific features and monthly fees. Notably, M.C. provides a substantial leverage ratio of 1:500, enabling traders to control larger positions relative to their initial investment.

However, it's important to exercise caution when considering M.C. as a trading platform. The regulatory status of the Chinese Gold & Silver Exchange Society (CGSE), associated with M.C., is under scrutiny, with allegations of being a “fake platform.” Regulatory authorities in different countries, including New Zealand, the United Kingdom, and Cyprus, have raised concerns about CGSE's legitimacy and reported negative ratings. Additionally, reviews and reports suggest that M.C. has faced numerous user complaints, including difficulties in fund withdrawals, frozen accounts, unauthorized transfers, and unresponsive customer service. These issues underscore potential risks associated with M.C. and its associated entities.

Pros and Cons

M.C. presents a set of advantages and disadvantages. On the positive side, it is licensed by multiple regulatory bodies, offering a diverse range of financial instruments, high leverage options, low spreads, access to the popular MT4 trading platform, and a variety of account types and deposit/withdrawal methods. However, it faces challenges related to regulatory scrutiny and warnings, concerns regarding its legitimacy, negative reviews and complaints, fees associated with certain withdrawal methods, reports of fraudulent activities, an unavailable main website, and questions about customer support and responsiveness.

Is M.C. Legit?

The Chinese Gold & Silver Exchange Society (CGSE) is currently under regulatory scrutiny, with a “fake platform” status and holding a License type AA issued by Hong Kong (Regulation Number: 081). The licensing organization associated with CGSE is 香港紅獅集團有限公司. It should be noted that there are concerns and warnings regarding the authenticity and legitimacy of CGSE, with claims of being a cloned platform and numerous investor complaints. Additionally, CGSE is associated with negative ratings and suspicion of plagiarism in various regulatory authorities, including New Zealand FSPR (regulatory number: 480686), the United Kingdom FCA (regulatory number: 771683), and Cyprus CYSEC (regulatory number: 299/16). Consequently, individuals are advised to exercise caution and be aware of the potential risks associated with CGSE.

Market Instruments

FUTURES

Futures are contracts that require the buyer to purchase an asset at a predetermined price on a specified date. Examples of futures contracts encompass stock futures, bond futures, and currency futures. These contracts serve purposes such as hedging against price fluctuations or speculating on future price changes.

OPTIONS

Options are contracts granting the buyer the right, though not the obligation, to buy an asset at a specified price on a predetermined date. Common instances of options contracts include call options and put options. Call options provide the purchaser with the ability to buy an asset, while put options grant the right to sell an asset. Options are typically utilized for hedging against price fluctuations or speculating on future price movements.

SWAPS

Swaps are contracts that involve the exchange of cash flows associated with two distinct assets. Examples of swap contracts encompass interest rate swaps, currency swaps, and commodity swaps. These contracts are employed to manage risks related to interest rates, currency exchange rates, or commodity prices.

FORWARDS

Forwards are contracts that obligate the buyer to purchase an asset at an agreed-upon price on a specified date. Unlike futures contracts, forwards are not traded on an exchange. They are employed for purposes such as hedging against price fluctuations or speculating on future price movements.

CFDs

CFDs (Contracts for Difference) are a type of derivative that allows traders to speculate on the price movements of an underlying asset without actual ownership. CFDs are traded on margin, enabling traders to control a larger position with a relatively small capital deposit. It is essential to note that CFDs are considered a high-risk investment and should be used cautiously, primarily by experienced traders.

Pros and Cons

Account Types

Standard Account: This is the most basic account type and has no monthly fees. It offers a maximum leverage of 1:100 and a trading volume of 100,000 contracts per month.

Premium Account: This account type has a monthly fee of $10. It offers a maximum leverage of 1:200 and a trading volume of 200,000 contracts per month.

VIP Account: This account type has a monthly fee of $100. It offers a maximum leverage of 1:500 and a trading volume of 500,000 contracts per month.

Pros and Cons

Leverage

M.C. offers a leverage ratio of 1:500, allowing traders to control positions that are up to 500 times the size of their initial investment.

Spreads & Commissions

M.C. offers spreads on currency pairs, starting from 0.2 pips. It does not charge commissions on currency pairs, but does charge commissions on other instruments, such as stocks and commodities. The commissions vary depending on the instrument. For example, the commission on US stocks is $0.005 per share, and the commission on gold is $10 per contract.

Deposit & Withdraw

M.C. offers a variety of deposit and withdrawal methods, including bank transfers, credit cards, and debit cards. The fees for deposits and withdrawals vary depending on the method used. For example, the fee for depositing money using a bank transfer is 0%, while the fee for withdrawing money using a credit card is 3%.

Pros and Cons

Trading Platforms

M.C. offers the MT4 (MetaTrader 4) trading platform to its users, a widely recognized and popular trading platform in the industry. MT4 provides traders with advanced tools and features for executing trades and analyzing market data, including access to a variety of technical indicators and charting tools. It supports trading in various financial instruments, including forex, commodities, and indices. MT4 is known for its user-friendly interface and robust capabilities, making it a preferred choice for many traders.

Pros and Cons

Customer Support

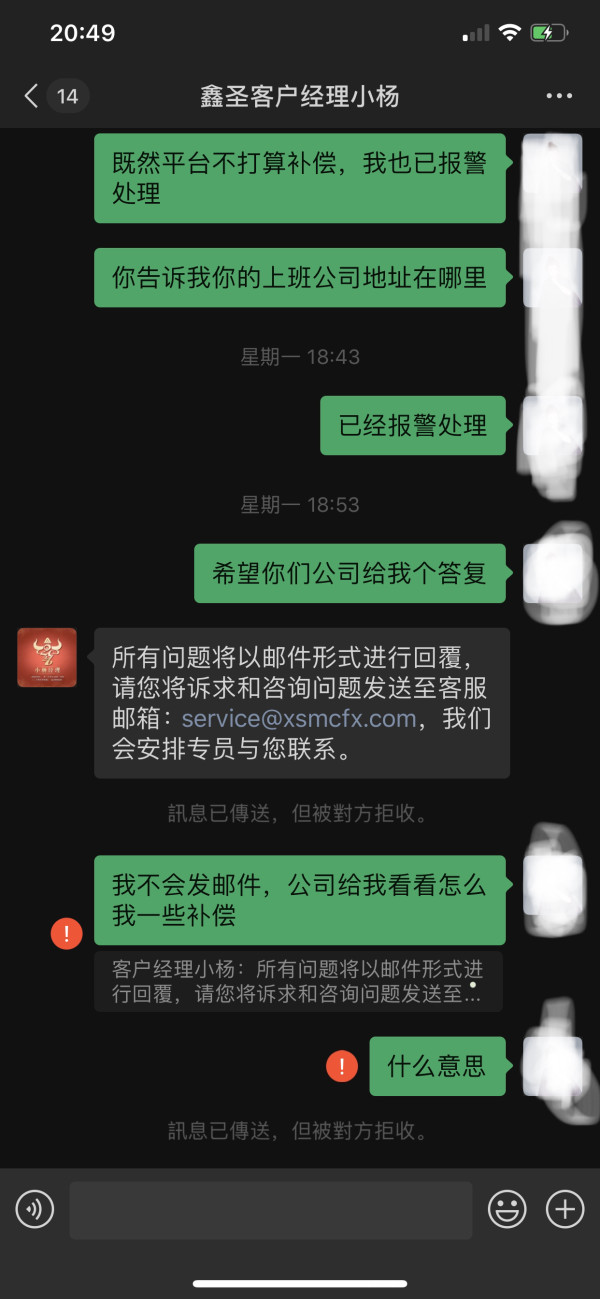

M.C. provides customer support through QQ at 800809110 and via email at service@xsmcfx.com. They can also be reached by phone at 8008-701-858 or 8008701858.

Reviews

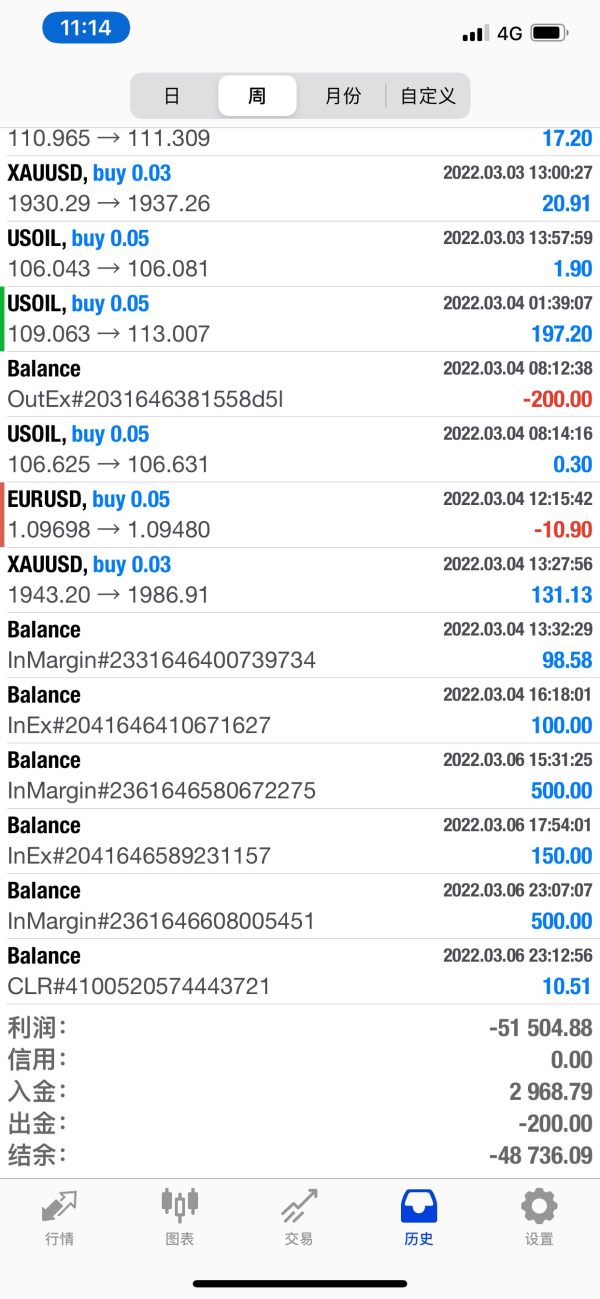

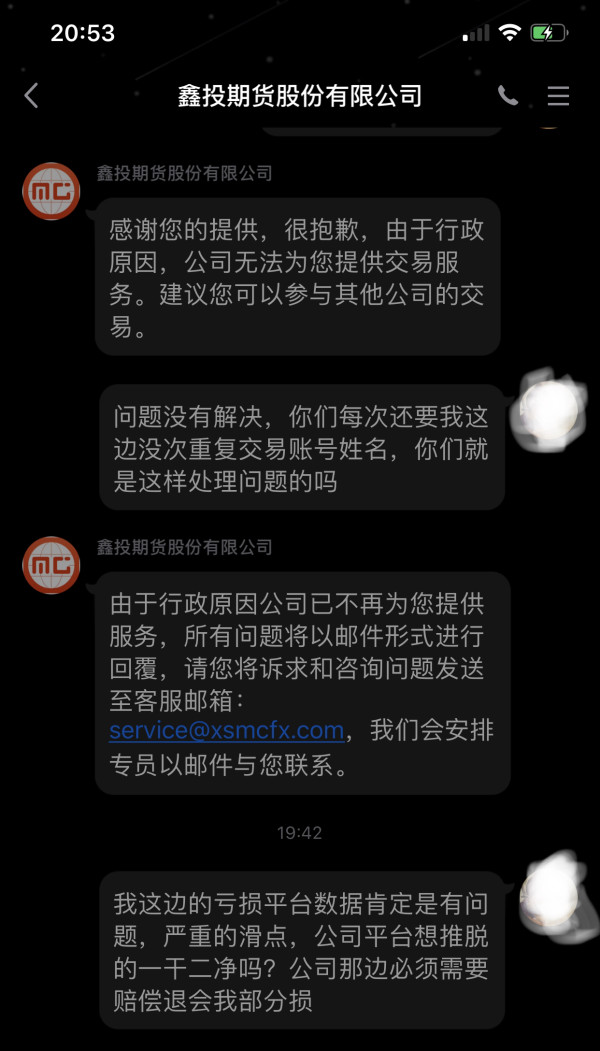

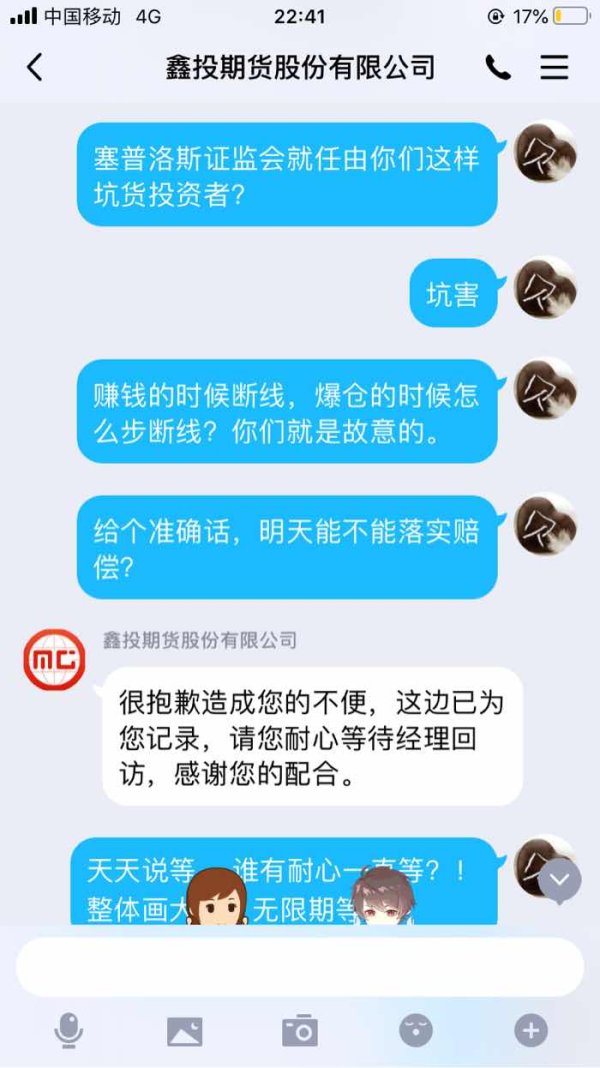

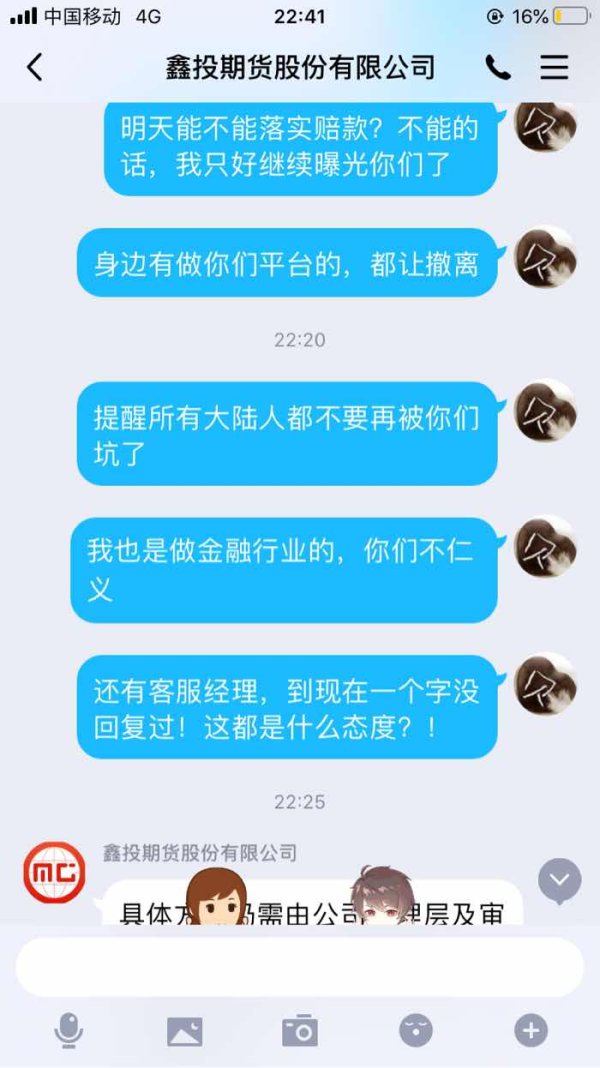

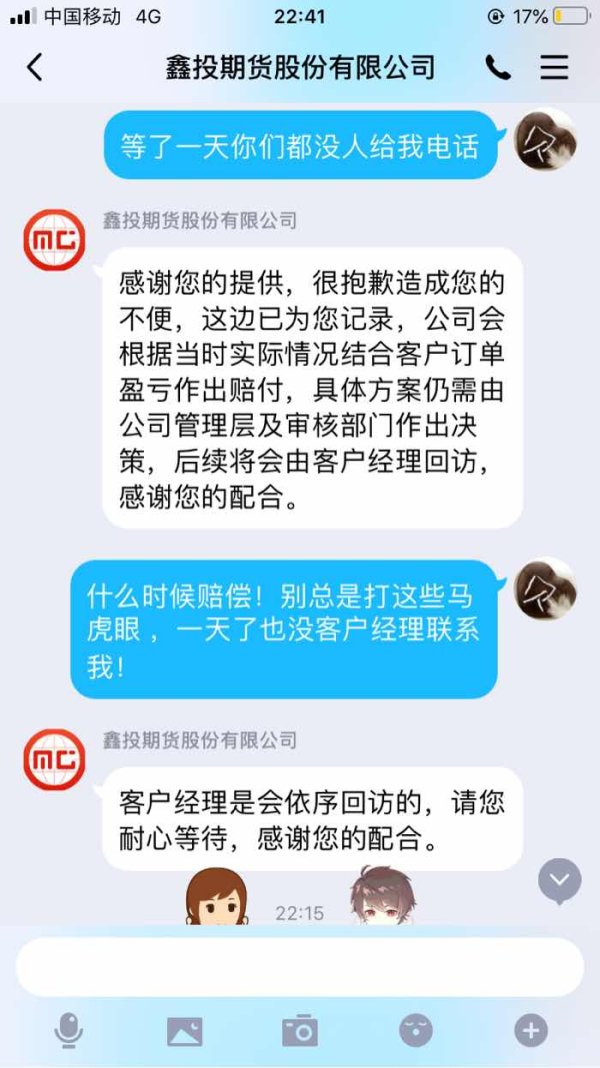

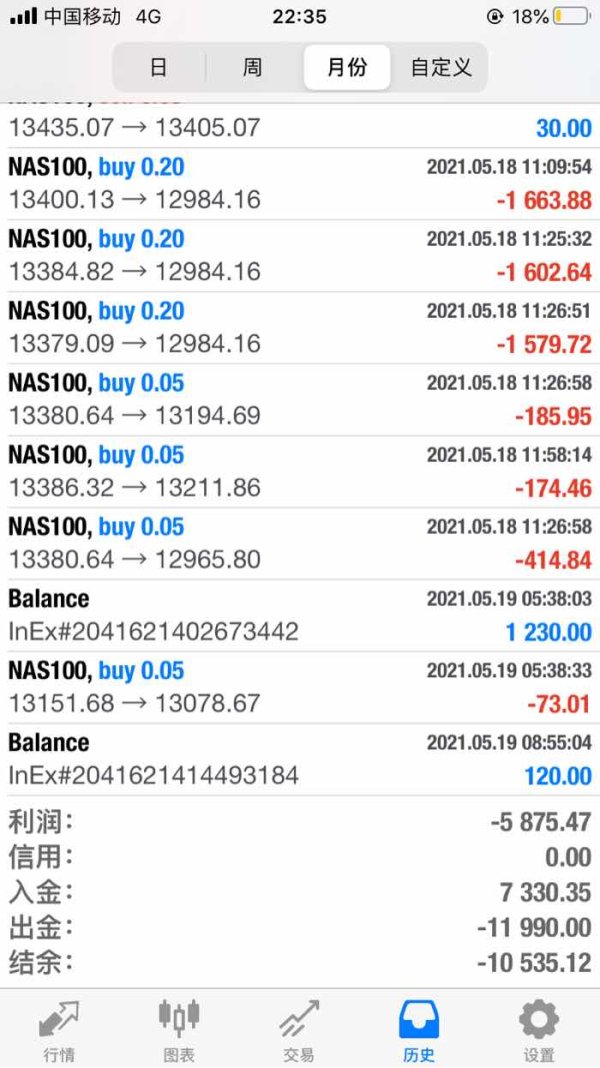

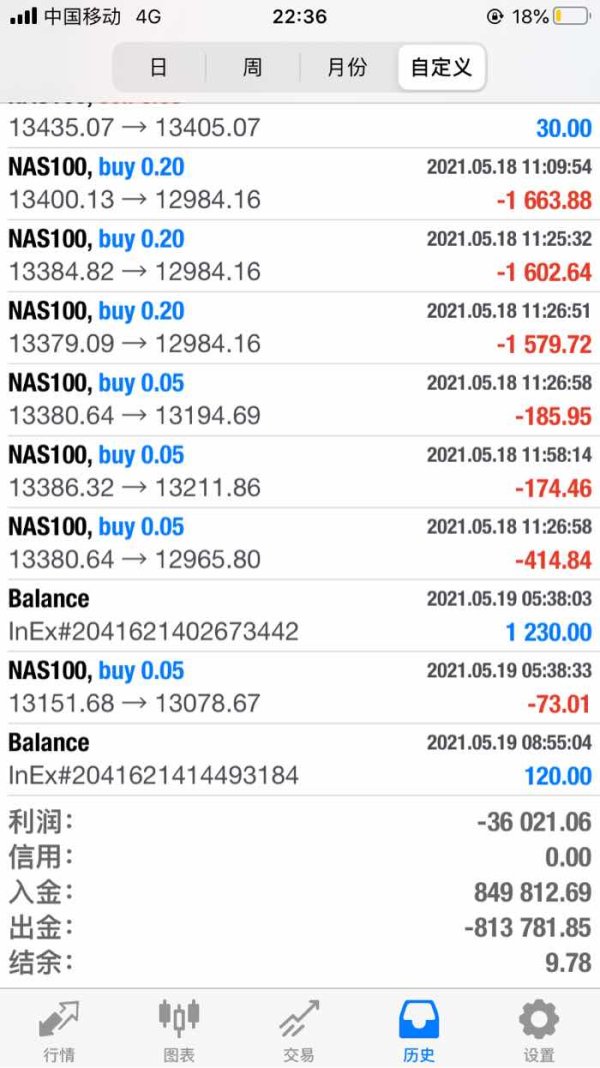

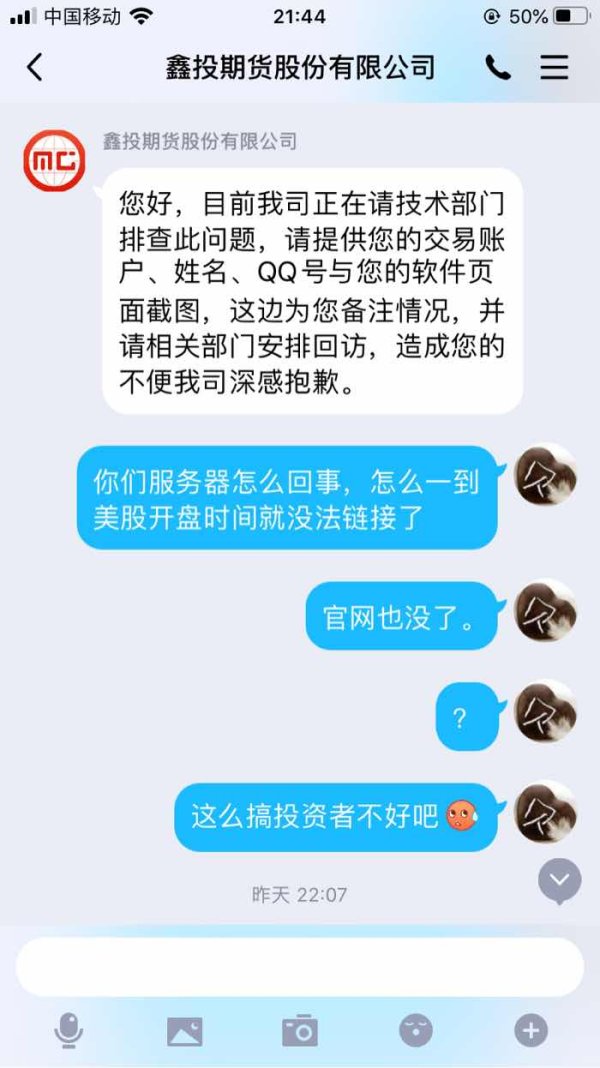

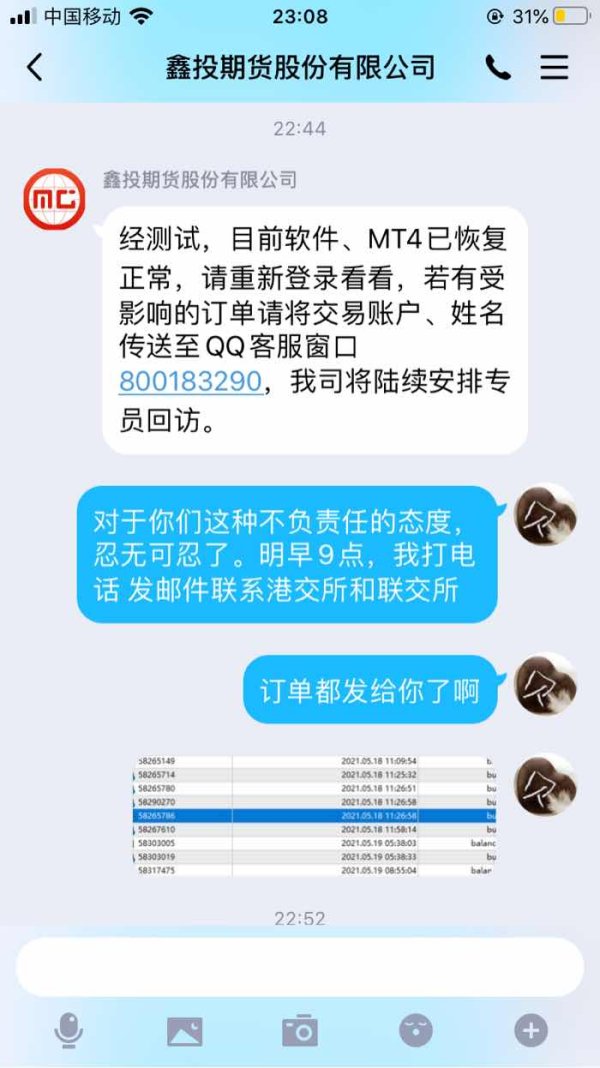

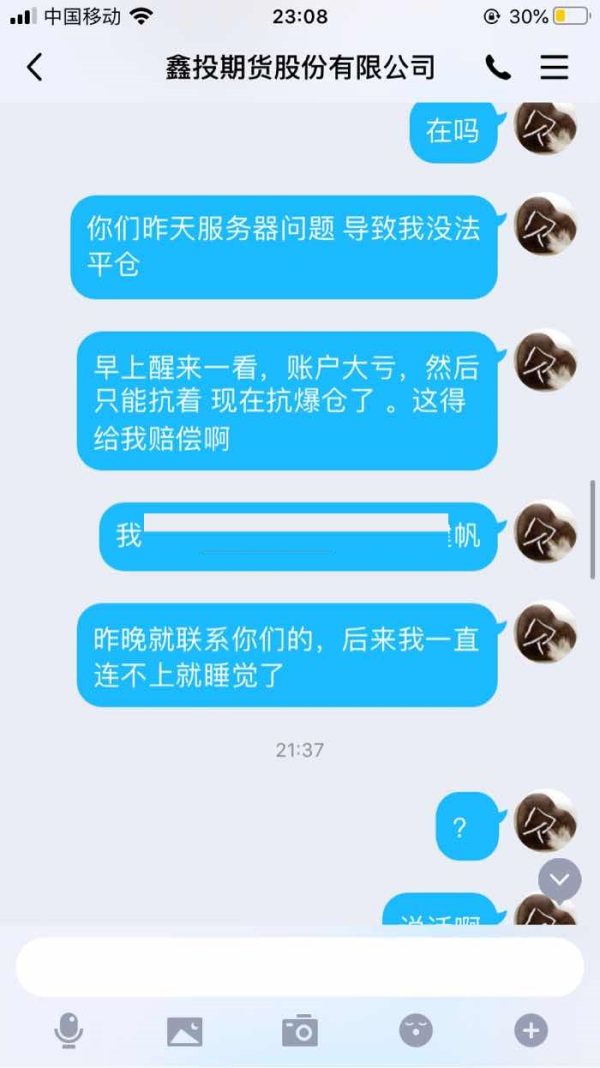

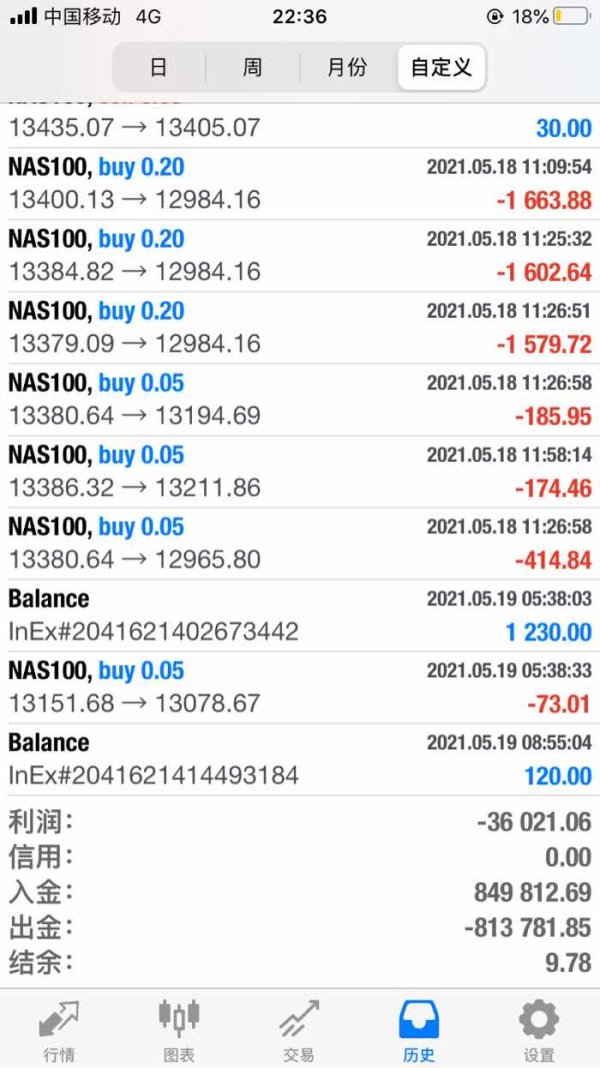

According to reviews on WikiFX, M.C. has received numerous complaints and reports of fraudulent activities from users. Some common issues reported include difficulties in withdrawing funds, frozen accounts, unauthorized fund transfers to personal accounts, and problems with closing positions. Users have expressed concerns about serious losses due to issues like internal data problems, slippages, and a lack of responsiveness from customer service. The platform's credibility has been questioned, with claims of deceptive practices and a negligent attitude towards customer problems. These reviews suggest a high level of dissatisfaction and potential risks associated with M.C.

Conclusion

In conclusion, Magic Compass New Zealand Limited (M.C.) presents both advantages and disadvantages. On the positive side, it offers a high leverage ratio of 1:500, enabling traders to control larger positions. It provides the widely recognized MT4 trading platform, known for its user-friendly interface and robust capabilities. Additionally, M.C. offers a variety of account types to cater to different trading needs. However, there are significant concerns regarding its legitimacy, as it is associated with regulatory scrutiny and warnings about its authenticity. Negative ratings and suspicions of plagiarism in regulatory authorities further raise doubts about its reliability. Reviews from users on WikiFX indicate numerous complaints, including difficulties in fund withdrawals, frozen accounts, and concerns about platform credibility. Therefore, individuals considering M.C. should exercise caution and thoroughly assess the associated risks.

FAQs

Q1: What is the full name of M.C. in Hong Kong?

A1: The full company name of M.C. in Hong Kong is Magic Compass New Zealand Limited.

Q2: Is M.C. considered legitimate?

A2: M.C. is currently under regulatory scrutiny, with concerns about its legitimacy due to claims of being a cloned platform and negative ratings from regulatory authorities.

Q3: What market instruments does M.C. offer?

A3: M.C. offers various market instruments, including futures, options, swaps, forwards, and CFDs.

Q4: What are the different account types offered by M.C.?

A4: M.C. offers Standard, Premium, and VIP account types, each with its own features and fees.

Q5: What leverage does M.C. provide to traders?

A5: M.C. offers a leverage ratio of 1:500, allowing traders to control positions up to 500 times their initial investment.

Q6: What are the deposit and withdrawal methods available with M.C.?

A6: M.C. offers a variety of deposit and withdrawal methods, including bank transfers, credit cards, and debit cards, each with its own associated fees.

Q7: What trading platform does M.C. offer?

A7: M.C. offers the widely recognized MT4 (MetaTrader 4) trading platform, known for its user-friendly interface and robust capabilities.

Q8: How can I contact M.C.'s customer support?

A8: You can contact M.C.'s customer support through QQ, email, or phone.

Q9: Are there any common issues reported by users regarding M.C.?

A9: Yes, users have reported issues such as difficulties in withdrawing funds, frozen accounts, and problems with closing positions, raising concerns about the platform's credibility.

Q10: Should I be cautious when considering M.C. as a trading option?

A10: Yes, given the reported issues and concerns about legitimacy, it's advisable to exercise caution when considering M.C. as a trading platform.

小飞侠35181

Hong Kong

After opening an account on this platform in 2020, when I needed to withdraw, I found that I could not withdraw funds. After several consultations with each other. After the amount negotiated by the two parties, the other party promised to make the payment, and then the platform kept changing the name and website. Recently, I negotiated the withdrawal amount with the other party. Please contact me immediately.

Exposure

2022-07-20

FX2510366683

Hong Kong

The customer service of the platform company did not handle the problem, the WeChat account manager blocked me, and deactivated my trading account for the platform to directly close my transaction with my consent, and the platform customer service has been playing balls. I hope customers who have been hacked will contact me and organize a search together. The reporter went to the police station to expose the platform website and recover the loss!

Exposure

2022-03-11

奈何88261

Hong Kong

The platform can not be opened since yesterday. Now I even can't see my balance

Exposure

2021-05-31

FX4609821290

Hong Kong

You can’t connect to the network if you profit. Make customers lose all! Do not be cheated! You should take warning from my experience!

Exposure

2021-05-20

FX4609821290

Hong Kong

MC cheats investors! Make me lose a lot!

Exposure

2021-05-20

FX4609821290

Hong Kong

MC cheats investors! Make me lose a lot!

Exposure

2021-05-20

常信

Hong Kong

No response

Exposure

2021-05-19

Libra82184

Hong Kong

In the beginning, I can withdraw funds. But then I was told that I could not withdraw a large amount of money cuz I am not their VIP member. I asked what was the definition of a large amount. The said 20,000. In the end, they rejected my application.

Exposure

2021-05-12

汪爱军

Hong Kong

They use erroneous signal to cheat investors into deposit, and change the deposit person and account frequently.

Exposure

2020-09-30

奈何88261

Hong Kong

The software can't be even opened when the market fluctuated greatly on May 18

Exposure

2020-09-18

耀元

Hong Kong

The invest system of MC is so stuck that I can’t close my positions, resulting in huge loss.

Exposure

2020-09-04

白开水先生

Hong Kong

MC shut my position compulsorily. How does this closing price come? Is it reasonable?

Exposure

2020-08-04

xn3132510982

Hong Kong

Problem: frozen account/fund transferred into private account/unable to withdraw Experience: In this middle April, when surfing the stock market, I saw a free recommendation on stock. Out of curiosity, I clicked in and added a teacher. He told me to follow his moments, on which there was some stock recommendation. Later, I was invited into a group, in which members showed some profit screenshots. They all pleaded the teacher to give livestreaming lessons. After doing so, the teacher advised us to trade index on Qirong security, saying that the stock market was volatile, in the living room. I joined and deposited 10 thousand RMB. Under teacher’s guidance, I made some profits through taring on a small position. But I always suffered losses on large position. The teacher asked me to add fund. Thus, I added 300 thousand to recover the losses, but ended up with 800 thousand losses. When I contacted the teacher, he still asked me to add fund. After I refused him, my account was frozen.

Exposure

2020-07-22

真爱永存

Hong Kong

The platform is out of regulation. The fund is transferred into private account. As long as you mentioned about the withdrawal, it will block your account.

Exposure

2020-07-20

不存在

Philippines

Each time, the fund-receiving account was different. There was also intermediary hint, which is nonexistent on other platforms. It is simply a scam.

Exposure

2020-07-20

真爱永存

Hong Kong

Negligence on the clients’ problems, blacklisting them directly , and severe slippage.

Exposure

2020-07-11

FX2119520094

Hong Kong

I withdrew $1913.28 at 19:00, July 6th, while only 13466 yuan was received.

Exposure

2020-07-06

FX2232962060

Hong Kong

It is simply a fraud platform. Take heed on it. The handling fee was a rip-off.

Exposure

2020-06-23

侯强

Hong Kong

When I made losses, the spread was similar with Jinshi Data. But when it came to profit, a 200-pip spread existed.

Exposure

2020-06-16

joker 东

Hong Kong

Whatever MT4 or the self-used software of MC used the third-party as funding channel. In addition, the trading amount, not operated by trader, changed everyday, as well as the funding channel. I doubted that it is a fraud platform.

Exposure

2020-06-15